Académique Documents

Professionnel Documents

Culture Documents

Accounting For Income Tax Outline

Transféré par

PatDabzDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Accounting For Income Tax Outline

Transféré par

PatDabzDroits d'auteur :

Formats disponibles

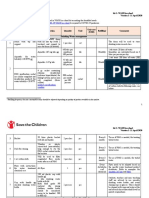

ACCOUNTING FOR INCOME TAX (TOPIC OUTLINE)

A. Accounting Income / Pre-Tax Income / Financial Income vs Taxable Income

1.

Accounting/Pre-tax/Financial Income - the net income of the period

2. Taxable Income income for the period determined in accordance with the rules established by the

tax authorities (BIR)

FINANCIAL INCOME

+/- Permanent Differences

Income SUBJECT to tax

+/- Temporary Differences

TAXABLE INCOME

Tax Rate

Current Income Tax Expense

B. Permanent Differences NO FUTURE TAX CONSEQUENCES

1.

Non-taxable Revenue these are DEDUCTED from Accounting Income

1) Interest income on deposits

2) Dividends received

2. Non-deductible Expenses these are ADDED to Accounting Income

1) Life insurance premium

2) Tax penalties, surcharges and fines

C. Temporary Differences

1.

Timing Differences

Deferred Tax Asset

Deferred Tax Liability

ADDED to Income Subject to Tax

DEDUCTED from Income subject to Tax

*causes Taxable Income > Accounting Income

*causes Taxable Income > Accounting Income

*gives rise to DTA (Deferred Tax Asset)

*gives rise to DTL (Deferred Tax Liability)

a. Advance Payments (advance rental, deposits)

a) Installment Sale - *cash basis taxation

b. Litigation Loss

b) Accelerated Depreciation

c. Research Cost

c) Development Cost

d. Impairment Loss

d) Prepaid Expenses

e. Doubtful Accounts (Provisions in AR)

2. Tax Base and Carrying Amount Differences

Deferred Tax Asset

Deferred Tax Liability

ADDED to Income Subject to Tax

DEDUCTED from Income subject to Tax

*causes Taxable Income > Accounting Income

*causes Taxable Income > Accounting Income

*gives rise to DTA (Deferred Tax Asset)

*gives rise to DTL (Deferred Tax Liability)

When Tax Base of ASSET > Carrying Amount

When Tax Base of ASSET < Carrying Amount

When Tax Base of LIABILITY < Carrying Amount

When Tax Base of LIABILITY > Carrying

Amount

3. Other Temporary Differences

Deferred Tax Asset

Deferred Tax Liability

ADDED to Income Subject to Tax

DEDUCTED from Income subject to Tax

*causes Taxable Income > Accounting Income

*causes Taxable Income > Accounting Income

* gives rise to DTA (Deferred Tax Asset)

* future deductible

a) Asset is revalued DOWNWARD

b) Tax Base of Investment in S, A and JV is

HIGHER than Carrying Amount

c) Operating Loss Carry-forward

* an EXCESS of tax deductions over gross income of the

year (resulting to a negative taxable income) maybe carried

forward to reduce the taxable income of the future years

* gives rise to DTL (Deferred Tax Liability)

* future taxable

a) Asset is revalued UPWARD

*DTL is recognized on Revaluation Surplus

*RS x Tax Rate = DTL

b) Tax base of Investment in S, A and JV is

LOWER than Carrying Amount

c) Cost of business combination allocated to the

identifiable asset and liabilities at FAIR VALUE

4. Unrecognizable Temporary Differences

Deferred Tax Asset

Deferred Tax Liability

1) Goodwill resulting from business combination

(goodwill at initial recognition)

2) Initial recognition of asset and liability

3) Undistributed profit

* the parent, investor or venture is able to control the timing

of the reversal of temporary differences

* it is probable that the temporary differences will not be

reversed in the future

D. Accounting Procedures

1) Determine the Taxable Income

Accounting/Pretax/Financial Income

+/- Permanent Differences

Income Subject to Tax

LESS: Taxable Temporary Differences

ADD: Deductible Temporary Differences

TAXABLE INCOME

2) Determine the Taxable Temporary Differences and Deferred Tax Liability

Taxable Temporary Differences X Tax Rate = Deferred Tax Liability

3) Determine the Deductible Temporary Differences and Deferred Tax Asset

Deductible Temporary Differences X Tax Rate = Deferred Tax Asset

4) Determine the Total Income Tax Expense

Income Tax Subject to Tax/*Accounting Tax X Tax Rate = TOTAL INCOME TAX EXPENSE

*(if there is no Permanent Differences)

