Académique Documents

Professionnel Documents

Culture Documents

Mark Strategy Icici L I

Transféré par

ravikiran1955Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Mark Strategy Icici L I

Transféré par

ravikiran1955Droits d'auteur :

Formats disponibles

A SUMMER- PROJECT REPORT

A Marketing Strategy and Role of Financial

Advisors

With Reference to

ICICI PRUDENTIAL LIFE INSURANCE CO. LTD.

Submitted to

BVU Institute of Management Kolhapur

For partial fulfillment of the requirement for the

award of the degree

Of

MASTER OF BUSINESS ADMINISTRATION

Submitted by

Mr. Nitesh Kumar

Under the guidance of

Mrs. M N Paliwal

(MIB)

Through the Director,

BVU Institute of Management

Kadamwadi, Kolhapur, 416003

2007-2008

BHARATI VIDYAPEETH UNIVERSITY

INSTITUTE OF MANAGEMENT

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

KOLHAPUR

Directors Recommendation

To,

Registrar,

BVU Institute of Management,

Kolhapur.

Sub: MBA Project Report

Sir,

I am recommending the project report titled

A Marketing Strategy & Role Of Advisor

prepared by Mr. Nitesh Kumar towards the

partial

fulfillment

of

the

university

requirement for the degree in Master of

Business Administration, 2007-2008, of BVU

Institute of Management, Kolhapur.

Thanking you.

Yours Faithfully

Dr. V. M. Chavan

(Director)

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

Guide Certificate

This is to certify that the report entitled A

marketing strategy and role of financial advisors

of ICICI prudential life insurance Co.Ltd.

Submitted to BVU Institute of management,

Kolhapur for the award of Master of Business

Administration

is

an

independent

research

carried out by Mr.Nitesh Kumar under my

supervision and guidance.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

To the best my knowledge and belief this has

not been previously submitted for the award of

any degree of Bharati Vidyapeeth University.

Place:

Date: /

Mrs. M N Paliwal

(P

roject Guide)

Declaration

To

The Director,

BVUIMK,, Kolhapur

I the understand hereby declare that the project

report

entitled "A

Strategy

and

role

with

special

life

insurance

study

of

marketing

of financial

reference

co.

to

ICICI

is

Advisors

"

prudential

bonafied work

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

prepared by me under the guidance of Mrs.

M N Paliwal is my original work.

The empirical findings in this report are

based on data collected by me . the matter

consisting in this report are based on data

collected

by

this report

is

me .

not

The matter

copied

consisting

from

any

in

other

sources. This report has not been presented

anywhere else for the award of any degree ,

diploma or title.

I understand that any such copying is liable to

be punished as the authorities deem fit.

Place:

Date: /

NITESH KUMAR

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

CHAPTER

TITLE

RESEARCH DESIGN

COMPANY PROFILE

CONCEPTUAL BACKGROUND

DATA ANALYSIS

FINDINGS AND SUGGESTIONS

QUESTIONNAIRE

BIBLIOGRAPHY

PAGE NO.

CHAPTER 1

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

RESEARCH DESIGN

CHAPTER 2

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

COMPANY PROFILE

CHAPTER 3

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

CONCEPTUAL BACKGROUND

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

CHAPTER 4

DATA ANALYSIS

CHAPTER 5

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

FINDINGS AND SUGGESTION

RESEARCH DESIGN

The business of the insurance is related to the protection

of the economical values of assets. The asset is valuable to the

owner, because he expects to get some benefits from it. IT is a

benefit because it meets some of his needs. Every asset is

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

expected to lose for a certain period time during which it will

perform. However the asset may get lost earlier. An accident or

some or some other unfortunate event may destroy it or make

it non functional. It creates losses to the effect of such adverse

situations.

Brief history of Insurance.

The beginning of the insurance business is traced to the

city of London. It started with the marine Business. Marine

traders, who used to gather at Lloyds coffee house in London,

agreed to share losses to goods during transportation by ship.

The first insurance police was issued in 1583 in England.

In India insurance began in 1870 with life insurance being

transacted by an English company the European and the

Albert. The first Indian insurance company was the "Bombay

mutual assurance society Ltd, formed in 1870.In 1956 LIC OF

India was nationalized on 1/9/1956.

