Académique Documents

Professionnel Documents

Culture Documents

Far 4 Project Paper

Transféré par

Parimalar RajindranCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Far 4 Project Paper

Transféré par

Parimalar RajindranDroits d'auteur :

Formats disponibles

BKAF 3073 2014

Case I : Green Berhad

EXECUTIVE SUMMARY

In Case No.1, Green Berhad is considering an investment in Alam Sdn Bhd, a

new joint venture company wishes that established at the end of year 2013. It is a way

to obtained extra profit to the company as the investment will pay them back with

dividend but it also comes with risk that Mr Najib Abdullah need to consider before

investing in Alam Sdn Bhd.

To compute the value of the equity of the Alam Sdn Bhd, we use the Present

Value instead of Present Value of Ordinary Annuity. The reason we choose Present

Value is due to we are doing forecasting in price of the share in order to make

decision to invest in Alam Sdn Bhd which is more suitable than the Present Value of

Ordinary Annuity. We use the abnormal earning valuation model. The value of equity

for Alam Sdn Bhd is the sum of the present value of expected future abnormal

earnings and beginning book value of asses.

We need to determine Alams intrinsic price-to-earnings (P/E) ratio. In order to

do that, we use formula value per share divided to EPS. The purpose is to determine

how much the investor is willing to pay for every RM current earnings by the

company. We also want to see the expected growth by the investor in future compare

on what had been forcasted by Green Bhd.

We will recommend to Mr Najib Abdullah to not invest in the Alam Sdn Bhd as

the investment will not benefit Green Berhad

The purpose of all the calculations above is to look of potential of Alam Sdn

Bhd. From that , we can recommend to Mr Najib Abdullah in order to make a decision

whether they want to invest in Alam Berhad or not.

BKAF 3073 2014

Case No.1

Question 1

Comment on how the Free Cash Flow spreadsheet calculation compares with how

accountants and auditors might compute free cash flow directly from the companys

financial statements.

2014

2015

2016

2017

2018

2019

2020

RM 2034

RM 2130

RM 2218

RM 2256

RM 2278

RM 2404

RM 2546

Beginning

of

book

RM 6300

value of net

asset

RM 6290

RM6830

RM 7330

RM 7220

RM 8260

RM 8850

10%

10%

10%

10%

10%

10%

RM 629

RM 683

RM 733

RM 722

RM 826

RM855

RM 1501

RM 1535

RM 1523

RM 1556

RM 1578

RM 1661

Net Income

Required

Rate

of

10%

Return

Required

normal

RM 630

earnings

Expected

future

RM 1404

abnormal

earnings

1.

Forecast expected future abnormal earnings

Present value of expected future abnormal earnings

Expected

future

abnormal

earnings

2014

2015

2016

2017

2018

2019

2020

RM 1404

RM 1501

RM 1535

RM 1523

RM 1556

RM 1578

RM 1661

0.82645

0.75131

0.68301

0.62092

0.56447

0.51316

RM 1241

RM 1153

RM 1040

RM 966

RM 891

RM 852

Present

0.90909

value factor

Present

value

of

RM 1276

each future

abnormal

earnings

BKAF 3073 2014

Sum of all present values

RM 7,419

Beginning equity book

value

RM 6,300

Value of business

opportunity

RM 13,719

Value per share = RM 13.71

Expected abnormal earnings beyond year 2020

Abnormal earning

1,661

Residual earning grow rate

1.06

Expected abnormal earning

1,760.66

Perpetuity factor[1/(0.1 0.06)]

25

44,016.50

Present value factor

0.51316

Present value of terminal value

22,587.51

RM

Beginning book value

6,300

Sum of all present value

7,419

Present value of terminal value

22,587.51

Value of equity Alam Sdn Bhd

36,306.51

BKAF 3073 2014

Question 2

Determine Alams intrinsic price-to-earnings (P/E) ratio. Assuming the actual marketbased P/E ratio is 20, provide your recommendations about this company in

comparison to the intrinsic P/E ratio.

