Académique Documents

Professionnel Documents

Culture Documents

Icici Prudential Life Insurance ... Vs Department of Income Tax On 20 June, 2012

Transféré par

hhhhhhhuuuuuyyuyyyyyDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Icici Prudential Life Insurance ... Vs Department of Income Tax On 20 June, 2012

Transféré par

hhhhhhhuuuuuyyuyyyyyDroits d'auteur :

Formats disponibles

Icici Prudential Life Insurance ...

vs Department Of Income Tax on 20 June, 2012

Income Tax Appellate Tribunal - Mumbai

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

ITA Nos.6854 to 6856 6509 7765 to 7767 and 7213 ICICI PRULIFE Mumbai F Ben

IN THE INCOME TAX APPELLATE TRIBUNAL

"F" Bench, Mumbai

Before Shri B. Ramakotaiah, Accountant Member

And Shri Vivek Varma, Judicial Member

ITA

ITA

ITA

ITA

No.6854/Mum/2010

No.6855/Mum/2010

No.6856/Mum/2010

No.6059/Mum/2011

:

:

:

:

ICICI Prudential Insurance

Co. Ltd, 1089 Appasaheb

Marathe Marg, Prabhadevi,

Mumbai 400025

PAN: AAACI 7351 P

(Appellant)

ITA

ITA

ITA

ITA

Vs.

year:

year:

year:

year:

2005-06)

2006-07)

2007-08)

2008-09)

Asstt. CIT, Cir-6(1)

Mumbai

(Respondent)

No.7765/Mum/2010

No.7766/Mum/2010

No.7767/Mum/2010

No.7213/Mum/2011

Asstt. CIT, Cir-6(1)

Mumbai

(Assessment

(Assessment

(Assessment

(Assessment

:

:

:

:

Vs.

(Appellant)

(Assessment

(Assessment

(Assessment

(Assessment

year:

year:

year:

year:

2005-06)

2006-07)

2007-08)

2008-09)

ICICI Prudential Insurance

Co. Ltd, 1089 Appasaheb

Marathe Marg, Prabhadevi,

Mumbai 400025

PAN: AAACI 7351 P

(Respondent)

Assessee by:

Shri S.E. Dastur and

Ms. Arati Vissanji

Department by: Shri Subachan Ram

Date of Hearing:

20/06/2012

Date of Pronouncement: 14/09/2012

ORDER

Per Bench:

These appeals are by assessee for the assessment years 2005- 06 to 2008-09 and cross appeals by

revenue for the respective assessment years. These appeals are on common issues, even though

amounts vary from year to year. Therefore, all the appeals were heard together and common order is

Indian Kanoon - http://indiankanoon.org/doc/37648666/

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

passed.

Page 1 of 77

ITA Nos.6854 to 6856 6509 7765 to 7767 and 7213 ICICI PRULIFE Mumbai F Bench

2. We have heard the learned Counsel Shri S.E. Dastur and the learned CIT (DR) Shri Subachan

Ram in detail and also perused the submissions made by the respective parties and reliance on

various case law and paper books placed on record in respective years. Their arguments were

incorporated wherever necessary. For the sake of convenience, the issues in assessment year

2005-06 are discussed elaborately.

ITA No.6854/Mum/2010 - AY 2005-06:

3. This is an assessee's appeal in which assessee has raised the following grounds:

"1. The CIT (Appeals) has erred in not accepting the loss of `.150.45 crores returned

by the appellant.

2. The CIT (Appeals) erred in holding that the surplus as reflected in

Form-I is the taxable income of the appellant.

3. The CIT(Appeals) erred in upholding the taxable income for the

year at `.98.96 crores by holding that the amount transferred from the

shareholder's account to account is not to be reduced from the surplus

disclosed in Form-I. It is prayed that the surplus considered for

computing taxable income should be after removing the effect of

transfer from Shareholder's account to account.

4. The CIT (Appeals) has erred in not accepting disallowance under

section 14A offered in revised return of income is on reasonable basis

but directed AO to decide the issue afresh".

4. The facts in brief are that assessee is a Public Limited Company registered under

the Companies Act, 1956. The Company was incorporated on July 20, 2000 with the

object of carrying on Life Insurance Business. The activities of the insurance are

governed by the Insurance Act, 1938, Insurance Regulatory and Development

Authority (IRDA) Act, 1999 as amended from time to time, IRDA rules and

Regulations from time to time made there under. The return of income for AY

2005-06 was filed on 27.10.2005 declaring a loss of `.150,46,83,807/-. The case was

selected for scrutiny and AO while accepting that assessee is in the business of life

insurance considered that income of assessee from Page 2 of 77 ITA Nos.6854 to

6856 6509 7765 to 7767 and 7213 ICICI PRULIFE Mumbai F Bench insurance

business is assessable as per section 44 of the Income Tax Act. He has considered the

Indian Kanoon - http://indiankanoon.org/doc/37648666/

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

Actuarial Valuation Report submitted in Form-I extracted in the assessment order

which is as under:

Form-I of the Actuarial Report:

Item

Description

No.

Balance of

Mathematical

fund shown

in Balance

reserves

(excluding

`.)

Sheet (`

(1)

01

02

(2)

Business

within India

Par policies

Non

Par

05

Policies

Totals

Total

business

par policies

Non

par

06

policies

Total

03

04

(3)

6702408920

`.)

Surplus (`

Negative

Reserves

`.)

(`

cost of bonus

`)

allocated)(`)

(4)

(5)

(6)

6411682550

290726370

12539400

28131258270

28064221830

67969900

59423230

34833667190

34475904380

358696280

71962640

6411682550

290726370

12539400

28131258270

28064221830

67969900

59423230

34833667190

34475904380

358696280

71962640

6702408920

Since there is a surplus declared at `.35,86,92,280/- in the form I AO asked assessee

to explain why the computation is not made according to the 'actuarial valuation' It

was the contention of assessee that the actuarial valuation has resulted in deficit

which were shown as loss whereas the Form-I represents the total surplus after

transfer of assets from shareholder's account to the account as per the IRDA rules.

The surplus has to be shown in order to declare dividend, bonus etc. under the rules

and the amount was transferred by way of infusion of fresh capital into the company

and transferred to the Policyholder's account. It was submitted that the transfer of

shareholder's funds does not give rise to any income and the actuarial surplus arrived

at was a deficit on which the return was filed and in case AO has to consider the

surplus in Form-I, then transfer of funds from shareholder's account should be

reduced from the above amount as it is only transfer of capital assets and not income.

AO, however, relying on the principles laid Page 3 of 77 ITA Nos.6854 to 6856 6509

7765 to 7767 and 7213 ICICI PRULIFE Mumbai F Bench down by the Hon'ble

Supreme Court in the case of LIC vs. CIT, 51 ITR 773 wherein it was held that the

assessment of the profits of an insurance business is completely governed by the rules

Indian Kanoon - http://indiankanoon.org/doc/37648666/

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

under the schedules and there is no power to do anything not contained in it. Further

he also relied on the judgment of the Hon'ble Bombay High Court in the case of LIC

vs. CIT, 115 ITR 45 to come to a conclusion that AO has no power to make adjustment

once provisions of section 44 were invoked. Accordingly he took the surplus as

declared in Form-I as the basis for computation of income and accordingly arrived at

the surplus at `.35,86,96,280/-. He also made an addition of deficit from Pension

Scheme at `.63,09,19,492/- before setting of the brought forward losses. He also

made disallowance under section 14A to an extent of `.4,42,584/- even though no

adjustment was made in the computation of income.

