Académique Documents

Professionnel Documents

Culture Documents

Colorado Case Proof of Emotional Damage

Transféré par

Dany ClementsonCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Colorado Case Proof of Emotional Damage

Transféré par

Dany ClementsonDroits d'auteur :

Formats disponibles

EMOTIONAL DAMAGES HOW PROVED BY AN AFFIDAVIT

MARCH 28, 2013

PUBLISH

UNITED STATES COURT OF APPEALS

FOR THE TENTH CIRCUIT

GLEN LLEWELLYN,

PlaintiffAppellant,

v. No. 11-1340

ALLSTATE HOME LOANS, INC.,

d/b/a Allstate Funding; OCWEN

LOAN SERVICING, LLC; NOMURA

CREDIT AND CAPITAL, INC.; NCC

SERVICING, LLC; CASTLE

MEINHOLD & STAWIARSKI, LLC,

DefendantsAppellees,

and

SHEARSON FINANCIAL

NETWORK, INC.; EQUITY PACIFIC

MORTGAGE, INC.; KEVIN RIDER;

OCWEN FINANCIAL

CORPORATION; NOMURA

SECURITIES INTERNATIONAL,

INC.,

Defendants.

APPEAL FROM THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF COLORADO

(D.C. No. 1:08-CV-00179-WJM-KLM)

The Ocwen Defendants contend Plaintiffs affidavit, without more, is

insufficient to create a genuine dispute as to whether their actions caused Plaintiff

to suffer emotional damages. They rely on the requirement imposed by several of

our sister circuits that plaintiffs who rely on their own testimony to establish

emotional harm must explain [their] injury in reasonable detail and not rely on

conclusory statements, unless the facts underlying the case are so inherently

degrading that it would be reasonable to infer that a person would suffer

emotional distress from the defendants action. Bagby v. Experian Info.

Solutions, Inc., 162 F. Appx 600, 605 (7th Cir. 2006)

Viewing Plaintiffs affidavit in the light most favorable to him and drawing

all reasonable inferences in his favor, as we must, we conclude Plaintiff has

provided sufficient evidence he suffered emotional damages as a result of the

Ocwen Defendants actions. See Robinson v. Equifax Info. Servs., LLC, 560 F.3d

235, 242 (4th Cir. 2009) (concluding the plaintiff sufficiently articulated and

demonstrated the emotional distress she experienced as she attempted to correct

[the credit reporting services] errors where she presented evidence that her

mental distress manifested itself as headaches, sleeplessness, skin acne, upset

stomach, and hair loss). We agree that in relying on his own testimony, Plaintiff

was required to explain [his] injury in reasonable detail and not rely on

conclusory statements, Bagby, 162 F. Appx at 605 (internal quotation marks

omitted), and conclude he has done precisely that. Plaintiff detailed the state of

his health prior to the Ocwen Defendants negative reporting, including the

dormancy of his pre-existing conditions; he identified his discovery of the Ocwen

Defendants negative credit reports as the event precipitating the deterioration of

his health; and he described, in great detail, the stress, anxiety, and physical

symptoms he experienced after learning of the negative reports and the effect

theyhad on his Crohns disease and depression. Plaintiffs attribution of his

symptoms and the deterioration of his health to the Ocwen Defendants actions is

-18not so incredible or conclusory we can ignore it.3 It is reasonable to infer from

the aggravation of Plaintiffs previously managed conditions and the development

of several new symptoms at precisely the time Plaintiff discovered the negative

reports on his credit report that the Ocwen Defendants actions caused these

forms of emotional damages. This inference is no less reasonable simply because

Plaintiff was diagnosed with diabetes and experienced other stressful life events

(including several foreclosures) during the same time period. See Bach v. First

Union Natl Bank, 149 F. Appx 354, 362 (6th Cir. 2005) (concluding that

although a stroke suffered by plaintiff during the same time as the FCRA violation

was clearly not a result of [the] violation, the fact that [the plaintiff]

had suffered a stroke [was] pertinent to the circumstances surrounding [her]

emotional distress).

