Académique Documents

Professionnel Documents

Culture Documents

Government Securities Lending and

Transféré par

anilnair88Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Government Securities Lending and

Transféré par

anilnair88Droits d'auteur :

Formats disponibles

GOVERNMENT SECURITIES LENDING AND

BORROWING INTRODUCTION IN INDIA

Pradeep Naik*

Securities borrowers and lenders

perform one very important economic

function - they provide better liquidity

in the markets.

Introduction

Securities lending involves the temporary

exchange of securities, usually for other

securities or cash of an equivalent value (or

occasionally a mixture of cash and

securities), with an obligation to redeliver a

like quantity of the same securities at a future

date. Most securities lending is structured to

give the borrower legal title to the securities

for the life of the transaction, even though,

economically, the terms are more akin to a

loan. The borrow fee is generally agreed in

advance and the lender has contractual

rights similar to beneficial ownership of the

securities, with rights to receive the

equivalent of all interest payments or

dividends and to have equivalent securities

returned. The importance of the transfer of

legal title is twofold. First, it allows the

borrower to deliver the securities onward, for

example in another securities loan or to

settle an outright trade. Second, it means

that the lender usually receives value in

exchange for the disposition of legal title

(whether in cash or securities), which ensures

that the loan is collateralized.

History

Securities lending has existed since at least

the 19th century with limited activity in a

few countries and these markets were

typically highly regulated to ensure that

stocks were only borrowed by specific

institutions, for specific purposes and often

through specialist intermediaries.

The first moves towards todays modern

market took place in North America in the

1960s and then developed in most other

domestic markets in the 1980s and 1990s.

The US market in the 1960s developed an

active inter-dealer market in loans of stock,

which was associated with increased short

selling activity and a rising incidence of

settlement fails. In the 1970s, US custodian

banks first began lending specific stocks to

broker-dealers on behalf of their clients such

as insurance companies, university

endowment funds and corporate investment

portfolios.

Meanwhile, the 1980s saw a dramatic

increase in the size of government securities

markets in many jurisdictions. This

prompted the development of repo markets

in many of the major government securities

*Shri Pradeep Naik, is Vice-President, Securities Settlement & Margins Department,

The Clearing Corporation of India Limited.

markets as traders looked to finance

inventories, cover short positions and use

repo to take and hedge interest rate

positions. The increasing use of repo by

central banks as a means of providing

secured liquidity in open market operations

was an important stimulus. The

development of an efficient settlement

infrastructure was also significant for

instance, the development of book-entry

settlement, and specific procedures for repos

allowing the delivery of general collateral.

By the end of the 1980s, US global custodian

banks, US securities firms and UK money

lenders started to develop todays offshore

securities lending markets. These firms were

able to effect securities lending transaction

outside the local market through settlement

on the books of foreign sub custodians. The

large US custodian banks began to run their

securities lending businesses on a global

basis in Europe, Japan and North America.

The 1990s have seen an intensification of

these trends. The globalisation of securities

lending markets has continued and

expanded to include new emerging markets.

An increasing number of market

participants have sought to borrow

securities in order to take leveraged positions

for example, taking a long position in one

instrument and a short position in another

in the expectation that the yield spread

between them will alter as a result of

anticipated economic or financial market

developments. Growth in derivatives

markets and the use of information and

execution technology (including access to

real-time information) have enabled

investors to build financial structures that

take on the exact exposures they wish to hold

while largely neutralising the associated

general market risks. Equally, they have

increased the scope for index and other

arbitrage trades to maintain the relationship

between derivatives markets and the

underlying cash markets. Securities lending

markets have provided the liquidity needed

to hold these positions. Meanwhile, market

authorities in many jurisdictions have

sought to address many of the legal,

regulatory and tax impediments to securities

lending. As authorities have taken action to

reduce the scope for activities such as tax

arbitrage, position taking to minimise

market risks has become the main driver

behind demand for securities borrowing.

Some key events have also shaped the

evolution of the market. For instance, in

1994, the increase in US short-term interest

rates led some securities lenders to

experience losses on their reinvested cash

collateral. In many cases, custodian banks

compensated customers for their losses even

where they were not legally obligated to do

so. This experience made lenders more aware

of the investment management side to their

securities lending activities. Many have

introduced risk/return analysis and industry

benchmarking.