Current Income Tax Expense

- OR

ADD: Deferred Tax Liability/Expense

LESS: Deferred Tax Asset/Benefit

TOTAL INCOME TAX EXPENSE

* this will appear in Current-Year Income Statement

5) From the Total tax Expense, distinguish which is:

a) Current Income Tax Expense (Current Tax Liability)

Income Tax Subject to Tax X Tax Rate = Income Tax Payable (CURRENT TAX LIABILITY)

* Income tax Benefit reduces the Current Tax Expense

* Income Tax Asset may be credited directly to Income Tax Expense (Valix:2013 p501)

b) Deferred Tax Expense (Non-current Liability) if any:

Deferred Tax Liability Deferred Tax Benefit = DEFERRED TAX LIABILITY

# when offsetting is allowed #when DTL is GREATER than DTA

6) Prepare Income Statement:

Accounting/Pretax/Financial Income

TOTAL Income Tax Expense:

ADD: Deferred Tax Liability / Increase in Deferred Tax Expense

LESS: Decrease in Deferred Tax Liability

LESS: Deferred Tax Benefit

NET INCOME

xxx

xxx

xxx

xxx

(xxx)

xxx

ADDENDUM:

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

Vous aimerez peut-être aussi

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)D'EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Évaluation : 3.5 sur 5 étoiles3.5/5 (17)

- Accounting For Income Tax..Document11 pagesAccounting For Income Tax..kalyanshreePas encore d'évaluation

- Accounting For Income TaxDocument18 pagesAccounting For Income TaxChirag PatelPas encore d'évaluation

- Accounting For Income TaxDocument4 pagesAccounting For Income Taxchowchow123Pas encore d'évaluation

- HO1 - Accounting For Income TaxDocument5 pagesHO1 - Accounting For Income TaxCharlesPas encore d'évaluation

- Accounting For Income Tax QuestionsDocument13 pagesAccounting For Income Tax QuestionszeyyahjiPas encore d'évaluation

- Accounting For Income TaxDocument4 pagesAccounting For Income TaxShaira Bugayong0% (2)

- Accounting For Income TaxesDocument16 pagesAccounting For Income TaxesMUNAWAR ALI100% (5)

- Accounting For Income Tax HandoutsDocument4 pagesAccounting For Income Tax HandoutsMichael Bongalonta0% (1)

- Accounting For Income Taxes - QuizDocument3 pagesAccounting For Income Taxes - QuizAngelica manaois100% (2)

- LiabilitiesDocument6 pagesLiabilitiesJi YuPas encore d'évaluation

- Accounting For Employment BenefitsDocument5 pagesAccounting For Employment BenefitsiamacrusaderPas encore d'évaluation

- CHAPTER 42 - Accounting For Income TaxDocument18 pagesCHAPTER 42 - Accounting For Income TaxJoshua Wacangan100% (1)

- Financialaccounting 3 Theories Summary ValixDocument10 pagesFinancialaccounting 3 Theories Summary ValixDarwin Competente LagranPas encore d'évaluation

- Deferred TaxDocument6 pagesDeferred TaxJayson Manalo GañaPas encore d'évaluation

- Full Pfrs vs. Pfrs For SmesDocument9 pagesFull Pfrs vs. Pfrs For SmesJames SalinasPas encore d'évaluation

- Lease AccountingDocument10 pagesLease AccountingXeanne Gloria100% (2)

- A U D I T I N G P R o B L e M S Finals Set ADocument7 pagesA U D I T I N G P R o B L e M S Finals Set AJerico MamaradloPas encore d'évaluation

- AC13.4.1 Module 4 Income TaxesDocument23 pagesAC13.4.1 Module 4 Income TaxesRenelle HabacPas encore d'évaluation

- Accounting For Income TaxesDocument25 pagesAccounting For Income TaxesKulet AkoPas encore d'évaluation

- FAR - Post-Employement Employee BenefitsDocument5 pagesFAR - Post-Employement Employee BenefitsJohn Mahatma Agripa100% (1)

- Quiz Income-TaxesDocument6 pagesQuiz Income-TaxesJhanelle Marquez33% (3)

- Retained EarningsDocument76 pagesRetained EarningsKristine DoydoraPas encore d'évaluation

- IADocument3 pagesIADeny SusantoPas encore d'évaluation

- CPAR Business & Transfer Taxes Testbank - Will and Testament - Estate Tax in The United States PDFDocument45 pagesCPAR Business & Transfer Taxes Testbank - Will and Testament - Estate Tax in The United States PDFLobna Adato100% (2)