In 1990 the Indian Govt. At the close of financial year

ending 31/3/2004, 12 new companies were registered with the

insurance regulatory and development Authority (IRDA) to

transact life insurance business in India.

What is the life insurance ?

Life insurance is a contract for payment of sum of Money

to the person assured (or failing him/her), to the person

entitled to receive the same. On the happening of the event

insured against usually the contract provides for the payment

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

of an amount on the date of maturity or at the specified date at

the periodic intervals or at unfortunate death, if it accurse

earlier. Among other thing, the contract also provides, for the

payment of premium periodically to the company by the

assured. Life insurance is universally acknowledged to be an

institution, which eliminates 'risk, substituting certainty for

uncertain and comes to the timely old of the family in the

unfortunate event of death or the breadwinner.

Scope of the study

This study is beneficial to understand the competitive

strategy planned by ICICI Prudential Company.

It helps to understand the Role performed by the Advisor

to achieve the desire goal through planned strategy.

It is very important from ICICI Prudential point of view

to understand

View of advisor about company.

What are the difficulties faced by them.

Their satisfaction level about commission and other

facilities.

To give guideline to the 'financial Advisor' about

- Effective selling.

-Awareness about how to understand the need of customer.

Main objective of the study

1) To study the various services provided or policies provided

by the ICICI Prudential.

2) To know the marketing strategy used by ICICI Prudential

in the competitive market.

3) To know the activities performed by the financial advisor.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

4) To know the importance of role played by financial advisor

in the insurance business.

5) To understand what are the important aspect personal

development of financial advisor.

Method of Data Collection

1) Questionnaire

By keeping in the view of objectiv of the study and consulting

industry guid a set of questionnaire was prepared

.Questionnaire format was 'yes ' or 'No' type , few Question

were of Multiple choice. Total number of the question include

in the data collection were eleven.

2) Interview

A formal interview were also conducted to elicit the response

from the respondents

3) Sample area

The area selected for the survey was within the limit of

kolhapur city.

4) Sample size

The total samples of the 110 advisor were selected for this

study.

Limitation

1) This study related to Kolhapur city only.

2) This study is limited to 110 respondents only.

3) Time limit was major constraint.

COMPANY PROFILE

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

ICICI BANK

ICICI Bank is India's second largest bank and largest

private sector bank with assets of Rs. 2823.72 billion as on September 30,

2006. ICICI Bank provides a broad spectrum of financial services to

individuals and companies. This includes mortgages, car and personal

loans, credit and debit cards, corporate and agricultural finance. The

Bank services a growing customer base through a multi-channel access

network which includes over 635 branches and extension counters, 2325

ATMs, call centers and Internet banking.

Prudential Plc

Established in London in 1848, Prudential plc, through its businesses

in the UK and Europe, the US and Asia, provides retail financial

services products and services to more than 21 million customers,

policy holder and unit holders worldwide. As of June 30, 2006, the

company had over 234 billion in funds under management.

Prudential has brought to market an integrated range of financial

services products that now includes life assurance, pensions, mutual

funds, banking, investment management and general insurance. In

Asia, Prudential is the leading European life insurance company with

a vast network of 23 life and mutual fund operations in twelve

countries - China, Hong Kong, India, Indonesia, Japan, Korea,

Malaysia, the Philippines, Singapore, Taiwan, Thailand and Vietnam.

Over view:

India's Number One private life insurer, ICICI Prudential Life

Insurance Company is a joint venture between ICICI Bank-one of

India's foremost financial services companies and Prudential plc-a

leading international financial services group headquartered in the

United Kingdom.

Total capital infusion stands at Rs. 15.85 billion, with ICICI Bank

holding a Stake of 74% and prudential plc holding 26%.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

Our Vision

To make ICICI Prudential the dominant Life and Pensions

player built on trust by world-class people and service.

This we hope to achieve by:

Understanding the needs of customers and offering them superior

products and service.

Leveraging technology to service customers quickly, efficiently

and conveniently.

Developing and implementing superior risk management and

investment strategies to offer sustainable and stable returns to our

policyholders

Providing an enabling environment to foster growth and learning

for our employees And above all, building transparency in all our

dealings.