Alams intrinsic price-to-earnings ratio (P/E ratio)

Value per share / EPS

= 36,306.51 / 2,034

= 17.85

It is mean that investor are willing to pay RM 20 for every RM current earnings by the

company. But it is show that Alams intrinsic price-to-earnings ratio is 17.85 which is

mean that the investor is expecting higher growth in the future compare on what had

been forcasted by Green Bhd and willing to pay more for every RM 1 earnings of the

company.

BKAF 3073 2014

Case II : CeasTECH Solutions Berhad

EXECUTIVE SUMMARY

In Case two we are required to discuss in detail regarding discounted cash flow

valuation of CeasTECH.

Cash flow valuation is a valuation method used to estimate the attractiveness of an

investment opportunity. It uses the future free cash flow projections and discounts

them to arrive at a present value, which is then used to evaluate the potential for

investment. If the value is higher than the current cost of investment that means that

the opportunity is good for the company.

CeasTECH Solutions Berhad develops digital media products, services, and

technologies for consumers and content development professionals. In our case

study, it is assumed that the stock is valued at RM13 per share, Current market price

for stock is RM8.71, Weighted average cost of capital of 12% and a Perpetual growth

rate of 5%..

Based on case 2, we have been given several information for CeasTECH Solutions

Berhad. Apart from that, we need to comment on how free cash flow spreadsheet

calculation compares with how accountants and auditors might compute free cash

flow. We determine it by compare the spreadsheet with actual annual report and see

the difference in terms of calculation of cash flow. We also need to identify annual

rate of growth in forecasted sales and free cash flow for each year given. We identify

it by using formula and comment the amount by see the percentage on that amount.

Besides, we also determine the role of WACC in discounted cash flow valuation

analysis. We identify it by make some calculation. Moreover, we also need to

comment on present value calculation. We identify it by looking at the spreadsheet

and make some calculation. Then, we need to identify why analyst subtract an amount

for net debt in arriving at equity value. We identify it by doing some calculation. Then

we need to analysis amount on share value.

The actions that we are going to recommend to the CeasTECH Solution Berhad and

Kencana Finance House is that the both companies needs to communicate with each

other regarding which method to be used in computing the share value. Because of

the lack of communication and teamwork between these 2 companies for preparing

the free cash flow statement brings the difference in result.

BKAF 3073 2014

CASE NO.2

Question 1

Comment on how the Free Cash Flow spreadsheet calculation compares with how

accountants and auditors might compute free cash flow directly from the companys

financial statements

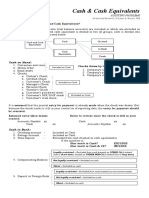

The computation of Free Cash Flow spreadsheet is by determines the EBITDA.

EBITDA is used to analyse and compare profitability between companies and

industries because it eliminates the effects of financing and accounting decisions.

EBITDA also non-GAAP measure that allows a greater amount of discretion as to what

is (and is not) included in the calculation. This also means that companies often

change the items included in their EBITDA calculation from one reporting period to

the next. After obtain the amount of EBITDA, the amount will subtract with capital

expenditures and cash taxes to get free cash flow.

While, the computation of Free Cash Flow for companies financial statement is by

compute the cash flow from operation (operating cash) minus capital expenditure.

But, to do it another way, look to the income statement and balance sheet. Start with

net income and add back charges for depreciation and amortization. Make an

additional adjustment for changes in working capital, which is done by subtracting

current liabilities from current assets. Then subtract capital expenditure (or spending

on plants and equipment).

BKAF 3073 2014

QUESTION 2

Compute the annual rate of growth in forecasted sales and free cash flow for each

year (2014 through 2021). Comment on the relative rates of sales and free cash flow

growth.

