Académique Documents

Professionnel Documents

Culture Documents

CardEase TestCardData

Transféré par

Gregorio GazcaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CardEase TestCardData

Transféré par

Gregorio GazcaDroits d'auteur :

Formats disponibles

CardEase

Test Payment

Card Data

An overview of test card information for integration testing on the

CardEase platform.

Author: Fred Spooner

st

Issue 1. 21 June 2013.

COMMERCIAL-IN-CONFIDENCE

Copyright (c) CreditCall Limited, 1999-2013

CreditCall

CardEase Test Payment Card Data

Action

Created

Name

Fred Spooner

Date

23/05/13

Release

Version

Draft 1

Draft 2

Draft 3

Date Released

24/05/13

21/06/13

01/07/13

Change Notice

Pages Affected

All

All

All

Remarks

Draft

Draft

Proofread

Distribution List

Name

Organisation

Title

David Kinmond

CreditCall Ltd.

Development Manager

Nigel Jewell

CreditCall Ltd.

Internet Services Manager

CreditCall Corporation

1133 Broadway, Suite 706

New York, NY 10010

USA

T +1 (212) 807 4979

F +1 (212) 330 8006

CreditCall Ltd

Merchants House South

Wapping Road

Bristol BS1 4RW

T 0117 930 4455

F 0117 930 4477

E support@creditcall.com

W www.creditcall.com

CreditCall

CardEase Test Payment Card Data

Contents

Section 1 Introduction

1.1

Overview

Section 2 Test Card Data

2.1

Engineers Test Card

2.2

Basic Test Cards

2.3

Test Cardholder Personal Information

Section 3 Special Amounts/Test Cases

3.1

Transaction Time

3.2

Address Verification Service (AVS)

3.3

Card Security Code (CSC)

3.4

3-D Secure

3.5

ICC Tags

3.6

Special Amounts

CreditCall Corporation

1133 Broadway, Suite 706

New York, NY 10010

USA

T +1 (212) 807 4979

F +1 (212) 330 8006

CreditCall Ltd

Merchants House South

Wapping Road

Bristol BS1 4RW

T 0117 930 4455

F 0117 930 4477

E support@creditcall.com

W www.creditcall.com

CreditCall

CardEase Test Payment Card Data

Section 1 - Introduction

1.1 OVERVIEW

This document provides various types of test payment card information that is available for integrators to use

during the testing phase of implementing a CardEase product. This data can be used on the test platform with

any CardEase service such as (but not limited to) CardEaseV1, CardEaseXML, and eKashu.

Keep in mind that these cards are not enrolled with any issuing bank, and therefore will not work (and should

not be used) on our live system at all. However, live functioning cards can also be used on the test platform

without any funds being reserved or transferred.

In addition to the basic information required by the CardEase platform, extra details such as cardholder

names and addresses, CSC numbers and 3-D Secure information are also provided, in order to aid in testing

the verification features of CardEase.

A list of special amounts can also be found in this document. They invoke specific response conditions when

provided in a CardEase request. This will be useful for ensuring that errors returned to the client application

by the CardEase platform are handled properly by the integrator.

Section 2 Test Card Data

2.1 ENGINEERS TEST CARD

The engineers test card behaves like a normal card when processing a request, except that CardEase will

always return the result: Test OK /Transaction Declined. Transactions using this cards information will only

test communication between the client application and the CardEase platform, and will not register on the

WebMIS test platform. There are no cardholder name or address details attached to this card data. Please

keep in mind that any ResultCode that is NOT explicitly Approved should be treated as Declined, and

the transaction should not be fulfilled.

Description

Card

Scheme

PAN

Valid

From

Valid

To

CSC

Track 2 (mag stripe)

Engineers test card

N/A

8944179900000997

01/06

12/49

555

;8944179900000997=49121010912?

Fig. A

CardEase Test Payment Card Data

CreditCall

2.2 BASIC TEST CARD INFORMATION

Below is a table of varying types of different card information that can be used while testing CardEase.

The corresponding cardholder name/address information can be found in section 2.3.

nd

N.B.: Track 2 refers to the 2 track of the magnetic stripe found on most payment cards. It contains the card

information required to process magnetic stripe transactions. PAN is an acronym for Primary Account

Number and refers to the long card number found on most payment cards.

Card

#

Card

Provider

PAN

Valid

From

Valid

To

CSC

3-D Secure

Password

Amex

341111597241002

01/06

12/20

1111

;341111597241002=2012030948492?

