Académique Documents

Professionnel Documents

Culture Documents

Schroder Syariah Balanced Fund

Transféré par

lancekim21Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Schroder Syariah Balanced Fund

Transféré par

lancekim21Droits d'auteur :

Formats disponibles

Fund Factsheet

Schroder Syariah Balanced Fund

All data expressed as of 30 December 2014

Fund Category: Balance

About Schroders

Effective Date

22 April 2009

PT. Schroder Investment Management Indonesia (''PT. SIMI'') is a 99% owned subsidiary of Schroders Plc. headquartered in the

United Kingdom. Schroders started its investment management business in 1926 and managed funds appoximately USD 447.7

billion (as of September 2014) for its clients worldwide. PT. SIMI manages funds aggregating IDR 60.21 trillion (as of December

2014) for its retail and institutional clients in Indonesia including pension funds, insurance companies and social foundations.

Effective Statement

S-3083/BL/2009

Launch Date

11 May 2009

Currency

Rupiah

Investment Objective

Unit Price (NAV per Unit)

IDR 2,130.35

The investment objective of Schroder Syariah Balanced Fund is to provide optimal capital growth through active portfolio

management in syariah-compliant equity, Islamic bonds (sukuk) and/or syariah-based money market instrument, including cash.

Fund Size

IDR 730.68 billion

Asset Allocation

Minimum Initial Investment

IDR 200,000 *

Syariah-compliant Equity:

5% - 79%

Top 10 Holdings

Number of Offered Units

2 Billion Units

Islamic Bonds (Sukuk):

Syariah-compliant money market:

5% - 79%

5% - 79%

(In Alphabetical Order)

Valuation Period

Daily

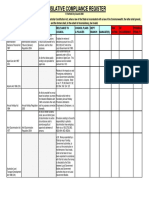

Portfolio Breakdown

Syariah-compliant Equity:

Subscription Fee

Max. 1.50%

Islamic Bonds (Sukuk):

Syariah-compliant money market:

Redemption Fee

Max. 0.50%

63.60%

7.21%

29.19%

Astra Int'l (Equity)

Bank BTPN Syr (TD)

Bank Danamon Syr (TD)

Kalbe Farma (Equity)

Pemb. Perumahan (Equity)

PT Telkom (Equity)

Bank OCBC NISP Syr (TD)

Bank Permata Syr (TD)

SR004 (Sukuk)

Unilever (Equity)

Performance

Management Fee

Max. 1.50% per annum

Custodian Bank

Deutsche Bank, Jakarta Branch

1 Month

2.63% 4.42%

0.72% 0.70%

16.05% (Jul-09)

-6.55% (Jan-11)

3 Month

Risk Return Profile

High Risk

Low Risk

Potentially

Higher Return

Potentially

Lower Return

6 Month

60%

40%

30%

20%

10%

0%

1 Year

3 Year

5 Year

33.97%

20.20%

69.72%

43.09%

Since Inception

113.04%

69.58%

Unit Price Movement since Inception

2,200

2,100

2,000

1,900

1,800

1,700

1,600

1,500

1,400

1,300

1,200

1,100

1,000

900

50%

YTD

6.23% 17.11% 17.11%

3.60% 10.64% 10.64%

Absolut Return for 24 Month Holding Period

Apr-11

Jun-11

Aug-11

Oct-11

Dec-11

Feb-12

Apr-12

Jun-12

Aug-12

Oct-12

Dec-12

Feb-13

Apr-13

Jun-13

Aug-13

Oct-13

Dec-13

Feb-14

Apr-14

Jun-14

Aug-14

Oct-14

Custodian Fee

Max. 0.25% per annum

ISIN Code

IDN000081403

Main Risk Factors

Risk of Deteriorating Economic and

Political Conditions.

Risk of Decrease In Investment

Value.

Risk of Liquidity.

Risk of Dissolution and Liquidation.