Providing an enabling environment to foster growth and learning

for our employees.

And above all, building transparency in all our dealings.

The success of the company will be founded in its unflinching

commitment to 5 core values -- Integrity, Customer First, Boundaryless,

Ownership and Passion. Each of the values describes what the company

stands for, the qualities of our people and the way we work.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

Working Of The Branch

Nature of the work of the various personnel:

Sale Manager:

Mr. Vijay Joshi, Sales manager is managing the Kolhapur

branch. Under him there are 20 unit managers working.

The sales manager oversees the branch in terms of sales and

administration. The sales function includes achievement of the sales

target of the branch with the respect to premium income for new

business in mouth, renewal premiums, numbers of policies sourced,

activation of the advisors and also driving various contests. Sales

manager also has important task of man power developed through

motivation, guidance and being a role model for the unit manager .

Unit Manager:

Unit managers manage the team of 25 Financial Advisors, whom

he recruits over a period of time from his own circle or through cold

calls. The unit manager has the responsibility to complete sales targets,

which is set out in the monthly gold sheet. He has to also motivate his

team for better performance.

Financial Advisor:

Advisors are independent financial consultants who work on

commission basis. They sell policies to clients as per companies rule and

regulations. They complete all documentation part and submit cases to

the operation department for further processing. As per current

insurance norms Financial Advisors are licensed and have authority to

business as per IRDA rules and regulations.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

ORGANISATION

STRUCTURE

SALES MANAGER

ASSISTANCE SALES

MANAGER

SENIOR AGENCY MANAGER

AGENCY MANAGER

UNIT MANAGER

ADVISOR

Savings & Wealth Creation Solutions

Cash Plus

CashBak

Lifeline Super.

Invest Shield Cashbak

Home Assure

Cancer Care:

CONCEPTUAL BACKGROUND

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

Marketing Segmentation

With an increase in the scale of operation, the segmentation

occupied a place of significance. In the insurance organization the

task of formulating the overall marketing strategies can't be

performed efficiently until we segment the market. The market for

the insurance business if found vast. The potential policyholders are

in very large number and their need and requirements are not

identical. The segmentation help the insurance organization in

dividing and subdividing the market into small segment in the needs

and requirements are fund by and large identical.

The segmentation would help insurance professionals in

marketing the promotional measure creatively. The advertisement

appeals, message, and campaigns proactive to the receiving capacity

of the target audience. The sells promotion measures can be

innovated to get a positive response. The personal selling may be

effective since the sales personal become aware of needs and

requirements to build sound product portfolio.

In brief study of segmentation would help insurance

organization to form best marketing strategy in the competitive

market.

Marketing Mix for insurance organization

The insurance organization need to assign due weight age for the

formulation of marketing mix. The emerging trends indicate that if

the insurance organization delay the process of formulating a sound

marketing for their business there will be sharp fall in their

marketing share in future, which would bring down the rate of

profitability.

Marketing mix helps to form effective marketing

strategy for insurance organization. There are various sub mixes of

marketing. Such as product mix, promotion mix, price mix, place

mix, people mix, process mix, and physical attraction.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

The Product Mix

The formulation of the product mix for the insurance business

is significant and product means service and schemes of insurance

organization.

In the context of formulating the product mix, it is essential that

the insurance organization promote innovative product. Product

portfolio includes even those services and schemes, which are likely to

get a positive response in the future.

In the view of the above the following aspects need due attention for

developing insurance product.

1) The formulation of product mix should be in the face of the

innovative product strategy.

2) The data processing department is supposed to collect necessary

information related to the changing level of expectations of prospects

so senior executive make the prospect portfolio productive to the user

and profitable to the insurance organization.

3) It is also significant to study the product life cycle of insurance

product.

4) A sound product portfolio is the need of the hour and therefore the

regulatory barriers constraints in activating the innovation process

should be minimized.

The Promotion Mix

In the formulation of marketing mix, promotion mix occupies a

place of outstanding significance. There are various dimensions of the

promotion mix such as Advertising, Public relation, Sales promotion,

World of mouth promotion, Personal selling and Telemarketing. All

the components of promotion need due attention of the insurance

professionals.

