Académique Documents

Professionnel Documents

Culture Documents

RH Petrogas 20150115 Cs - Initiate PDF

Transféré par

Invest StockTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

RH Petrogas 20150115 Cs - Initiate PDF

Transféré par

Invest StockDroits d'auteur :

Formats disponibles

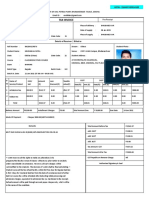

14 January 2015

Asia Pacific/Singapore

Equity Research

Oil & Gas Exploration & Production / Energy

RH Petrogas Limited

(RHPG.SI / RHP SP)

Rating

NEUTRAL* [V]

Price (13 Jan 15, S$)

0.38

Target price (S$)

0.40

Upside/downside (%)

3.9

Mkt cap (S$ mn)

283.1 (US$ 212.0)

Enterprise value (US$ mn)

226.68

Number of shares (mn)

735.28

Free float (%)

33.0

52-week price range

0.96 - 0.33

ADTO - 6M (US$ mn)

3.0

*Stock ratings are relative to the coverage universe in each

analyst's or each team's respective sector.

Target price is for 12 months.

[V] = Stock considered volatile (see Disclosure Appendix).

Research Analysts

Shew Heng Tan

65 6212 3014

shewheng.tan@credit-suisse.com

David Hewitt

65 6212 3064

david.hewitt@credit-suisse.com

Share price performance

Price (LHS)

Rebased Rel (RHS)

2

1.5

1

0.5

0

Jan-13 May-13 Sep-13 Jan-14 May-14 Sep-14

200

150

100

50

0

The price relative chart measures performance against the

FTSE STRAITS TIMES IDX which closed at 3333.45 on

13/01/15

On 13/01/15 the spot exchange rate was S$1.34/US$1

Performance Over

Absolute (%)

Relative (%)

1M

8.5

7.3

3M

-23.8

-29.4

12M

-36.4

-43.1

INITIATION

Caught in an ambivalent position

We initiate coverage on RH Petrogas Limited with a NEUTRAL rating and

S$0.40 target price.

Fuyu-1 Block (China) in the spotlight. The value of the stock is dominated by

the Chinese block, Fuyu-1, which is under development. Fuyu-1 sits in the same

basin as China's largest onshore oil field, Da Qing. In October 2014, the

company obtained final approval from NDRC to produce an estimated 7.2 mm

bbl (21%), which leaves 26.9 mm bbl (79%) of oil awaiting the next phase of

approval from CNPC and NDRC.

Yet to decide on licence extensions for Basin and Island PSCs (Indonesia).

Basin and Island PSCs are two producing blocks in Indonesia. Much value

resides in undeveloped resources, which risk being eroded upon licence expiry

in 2020. There is a six-well development drilling campaign scheduled in the

Basin PSC in 2015 to maintain revenue on cost recovery basis. Feasibility

studies are ongoing for the Koi and TBC fields in Island PSC. The window for

development is limited unless there are licence extensions for the PSCs.

Triple building blocks to valuation. The three keys to growing NAV in the next

24 months are: (1) commercial production from Fuyu-1, (2) finalisation of

development plans for Island PSC and (3) final approval for Phase 2

development of Fuyu-1. Mr Francis Chang, an industry veteran with over 35

years of experience, was appointed CEO in January 2014. It will be interesting

to see how he will bring the company forward, with the possibility of minor

acquisitions to boost its portfolio.

Key risks. RH Petrogas' performance as operator will likely influence how soon

ODP for the next phase of development at Fuyu-1 will come forth. The company

is operator and it is their first block moving from development to production.

Financial and valuation metrics

Year

Revenue (US$ mn)

EBITDAX (US$ mn)

EBIT (US$ mn)

Net profit (US$ mn)

EPS (CS adj.) (US$)

Change from previous EPS (%)

Consensus EPS (US$)

EPS growth (%)

P/E (x)

Dividend yield (%)

EV/EBITDAX (x)

P/B (x)

ROE (%)

Net debt/equity (%)

12/13A

86.4

24.3

-30.9

-37.1

-0.06

n.a.

n.a.

n.m.

-5.0

0

8.5

1.2

-20.7

net cash

12/14E

73.7

20.5

9.0

1.3

0.00

-0.01

n.m.

156.9

0

11.1

1.3

0.8

9.1

12/15E

76.1

16.6

4.6

-0.7

-0.00

n.m

0.01

n.m.

-288.1

0

15.4

1.3

-0.5

27.9

12/16E

87.3

24.2

11.5

2.9

0.00

0.02

n.m.

72.9

0

10.8

1.3

1.8

30.5

Source: Company data, Thomson Reuters, Credit Suisse estimates

DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST

CERTIFICATIONS, AND THE STATUS OF NON-US ANALYSTS. US Disclosure: Credit Suisse does and seeks to do

business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a

conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in

making their investment decision.

CREDIT SUISSE SECURITIES RESEARCH & ANALYTICS

BEYOND INFORMATION

Client-Driven Solutions, Insights, and Access

14 January 2015

Focus Charts

Figure 1: RH Petrogas: Working interest production

profile

8.0

Figure 2: Phase 1 drilling campaign and gross production

at Yong Ping oil field, Fuyu-1 Block

10,000

m boe/d

b/d

wells

9,000

7.0

300

8,000

6.0

6,000

4.0

5,000

300

250

7,000

5.0

300

250

200

150

4,000

3.0

100

3,000

2.0

2,000

1.0

100

43

1,000

50

15

2010A

2012A

2014

2016

2018

Basin & Island PSC

2020

2014

2022

350

Fuyu 1 Block

2015

2016

2017

2018

2019

Wells drilled per year (RHS)

2020

2021

2022

Gross production

Source: Company data, Credit Suisse estimates

Source: Company data, Credit Suisse estimates

Figure 3: 24-month catalyst map

Figure 4: Corresponding upside to NAV value based on

24-month catalysts

1H15

2H15

1H16

2H16

70.0

Sanctioned Projects

Fuyu 1 - Yong Ping

Scts/share

+16.2

62

60.0

First prodn

50.0

Fuyu 1 - Later Phase

ODP approv al

40.0

40

+3.3

+0.8

Fuyu 1-prod

Koi-submit

POD

+2.5

30.0

Assets under appraisal

20.0

Koi

10.0

FEED & submit POD

0.0

TBC

Base NAV

FEED & submit POD

Source: Credit Suisse estimates

TBC-submit Fuyu 1-ODP Possible NAV

POD

2nd Phase

Source: Credit Suisse estimates

Figure 5: RH PetrogasStock price movement to key corporate events

1.10

1.00

S$/share

27 Apr 2009:

Purchased Fuyu 1 Block

(Exploration, China)

3 Dec 2009:

Purchased West Belida PSC

(Exploration, Indonesia)

0.90

Disposal of

electronics business

to focus solely on

E&P

0.80 Capital raising &

Chinese

Ministry's

0.70 verification of

resources at

Fuyu 1 Block

Capital raising &

Exploration drilling

at Island and Basin

PSCs

20 Sep 2010:

Purchased Basin & Island PSCs

from Pearl

0.60

11 Dec 2012:

Seismic option on Block M-1

(Ceased, Myanmar)

6 Sep 2010:

Purchased Basin & Island PSCs

from Lundin

(Producing, Indonesia)

0.50

0.40

0.30

Apr-09

Rumoured

takeover offer

Aug-09

Dec-09

Apr-10

Aug-10

Dec-10

Apr-11

Aug-11

16 Oct 2014:

ODP approval

for Fuyu 1 Block

from NDRC

6 Dec 2012:

Entered into SK331 PSC

(Exploration, Malaysia)

Dec-11

Apr-12

Aug-12

Dec-12

Apr-13

Aug-13

Dec-13

Apr-14

Aug-14

Dec-14

Source: Bloomberg, Company data up to 13 Jan 2015

RH Petrogas Limited

(RHPG.SI / RHP SP)

14 January 2015

Investment Summary

Caught in an ambivalent position

We initiate coverage on RH Petrogas with a NEUTRAL rating and a S$0.40 target price.

The company's portfolio comprises of five assetstwo producing assets in Indonesia, one

asset under development in China and two exploration assets in Indonesia and Malaysia.

The current and upcoming production is predominantly that of oil. RH Petrogas transited to

the oil and gas sector on the Singapore Stock Exchange (SGX) in 2009/10 and benefitted

from investors' euphoria over the sector, which was booming with increasing oil price post

global financial crisis. However, the crude price environment has changed.