Performance

Schroder Syariah Balanced Fund

Benchmark (50%JII+50% ADR Syariah**)

Best Monthly Return:

Worst Monthly Return:

Schroder Syariah Balanced Fund

Benchmark (50%JII+50% ADR Syariah**)

May-09

Jul-09

Sep-09

Nov-09

Jan-10

Mar-10

May-10

Jul-10

Sep-10

Nov-10

Jan-11

Mar-11

May-11

Jul-11

Sep-11

Nov-11

Jan-12

Mar-12

May-12

Jul-12

Sep-12

Nov-12

Jan-13

Mar-13

May-13

Jul-13

Sep-13

Nov-13

Jan-14

Mar-14

May-14

Jul-14

Sep-14

Nov-14

Switching Fee

Max. 0.50%

Returns are calculated based on changes in unit prices

during 24-month holding periods. Source: Schroders.

Awards

1

Investor Award 2014 : as The Best Syariah Balanced Fund based on 5 year performance.

Investor Award 2013 : as The Best Syariah Balanced Fund based on 1 year performance.

Asian Asset Management Award 2012: The Best Islamic Product

Investor Award 2012 : as The Best Syariah Balanced Fund based on 3 year performance.

* not applicable if transaction is

made through distribution agent.

Islamic Finance Award 2010 by KARIM Business Consulting : as The Most Expansive Islamic Balanced Fund

Investor Award 2010 : as The Best Syariah Balanced Fund based on 1 year performance.

** ADR Syariah: average return on syariah deposits.

INVESTMENT IN MUTUAL FUND CONTAINS RISKS. PRIOR TO INVESTING IN MUTUAL FUND, INVESTOR MUST READ AND UNDERSTAND THE FUND PROSPECTUS. PAST

PERFORMANCE DOES NOT INDICATE FUTURE PERFORMANCE.

This report has been prepared by PT Schroder Investment Management Indonesia for information purpose only. It should not be considered as an offer to sell, or a solicitation of an

offer to buy. All reasonable care has been taken to ensure that the information contained herein is not untrue or misleading, but no representation is made as to its accuracy or

completeness, no reliance should be placed on it and no liability is accepted for any loss arising from reliance on it. From time to time, PT Schroder Investment Management

Indonesia, its affiliated companies and any of its or their officers may have an interest in any transaction, securities or commodities referred to in this report. Also PT Schroder

Investment Management Indonesia or its affiliated companies, may perform services, for, or solicit business from, any company referred to in this report. Past performance is not

necessarily a guide to future performance, the price of units may go down as well as up and cannot be guaranteed. Investors should read the prospectus before investing.

Vous aimerez peut-être aussi

- Fact Sheet Schroder Dana PrestasiDocument1 pageFact Sheet Schroder Dana PrestasiAntung FebbyPas encore d'évaluation

- Schroder Dana Istimewa: Fund FactsheetDocument1 pageSchroder Dana Istimewa: Fund FactsheetbtishidbPas encore d'évaluation

- Schroder Dana Prestasi Gebyar Indonesia II MF IDENDocument1 pageSchroder Dana Prestasi Gebyar Indonesia II MF IDENJohanes SetiawanPas encore d'évaluation

- Schroder Dana Istimewa: Fund FactsheetDocument1 pageSchroder Dana Istimewa: Fund FactsheetWacadd OfcaipiPas encore d'évaluation

- Prospektus Schroeder Dana Mantap PlusDocument1 pageProspektus Schroeder Dana Mantap PlusJames McCulloughPas encore d'évaluation

- Schroder Dana Prestasi Plus MF IDENDocument1 pageSchroder Dana Prestasi Plus MF IDENHatta WiryaPas encore d'évaluation

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksrajdeeppawarPas encore d'évaluation

- Public Islamic Sector Select FundDocument4 pagesPublic Islamic Sector Select FundArmi Faizal AwangPas encore d'évaluation