The development of active repo market in

various countries from 1993 onwards has a

number of specific implications for market

participants, for securities market

infrastructure, and for market authorities,

including central banks and securities

regulators. The common theme connecting

all of these various implications is the need

for a clear understanding and identification

of the risks and risk management approaches

associated with securities lending.

Receive payments (known as corporate

actions) equivalent to any coupons,

interest or other rights that have arisen

on the securities in the interim;.

Receive a fee for lending the security.

The fee is normally calculated at an

annual rate based on the value of

securities borrowed. The fee amount will

also depend on the demand/supply

equations for the specific securities at

the material time;

Require collateral from the borrower,

either in the form of cash or other

securities. The amount of collateral

requirement may vary during the course

of the loan to accommodate changes in

the value of the securities lent. Generally

the value of the collateral will be higher

than the value of the securities loaned

towards haircut. Collateral is marked to

market, (usually daily) when the current

value of collateral held is compared with

current value of the loaned stock. Based

on the outcome of such valuation, some

of the collateral held may be returned in

surplus situations, or margin calls made

in deficit situations. Interest and other

income arising on the collateral will

generally be returned to the borrower.

Relevance

The relevance of such an arrangement arises

from its ability to generate market liquidity

when required to cover short positions that

arise in securities settlement.

Simultaneously, it is an avenue through

which dormant securities in an investors

portfolio can be utilized for short tenor

lending to generate fee based income,

especially in a volatile market. It constitutes

a collateralized loan of securities for a

limited period of time in a transparent

structured institutional framework.

At the micro level, securities lending, as a

practice has evolved to assist market makers

and other security dealers to obtain

securities on loan for a temporary period to

meet deliveries on sales that they have made

of those securities, when the dealer has

insufficient stock of its own to meet the

delivery. It is an essential mechanism to

ensure liquidity and efficient operations of

the Securities market.

Together with retaining the right to have the

borrowed security replaced at a future date

with securities of the same kind and amount,

the lender will normally:

Institutional investors are increasingly

joining securities lending programmes to

generate returns on assets that would

otherwise remain idle. Various securities

lending programmes allow clients to retain

full beneficial ownership of loaned

securities throughout the term of a loan.

Clients can also recall the loan at any time if

they wish to sell the securities, exercise

voting rights or participate in corporate

actions. Investors also use income from

securities lending to offset their custody

costs. Institutional investors participate in

securities borrowing programs mainly to

pursue portfolio strategies such as arbitrage

and short selling.

Objectives

To improve settlement efficiency by

reducing settlement failures

To enhance the liquidity of instruments

through the market making process

To increase the attractiveness of

instruments by enhancing yields for

lenders

Legal Position

Legal title of securities lent passes from

lender to borrower at the time of lending and

back to lender from borrower when the

securities are returned.

The lender still retains risk and exposure to

the market place for the lent securities as well

as all the benefits including corporate

actions or dividends. The lender does lose

the voting rights to the securities over the

loan period.

The lender has the right to recall securities

on loan at any time, unless otherwise agreed

with the borrower.

Risks

The risks inherent in lending securities are

not always readily apparent, but must be

recognised as an important consideration

when operating a Securities Lending

programme.

1. Counterparty Risk

Many complications could arise when

counterparty defaults on its obligations. A

thorough credit assessment and quality of

the management of all counterparties is

usually undertaken to determine their

financial status. Reviews are then

undertaken regularly.

2. Collateral Adequacy

The haircut which represents the margin

above market value must adequately cover

market fluctuations, particularly in a rising

market. This risk is minimised by

continually monitoring collateral levels and

making timely margin calls.

Current market practice dictates collateral to

be around 105 110% of the market value of

the loaned securities.

3. Collateral Title Risk

A lender should always ensure there is clear

title to the collateral he holds. This is

especially so with cash. An existing charge

over the borrowers assets may give a

liquidator the right to recall cash collateral

without necessarily returning the underlying

stock because of imperfect set-off. To a large

extent, these problems are addressed through

proper documentation in the form of a

Master Securities Lending Agreement.

due date. The lender must also ensure that

where securities were on loan over exentitlement dates, but returned prior to the

payable date, that the benefit due is secured.