- Far Quick Notes and Test Bank PDFDocument72 pagesFar Quick Notes and Test Bank PDFFujikoPas encore d'évaluation

- Definition Explained:: Liabilities A Liability Is ADocument26 pagesDefinition Explained:: Liabilities A Liability Is ACurtain SoenPas encore d'évaluation

- Investments in Debt SecuritiesDocument19 pagesInvestments in Debt SecuritiesdfsdfdsfPas encore d'évaluation

- At-5909 Risk AssessmentDocument8 pagesAt-5909 Risk AssessmentVeron BrionesPas encore d'évaluation

- QUIZ 3 Financial Forecasting and BudgetingDocument9 pagesQUIZ 3 Financial Forecasting and BudgetingPRINCESS HONEYLET SIGESMUNDOPas encore d'évaluation

- FAR 6.3MC - Provisions, Contingent Liabilities and Contingent AssetsDocument5 pagesFAR 6.3MC - Provisions, Contingent Liabilities and Contingent Assetskateangel ellesoPas encore d'évaluation

- Pas 12 Income TaxesDocument15 pagesPas 12 Income TaxesrandyPas encore d'évaluation

- Accounting For Income TaxesDocument7 pagesAccounting For Income TaxesHenry ListerPas encore d'évaluation

- Current LiabilitiesDocument2 pagesCurrent LiabilitiesjinkyPas encore d'évaluation

- Accounting For Bonds PayableDocument31 pagesAccounting For Bonds PayableJon Christian Miranda100% (2)

- Intermediate Accounting 5EDocument44 pagesIntermediate Accounting 5Ejahanzeb90100% (1)

- IntAcc 3 Non-Financial LiabilitiesDocument10 pagesIntAcc 3 Non-Financial LiabilitiesKim EllaPas encore d'évaluation

- Homework in Internal ControlDocument7 pagesHomework in Internal ControlAdam SmithPas encore d'évaluation

- CAT Module 1 Payroll Accounting (Updated)Document47 pagesCAT Module 1 Payroll Accounting (Updated)Anonymous Lz2qH7Pas encore d'évaluation

- Tax: TRAIN Illustrative Problems: Long Problem With FormsDocument23 pagesTax: TRAIN Illustrative Problems: Long Problem With FormsNooroddenPas encore d'évaluation

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document19 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo Gironella67% (3)

- CORRECTION OF ERRORS Theories PDFDocument7 pagesCORRECTION OF ERRORS Theories PDFJoy Miraflor AlinoodPas encore d'évaluation

- Gross Estate Tax Quizzer 1103aDocument6 pagesGross Estate Tax Quizzer 1103aCharry Ramos67% (3)

- Diluted Earnings Per ShareDocument3 pagesDiluted Earnings Per ShareJohn Ace MadriagaPas encore d'évaluation

- 12 x10 Financial Statement AnalysisDocument19 pages12 x10 Financial Statement Analysisrhazumie67% (3)

- Lesson 6 - Liabilities - Substantive Tests of Details of BalancesDocument30 pagesLesson 6 - Liabilities - Substantive Tests of Details of BalancesNiña YastoPas encore d'évaluation

- Preferential TaxationDocument8 pagesPreferential TaxationAngelica Nicole TamayoPas encore d'évaluation

- QUIZ7 Audit of LiabilitiesDocument3 pagesQUIZ7 Audit of LiabilitiesCarmela GulapaPas encore d'évaluation

- Chapter 25 - Substantive Test of LiabilitiesDocument10 pagesChapter 25 - Substantive Test of LiabilitiesQuijano GpokskiePas encore d'évaluation

- Accounting For Income Tax QuestionsDocument13 pagesAccounting For Income Tax QuestionsReina Erasmo SulleraPas encore d'évaluation

- Documentary Stamp TaxDocument6 pagesDocumentary Stamp TaxchrizPas encore d'évaluation

- Internal Control Affecting Liabilities and EquityDocument8 pagesInternal Control Affecting Liabilities and EquityPrincess Carol HolandaPas encore d'évaluation

- Tax 06-Tax On IndividualsDocument9 pagesTax 06-Tax On IndividualsDin Rose GonzalesPas encore d'évaluation