Visa Debit

4539791001730106

01/06

12/20

222

;4539791001730106=20061010912?

Diners

36555500001111

01/06

12/20

Discover

6011000991300009

01/06

12/20

JCB

3566000020000410

01/06

12/20

Maestro

(Int.)

6759184500000120768

01/06

12/20

777

;6759184500000120768=2012101?

Maestro

(Int.)

6333000023456788

01/06

12/20

888

;6333000023456788=20062060912?

MasterCard

5301250070000191

01/06

12/20

999

;5301250070000191=20121010912?

Visa

4012000033330026

01/06

12/20

123

;4012000033330026=20121011000012345678?

10

Visa

4111111111111111

06/06

12/20

11

Maestro (UK)

675940111800103233

01/06

12/20

456

12

MasterCard

5123450000000008

01/06

12/20

512

12345

;5123450000000008=2012?

13

Visa

4123450131003312

01/06

12/20

412

12345

;4123450131003312=2012?

14

Solo

676740055051020218

06/09

12/20

563

15

Maestro (UK)

6759111011100000

01/06

12/20

000

Track 2 (mag stripe)

;36555500001111=20121011234567440?

444

;6011000991300009=201210110000?

;3566000020000410=20121011000000000000?

;4111111111111111=20121011000012345678?

;675940111800103233=2012101000006?

;676740055051020218=2012?

password

;6759111011100000=2012?

Fig. B

N.B. the Card # field identifies which name and address is allocated to which card data, e.g. card #9, a Visa card with

PAN 4012000033330026, belongs to Charlotte Dennis who lives at 123 Fake Street.

CardEase Test Payment Card Data

CreditCall

2.3 TEST CARDHOLDER PERSONAL INFORMATION

Card

#

Title

First Name

Surname

Address

Line 1

Mr

Hayden

Dyer

Mr

Sean

Mr

Address

Line 2

Town/

City

Country

ZIP/Post

Code

Home Phone #

Mobile Phone #

Fraud Risk

Result

27 Broadway

New York

USA

10004 - 1601

01173111001

07777000001

Low

Fitzgerald

34 Broadway

New York

USA

10004 - 1608

01173111002

07777000002

Low

Harley

Sims

Diners Club UK Ltd

Salford

UK

M5 3BH

01173111003

07777000003

Low

Mr

Oliver

Begum

16 5TH ST SE

Washington DC

USA

20003-1120

01173111004

07777000004

Low

Mr

Owen

Hardy

Flat 10

47 Park Street

London

UK

W1K 7EB

01173111005

07777000005

Medium

Mr

Finlay

Wheeler

1 Cornwallis Avenue

Clifton

Bristol

UK

BS8 4PP

01173111006

07777000006

Medium

Mr

Cameron

Weston

1 Bd Victor

Paris

France

75015

01173111007

07777000007

Medium

Mr

Anthony

Tyler

73 Whiteladies Road

Bristol

UK

BS8 2NT

01173111008

07777000008

Medium

Mrs

Charlotte

Dennis

123 Fake Street

Springfield

USA

SF1234

01173111009

07777000009

High

10

Mrs

Zoe

Webb

28 Bishopgate Street

Sedgeford

UK

PE36 4AW

01173111010

07777000010

High

11

Mrs

Holly

Cole

Flat 1

Manchester

UK

BL1 7TY

01173111011

07777000011

High

12

Mrs

Kiera

Cook

56 Gloucester Road

Glasgow

UK

GL1 2US

01173111012

07777000012

High

13

Miss

Shannon

Freeman

782 Northampton Lane

Hull

UK

HL8 2UA

01173111013

07777000013

Low

14

Miss

Amelie

Johnson

432 Main Road

Bath

UK

BA2 8UY

01173111014

07777000014

Medium

15

Miss

Anna

Barrett

3 Wapping Road

Bristol

UK

BS1 7YT

01173111015

07777000015

High

53 Diners Road

Clifton

10 High Street

Fig. C

CreditCall

CardEase Test Payment Card Data

Section 3 Special Amounts/Test Cases

There are a few parameters to consider when making use of the CardEase testing platform. This section explains some

of the results that can be expected from doing so.

3.1 TRANSACTION TIME

The CardEase test platform will sleep for a random amount of time (between 250-2000ms) to simulate a

real authorisation transaction with the payment processor.