5. The matter was contested before the CIT (A) and assessee made elaborate

submissions. The main contention was that Form-I is a report prepared as a part of

actuarial report and abstracts under the IRDA Regulations to ascertain segment-wise

cumulative allowability of actuarial valuation shown as mathematical errors. It was

submitted that Form - I does not provide the Profit & Loss A/c of entire business but

shows the asset- liability position of only . It was further explained that IRDA has

made specific rules to segregate the account and shareholder's account and revised

the form for presentation of insurance accounts as prescribed in IRDA(Preparation of

Financial statements and Auditor's Report of Insurance companies) Regulations

2002. According to the Regulations, Profit & Loss A/c of life insurance company is

divided into a technical account (policy holder's account) also called as revenue

account and non-technical account (shareholder's account) also called Profit & Loss

A/c. It was further submitted that technical accounts deals with all the transactions

relating to the Page 4 of 77 ITA Nos.6854 to 6856 6509 7765 to 7767 and 7213 ICICI

PRULIFE Mumbai F Bench including income from premium and expenditure and

actuarial provision shown segment-wise. All the transactions relating to

shareholder's like funding the deficit of the account, income earned on investment of

share capital and reserves are dealt with the non technical account called

shareholder's account. As per the Regulations the format for presentation of account,

the impact of actuarial valuation is shown in the Revenue Account relating to for the

year and the surplus/deficit is arrived at. It was submitted that in order to compute

the effect for the Income Tax computation result of account and shareholder's

account needs to be combined and accordingly assessee filed surplus/deficit

calculated after combining the and shareholder's accounts.

6. The learned CIT (A) however, did not agree with the above contentions and stated

that section 44 r.w. part-A of first schedule to the Income Tax (Rule 2) provides for

mechanism of arriving at the surplus of the insurance business and the actuarial

surplus as disclosed in Form-I which is part of the actuarial report duly certified by

the appointed Actuary of the Company should be considered as income from life

insurance business as per the Act. Therefore, he agreed with AO's action and rejected

assessee's contention. Assessee is aggrieved on this issue and raised grounds no 1 to

3.

Indian Kanoon - http://indiankanoon.org/doc/37648666/

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

7. The learned Counsel drawing our attention to the special scheme of assessment as

provided in section 44 of the Income tax Act and First schedule of Income tax act and

more particularly Rule-2 submitted that insurance business was governed by the

actuarial valuation and not by the general Profit & Loss A/c prepared in other

company. Insurance business is regulated by the Insurance Act 1938 and further by

the IRDA Act 1999. As per the Regulations issued by the IRDA which assessee has to

follow, as it was incorporated after the legislation of the IRDA Act, it has to maintain

the accounts as per the new Regulations and accordingly Page 5 of 77 ITA Nos.6854

to 6856 6509 7765 to 7767 and 7213 ICICI PRULIFE Mumbai F Bench shown policy

holder's account and shareholder's account. There was a negative balance in

policyholder's account to an extent of `.201.60 crores. The law requires the deficit in

policyholder's account should be made good before declaring any bonus or dividend

and this deficit should be fulfilled by transferring corresponding amount from

shareholder's account. Accordingly during the year, assessee has transferred an

amount to the extent of `.233.35 crores from shareholder's account to policyholder's

account. As the transfer should be supported by assets, assessee has issued shares

afresh to the extent of `.250 crores and increased the capital to that extent. Since the

amount transferred from shareholder's account is nothing but transfer of capital

from shareholder's account to policyholder's account, it was the submission that the

surplus arrived at after the transfer of the capital cannot be considered as income of

assessee. It was like taxing the capital receipt/ sum which can not be regarded as

income. Without prejudice to the claim, it was also submitted that assessee has filed

the returns consolidating the policyholder's account and shareholder's account and

the credit in the policyholder's account is matched by the debit in the shareholder's

account. This is tax neutral. Therefore, AO was not correct in considering the surplus

which arose due to transfer of share capital as per the IRDA Regulations.

8. The learned Counsel also explained the history of the case. It was the submission

that this issue of examining the actuarial surplus was first time taken up under

section 263 in assessment years 2003-04 and 2004-05, for the first time by the CIT

and this matter has been contested before the ITAT. ITAT vide ITA No.3270 and

4685/Mum/2008 dated 22.01.2009 has set aside the orders of the CIT as there was

no prejudice caused to the Revenue in the order under section 143(3). This order was

contested before the Hon'ble High Court which dismissed the Revenue appeal and

Page 6 of 77 ITA Nos.6854 to 6856 6509 7765 to 7767 and 7213 ICICI PRULIFE

Mumbai F Bench further contested before the Hon'ble Supreme Court which also did

not admit and dismissed Revenue appeals. However, the Revenue took proceedings

under section 147 and reopened assessment from assessment years 2002-03 to

2004-05 on the very same issue which was contested by way of writ petition filed

before the Hon'ble High Court. The Hon'ble High Court vide orders dated

19/03/2010 reported in 325 ITR 471 quashed the notices under section 148 issued in

this regard. The Hon'ble High Court also considered on merits all the issues and

rejected the Revenue contentions. So, it was submitted that upto the assessment year

2004-05 assessee's computation of actuarial deficit i.e. loss arrived at in the life

Indian Kanoon - http://indiankanoon.org/doc/37648666/

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

insurance business was accepted.

9. Referring to the notes to the computation, the learned Counsel drew our attention

to various notes (page-5 of the paper book) to submit that consequent to the IRDA

recommendations, the insurance companies are maintaining the account as per the

format prescribed under Insurance Act 1938 for presentation of insurance accounts

and as per the revised format for the presentation of accounts in the new Regulations

under IRDA, the impact of the actuarial valuation is transferred to the revenue

account relating to policy holders for the year and the surplus/deficit is disclosed

therein. It was further submitted that the earlier formats for presentation of accounts

aggregated the results relating to shareholder's and policyholder's and thus the

surplus/deficit was including the impact of both. There is a scheme of presentation of

accounts currently in force for life insurance companies and the new formats were

prescribed for complying with the IRDA Regulations. It was the submission that even

though amendment was brought in Rule 5 in First Schedule for General Insurance

business to incorporate changes brought by I R D Act no such amendment was

brought in Rule-2. Therefore, the manner of taxing the life insurance companies has

not been realigned with the Page 7 of 77 ITA Nos.6854 to 6856 6509 7765 to 7767

and 7213 ICICI PRULIFE Mumbai F Bench changes as prescribed by the IRDA. It

was further submitted that there is a deficit of `.233,34,76,828/- in the policyholder's

account format-A-RA which has been made good by transfer of funds from the

shareholder's account. Therefore, the figures that appeared in Form-I are subsequent

to this transfer from shareholder's account. It was further submitted that the earlier

format did not provide for segregating insurance business into and shareholder's and

therefore, the requirement to transfer funds from one account to other and the need

thereof for aggregating two accounts to reflect the outcome of surplus or deficit did

not arise at that time. In order to arrive at the actuarial surplus/ deficit as per the

Insurance Act, 1938 it was submitted that the accounts are aggregated and

accordingly assessee has filed the return of income. As per the account before

transfer of the amounts, there was a deficit to an extent of `.161,40,61,362/- and

surplus in shareholder's account of `.10,93,77,555/-. In view of this assessee arrived

at a loss of `.150,46,83,807/- for the valuation year ended 31.03.2005 by combing

both accounts. The learned Counsel referred to the actuarial valuation report placed

in the paper book and also reconciliation statement as per Rule-2 and submitted that

the reconciliation statement is as per the rules under Insurance Act 1938.

10. It was further submitted that even if one were to accept the flipside of the

accounting, AO cannot take only one side of the account to tax the surplus arrived

after transfer of capital funds from the shareholder's account. If one were to accept

the transfer from one account to another, the surplus in policyholder's account will

get nullified by deficit in shareholder's account consequent to transfer from one to

another. If the method is to be followed as per the Insurance Act, 1938, then the

combined account which assessee has followed is correct method and AO has no

option than to accept the accounts as prepared under the Insurance Act, 1938.