Initiate coverage on RH

Petrogas with a NEUTRAL

rating and S$0.40 target price

Fuyu-1 Block (China) in the spotlight

The value in the stock is largely built on the premise of obtaining a final approval from the

National Development and Reform Commission (NDRC) for the overall development plan

(ODP) on Fuyu-1 Block. Two-third of the total asset value resides in this Block. In October

2014, the company obtained the final approval to produce an estimated 7.2 mm bbl of oil (21%

of 2C contingency resources in the Fuyu-1 Block), which leaves 26.9 mm bbl (79%) of oil

awaiting for the next phase of approval from CNPC and NDRC. The development is low capital

intensive as it requires drilling shallow wells (200300 m). However, the operating cost is

higher as it requires US$10/bbl more to apply the huff and puff technique to bring up heavy oil.

Value in Fuyu-1 Block is

only partially realised until

final ODP approval for

Phase 2 is obtained

Yet to decide on licence extensions for Basin and

Island PSCs in Indonesia

Basin and Island PSCs are RH Petrogas' two producing blocks in Indonesia. Much of the

value resides in undeveloped resources in the block, which risk being eroded upon licence

expiry in 2020. It is unlikely that the operator of Basin PSC will invest further after a sixwell development drilling campaign in 2015. Island PSC still holds 21.9 mm boe of 2C

contingency resources and has more favourable fiscal terms than Basin PSC. The

operators of Island PSC are making feasibility studies for developments in Koi and TBC

fields. The window for development could be limited unless there is licence extension.

Undertaking feasibility studies

on Koi and TBC fields in

Island PSC, however window

for development is limited

unless there is licence

extension

Triple building blocks to valuation

The key building blocks to growing Net Asset Value (NAV) in the next 24 months are (1)

commercial production from the Fuyu-1 Block, (2) finalisation of development plans in

Island PSC and (3) obtaining approval on ODP for the next phase of development in Fuyu1 Block from CNPC and NDRC. Mr Francis Chang, an industry veteran with over 35 years

of experience was appointed as CEO in January 2014. We believe that the company is

looking out for minor acquisition opportunities to boost its portfolio ahead of the 2020

expiry of Basin and Island PSCs. Southeast Asia will most likely remain RH Petrogas'

main area of focus going forward. The Chinese block is likely a one-off opportunity for RH

Petrogas as conventional onshore licences in China have been harder to come by.

The main catalyst to

valuation is obtaining final

approval for Phase 2 of

Fuyu-1 block

Financials: Adapting to a new crude price environment

The company had previously operated in a US$100/bbl crude environment. With uncertain

crude price going in 2015, the company's earnings and operating cash flows will likely be

hit by lower crude prices.

Investment risks

The company is operator of Fuyu-1 and it is their first block moving from development to

production. The Chinese authorities and partner CNPC, will likely be monitoring the

company's abilities and their performance may influence how soon ODP approval for

Phase 2 will come forth.

RH Petrogas' performance as

operator will likely influence

how soon ODP for Phase 2 at

Fuyu-1 will come forth

RH Petrogas Limited

(RHPG.SI / RHP SP)

14 January 2015

RH Petrogas Limited RHPG.SI / RHP SP

Price (13 Jan 15): S$0.38, Rating:: NEUTRAL [V], Target Price: S$0.40, Analyst: David Hewitt

Target price scenario

Scenario

Upside

Central Case

Downside

Income statement (US$ mn)

Sales revenue

Cost of goods sold

SG&A

Other operating exp./(inc.)

EBITDAX

Exploration expense

EBITDA

Depreciation & amortisation

EBIT

Net interest expense/(inc.)

Associates/JV

Forex losses (gains)

Non-operating inc./(exp.)

Recurring PBT

Exceptionals/extraordinaries

Taxes

Profit after tax

Other after tax income

Minority interests

Preferred dividends

Reported net profit

Analyst adjustments

Net profit (Credit Suisse)

Cash flow (US$ mn)

EBIT

Net interest

Tax paid

Working capital

Other cash & non-cash items

Operating cash flow

Capex

Free cash flow to the firm

Disposals of fixed assets

Acquisitions

Divestments

Associate investments

Other investment/(outflows)

Investing cash flow

Equity raised

Dividends paid

Net borrowings

Other financing cash flow

Financing cash flow

Total cash flow

Adjustments

Net change in cash

Balance sheet (US$ mn)

Cash & cash equivalents

Current receivables

Inventories

Other current assets

Current assets

Property, plant & equip.

Investments

Intangibles

Other non-current assets

Total assets

Accounts payable

Short-term debt

Current provisions

Other current liabilities

Current liabilities

Long-term debt

Non-current provisions

Other non-current liab.

Total liabilities

Shareholders' equity

Minority interests

Total liabilities & equity

Key earnings drivers

TP

0.40

%Up/Dwn Assumptions

3.90

12/13A

86.4

58.7

6.1

(2.7)

24.3

44.2

(19.9)

11.0

(30.9)

3.3

(34.2)

(28.8)

2.9

(65.9)

(65.9)

28.8

(37.1)

12/13A

(59.6)

2.5

5.3

(14.7)

78.6

12.1

(48.0)

(35.9)

(50.0)

56.1

4.9

1.5

62.6

24.7

0.01

24.7

12/13A

52.4

34.8

1.0

0.62

88.8

1.6

111.1

133.0

334.5

64.1

13.7

2.2

0.26

80.2

33.5

42.3

1.3

157.3

177.2

334.5

12/14E

73.7

55.2

6.0

(8.0)

20.5

20.5

11.5

9.0

2.9

6.0

(20.5)

4.7

(19.1)

(19.1)

20.5

1.3

12/14E

(11.5)

1.8

4.7

(12.2)

12.7

(4.4)

(21.2)

(25.6)

2.8

(19.7)

0.5

(10.2)

0.2

(9.4)

(33.6)

0.01

(33.6)

12/14E

18.9

24.2

2.0

0.50

45.6

1.5

90.6

145.1

283.0

42.4

13.7

2.0

0.15

58.2

19.8

43.0

1.3

122.4

158.6

2.0

283.0

12/15E

76.1

58.6

8.0

(7.1)

16.6

16.6

12.0

4.6

5.3

(0.7)

0.1

(0.7)

(0.7)

(0.7)

12/15E

4.6

4.2

0.1

1.7

1.3

11.9

(39.9)

(28.0)

(41.8)

36.3

36.3

6.4

0.01

6.4

12/15E

25.3

25.0

2.1

0.50

52.9

2.0

90.6

175.5

321.1

44.9

13.7

2.0

0.15

60.8

56.2

43.0

1.3

161.2

157.9

2.0

321.1

12/16E

87.3

62.9

8.0

(7.9)

24.2

24.2

12.8

11.5

5.7

5.8

2.9

2.9

2.9

2.9

12/16E

11.5

4.6

2.9

(0.7)

(4.4)

13.9

(17.1)

(3.2)

(19.0)

6.3

6.3

1.3

0.01

1.3

12/16E

26.6

28.7

2.4

0.50

58.2

2.5

90.6

182.3

333.7

48.3

2.0

0.15

50.4

76.2

43.0

1.3

170.9

160.8

2.0

333.7

Per share data

Shares (wtd avg.) (mn)

EPS (Credit Suisse)

(US$)(US$)

DPS

BVPS (US$)

Operating CFPS (US$)

Key ratios and

valuation

Growth(%)

Sales revenue

EBIT

Net profit

EPS

Margins (%)

EBITDAX

EBITDA

EBIT

Pre-tax profit

Net profit

Valuation metrics (x)

P/E

P/B

Dividend yield (%)

P/CF

EV/sales

EV/EBITDAX

EV/EBITDA

EV/EBIT

ROE analysis (%)

ROE

ROIC

Asset turnover (x)

Interest burden (x)

Tax burden (x)

Financial leverage (x)

Credit ratios

Net debt/equity (%)

Net debt/EBITDA (x)

Interest cover (x)

12/13A

12/13A

639.7

(0.06)

0.24

0.02

12/13A

12/14E

12/14E

733.8

0.00

0.22

(0.01)

12/14E

12/15E

12/15E

734.8

(0.00)

0.21

0.02

12/15E

12/16E

12/16E

735.8

0.00

0.22

0.02

12/16E

0.0

(268)

