Académique Documents

Professionnel Documents

Culture Documents

Valuing GPS stock using DCF model and key assumptions

Transféré par

Lucas TrianaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Valuing GPS stock using DCF model and key assumptions

Transféré par

Lucas TrianaDroits d'auteur :

Formats disponibles

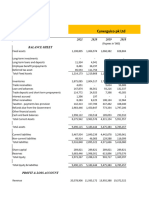

Valuation price

Potential upside

Last traded price

Common Stock

Perpetual growth rate

WACC

Assuptions

$

$

50.89

16.72%

43.60

423.6

2%

10.0%

2012

Conventions

Assumptions or explanations

2013

2014 E

2015 E

2016 E

2017 E

2018 E

2019 E

2020 E

2021 E

2022 E

2023 E

Revenue

Revenue growth

15,650

16,150

3.19%

16,430

1.73%

16,864

2.64%

17,463

3.55%

18,083

4.46%

18,889

5.37%

19,903

6.28%

21,152

7.18%

22,671

8.09%

24,506

9.00%

26,711

9.00%

Operating costs

Operating margin

9,480

60.58%

9,855

61.02%

10,099

61.47%

10,441

61.91%

10,890

62.36%

11,357

62.81%

11,948

63.25%

12,678

63.70%

13,568

64.15%

14,644

64.59%

15,939

65.04%

17,492

65.49%

Operating profit

6,170

6,295

6,331

6,423

6,573

6,725

6,941

7,224

7,583

8,027

8,567

9,219

4144

-2.01%

536

-4.11%

4310

4.00%

517

-3.50%

4270

-0.93%

502

-2.97%

4190

-1.86%

489

-2.53%

4106

-2.01%

479

-2.15%

4024

-2.01%

470

-1.83%

3943

-2.01%

463

-1.55%

3864

-2.01%

457

-1.32%

3786

-2.01%

451

-1.12%

3710

-2.01%

447

-0.95%

3635

-2.01%

444

-0.81%

Total Operating Expenses

Operating expenses growth

Depreciation

Depreciation change

4229

559

EBIT

Operating margin

EBITDA

1,941

12.40%

2,500

2,151

13.32%

2,687

2021

12.30%

5,814

2153

12.77%

5,921

2382

13.64%

6,084

2619

14.48%

6,247

2917

15.44%

6,471

3282

16.49%

6,762

3720

17.59%

7,127

4241

18.71%

7,575

4857

19.82%

8,120

5583

20.90%

8,775

Net Interest Income

Taxes

Income tax rate

-81

726

37.40%

-56

813

37.80%

760

37.60%

809

37.60%

896

37.60%

985

37.60%

1,097

37.60%

1,234

37.60%

1,399

37.60%

1,595

37.60%

1,826

37.60%

2,099

37.60%

1,296

1,394

1,261

1,343

1,487

1,634

1,820

2,048

2,321

2,646

3,031

3,484

N/A

4.16%

4.16%

4.25%

4.25%

4.25%

4.25%

4.25%

4.25%

4.25%

4.25%

4,430

7.21%

2,445

4.31%

1,985

1,510

N/A

3,419

7,849

4,749

7.21%

2,550

4.31%

2,199

1,536

683

4,102

8,852

5,092

7.21%

2,660

4.31%

2,432

1,577

702

4,804

9,896

5,459

7.21%

2,775

4.31%

2,684

1,633

742

5,546

11,005

5,853

7.21%

2,894

4.31%

2,959

1,691

769

6,315

12,168

6,275

7.21%

3,019

4.31%

3,256

1,766

803

7,118

13,393

6,728

7.21%

3,149

4.31%

3,578

1,861

846

7,963

14,691

7,213

7.21%

3,285

4.31%

3,928

1,978

899

8,862

16,075

7,733

7.21%

3,426

4.31%

4,307

2,120

964

9,826

17,559

8,291

7.21%

3,574

4.31%

4,717

2,291

1041

10,867

19,158

8,889

7.21%

3,728

4.31%

5,161

2,497

1135

12,003

20,891

1,538

(804)

2,342

4,787

2,221

(832)

3,053

5,604

2,923

(861)

3,784

6,444

3,665

(891)

4,556

7,331

4,434

(922)

