Académique Documents

Professionnel Documents

Culture Documents

AKL - Pert 2-2

Transféré par

Astri Ririn ErnawatiDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

AKL - Pert 2-2

Transféré par

Astri Ririn ErnawatiDroits d'auteur :

Formats disponibles

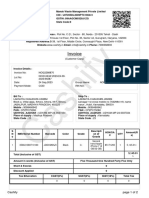

Asistensi AKL1

CH. 2 Consolidation of Wholly Owned Subsidiaries with No Differential

Soal 1 - Consolidated Worksheet at End of First Year (100% Ownership, No

Differential, Equity Method)

Parent Company acquired 100 percent of Sub Company outstanding common

stock for $245.000 on January 1, 20X5, when the book value of Subs net assets

was equal to $245.000. Parent uses the equity method to account for

investments. Trial balance data for Parent and Sub as of December 31, 20X5 are

as follows:

Parent Company

Sub Company

Balance Sheet Item

Debit

Credit

Debit

Credit

Cash

65.000

80.000

Account Receivable

130.000

80.000

Building & Equipment

550.000

175.000

Investment in Sub

265.000

Depreciation Expense

15.000

5.000

Other Expense

60.000

15.000

Dividends Declared

30.000

10.000

Accum. Depr.

350.000

25.000

Accounts Payable

60.000

45.000

Common Stock

400.000

175.000

Retained Earnings

150.000

70.000

Sales

125.000

50.000

Income from Sub

30.000

1.115.000 1.115.000 365.000 365.000

Required:

a. Prepare the journal entries on Parents books for the acquisition of Sub

on January 1, 20X5, as well as any normal equity method entry(ies)

related to investment in Sub Company during 20X5.

b.

Prepare a consolidation worksheet for 20X5 in good form.

Soal 2- Consolidated Worksheet at End of First Year (100% Ownership, No

Differential, Cost Method)

PT Lumajang purchased 100% of PT Garut's voting stock for Rp 170.000.000 on

January 1, 20X6, at underlying book value. PT Lumajang uses the cost method in

accounting for its ownership of PT Garut. On December 31, 20X4, the trial

balance of the two companies are as follows:

Item

Current Assets

Depreciable Assets

Investment in PT Garut Stock

Depreciation Expense

Other Expense

Dividend Declared

Acc. Depreciation

Current Liabilities

Long-term Debt

Common Stock

Retained Earning

Sales

Dividend Income

PT Lumajang

Debit

Credit

238,000,000

500,000,000

170,000,000

25,000,000

150,000,000

50,000,000

200,000,000

70,000,000

100,000,000

200,000,000

318,000,000

230,000,000

15,000,000

1,133,000,000

1,133,000,000

PT Garut

Debit

Credit

160,000,000

300,000,000

15,000,000

90,000,000

15,000,000

90,000,000

50,000,000

120,000,000

100,000,000

70,000,000

150,000,000

580,000,000

580,000,000

Required:

a. Prepare any cost method journal entry(ies) related to the investment in

Sub Company during 20X6.

b. Prepare a consolidation worksheet for 20X6 in good form.

Consolidation Worksheet

Consolidation Worksheet

Parent Co.

Income Statement

Sales

Depreciation Expense

Other Expense

Income from Sub

Net Income

Statement of Retained Earnings

Beginning Balance

Net Income

Less: Dividends Declared

Ending Balance

Balance Sheet

Cash

Account Receivable

Building & Equipment

Accum. Depr.

Investment in Sub

Total Assets

Accounts Payable

Common Stock

Retained Earnings

Total Liab & Eq.

Sub Co.

Dr.

Cr.

Consolidated

PT Lumajang

Income Statement

Sales

Depreciation Expense

Other Expense

Dividend Income

Net Income

Statement of Retained Earnings

Beginning Balance

Net Income

Less: Dividends Declared

Ending Balance

Balance Sheet

Current Assets

Depeciable Assets

Acc. Depreciation

Investment in PT Garut

Total Assets

Current Liablities

Long-term Debt

Common Stock

Retained Earnings

Total Liab & Eq.

PT Garut

Dr.

Cr.