- AP.2808 - Audit of Equity MAY 2020: Auditing Problems Ocampo/Cabarles/Soliman/OcampoDocument5 pagesAP.2808 - Audit of Equity MAY 2020: Auditing Problems Ocampo/Cabarles/Soliman/OcampoMay Grethel Joy PerantePas encore d'évaluation

- Theory of AccountsDocument4 pagesTheory of AccountsROB101512Pas encore d'évaluation

- Book Value and Earnings Per ShareDocument6 pagesBook Value and Earnings Per ShareLui67% (3)

- The Philippine Financial Reporting Standards: PFRS Updates TrainingDocument74 pagesThe Philippine Financial Reporting Standards: PFRS Updates TrainingMara Shaira Siega100% (1)

- Income Taxes NotesDocument3 pagesIncome Taxes NotesAiden Pats100% (2)

- A Guide To Solving Accounting Problems in Income TaxDocument3 pagesA Guide To Solving Accounting Problems in Income TaxMargery BumagatPas encore d'évaluation

- Accounting Information System by James Hall Chapter 2 SummaryDocument4 pagesAccounting Information System by James Hall Chapter 2 SummaryPatDabz86% (7)

- 1 2005 XU CSG ConstitutionDocument14 pages1 2005 XU CSG ConstitutionPatDabzPas encore d'évaluation

- 6 Local Government Code PDFDocument16 pages6 Local Government Code PDFPatDabzPas encore d'évaluation

- XU Student Org Financing Guidelines 2016 PDFDocument17 pagesXU Student Org Financing Guidelines 2016 PDFPatDabzPas encore d'évaluation

- True Love Waits Philippines, Inc.: DonationsDocument1 pageTrue Love Waits Philippines, Inc.: DonationsPatDabzPas encore d'évaluation

- Law-3 Test BanksDocument42 pagesLaw-3 Test BanksPatDabz77% (13)

- Acg 4361 Chapter 17 Study Probes SolutionDocument18 pagesAcg 4361 Chapter 17 Study Probes SolutionPatDabzPas encore d'évaluation

- Garuda Indonesia Case AnalysisDocument8 pagesGaruda Indonesia Case AnalysisPatDabz67% (3)

- True Love Waits Philippines, Inc.: FormatDocument4 pagesTrue Love Waits Philippines, Inc.: FormatPatDabzPas encore d'évaluation

- Law Outline Finals PDFDocument20 pagesLaw Outline Finals PDFPatDabzPas encore d'évaluation

- Min Max ProblemsDocument2 pagesMin Max ProblemsPatDabzPas encore d'évaluation

- Process Costing Test Bank SOLUTIONDocument7 pagesProcess Costing Test Bank SOLUTIONPatDabzPas encore d'évaluation

- Acg 4361 Chapter 17 Study Probes SolutionDocument18 pagesAcg 4361 Chapter 17 Study Probes SolutionPatDabzPas encore d'évaluation

- 2013 AAU Volleyball Handbook & Regulations: Amateur Athletic UnionDocument28 pages2013 AAU Volleyball Handbook & Regulations: Amateur Athletic UnionPatDabzPas encore d'évaluation

- 01 Management, The Controller, & Cost AccountingDocument4 pages01 Management, The Controller, & Cost AccountingJay-ar PrePas encore d'évaluation

- BA13 ReviewerDocument5 pagesBA13 ReviewerPatDabzPas encore d'évaluation

- Negotiable Instruments SpecimenDocument5 pagesNegotiable Instruments SpecimenPatDabzPas encore d'évaluation

- Standard Performance EvaluationDocument1 pageStandard Performance EvaluationPatDabzPas encore d'évaluation

- Quality Function Deployment & House of QualityDocument11 pagesQuality Function Deployment & House of QualityAmit MundhePas encore d'évaluation

- The Modern Learning CommonsDocument2 pagesThe Modern Learning CommonsVeka MilenkovaPas encore d'évaluation

- Long Problems Process Costing PDFDocument8 pagesLong Problems Process Costing PDFPatDabzPas encore d'évaluation

- Problems Process Costing SOLUTIONDocument12 pagesProblems Process Costing SOLUTIONPatDabz67% (3)

- Process Costing TEST BANKDocument7 pagesProcess Costing TEST BANKPatDabz67% (6)

- TaxDocument31 pagesTaxanna pinedaPas encore d'évaluation

- Introduction To Radar Warning ReceiverDocument23 pagesIntroduction To Radar Warning ReceiverPobitra Chele100% (1)

- LISTA Nascar 2014Document42 pagesLISTA Nascar 2014osmarxsPas encore d'évaluation

