Académique Documents

Professionnel Documents

Culture Documents

How To Abatement Procedures 2015

Transféré par

Dan RiveraCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

How To Abatement Procedures 2015

Transféré par

Dan RiveraDroits d'auteur :

Formats disponibles

Real Estate Abatement Procedure- Fiscal Year 2015

What is an abatement?

An abatement is a reduction of property tax. It is based on a reduction in the assessed value of the taxable property. A taxpayer may

only apply for an abatement for the current fiscal year and only if there is a dispute concerning property valuation or classification. An

application cannot be filed on taxes from previous years.

Who can apply?

As a general rule, an application may be filed by the person to whom the tax has been assessed, or by the person who has acquired title

after January 1.

What are the requirements for an abatement of real property taxes?

A taxpayer may contest his or her tax liability on specific grounds:

Overvaluation the assessed value is considered too high.

Disproportionate Assessment pertains to entire property classes, not any individual unit or development.

Improper Classification for example, a property is classified as commercial when it is actually residential.

Statutory Exemption the property qualifies for exemption from taxation based on its ownership use.

Abatement Procedure

For Fiscal Year 2015, abatement applications must be filed after the 3rd quarter tax bill is issued and no later than February 2, 2015 at

4:30PM. Application forms are available in the Assessing Department, Room 103, 200 Common Street Lawrence, MA 01840 (City

Hall) or abatement application forms are also available online immediately following the issuance of the third quarter tax bill at

www.cityoflawrence.com.

NOTE: Applications must be received or postmarked on or before February 2, 2015. No abatement can be granted unless the

application is filed on time. To be timely filed, an application must be (1) actually received in the assessors office by the close of

business on or before the application due date, or (2) postmarked by the United States Postal Service, as mailed first class postage

prepaid to the proper address of the assessors on or before the application due date.

What information will be requested when I file an abatement application?

The Assessing Department is authorized by law to request information that is necessary to properly determine the fair cash value of

the property (i.e. income and expenses). The failure to provide the information requested on the form within thirty (30) days of the

date on which the application for abatement was filed will result in a denial of the application and may bar an appeal to the

Appellate Tax Board.

Payment of Tax

To avoid interest charges, the full tax due must be paid by the due date. Interest will be due if the payment is received late. The tax

must be paid by the date due in order to maintain the right to appeal an abatement decision of the Assessing Department. Failure to

pay in a timely manner jeopardizes your right to appeal.

Assessing Department Actions

The Assessing Department has three (3) months from the date of filing to process all abatement applications. You will be informed of

the status of the application through the following notices:

Notice of Approval

The Assessing Department will abate the amount specified in the notice. Overpayments based on the abatement will be reimbursed.

Notice of Denial

No abatement will be granted. A denial will be issued in cases where the Assessing Department has made a decision based on the

merits of the abatement application, failure of the applicant to file information requested, or for reasons of inaction in cases where the

department has not made a determination on an application within three (3) months of its filing date.

Appeal to the Appellate Tax Board (ATB)

You have three months from the date on which the Assessing Department made its decision (to grant or deny an abatement for any

reason including inaction) to file an appeal to the Appellate Tax Board. Appeal forms can be obtained at the ATB. The ATB is

located at 100 Cambridge St., 2nd Floor Suite 200, Boston, MA 02114. The telephone number is (617) 727-3100.

You may elect to file an appeal to the ATB if:

You are dissatisfied with an amount of abatement granted.

You disagree with the decision of the Assessing department to deny the abatement application.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- IQ and Immigration Policy - Jason RichwineDocument166 pagesIQ and Immigration Policy - Jason RichwineHuffPost Politics67% (9)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Wills Handout PDFDocument52 pagesWills Handout PDFMichael CarrPas encore d'évaluation

- Public International Law PDFDocument734 pagesPublic International Law PDFHexzy JanePas encore d'évaluation

- Essential Employee Guidance Covid 19Document4 pagesEssential Employee Guidance Covid 19Dan RiveraPas encore d'évaluation

- Friday Briefing CallDocument21 pagesFriday Briefing CallDan RiveraPas encore d'évaluation

- COVID-19 - Summary Business Emergency Order Letter - Lawrence BOHDocument1 pageCOVID-19 - Summary Business Emergency Order Letter - Lawrence BOHDan RiveraPas encore d'évaluation

- Rivera - Spring 2017 Biz ReceptionDocument1 pageRivera - Spring 2017 Biz ReceptionDan RiveraPas encore d'évaluation

- Rivera Business Fundraiser 2016Document1 pageRivera Business Fundraiser 2016Dan RiveraPas encore d'évaluation

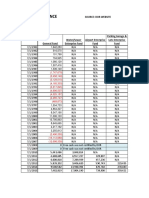

- Freecash Certifications FY1981-FY2015Document1 pageFreecash Certifications FY1981-FY2015Dan RiveraPas encore d'évaluation