Consolidated

Vous aimerez peut-être aussi

- M Com Part I Accounts Question PDFDocument15 pagesM Com Part I Accounts Question PDFpink_key711Pas encore d'évaluation

- 21St Century Computer Solutions: A Manual Accounting SimulationD'Everand21St Century Computer Solutions: A Manual Accounting SimulationPas encore d'évaluation

- Assignment Questions Jan 2012 Non-BentleyDocument10 pagesAssignment Questions Jan 2012 Non-Bentleyvaisag_01Pas encore d'évaluation

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionD'EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionPas encore d'évaluation

- Consolidation Exmpl 3Document5 pagesConsolidation Exmpl 3tejas_desai775Pas encore d'évaluation

- ACCT5101Pretest PDFDocument18 pagesACCT5101Pretest PDFArah OpalecPas encore d'évaluation

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideD'EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuidePas encore d'évaluation

- Financial Reporting RTP CAP-III June 2016Document24 pagesFinancial Reporting RTP CAP-III June 2016Artha sarokarPas encore d'évaluation

- Advanced Accounting QN August 2018 Group AssignmentDocument9 pagesAdvanced Accounting QN August 2018 Group AssignmentGift MoyoPas encore d'évaluation

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideD'EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuidePas encore d'évaluation

- Corporate LiquidationDocument7 pagesCorporate LiquidationJemarie Alamon100% (1)

- Frequently Asked Questions in International Standards on AuditingD'EverandFrequently Asked Questions in International Standards on AuditingÉvaluation : 1 sur 5 étoiles1/5 (1)

- Corporate LiquidationDocument7 pagesCorporate LiquidationNathallie CabalunaPas encore d'évaluation

- F. Financial Aspect-FinalDocument16 pagesF. Financial Aspect-FinalRedier Red100% (1)

- Aud Theo Part 2Document10 pagesAud Theo Part 2Naia Gonzales0% (2)

- Soal Asistensi 4 - Statement of Cash FlowDocument3 pagesSoal Asistensi 4 - Statement of Cash FlowAbraham Alloy Sembiring MelialaPas encore d'évaluation

- 19684ipcc Acc Vol2 Chapter2Document0 page19684ipcc Acc Vol2 Chapter2kevalcharlaPas encore d'évaluation

- Advanced Accounting Part II Quiz 13 Intercompany Profits Long QuizDocument14 pagesAdvanced Accounting Part II Quiz 13 Intercompany Profits Long QuizRarajPas encore d'évaluation

- © The Institute of Chartered Accountants of IndiaDocument56 pages© The Institute of Chartered Accountants of IndiaTejaPas encore d'évaluation

- Company Accounting 9th Edition Solutions PDFDocument37 pagesCompany Accounting 9th Edition Solutions PDFatup12367% (9)

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsIrfanPas encore d'évaluation

- 07 11 2014 CA FINAL FR Nov 14 Guideline AnswersDocument16 pages07 11 2014 CA FINAL FR Nov 14 Guideline AnswersAmol TambePas encore d'évaluation

- CH 03Document56 pagesCH 03Zelalem GirmaPas encore d'évaluation

- QR Sept10Document1 pageQR Sept10Sagar PatilPas encore d'évaluation

- 2010-10-22 003512 Yan 8Document19 pages2010-10-22 003512 Yan 8Natsu DragneelPas encore d'évaluation

- Accounting RTPDocument40 pagesAccounting RTPMayur KundarPas encore d'évaluation

- Discussion Questions 8-1:: Unit 8 Audit of Equity Accounts Estimated Time: 4.5 HOURSDocument7 pagesDiscussion Questions 8-1:: Unit 8 Audit of Equity Accounts Estimated Time: 4.5 HOURSmimi96Pas encore d'évaluation

- Discussion 2 Second SemDocument8 pagesDiscussion 2 Second SemEmey Calbay100% (1)

- Accounting For Business CombinationDocument17 pagesAccounting For Business CombinationTrace ReyesPas encore d'évaluation

- Tut 2-AfaDocument10 pagesTut 2-AfaDiệp HyPas encore d'évaluation

- BKAF3073 Chapter 3Document84 pagesBKAF3073 Chapter 3Shahrul IzwanPas encore d'évaluation

- Test - Consolidated Financial StatementsDocument1 pageTest - Consolidated Financial StatementsSibika GadiaPas encore d'évaluation

- Test - Consolidated Financial StatementsDocument1 pageTest - Consolidated Financial StatementsSibika GadiaPas encore d'évaluation

- AcctsDocument63 pagesAcctskanchanthebest100% (1)