(708)

(592)

(14.7)

129

104

103

3.2

(49)

(155)

(154)

14.7

149

496

495

28.1

(23.1)

(35.7)

(39.6)

(43.0)

27.8

27.8

12.2

8.2

1.8

21.8

21.8

6.1

(0.9)

(1.0)

27.8

27.8

13.1

6.7

3.3

(5)

1.19

15.2

2.39

8.5

(10.4)

(6.7)

157

1.33

(47.9)

3.08

11.1

11.1

25.2

(288)

1.34

17.8

3.37

15.4

15.4

55.7

73

1.32

15.2

3.00

10.8

10.8

22.8

(20.7)

(17.6)

0.26

1.11

1.05

1.89

0.8

6.9

0.26

0.67

1.33

1.76

(0.5)

2.7

0.24

(0.15)

1.10

2.01

1.8

2.8

0.26

0.51

0.50

2.05

(3.0)

0.26

(9.3)

9.1

0.71

3.1

27.9

2.68

0.9

30.5

2.05

2.0

Source: Company data, Thomson Reuters, Credit Suisse estimates

12MF P/E multiple

120

100

80

60

40

20

0

Jan-11

Sep-11

May-12

Jan-13

Sep-13

May-14

Dec-14

May-14

Dec-14

12MF P/B multiple

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0.0

Jan-11

Sep-11

May-12

Jan-13

Sep-13

Source: IBES

RH Petrogas Limited

(RHPG.SI / RHP SP)

14 January 2015

Caught in an ambivalent position

Early entrant to the Singapore oil and gas market. RH Petrogas has been an oil and

gas player on the Singapore Stock Exchange (SGX) for five years. The company

transformed itself at the doldrums of the electronics cycle to foray into the exploration and

production (E&P) of oil in 2009, a time when crude price was recovering from the bottom,

post the global financial crisis. The company went on an acquisition spree in 2009/10 to

purchase four assets, which still form the backbone of the company today. In 2012, RH

Petrogas added a fifth asset when it entered into a PSC with Petronas Carigali in Malaysia.

RH Petrogas transited into

the E&P sector in 2009/10

at a time when oil price was

recovering from GFC

Figure 6: RH Petrogas' asset acquisition history

Assets

Fuy u 1 PSC

West Belida PSC

Basin & Island PSCs

SK331 PSC

Country

Completion

Purchase Stake

Price

Operator

Song Liao Basin, China

17-Aug-09

49%

S$110mn

RH Petrogas

Ex ploration

Onshore

9-Jan-38

South Sumatra, Indonesia

14-Jun-10

94%

S$0.4mn

RH Petrogas

Ex ploration

Onshore

4-May -39

West Papua, Indonesia

29-Dec-10

Producing

14.3mm bbl

Saraw ak, Malay sia

6-Dec-12

Ex ploration

60% - Basin PSC

33.2% - Island PSC

80%

US$73.83mn

na

PetroChina - Basin PSC

PetroChina & Pertamina - Island PSC

RH Petrogas

Status at purchase 2P Reserves

PSC expiry

Onshore/ 15-Oct-20 for Basin PSC

Offshore 22-Apr-20 for Island PSC

Onshore

5-Dec-40

Source: Company data, Credit Suisse estimates

Influential board and experienced management. The company's primary focus area for

growth and expansion is conventional oil and gas in Southeast Asia (SEA) and China. The

assets of the company reflect the wide influence of the Executive Chairman, Tan Sri Datuk

Sir Tiong Hiew King, in the region. Mr Tiong owns a conglomerate in Malaysia covering

timber, oil palm plantations, oil and gas, media and publishing, mining, fishery and

manufacturing businesses. The SEA-Chinese co-operation is apparent in PSCs in West

Papua where RH Petrogas is in partnership with CNPC/PetroChina together with local

partner, Pertamina. The current CEO, Mr Francis Chang, was promoted to the role in

January 2014. He joined the company in 2010 as Vice President of Exploration and

Production (E&P). Mr Chang has over 35 years of global E&P experience with North

American companies such as Anadarko, Burlington Resources and Amoco. Prior to joining

RH Petrogas, he spent the last seven years in China.

The company is helmed by

an influential Chairman and

a very experienced CEO

Conventional Southeast Asian/Chinese oil play. Even though the company's first oil

block is in China, future licences in conventional oil and gas blocks will be difficult to obtain

given that local Chinese oil and gas players have grown bigger with access to funds for

development. However, RH Petrogas is well situated within the Southeast Asian focus, an

area with rich hydrocarbon resources. Southeast Asia holds 72.4 bn bbl of recoverable oil

and 26.7 tcm of gas resources according to IEA. With robust economic growth as a region,

oil consumption has grown 52% from 3.6 mmb/d to 5.5 mmb/d and gas consumption has

grown 92% from 7.5 bcf/d to 14.4 bcf/d from 2000 to 2013. Crude production has not kept

pace with demand resulting in the region being a net importer of crude oil. Government

policies are supportive in growing the oil and gas sector to meet increasing domestic

demand. Investment in the region is robust with increased capital expenditure of more

than two times from US$9.5 bn to US$24.8 bn from 200513.

While the Fuyu-1 Block

appears to be a one-off in

China, SEA remains a land of

opportunity for the company

RH Petrogas Limited

(RHPG.SI / RHP SP)

14 January 2015

Figure 7: Southeast Asiademand and supply of oil

6

Figure 8: Southeast Asiacapital expenditure

25

mm b/d

US$bn

23

21

3

2

19

17

15

(1)

13

(2)

11

Widening demand-supply gap

(3)

(4)

00

01

02

03

Oil production

04

05

06

07

Oil consumption

08

09

10

11

12

13

Demand-supply gap

Source: BP Statistical Review of World Energy 2014

7

2005

2006

2007

2008

2009

Figure 9: RH Petrogas' daily production against peers

8,000

2011

2012

2013 2014E

Source: Woodmac

E&P stock premium is eroded as more players jump on the bandwagon. There are

more upstream companies in the oil and gas sector listed on SGX today than in 2010

when RH Petrogas entered the sector. In 2H2013, three new companiesLinc Energy,

KrisEnergy and Rex (upstream technology) were newly listed on SGX. Listed companies

such as Ramba Energy and Giken Sakata, which own other core businesses are also

trying to transit into the E&P business. Therefore, investors now have more investment

options. Coupled with an uncertain oil price environment, the sieve will get finer as

investors shed their initial euphoria on the sector to seek out companies which can offer

growth, strong financial position and hold quality assets.

9,000

2010

More players have joined

the E&P game on SGX

since 2013

Figure 10: RH Petrogas' reserves/resources against peers

boe/d

2P Reserves

7,403

166.3

Linc

7,000

Kris

6,000

5,000

4,350

4,000

3,910

-

32.3

RHP

19.1

2C Resources

3,000

2,000

Kris

1,000

RHP

Kris

RHP

Liquids

Source: Company data as at Sep 2014

Gas

Linc

182.8

62.7

-

50

mm boe

100

Liquids

150

200

Gas

Source: Company data as at Oct 2014. Linc Energy does not publish

2C contingency resources

RH Petrogas Limited

(RHPG.SI / RHP SP)

14 January 2015

Fuyu-1 Block (China) in the spotlight

The dragon arrived as smaller than anticipated. The Fuyu-1 PSC was the first asset and

bedrock of RH Petrogras' portfolio. The stock sat on excitement over the Fuyu-1 Block as it

resides in the same basin as China's largest onshore oil field, Da Qing, in the Song Liao Basin.

It is an onshore conventional low-capital intensive oil project. The company received a final

approval for its ODP on the Yong Ping oil field in the block to commence the first phase of

development to produce an estimated gross of 14.6 mm bbl (7.2 mm bbl net) of oil in October

2014. The approval includes the drilling of 1,008 development wells over five years. It takes an

average of seven days to drill each well. There remains 55 mm bbl (26.9 mm bbl net) of 2C

contingency resources in the block, which require a subsequent ODP approval. This is the first

block going into production where RH Petrogas acts as a project operator.

