Académique Documents

Professionnel Documents

Culture Documents

Tax Statement 2014 Cbhs

Transféré par

Chandra BhattCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tax Statement 2014 Cbhs

Transféré par

Chandra BhattDroits d'auteur :

Formats disponibles

CBHS Health Fund Limited

ABN 87 087 648 717

Locked Bag 5014

Parramatta NSW 2154

Member Care Centre 1300 654 123

Email help@cbhs.com.au

Website cbhs.com.au

Private Health Insurance Statement 1 July 2013 to 30 June 2014

Mrs Geeta Bhatt

18 Champion St

GLENFIELD NSW 2167

Statement Print Date: 9 July 2014

Keep this statement - Use the following information to complete your 2014 income tax return

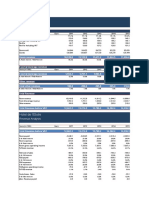

The table below provides details of your 2013-14 private health insurance policy. Each adult beneficiary on the

policy will receive their own statement showing their share of the policy only.

The Australian Government has changed the way the rebate is calculated and applied to premiums. Rebate

percentages are adjusted on 1 April each year. If you paid premiums for your policy before and on or after 1 April,

the table below will contain at least two lines of information. Where more than one line of information has been

provided, the information from each line must be entered separately at the corresponding labels on the income tax

return at Private health insurance policy details.

You will need to nominate a tax claim code when completing the Private health insurance policy details section

of your tax return. Read the tax return instructions to determine the tax claim code appropriate for your situation.

Australian Government Rebate on private health insurance

Health

Insurer ID

B

B

CBH

CBH

Membership

Number

C

C

223774

223774

Your premiums

eligible for

Australian

Government

rebate

J

J

$645

$203

Your Australian

Government

rebate received

K

K

$194

$59

Benefit

code

L

L

Other adult

beneficiaries for the

policy

30

31

Chandra Bhatt

Chandra Bhatt

IMPORTANT - If you have more than one line of information in the table above, make sure each line is input

separately into your income tax return. Do not add-up amounts reported in any column or row and input a total.

Rounding Disclaimer for legislative purposes, any amounts detailed in the table above are rounded to a whole dollar and do

not include any Lifetime Health Cover Loading applicable to cover after 30 June 2013. As such the amounts detailed

may not reconcile with the actual amounts.

M2

Medicare Levy Surcharge

If you and all of your dependants (including your spouse) did not have an appropriate level of private patient hospital cover for

the full financial year (365 days) you may be liable for the Medicare Levy Surcharge see 2014 Individual tax return

instructions question M2.

Number of days this policy provides an appropriate level of private patient hospital cover

For your information only number of days covered by ancillary cover (or extras cover)

For more information go to cbhs.com.au/tax2014

365

Vous aimerez peut-être aussi

- Application For Housing Assistance: Use This Form To Apply For Social Housing Assistance in New South WalesDocument18 pagesApplication For Housing Assistance: Use This Form To Apply For Social Housing Assistance in New South WalesVincent HardyPas encore d'évaluation

- Your Centrelink Statement For Parenting Payment: Reference: 207 828 705JDocument3 pagesYour Centrelink Statement For Parenting Payment: Reference: 207 828 705JLupe VakaPas encore d'évaluation

- CV Daniel PDFDocument3 pagesCV Daniel PDFDanielWildSheepZaninPas encore d'évaluation

- Monica L Lindo Tax FormDocument2 pagesMonica L Lindo Tax Formapi-299234513Pas encore d'évaluation

- MyafDocument2 pagesMyaffPas encore d'évaluation

- Transaction Details Amount in PKR Closing Balance DateDocument2 pagesTransaction Details Amount in PKR Closing Balance DateediealiPas encore d'évaluation

- Answer Key AssessmentDocument7 pagesAnswer Key AssessmentBesha Sorigano50% (2)

- Wage Easy ATO Payment Summaries (2018 Jun 28)Document1 pageWage Easy ATO Payment Summaries (2018 Jun 28)Haillander Lopes viannaPas encore d'évaluation

- Your Centrelink Statement For Youth Allowance: Reference: 280 993 398VDocument3 pagesYour Centrelink Statement For Youth Allowance: Reference: 280 993 398Vbob0% (1)

- Medicare Enrolment Form (MS004) PDFDocument13 pagesMedicare Enrolment Form (MS004) PDFDanielWildSheepZaninPas encore d'évaluation

- Your Centrelink Statement For Disability Support Pension: Reference: 204 552 505CDocument3 pagesYour Centrelink Statement For Disability Support Pension: Reference: 204 552 505CChellii McgrailPas encore d'évaluation