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksKabeer ChawlaPas encore d'évaluation

- 29 Jan 2014 Fact Sheet1Document1 page29 Jan 2014 Fact Sheet1faisaladeemPas encore d'évaluation

- P 09 P Smallcap PKF - EngDocument5 pagesP 09 P Smallcap PKF - EngherbertPas encore d'évaluation

- RHB-OSK Malaysia DIVA Fund-PhsDocument5 pagesRHB-OSK Malaysia DIVA Fund-PhsNur Hidayah JalilPas encore d'évaluation

- Regular Savings - May 2015Document10 pagesRegular Savings - May 2015Advisesure.comPas encore d'évaluation

- 08 Jan 2014 Fact SheetDocument1 page08 Jan 2014 Fact SheetfaisaladeemPas encore d'évaluation

- 17 Nov 2013 Fact SheetDocument1 page17 Nov 2013 Fact SheetfaisaladeemPas encore d'évaluation

- Factsheet - Dec 2014 - RHB Osk Asr-Eng - FinalDocument1 pageFactsheet - Dec 2014 - RHB Osk Asr-Eng - FinalDian SmilePas encore d'évaluation

- 21 Aug 2013 Fact Sheet (Bisb)Document1 page21 Aug 2013 Fact Sheet (Bisb)faisaladeemPas encore d'évaluation

- Prospectus MT PR UscDocument362 pagesProspectus MT PR Uschakimali45Pas encore d'évaluation

- Proven Skills in Wealth GenerationDocument6 pagesProven Skills in Wealth GenerationNishit VaswaniPas encore d'évaluation

- Equity / Growth Fund Debt/ Income FundDocument6 pagesEquity / Growth Fund Debt/ Income FundChiunnu JanuPas encore d'évaluation

- 02 Oct 2013 Fact SheetDocument1 page02 Oct 2013 Fact SheetfaisaladeemPas encore d'évaluation

- Portfolio Management ServiceDocument75 pagesPortfolio Management ServiceBharti BolwaniPas encore d'évaluation

- NFO Note - Sundaram Multi Asset Allocation Fund-202401081632395341688Document5 pagesNFO Note - Sundaram Multi Asset Allocation Fund-202401081632395341688kuchbhisochoPas encore d'évaluation

- WSM - FinalDocument33 pagesWSM - FinalVipul VermaPas encore d'évaluation

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksLaharii MerugumallaPas encore d'évaluation

- EWM Fund 2 FactsheetDocument2 pagesEWM Fund 2 FactsheetNicky TsaiPas encore d'évaluation

- Analysis of Mutual Fund and Selling The of Mutual Fund of RELIGAREDocument38 pagesAnalysis of Mutual Fund and Selling The of Mutual Fund of RELIGARENeha JainPas encore d'évaluation

- Sip Dissertation - Final - Final For CollegeDocument17 pagesSip Dissertation - Final - Final For Collegevikashirulkar922Pas encore d'évaluation

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069Pas encore d'évaluation

- Birla Sun Life Cash ManagerDocument6 pagesBirla Sun Life Cash ManagerrajloniPas encore d'évaluation

- Capital Letter August 2011Document5 pagesCapital Letter August 2011marketingPas encore d'évaluation

- ICICIdirect HighDividendYieldStocks 2011Document2 pagesICICIdirect HighDividendYieldStocks 2011kprgroupPas encore d'évaluation

- Value Research: FundcardDocument4 pagesValue Research: FundcardYogi173Pas encore d'évaluation

- Eastspring Investments Dinasti Equity Fund Product HighlightsDocument8 pagesEastspring Investments Dinasti Equity Fund Product HighlightsGrab Hakim RazakPas encore d'évaluation

- Investor Perception On Investment AvenuesDocument55 pagesInvestor Perception On Investment AvenuesVenkatrao Vargani100% (1)