A) Advertising

Advertising is the paid form of persuasive communications. It

found important to promote the insurance business. The advertising

professional bears the responsibility of making the advertising

slogans, Appeals, campaigns creative so process of sensitizing the

prospects is found pro-active.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

B) Publicity

In addition to the advertisement the insurance professional also

need to think in favor of publicity. It is a device to promote business

without making any payment and so it also called as unpaid form of

persuasive communications. Bearing with the media is an important

aspect of publicity. Public relation officers, branch manager financial

advisors or even media people play important role to make publicity

in actual field.

C) Sales promotion

We find sales promotion a device to promote sales to meat a

certain target. It is temporary device. It is meant for the end user of

the services and the channels found instrumental in promoting the

services. In business incentives to the policyholder or to the financial

advisor for promoting the business are the sales promotion tools. The

insurance organizations offer innovative tools of sales promotion and

increase or decrease the duration depending upon the business

condition vis--vis the emerging trends in business.

Price Mix

In the insurance business the pricing decision are concerned

with the charged against the policies. Interest charged for default in

the payment of premium and credit facilities, commission charged for

underwriting and consulting services. The formulation of pricing

strategy becomes significant with the viewpoint of influencing the

target market or prospects. The insurance organization adopt such a

strategy for pricing that makes it a motivational tool and paves the

ways for increasing the insurance business.

Following point helps us to adopt a good pricing strategy

A) Marketing possible cost of effectiveness.

B) Restructuring of premium.

C) Due priority to profit generating investments.

D) Making the ways for maximizing profitability.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

Place Mix

In the place mix there would be focus on two important factsManaging insurance personal and location of the branch.

The transformation of the potential policyholder into the actual

policyholder is a difficulties task. This depends upon the professional

excellence of insurance professional. There is constant change in the

fashion and other external environment. This form the perception

and expectation of potential customer. These changes required to

study by the company and guide their insurance professionals for

successful selling of insurance.

While location of insurance branches managers need to consider

a number of factors, such as smooth accessibility, availability of

infrastructure facilities and management of brand offices and

premises. His facility includes good condition roads, power facilities,

communication, services information services or so on.

The People

In Insurance business insurance personals are more important

component of marketing mix. Financial Advisor provides attention on

the development of insurance professionals. The development of

personal is such a way that an organization succeeds in making

possible productive utilization of technologies used or likely to be

used.

The insurance organization has been making use of sophisticated

information technologies to improve the quality of their services. The

use of computers micro computers, fax machines, sophisticated

telephone services, e-mailing, internet and intranet services, have

been found throwing a big impact on the perception of quality of

services.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

DATA ANALYSIS

Table No.1: Area of residence:

The following table shows the percentage of advisors on the basis

of area of residence.It helps us to understand the percentage of advisors

recruited from urban and rural area. It is important because it defines

the market, where he sales polices mostly.

Address

Kolhapur

Rural

Total

No of respondents

93

17

110

Percentage

84.54

15.45

100

Area of residence

16%

Kolhapur

Rural

84%

Interpretation:

The above table shows that 84% of advisors recruited by the

company are from Kolhapur city itself and 16% advisors are from the

rural area. It shows that there is much potential available for the

company to expand their business in the rural area. It is the root cause

of the companies point of view but also for the overall economy of the

country.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

Table No. 2: Age Group:

Following table shows the percentage of advisor on the basis of the age

group.Deferent age group of advisor can create relation with their own

age group of Customers, which helps company to sale, every product of

the companies product portfolio.

Age group

20-30

30-40

40-50

50-60

Total

No of respondents

70

25

8

7

110

Percentage

63.63

22.72

7.2

6.36

100

Age group

7%

6%

20-30

30-40

23%

40-50

64%

50-60

Interpretation:

The above table shows 64% of the total advisors age is between

(20-30), and 23% of advisors is between (30-40) age group.

It is clear from this data that young generation is mush interested to

enter in the insurance business. Insurance business required aggression

and enthusiasm. Young generation have this quality.

But only 13% advisors are in 40-60 age groups. If company have more

advisors from this they may be able to sale retirement pension polices

more efficiently.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

Table No. 3: Education Of The Advisors:

Following table shows the education level of advisors.