3.2 ADDRESS VERIFICATION SERVICE (AVS)

If a live payment card (i.e. not a test card detailed in this document) is used, the CardEase test platform will

by default return the ZIP/post code and address as matched, even if it does not match the cardholders

details.

3.3 CARD SECURITY CODE (CSC)

The test cards in this document with associated CSCs will be checked for a match by the test CardEase

platform, and the transaction will be declined if they do not match. Any other card information will result in a

not checked result when a CSC isnt provided, or matched if one is provided, regardless of whether it is

correct or not.

In a live environment, authorisation (including preauth) requests that are supplied a CSC send it on to the

acquirer. The acquirer may or may not decline the transaction based on a failed CSC check, but it is safer to

assume that it will not. It is advisable for an integrator to check the CSC result when the response contains an

approved result code, if they require this extra layer of security.

3.4 3-D SECURE

A transaction ID (XID) of MDAwMDAwMDAwMDAwMDAwMDAwMDAw=" (without double quotes) will

cause the transaction to be declined.

3.5 ICC TAGS

When performing ICC transactions on the CardEase test platform, the Issuer Authentication Data tag must be

set to a specific value in order to achieve approval from the mock card issuer:

Tag

Value

0x91

1122334455667788

Fig. D

CardEase Test Payment Card Data

CreditCall

3.6 SPECIAL AMOUNTS

The amounts specified in fig. E below will invoke a certain response when processed in a transaction. These

amounts will trigger the anticipated response when used with a non-test card, that is, a card not detailed

above in this document.

Amount (Major

Units)

Result

Notes

1.00

2.00

3.00

Approved

Approved

Approved

AuthCode will be random value.

AuthCode always 22222.

AuthCode always AAAAA.

AuthCode always 12AB34.

4.00

Approved

When using EMV, returns issuer script results for an ICC transaction.

5.00

6.00

Declined

Decline + Capture

ARC=05.

ARC=04.

47.23

Voice Referral

Will return phone number (fake or CreditCall office).

47.25

47.26

47.27

Approved

Approved

Approved

Authorisation takes 23s AuthCode will be random.

ARC=08 (Partial Approval).

ARC=08 (Approval with ID).

48.03

48.04

48.05

48.06

Declined

Declined

Declined

Declined

Extended PaymentProvider error code: host_connection_error.

Extended PaymentProvider error code: host_connection_timeout.

Extended PaymentProvider error code: host_request_rejected.

Extended PaymentProvider error code: host_response_invalid.

Fig. E

Vous aimerez peut-être aussi

- SSNDocument1 377 pagesSSNBrymo Suarez100% (9)

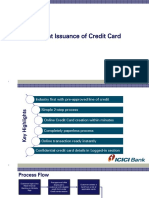

- Instant Issuance of Credit Card - Process Flow-1Document15 pagesInstant Issuance of Credit Card - Process Flow-1pawanPas encore d'évaluation

- Join Us On Telegram Channel For Real Hacker @Accounts_HackedDocument4 pagesJoin Us On Telegram Channel For Real Hacker @Accounts_HackedKeith cantel50% (2)

- Evaluation of Some SMS Verification Services and Virtual Credit Cards Services for Online Accounts VerificationsD'EverandEvaluation of Some SMS Verification Services and Virtual Credit Cards Services for Online Accounts VerificationsÉvaluation : 5 sur 5 étoiles5/5 (1)

- HSBC Gold Credit CardDocument100 pagesHSBC Gold Credit Cardkumar_chemicalPas encore d'évaluation

- Hacking Point of Sale: Payment Application Secrets, Threats, and SolutionsD'EverandHacking Point of Sale: Payment Application Secrets, Threats, and SolutionsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Database Vault - DocumentationDocument19 pagesDatabase Vault - DocumentationKhalid SiddiquiPas encore d'évaluation

- Mercury Drug Citi Card: Minimum Amount Due : 34,859.75 Overlimit AmountDocument4 pagesMercury Drug Citi Card: Minimum Amount Due : 34,859.75 Overlimit AmountSchatz Rah JechaPas encore d'évaluation

- Debit Cards - All You Need To KnowDocument48 pagesDebit Cards - All You Need To KnowDavid Ramirez100% (1)

- Give freedom to choose with a vanilla visa gift cardDocument1 pageGive freedom to choose with a vanilla visa gift cardSamridhi RaiPas encore d'évaluation

- Safari - Oct 13, 2020 at 6:15 PMDocument1 pageSafari - Oct 13, 2020 at 6:15 PMJaboris JohnPas encore d'évaluation