- 02 Jan 2014 Fact Sheet1Document1 page02 Jan 2014 Fact Sheet1faisaladeemPas encore d'évaluation

- DaburIndia ICICI 130412Document2 pagesDaburIndia ICICI 130412Vipul BhatiaPas encore d'évaluation

- Annual ReportDocument83 pagesAnnual ReportHari PrasadPas encore d'évaluation

- Ip PDFDocument11 pagesIp PDFhananPas encore d'évaluation

- Nikko Spore Divd Fund FactsheetDocument2 pagesNikko Spore Divd Fund FactsheetSivakumar NityanandanPas encore d'évaluation

- L&T Infra BondsDocument6 pagesL&T Infra BondsPramod MorePas encore d'évaluation

- Australian Super PDSDocument28 pagesAustralian Super PDSscribddsdPas encore d'évaluation

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069Pas encore d'évaluation

- Profile of The CompanyDocument44 pagesProfile of The CompanyVijay NautiyalPas encore d'évaluation

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069Pas encore d'évaluation

- A Study of Investment Pattern of ICICI Bank CustomersDocument21 pagesA Study of Investment Pattern of ICICI Bank CustomersMelvin Mathew100% (1)

- Fundcard DWSCashOpportunitiesRegDocument4 pagesFundcard DWSCashOpportunitiesRegYogi173Pas encore d'évaluation

- Combined KIM For Liquid & Debt SchemesDocument15 pagesCombined KIM For Liquid & Debt SchemesSrikanth SwaPas encore d'évaluation

- Persistent Systems: September 23, 2013 Q2 FY14Document2 pagesPersistent Systems: September 23, 2013 Q2 FY14abhaykatPas encore d'évaluation

- Factsheet August 2012 V10Document13 pagesFactsheet August 2012 V10Roshni BhatiaPas encore d'évaluation

- Id IciciDocument11 pagesId IciciKhaisarKhaisarPas encore d'évaluation

- Tetrad Investment ProductsDocument5 pagesTetrad Investment ProductsNyasha Nyaguwa WizPas encore d'évaluation

- Stock Market Investing for Beginners: Investing Tactics, Tools, Lessons, and Proven Strategies to Make Money by Investing & Trading Like Pro in the Stock Market for BeginnersD'EverandStock Market Investing for Beginners: Investing Tactics, Tools, Lessons, and Proven Strategies to Make Money by Investing & Trading Like Pro in the Stock Market for BeginnersPas encore d'évaluation

- HDFC Prudence Fund Leaflet-July 2016 14072016Document4 pagesHDFC Prudence Fund Leaflet-July 2016 14072016J.K. GarnayakPas encore d'évaluation

- What Is A Risk Profile FormDocument4 pagesWhat Is A Risk Profile FormMahmood 786Pas encore d'évaluation

- Chapter - I: 1.1 BackgroundDocument42 pagesChapter - I: 1.1 BackgroundRajPas encore d'évaluation

- Sharekhan's Top Equity Mutual Fund Picks: April 20, 2012Document4 pagesSharekhan's Top Equity Mutual Fund Picks: April 20, 2012rajdeeppawarPas encore d'évaluation

- PRUlink Funds Report 2010Document367 pagesPRUlink Funds Report 2010Su PeiPas encore d'évaluation

- Summer Internship Presentation On Risk and Return Analysis of Different Investment Alternatives Under The Guidance ofDocument21 pagesSummer Internship Presentation On Risk and Return Analysis of Different Investment Alternatives Under The Guidance ofshwetazzPas encore d'évaluation

- Us Aers Testing and Monitoring The Fifth IngredientDocument8 pagesUs Aers Testing and Monitoring The Fifth Ingredientlancekim21Pas encore d'évaluation

- Compliance Bulletin Data PrivacyDocument1 pageCompliance Bulletin Data Privacylancekim21Pas encore d'évaluation