Formula: Annual Rate of Growth:

2014

Forecasted

2015

2016

24.57% 70.67% 48.06%

2017

2018

2019

2020

2021

72.96% 15%

15%

15%

15%

Sales

Free Cash 17.95% 82.61% 107.14% 94.25% 17.46% 27.46% 31.62% 19.82%

Flow

Computation:

Year

Forecast sale

Free cash flow

2014

2015

2016

2017

2018

2019

2020

2021

BKAF 3073 2014

Comment:

Free Cash Flow depends on sales because to get free cash flow, we need to use

EBITDA. In calculation of EBITDA, the formula is sales minus expenses. EBITDA will

be high if sales is high, then it also effect the free cash flow which is free cash flow

will become increases. Apart from the calculation also, we can identify on how many

revenues will change to cash. This can be identified by the percentage of the forecast

sales and free cash flow that have been computed. The higher the percentage of sales

and free cash flow, the higher the probability of revenues that will change to cash.

Question 3

What role does the 12% weighted average cost of capital assumption play in the

discounted cash flow valuation analysis?

Weighted Average Cost of Capital (WACC) is used in discounting cash flows for

calculation of NPV and other valuations for investment analysis. WACC represents

the average risk faced by the organization. It would require an upward adjustment if it

has to be used to calculate NPV of project which are more risk than the company's

average projects and a downward adjustment in case of less risky projects.

For the CeasTECH Solutions Berhad, the 12% will determine how much the company

get went they make an investment. But, if the company's return is less than WACC,

the company is shedding value, which indicates that investors should put their money

elsewhere. The 12% WACC also will help the company to decide whether to invest or

not because WACC will present the minimum rate of return at which company

produce for the investor.

BKAF 3073 2014

Question 4

Write a brief paragraph explaining to someone unfamiliar with present value

calculations how the figure RM155.19 for Present value 20142021 is computed.

Present value is a future amount of money that has been discounted to reflect its

current value, as if it existed today. The formula to get present value is;

Where FV is the future amount of money that must be discounted,

is the number of

compounding periods between the present date and the date where the sum is worth

FV , r is the interest rate for one compounding period (the end of a compounding

period is when interest is applied, for example, annually, semi-annually, quarterly,

monthly, daily). The interest rate r, is given as a percentage, but expressed as a

decimal in this formula.

CeasTECH also used the same formula above to calculate PV. The calculations of PV

for year 2014 until 2021 are shown below in the table 1.1 and it has been simplified.

After get the PV for each year, from 2014 until 2021, CeasTECH make sum all the PV

for each year to get that amount which is RM155.19. That is how CeasTECH calculate

the amount.

Table 1.1

Year

Present value

2014

4.6(0.893)=4.11

2015

8.4(0.797)=6.7

2016

17.4(0.711)=12.38

2017

33.8(0.636)=21.48

2018

39.7(0.567)=22.53

2019

50.6(0.5070)=25.64

2020

66.6(0.452)=30.13

2021

79.8(0.404)=32.23

Total of present value 155.2

BKAF 3073 2014

Question 5

Explain how the figure RM460.43 for Present value beyond 2021 is computed.

The first step to determine the figure RM460.43 for present value beyond 2021 is by

identifies the terminal value (TV). It refers to the value of the company at the end of

the forecasting period. In order to identify that, we need to use free cash flow, WACC

and perpetual growth rate. All of this has been given in the spreadsheet. The

calculations are as below:

=RM1, 140.00

Once TV has been determined, we calculate the Discounted Rate in order to determine

the Present Value of Terminal Value. The calculations are as below:

=RM 460.43

Based on the calculation above, RM1140 is from the terminal values that have been

computed, while the 0.12 is the WACC percentage and the n=8 are referring to year

from 2014 until 2021.

10

BKAF 3073 2014

Question 6

Why does the analyst team subtract an amount for net debt in arriving at Equity

value? (Note: The term net debt is defined for spreadsheet purposes as financial

liabilities (e.g., loans) minus any financial assets (e.g., money market investments)

and is negative in the spreadsheet because CeasTECHs financial assets exceed its

financial liabilities.)