Final regulatory approval

only covers c.20%

resources in Fuyu-1,

requiring a second approval

for the remaining resources

CNPC is a ready buyer of crude in the Fuyu-1 Block. RH Petrogas has entered into an

oil sales agreement with CNPC. CNPC has established oil and gas operation facilities in

the Song Liao Basin. The oil quality is heavy with a density of 18.5 API. We estimate

sales price to be at a 15% discount to Brent. The oil will be trucked to CNPC processing

facilities, which are 5 km away, for processing and blending with lighter oil. Production at

the Yong Ping oil field is expected to commence in 2Q2015 with peak production to be

achieved by 2019. RH Petrogas will be applying the huff and puff technique to flow the oil

out of the field, and hence we added US$10/bbl into the operating cost.

Production at Fuyu-1 is

expected in 2Q2015 and

CNPC is a ready buyer of

the crude

Low-capital investment in the Fuyu-1 Block. RH Petrogas has invested close to US$30

mn in the exploration and appraisal phase. Development capex associated with drilling

1,008 wells and related facilities is estimated to be about US$58 mn from 2014 to 2019

(US$50,000 per well) as these are shallow wells ranging from 200300 m in depth. RH

Petrogas completed 15 wells by the end of 2014. The production profile is estimated on a

gross 10 b/d production per well, with declines starting to set in from 2020.

Fuyu-1 Block has low capital

requirement with an

estimated development

budget of US$58 mn

Figure 11: Fuyu 1 block is situated in Northeast China,

Figure 12: Phase 1 drilling campaign and gross

Song Liao Basin

production at Yong Ping oil field, Fuyu-1 Block

10,000

b/d

wells

9,000

300

8,000

300

300

250

7,000

350

250

6,000

200

5,000

150

4,000

100

3,000

2,000

1,000

100

43

50

15

2014

2015

2016

2017

2018

Wells drilled per year (RHS)

Source: Company Presentation

2019

2020

2021

2022

Gross production

Source: Company guidance, Credit Suisse estimates

Second ODP approval needed to fully realise value in Fuyu-1 Block. As a first time

operator, the company's back-end loaded drilling campaign is very sensible for it to iron

out operational issues. Chinese authorities and partner CNPC, together, will likely be

monitoring the company's abilities and performance. The company believes that ODP

approval for phase 2 could be forthcoming in the next two to three years. New drilling is

most likely required in phase 2 of development. Besides oil, the company is also doing

exploration work to ascertain deep gas potential in the block.

ODP approval for Phase 2

in Fuyu-1 is estimated to be

in two to three years

RH Petrogas Limited

(RHPG.SI / RHP SP)

14 January 2015

Yet to decide on licence extensions

for Basin and Island PSCs in

Indonesia

Yet to decide on licence extension in Basin and Island PSCs (Indonesia). The Basin

and Island PSCs are bread and butter assets for RH Petrogas. Since their acquisition in

2010, they have provided the company with production and cash flows to support

exploration and appraisal activities. Even though there is exploration upside in these two

blocks, their PSC expiry in 2020 puts a limit on their full realisation. The company has

achieved a 50% exploration drilling success rate for the two PSCs in the last four years,

writing off c.$30 mn in 2013 associated with unsuccessful exploration. We understand that

PSC extension is under consideration.

Basin and Island PSCs

expire in 2020, and licence

extension is under

consideration

Six-well development drilling campaign in Basin PSC in 2015. There are plans to drill

six development wells in Basin PSC in 2015. These are pending regulatory approval,

which are expected to come by early 2015. Four wells are targeted at the North Klalin field

and two wells at the Southeast Walio field. The gross capex expected for the development

campaign is US$50 mn (US$30 mn net). The development of these fields do not add to

valuation as we understand from the company that their reserves have already been

booked. However, they will help the company in maintaining the production and

commercialisation of reserves. This investment also ensures the cost recovery portion of

revenue from the Basin PSC until expiry. There is no plan to invest further in the Basin

PSC after its development drilling campaign in 2015 unless there is licence extension.

Developing drilling in Basin

PSC in 2015 to maintain

production and revenue

Significant resources in Island PSC, a licence extension could justify further

developmental investment. The company plans to re-activate the offshore TBA field,

which ceased production in 2010. The TBA field has gross c.2 mm bbl (0.66 mm bbl net)

of remaining reserves. Production is targeted for 1Q2015 when an FPSO is secured and

brought to location. Further development could be expected in Island PSC as the reserves

are running low at less than 1.5 mm boe and a significant 2C resources of 21.9 mm boe

remaining. Fiscal terms at Island PSC are also more favourable than Basin PSC. The two

targets for future development are the Koi and TBC fields. Preliminary front end

engineering design ('pre-FEED') study commenced in 2014 to evaluate the development

design and concept of the Koi field. Koi holds a gross 12 mm bbl (4 mm bbl net) of oil. The

TBC gas and condensate field is another potential candidate for future development. A

new CNG plant is being considered to process the gas feed. TBC is estimated to have

gross 182 bcf (60 bcf net) of gas and 6 mm bbl (2 mm bbl net) of condensate.

The company is conducting

feasibility studies on Koi and

TBC fields for future

development

Figure 13: Development plans for Basin and Island PSCs

Block

Operator

Basin PSC

PetroChina

Island PSC

PetroChina & Pertamina

Fields

Development Plan

North Klalin

Southeast Walio

TBA

Time frame 2P Reserves (net)

4 development wells

2 development wells

Secure FPSO

2015

2015

2015

Koi

Pre-FEED study

2014/2015

TBC

Feasibility study on feeding gas to CNG plant

2015/2016

Booked

Booked

Booked

4mm bbl

Not booked

70bcfe

Not booked

Source: Company data, Credit Suisse estimates

Slight increase in gas sales in Indonesian PSCs. While oil is predominantly the focus of

Basin and Island PSCs, the company has been making efforts to commercialise their gas

production. Sales are expected to increase from 5 mmcf/d to 8 mmcf/d starting January

2015 and to 10 mmcf/d in years after. Gas prices are locked in for two years at $4/mcf.

Efforts are made to

commercialise gas

production at Basin and

Island PSCs

RH Petrogas Limited

(RHPG.SI / RHP SP)

14 January 2015

Figure 14: RH Petrogas: Working interest production profile

8.0

m boe/d

7.0

6.0

5.0

4.0

3.0

2.0

1.0

-

2010A

2011A

2012A

2013A

2014

2015

2016

Basin & Island PSC

2017

2018

2019

2020

2021

2022

Fuyu 1 Block

Source: Company data, Credit Suisse estimates

Plan for one exploration well in SK331 PSC (Malaysia). RH Petrogas (80% stake) entered

into the SK331 PSC in Sarawak Malaysia with Petronas in December 2012. Preliminary study

indicated that the prospective resources could be gas prone. If true, there is an opportunity for

it to become a feedstock source to the Bintulu LNG production facilities, which are located

within SK331. Seismic acquisition was completed in November 2014. The company targets to

process and interpret seismic data, and drill one exploration well in 2015 budgeted at gross

US$25 mn (US$ 10.2mn net). The farm out of 39.2% stake of SK 331 to Tumbuh Tiasa was

completed in September 2014 for US$2.79 mn, leaving the company with a 40.8% stake. The

company is optimistic about this block based on exploration work to date.

Preliminary studies indicate

that prospective resources

in SK331 are gas prone

Figure 15: Bintulu LNG facility, operated by Malaysia LNG (Petronas) is located within

SK331 PSC

Bintulu

SK331

Source: Company presentation

RH Petrogas Limited

(RHPG.SI / RHP SP)

14 January 2015

Passive exploration strategy in West Belida (Indonesia). RH Petrogas purchased West

Belida PSC from Orchard Energy in June 2010. The company wrote off US$7.2 mn of

unsuccessful exploration expense associated with Gitar-1 well in the block. The West

Belida exploration licence is expiring in May 2015. The company is conducting passive

seismic programme and will be making a decision on whether to extend the exploration

licence based on the result by 1Q2015.

A decision on whether to

extend exploration licence in

West Belida is expected by

1Q2015

RH Petrogas Limited

(RHPG.SI / RHP SP)

10

14 January 2015

Triple building blocks to valuation

Risked valuation suggests target price of S$0.40/share. The net asset value of the

stock is S$0.84 on an un-risked basis. On a risked adjusted basis, we arrive at

S$0.40/share. Fuyu-1 Block dominates two-third of the total asset valuation of RH

Petrogas. To arrive at our valuation:

We differentiate between Phase 1 and 2 of Fuyu-1 Block. We allocated 70% risking

factor to Phase 1's estimated volume on the basis that this is the company's first

operatorship on a developing/producing block, a lack of production history and expert

view on the block presently (the reserve auditor's report will only be ready in 1Q2015).