4. Delivery Risk

The Indian Position

Delivery risks occur both when Securities

have been lent and collateral has not been

received at the same time or prior to the loan,

and when collateral is being returned but the

loan return has not been received. In todays

electronic society delivery risk can be

reduced with Delivery Versus Payment (DVP)

transactions. At this time only cash

transactions are covered under DVP..

In India, the government securities market

has witnessed drastic changes since 1994 i.e.

inception of Primary Dealers (PD) system.

Till that time banking sector was investing

only for the purpose of statutory

requirements and Funds and Insurance

companies as final investors. Introduction

of PDs in India has helped move towards

achieving the objective of increase in market

depth and liquidity as well. Moreover, PDs,

while acting as market makers, have made

the market more vibrant along with existing

market players and new players like Foreign

Institutions, Mutual Funds and Insurance

Companies. The daily turnover in outright

transactions has increased manifolds from a

few hundred crores in 1990-93 to well over

two/three thousand croes today. Indeed, it

has even gone beyond ten thousand crores a

day in 2004. Further, at the instance of RBI,

CCIL became operational from Feb. 2002

extending guaranteed settlement of

government securities trades with netting

benefits which has improved manifold

efficiencies in the settlement system

facilitating the introduction of DVP III

settlement system on 01 April 2004.

5. Regulatory Risk

Participants should always be aware of any

regulatory constraints, for example, in some

countries a loan of securities can not be

outstanding for a term longer than 12

months else it is classed as a sale and the

return would be classed as a purchase.

6. Market Risk

Although maintaining margins through

Mark to Market alleviates market risk, the

risk can be made up of many components

including price volatility, market liquidity

and exchange rate fluctuations. Strong

procedures and control systems are essential

in managing this risk.

st

7. Accrued Benefits

The lender must be able to accurately

determine which benefits he is due, and the

borrower must be able to remit them on the

To ensure timely and efficient securities

settlement in the Government Securities

Market as also to achieve reductions in

attendant systemic and operational risks, a

s e c u r i t i e s b o r ro w i n g a n d l e n d i n g

arrangement in government securities was

considered necessary to effectively meet

instances of securities shortages in the

settlement processes. Accordingly, in terms

of the authority vested with RBI in the

Finance Bill 2002-2003, a Securities Lending

and Borrowing Scheme for government

securities was approved by RBI on 3 April

2003. The transactions under the scheme

stands exempted from capital gains tax. The

key guidelines of the Scheme are

rd

The scheme is a limited purpose one

with its scope and purpose restricted to

assist CCIL in ensuring timely

settlement of government securities

transactions in the secondary market

Only CCIL is authorized to borrow

securities under the scheme;

RBI proposes to keep membership to the

scheme restricted to the bare minimum;

Specific RBI approval is necessary to

admit market participants into the

scheme;

The Scheme has been operationalised by

CCIL with effect from 25 October 2004.

Currently two large market players

participate as approved members of the

Scheme. The arrangement entails transfer of

ear-marked securities to a dedicated SGL

Account with RBI by the participating

members which can be accessed by CCIL to

handle shortages.

th

The above Securities Lending & Borrowing

Scheme strengthens CCILs ability to meet

instances of securities shortages. However,

there is still scope for shortage allocations

due to the variety of instruments available

for trading in the secondary market some of

which have very little liquidity, for instance

most of the State Government Development

Loans. The probability of default on any of

such instruments in a day can not be

estimated with any degree of preciseness.

Further keeping all such securities readily

available at all times is impracticable. This

has a limitation in CCILs ability to meet all

instances of securities shortages under the

current T+0 settlement system especially in

the light of relative settlements taking place

towards late evening well after market hours.

Once the market moves to T+1 settlement

system and subject to requisite regulatory

approval wider participation as also

alternate methodologies such as automatic

electronic access to concerned SGL Accounts

through a deemed repo arrangement;

introduction of real time Market Auction

System etc. could be considered.

The existence of an efficient Securities

Lending and Borrowing Program capable of

meeting the twin objective of injecting

market liquidity and meeting all instances of

securities shortages on a cost-effective basis

is imperative before ushering in important

market reforms such as short-selling in

government securities.