- Adam Rizk Tenancy Application FormDocument2 pagesAdam Rizk Tenancy Application FormRam PPas encore d'évaluation

- HTTPSWWW Servicesaustralia Gov Ausitesdefaultfiles2023-03sa466-2304en-F PDFDocument35 pagesHTTPSWWW Servicesaustralia Gov Ausitesdefaultfiles2023-03sa466-2304en-F PDFsiawashPas encore d'évaluation

- 26082021-PAYG Payment Summary-G Khajarian (CLAIM-00464429)Document1 page26082021-PAYG Payment Summary-G Khajarian (CLAIM-00464429)Garo KhatcherianPas encore d'évaluation

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeD'EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadePas encore d'évaluation

- Statement 31072012Document11 pagesStatement 31072012Amrinder Setia100% (1)

- Manpreet Kaur USQ Application FormDocument5 pagesManpreet Kaur USQ Application FormGagandeep KaurPas encore d'évaluation

- Child Care Subsidy (0028112904)Document9 pagesChild Care Subsidy (0028112904)ammar naeemPas encore d'évaluation

- Form Ferick Done - JPGDocument9 pagesForm Ferick Done - JPGAnnie LamPas encore d'évaluation

- Australian Passport Renewal Application: Providing Two Identical Photographs of YourselfDocument2 pagesAustralian Passport Renewal Application: Providing Two Identical Photographs of YourselfAnonymous mi90esG9Pas encore d'évaluation

- SR Notice of Assessment 2015Document1 pageSR Notice of Assessment 2015Ded MarozPas encore d'évaluation

- Early Release Superannuation Approval 7115569398585Document1 pageEarly Release Superannuation Approval 7115569398585DanielWildSheepZaninPas encore d'évaluation

- Customer Services OnlineDocument1 pageCustomer Services OnlineBrendan Han YungPas encore d'évaluation

- Chorinho Pacoqui o Du SilvaDocument9 pagesChorinho Pacoqui o Du SilvaAlejo GarciaPas encore d'évaluation

- Business Activity Statement: Summary of AmountsDocument2 pagesBusiness Activity Statement: Summary of AmountsSimona StratulatPas encore d'évaluation

- Invoice 39618325Document1 pageInvoice 39618325sam huangPas encore d'évaluation

- Parenting Payment - P240503786Document2 pagesParenting Payment - P240503786Izzy BaePas encore d'évaluation

- Business Taxation Solman Tabag@garcia PDFDocument42 pagesBusiness Taxation Solman Tabag@garcia PDFJoey AbrahamPas encore d'évaluation

- Income Tax Account Statement of Account: MR Daniel Zanin 25 Bulgoon CR Ocean Shores NSW 2483Document2 pagesIncome Tax Account Statement of Account: MR Daniel Zanin 25 Bulgoon CR Ocean Shores NSW 2483DanielWildSheepZaninPas encore d'évaluation

- Oscf PDFDocument9 pagesOscf PDFAnnie LamPas encore d'évaluation

- Filled The Dandiwal Family Trust Casual 2019 5179Document8 pagesFilled The Dandiwal Family Trust Casual 2019 5179Annie LamPas encore d'évaluation

- ZhI6Jn6596kJrCx96K97699d759798eeb2 67922000Document3 pagesZhI6Jn6596kJrCx96K97699d759798eeb2 67922000Char LaPlante SlovenzPas encore d'évaluation

- The Property Investors Alliance: Electricity Gas Phone Internet Pay TV InsuranceDocument4 pagesThe Property Investors Alliance: Electricity Gas Phone Internet Pay TV InsuranceRaza RPas encore d'évaluation

- Your Statement: Smart AccessDocument1 pageYour Statement: Smart AccesshanhPas encore d'évaluation

- HR Manager Digital Technology & Innovation 1 Charles ST, Level 3A ParramattaDocument3 pagesHR Manager Digital Technology & Innovation 1 Charles ST, Level 3A ParramattaKiran PPas encore d'évaluation

- Https Download - Ib.nab - Com.au Ibdownload Download 947636060-22aug2014Document2 pagesHttps Download - Ib.nab - Com.au Ibdownload Download 947636060-22aug2014gizzelenePas encore d'évaluation

- Prefill 2019Document2 pagesPrefill 2019Usama AshfaqPas encore d'évaluation

- CHAPTER 6 7 and 8 TAXDocument38 pagesCHAPTER 6 7 and 8 TAXMark Lawrence Yusi100% (1)