We will fully derisk the value in the block when commercial production commences.

We used un-risked valuation in Phase 1 on a per boe basis as a proxy for Phase 2 in

Fuyu-1 block. We allocated a risk factor of 50% to Phase 2 to indicate that these are

volumes awaiting governmental approval. We understand from the company that

subsequent ODP approval process should be swifter than the first approval.

The valuation of 2P reserves in Basin and Island PSCs have been fully derisked. Until

development plans for Koi and TBC are confirmed, they are risked at 30% as 2C

resources. The value in Basin and Island PSCs will be eroded at the end of the expiry

of the PSCs if there is no extension.

Fuyu-1 Block holds two-third

of total asset valuation of

the company

Figure 16: RH Petrogas: Sum-of-the-parts table

Assets

Country

WI

(%)

Unrisked

Reserves / Unrisked

Risk

Risked

Valuation

Resources Valuation

factor

Valuation

US$mn

US$'m

Unrisked

Risked

Valuation Valuation

mm boe

US$/boe

SGct/sh

SGct/sh

22.8

8.6

2.6

100%

22.8

4.1

4.1

7.9

1.3

5.9

100%

7.9

1.4

1.4

30.7

10.0

30.7

5.5

5.5

Producing

Kepala Burung (Basin) PSC

Indonesia

60%

Salaw ati Kepala Burung (Island) PSC Indonesia 33.2%

Total

In development

Fuy u 1 Block - Phase I

China

49%

60.6

7.2

8.4

70%

42.4

10.8

7.6

Fuy u 1 Block - Later Phase

China

49%

226.6

26.9

8.4

50%

113.3

40.5

20.2

287.2

34.1

155.7

51.3

27.8

Total

Under appraisal

Kepala Burung (Basin) PSC

36.1

13.7

2.6

30%

10.8

6.5

1.9

Salaw ati Kepala Burung (Island) PSC Indonesia 33.2%

Indonesia

130.2

21.9

5.9

30%

39.0

23.3

7.0

Total

166.3

35.6

49.9

29.7

8.9

484.2

79.7

236.3

86.5

42.2

Total asset value

Cash / (Net debt)

Net asset value (NAV)

60%

(15.1)

469.0

(15.1)

221.2

(2.7)

83.8

(2.7)

39.5

Source: Credit Suisse estimates

Fuyu-1 Block is the main catalyst. The charts below show the catalyst map for the stock

and corresponding upside to NAV. The next catalyst for RH Petrogas will be the

commercial production in Phase 1 Fuyu-1 Block in spring 2015. We believe that ODP

approval for Phase 2 in Fuyu-1 Block is only likely to come when commercial production

stabilises in two to three years. The next catalysts for RHP's assets are development plans

for Koi and TBC in Island PSCs. We view Koi development to be more probable given that

pre-FEED study has commenced and the volumes associated are smaller. The TBC

development plan is more likely upon a licence extension on Island PSC.

Final ODP approval for

Phase 2 Fuyu-1 is the main

catalyst for the stock

RH Petrogas Limited

(RHPG.SI / RHP SP)

11

14 January 2015

Figure 17: 24-month catalyst map

1H15

2H15

Sanctioned Projects

Figure 18: Corresponding upside to NAV

1H16

2H16

70.0

Scts/share

+16.2

62

60.0

Fuyu 1 - Yong Ping

First prodn

50.0

Fuyu 1 - Later Phase

ODP approv al

40

40.0

Assets under appraisal

Koi

+0.8

+3.3

+2.5

30.0

FEED & submit POD

TBC

20.0

FEED & submit POD

10.0

0.0

Base NAV Fuyu 1-prod Koi-submit TBC-submit Fuyu 1-ODP Possible NAV

POD

POD

2nd Phase

Source: Credit Suisse estimates

Source: Credit Suisse estimates

Figure 19: NAV sensitivity to crude price changes

Crude Assumptions US$/bbl

Risked NAV

Scts/share

Unrisked NAV

Scts/share

95

48

100

85

42

89

CS assumptions

40

83

75

35

76

65

28

61

55

18

42

45

0.2

8.9

Source: Credit Suisse estimates. CS' crude assumptions are US$75.3/bbl in 2015, US$80/bbl in 2016-19

and US$85/bbl long-term.

Ammunition in a soft-crude environment is quality assets. The stock price of RH

Petrogas had previously moved with corporate events, mostly driven by market euphoria

around the oil and gas business and Chinese oil consumption. The bullish investor

sentiments worked in a high oil price environment. However, with low oil prices, investors

will be more selective, looking for companies with strong asset base and execution. While

the company is growing its production at the Fuyu-1 Block, it will also need other assets to

replace production, which may cease at Basin and Island PSCs if their licences are not

extended. We believe that the company will be looking out for possible minor acquisitions

in the market place to boost its portfolio. The Chinese block is a likely one-off opportunity

for RH Petrogas as conventional onshore licences in China have been harder to come by.

Southeast Asia will most likely remain RH Petrogas' main area of focus.

Minor acquisition in the future

is possible as the company

looks to boost its portfolio

RH Petrogas Limited

(RHPG.SI / RHP SP)

12

14 January 2015

Figure 20: RH Petrogas stock price movement to key corporate events

1.10 S$/share

27 Apr 2009:

Purchased Fuyu 1 Block

(Exploration, China)

1.00

3 Dec 2009:

Purchased West Belida PSC

(Exploration, Indonesia)

0.90

0.80 Capital raising &

Chinese

Ministry's

0.70 verification of

resources at

Fuyu 1 Block

0.60

Disposal of

electronics business

to focus solely on

E&P

Capital raising &

Exploration drilling

at Island and Basin

PSCs

20 Sep 2010:

Purchased Basin & Island PSCs

from Pearl

11 Dec 2012:

Seismic option on Block M-1

(Ceased, Myanmar)

6 Sep 2010:

Purchased Basin & Island PSCs

from Lundin

(Producing, Indonesia)

0.50

0.40

0.30

Apr-09

Rumoured

takeover offer

Aug-09 Dec-09

Apr-10

Aug-10 Dec-10

Apr-11

Aug-11 Dec-11

6 Dec 2012:

Entered into SK331 PSC

(Exploration, Malaysia)

Apr-12

Aug-12 Dec-12

Apr-13

Aug-13 Dec-13

16 Oct 2014:

ODP approval

for Fuyu 1 Block

from NDRC

Apr-14

Aug-14 Dec-14

Source: Bloomberg, Company data, Credit Suisse estimates up to 13 Jan 2015

Figure 21: EV/2P multiple of E&Ps with SEA assetsRH Petrogas is trading above global median

Source: Company data, Bloomberg, Credit Suisse estimates as on 13 Jan 2015

RH Petrogas Limited

(RHPG.SI / RHP SP)

13

14 January 2015

Figure 22: EV/(2P+2C) multiple of E&Ps with SEA assetsRHP gas trading below global median

Source: Company data, Credit Suisse estimates, Credit Suisse estimates as on 13 Jan 2015

Figure 23: PSC assumptions for field valuations

Basin

Realised prices:

Discount to Brent

3%

Volume

2P reserves

Govt levies:

First tranche petroleum

20%

VAT

Royalty

Special oil levy

Cost oil cap

100% of net revenue

Profit oil - govt share

70%

Profit gas - govt share

46%

DMO price

15% of Brent

DMO quantity

25% *profit oil-contractor share*prodn

Income tax

44%

Island

Fuyu-1

3%

2P reserves

15%

2P reserves

20%

100% of net revenue

60%

42%

US$0.20/bbl

25% *profit oil-contractor share*prodn

48%

5%

0-12.5%

0-40%

65% of gross revenue

51%

25%

Source: Credit Suisse estimates

RH Petrogas Limited

(RHPG.SI / RHP SP)

14

14 January 2015

Financials: Adapting to a new crude

environment

New crude environment for RH Petrogas. The company previously operated in a

US$100/bbl crude environment. For a young E&P, it has maintained a healthy earnings

track record except for a goodwill and exploration write-off in 2013. Figure 24 is an

earnings sensitivity table on the company in a less certain oil price environment. Though

earnings risk is going negative, EBITDA breaks even at about US$47/bbl.