- ACC 310F: Foundations of Accounting Class Notes - Chapter 1 (Pages 2-8), Chapter 2 and Chapter 3 (Pages 74-79)Document11 pagesACC 310F: Foundations of Accounting Class Notes - Chapter 1 (Pages 2-8), Chapter 2 and Chapter 3 (Pages 74-79)shower_of_gold100% (1)

- 10-Casiguran Aurora 2010 Part1-Notes To FSDocument9 pages10-Casiguran Aurora 2010 Part1-Notes To FSKasiguruhan AuroraPas encore d'évaluation

- Ch01 Beams12ge SMDocument11 pagesCh01 Beams12ge SMWira MokiPas encore d'évaluation

- AccountDocument67 pagesAccountchamalix100% (1)

- Revised Financial Results For Sept 30, 2015 (Result)Document3 pagesRevised Financial Results For Sept 30, 2015 (Result)Shyam SunderPas encore d'évaluation

- Quiz - 3 ABC Problem SolvingDocument6 pagesQuiz - 3 ABC Problem SolvingAngelito Mamersonal0% (1)

- Maynard CompanyDocument5 pagesMaynard CompanySantosh GovindarajanPas encore d'évaluation

- Chapter 4Document25 pagesChapter 4Anonymous XOv12G67% (3)

- Financial Accounting11Document14 pagesFinancial Accounting11AleciafyPas encore d'évaluation

- Gujarat Technological University: InstructionsDocument4 pagesGujarat Technological University: InstructionsMuvin KoshtiPas encore d'évaluation

- Al-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsDocument3 pagesAl-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsXaXim XhxhPas encore d'évaluation

- Suggested Answer Paper CAP III Dec 2019Document146 pagesSuggested Answer Paper CAP III Dec 2019Ankit Jung RayamajhiPas encore d'évaluation

- Multiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer SheetDocument6 pagesMultiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer SheetYaj CruzadaPas encore d'évaluation

- Accounting Lesson Balance Sheet and Income StatementDocument7 pagesAccounting Lesson Balance Sheet and Income StatementSagar Sachdeva100% (2)

- c6 Question BankDocument25 pagesc6 Question BankWaseem Ahmad QurashiPas encore d'évaluation

- Psak 15 Investment in AssociateDocument8 pagesPsak 15 Investment in Associatevrizkal ferlyPas encore d'évaluation

- Sbi Mutual Funds (Analysis of Financial Stastement)Document4 pagesSbi Mutual Funds (Analysis of Financial Stastement)Krishna Prasad GaddePas encore d'évaluation

- Attention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Document17 pagesAttention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Mahalaxmi RamasubramanianPas encore d'évaluation

- IFRS Pills Reloaded Day 29 & 30Document2 pagesIFRS Pills Reloaded Day 29 & 30melo landryPas encore d'évaluation

- Group 4 Symphony FinalDocument10 pagesGroup 4 Symphony FinalSachin RajgorPas encore d'évaluation

- Lesson 1 Notes - Advanced FRDocument8 pagesLesson 1 Notes - Advanced FRwambualucas74Pas encore d'évaluation

- Advanced Accounting 2 Consolidated FsDocument90 pagesAdvanced Accounting 2 Consolidated FsrichelledelgadoPas encore d'évaluation

- Ectangle Harmaceuticals TD: Prepared byDocument8 pagesEctangle Harmaceuticals TD: Prepared byOndhotara AkashePas encore d'évaluation

- 2004 Rga Qe PaperDocument29 pages2004 Rga Qe PaperAstri Ririn ErnawatiPas encore d'évaluation

- David sm13 PPT 05Document17 pagesDavid sm13 PPT 05Mughal HijabPas encore d'évaluation

- The Internal Environment Competitive Strategy ComboDocument31 pagesThe Internal Environment Competitive Strategy ComboAstri Ririn ErnawatiPas encore d'évaluation

- Jurnal KhususDocument18 pagesJurnal KhususAstri Ririn ErnawatiPas encore d'évaluation

- Solution Asistensi Pertemuan 9Document6 pagesSolution Asistensi Pertemuan 9Astri Ririn ErnawatiPas encore d'évaluation

- Solution Asistensi Chapter 11Document7 pagesSolution Asistensi Chapter 11Astri Ririn ErnawatiPas encore d'évaluation

- 6 Kalimas of Islam With English TranslationDocument5 pages6 Kalimas of Islam With English TranslationAfaz RahmanPas encore d'évaluation