Indian Kanoon - http://indiankanoon.org/doc/37648666/

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

Page 8 of 77

ITA Nos.6854 to 6856 6509 7765 to 7767 and 7213 ICICI PRULIFE Mumbai F Bench

11. The learned Counsel referring to Rule-2 submitted that the actuarial valuation

made in accordance with the Insurance Act, 1938 (Act No.4 of 1938) should be read

to mean that it is an incorporation into the Income Tax Act and not a mere reference.

Therefore, it was his submission that the actuarial valuation has to be computed in

accordance with the Insurance Act, 1938 then existing and not with reference to the

subsequent amendments made in the formats under the IRDA Act. He then referred

to the principle of 'legislation by incorporation' and 'legislation by reference' and

referred to the decisions of the Hon'ble Supreme Court of India in the case of

Mahindra & Mahindra Ltd vs. Union of India & Others (1979) 2 Supreme Court cases

529 given in the context of MRTP Act, 1969 and Bharat Cooperative Bank Mumbai

Ltd vs. Cooperative Bank Employees Union AIR 2007 (SC) 2320

12. The learned Counsel also submitted that in case the language of the statutory

provision is ambiguous and capable of two constructions, that construction must be

adopted which will give meaning and effect to the other provisions of the enactment

rather than that which will give none. He referred to the decision of the Hon'ble

Supreme Court in the case of Addl. CIT vs. Surat Art Silk Cloth Manufacturers

Association 121 ITR 1(SC) to submit that the construction which is in tune with the

provisions of the Act can only be adopted and referred to the following from the

above said order.

"It is true that the consequences of a suggested construction cannot

alter the meaning of a statutory provision where such meaning is plain

and unambiguous, but they can certainly help to fix its meaning in

case of doubt or ambiguity. Let us examine what would be the

consequences of the construction contended for on behalf of the

revenue. If the construction put forward on behalf of the revenue were

accepted, then as already pointed out above, no trust or institution

whose purpose is promotion of an object of general public utility,

would be able to carry on any business, even though such business is

held under trust or legal obligation to apply its income wholly to the

charitable purpose or is carried on by the trust or institution for the

purpose of earning profit to be Page 9 of 77 ITA Nos.6854 to 6856

6509 7765 to 7767 and 7213 ICICI PRULIFE Mumbai F Bench utilized

exclusively for feeding the charitable purpose. If any such business is

carried on, the purpose of the trust or institution would cease to be

charitable and not only the income from such business but the entire

income of the trust or institution from whatever source derived, would

lose the tax exemption. The result would be that no trust or institution

established for promotion of an object of general public utility would

Indian Kanoon - http://indiankanoon.org/doc/37648666/

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

be able to engage in business for fear that it might lose the tax

exemption altogether and a major source of income for promoting

objects of general public utility would be dried up. It is difficult to

belief that the legislature could have intended to bring about a result

so drastic in its consequence. If the intention of the legislature were to

prohibit a trust or institution established for the promotion of an

object of general public utility from carrying on any activity for profit,

it would have provided in the clearest terms that no such trust or

institution shall carry on any activity for profit, instead of using

involved and obscure language giving rise to linguistic problems and

promoting interpretative litigation. The legislature would have used

language leaving no doubt as to what was intended and not left its

intention to be gathered by doubtful implication from an amendment

made in the definition clause and that too in language far from clear".

13. The learned Counsel further relied on principle laid down by Hon'ble Himachal

Pradesh High Court decision in Yogendra Chandra Vs CWT 187 ITR 58 to submit that

if a literal interpretation as suggested by Revenue is accepted, it would lead to a

manifestly absurd result which is not the intention of legislature. In this case the

capital transfer was considered as income in the pretext of relying on Form I. He

referred to AO's order to submit that the Hon'ble Supreme Court in the case of LIC

vs. CIT 51 ITR 773 had approved that AO has to arrive at the profits of the insurance

business as per first schedule and he was not empowered to make any variation. To

that extent, the accounts that were prepared under the Insurance Act, 1938 are to be

accepted. However, it was submitted that reliance on the Hon'ble Bombay High Court

judgment in LIC vs. CIT 115 ITR 45 is not correct as that judgment was reversed by

the Hon'ble Supreme Court in 219 ITR 410. Therefore, it was submitted that AO

relied on the over-ruled Page 10 of 77 ITA Nos.6854 to 6856 6509 7765 to 7767 and

7213 ICICI PRULIFE Mumbai F Bench judgment to deny assessee the benefit of

combining the accounts. It was submitted that the rules and provisions has to be

implemented by making a harmonious reading of the provisions and internal transfer

should be permitted which was made as per IRDA Regulations for which the Income

Tax Act was not amended to incorporate the changes.

14. Ld. Counsel also referred to the annual accounts, various forms and Regulations

and filed reconciliation statements placed before authorities to explain the rationale

of arriving at surplus/deficit as was done by assessee company.

15. In reply the learned DR submitted that there is no relevance of the proceedings

initiated under section 263 and 147 to the issue in present as their actions are under

different provisions and are different matter altogether. It was his submission that

the ITAT order against appeal on order under section 263 had no impact as ITAT

considered the issue in the context of erroneous and prejudice to the interest of

Revenue. Likewise dismissal of SLP does not establish any law and the factual

Indian Kanoon - http://indiankanoon.org/doc/37648666/

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

position was not affected by the orders of the High Court or Supreme Court. He then

referred to the provisions of law under section 44 of the Income Tax Act, Rule-2 of

first schedule and the actuarial report placed on record to submit that assessee has

prepared the actuarial surplus under the IRDA Regulations which AO has accepted as

per the provisions of law. There may be credit or transfer from shareholder's funds

but AO has no option than to arrive at the surplus as disclosed in Form-I as per the

rules. He also referred to Form-I and the surplus as per the actuarial valuation

extracted by AO in the assessment order itself. He relied on the principles laid down

by the Hon'ble Supreme Court in the case of Vegetable Products, 88 ITR 192 with

reference to the provisions for interpretation of law and further in the case of

Hindustan Construction Co. Ltd. v. CIT 208 ITR 291.

Page 11 of 77

ITA Nos.6854 to 6856 6509 7765 to 7767 and 7213 ICICI PRULIFE Mumbai F Bench

16. Ld CIT DR further submitted that in case there are any transfers from one

account to another account, that issue is not for AO to examine as the actuary arrived

at the surplus and reported in Form-I which is the basis for assessment under Rule-2

of first schedule to the Income Tax Act. Whether there is a surplus or not in the

actuarial report can only be verified by AO under Rule-2 and he is duty bound to act

on the basis of form as prescribed under the Regulations which indicate surplus

during the year which AO has accepted as mandated by the statutory provisions and

the legal interpretations. It was further submitted that as far as life insurance

business is concerned, the old provisions will apply and as there is no amendment to

the Act as such the IRDA can only modify the format of reporting. He also submitted

that there is no contradiction in the old and new format prescribed under the IRDA

and relied on the decision of the Hon'ble Supreme Court in the case of Surana Steels

Pvt. Ltd vs. Dy. CIT, 104 Taxman 188 (SC) to submit that reference to the other

provisions are not required when the Act is very clear. It was further submitted that

the regulatory provisions for other insurance businesses have taken profit as Profit &

Loss A/c as basis for the computation but for the life insurance business, they have

taken a different method of calculation based on determination of actuarial

surplus/deficit. It was submitted that as far as life insurance business is concerned,

the intention of the legislature is not to consider capital or revenue but only to arrive

at surplus or deficit. It was further submitted that even though amendment was made

to Rule-5, no such amendment was made in Rule-2 of Part-A of first schedule and

virtually there was no change from the situation from Insurance Act 1938 to IRDA

Act1999. It is very clear that actuarial report is nothing to do with shareholder's but

only.