Contrary to the Ocwen Defendants assertion, Plaintiff was not required to

produce evidence to corroborate his detailed and specific testimony in order

tosurvive summary judgment. Although several of our sister circuits require a

plaintiff to describe his or her emotional distress in reasonable detail, Bagby,

162 F. Appx at 605 (internal quotation marks omitted), the Ocwen Defendants

have not pointed to, nor have we found, any circuit that additionally requires

corroborating evidence. As the Sixth Circuit explained, An injured persons

testimony alone may suffice to establish damages for emotional distress provided

that she reasonably and sufficiently explains the circumstances surrounding the

injury and does not rely on mere conclusory statements. Bach, 149 F. Appx at

361 (emphasis added). Plaintiff described the circumstances surrounding his

injury in reasonable and sufficient detail that he was not required to produce

further evidence of his emotional distress. We conclude that his affidavit alone

created a genuine dispute as to whether the Ocwen Defendants actions caused

him to suffer emotional damages.

FOOTNOTE

We acknowledge that Plaintiffs description of the damages he suffered

includes several physical symptoms in addition to forms of emotional distress. At

trial, Plaintiffs ability to recover for the various physical symptoms he describes

will turn, in part, on his ability to establish that the physical symptoms are

manifestations of the emotional distress he experienced. At this stage, however,

it is sufficient that Plaintiff presented a detailed description of various

manifestations of emotional distress he allegedly experienced as a result of the

Ocwen Defendants actions. These include, but are not limited to, drenching

night sweats, panic attacks, great stress and anxiety, and the feeling he could

not recover. (App. at 1205-06.) Plaintiffs ability to seek damages for the other

various physical symptoms will be more appropriately addressed by the district

court through pre-trial and trial motions.

3

Plaintiff contends that, in addition to his actual damages, he is entitled to

recover statutory and punitive damages under 15 U.S.C. 1681n because the

Ocwen Defendants willfully violated the FCRA. A willful violation is either

an intentional violation or a violation committed by an agency in reckless

disregard of its duties under the FCRA. Birmingham, 633 F.3d at 1010.

Recklessness is measured by an objective standard: action entailing an

unjustifiably high risk of harm that is either known or so obvious that it should be

-known. Id. (quoting Safeco Ins. Co. of Am. v. Burr, 551 U.S. 47, 68 (2007)).

[A] company subject to FCRA does not act in reckless disregard of it unless the

action is not only a violation under a reasonable reading of the statutes terms, but

shows that the company ran a risk of violating the law substantially greater than

the risk associated with a reading that was merely careless. Id. (quoting Safeco,

551 U.S. at 69) (alterations in original). The district court concluded that,

although there was a genuine dispute as to whether the Ocwen Defendants

violated the FCRA, Plaintiff had failed to present evidence that any such violation

was willful.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

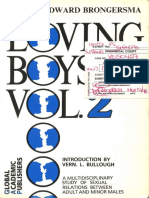

- Edward Brongersma - Loving Boys Vol. 2Document258 pagesEdward Brongersma - Loving Boys Vol. 2RaymondGraciaPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Mers and Merscorp Agree To A Cease and Desist Order - Occ Involved - 4-13-2011Document31 pagesMers and Merscorp Agree To A Cease and Desist Order - Occ Involved - 4-13-201183jjmack100% (7)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devon Christie, A042 259 741 (BIA April 26, 2017)Document13 pagesDevon Christie, A042 259 741 (BIA April 26, 2017)Immigrant & Refugee Appellate Center, LLC100% (1)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Dante's Inferno - Canto SummariesDocument3 pagesDante's Inferno - Canto SummariesAmazinglyTamPas encore d'évaluation

- Understanding violence against womenDocument1 pageUnderstanding violence against womenMiracle WhitesPas encore d'évaluation

- Jones v. Superior CourtDocument4 pagesJones v. Superior CourtKerriganJamesRoiMaulitPas encore d'évaluation

- Misbehavior and Mistake in Bankruptcy Mortgage ClaimsDocument48 pagesMisbehavior and Mistake in Bankruptcy Mortgage ClaimsCarrieonicPas encore d'évaluation

- Pacificrepublicmortcorp STOPOrderDocument3 pagesPacificrepublicmortcorp STOPOrderDany ClementsonPas encore d'évaluation

- 7th Cause of Action IIIDocument1 page7th Cause of Action IIIDany ClementsonPas encore d'évaluation

- Cop 111610 ReportDocument127 pagesCop 111610 ReportwordbabeyPas encore d'évaluation

- McMahon - Article - Final As To TwomblyDocument20 pagesMcMahon - Article - Final As To TwomblyDany ClementsonPas encore d'évaluation

- McMahon - Article - Final As To TwomblyDocument20 pagesMcMahon - Article - Final As To TwomblyDany ClementsonPas encore d'évaluation