- PAYG Payment Summary Individual Non-Business: Ai Thi Hoai Nguyen 1/3 Mary ST North Melbourne Vic 3051Document1 pagePAYG Payment Summary Individual Non-Business: Ai Thi Hoai Nguyen 1/3 Mary ST North Melbourne Vic 3051hungdahoangPas encore d'évaluation

- PAYG Payment Summary - Individual Non-Business: Muhammad Danish 22/324 Woodstock Avenue Mount Druitt NSW 2770Document1 pagePAYG Payment Summary - Individual Non-Business: Muhammad Danish 22/324 Woodstock Avenue Mount Druitt NSW 2770Danish MuhammadPas encore d'évaluation

- Grant For Crisis Payment S303833612Document2 pagesGrant For Crisis Payment S303833612anthony rudduck100% (1)

- Pandemic Leave Disaster Payment: Claim ForDocument8 pagesPandemic Leave Disaster Payment: Claim ForSarah VirziPas encore d'évaluation

- Licence or Learner Permit ApplicationDocument2 pagesLicence or Learner Permit ApplicationameenPas encore d'évaluation

- About Sanda Islam Your Family Assistance: Reference: 605 730 292XDocument3 pagesAbout Sanda Islam Your Family Assistance: Reference: 605 730 292XAriful RussellPas encore d'évaluation

- Overpayment M249802319Document2 pagesOverpayment M249802319Simon ChownPas encore d'évaluation

- PAYG Payment Summary - Individual Non-Business: Matthew Burn 1933b/702 Harris Street Ultimo NSW 2007Document1 pagePAYG Payment Summary - Individual Non-Business: Matthew Burn 1933b/702 Harris Street Ultimo NSW 2007Anonymous JytY5quhSgPas encore d'évaluation

- Child Care Subsidy (0028112904) PDFDocument9 pagesChild Care Subsidy (0028112904) PDFammar naeemPas encore d'évaluation

- Income Tax Account Statement of Account: MR Brock W Johnson 177 Barrabool RD Highton Vic 3216Document2 pagesIncome Tax Account Statement of Account: MR Brock W Johnson 177 Barrabool RD Highton Vic 3216Annie LamPas encore d'évaluation

- Pre-Filling Report 2017: Taxpayer DetailsDocument2 pagesPre-Filling Report 2017: Taxpayer DetailsUsama AshfaqPas encore d'évaluation

- PAYG Payment Summary - Individual Non-Business: Fook Ngo 139 Railway Avenue Laverton VIC 3028Document1 pagePAYG Payment Summary - Individual Non-Business: Fook Ngo 139 Railway Avenue Laverton VIC 3028Fook NgoPas encore d'évaluation

- WWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enDocument17 pagesWWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enLeslie BrownPas encore d'évaluation

- NRAS Tenancy Managers - Australian Government Department Families, Housing, Community Services and Indigenous AffairsDocument12 pagesNRAS Tenancy Managers - Australian Government Department Families, Housing, Community Services and Indigenous Affairsbackch9011Pas encore d'évaluation

- Verification of Medical Condition(s) : Instructions For The Customer Information For The DoctorDocument3 pagesVerification of Medical Condition(s) : Instructions For The Customer Information For The DoctorElise SloperPas encore d'évaluation

- Partner Details: This Form Lets Us Know You Are PartneredDocument19 pagesPartner Details: This Form Lets Us Know You Are PartneredgouthamreddysPas encore d'évaluation

- Rent Subsidy Review - Your New Rent and Water Charge: Assessment Details Table at The End of This LetterDocument3 pagesRent Subsidy Review - Your New Rent and Water Charge: Assessment Details Table at The End of This Letteranthony rudduckPas encore d'évaluation

- Dfadsfadfagffdfasdfadfadfas FaDocument16 pagesDfadsfadfagffdfasdfadfadfas FaTyrone DomingoPas encore d'évaluation

- Application To Copy or Transfer From One Medicare Card To AnotherDocument6 pagesApplication To Copy or Transfer From One Medicare Card To AnotherDavid LockeridgePas encore d'évaluation

- Visa Application Form NA EnglishDocument9 pagesVisa Application Form NA EnglishVamshi UkoPas encore d'évaluation

- 1420 Form For Applicants PDFDocument21 pages1420 Form For Applicants PDFsarangowaPas encore d'évaluation

- 3169 1306enDocument3 pages3169 1306enmilitia14Pas encore d'évaluation

- What You Need To Do Now: Manage Your Policy OnlineDocument25 pagesWhat You Need To Do Now: Manage Your Policy OnlineManish JaiswalPas encore d'évaluation

- Change Investments AussuperDocument2 pagesChange Investments AussuperSusi RamadhaniPas encore d'évaluation