17. Ld.CIT DR further submitted that meaning of actuarial surplus used in Rule-2 is

not defined. As per Rule 4 of the IRDA Page 12 of 77 ITA Nos.6854 to 6856 6509

7765 to 7767 and 7213 ICICI PRULIFE Mumbai F Bench Regulations, actuarial report

Indian Kanoon - http://indiankanoon.org/doc/37648666/

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

was abstracted in a statement to be prepared by the actuary as per procedure. In view

of this the actuarial report provided in Form-I is the base for the assessment for AO.

The Regulations 8 of the IRDA starts as a statement showing total amount of surplus

arisen during the inter valuation period. Further it depends on the composition of

surplus which consist of A to F items and item J talks about the total surplus (a to

i). Since Form I indicate surplus for the total business, the total surplus has to be

considered as actuarial surplus for the purpose of Rule-2 for the inter valuation

period. He also further referred to the guidelines issued in IRDA circular 2004 to

state that transfer of funds shall not be reversible in nature. He also referred to AO's

order passed in assessment year 2008-09 which is little more elaborate than the

order in assessment year 2005-06 to support the stand of the Revenue that the

surplus arrived at in Form I is the actuarial surplus to be brought to tax under the

rules. The learned DR in his submission also referred to the Hon'ble Supreme Court

judgment in the case of LIC vs. CIT 51 ITR 773 (SC) for the primacy of section 44 and

Rule-2 in arriving at the actuarial valuation. He supported the order of AO and the

CIT (A).

18. We have considered the submissions and perused the record and relevant

provisions and the case laws relied upon. There is no dispute with the taxability of

insurance business as governed by the provisions of section 44 of the Act r.w. First

schedule of Income Tax Act 1961. Section 44 provides as under:

"44. Notwithstanding anything to the contrary contained in the

provisions of this Act relating to the computation of income

chargeable under the head "Interest on securities", "Income from

house property", "Capital gains" or "Income from other sources", or in

section 199 or in sections 28 to[43B], the profits and gains of any

business of insurance, including any such business carried on by a

mutual insurance company or by a co-operative society, shall be

computed in accordance with the rules contained in the First

Schedule.

Page 13 of 77

ITA Nos.6854 to 6856 6509 7765 to 7767 and 7213 ICICI PRULIFE Mumbai F Bench

The First schedule contains three parts A, B & C. Part-A pertains to life insurance

business, Part-B for other business and Part-C other provisions. The relevant rules in

Part A for life insurance business are as under:

"Profits of Life Insurance business to be computed separately

1. In the case of a person who carries on or at any time in the previous

year carried on life insurance business, the profits and gains of such

Indian Kanoon - http://indiankanoon.org/doc/37648666/

10

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

person from hat business shall be computed separately from his

profits and gains from any other business.

Computation of profits of life insurance business

2. The profits and gains of life insurance business shall be taken to be

the annual average of the surplus arrived at by adjusting the surplus or

deficit disclosed by the actuarial valuation made in accordance with

the Insurance Act, 1938 (4 of 1938) in respect of the last

inter-valuation period ending before the commencement of the

assessment year, so as to exclude from it any surplus or deficit

included therein which was made in any earlier inter-valuation period.

Deductions

3. Omitted Adjustment of tax paid by deduction at source

4. Where for any year an assessment of the profits of life insurance

business is made in accordance with the annual average of a surplus

disclosed by a valuation for an inter- valuation period exceeding

twelve months, then in computing the income-tax payable for that

year, credit shall not be given in accordance with section 199 for the

income-tax paid in the previous year, but credit shall be given for the

annual average of the income-tax paid by deduction at source from

interest on securities or otherwise during such period".

Rule-7 defines 'life insurance business' means life insurance business as defined in

clause-2 of section 2 of Insurance Act 1938. Assessee incorporated after the

enactment of the IRDA 1999, is in the life insurance business and there is no dispute

with that. As per section 44 for a business involved in insurance business

notwithstanding contained in any other head of income like interest Page 14 of 77 ITA

Nos.6854 to 6856 6509 7765 to 7767 and 7213 ICICI PRULIFE Mumbai F Bench on

securities, house property, capital gains and other sources, the income from profits

and business are to be computed according to the first schedule. Primacy of Sec.44

and power of AO to compute as per Rule 2 of First Schedule was also decided by

Hon'ble Supreme Court in number cases relied on by both parties. As the dispute is

not with the above, there is no need to reiterate those principles or discuss cases in

this order.

19. Rule-2 is the main computation provision which is applicable to the life insurance

business. As per Rule-2 the profits and gains of life insurance business shall be taken

to be the annual average of the surplus arrived at by adjusting the surplus or deficit

disclosed by the actuarial valuation made in accordance with the insurance act, in

respect of the last inter valuation period so as to exclude any surplus or deficit

included therein which was made in any inter valuation period. According to the rule

Indian Kanoon - http://indiankanoon.org/doc/37648666/

11

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

the surplus or deficit between two valuation periods can only be taken as income or

loss of the period. Thus if there is a surplus in earlier valuation of 'Y' amount and

surplus in the later valuation at 'X' amount, the difference between X & Y will be the

income of the inter valuation period for the purpose of Rule 2. Therefore, actuarial

evaluation done in respective periods has importance. Before the IRDA Act, only Life

Insurance Corporation was permitted to involve itself in life insurance business. The

actuarial valuation was not undertaken every year but once in three years. Therefore,

the rule provides for only average of the surplus to arrive between two inter valuation

periods. However, with the enactment of IRDA Act 1999 and Regulations therein not

only the private participants were permitted to do business but presentation of

accounts and reports were modified.

Past history of the assessee company:

20. Assessee company was governed by the IRDA Act and its Regulations from its

inception. In earlier years attempts were made Page 15 of 77 ITA Nos.6854 to 6856

6509 7765 to 7767 and 7213 ICICI PRULIFE Mumbai F Bench by Revenue to disturb

the Incomes or losses assessed both under Sec. 263 and Sec. 147, as briefly stated in

Ld. Counsel's arguments. The incomes and Losses shown by assessee in various

assessment years are as under:

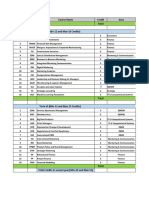

A.Y.

2001-02

2001-03

2003-04

2004-05

2005-06

2006-07

2007-08

2008-09

Returned

Income/(loss)

(204,359,146)

(854,736,440)

(987,036,885)

(1,742,378,630)

(1,505,539,430)

(2,005,534,043)

(4,128,758,204)

8,233,771,502)

Surplus/(deficit)

as per A-RA

(206,619,000)

177,434,000

22,000

(22,000)

(317,487,000)

1100,641,000)

(1,360,152,000)

(3,251,153,000)

Amount

transferred

from SHA

1,241,806,000

1,583,784,000

2,367,746,000

2,333,474,000

2,306,655,000

7,579,972,000

16,063,495,000

Surplu

per Fo

358,69

775,73

1,426,03

3,029,12

21. The dispute in this case is in adopting the amount of surplus or deficit as per

actuarial valuation. There is no dispute with method of actuarial valuation. The

dispute is centered around the amounts represented in Form-I as per the IRDA

Regulations. Consequent to changes brought by IRDA Act, and its Regulations the

revised format in Form I deviates from the Form-I prescribed under Insurance Act

1938. Assessee reconciles the form with old Regulations and filed return of income/

loss. The AO adopts the 'Total Surplus' stated in Form-I under new Regulations

ignoring the assessee submissions about changes in accounting procedures and need

for reconciliation. This aspect was examined by the Hon'ble Bombay High Court in

the assessee own case of ICICI Prudential Life Insurance Co. Ltd. vs. ACIT 325 ITR

471 (Bom.). The facts examined by the Hon'ble Bombay High Court pertain to the

assessment year 2003-04 wherein consequent to the reopening of the assessment

Indian Kanoon - http://indiankanoon.org/doc/37648666/

12

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

under section 148, the matter was challenged before the Hon'ble Bombay High Court.