(Source BIS and RBI guidelines.)

Vous aimerez peut-être aussi

- A simple approach to bond trading: The introductory guide to bond investments and their portfolio managementD'EverandA simple approach to bond trading: The introductory guide to bond investments and their portfolio managementÉvaluation : 5 sur 5 étoiles5/5 (1)

- Explain The Scope, Importance, Features, Advantages and Disadvantages of Securitization (Special Purpose Vehicle)Document6 pagesExplain The Scope, Importance, Features, Advantages and Disadvantages of Securitization (Special Purpose Vehicle)somilPas encore d'évaluation

- BAP 4 Capital Market L1-3Document17 pagesBAP 4 Capital Market L1-3Mabel Jean RambunayPas encore d'évaluation

- Equity FianaceDocument12 pagesEquity FianaceAnand BiradarPas encore d'évaluation

- Asset Securitization in Asia: Ian H. GiddyDocument30 pagesAsset Securitization in Asia: Ian H. Giddy111Pas encore d'évaluation

- Investment ManagementDocument4 pagesInvestment ManagementCaroline B CodinoPas encore d'évaluation

- Financial MarketDocument8 pagesFinancial Marketshahid3454Pas encore d'évaluation

- Bonds Decoded: Unraveling the Mystery Behind Bond MarketsD'EverandBonds Decoded: Unraveling the Mystery Behind Bond MarketsPas encore d'évaluation

- BX2032 WK 7 NOTES Financial Institutions and MarketDocument6 pagesBX2032 WK 7 NOTES Financial Institutions and MarketRetemoi CookPas encore d'évaluation

- Real Estate Securitization Exam NotesDocument33 pagesReal Estate Securitization Exam NotesHeng Kai Li100% (1)

- Securitization of Life InsuranceDocument59 pagesSecuritization of Life Insurancemiroslav.visic8307100% (1)

- Chapter 5 FIMDocument13 pagesChapter 5 FIMMintayto TebekaPas encore d'évaluation

- Bond MarketDocument17 pagesBond Marketjai shree ramPas encore d'évaluation

- Financial Markets (Chapter 8)Document4 pagesFinancial Markets (Chapter 8)Kyla DayawonPas encore d'évaluation

- Critical Examination of The Financial Market EfficiencyDocument10 pagesCritical Examination of The Financial Market EfficiencybatterluckPas encore d'évaluation

- Copfin ModuleDocument110 pagesCopfin ModuleLuckmore ChivandirePas encore d'évaluation

- Innovations in Financial IntermediationDocument112 pagesInnovations in Financial IntermediationDipesh JainPas encore d'évaluation

- AE 18 Group 04Document14 pagesAE 18 Group 04rayvie.sanchezPas encore d'évaluation

- Investing Made Easy: Finding the Right Opportunities for YouD'EverandInvesting Made Easy: Finding the Right Opportunities for YouPas encore d'évaluation

- Mastering the Market: A Comprehensive Guide to Successful Stock InvestingD'EverandMastering the Market: A Comprehensive Guide to Successful Stock InvestingPas encore d'évaluation

- Assientment 3Document6 pagesAssientment 3anvithapremagowdaPas encore d'évaluation

- Muhammad Abdullah (6772) Capital & Money MarketDocument5 pagesMuhammad Abdullah (6772) Capital & Money MarketMuhammad AbdullahPas encore d'évaluation

- Securitisation An Overview: H HE EM ME EDocument8 pagesSecuritisation An Overview: H HE EM ME Ejlo42Pas encore d'évaluation

- Money BankingDocument11 pagesMoney BankingRose DallyPas encore d'évaluation

- Ramiro, Lorren - Money MarketsDocument4 pagesRamiro, Lorren - Money Marketslorren ramiroPas encore d'évaluation

- Money and Capital Markets 8526Document11 pagesMoney and Capital Markets 8526mariamehdi22Pas encore d'évaluation

- Ashwini ReportDocument49 pagesAshwini ReportKavya SonuPas encore d'évaluation

- The Finace Master: What you Need to Know to Achieve Lasting Financial FreedomD'EverandThe Finace Master: What you Need to Know to Achieve Lasting Financial FreedomPas encore d'évaluation