5,355

8,250

5,237

(954)

6,190

9,209

6,082

(987)

7,069

10,219

6,981

(1,021)

8,003

11,287

7,945

(1,057)

9,002

12,428

8,986

(1,093)

10,080

13,654

10,122

(1,131)

11,253

14,981

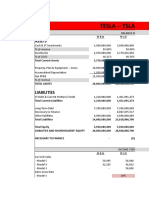

Net Income

CAPEX/Sales

Total current assets

current asset growth

Total current liabilities

current liabilities growth

Working capital

Cash

CAPEX

LT assets

Total Assets

Debt outstanding

Other LT liabilities

LT Liabilities

Total Liabilities

Free Cash Flow

NOPAT

N/A

4,132

2,344

1,788

1,460

N/A

3,338

7,470

1,455

(777)

2,232

4,576

2012

2013

2014 E

2015 E

2016 E

2017 E

2018 E

2019 E

2020 E

2021 E

2022 E

2023 E

1215

1338

1261

1343

1487

1634

1820

2048

2321

2646

3031

3484

559

16.75%

N/A

328

536

15.68%

N/A

475

147

517

12.61%

683

663

188

502

10.45%

702

855

192

489

8.82%

742

1,052

197

479

7.58%

769

1,268

216

470

6.60%

803

1,490

222

463

5.81%

846

1,718

228

457

5.15%

899

1,950

233

451

4.59%

964

2,187

237

447

4.11%

1,041

2,425

239

444

3.70%

1,135

2,663

238

1,283

1,336

1,430

1,561

1,710

1,892

2,112

2,371

2,675

3,030

37,893

Cash Flows

PV

Total

1,283

1,166

25,649

1,336

1,104

1,430

1,075

1,561

1,066

1,710

1,062

1,892

1,068

2,112

1,084

2,371

1,106

2,675

1,135

40,923

15,783

Non operating assets

LT Liabilities

Enterprise value

1,510

5,604

21,555

Free Cash Flow

Perpetuity value

Stock Price

Cost of capital

Rf Yield UST 10 YR

Beta

Equity risk premium

WACC

$ 50.89

2.02%

1.38

5.78%

10.00%

Sensitivity analysis

WACC

Depreciation

Depreciation/LT assets

CAPEX

Working capital (excl. Cash)

Change in Working capital

$ 50.89

10.5% $

10.0% $

9.5% $

Perpetual growth rate

1.50%

2.0%

2.50%

45.0 $ 46.7 $ 48.7

48.8 $ 50.9 $ 53.2

53.1 $ 55.5 $ 58.3

Tocompute GPSs stockpricethefollowingassumptionswereused:

Revenuegrowthisassumedtoreturntopositivegroundgraduallytoreachhighsingledigitgrowthfromsupplychainimprovements

Grossmarginisassumedtoremainincreseofcurrentlowcottonpricesandfrabicplatformingscalingleverage

TheYear-over-yeardepreciationchangeis assumednegativeas thecompany is closing facilities in theUSwhileopening internationally through franchises.

Simpledecaybecausestoreclosingis limited.

Taxrateiscomputedasthehistoricalaverage.

CAPEX/salesisassumedtogrowataconstantrateusingestimationsfrom4traders.comfor2015and2016.

Currentassetsgrowthisassumedconstantequalthelastyear'schange.

Current liabilitiesarenotdecreasingas it isassumedthat thecompanyneedsto raisecapital towork. It isassumedthat theygrowat thesamepaceasthey

didlastyear.

It isassumedthatCAPEXistheonlyaccountthatwillmodifylongtermassets.

Cashandshortterminvestmentsaretheonlyaccountstakenintoconsiderationasnon-operatingassets.

RiskfreeyieldtakenasJanuary8th,2015USTreasurynoteyield.

Equity risk premium taken from Damodarans website.