The entire scheme, various Regulations applicable, change in formats and method of

accounts were elaborately discussed by the Hon'ble Bombay High Court as under:

"During the course of the assessment year 2003-04, the petitioner filed a return of

income on November 27, 2003, Page 16 of 77 ITA Nos.6854 to 6856 6509 7765 to

7767 and 7213 ICICI PRULIFE Mumbai F Bench reporting a net loss of Rs. 98.70

crores. The statement of the computation of profits and gains from business shows an

actuarial deficit of Rs. 158.37 crores. After excluding a deficit of Rs. 48.47 crores,

arising out of pension schemes exempt under section 10(23AAB), the deficit in the

account stood at Rs. 109.90 crores. The petitioner had an income surplus in the

shareholder's' account of Rs. 11.20 crores. As a result, the deficit from the insurance

business was Rs. 98.70 crores. Section 44 of the Income-tax Act, 1961, provides that

notwithstanding anything contained to the contrary in the provisions of the Act

relating to the computation of income chargeable under the head "Interest on

securities", "Income from house property", "Capital gains" or "Income from other

sources" or in section 199 or in sections 28 to 43B the profits and gains of any

business of insurance shall be computed in accordance with the rules contained in

the First Schedule to the Act. Rule 2 of the First Schedule provides as follows:

"The profits and gains of life insurance business shall be taken to be

the annual average of the surplus arrived at by adjusting the surplus or

deficit disclosed by the actuarial valuation made in accordance with

the Insurance Act, 1938, in respect of the last inter- valuation period

ending before the commencement of the assessment year, so as to

exclude from it any surplus or deficit included therein which was made

in any earlier inter-valuation period."

Before 1999, companies engaged in the business of life insurance were required to

prepare one consolidated account. Section 11 of the Insurance Act, 1938 was

amended so as to include sub-sections (1A) and (1B). Subsection (1A) to section 11

provides that every insurer, on or after the commencement of the IRDA Act, 1999, in

respect of insurance business transacted by him and in respect of shareholder's'

funds, shall, at the expiration of each financial year, prepare with reference to that

year, a balance sheet, a profit and loss account, a separate account of receipts and

payments, and revenue account in accordance with the Regulations made by the

Authority. Section 13(1) provides that every insurer carrying on life insurance

business shall, inter alia, in respect of the life insurance business transacted in India,

cause an investigation to be made each year by an actuary into the financial condition

of the life insurance business carried on by him, including a valuation of his liabilities

and shall cause an abstract of the report of such actuary to be made in accordance

with the Regulations laid down in Part I of the Fourth Schedule Page 17 of 77 ITA

Nos.6854 to 6856 6509 7765 to 7767 and 7213 ICICI PRULIFE Mumbai F Bench and

in conformity with the requirements of Part II of that Schedule. The fifth proviso to

Indian Kanoon - http://indiankanoon.org/doc/37648666/

13

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

section 13 stipulates that on or after the commencement of the IRDA Act, 1999 every

insurer shall cause an abstract of the report of the actuary to be made in the manner

specified by the Regulations made by the Authority.

In exercise of the powers conferred by section 114A of the Insurance Act, 1938, the

IRDA notified the Insurance Regulatory and Development Authority (Actuarial

Report and Abstract) Regulations, 2000. Regulations 3 and 4 stipulate the procedure

for preparation of actuarial reports and abstracts and the requirements applicable.

Under Regulation 3(4)(v), each abstract and statement is to be accompanied by a

certificate signed by the appointed actuary, inter alia, stating that in his opinion, the

mathematical reserves are adequate to meet the insurer's future commitments under

contracts and the reasonable expectation of policyholder's. Each insurer is required

to prepare statements which are to be annexed to the abstract and a list of those

statements is set out in Regulation 4(2). Regulation 8 provides that a statement

showing the total amount of surplus arising during the inter-valuation period and

allocation of such surplus, shall be furnished separately for participating business

and for non-participating business, together with the particulars as mentioned in the

Regulation. The composition of surplus, inter alia, includes the surplus shown by

Form I, interim bonuses, loyalty additions and sums transferred from shareholder's'

funds during the inter-valuation period.

The Authority has also notified the Insurance Regulation and Development Authority

(Preparation of Financial Statements and Auditor's Report of Insurance Companies)

Regulations, 2002. Part V deals with the provision of financial statements. Every

insurer is required to prepare

(i) a revenue account which is also described as a policyholder's' account; and (ii) a

profit and loss account, which is also described as a shareholder's' account, apart

from a balance-sheet. The statutory forms are prescribed by the Regulations. Form

A-RA is prescribed for the preparation of the revenue account or the policyholder's'

account. Form A-RA reflects the surplus or, as the case may be, the deficit generated

in the revenue account for the year ending 31st March. As a result of the Regulations,

the petitioner which is engaged in the business of life insurance is required to prepare

and maintain two accounts namely, (i) a revenue Page 18 of 77 ITA Nos.6854 to 6856

6509 7765 to 7767 and 7213 ICICI PRULIFE Mumbai F Bench account of

policyholder's, and (ii) a profit and loss account of shareholder's. For the previous

year which ended on March 31, 2003, the policyholder's' account reflected a deficit of

Rs. 158.37 crores. This deficit was made good by the transfer of an amount of Rs.

158.37 crores from the shareholder's' account to the policyholder's account. This was

essentially an internal transfer of funds. Form I which has been prepared by the

petitioner in pursuance of the IRDA Regulations of 2000 reflected a nil deficit

consequent upon the transfer of an amount of Rs. 158.37 crores from the

shareholder's' account to the policyholder's account. The source for making a transfer

of Rs. 158.37 crores from the shareholder's' account originated in the infusion of

Indian Kanoon - http://indiankanoon.org/doc/37648666/

14

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

capital from shareholder's during the course of the previous year relevant to the

assessment year in question.

During the course of the assessment proceedings for the assessment year 2003-04,

the petitioner furnished a note to the computation of income. The salient aspects

which were highlighted in the note were as follows:

(i) The erstwhile format for the presentation of surplus/deficit required each

insurance company to aggregate the results relating to shareholder's' operations and

policyholder's' operations. The impact of the consolidated revenue account was

transferred to the actuary's valuation balance-sheet in Form I which disclosed the

surplus/deficit for the year;

(ii) The format for presentation of the insurance accounts was amended by the

Regulations of 2000 and by the revised format, the impact of the actuarial valuation

was transferred to the revenue account relating to the policyholder's for the year and

the surplus/deficit was disclosed therein ;

(iii) The profit and loss for shareholder's and the surplus/deficit for policyholder's are

since segregated into two separate accounts after the amended Regulations;

(iv) For the financial year ending March 31, 2003, the actuarial valuation as disclosed

in Form I shows a nil surplus/deficit as regards the business of policyholder's. The

actual deficit of Rs. 158.37 crores in the policyholder's' account (Form A-RA) was

made good by a transfer of an equivalent sum from the shareholder's' account.

Hence, the figures showing a nil deficit in Form I were subsequent to the transfer;

(v) The total deficit in the policyholder's' account for tax purposes was Rs. 109.90

crores (Rs.158.37 crores less an Page 19 of 77 ITA Nos.6854 to 6856 6509 7765 to

7767 and 7213 ICICI PRULIFE Mumbai F Bench amount of Rs. 48.47 crores on

account of exempt pension schemes);

(vi) In the shareholder's' account, there was a net surplus of Rs. 11.19 crores;

(vii) Consequently, while there was a net surplus in the shareholder's' account of Rs.

11.19 crores, there was a net deficit in the policyholder's' account of Rs. 109.90 crores;

(viii) Consequently, in determining the profits and gains under section 44 read with

rule 2, the loss was computed at Rs. 98.70 crores by aggregating the surplus in the

shareholder's' account with the deficit in the policyholder's' account for the purposes

of taxation.