Figure 24: RH Petrogas' earnings sensitivity table

Crude Assumptions

2015 EPS

2016 EPS

2017 EPS

US$/bbl

UScts

UScts

UScts

95

0.8

0.9

1.6

85

0.4

0.6

1.1

CS assumptions

(0.1)

0.4

0.9

75

(0.1)

0.2

0.6

65

(0.7)

(0.1)

0.1

55

(1.4)

(0.5)

(0.4)

45

(2.9)

(1.3)

(1.2)

Source: Credit Suisse estimates. CS' crude assumptions are US$75.3/bbl in 2015, US$80/bbl in 2016-19

and US$85/bbl long-term

Figure 25: RH Petrogas' EBITDA sensitivity table

Crude Assumptions

2015 EBITDA

2016 EBITDA

2017 EBITDA

US$/bbl

US$'m

US$'m

US$'m

95

24.8

32.0

43.7

85

20.7

26.8

36.5

CS assumptions

16.6

24.2

32.9

75

16.5

21.7

29.3

65

12.4

16.5

22.1

55

8.3

11.3

14.8

45

(2.0)

(1.0)

2.3

Source: Credit Suisse estimates. CS' crude assumptions are US$75.3/bbl in 2015, US$80/bbl in 2016-19

and US$85/bbl long-term

Capex will taper off post 2015 as Fuyu-1 block is low cost. RH Petrogas' capital

expenditure should reach a peak of c.US$40 mn in 2015 and ease off in the years after

based on their existing portfolio. The bulk of 2015 capex will be US$20 mn net to RH

Petrogas on the six-well development programme in the Basin PSC. At the moment, the

company does not have plans to invest further in the block. An estimated US$6 mn will be

spent on its 40-well drilling plan in the Fuyu-1 Block in 2015. RH Petrogas' back-end

loaded drilling programme in Fuyu-1 is sensible as it gives them time to test out any

teething issues on their first operatorship and gives ample time to raise development

funding, if necessary. Exploration related expenses will mostly be focused on SK331 PSC

in Sarawak estimated at US$10.2 mn for drilling one well in 2015.

Capital spending slows down

after 2015, based on current

plan, until new development

projects are injected

Figure 26: RH Petrogas' capital expenditure requirements based on existing portfolio

60

US$m

50

40

30

20

10

2010A

2011A

2012A

2013A

2014

2015

2016

2017

2018

2019

Source: Company data, Credit Suisse estimates

RH Petrogas Limited

(RHPG.SI / RHP SP)

15

14 January 2015

Internal funding may be able to sustain the status quo capex plan. RH Petrogas ended

3Q2014 with cash in hand of US$29 mn. In October 2013, RH Petrogas raised equity funding

of S$70.3 mn net (priced at S$0.63/share) for exploration, development and production

expenditure at Basin and Island PSCs and S$41.6 mn net (priced at S$0.80/share) in

September 2009 for acquisition of Kingworld Resources and E&A capital expenses at the

Fuyu-1 Block. RH Petrogas' 2015 capital expenditure plan is estimated at US$42 mn mainly for

a six-well development drilling programme in Basin PSC, Fuyu-1 development and SK331

exploration. If there are plans to develop Koi and TBC in Island PSC and also make

acquisitions to augment its current portfolio, RH Petrogas will need to raise more capital.

Figure 27: Leverage ratios of RH Petrogas vs peers

80%

70%

67%

65%

60%

50%

38%

40%

30%

25%

19%

20%

10%

3%

0%

Net Debt / (Net Debt + Equity)

Total Debt / (Total Debt + Equity)

Linc

Kris

RHP

Source: Company data

RH Petrogas Limited

(RHPG.SI / RHP SP)

16

14 January 2015

Investment Risks

Crude and gas price risk

As RH Petrogas' production is predominantly oil, the uncertainty in oil price will impact its

near-term earnings. In the past five years, the company has operated in a US$100/bbl oil

environment. Going forward, there will be less certainty on oil prices.

Executive/development risk

RH Petrogas is the operator of the Fuyu-1 Block. It is first time that the company is playing the

role of an operator in a block moving from development to production. This block accounts for

about two-third of the total asset value of the company, and hence the Fuyu-1 Block is critical

to the success of the company. As the company moves into the development phase at the

Fuyu-1 block, the CEO's over 35 years of E&P experience (of which seven years were spent in

China) are brought to the fore on making Fuyu-1 a success.

Regulatory and political risk

While China is a land of opportunities from a resource and consumption perspective, any

evolving regime is still capricious. There remains commercialisation uncertainty in 2C

contingency resources in the Fuyu-1 block until the company receives a final ODP

approval for Phase 2 development.

PSC expiry

Basin and Island PSCs have been the sole contributors to the production and revenues of the

company. With their PSC expiration approaching in 2020, RH Petrogas needs to grow new

sources of production and revenues. With the significant 2C contingency resources residing in

these two PSCs, valuation associated with these are at a risk of being eroded over time.

Exploration risk

All E&P companies are subject to exploration risk. RH Petrogas had written off

unsuccessful exploration expenses of over US$30 mn in 2013 in the Basin and Island

PSCs. We believe that the company will be cautious with exploration expenditure in

SK331 Malaysia and West Belida in Indonesia where they hold operatorship.

Organic vs Inorganic growth

RH Petrogas has had a stable portfolio in the last five years. There were two announced

attempts at growing its assets, the SK331 PSC in Malaysia and Block M-1 in Myanmar, which

the company decided not to farm into. The selection for assets for future growth and how the

newly appointed CEO will chart the future course of the company will be interesting to see.

RH Petrogas Limited

(RHPG.SI / RHP SP)

17

RH Petrogas Limited

(RHPG.SI / RHP SP)

Figure 28: Valuation summary of companies with SEA assets

Companies

Tickers

Price

Market Cap

Net Debt

EBITDA

Debt

/

Capit

al

EV /

EBITDA

(Y=0)

EV /

EBITDA

(Y+1)

PE

(Y=0)

PE

(Y+1)

PB

(Y=0)

PB

(Y+1)

Price-to

Sales

(Y=0)

Price-to

Sales

(Y+1)

(US$'mn)

(US$'mn)

(US$'mn)

(x)

(x)

(x)

(x)

(x)

(x)

(x)

(x)

(x)

Enterpris

e Value

13-Jan-15

(LC)

(US$'mn)

Singapore

KrisEnergy

KRIS SP Equity

0.65

507

654

(129)

28

20

32.8

28.9

na

28.4

1.1

1.2

3.8

5.8

Linc Energy

LNC SP Equity

0.64

281

682

290

(4)

52

na

6.1

na

na

0.7

0.7

2.2

1.2

RH Petrogas

RHP SP Equity

RMBA SP

Equity

0.39

212

222

(5)

(16)

21

na

14.2

na

32.1

1.3

na

2.4

2.1

Ramba Energy

0.31

88

126

(8)

13

na

na

na

na

1.5

na

1.5

na

Interra Resources

ITRR SP Equity

0.16

55

51

(10)

27

3.3

na

na

na

0.7

na

0.9

na

Benakat Integra

PT Energi Mega

Persada

BIPI IJ Equity

118

342

981

662

138

60

na

na

na

na

0.7

na

1.3

na

ENRG IJ Equity

110

390

883

578

462

45

1.8

na

na

na

0.4

na

0.5

na

PT Medco Energi

MEDC IJ Equity

3,195

845

1,500

383

349

50

4.8

4.7

36.3

12.1

0.8

0.9

1.0

1.1

AWE

AWE AU Equity

1.24

533

499

(34)

124

5.9

4.7

155.0

1,240.0

0.7

0.7

2.0

2.3

Carnarvon Petroleum

CVN AU Equity

0.14

113

97

(16)

na

10.1

35.0

na

1.5

1.0

6.0

7.1

Cue Energy

CUE AU Equity

0.09

49

15

(33)

4.3

1.0

8.5

7.1

0.5

na

1.7

1.4

Horizon Oil

HZN AU Equity

0.13

138

245

106

71

46

na

2.9

5.9

7.6

0.6

0.6

0.9

1.0

Lion Energy

LIO AU Equity

0.15

12

(5)

(1)

na

na

na

na

1.1

na

1.3

na

Nido Petroleum

NDO AU Equity

0.03

47

31

(21)

10

1.7

1.2

na

na

0.5

0.5

0.7

0.8

Otto Energy

OEL AU Equity

0.10

90

82

(8)

17

5.1

4.5

4.1

7.0

1.0

na

1.5

1.1

Tap Oil

TAP AU Equity

0.38

76

89

(36)