The analyst team subtract an amount for net debt in arriving at equity value. The

amount of RM615.6 million is representing enterprise value which is the value of a

companys net operating assets. So, to get equity value, CeasTECH Berhad needs to

subtract their net operating assets with net debt. The method used by the analyst

(Discounted Cash Flow Valuation), the result of adding all the present value for the

future cash flow forecasted and also the Terminal Value RM 615.60 is actually show

the value of the business as whole. Furthermore, as CeasTECH forecast earnings

growth for the firm, they generally assume that it will increase debt as it grows. So,

they no need to subtract out the value of these future debt issues when estimating

equity value today because it is a current value and these future claims do not exists

today.

Enterprise value Net debt = Equity value

11

BKAF 3073 2014

Question 7

What share value estimate would the Kencana Finance House team have calculated if

they had used an? Why?

2014

RM

Expected future value(net income)

137.4

Required (normal) earnings:

beginning equity book value

672.1

Investors required rate of return (%)

12

required normal earnings

80.652

Expected future abnormal earnings

56.75

Expected future abnormal earnings

56.75

present value factor

4.11

-present value factor of abnormal earnings

52.64

Equity value

672.1

share outstanding

52.64

share value

12.77

If using an abnormal earnings value approach, the estimate share value of Kencana

Finance House team is RM12.77. In general, abnormal earnings value approach and a

discounted cash flow approach should give the same equity value but for this case,

theres different between both approached.

The major difference between the two approaches is:

a) Abnormal earnings valuation recognizes that the accrual process may already

have performed a portion of the task.

b) The discounted cash flows approach moves back to the primitive cash flows

underlying the accruals.

12

BKAF 3073 2014

Question 8

8) Sometimes analysts research reports contain inadvertent computational errors.

What would the estimated value of CeasTECHs stock have been if the Kencana

Finance House team mistakenly used 34.60 million shares outstanding rather than the

correct 51.69 million share count?

The estimated value of of CeasTECHs stock have been if the Kencana Finance House

team mistakenly used 34.60 million shares outstanding rather than the correct 51.69

million share count is as calculated below;

Value of price per shares

1) Correct Equity Value

2) Incorrect Equity Value

= 51.69 million

= 34.60 million

672.1m34.6m shares

= RM 19.42 per shares

Current market price of RM8.71

If Kencana Finance House mistakenly used 34.6 million shares.

The estimated value of CeasTeach will be RM10.72 (RM 19.42 RM 8.71).

If Kencana Finance House use the correct shares, which is rm51.69m million.

The estimated value will be RM 4.29 (RM 13 - RM 8.71).

This computation mistake will affect the decision making of the investors whether

they want invest or not and the research report will provide an inaccurate information

that may influence the entitys reputation and images. So, if the CeasTECHs have

been mistakenly recorded the number of share outstanding, the shareholders can

expect their return in the future because the errors are higher than the expected. The

high estimated share value will lead to the meaning of the share is more valued

compare to the actual value of the share. The users will be overvalued the share

value. This mistaken number of share creates misunderstanding as the information

incorrect. Thus, wrong report analysis lead to wrong decision making and this

wrongness also can affect the organization.

13

BKAF 3073 2014

REFERENCES

1. Definition

of

Discounted

Cash

Flow.

Retrieved

from

<http://www.investopedia.com/terms/d/dcf.asp>

2. Definition

of

Abnormal

Earnings

Valuation

Model.

Retrieved

from

<http://www.investopedia.com/terms/a/abnormal-earnings-valuation-model.asp>

3. Lawrence Revsine (2012). Financial reporting and Analysis (5th Edition). The Role of

Financial Information in Valuation, Cash Flow Analysis, and Credit Risk Assessment.

McGraw-Hill. New York.