- ADF Army Recruit Course Day by Day V8 PDFDocument1 pageADF Army Recruit Course Day by Day V8 PDFR ShoosmithPas encore d'évaluation

- Tax PackDocument3 pagesTax PackPETERPas encore d'évaluation

- Just Online Registration Receipt For Transaction - 106682Document3 pagesJust Online Registration Receipt For Transaction - 106682Mohamad Adli AbdullahPas encore d'évaluation

- Multiple-Choice-Questions FinalDocument3 pagesMultiple-Choice-Questions FinalFreann Sharisse Austria100% (1)

- Revenue Regulations No 3-98 FBTDocument15 pagesRevenue Regulations No 3-98 FBTeric yuulPas encore d'évaluation

- Compilation Case Digests Tax 2Document15 pagesCompilation Case Digests Tax 2rgomez_940509Pas encore d'évaluation

- US Internal Revenue Service: f1098c - 2005Document7 pagesUS Internal Revenue Service: f1098c - 2005IRSPas encore d'évaluation

- 2022 Chart - Barrister - Family CalculationsDocument3 pages2022 Chart - Barrister - Family CalculationsManit SainiPas encore d'évaluation

- Income Tax in India - Wikipedia, The Free EncyclopediaDocument10 pagesIncome Tax in India - Wikipedia, The Free EncyclopediakandurimaruthiPas encore d'évaluation

- TP1-W2-S3-R0 Sri Annisa KatariDocument3 pagesTP1-W2-S3-R0 Sri Annisa Katarisri annisa katariPas encore d'évaluation

- Resolution Restoring Homestead Rebate and Senior Freeze ProgramsDocument2 pagesResolution Restoring Homestead Rebate and Senior Freeze Programsjmjr30Pas encore d'évaluation

- Credit Note: (Original For Recipient)Document2 pagesCredit Note: (Original For Recipient)Swetha WariPas encore d'évaluation

- Annexure IV Financial Bid Offer Letter To Be Given by The OwnerDocument2 pagesAnnexure IV Financial Bid Offer Letter To Be Given by The OwneramareshluckyyPas encore d'évaluation

- IAS 41 Agriculture Sets Out The Accounting For Agricultural ActivityDocument3 pagesIAS 41 Agriculture Sets Out The Accounting For Agricultural ActivityZes OPas encore d'évaluation

- 00, Chah Tali Wala Mouza Nagni Post Office Jhambhi Wahin, Basti Nagni, Lodhran Kahror Pakka Shahid IqbalDocument3 pages00, Chah Tali Wala Mouza Nagni Post Office Jhambhi Wahin, Basti Nagni, Lodhran Kahror Pakka Shahid IqbalBahawalpur 24/7Pas encore d'évaluation

- Net of Withholding Kailangan Niyo I Gross Up, KayaDocument7 pagesNet of Withholding Kailangan Niyo I Gross Up, KayaJPPas encore d'évaluation

- Hotel de L - Etoile Income StatementDocument2 pagesHotel de L - Etoile Income StatementasadPas encore d'évaluation

- List Tax Haven CountryDocument13 pagesList Tax Haven CountrybriePas encore d'évaluation

- Taxation UPDocument28 pagesTaxation UPmarkbagzPas encore d'évaluation

- LSMW Mat ExtnDocument77 pagesLSMW Mat ExtnAjay KumarPas encore d'évaluation

- Assignment 1 - QuestionsDocument10 pagesAssignment 1 - QuestionsShinza Jabeen0% (3)

- Watcho Dhamaal - Oct 19, 2022 - 1666175762Document1 pageWatcho Dhamaal - Oct 19, 2022 - 1666175762ParteekPas encore d'évaluation

- Congress of The Philippines Metro ManilaDocument13 pagesCongress of The Philippines Metro ManilaLyna Manlunas GayasPas encore d'évaluation

- Kalindi Exp Sleeper Class (SL)Document1 pageKalindi Exp Sleeper Class (SL)Gaurav kumarPas encore d'évaluation

- Tax Accountin 11Document3 pagesTax Accountin 11Muhammad Raihan AdzdzikrullohPas encore d'évaluation

- Essentials of Federal Taxation 3rd Edition Spilker Solutions ManualDocument35 pagesEssentials of Federal Taxation 3rd Edition Spilker Solutions Manualxavialaylacs4vl4100% (26)

- ST Charles Tax AssessmentsDocument613 pagesST Charles Tax AssessmentscherylwaityPas encore d'évaluation

- WSJ+ Tax-Guide 2022Document73 pagesWSJ+ Tax-Guide 2022JoePas encore d'évaluation