(36)

na

na

na

3.0

0.6

0.6

3.6

2.6

PTTEP TB

Equity

108

13,006

13,704

1,666

4,905

26

3.7

2.6

7.4

8.5

1.0

1.0

1.7

1.7

Premier Oil

PMO LN Equity

137

1,058

2,736

1,440

911

47

4.9

2.7

3.7

7.9

0.5

0.5

0.7

0.7

SOCO

SIA LN Equity

254

1,278

994

(210)

471

5.0

2.5

8.5

12.5

1.1

0.3

2.4

2.7

Bengal Energy

BNG CN Equity

0.21

11

16

16

4.2

na

na

na

0.3

na

0.8

na

Niko Resources

NKO CN Equity

0.25

20

253

316

(129)

62

na

na

na

na

0.1

na

0.1

na

Pan Orient

POE CN Equity

1.73

82

70

(35)

17

5.8

na

na

na

0.4

na

3.5

na

Indonesia

Australia

Thailand

PTTEP

International

Canada

18

14 January 2015

Source: Bloomberg, Credit Suisse estimates as at 13 Jan 2015

14 January 2015

Company Financial Statements

Figure 29: RH PetrogasIncome Statement

Year end 31 Dec (US$'000)

2011A

2012A

Revenue

89,424

86,376

Cost of sales

(56,810)

(54,179)

Gross profit

32,614

32,197

2013A

86,393

(58,720)

27,673

2014

74,439

(55,239)

19,200

2015

76,087

(58,565)

17,522

2016

87,295

(62,904)

24,391

Administrative expenses

Other expenses

Other income

Finance costs

Profit (Loss) before tax

Income tax

Profit / (Loss)

(5,329)

(7,293)

599

(1,776)

(5,319)

(8,487)

39

(2,222)

(6,114)

(82,595)

1,442

(3,340)

(6,000)

(24,000)

51

(2,944)

(8,000)

(5,000)

100

(5,291)

(8,000)

(5,000)

100

(5,670)

18,815

(15,883)

2,932

16,208

(10,105)

6,103

(62,934)

(2,949)

(65,883)

(13,693)

(4,700)

(18,393)

(669)

(67)

(736)

5,821

(2,911)

2,911

Source: Company data, Credit Suisse estimates

RH Petrogas Limited

(RHPG.SI / RHP SP)

19

14 January 2015

Figure 30: RH PetrogasBalance Sheet

Year end 31 Dec (US$'000)

2011A

2012A

Current Assets

Cash & ST deposits

Inventories

Trade & other receivables

Derivatives

Others

Total current assets

2013A

2014

2015

2016

23,623

5,043

5,535

945

35,146

28,615

6,494

8,816

17

539

44,481

52,448

953

34,821

1

621

88,844

19,367

2,039

24,473

500

46,379

26,026

2,085

25,015

500

53,625

27,293

2,392

28,700

500

58,885

Non-current Assets

Oil & gas properties

Exploration & evaluation assets

Other PPE

Goodwill

Total non-current assets

64,636

53,449

1,187

139,872

259,144

67,657

66,571

911

139,872

275,011

73,455

59,519

1,593

111,115

245,682

86,013

59,124

1,543

90,641

237,321

106,412

69,124

2,043

90,641

268,220

108,222

74,124

2,543

90,641

275,530

Total assets

294,290

319,492

334,526

283,700

321,846

334,415

1,387

2,425

49,152

3,194

56,158

5,280

2,798

49,403

488

57,969

13,680

2,190

64,079

257

80,206

13,680

2,000

42,375

150

58,205

13,680

2,000

44,927

150

60,757

2,000

48,255

150

50,405

Non-current liabilities

Loans & borrowings

Provisions

Deferred tax liabilities

Others

Total non-current liabilities

78,628

3,046

37,619

9,011

128,304

37,006

2,371

39,817

1,301

80,495

33,526

4,197

38,066

1,301

77,090

19,846

5,000

38,000

1,301

64,147

56,166

5,000

38,000

1,301

100,467

76,166

5,000

38,000

1,301

120,467

Total liabilities

Net assets

184,462

109,828

138,464

181,028

157,296

177,230

122,352

161,348

161,224

160,622

170,872

163,543

Equity

Share capital

Reserves

Non-controlling interest

Total equity

138,201

(28,373)

109,828

199,640

(18,612)

181,028

257,650

(80,420)

177,230

258,160

(98,803)

1,991

161,348

258,160

(99,529)

1,991

160,622

258,160

(96,608)

1,991

163,543

Current liabilities

Loans & borrowings

Income tax payable

Trade & other payables

Derivatives

Total current liabilities

Source: Company data, Credit Suisse estimates

RH Petrogas Limited

(RHPG.SI / RHP SP)

20

14 January 2015

Figure 31: RH PetrogasCash Flow Statement

Year end 31 Dec (US$'000)

Operating Activities

Pretax profit/(loss)

Allowance for doubtful trade receivables

Allowance for inventory obsolescence

Allowance for doubtful debt

Amortisation of upfront fee paid for loans granted

Depletion & amortisation of oil & gas properties

Depreciation of other plant & equipment

Realisation of foreign ccy tx on dissolution of subsidiaries

Interest on bank loans

Interest income from bank deposits

Impairment loss on goodwill

Loss on disposal of other plant & equipment

Net FV (gain)/loss on derivatives

Share-based payments

Unwinding of discount on decommissioning provisions

Unsuccessful exploration & evaluation expenditure

Cancellation fee/write off of upfront fees paid on bank loans refinancing

Others

OCF before changes in WC

Changes in working capital:

Decrease/(increase) in inventories

Increase in trade and other receivables

Increase in trade and other payables

CF from operations

Income tax paid

Interest paid

Interest received

Net CF from operating activities

2011A

2012A

2013A

2014

2015

2016

18,815

469

264

12,975

434

1,472

(9)

13

112

758

304

35,607

16,208

333

456

220

10,389

437

1,811

(19)

53

1,078

559

411

1,502

789

34,227

(62,934)

4,356

393

10,531

422

4,557

2,563

(30)

28,757

86

965

777

44,213

34,656

(13,693)

(100)

11,048

450

1,844

(12)

20,474

5

100

120

1,100

1,266

(7,571)

15,031

(669)

(100)

11,516

500

4,191

(16)

120

1,100

(2,220)

14,423

5,821

(100)

12,273

500

4,570

(16)

120

1,100

(2,220)

22,048

2,280

20,477

(15,590)

42,774

(10,621)

(1,472)

9

30,690

(1,905)

(3,570)

(242)

28,510

(7,539)

(1,811)

19

19,179

1,193

(26,465)

10,585

19,969

(5,302)

(2,563)

30

12,134

(1,086)

10,348

(21,704)

2,589

(4,700)

(1,844)

12

(3,944)

(45)

(542)

2,551

16,387

(67)

(4,191)

16

12,145

(307)

(3,685)

3,328

21,384

(2,911)

(4,570)

16

13,920

Investing activities

Additions to oil and gas properties

Additions to exploration and evaluation assets

Cash call contributions for asset retirement obligations

Proceeds from disposal of subsidiary

Purchase of other plant and equipment

Net CF used in investing activities

(12,849)

(15,495)

(656)

(60)

(29,060)

(10,810)

(17,169)

(1,087)

(174)

(29,240)

(19,407)

(28,578)

(911)

(1,083)

(49,979)

(13,211)

(8,000)

(900)

2,786

(400)

(19,725)

(29,916)

(10,000)

(900)

(1,000)

(41,816)

(12,082)

(5,000)

(900)

(1,000)

(18,982)

Financing activities

Increase in charge over project accounts

Net (decrease)/increase in amounts due to related parties

Decrease on short-term deposit pledged

Proceeds from loans and borrowings

Loan from non-controlling interest

Proceeds from issuance of new shares

Proceeds from exercise of employee share options

Purchase of crude oil commodity options

Repayment of loans and borrowings

Repayment of advances from a corporate shareholder

Share issuance expenses

Upfront fee paid for loans granted

Net cash from financing activities

(100)

(10,000)

31,099

(4,000)

16,999

(1,767)

874

44,486

(28,700)

(93)

(645)

14,155

884

10,900

58,199

940

(300)

(5,980)

(2,093)

62,550

3,503

510

292

(48)

(13,680)

(9,423)