- Motion To Remand To US District Court by PlaintiffDocument11 pagesMotion To Remand To US District Court by PlaintiffDany ClementsonPas encore d'évaluation

- Vikas Booklet English II 2017 PDFDocument296 pagesVikas Booklet English II 2017 PDFPadmanabha Rao76% (100)

- Filed: Patrick FisherDocument6 pagesFiled: Patrick FisherScribd Government DocsPas encore d'évaluation

- Final PPT Governmental Programs For The VictimsDocument21 pagesFinal PPT Governmental Programs For The VictimsJohn Paul OrceradaPas encore d'évaluation

- Tier 4 Student Application SummaryDocument12 pagesTier 4 Student Application SummaryRitesh ShresthaPas encore d'évaluation

- PCJS ProcessDocument1 pagePCJS ProcessJopher Nazario0% (1)

- Criminal Law Important Words1Document9 pagesCriminal Law Important Words1Domie Phil Magaway AlejandrinoPas encore d'évaluation

- Sample Complaint Preliminary Attachment With WritDocument10 pagesSample Complaint Preliminary Attachment With WritStrawberry RazPas encore d'évaluation

- Report On Incidents of Bullying and Retaliation: New Lebangon Elementary SchoolDocument1 pageReport On Incidents of Bullying and Retaliation: New Lebangon Elementary Schooladonis_abellanosaPas encore d'évaluation

- Print Edition: February 03, 2014Document21 pagesPrint Edition: February 03, 2014Dhaka TribunePas encore d'évaluation

- Chapter 5 Questions - GroupDocument5 pagesChapter 5 Questions - GroupKarla AmoresPas encore d'évaluation

- 2014-08-06 DOI ECTP Report - Mark Peters (15letter)Document6 pages2014-08-06 DOI ECTP Report - Mark Peters (15letter)Progress QueensPas encore d'évaluation

- Women Trapped in Human Trafficking-1894Document4 pagesWomen Trapped in Human Trafficking-1894Meghana BhuvadPas encore d'évaluation

- Test Bank For Criminology The Core 7th Edition by SiegelDocument19 pagesTest Bank For Criminology The Core 7th Edition by Siegelrowandanhky4pPas encore d'évaluation

- Car Park Manager Charged After Fire: by Zul OthmanDocument1 pageCar Park Manager Charged After Fire: by Zul Othmanapi-27309426Pas encore d'évaluation

- Criminal MindsDocument4 pagesCriminal MindsMartie XOXOPas encore d'évaluation

- Attached and Marked As Annex "A" Is The USB Containing The Video Attached and Marked As Annex "B-Series" Are The Screenshots From The VideoDocument2 pagesAttached and Marked As Annex "A" Is The USB Containing The Video Attached and Marked As Annex "B-Series" Are The Screenshots From The Videomichelle BarrancoPas encore d'évaluation

- Prof Manzoor Iqbal Awan-Bahria University-Conflict Management-Fall 2012-BBA VI B-Student Projects Compilation-16 January 2013Document91 pagesProf Manzoor Iqbal Awan-Bahria University-Conflict Management-Fall 2012-BBA VI B-Student Projects Compilation-16 January 2013Manzoor AwanPas encore d'évaluation

- Health and Medical Response To Active Shooter and Bombing EventsDocument19 pagesHealth and Medical Response To Active Shooter and Bombing Eventsepraetorian0% (1)

- Court upholds death penalty for man who beat toddler to deathDocument122 pagesCourt upholds death penalty for man who beat toddler to deathDana GoanPas encore d'évaluation

- Ernesto Cabrera Rodriguez Mug ShotDocument8 pagesErnesto Cabrera Rodriguez Mug Shotreef_galPas encore d'évaluation

- LSB1 31 March - Mystery StoryDocument3 pagesLSB1 31 March - Mystery StoryMadalina GheorghiuPas encore d'évaluation

- Chanrobles Virtual Law LibraryDocument3 pagesChanrobles Virtual Law LibraryEarl Andre PerezPas encore d'évaluation

- Washoe County District Attorney's Office Releases Report On Fatal Officer-Involved Shooting in SparksDocument28 pagesWashoe County District Attorney's Office Releases Report On Fatal Officer-Involved Shooting in SparksReno Gazette JournalPas encore d'évaluation

- 6 - Rule 114 - BailDocument11 pages6 - Rule 114 - BailRache GutierrezPas encore d'évaluation

- The King of Everything 2Document5 pagesThe King of Everything 2ZADRACK FIELPas encore d'évaluation