Vous aimerez peut-être aussi

- Business Valuation - ROTIDocument21 pagesBusiness Valuation - ROTITEDY TEDYPas encore d'évaluation

- China Gas Holdings Ltd. Balance Sheets and Income Statements from 2011-2020Document6 pagesChina Gas Holdings Ltd. Balance Sheets and Income Statements from 2011-2020ckkeicPas encore d'évaluation

- Annual Report Analysis of Allied BankDocument4 pagesAnnual Report Analysis of Allied BankAhmedPas encore d'évaluation

- Income Statement 2014 2015: 3. Net Revenue 5. Gross ProfitDocument71 pagesIncome Statement 2014 2015: 3. Net Revenue 5. Gross ProfitThu ThuPas encore d'évaluation

- BMP Bav ReportDocument79 pagesBMP Bav ReportThu ThuPas encore d'évaluation

- HanssonDocument11 pagesHanssonJust Some EditsPas encore d'évaluation

- BMP Bav Report FinalDocument93 pagesBMP Bav Report FinalThu ThuPas encore d'évaluation

- DCF TVSDocument17 pagesDCF TVSSunilPas encore d'évaluation

- Analisa SahamDocument10 pagesAnalisa SahamGede AriantaPas encore d'évaluation

- Business Evaluation CalculationsDocument16 pagesBusiness Evaluation CalculationsSoham AherPas encore d'évaluation

- Data (2)Document3 pagesData (2)DinoPas encore d'évaluation

- HABT Model 5Document20 pagesHABT Model 5Naman PriyadarshiPas encore d'évaluation

- Vertical Analysis FS Shell PHDocument5 pagesVertical Analysis FS Shell PHArjeune Victoria BulaonPas encore d'évaluation

- VNM ValuationDocument143 pagesVNM ValuationGia Nguyễn Viết QuốcPas encore d'évaluation

- Income Statement, Balance Sheet, Cash Flow Analysis 2016-2021Document9 pagesIncome Statement, Balance Sheet, Cash Flow Analysis 2016-2021Shahrukh1994007Pas encore d'évaluation

- At Tahur LimitedDocument24 pagesAt Tahur Limitedcristiano ronaldooPas encore d'évaluation

- Stock Valuation Spreadsheet TemplateDocument5 pagesStock Valuation Spreadsheet TemplatebgmanPas encore d'évaluation

- M Saeed 20-26 ProjectDocument30 pagesM Saeed 20-26 ProjectMohammed Saeed 20-26Pas encore d'évaluation

- Coca Cola Company Financial Ratios SummaryDocument66 pagesCoca Cola Company Financial Ratios SummaryZhichang ZhangPas encore d'évaluation

- Analysis of Balance Sheet Trends Over TimeDocument208 pagesAnalysis of Balance Sheet Trends Over TimeB SPas encore d'évaluation

- Financial AnalysisDocument9 pagesFinancial AnalysisSam SumoPas encore d'évaluation

- FINANCIAL PERFORMANCEDocument16 pagesFINANCIAL PERFORMANCELaston Milanzi50% (2)

- Heritage CaseDocument3 pagesHeritage CaseGregory ChengPas encore d'évaluation

- Analisis Saham Metode Ceklist (Rani Evelin & Muhammad Zikri)Document32 pagesAnalisis Saham Metode Ceklist (Rani Evelin & Muhammad Zikri)Yogi Fernanda RingoPas encore d'évaluation

- MSFTDocument83 pagesMSFTJohn wickPas encore d'évaluation

- External Funds Need-Spring 2020Document8 pagesExternal Funds Need-Spring 2020sabihaPas encore d'évaluation

- FSADocument4 pagesFSAAreeba AslamPas encore d'évaluation

- Group 2 BUS 303 AssignmentDocument3 pagesGroup 2 BUS 303 Assignmentduch mangPas encore d'évaluation

- 1Document617 pages1Nelz CayabyabPas encore d'évaluation

- Exhibit 2 Amazon Financials, 2006-2017 (Millions USD) : Fiscal Year 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017Document1 pageExhibit 2 Amazon Financials, 2006-2017 (Millions USD) : Fiscal Year 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017AviralPas encore d'évaluation

- Forcast SalesDocument4 pagesForcast SalesnbemathPas encore d'évaluation

- Forecasting KAEF Kelompok 1 v1.1.2 (Beta)Document6 pagesForecasting KAEF Kelompok 1 v1.1.2 (Beta)Suhailah AflakhaddinPas encore d'évaluation

- PSU Banks Comparative Analysis FY21Document10 pagesPSU Banks Comparative Analysis FY21Ganesh V0% (1)