- Payments in Order Management in R12 (Doc ID 1164613.1) : Applies ToDocument33 pagesPayments in Order Management in R12 (Doc ID 1164613.1) : Applies ToManoj100% (1)

- Anonymous Credit CardsDocument10 pagesAnonymous Credit Cardspratul_baheti100% (2)

- 4 41641 Attacks On Point of Sale SystemsDocument12 pages4 41641 Attacks On Point of Sale Systemsanna leePas encore d'évaluation

- Credit Card Management Information SysteDocument9 pagesCredit Card Management Information SysteAnant JainPas encore d'évaluation

- Merchant Codes For Instore CardingDocument1 pageMerchant Codes For Instore Cardingjame staylorPas encore d'évaluation

- Wifi IdDocument1 pageWifi IdSandi Surya WijayaPas encore d'évaluation

- Debit Card & Credit Card: Presented By:-Amrish SaddamDocument22 pagesDebit Card & Credit Card: Presented By:-Amrish Saddamprakash singh bishtPas encore d'évaluation

- OPERA Credit Card Encryption Key Utility 50Document18 pagesOPERA Credit Card Encryption Key Utility 50eltoroPas encore d'évaluation

- Sell CCV All Country ICQ 749206811 Dumps Pin Track2 Pin MSR606 ATM Cashout EMV ChipDocument3 pagesSell CCV All Country ICQ 749206811 Dumps Pin Track2 Pin MSR606 ATM Cashout EMV Chipnguyen cuongPas encore d'évaluation

- Credit Card Number - Administrator - 10-22-2018Document14 pagesCredit Card Number - Administrator - 10-22-2018Voona ChandanPas encore d'évaluation

- Issuer Security Guidelines 25-April-14 20140502035916164Document82 pagesIssuer Security Guidelines 25-April-14 20140502035916164Gregorio GazcaPas encore d'évaluation

- TC For Amazon Pay Credit CardDocument35 pagesTC For Amazon Pay Credit Cardnt05sw7mryPas encore d'évaluation

- Kohl's $15 e-Gift Card redemption detailsDocument2 pagesKohl's $15 e-Gift Card redemption detailsNirav DahiwalaPas encore d'évaluation

- PayPass - MChip 4 Card Technical Specification (V1.3.1)Document46 pagesPayPass - MChip 4 Card Technical Specification (V1.3.1)OgarSkali67% (3)

- Web VulnDocument3 pagesWeb VulnwarnoPas encore d'évaluation

- AcquirerMerchant 3DS QRG 9.06.18Document2 pagesAcquirerMerchant 3DS QRG 9.06.18Rabih AbdoPas encore d'évaluation

- Prepaid CardsDocument4 pagesPrepaid CardsVikramjeet SinghPas encore d'évaluation

- DownloadDocument11 pagesDownloadČaušević NezirPas encore d'évaluation

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeD'EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadePas encore d'évaluation

- Magtek 1-380 Manual IntellicoderDocument31 pagesMagtek 1-380 Manual IntellicoderSelvolPas encore d'évaluation

- Nma Merchant ApplicationDocument5 pagesNma Merchant Applicationapi-257017808Pas encore d'évaluation

- Credit CardsDocument1 pageCredit CardsKedar L. Co0% (1)

- SDFS, K, KKDocument4 pagesSDFS, K, KKheadpncPas encore d'évaluation

- CCDocument22 pagesCCFarhan KhanPas encore d'évaluation

- How to Manage Credit WiselyDocument36 pagesHow to Manage Credit WiselyAmara MaduagwuPas encore d'évaluation

- Toaz - Info Icq 353667965 Sell CCV Fullz Track Dumps Usa Eu Uk Good 2019 PRDocument3 pagesToaz - Info Icq 353667965 Sell CCV Fullz Track Dumps Usa Eu Uk Good 2019 PRSam NormanPas encore d'évaluation

- PP Live 2017Document2 pagesPP Live 2017Arwan Suryadi PramantaPas encore d'évaluation

- Test Credit Card NumbersDocument2 pagesTest Credit Card NumbersJoycelyn Sampaio Wan100% (2)

- Merchant Manual (En)Document137 pagesMerchant Manual (En)Abu Rahma Sarip RamberPas encore d'évaluation

- Popular Tools CatalogDocument24 pagesPopular Tools CatalogCarbide Processors IncPas encore d'évaluation