Today there are 15 insurance companies in the insurance market. This

creates tuff competition. Unit link insurance polices required a good

knowledge of share market. Educated advisors can convince customer

more effectively.

Education

H.S.C

Graduate

Post Graduate

Total

No of respondent

10

77

23

110

Percentage

9

68

23

100

Interpretation

From above data it is clear that 70% of the advisors are Graduate and

21% Post Graduate.

It is helpful and also one of the strength of the company that companies

majority advisors is highly educated. It helps them to sell unit link

policies, which required good market knowledge. Even educated

advisors can make publicity and create awareness of company in the

competitive market, by mouth-to-mouth publicity, which is the most

effective way of the promotion in insurance business.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

Table No. 4 : Type of Business Done:

Following table shows time devoted by advisors to insurance business.

Insurance selling is not only one time activity but it requires creating

mutual relationship with customer. So it is important to know how

many advisors are devoting their full time for this business.

Type of business

done

Full time

Part time

Total

No of respondent

Percentage

35

75

110

31.81

68.19

100

Percentage

Type Of Business Done

68.19

80

60

40

31.81

20

0

Full time

Part time

Type

Interpretation

From above table it is clear that 31.80% advisors are doing full time

business and 68.19% are part time.

It is better for company to have more full time advisors, because to get

success in the insurance business it required creating a personal relation

with the customer. A good customer relationship management (CRM) is

the key factor for success in this business. So full time working advisors

can create a permanent relationship with customer, they can motive

guide and advise their client for investment and even they can provide

best after sales services.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

Table No .5 : Profile of the client:

The table below shows the profile of the client to whom advisors sold

policies.It helps us to understand the target group of customer of

advisors. This more or less depends up on the residential area, education

level and age of the advisors.

Profile of the client

Professional

Business class

Services class

Farmer

No of respondents

25

40

30

15

Percentage

23

36

27

14

Interpretation:

From the above table it is clear that Iciciprudentials advisors

have successfully created business from professional, services class

people. This group of customer has income to invest in insurance and

also they are aware about importance of insurance.

But only 14% advisors approaches towards farmers. but it is demand of

hour to create of saving amount even the farmers and motivate them to

invest them in more profit making financial assets.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

Table No. 6 : Need Of Customer:

This table shows how advisors understand the need of their customer to

sale the particular policy.It helps us to understand on which aspect

advisors are focusing their attention to sell the particular polices.

Need

Occupation

Income

Age

All

Total

No of Respondent

64

84

51

6

110

Percentage

58..18

76.36

46.36

5.4

100

Need of customers

5.4

46.36

58.18

x

occupation

Income

Age

All

76.36

Interpretation:

From above table it clear that 76.36% advisors are focusing on the

income of the customer, where as 58.18% advisors are on occupation

and 46.36% are on age.

From this data it is clear that income, occupation of the clients is most

dominant factor for the insurance investment. Insurance investment

gives them triple benefit such as good return, with security, and even tax

deduction.By focusing on age advisors can decide on the children and

pension insurance plan.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

Table No. 7:Difficulties faced:

Following table shows the opinion about the difficulties faced by the

advisors while selling polices. It helps us to understand the

difficulties faced by which company can able to find out the remedies

o the particular problem which helps to expand the business .

Difficulties faced

Private company

Low Awareness of icicipru

More premium

More competition

No difficulties face

No of respondents

58

23

57

34

11

Percentage

52.72

21

51.81

31

11

Interpretation:

From above table it is clear that 52.57% advisors say that most

difficulties faced by them is low level acceptance of the private

insurance Co. Though the insurance industry is open for private sector

from 2000 and Iciciprudential is the no.1 private player in this sector,

still people have low acceptance level of private insurance Co. Further

52% advisor also says premium of the policies is more, it is one of the

difficulty faced by the advisors.21% advisors say customer has low

awareness of Icici prudential.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

Table No. 8: Satisfaction with the commission:

Following table shows the satisfaction level of the advisors for the

commission they get from the company.In the insurance business

satisfaction for the commission of the advisors is most important

because advisors will work only if they get good commission. So it helps

us to understand satisfaction of the advisors for the commission which

they get from the company.