- Método Incremento Porcentual (Caso Agro)Document1 pageMétodo Incremento Porcentual (Caso Agro)Rubén GaliciaPas encore d'évaluation

- New Heritage ExhibitsDocument4 pagesNew Heritage ExhibitsBRobbins12100% (16)

- Public Sector Banks Comparative Analysis 3QFY24Document10 pagesPublic Sector Banks Comparative Analysis 3QFY24Sujay AnanthakrishnaPas encore d'évaluation

- Ratio CalculationDocument105 pagesRatio Calculationfauziah06Pas encore d'évaluation

- Tech MahindraDocument17 pagesTech Mahindrapiyushpatil749Pas encore d'évaluation

- Samyak Jain - IIM RanchiDocument2 pagesSamyak Jain - IIM RanchiNeha GuptaPas encore d'évaluation

- Consolidated Statements of Income and Other Comprehensive Income (In Million Rupiah) Description 2021 2020 2019 2018 2017Document4 pagesConsolidated Statements of Income and Other Comprehensive Income (In Million Rupiah) Description 2021 2020 2019 2018 2017Ferial FerniawanPas encore d'évaluation

- Income Statement For AAPLDocument1 pageIncome Statement For AAPLEzequiel FriossoPas encore d'évaluation

- Analisis Lap KeuDocument10 pagesAnalisis Lap KeuAna BaenaPas encore d'évaluation

- NikeDocument3 pagesNikeAdhiraj MukherjeePas encore d'évaluation

- Tesla ForecastDocument6 pagesTesla ForecastDanikaLiPas encore d'évaluation

- Shell Financial Data BloombergDocument48 pagesShell Financial Data BloombergShardul MudePas encore d'évaluation

- Income Statement Analysis and Projections 2005-2010Document5 pagesIncome Statement Analysis and Projections 2005-2010Gullible KhanPas encore d'évaluation

- Financial Statements For BYCO Income StatementDocument3 pagesFinancial Statements For BYCO Income Statementmohammad bilalPas encore d'évaluation

- Financial Management Insights of Exide IndustriesDocument10 pagesFinancial Management Insights of Exide IndustriesAlok ChowdhuryPas encore d'évaluation

- Astra International TBK.: Balance Sheet Dec-2006 Dec-2007Document18 pagesAstra International TBK.: Balance Sheet Dec-2006 Dec-2007sariPas encore d'évaluation

- Pricing - Group Case Study Data TablesDocument40 pagesPricing - Group Case Study Data TablesSound StudyPas encore d'évaluation

- Understanding Private Bank Fundamentals and RatiosDocument19 pagesUnderstanding Private Bank Fundamentals and RatiosAbhishekPas encore d'évaluation

- Final Report (Mughal Iron Steel)Document27 pagesFinal Report (Mughal Iron Steel)Pooja MandhanPas encore d'évaluation

- Gildan Model BearDocument57 pagesGildan Model BearNaman PriyadarshiPas encore d'évaluation

- Appendices Financial RatiosDocument3 pagesAppendices Financial RatiosCristopherson PerezPas encore d'évaluation

- thu-BAV VNMDocument45 pagesthu-BAV VNMLan YenPas encore d'évaluation

- The - Model - Class WorkDocument16 pagesThe - Model - Class WorkZoha KhaliqPas encore d'évaluation

- Customer Demand Cube: PurposeDocument15 pagesCustomer Demand Cube: PurposeTiyaPas encore d'évaluation

- AnandamDocument12 pagesAnandamNarinderPas encore d'évaluation

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachD'EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachÉvaluation : 3 sur 5 étoiles3/5 (3)

- Description PT Casio (Induk) PT Kenko (Anak)Document4 pagesDescription PT Casio (Induk) PT Kenko (Anak)OLIVIA CHRISTINAPas encore d'évaluation

- International Capital Budgeting: Dr. Ch. Venkata Krishna Reddy Associate ProfessorDocument39 pagesInternational Capital Budgeting: Dr. Ch. Venkata Krishna Reddy Associate Professorkrishna reddyPas encore d'évaluation

- MNC Nep PresentationDocument53 pagesMNC Nep PresentationSaajan RathodPas encore d'évaluation