- FY14 Free Cash CertificationDocument1 pageFY14 Free Cash CertificationDan RiveraPas encore d'évaluation

- Law Land: The Definitive Gateway CityDocument2 pagesLaw Land: The Definitive Gateway CityDan RiveraPas encore d'évaluation

- FY12 Free Cash CertificationDocument1 pageFY12 Free Cash CertificationDan RiveraPas encore d'évaluation

- FY11 Free Cash CertificationDocument1 pageFY11 Free Cash CertificationDan RiveraPas encore d'évaluation

- FY13 Free Cash CertificationDocument1 pageFY13 Free Cash CertificationDan RiveraPas encore d'évaluation

- CSC vs. DUMLAODocument6 pagesCSC vs. DUMLAOJ Velasco PeraltaPas encore d'évaluation

- WWW Bible Believers Org AuDocument4 pagesWWW Bible Believers Org Aubook3156Pas encore d'évaluation

- Group 6 - Navarro V PV Pajarillo LinerDocument2 pagesGroup 6 - Navarro V PV Pajarillo LinerCharles Bill RafananPas encore d'évaluation

- Rule of Law: Anu Solanki KambleDocument35 pagesRule of Law: Anu Solanki KambleIshita AgarwalPas encore d'évaluation

- Q .7 Ultra ViresDocument6 pagesQ .7 Ultra ViresMAHENDRA SHIVAJI DHENAK100% (2)

- ClearanceDocument1 pageClearanceDonna EvangelistaPas encore d'évaluation

- Urquiaga Vs CA - Predecessor in Interest and Reversion ProceedingDocument1 pageUrquiaga Vs CA - Predecessor in Interest and Reversion ProceedingCarl Montemayor100% (1)

- Hindu Marriage Act 1955 - Summary of Key PointsDocument4 pagesHindu Marriage Act 1955 - Summary of Key PointsDeepak GoswamiPas encore d'évaluation

- 1.people Vs Ferrer Case DigestDocument6 pages1.people Vs Ferrer Case Digesttink echiverePas encore d'évaluation

- Dr. Babasaheb Ambedkar Marathwada University, AurangabadDocument2 pagesDr. Babasaheb Ambedkar Marathwada University, AurangabadMohit NarayanPas encore d'évaluation

- In The First-Tier Tribunal General Regulatory Chamber (Information Rights) APPEAL: EA/2017/0062Document18 pagesIn The First-Tier Tribunal General Regulatory Chamber (Information Rights) APPEAL: EA/2017/0062IR Tribunal - vexatious 2Pas encore d'évaluation

- ST Mochtas Football Club - Code of Conduct EthicsDocument7 pagesST Mochtas Football Club - Code of Conduct EthicsDavid BellewPas encore d'évaluation

- The Asian-African Legal Consultative Organization (AALCO) and Its Relations With The People's Republic of ChinaDocument46 pagesThe Asian-African Legal Consultative Organization (AALCO) and Its Relations With The People's Republic of ChinaNaina MathewPas encore d'évaluation

- 21.a OSG Vs Ayala Land Et - AlDocument2 pages21.a OSG Vs Ayala Land Et - AlMarion JossettePas encore d'évaluation

- 5 Gabelo Vs CaDocument2 pages5 Gabelo Vs CabchiefulPas encore d'évaluation

- Jo AbellanaDocument7 pagesJo Abellanarachelle baggaoPas encore d'évaluation

- Personnel Security ProgramDocument100 pagesPersonnel Security ProgramLawrence R. San JuanPas encore d'évaluation

- People V LimacoDocument4 pagesPeople V LimacoRich ReyesPas encore d'évaluation

- Republic of The Philippines V Sunvar Relaty DevtDocument2 pagesRepublic of The Philippines V Sunvar Relaty DevtElah ViktoriaPas encore d'évaluation

- Lesson 1 - Subjectivism: Chapter 6 - Theories of Senses of SelfDocument14 pagesLesson 1 - Subjectivism: Chapter 6 - Theories of Senses of SelfWild Rift100% (1)

- PHL 1B ETHICS 4MODULE 4 Without EvaluationDocument9 pagesPHL 1B ETHICS 4MODULE 4 Without EvaluationRommel Soliven EstabilloPas encore d'évaluation

- Law19e UnitResourceBook U1Document108 pagesLaw19e UnitResourceBook U1Pistons TankPas encore d'évaluation

- Fiel Vs Banawa 76 OG 619Document5 pagesFiel Vs Banawa 76 OG 619Adah FeliciaPas encore d'évaluation

- Namibia: Annual Human Rights Report: 2009Document189 pagesNamibia: Annual Human Rights Report: 2009André Le RouxPas encore d'évaluation

- United States Bankruptcy Court Southern District of New YorkDocument5 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsPas encore d'évaluation

- 168667-2013-Spouses Gaditano v. San Miguel Corp.Document6 pages168667-2013-Spouses Gaditano v. San Miguel Corp.Germaine CarreonPas encore d'évaluation