Respondent

Yes

No

Total

No. Of

Respondents

91

19

110

Percentage

82.72

17.27

100

Interpretation:

Above table clear that 83% advisors are satisfied with the commission

they are getting from the company. It shows that company is giving

good commission and other facilities to advisors. Advisors are the key

person in insurance business their satisfaction with commission helps

company to plan their marketing strategy more aggressively and

effectively in the competitive market.But 17% advisors are not satisfied;

there low level of satisfaction should be focused and improved by the

company.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

FINDINGS & SUGGESTIONS

FINDINGS

Majority of the advisors recruited by the company is from

Kolhapur city and urban area. So there is much potential for the

company to expand their business in the rural area of Kolhapur.

Company has more numbers of advisors in between age group of

20 to 30 and 30 to 40. This generation is more enthusiastic and

interested to enter in the insurance business.

Even there is other different age group of advisors working in

company.

Most of the advisors are doing insurance business as a supporting

business with the present job and even some advisors devoting full

time for this business.

ICICIPrudential advisors have successfully created business from

professional, businessman, service class people.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

SUGGESTIONS

India has a big untapped market especially in the rural area .that

can be captured by the company.

Right person at right time, at right place, and at the right

quantity is very important. So company should recruit more

advisors from different age group and even from urban and rural

area.

Make a segmentation of the potential available market and offer

the product to the each target group of the customer.

Insurance business is the direct marketing through financial

advisors. Good customer relationship management (CRM) is the

basic requirement for the success in this business. So company

should recruit more advisors who will devote their more time for

this business.

Very few advisors are approaching towards the farmers and rural

people. But even this group of customer also has good investment

abilities. Expansion of insurance business among this group of

society is necessity of our economy.

Company also plan continuous training programs for

advisors as

per their requirement. By which they can update their selling

Skill as per the changing market requirement.

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

QUESTIONNAIRE

Name:.

Address:.

Tel no.:

Mob.no.:.

Age :

No. of policy sold:.

No. of years in business:..

1. Which type of business done?

Full time

Part time

2. How do you create your own data-base?

Personal selling

Telecalling

Cold calling

Farmer

3. What is the profile of your client ?

Professionals

Business class

Service class

Others

4. How do you understand the needs of customers ?

Occupation

Income

Age

Other factors

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

5. Which policy you sold must?

Unit link

Traditional plan

6. What kind of difficulties you face during selling of policies ?

Low acceptance level of private insurance

Low awareness of ICICI prudential

More among of premium

More competition

Any other..

7. Are you satisfied with the commission you get from ICICI ?

Yes

No

8. If yes then scale :

0 to 25 %

25 to 50 %

50 to 75 %

75 to 100 %

9. What kind of facilities you get from ICICI ?

Training

Telephone

Support of UM.

Contest

Any other

10.Are you satisfied with their job?

Yes

No

HOW?

.

.

11.What it take to become successful in the field of insurance

advisors?

--------------------------------------------------------------------- BVU IMK KOLHAPUR

-----------------------------------------------------------ICICI PRUDENTIAL [MBA 2007-08]

..

..

BIBLIOGRAPHY

WEBSITES:

www.google.com

www.iciciprulife.com

Marketing management

By :- Kotler & Killer

Sales management

By :- S.A.Chunawalla

--------------------------------------------------------------------- BVU IMK KOLHAPUR

Vous aimerez peut-être aussi

- Assessment of Groundwater Quality in The Vicinity of Natural NalaDocument116 pagesAssessment of Groundwater Quality in The Vicinity of Natural Nalaravikiran1955Pas encore d'évaluation

- ChetanDocument116 pagesChetanravikiran1955Pas encore d'évaluation

- Assessment of Groundwater Quality in The Vicinity of Natural NalaDocument117 pagesAssessment of Groundwater Quality in The Vicinity of Natural Nalaravikiran1955Pas encore d'évaluation

- PallaviDocument116 pagesPallaviravikiran1955Pas encore d'évaluation

- Assessment of Groundwater Quality in The Vicinity of Natural NalaDocument116 pagesAssessment of Groundwater Quality in The Vicinity of Natural Nalaravikiran1955Pas encore d'évaluation