- Activity 3 Interpret and TeachDocument1 pageActivity 3 Interpret and Teachlancekim21Pas encore d'évaluation

- D - Introduction To Philippine Folk DanceDocument4 pagesD - Introduction To Philippine Folk DanceNicole MatutePas encore d'évaluation

- D - Introduction To Philippine Folk DanceDocument4 pagesD - Introduction To Philippine Folk DanceNicole MatutePas encore d'évaluation

- DPA QuickGuidefolder 1019 PDFDocument1 pageDPA QuickGuidefolder 1019 PDFMa Mayla Imelda LapaPas encore d'évaluation

- Assessment of Compliance With Rules and Regulations On Bank ProtectionDocument5 pagesAssessment of Compliance With Rules and Regulations On Bank Protectionlancekim21100% (1)

- Navigating The Changes To Ifrs 2020Document60 pagesNavigating The Changes To Ifrs 2020lancekim21Pas encore d'évaluation

- Legal Compliance ChecklistDocument19 pagesLegal Compliance Checklistlancekim21Pas encore d'évaluation

- Fair Lending Training ChecklistDocument1 pageFair Lending Training Checklistlancekim21Pas encore d'évaluation

- Legislative Compliance RegisterDocument26 pagesLegislative Compliance Registerlancekim21Pas encore d'évaluation

- Summary of Risk Rating Exercise Feedback IA&C v2Document54 pagesSummary of Risk Rating Exercise Feedback IA&C v2lancekim21Pas encore d'évaluation

- Pub CH Compliance Management SystemsDocument40 pagesPub CH Compliance Management Systemslancekim21Pas encore d'évaluation

- RPAC - 26 July 2019Document21 pagesRPAC - 26 July 2019lancekim21Pas encore d'évaluation

- Raci GuideDocument7 pagesRaci Guidelancekim21Pas encore d'évaluation

- Data Privacy Consent FormDocument1 pageData Privacy Consent FormAraceli Gloria100% (2)

- PNB Data Privacy Client Consent FormDocument1 pagePNB Data Privacy Client Consent Formlancekim21Pas encore d'évaluation

- 2019legislation - Revised Corporation Code Comparative Matrix PDFDocument120 pages2019legislation - Revised Corporation Code Comparative Matrix PDFlancekim21Pas encore d'évaluation

- 2019legislation - Revised Corporation Code Comparative Matrix PDFDocument120 pages2019legislation - Revised Corporation Code Comparative Matrix PDFlancekim21Pas encore d'évaluation

- Joint Ventures in The Philippines - Nicolas & de Vega Law OfficesDocument5 pagesJoint Ventures in The Philippines - Nicolas & de Vega Law Officeslancekim21Pas encore d'évaluation

- 5 Money Rules The Rich Have MasteredDocument163 pages5 Money Rules The Rich Have Masteredlancekim21100% (3)

- Port Management and Operations PDFDocument429 pagesPort Management and Operations PDFAbdul Wahab100% (1)

- CL2015 20 PDFDocument24 pagesCL2015 20 PDFlancekim21Pas encore d'évaluation

- Joint VentureDocument35 pagesJoint VentureleeashleePas encore d'évaluation

- Tool Project ManagerDocument21 pagesTool Project Managersharafudheen_sPas encore d'évaluation

- Salesforce The Path Toward EqualityDocument18 pagesSalesforce The Path Toward Equalitylancekim21Pas encore d'évaluation

- HSBC Training Deck - Income and GrowthDocument42 pagesHSBC Training Deck - Income and Growthlancekim21Pas encore d'évaluation

- CL2013 33Document25 pagesCL2013 33lancekim21Pas encore d'évaluation

- CPI2017 FullDataSetDocument92 pagesCPI2017 FullDataSetDouglas EstradaPas encore d'évaluation

- CL2015 20 PDFDocument24 pagesCL2015 20 PDFlancekim21Pas encore d'évaluation

- Metro Cash and CarryDocument12 pagesMetro Cash and CarrySumit JaiswalPas encore d'évaluation