14

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- SoftwareDocument38 pagesSoftwareRaven R. LabiosPas encore d'évaluation

- Comprehensive BudgetDocument50 pagesComprehensive BudgetAlfitri PuspitaPas encore d'évaluation

- Starbucks Coffee CompanyDocument23 pagesStarbucks Coffee CompanyParimalar RajindranPas encore d'évaluation

- Paper LBO Model Example - Street of WallsDocument6 pagesPaper LBO Model Example - Street of WallsAndrewPas encore d'évaluation

- Corporate Board ResolutionDocument2 pagesCorporate Board ResolutionkimitiPas encore d'évaluation

- AP 5904 InvestmentsDocument9 pagesAP 5904 InvestmentsJake BundokPas encore d'évaluation

- LECTURE NOTES - Aud ProbDocument15 pagesLECTURE NOTES - Aud ProbJean Ysrael Marquez100% (1)

- Hedging HandbookDocument931 pagesHedging HandbookNicolas FontanaPas encore d'évaluation

- Corporate Reporting Past Question Papers (ICAB)Document55 pagesCorporate Reporting Past Question Papers (ICAB)Md. Zahidul Amin100% (1)

- ConclusionDocument2 pagesConclusionParimalar Rajindran83% (6)

- WalmartDocument32 pagesWalmartParimalar Rajindran100% (1)

- An Overview of GST MalaysiaDocument23 pagesAn Overview of GST MalaysiaParimalar RajindranPas encore d'évaluation

- An Overview of GST MalaysiaDocument23 pagesAn Overview of GST MalaysiaParimalar RajindranPas encore d'évaluation

- Analysis of Business CombinationsDocument58 pagesAnalysis of Business Combinationstehsin123Pas encore d'évaluation

- Ex-21 1Document7 pagesEx-21 1Billy FowlerPas encore d'évaluation

- FABM 1 NotesDocument13 pagesFABM 1 NotesNestyn Hanna VillarazaPas encore d'évaluation

- What Is A Real Estate Investment Trust?: AreitisaDocument45 pagesWhat Is A Real Estate Investment Trust?: AreitisakoosPas encore d'évaluation

- 01 - Preweek Lecture and ProblemsDocument15 pages01 - Preweek Lecture and ProblemsMelody GumbaPas encore d'évaluation

- Inter Accounts Super 20 QuestionsDocument41 pagesInter Accounts Super 20 QuestionsOm AgarwalPas encore d'évaluation

- Report On IFIC Bank LimitedDocument34 pagesReport On IFIC Bank LimitedGazi Shahbaz Mohammad0% (1)

- FinancialStatement 2019Document298 pagesFinancialStatement 2019Tonga ProjectPas encore d'évaluation

- Working CapitalDocument26 pagesWorking CapitalJuan CarlosPas encore d'évaluation

- R10 Rogers Et Al., 2002, HBR, Lessons From Private-Equity MastersDocument9 pagesR10 Rogers Et Al., 2002, HBR, Lessons From Private-Equity MastersRitwik KumarPas encore d'évaluation

- Chapter 04Document101 pagesChapter 04Ha100% (1)

- Phil. Cpa Licensure Examination AuditingDocument9 pagesPhil. Cpa Licensure Examination AuditingbasmalabassyPas encore d'évaluation

- BF PP 2017Document4 pagesBF PP 2017Revatee HurilPas encore d'évaluation

- Accountancy Project - SampleDocument14 pagesAccountancy Project - SampleAdityaPas encore d'évaluation

- AnswersDocument9 pagesAnswersSandip AgarwalPas encore d'évaluation

- CH 4 Smart BookDocument32 pagesCH 4 Smart BookEmi NguyenPas encore d'évaluation

- 2012Document133 pages2012MwiAccounts BranchPas encore d'évaluation

- Regulatory Framework of Corporate GovernanceDocument21 pagesRegulatory Framework of Corporate GovernanceKEVAL SHAHPas encore d'évaluation

- LIC AR 2018 19 Final Web PDFDocument344 pagesLIC AR 2018 19 Final Web PDFArshdeep KaurPas encore d'évaluation

- NHTM Ch3Document19 pagesNHTM Ch3jnaxx27Pas encore d'évaluation

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooPas encore d'évaluation

- Glenn Grimes Is The Founder and President of Heartland ConstructionDocument1 pageGlenn Grimes Is The Founder and President of Heartland Constructiontrilocksp SinghPas encore d'évaluation