- VahidaDocument116 pagesVahidaravikiran1955Pas encore d'évaluation

- Assessment of Groundwater Quality in The Vicinity of Natural NalaDocument117 pagesAssessment of Groundwater Quality in The Vicinity of Natural Nalaravikiran1955Pas encore d'évaluation

- Latter Head (Repaired)Document15 pagesLatter Head (Repaired)ravikiran1955Pas encore d'évaluation

- Final Report - 2 CopiesDocument130 pagesFinal Report - 2 Copiesravikiran1955Pas encore d'évaluation

- Dhanvantari Bhag 20 PDFDocument378 pagesDhanvantari Bhag 20 PDFravikiran1955Pas encore d'évaluation

- TanujaDocument117 pagesTanujaravikiran1955Pas encore d'évaluation

- Mr. Shital Parasharam Suryavanshi.: Curriculum VitaeDocument2 pagesMr. Shital Parasharam Suryavanshi.: Curriculum Vitaeravikiran1955Pas encore d'évaluation

- "Design and Manufacturing of Plastic Shedding Machine": Loknete Hon. Hanmantrao Patil Charitable Trust'sDocument1 page"Design and Manufacturing of Plastic Shedding Machine": Loknete Hon. Hanmantrao Patil Charitable Trust'sravikiran1955Pas encore d'évaluation

- Dr. Ashfak ShikalgarDocument4 pagesDr. Ashfak Shikalgarravikiran1955Pas encore d'évaluation

- A PuneDocument2 pagesA Puneravikiran1955Pas encore d'évaluation

- Kalpana Medicals: 1 Printed by On 30/09/2017 at 12:42PM Page NoDocument2 pagesKalpana Medicals: 1 Printed by On 30/09/2017 at 12:42PM Page Noravikiran1955Pas encore d'évaluation

- Shakha101 03 10 17Document2 pagesShakha101 03 10 17ravikiran1955Pas encore d'évaluation

- Shakha101 03 10 17Document2 pagesShakha101 03 10 17ravikiran1955Pas encore d'évaluation

- Resume: Education Qualification Degree University/Board YearDocument1 pageResume: Education Qualification Degree University/Board Yearravikiran1955Pas encore d'évaluation

- HDFC SavingDocument3 pagesHDFC Savingravikiran1955100% (1)

- Dr. Davande S.ADocument1 pageDr. Davande S.Aravikiran1955Pas encore d'évaluation

- Dr. Davande S.ADocument1 pageDr. Davande S.Aravikiran1955Pas encore d'évaluation

- Troponin VADocument8 pagesTroponin VAravikiran1955Pas encore d'évaluation

- Business Mantra Marketing Services: InvoiceDocument1 pageBusiness Mantra Marketing Services: Invoiceravikiran1955Pas encore d'évaluation

- Program Name: Campus: School/Faculty: Program Duration:: Read InstructionsDocument1 pageProgram Name: Campus: School/Faculty: Program Duration:: Read Instructionsravikiran1955Pas encore d'évaluation

- Above Rates Are Negotiable As Per Your OrderDocument1 pageAbove Rates Are Negotiable As Per Your Orderravikiran1955Pas encore d'évaluation

- Name: MR - Ananda Ashok Sokate: 2 Date of BirthDocument1 pageName: MR - Ananda Ashok Sokate: 2 Date of Birthravikiran1955Pas encore d'évaluation

- Shivaji UniversityDocument1 pageShivaji Universityravikiran1955Pas encore d'évaluation

- DayanandDocument1 pageDayanandravikiran1955Pas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- ICICI - History - Objectives - Functions - Financial Assistance - RolesDocument10 pagesICICI - History - Objectives - Functions - Financial Assistance - RolesHebaPas encore d'évaluation

- Evolution of Leasing in IndiaDocument8 pagesEvolution of Leasing in IndiaTithi Raheja100% (1)

- Banking and Financial Awareness Digest June 2021Document9 pagesBanking and Financial Awareness Digest June 2021Sakshi GuptaPas encore d'évaluation

- Comparative Analysis Financial Performance of INDUSIND BANK With Other Four BanksDocument85 pagesComparative Analysis Financial Performance of INDUSIND BANK With Other Four Bankskawalpreetyahoo0% (1)