- Walmart Write UpDocument5 pagesWalmart Write UpKumar RaviPas encore d'évaluation

- Project SelectionDocument17 pagesProject SelectionCecilia Camarena QuispePas encore d'évaluation

- 2014 Property Value StudyDocument8 pages2014 Property Value StudyGeorge KubantsevPas encore d'évaluation

- Victory INCR Investment Grade Convertible Fund 2022 - 1QDocument3 pagesVictory INCR Investment Grade Convertible Fund 2022 - 1Qag rPas encore d'évaluation

- Exchange For Physicals (EFP) : What Is It?Document2 pagesExchange For Physicals (EFP) : What Is It?Doan Pham ManhPas encore d'évaluation

- DK Selling StrategiesDocument7 pagesDK Selling StrategiesMilan DzigurskiPas encore d'évaluation

- Report of Holi T ShirtDocument7 pagesReport of Holi T ShirtShrestha AnjalPas encore d'évaluation

- India China Starch Sector Analysis September 2010Document12 pagesIndia China Starch Sector Analysis September 2010girishnarangPas encore d'évaluation

- Monopoly Case Study - Indian Railways and Its PerformanceDocument2 pagesMonopoly Case Study - Indian Railways and Its PerformanceBivek BasumataryPas encore d'évaluation

- Practice Set 2 (Cost Segregation and CVP)Document2 pagesPractice Set 2 (Cost Segregation and CVP)Jessica Aningat0% (1)

- S Z C I S ..................................................................................................................... 12Document15 pagesS Z C I S ..................................................................................................................... 12darkheart_29Pas encore d'évaluation

- Forex MarketDocument33 pagesForex MarketRiad TalukderPas encore d'évaluation

- Lecture Notes XII Principles of TaxationDocument6 pagesLecture Notes XII Principles of TaxationNgamije Jackson67% (3)

- EconomicsDocument19 pagesEconomicssam713Pas encore d'évaluation

- ACF, 41,44 I 45-69Document61 pagesACF, 41,44 I 45-69Marija MilojicPas encore d'évaluation

- Mcrae, Mark - Sure-Fire Forex TradingDocument113 pagesMcrae, Mark - Sure-Fire Forex TradingJovica Damnjanovic100% (2)

- Investment Group Assignment Zaki and LeeDocument18 pagesInvestment Group Assignment Zaki and LeeLeeZhenXiangPas encore d'évaluation

- Lecture 6 Market Structures PDFDocument4 pagesLecture 6 Market Structures PDFReinaPas encore d'évaluation

- Ball and Brown RelatedDocument5 pagesBall and Brown RelatedLin XinPas encore d'évaluation

- AE212 - Module 3 ACCTG FOR MATERIALSDocument23 pagesAE212 - Module 3 ACCTG FOR MATERIALSUchayyaPas encore d'évaluation

- Final PPTDocument141 pagesFinal PPTJanhvi ShahPas encore d'évaluation

- Mod5Act1 - Distribution To ShareholdersDocument12 pagesMod5Act1 - Distribution To ShareholdersArnelli Marie Asher GregorioPas encore d'évaluation

- Accounting Icom Part 2Document2 pagesAccounting Icom Part 2Ayman ChishtyPas encore d'évaluation

- Countries by CurrencyDocument4 pagesCountries by CurrencySphurti AgarwalPas encore d'évaluation

- 17 Merger Consequences b4 ClassDocument40 pages17 Merger Consequences b4 ClassmikePas encore d'évaluation

- Levi StraussDocument7 pagesLevi Strausslc_surjeetPas encore d'évaluation

- Ortho 500Document3 pagesOrtho 500Hitesh Takhtani50% (2)

- Construction AuditingDocument49 pagesConstruction AuditingWalid Marhaba100% (1)