- GFB Outlook Report q4 2022 2Document21 pagesGFB Outlook Report q4 2022 2ngothientaiPas encore d'évaluation

- Financial Management - Module 3Document20 pagesFinancial Management - Module 3Jane BiancaPas encore d'évaluation

- SyllabusDocument76 pagesSyllabusamattirkeyPas encore d'évaluation

- Ass 2Document4 pagesAss 2Asim HussainPas encore d'évaluation

- Calcutta Stock Exchange Limited: Summer Internship Project ReportDocument4 pagesCalcutta Stock Exchange Limited: Summer Internship Project ReportNikhil SaurabhPas encore d'évaluation

- Oh My FongDocument22 pagesOh My FongDelpiero AlesaandroPas encore d'évaluation

- The Global Financial System: Brief Chapter SummaryDocument25 pagesThe Global Financial System: Brief Chapter Summarybernandaz123Pas encore d'évaluation

- ECONOMIC ROLES OF GovtDocument12 pagesECONOMIC ROLES OF GovtLibrarian 1975Pas encore d'évaluation

- ProductivityDocument14 pagesProductivityLinh Nguyen HoaiPas encore d'évaluation

- Lean Fundly - Pitch Deck 02-11-13 V 0.3Document18 pagesLean Fundly - Pitch Deck 02-11-13 V 0.3analyticsvr100% (1)

- Newell Company Acquisition StrategyDocument7 pagesNewell Company Acquisition StrategyAshutosh K Tripathy0% (1)

- Orientation Ac1201Document10 pagesOrientation Ac1201gel hannaPas encore d'évaluation

- Conspiracy of The Rich PDFDocument290 pagesConspiracy of The Rich PDFMinhTien Pham100% (9)

- 1 Understanding and Analyzing Business TransactionsDocument2 pages1 Understanding and Analyzing Business Transactionsapi-299265916Pas encore d'évaluation

- 462 Chapter 5 Notes 2019Document23 pages462 Chapter 5 Notes 2019Shajid Ul HaquePas encore d'évaluation

- Annual Report 2011 HighlightsDocument73 pagesAnnual Report 2011 HighlightsDanesh RanchhodPas encore d'évaluation

- Topic 1 - Overview: Licensing Exam Paper 1 Topic 1Document18 pagesTopic 1 - Overview: Licensing Exam Paper 1 Topic 1anonlukePas encore d'évaluation

- Differentiating The Forms of Business Organization and Giving Examples of Forms of Business OrganizationsDocument24 pagesDifferentiating The Forms of Business Organization and Giving Examples of Forms of Business OrganizationsJohn Fort Edwin AmoraPas encore d'évaluation

- Reflection Note4 1711031 MayankDocument5 pagesReflection Note4 1711031 MayankMK UPas encore d'évaluation

- Regional Strategy: 6 Key Themes for ASEAN Equities in 2018Document218 pagesRegional Strategy: 6 Key Themes for ASEAN Equities in 2018HaMy TranPas encore d'évaluation

- MBA 308 - Short-Term Financing OptionsDocument5 pagesMBA 308 - Short-Term Financing OptionsJhaydiel JacutanPas encore d'évaluation

- CVP Review Problem P 6.29 P 6.30Document4 pagesCVP Review Problem P 6.29 P 6.30nehal hasnain refath0% (1)

- Unit 1 - Essay QuestionsDocument7 pagesUnit 1 - Essay QuestionsJaijuPas encore d'évaluation

- Concept of Tax Planning and Specific Management Decisions: CHANIKA GOEL (1886532) RITIKA SACHDEVA (1886586)Document34 pagesConcept of Tax Planning and Specific Management Decisions: CHANIKA GOEL (1886532) RITIKA SACHDEVA (1886586)parvati anilkumarPas encore d'évaluation

- Majesco To Present at The Aegis Capital Corp. 2016 Growth Conference On September 22, 2016 (Company Update)Document2 pagesMajesco To Present at The Aegis Capital Corp. 2016 Growth Conference On September 22, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- Urban Planning For City LeadersDocument187 pagesUrban Planning For City LeadersUnited Nations Human Settlements Programme (UN-HABITAT)100% (3)

- Pro Forma Financial Statements4Document50 pagesPro Forma Financial Statements4SakibMDShafiuddinPas encore d'évaluation