- Comparative Financial Strength of Sbi and Icici BankDocument64 pagesComparative Financial Strength of Sbi and Icici BankSupritee beheraPas encore d'évaluation

- SM ICICI Change Management FreeDocument36 pagesSM ICICI Change Management FreeHimanshu Oza100% (1)

- Role of Mutual Funds in Growth of Financial Market" With Special Reference To ICICI .CDocument90 pagesRole of Mutual Funds in Growth of Financial Market" With Special Reference To ICICI .C2014rajpointPas encore d'évaluation

- Sample Board ResolutionDocument4 pagesSample Board ResolutionKaka Poli0% (1)

- Corporate GovernanceDocument5 pagesCorporate Governancekunal mirchandaniPas encore d'évaluation

- Focus On ICICI BankDocument5 pagesFocus On ICICI Bankvimalbakshi0% (1)

- In-Depth Study of Housing Finance SectorDocument134 pagesIn-Depth Study of Housing Finance SectorSnehraj AmburlePas encore d'évaluation

- Emerging Marketing Strategies of Private Banks Comparison, Suggestions and AnalysisDocument11 pagesEmerging Marketing Strategies of Private Banks Comparison, Suggestions and AnalysisSHIVAM SRIVASTAV0% (1)

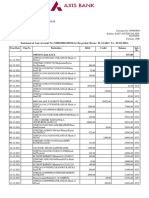

- Statement of Axis Account No:920010006130934 For The Period (From: 01-12-2021 To: 09-05-2022)Document13 pagesStatement of Axis Account No:920010006130934 For The Period (From: 01-12-2021 To: 09-05-2022)subhadeepPas encore d'évaluation

- Detailed StatementDocument17 pagesDetailed Statementsanket enterprisesPas encore d'évaluation

- Mr. Akshay Sable: N.G Bedekar College ThaneDocument46 pagesMr. Akshay Sable: N.G Bedekar College ThaneAkshay SablePas encore d'évaluation

- Varun CVDocument3 pagesVarun CVChandrasen GuptaPas encore d'évaluation

- Icici Group Code of Business Conduct and Ethics 2017Document31 pagesIcici Group Code of Business Conduct and Ethics 2017shreyas patil67% (6)

- Financial Statement Analysis of ICICI BankDocument43 pagesFinancial Statement Analysis of ICICI BankAnonymous g7uPednIPas encore d'évaluation

- List Sub Brokers CancelledDocument48 pagesList Sub Brokers Cancelledpri panPas encore d'évaluation

- Investor Presentation: Q4FY15 UpdateDocument34 pagesInvestor Presentation: Q4FY15 UpdateAditya NagpalPas encore d'évaluation

- Icici Bank Case CRMDocument28 pagesIcici Bank Case CRMRohit SemlaniPas encore d'évaluation

- ICICI Bank PPT - Internship 2021-2022 DMII SDocument26 pagesICICI Bank PPT - Internship 2021-2022 DMII Srohitsf22 olypmPas encore d'évaluation

- Claim Form For InsuranceDocument3 pagesClaim Form For InsuranceSai PradeepPas encore d'évaluation

- Placement2 - Details - 1645091806 - IBS Placement 2022Document6 pagesPlacement2 - Details - 1645091806 - IBS Placement 2022Divya ShindePas encore d'évaluation

- Arvind CV NewDocument3 pagesArvind CV NewAnsh SainiPas encore d'évaluation

- ICICIDocument21 pagesICICIBHAVYA ANUSHA SATHI 122023604014Pas encore d'évaluation

- Famous All Over The: CompaniesDocument37 pagesFamous All Over The: CompaniesChitra ChauhanPas encore d'évaluation

- GK Tornado For Bank Exams - Gradeup - pdf-98 PDFDocument36 pagesGK Tornado For Bank Exams - Gradeup - pdf-98 PDFPrince VegetaPas encore d'évaluation

- Marwari CollegeDocument35 pagesMarwari CollegeAvinashPas encore d'évaluation

- Amit KinraDocument3 pagesAmit Kinradr_shaikhfaisalPas encore d'évaluation