During the course of the assessment proceedings, letters were addressed to the

Assessing Officer specifically in order to clarify the position of the deficit in the

Indian Kanoon - http://indiankanoon.org/doc/37648666/

15

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

policyholder's' account. By its letter dated December 27, 2005, the petitioner clarified

that the deficit in the policyholder's' account as reflected by Form A-RA had been met

by a transfer from the shareholder's' account. The figures relating to surplus/deficit

in Form I were subsequent to the internal transfer of funds. The assessee contended

that the transfer from the shareholder's' to the policyholder's' account was an internal

adjustment and was tax neutral. Before the assessment proceedings came to be

concluded for the assessment year 2003-04, an audit query was raised with reference

to the assessment year 2002-03. The audit report dated May 4, 2005 specifically

raised a question as to whether the petitioner should have been allowed to claim a

deficit in the policyholder's' account since the deficit disclosed by the actuarial

valuation in Form I was shown to be nil. In response to the audit query, the petitioner

addressed a letter dated December 29, 2005, contending that the First Schedule to

the Income-tax Act did not refer to any particular form for calculating the taxable

surplus and instead mentions that the actuarial surplus calculated under the

provision of the Insurance Act, 1938, has to be considered. The petitioner reiterated

its position that Form I showed a zero surplus because, it has already considered,

inter alia, the transfers made from the shareholder's' account to the policyholder's'

account to nullify the deficit as per the IRDA Regulations. The same position has

been reiterated by a letter dated December 30, 2005 to the Assessing Officer".

It was further observed vide Para 18 (Page No.480) as under:

The record before the court shows that the assessee had in its

computation of income disclosed that the policyholder's' account

showed that (i) there was a deficit of Rs. 109.90 Page 20 of 77 ITA

Nos.6854 to 6856 6509 7765 to 7767 and 7213 ICICI PRULIFE

Mumbai F Bench crores (comprising Rs. 158.37 crores minus Rs.

48.47 crores arising out of exempt pension funds) ; (ii) there was a

transfer of funds to the extent of Rs. 158.37 crores from the

shareholder's' account to the policyholder's' account ; and (iii) that the

deficit in the policyholder's' account was adjusted only by an internal

transfer of funds from the shareholder's' account to the policyholder's'

account. By its letters dated December 27, 2005 and December 30,

2005, which were filed in response to queries raised by the Assessing

Officer, the assessee disclosed (a) the manner in which the profits and

gains under section 44 read with the First Schedule were arrived at, so

as to reflect a loss of Rs. 98.70 crores ; (b)the fact that the nil surplus

shown in the report of the actuarial valuation in Form I was

subsequent to the transfer of funds from the shareholder's' account to

the policyholder's' account. When the assessment proceedings

pertaining to the assessment year 2003-04 were pending, an audit

query came to be raised in regard to a similar claim for loss during the

assessment year 2002-03. The petitioner responded to the audit query

by its letter dated December 29, 2005. The letters addressed by the

Indian Kanoon - http://indiankanoon.org/doc/37648666/

16

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

petitioner, including the note appended to the computation of income

clearly set out the fact that there was a surplus in the shareholder's'

account and that the deficit in the policyholder's' account was met by a

transfer from the share holders' account to the policyholder's' account.

The petitioner disclosed that in Form I, the surplus/deficit was shown

to be nil and submitted that the position reflected in Form I was

subsequent to the internal transfer of funds which took place from the

shareholder's' to the policyholder's' account. It is after the petitioner

had filed its explanation by several letters that the Assessing Officer

passed an order of assessment under section 143(3)".

22. Further vide Para 21 (Page 482), the method of accounting and Regulations were

further analysed as under:

While dealing with the reopening of the assessment for the assessment

year 2004-05, the principal question before the court is as to whether

there was any tangible material before the Assessing Officer to form a

reason to believe that income chargeable to tax had escaped

assessment. In the prefatory part of this judgment, a reference has

been made to the relevant provisions of the Insurance Act, 1938 and to

the Regulations of 2000 and 2002, which have a bearing on the

formulation of the accounts, of an assessee like the petitioner who

engages in the business of life insurance. Section 13(1) of the

Insurance Act, 1938 which was inserted by the Insurance Regulatory

Authority Act, 1999 requires every insurer upon Page 21 of 77 ITA

Nos.6854 to 6856 6509 7765 to 7767 and 7213 ICICI PRULIFE

Mumbai F Bench the commencement of the Act to maintain separate

accounts in respect of the insurance business transacted by the insurer

and in respect of the shareholder's funds. Regulations 3 and 4 of the

Regulations of 2000 provide the procedure and requirements in the

preparation of the actuarial report and abstract. Form I, it may be

noted, is one of the summary statements that is required to be

prepared by the insurer under Regulation 4(2). Part V of the 2000

Regulations deals with the preparation of the financial statement and

requires the insurer to prepare; (i) a revenue account, also called a

policyholder's' account ; and (ii) a profit and loss account, also called

the shareholder's' account. Form A-RA is the form in which the

policyholder's' account is to be filed. Form A-RA requires a disclosure

of (a) premiums earned, income from investments and other income ;

(b) commission, operating expenses, provision for doubtful debts,

debts written off, provision for tax and other than taxation ; (c)

benefits, interim bonuses and change in valuation of liability in

respect of life policies. The surplus/deficit is computed at the foot of

the account by deducting the amounts computed under (b) and (c)

Indian Kanoon - http://indiankanoon.org/doc/37648666/

17

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

above from the figures of income in (a).

During the course of the assessment, the assessee had set out the computation in the

policyholder's' account and in the shareholder's' account.

According to the assessee, the net result of the operations is reflected in the

policyholder's' account which has been made good by transfer from the shareholder's'

account. A circular has been issued on March 23, 2004 by the Insurance Regulatory

Development Authority, to specify the conditions which are required to be fulfilled

where an insurer intends to declare a bonus when there is a deficit in the life fund.

The condition which is prescribed in the circular is that the accumulated deficit in the

policyholder's' account must be made good by a transfer of funds from the

shareholder's' account to the policyholder's' account. The circular clarifies that the

transfer from the shareholder's' account can be out of the profit and loss account,

balance or reserves in the shareholder's' account or by drawing upon the paid up

capital of the insurer. The transfer of funds made from the shareholder's' account to

the policyholder's' account is to be irreversible. What the circular emphasizes is that

an insurer who intends to declare a bonus has to ensure, in the event that there is a

deficit in the policyholder's' account, that the deficit is effaced Page 22 of 77 ITA

Nos.6854 to 6856 6509 7765 to 7767 and 7213 ICICI PRULIFE Mumbai F Bench by a

transfer of funds from the shareholder's' account".

The Assessing Officer, while reopening the assessment has not put forth any tangible

material on the basis of which he could have formed a reasonable belief that income

chargeable to tax has escaped assessment. He has merely altered or changed the

opinion which was formed during the assessment proceedings". (emphasis supplied)

The Hon'ble Bombay High Court on the facts of the case held that reopening is bad in

law. In arriving at that decision, the Hon'ble High Court examined the entire scheme

of presentation of accounts and arriving at surplus. Therefore not only the

Regulations which are binding on the assessee were discussed but computation made

there under was also considered in the above decision.

23. The dispute in these years is also similar. Eventhough Ld.CIT DR submitted that

those years has no effect on deciding this issue, we are aware about consequential

effects in later years and the need to follow uniform methodology. Therefore an

attempt was made to examine and reconcile the various contentions in this order. It

was the assessee contention that the surplus or deficit amount should be arrived at

after adjusting both Accounts there by neutralising the transfer of capital funds from

Shareholder's account to policyholder's account as per Regulations and prudent

business practice and international practices being followed by assessee company.

AO's contention is based on amounts referred in Form I.