- Customer Bank InfoDocument4 pagesCustomer Bank Infoluisparini0% (1)

- American Express Travel PDFDocument4 pagesAmerican Express Travel PDFfooPas encore d'évaluation

- Bank Card Types & FeaturesDocument2 pagesBank Card Types & Featuresalex_212Pas encore d'évaluation

- Process Credit Card AuthorizationDocument2 pagesProcess Credit Card AuthorizationJian GabatPas encore d'évaluation

- BWT Septron Line 31-61 Rev01!08!05-18 Opm enDocument56 pagesBWT Septron Line 31-61 Rev01!08!05-18 Opm enDavide Grioni100% (1)

- CC NumberDocument1 pageCC NumberMuhammad Rizki SalmanPas encore d'évaluation

- PNG Spring05Document16 pagesPNG Spring05David SarifPas encore d'évaluation

- Chapter-1 Introduciton: 1.1 What Is Debit C Ard?Document60 pagesChapter-1 Introduciton: 1.1 What Is Debit C Ard?glorydharmarajPas encore d'évaluation

- Visa Public Key Tables June 2014Document8 pagesVisa Public Key Tables June 2014Gregorio GazcaPas encore d'évaluation

- 7 React Redux React Router Es6 m7 SlidesDocument19 pages7 React Redux React Router Es6 m7 Slidesaishas11Pas encore d'évaluation

- CcinfoDocument2 pagesCcinfoheadpncPas encore d'évaluation

- 066-078 SmartCards tcm28-36814Document13 pages066-078 SmartCards tcm28-36814kokome35Pas encore d'évaluation

- Random Test Credit Card NumbersDocument3 pagesRandom Test Credit Card NumbersLope100% (1)

- HDFC Bank Credit Card Customer Care Number - 24x7Document5 pagesHDFC Bank Credit Card Customer Care Number - 24x7Baswamy CsePas encore d'évaluation

- Visa Issuer Pin Security GuidelineDocument56 pagesVisa Issuer Pin Security GuidelineKirbynPas encore d'évaluation

- Amex WS PIP Terminal Interface Spec ISO Apr2011Document232 pagesAmex WS PIP Terminal Interface Spec ISO Apr2011g10844677Pas encore d'évaluation

- Amex Case StudyDocument12 pagesAmex Case StudyNitesh JainPas encore d'évaluation

- Ericsson 3G Chapter 5 (Service Integrity) - WCDMA RAN OptDocument61 pagesEricsson 3G Chapter 5 (Service Integrity) - WCDMA RAN OptMehmet Can KahramanPas encore d'évaluation

- EMV v4.3 Book 4 Other Interfaces 20120607062305603Document154 pagesEMV v4.3 Book 4 Other Interfaces 20120607062305603Gregorio GazcaPas encore d'évaluation

- WH Credit Card DataDocument39 pagesWH Credit Card DataFlaviub23Pas encore d'évaluation

- BBB8001240704 Bop+SDD AmexDocument4 pagesBBB8001240704 Bop+SDD AmexDeepanjali DasPas encore d'évaluation

- EMV v4.3 Book 3 Application Specification 20120607062110791Document230 pagesEMV v4.3 Book 3 Application Specification 20120607062110791Gregorio GazcaPas encore d'évaluation

- EMV v4.3 Book 3 Application Specification 20120607062110791Document230 pagesEMV v4.3 Book 3 Application Specification 20120607062110791Gregorio GazcaPas encore d'évaluation

- Bank Toll Free Credit Card NumbersDocument4 pagesBank Toll Free Credit Card NumbersDavid Phillip KellyPas encore d'évaluation

- VisaMasterCard Card Auto DebitDocument2 pagesVisaMasterCard Card Auto DebitMuizz LynnPas encore d'évaluation

- TraceDocument106 pagesTracemanu choudharyPas encore d'évaluation

- MessagesDocument4 pagesMessagesBridgett Poole100% (1)

- MinidumpDocument2 pagesMinidumpMilanisti22Pas encore d'évaluation

- Termpaper of Q.TDocument10 pagesTermpaper of Q.TKomica KimsPas encore d'évaluation

- PCI PIN Security RequirementsDocument86 pagesPCI PIN Security RequirementsAndrew ScrivnerPas encore d'évaluation

- Emv Integrated Circuit Card ApplicationDocument58 pagesEmv Integrated Circuit Card ApplicationGregorio GazcaPas encore d'évaluation