50,000

(13,680)

36,320

20,000

(13,680)

6,320

18,629

(661)

2,897

20,865

4,094

5

20,865

24,964

24,705

12

24,964

49,681

(33,091)

10

49,681

16,600

6,649

10

16,600

23,259

1,258

10

23,259

24,526

Net increase in cash & cash equivalents

Effect of exchange rate changes

Beginning

End

Source: Company data, Credit Suisse estimates

RH Petrogas Limited

(RHPG.SI / RHP SP)

21

14 January 2015

Appendix 1: Management profiles

Executive Chairman: Mr Tan Sri Datuk Sir Tiong Hiew King

Mr Tiong was appointed to the company as Executive Chairman and Executive Director

since March 2008. He is the executive Chairman of the Rimbunan Hijau Group (RH

Group), which is a large Malaysian conglomerate covering timber, oil palm plantations, oil

and gas, media and publishing, mining, fishery and manufacturing businesses. He is also

the Chairman of Media Chinese International Limited, a publicly listed media company in

both Hong Kong and Malaysia, which publishes five Chinese language newspapers. Mr

Tiong was conferred the Knight Commander of the Most Excellent Order of the British

Empire by Queen Elizabeth II in June 2009 and awarded the 'Malaysian Business

Leadership Award 2010The Lifetime Achievement award' in recognition of his

entrepreneurship success.

Executive Director: Mr Dato Tiong Ik King

Mr Tiong was the Executive Chairman of the company since March 2005 and was redesignated as Executive Director in March 2008. He is the younger brother of the

Executive Chairman. He is also an Executive Director of Media Chinese International. He

was trained as a physician with degrees from the National University of Singapore and UK

Royal College of Physicians.

Group CEO: Mr Francis Chang Cheng-Hsing

Mr Chang was appointed as the Group CEO of RH Petrogas on 1 January 2014. He had

joined RH Petrogas as Vice President of Exploration and Production in 2010. He has more

than 35 years of experience in the oil and gas industry, with US-based major and

independent oil companies such as Texas American Resources, Kerr McGee/Anadarko

Petroleum, Burlington Resources and Amoco working on assets in five continents. Before

joining RH Petrogas, he served as Vice President for International Operations at GNT

International and Chief Geophysicist for Anadarko Petroleum based in Beijing, China for

seven years. He was trained in geology from the National Taiwan University and attended

graduate school in Geophysics at Harvard University.

RH Petrogas Limited

(RHPG.SI / RHP SP)

22

14 January 2015

Companies Mentioned (Price as of 13-Jan-2015)

China National Petroleum Corporation (Unlisted)

Giken Sakata (GISK.SI, S$0.25)

KrisEnergy Ltd (KRIS.SI, S$0.645)

Linc Energy Ltd (LINC.SI, S$0.64)

Pertamina (Unlisted)

PetroChina (0857.HK, HK$8.79)

RH Petrogas Limited (RHPG.SI, S$0.38[V])

Disclosure Appendix

Important Global Disclosures

David Hewitt and Shew Heng Tan, each certify, with respect to the companies or securities that the individual analyzes, that (1) the views expressed

in this report accurately reflect his or her personal views about all of the subject companies and securities and (2) no part of his or her compensation

was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

The analyst(s) responsible for preparing this research report received Compensation that is based upon various factors including Credit Suisse's

total revenues, a portion of which are generated by Credit Suisse's investment banking activities

As of December 10, 2012 Analysts stock rating are defined as follows:

Outperform (O) : The stocks total return is expected to outperform the relevant benchmark*over the next 12 months.

Neutral (N) : The stocks total return is expected to be in line with the relevant benchmark* over the next 12 months.

Underperform (U) : The stocks total return is expected to underperform the relevant benchmark* over the next 12 months.

*Relevant benchmark by region: As of 10th December 2012, Japanese ratings are based on a stocks total return relative to the analyst's coverage universe which

consists of all companies covered by the analyst within the relevant sector, with Outperforms representing the most attractive, Neutrals the less attractive, and

Underperforms the least attractive investment opportunities. As of 2nd October 2012, U.S. and Canadian as well as European ra tings are based on a stocks total

return relative to the analyst's coverage universe which consists of all companies covered by the analyst within the relevant sector, with Outperforms representing the

most attractive, Neutrals the less attractive, and Underperforms the least attractive investment opportunities. For Latin American and non-Japan Asia stocks, ratings

are based on a stocks total return relative to the average total return of the relevant country or regional benchmark; prior to 2nd October 2012 U.S. and Canadian

ratings were based on (1) a stocks absolute total return potential to its current share price and (2) the relative attractiv eness of a stocks total return potential within

an analysts coverage universe. For Australian and New Zealand stocks, 12-month rolling yield is incorporated in the absolute total return calculation and a 15% and

a 7.5% threshold replace the 10-15% level in the Outperform and Underperform stock rating definitions, respectively. The 15% and 7.5% thresholds replace the +1015% and -10-15% levels in the Neutral stock rating definition, respectively. Prior to 10th December 2012, Japanese ratings were based on a stocks total return

relative to the average total return of the relevant country or regional benchmark.

Restricted (R) : In certain circumstances, Credit Suisse policy and/or applicable law and regulations preclude certain types of communications,

including an investment recommendation, during the course of Credit Suisse's engagement in an investment banking transaction and in certain other

circumstances.

Volatility Indicator [V] : A stock is defined as volatile if the stock price has moved up or down by 20% or more in a month in at least 8 of the past 24

months or the analyst expects significant volatility going forward.

Analysts sector weightings are distinct from analysts stock ratings and are based on the analysts expectations for the fundamentals and/or

valuation of the sector* relative to the groups historic fundamentals and/or valuation:

Overweight : The analysts expectation for the sectors fundamentals and/or valuation is favorable over the next 12 months.

Market Weight : The analysts expectation for the sectors fundamentals and/or valuation is neutral over the next 12 months.

Underweight : The analysts expectation for the sectors fundamentals and/or valuation is cautious over the next 12 months.

*An analysts coverage sector consists of all companies covered by the analyst within the relevant sector. An analyst may cov er multiple sectors.

Credit Suisse's distribution of stock ratings (and banking clients) is:

Global Ratings Distribution

Rating

Versus universe (%)

Of which banking clients (%)

Outperform/Buy*

46%

(53% banking clients)

Neutral/Hold*

38%

(50% banking clients)

Underperform/Sell*

14%

(43% banking clients)

Restricted

2%

*For purposes of the NYSE and NASD ratings distribution disclosure requirements, our stock ratings of Outperform, Neutral, an d Underperform most closely

correspond to Buy, Hold, and Sell, respectively; however, the meanings are not the same, as our stock ratings are determined on a relative basis. (Please refer to

definitions above.) An investor's decision to buy or sell a security should be based on investment objectives, current holdin gs, and other individual factors.

RH Petrogas Limited

(RHPG.SI / RHP SP)

23

14 January 2015

Credit Suisses policy is to update research reports as it deems appropriate, based on developments with the subject company, the sector or the

market that may have a material impact on the research views or opinions stated herein.

Credit Suisse's policy is only to publish investment research that is impartial, independent, clear, fair and not misleading. For more detail please refer

to Credit Suisse's Policies for Managing Conflicts of Interest in connection with Investment Research: http://www.csfb.com/research-andanalytics/disclaimer/managing_conflicts_disclaimer.html

Credit Suisse does not provide any tax advice. Any statement herein regarding any US federal tax is not intended or written to be used, and cannot

be used, by any taxpayer for the purposes of avoiding any penalties.

Price Target: (12 months) for RH Petrogas Limited (RHPG.SI)

Method: Our target price of S$0.40/share for RH Petrogas is based on individual run-out discounted cash flow (DCF) model for each asset using

assumptions published in the initiation report. We first derive the unrisked valuation and then assign a probability based on our risking

methodology to reflect the asset's current stage of development to arrive at a risked valuation. From the risked asset valuation, we remove

net debt to arrive at our target price of S$0.40/share for RH Petrogas.

Risk:

Risks that could impede achievement of our S$0.40 target price for RH Petrogas include: (1) Uncertainty in crude oil price movement. (2)

Successfully bringing Phase 1 of Fuyu-1 Block (China) development into from development into commercial production. (3) Obtaining final

ODP approval on Phase 2 of Fuyu-1 Block. (4) Developing or acquiring assets in time to replace the value which may be eroded upon