Import of Insurance Act 1938:

Indian Kanoon - http://indiankanoon.org/doc/37648666/

18

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

24. Before analyzing the issue, it is necessary to discuss the principles of

'incorporation' of Insurance Act 1938 into the Income Tax Act 1961. As rightly

pointed out by the learned Counsel, the reference to the Insurance Act 1938 in the

Income Tax Act as such can only be considered as 'legislation by incorporation'. The

principles of 'legislation by incorporation' and 'legislation by Page 23 of 77 ITA

Nos.6854 to 6856 6509 7765 to 7767 and 7213 ICICI PRULIFE Mumbai F Bench

reference' are discussed by the Hon'ble Supreme Court in a number of cases, more so

in the following cases.

25. In the case of Mahindra & Mahindra Ltd vs. Union of India & Others, the Hon'ble

Supreme Court on the principles of interpretation of statutes on section 8(1) of

general Clauses Act 1897 held as under:

Interpretation of Statutes - Legislation by reference and by

incorporation-Difference - In former case Section 8(1) of General

Clauses Act applicable - But in latter case subsequent repeal or

amendment of the provision incorporated does not affect the

incorporating statute General Clauses Act, 1897,Section 8(1) (paras 8 and 9) "8. The first question that

arises for consideration on the preliminary objection of the respondents is as to what

is the true scope and ambit of an appeal under Section 55., That section provides

inter alia that any person aggrieved by an order made by the Commission under

Section 13 may prefer an appeal to this Court on "one or more of 'the grounds

specified in Section 100 of the Code of Civil Procedure, 1908". Now at the pate when

Section 55 was enacted, namely, December 27, 1969, being the date of coming into

force of the Act, Section 100 of the Code of Civil Procedure specified three grounds on

which a second appeal could be, brought to the High Court and one of these grounds

was that the decision appealed against was contrary It was sufficient under Section

100 as it stood then that there should be a question of law in order to attract the

jurisdiction of the High Court in second appeal and, therefore, if the reference in

Section 55 were to the grounds set out in the then existing Section 100, there can be

no doubt that an appeal would lie to this Court under Section 55 on a question of law.

But subsequent to the enactment of Section 55, Section 100 of the Code of Civil

Procedure was substituted by a new section by Section 37 of the Code of Civil

Procedure (Amendment) Act, J 976 with effect from February 1, 19'77 and the new

Section 100 provided that a second appeal shall lie to the High Court only if the High

Court is satisfied that the case involves a substantial question of law. The three

grounds on which a second appeal could lie under the former Section 100 were

abrogated and in their place only one ground was substituted which was a highly

stringent ground, namely, that there' should be a substantial question of law. This

was the new Section 100 which was in force on the date when the present appeal was

'preferred by the appellant and the argument of the respondents was that the

maintainability of Page 24 of 77 ITA Nos.6854 to 6856 6509 7765 to 7767 and 7213

Indian Kanoon - http://indiankanoon.org/doc/37648666/

19

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

ICICI PRULIFE Mumbai F Bench the appeal was, therefore, required to be judged by

reference to the ground specified in the new Section 100 and the appeal could be

entertained only if there was a substantial question of law. The respondents leaned

heavily on Section 8(1) of the General Clauses Act, 1897 which provides:

Where this Act or any Central Act or Regulation made after the commencement of

this Act, repeals and re-enacts, with or without modification, any provision of a

former enactment, then references in any other enactment or in any instrument to

the provision so repealed shall, unless a different intention appears, be construed as

references to .the provision so re- enacted and contended that the substitution of the

new Section 100 amounted to repeal and re-enactment, of the former Section 100

and, therefore, on an application of the rule of interpretation enacted in Section 8(1),

the reference in Section 55 to Section 100 must be construed as reference to the new

Section 100 and the- appeal could be maintained only on ground" specified in the

new Section 100, that IS, on a substantial question of law. We do not think this

contention is well founded. It ignores the 'distinction between a mere reference to or

citation' of one statute in another and an incorporation which in effect means bodily

lifting a provision of one enactment and making it a part of another. Where there is

mere reference to or citation of one enactment in another without incorporation;

Section 8(1) applies and the repeal and re-enactment of the provision referred to or

cited, has the effect set out in that section and the reference to the provision repealed

is required to be construed, as reference to the provision as' 're-enacted. Such was the

case in the Collector of Customs v. Nathella Sampathu Chetty" and New Central Jute

Mills Co. Ltd. v. Assistant Collector of Central Excise. But where a provision of one

statute is Incorporated in another, 'the repeal or amendment of the former does not

affect the latter. The effect of incorporation is as if 'the provision incorporated were

written' out in the incorporating statute and were a part of it. Legislation by

incorporation is a common legislative device employed by the legislature, where the

legislature for convenience of drafting incorporates provisions from an existing

statute by reference to: that statute instead of setting out for itself at length the

provisions which it desires to adopt. Once the incorporation is made, the provision

incorporated becomes an integral part of the statute in which it is transposed and

thereafter there is no need to refer to the statute from which the incorporation is

made and any' subsequent amendment made in it has no effect on the incorporation

statute. Lord Esher, M. R." while dealing with legislation in incorporation in In re

Wood's Estate" pointed out at page 615 :

If a subsequent Act brings into itself by reference some of the Page 25 of 77 ITA

Nos.6854 to 6856 6509 7765 to 7767 and 7213 ICICI PRULIFE Mumbai F Bench

clauses of a former Act, the legal effect of that, as has often been held, is to write

those sections into the new Act, just as if they' had been actually written in it with the

pen, or printed in it, and, the .moment you pave those clauses in the later Act, you

have no occasion to refer to .the former Act at all. ' Lord Justice Brett, also observed

to' the same effect in 'Clarke v. Bradlaugh": ..... there is a' rule of construction that,

Indian Kanoon - http://indiankanoon.org/doc/37648666/

20

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

where statute is incorporated by reference into a second . statute, the repeal of the

first statute by a third statute does not affect the second. This was the rule applied by

the Judicial Committee of the Privy Council in Secretary of State' for India in Council

v; Hindustan Co-operative Insurance Society Ltd.". The Judicial Committee pointed

out in this case that the provisions of the Land Acquisition Act, 1894 having been

incorporated in the Calcutta Improvement Act, 1911 and become an integral part of it,

the subsequent amendment of the Land Acquisition Act, 1894 by the addition of

sub-section (2) in Section 26 had no effect on the Calcutta Improvement Act, 1911

and could not be read into it. 'Sir George Lowndes delivering the opinion of the

Judicial Committee observed at page 267 :

In this country it is accepted that where a statue is incorporated by reference into a

second statute, the repeal of the first statute does not affect the second: see the cases

collected in Craies on Statue Law 3rd ed. pp. 349, 350 ... The independent existence

of the two Acts is, therefore, recognized; despite the death of the parent Act, its

.offspring survives in, the incorporating Act. It seems to be no less .logical: to hold

that where certain provisions from an existing Act, have been incorporated into a

subsequent Act, .no addition to the former Act, which is not expressly made

applicable to the subsequent Act, :can be deemed to be incorporated in it, at all

events if it is possible for the subsequent Act to function effectually without the

addition. So also in Ram Sarup v. M Munshi, it was held by this Court that since the

definition of 'agricultural land' in the Punjab Alienation, of Land' Act, 1900 as bodily

incorporated, in the Punjab Pre-emption Act, 1913, the' repeal of the former Act .had

no effect on the continued operation of, the latter. Rajagopala Ayyangar, J., "speaking

for the Court observed at pages 868-869 of the Report : Where the provisions of an

Act are' incorporated' by reference in a later Act the' 'repeal 'of 'the' earlier Act has, in

general, no effect upon the construction or effect of the Act' in which its provisions

have been incorporated.