- PCI PIN Security RequirementsDocument86 pagesPCI PIN Security RequirementsAndrew ScrivnerPas encore d'évaluation

- RDZ Workbench - BMS Map EditorDocument80 pagesRDZ Workbench - BMS Map EditorGregorio Gazca100% (1)

- EMV v4.3 Book 2 Security and Key Management 20120607061923900Document174 pagesEMV v4.3 Book 2 Security and Key Management 20120607061923900Gregorio GazcaPas encore d'évaluation

- EMV v4.3 Book 2 Security and Key Management 20120607061923900Document174 pagesEMV v4.3 Book 2 Security and Key Management 20120607061923900Gregorio GazcaPas encore d'évaluation

- Amniotic Membrane in Oral and Maxillofacial SurgeryDocument13 pagesAmniotic Membrane in Oral and Maxillofacial SurgerySooraj SPas encore d'évaluation

- Divide Fractions by Fractions Lesson PlanDocument12 pagesDivide Fractions by Fractions Lesson PlanEunice TrinidadPas encore d'évaluation

- Data Sheet FC SIDocument2 pagesData Sheet FC SIAndrea AtzeniPas encore d'évaluation

- Chapter 1Document2 pagesChapter 1Nor-man KusainPas encore d'évaluation

- METRIC_ENGLISHDocument14 pagesMETRIC_ENGLISHKehinde AdebayoPas encore d'évaluation

- Foundry Technology GuideDocument34 pagesFoundry Technology GuidePranav Pandey100% (1)

- Löwenstein Medical: Intensive Care VentilationDocument16 pagesLöwenstein Medical: Intensive Care VentilationAlina Pedraza100% (1)

- What Is Inventory Management?Document31 pagesWhat Is Inventory Management?Naina SobtiPas encore d'évaluation

- Teacher Commitment and Dedication to Student LearningDocument8 pagesTeacher Commitment and Dedication to Student LearningElma Grace Sales-DalidaPas encore d'évaluation

- An Improved Ant Colony Algorithm and Its ApplicatiDocument10 pagesAn Improved Ant Colony Algorithm and Its ApplicatiI n T e R e Y ePas encore d'évaluation

- AIIMS Mental Health Nursing Exam ReviewDocument28 pagesAIIMS Mental Health Nursing Exam ReviewImraan KhanPas encore d'évaluation

- Appendix B, Profitability AnalysisDocument97 pagesAppendix B, Profitability AnalysisIlya Yasnorina IlyasPas encore d'évaluation

- Farm mechanization subsidy applications invitedDocument2 pagesFarm mechanization subsidy applications inviteddraqbhattiPas encore d'évaluation

- BILL of Entry (O&A) PDFDocument3 pagesBILL of Entry (O&A) PDFHiJackPas encore d'évaluation

- UntitledDocument4 pagesUntitledMOHD JEFRI BIN TAJARIPas encore d'évaluation

- 2020 - Audcap1 - 2.3 RCCM - BunagDocument1 page2020 - Audcap1 - 2.3 RCCM - BunagSherilyn BunagPas encore d'évaluation

- Control Systems Engineering by S C Goyal U A Bakshi PDFDocument3 pagesControl Systems Engineering by S C Goyal U A Bakshi PDFShubham SinghPas encore d'évaluation

- 50hz Sine PWM Using Tms320f2812 DSPDocument10 pages50hz Sine PWM Using Tms320f2812 DSPsivananda11Pas encore d'évaluation

- Insert BondingDocument14 pagesInsert BondingHelpful HandPas encore d'évaluation

- Export - Import Cycle - PPSXDocument15 pagesExport - Import Cycle - PPSXMohammed IkramaliPas encore d'évaluation

- Rev F AvantaPure Logix 268 Owners Manual 3-31-09Document46 pagesRev F AvantaPure Logix 268 Owners Manual 3-31-09intermountainwaterPas encore d'évaluation

- Textile Finishing Different Types of Mechanical Finishes For TextilesDocument3 pagesTextile Finishing Different Types of Mechanical Finishes For TextilesMohammed Atiqul Hoque ChowdhuryPas encore d'évaluation

- AWK and SED Command Examples in LinuxDocument2 pagesAWK and SED Command Examples in Linuximranpathan22Pas encore d'évaluation

- Capex Vs RescoDocument1 pageCapex Vs Rescosingla.nishant1245Pas encore d'évaluation