- Marshall Baillieu: Ian Marshall Baillieu (Born 6 June 1937) Is A Former AustralianDocument3 pagesMarshall Baillieu: Ian Marshall Baillieu (Born 6 June 1937) Is A Former AustralianValenVidelaPas encore d'évaluation

- bz4x EbrochureDocument21 pagesbz4x EbrochureoswaldcameronPas encore d'évaluation

- DTMF Controlled Robot Without Microcontroller (Aranju Peter)Document10 pagesDTMF Controlled Robot Without Microcontroller (Aranju Peter)adebayo gabrielPas encore d'évaluation

- Management Interface For SFP+: Published SFF-8472 Rev 12.4Document43 pagesManagement Interface For SFP+: Published SFF-8472 Rev 12.4Антон ЛузгинPas encore d'évaluation

- 1 s2.0 S0304389421026054 MainDocument24 pages1 s2.0 S0304389421026054 MainFarah TalibPas encore d'évaluation

- Modeling and Fuzzy Logic Control of A Quadrotor UAVDocument5 pagesModeling and Fuzzy Logic Control of A Quadrotor UAVAnonymous kw8Yrp0R5rPas encore d'évaluation

- Solved - in Capital Budgeting, Should The Following Be Ignored, ...Document3 pagesSolved - in Capital Budgeting, Should The Following Be Ignored, ...rifa hanaPas encore d'évaluation

- Fact Pack Financial Services KenyaDocument12 pagesFact Pack Financial Services KenyaCatherinePas encore d'évaluation

- Cara Membuat Motivation LetterDocument5 pagesCara Membuat Motivation LetterBayu Ade Krisna0% (1)

- Adjectives With Cork English TeacherDocument19 pagesAdjectives With Cork English TeacherAlisa PichkoPas encore d'évaluation

- CPM W1.1Document19 pagesCPM W1.1HARIJITH K SPas encore d'évaluation

- I.V. FluidDocument4 pagesI.V. FluidOdunlamiPas encore d'évaluation

- Government of India Act 1858Document3 pagesGovernment of India Act 1858AlexitoPas encore d'évaluation

- 1.2 The Main Components of Computer SystemsDocument11 pages1.2 The Main Components of Computer SystemsAdithya ShettyPas encore d'évaluation

- h6811 Datadomain DsDocument5 pagesh6811 Datadomain DsChristian EstebanPas encore d'évaluation

- Aisc Research On Structural Steel To Resist Blast and Progressive CollapseDocument20 pagesAisc Research On Structural Steel To Resist Blast and Progressive CollapseFourHorsemenPas encore d'évaluation

- How To Unbrick Tp-Link Wifi Router Wr841Nd Using TFTP and WiresharkDocument13 pagesHow To Unbrick Tp-Link Wifi Router Wr841Nd Using TFTP and WiresharkdanielPas encore d'évaluation

- Fast Binary Counters and Compressors Generated by Sorting NetworkDocument11 pagesFast Binary Counters and Compressors Generated by Sorting Networkpsathishkumar1232544Pas encore d'évaluation

- Company Law Handout 3Document10 pagesCompany Law Handout 3nicoleclleePas encore d'évaluation

- Kuper ManualDocument335 pagesKuper Manualdonkey slap100% (1)

- Planas V Comelec - FinalDocument2 pagesPlanas V Comelec - FinalEdwino Nudo Barbosa Jr.100% (1)

- Double Inlet Airfoil Fans - AtzafDocument52 pagesDouble Inlet Airfoil Fans - AtzafDaniel AlonsoPas encore d'évaluation

- Enumerator ResumeDocument1 pageEnumerator Resumesaid mohamudPas encore d'évaluation

- La Bugal-b'Laan Tribal Association Et - Al Vs Ramos Et - AlDocument6 pagesLa Bugal-b'Laan Tribal Association Et - Al Vs Ramos Et - AlMarlouis U. PlanasPas encore d'évaluation

- Nasoya FoodsDocument2 pagesNasoya Foodsanamta100% (1)

- Gogte Institute of Technology: Karnatak Law Society'SDocument33 pagesGogte Institute of Technology: Karnatak Law Society'SjagaenatorPas encore d'évaluation

- Kit 2: Essential COVID-19 WASH in SchoolDocument8 pagesKit 2: Essential COVID-19 WASH in SchooltamanimoPas encore d'évaluation

- Developments in Prepress Technology (PDFDrive)Document62 pagesDevelopments in Prepress Technology (PDFDrive)Sur VelanPas encore d'évaluation