In the circumstances, therefore, the repeal of the Punjab Alienation Page 26 of 77 ITA

Nos.6854 to 6856 6509 7765 to 7767 and 7213 ICICI PRULIFE Mumbai F Bench of

Land Act of 1900 has no effect on the continued operation of the Pre-emption Act

and the expression~, 'agricultural land' in the later Act has to be read as if the

definition in the Alienation of Land Act 1900, had been bodily transposed into it. :

The decision of this Court in Bolani Ores Ltd. v. State 'of Orissa" also proceeded on

the same principle. There the question arose in regard to the interpretation of Section

2(c) of the Bihar and Orissa Motor Vehicles Taxation' Act, 1930 (hereinafter referred

to as the Taxation Act). This section when enacted adopted the definition of 'motor

vehicle' contained in Section 2(18) of the Motor Vehicles Act, 1939. Subsequently,

Section 2(18) was amended by Act 100 of 1956 but no corresponding amendment was

made in the definition contained in Section 2(c) of the Taxation Act. The argument

advanced before the Court was that the definition in Section 2(c) of the Taxation Act

was not a definition by incorporation but only a definition by reference and the

Indian Kanoon - http://indiankanoon.org/doc/37648666/

21

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

meaning of 'motor vehicle' in Section 2(c) must, therefore, be taken to be the same as

defined from time. to time in Section 2(18) of the' Motor Vehicles Act, 1939. This

argument was negatived by the Court and it was held that this was a case of

incorporation and not reference and the definition' in Section 2(18) of the Motor

Vehicles Act, 1939 as then existing was incorporated in Section 2(c) of the 'Taxation

Act and neither repeal of the Motor Vehicles Act, 1939 nor any .amendment in, it

would affect the definition of 'motor vehicle' in Section 2 (c) of the.-Taxation Act. It

is, therefore, clear that if there is mere reference to a provision. of one statute in

another without incorporation, then, unless a different intention clearly appears,

Section 8(1) would apply and the reference- would ; be construed as a reference to the

provision as may be in force from time to time in the former statute. But if a

provision of one statute is incorporated in another, any subsequent. amendment in

the former statute or even its total repeal would not affect the provision as

incorporated in the latter statute. The question is to which category the present case

belongs.

9. We have no doubt that Section 55 is an instance of legislation by incorporation and

not legislation by reference. Section 55 provides for an appeal to this Court on' "one

or more of the grounds specified in Section 100". It is obvious that the legislature did

not want to confer an unlimited right of appeal, but wanted to restrict it and turning

to Section 100, it found that the grounds there set out were appropriate for restricting

the right of appeal and hence it incorporated them in Section 55. The right of appeal

was clearly intended to be limited to the grounds set out in the then existing

Section 100. Those were the grounds which were before the Legislature and to which

the Legislature could have applied its mind and it is reasonable to assume that it was

with reference to those specific and known grounds that the Legislature intended to

Page 27 of 77 ITA Nos.6854 to 6856 6509 7765 to 7767 and 7213 ICICI PRULIFE

Mumbai F Bench restrict the right of appeal. The Legislature could never have been

intended to limit the right of appeal to any ground or grounds which might from time

to time find place in Section 100 without knowing what those grounds were. The

grounds specified in Section 100 might be changed from' time to time having regard

to the legislative policy relating to second appeals and it is difficult to see' any valid

reason why the Legislature should have thought it necessary that these changes

should also be reflected in Section 55 which deals with the right of appeal in a totally

different context. We fail to appreciate what relevance the legislative policy in 'regard

to second appeals has to the right of appeal under Section 55 so that Section 55

should be inseparably linked or yoked to .Section 100 and whatever changes take

place in Section 100 must be automatically read into Section 55. It must be

remembered that the Act is a self-contained Code dealing with monopolies and

restrictive trade practices and it is not possible to believe that the Legislature could

have made the right of 'appeal under such a code. dependent on the vicissitudes

through which a section in another statute might pass from time to time. The scope

and ambit of the appeal could not have been intended to fluctuate or vary with every

change in the grounds set out in Section 100. Apart from the absence of any rational

Indian Kanoon - http://indiankanoon.org/doc/37648666/

22

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

justification for doing so, such an indissoluble linking of Section 55 with Section 100

could conceivably lead to a rather absurd and startling result. Take for example a

situation where Section 100 might be repealed altogether by the Legislature - a

situation which cannot be regarded as wholly unthinkable. If the construction

contended for on behalf of the respondents were accepted, Section 55 would in such a

case be reduced to futility and the right of appeal would be wholly gone, because then

there would be no grounds on which an appeal could lie. Could such a consequence

ever have been contemplated by the Legislature? - The Legislature clearly

'intended that the e should be a right of appeal, though on limited grounds, and it

would be absurd to place on the language of Section 55 an interpretation which

might, in a given situation, result in denial of the right of appeal altogether and thus

defeat the plain object and purpose of the section. We must, therefore, hold that on a

proper interpretation the grounds specified in the then existing Section 100 were

incorporated in Section 55 and the substitution of the new Section 100 did not affect

or restrict the grounds as incorporated and since the present appeal admittedly raises

questions of law, it is clearly maintainable under Section 55. We may point out that

even if the right of appeal under Section 55 were restricted to the ground specified in

the new Section 100, the present appeal would still be maintainable, since it involves

a substantial question of law relating to the interpretation of section 13(2). What

should be the test for determining whether a question of law raised in an appeal is

substantial has been laid. down by this Court in Sir Chunilal V. .Mehta and Sons Ltd.

N. The Century Page 28 of 77 ITA Nos.6854 to 6856 6509 7765 to 7767 and 7213

ICICI PRULIFE Mumbai F Bench Spinning and Manufacturing Co. Ltd." and it has

been held that the proper test would be whether the question of' law - is of general

public importance or whether it directly and substantially affects, the rights of the'

parties, and if so, whether it is 'either an open question in the sense that it is not

finally settled by this Court or 'by the 'Privy Councilor by the Federal Court or is not

free from difficulty or calls for discussion of alternative' views. The question of

interpretation of Section 13(2) which arises in the present appeal directly and

substantially affects the rights of the parties and it is an open question in the sense

that it is not finally settled by this Court and it is, therefore, clearly a substantial

question of Jaw within the meaning of. this test. We must, therefore, reject the

preliminary objection raised on behalf of the respondents against the maintainability

of the present appeal:

26. Further in the case of Bharat Co-operative Bank (Mumbai) Ltd vs. Co-operative

Bank Employees Union,( supra) this issue was considered by the Hon'ble Supreme

Court vide Paras 12 to 29 and held as under:

"12. The main question raised for determination is whether the afore-noted

amendments to the BR Act, particularly insertion of Section 56 in the new format

w.e.f. 1st March, 1966, after the insertion of the definition of "Banking Company" in

the ID Act by Act 54 of 1949 will apply mutatis mutandis to the matters governed by

the ID Act?

Indian Kanoon - http://indiankanoon.org/doc/37648666/

23

Icici Prudential Life Insurance ... vs Department Of Income Tax on 20 June, 2012

13. As there is no indication in the ID Act as to the applicability or otherwise of the

subsequent amendments in the BR Act, the question posed has to be answered in the

light of the two concepts of statutory interpretation, namely, incorporation by

reference and mere reference or citation of one statute into another. Thus, answer to

a rather intricate question hinges on the test whether at the time of insertion of the

definition of the term "Banking Company" in the form of sub-section (bb) of Section

2 of the ID Act by the 1949 Act it was a mere reference to the Banking Companies Act,

1949 (later re-christened as the Banking Regulation Act) or the intendment of the

legislature was to incorporate the said definition as it is in the ID Act?

14. Before adverting to the said core issue, we may briefly notice the distinction

between the two afore-mentioned concepts of statutory interpretation, viz., a mere

reference or citation of one statute in another and incorporation by reference.

Legislation by incorporation is a common legislative device where the legislature, for