- POLITICAL SYSTEM of USADocument23 pagesPOLITICAL SYSTEM of USAMahtab HusaainPas encore d'évaluation

- Important SAP MM Tcodes 1Document2 pagesImportant SAP MM Tcodes 1shekharPas encore d'évaluation

- Stanley Chesley v. Kentucky Bar Association, KBA Reponse Brief To Board of Governors, 5/10/11Document81 pagesStanley Chesley v. Kentucky Bar Association, KBA Reponse Brief To Board of Governors, 5/10/11stanwichPas encore d'évaluation

- Intro To Lockpicking and Key Bumping WWDocument72 pagesIntro To Lockpicking and Key Bumping WWapi-3777781100% (8)

- ADR PresentationDocument9 pagesADR PresentationAshraf AliPas encore d'évaluation

- Historical Background of The PNPDocument1 pageHistorical Background of The PNPGloria AsuncionPas encore d'évaluation

- DENTAL JURIS - Dental Legislation PDFDocument2 pagesDENTAL JURIS - Dental Legislation PDFIsabelle TanPas encore d'évaluation

- Safety Data Sheet: Ubstance and Ource DentificationDocument6 pagesSafety Data Sheet: Ubstance and Ource DentificationMuhPas encore d'évaluation

- The Hamas CharterDocument16 pagesThe Hamas CharterFrancesca PadovesePas encore d'évaluation

- TRUE OR FALSE. Write TRUE If The Statement Is True and Write FALSE If The Statement Is FalseDocument2 pagesTRUE OR FALSE. Write TRUE If The Statement Is True and Write FALSE If The Statement Is FalseBea Clarence IgnacioPas encore d'évaluation

- Punjab National BankDocument28 pagesPunjab National Bankgauravdhawan1991Pas encore d'évaluation

- Approaches To CSRDocument3 pagesApproaches To CSRBryann Nyangeri100% (7)

- Bill Iphone 7fDocument2 pagesBill Iphone 7fyadawadsbPas encore d'évaluation

- House ReceiptDocument1 pageHouse ReceiptArunPas encore d'évaluation

- Parole and ProbationDocument12 pagesParole and ProbationHare Krishna RevolutionPas encore d'évaluation

- Eastern Broadcasting CorpDocument2 pagesEastern Broadcasting CorpEijnedObidocsePas encore d'évaluation

- Chapter 1 - Electricity and MagnetismDocument41 pagesChapter 1 - Electricity and MagnetismDarwin Lajato TipdasPas encore d'évaluation

- AMENDED COMPLAINT Blair vs. 3 Boys Farms-Cannabis Cures Investments 2019Document23 pagesAMENDED COMPLAINT Blair vs. 3 Boys Farms-Cannabis Cures Investments 2019Teri BuhlPas encore d'évaluation

- Questa Sim Qrun UserDocument50 pagesQuesta Sim Qrun UsertungnguyenPas encore d'évaluation

- 55 Salas, Jr. vs. Aguila, G.R. 202370, September 23, 2013Document3 pages55 Salas, Jr. vs. Aguila, G.R. 202370, September 23, 2013Lara Yulo100% (1)

- UHF Integrated Long-Range Reader: Installation and User ManualDocument24 pagesUHF Integrated Long-Range Reader: Installation and User ManualARMAND WALDOPas encore d'évaluation

- Banking Sector Reforms: by Bhupinder NayyarDocument18 pagesBanking Sector Reforms: by Bhupinder NayyarPraveen SinghPas encore d'évaluation

- MahindraDocument3 pagesMahindrachiru14310% (1)

- 2.7 Industrial and Employee RelationDocument65 pages2.7 Industrial and Employee RelationadhityakinnoPas encore d'évaluation

- Ifm BopDocument18 pagesIfm Bopsunil8255Pas encore d'évaluation

- QCP Installation of Ahu FahuDocument7 pagesQCP Installation of Ahu FahuThulani DlaminiPas encore d'évaluation

- HW1Document4 pagesHW1hung hoangPas encore d'évaluation

- Health and Privacy PDFDocument40 pagesHealth and Privacy PDFMonika NegiPas encore d'évaluation

- Birch Bark Roll of The Woodcraft Indians Containing Their Constitution Laws Games and Deeds Ernest Thompson Seton 1907Document88 pagesBirch Bark Roll of The Woodcraft Indians Containing Their Constitution Laws Games and Deeds Ernest Thompson Seton 1907Shivananda2012100% (2)