- Saint Mary'S University: Faculty of Accounting and FinanceDocument10 pagesSaint Mary'S University: Faculty of Accounting and FinanceruhamaPas encore d'évaluation

- Saint Mary'S University: Faculty of Accounting and FinanceDocument10 pagesSaint Mary'S University: Faculty of Accounting and FinanceruhamaPas encore d'évaluation

- Retail BankingDocument9 pagesRetail BankingMohan KottuPas encore d'évaluation

- Cash Money Markets: Minimum Correct Answers For This Module: 6/12Document15 pagesCash Money Markets: Minimum Correct Answers For This Module: 6/12Jovan SsenkandwaPas encore d'évaluation

- Module 1 3 - BofiDocument75 pagesModule 1 3 - BofiJohn Ray AmadorPas encore d'évaluation

- Assignment No 02Document13 pagesAssignment No 02Shivani BalaniPas encore d'évaluation

- Part One: Money and Capital Market: Chapter Four Financial Markets in The Financial SystemDocument22 pagesPart One: Money and Capital Market: Chapter Four Financial Markets in The Financial SystemSeid KassawPas encore d'évaluation

- Chapter Four FinalDocument18 pagesChapter Four FinalSeid KassawPas encore d'évaluation

- 1 I 1.1 O F S: Ntroduction Verview OF THE Inancial YstemDocument8 pages1 I 1.1 O F S: Ntroduction Verview OF THE Inancial YstemAyanda Yan'Dee DimphoPas encore d'évaluation

- Money Markets and Capital MarketsDocument4 pagesMoney Markets and Capital MarketsEmmanuelle RojasPas encore d'évaluation

- Tutorial Chap 5Document3 pagesTutorial Chap 5Hasya AuniPas encore d'évaluation

- Securitization & Subprime Crisis.: (Type The Document Subtitle)Document13 pagesSecuritization & Subprime Crisis.: (Type The Document Subtitle)bhargavmenamPas encore d'évaluation

- SecuritisationDocument43 pagesSecuritisationRonak KotichaPas encore d'évaluation

- Lim Yew Joon B19080668 FMI Tutorial 4Document7 pagesLim Yew Joon B19080668 FMI Tutorial 4Jing HangPas encore d'évaluation

- Bond MarketsDocument8 pagesBond MarketsZaira Mae DungcaPas encore d'évaluation

- Basics of Securitisation of AssetsDocument2 pagesBasics of Securitisation of Assetslapogk100% (1)

- Financial MarketsDocument8 pagesFinancial MarketsDennis Korir100% (1)

- SecuritizationDocument46 pagesSecuritizationHitesh MorePas encore d'évaluation

- SecuritizationDocument12 pagesSecuritizationNit VictorPas encore d'évaluation

- FN302 01-FinAssets&Mkts RevisionDocument17 pagesFN302 01-FinAssets&Mkts RevisionAmani UrassaPas encore d'évaluation

- Lecture # 15Document14 pagesLecture # 15Zohaib Jamil WahajPas encore d'évaluation

- Overview of The Financial EnvironmentDocument39 pagesOverview of The Financial EnvironmentchingPas encore d'évaluation

- Financial System and MarketsDocument17 pagesFinancial System and MarketsDipesh GautamPas encore d'évaluation

- Chapter 1 - IntroductionDocument41 pagesChapter 1 - IntroductionMuhd Rizzwan0% (1)

- The Capital MarketDocument5 pagesThe Capital MarketJasleen kaurPas encore d'évaluation

- Study Guide E2: Sources of and Raising, Long-Term FinanceDocument32 pagesStudy Guide E2: Sources of and Raising, Long-Term Financesrgtlhr_325131857Pas encore d'évaluation

- FM Assignment AnswersDocument4 pagesFM Assignment Answerskarteekay negiPas encore d'évaluation

- W ElcomeDocument18 pagesW ElcomeRamesha SPas encore d'évaluation

- The Financial System and Interest Rates & Risk and ReturnsDocument69 pagesThe Financial System and Interest Rates & Risk and ReturnsJason DurdenPas encore d'évaluation

- FinmartDocument3 pagesFinmartAngelica Faye DuroPas encore d'évaluation

- Case 2Document10 pagesCase 2Kim BihagPas encore d'évaluation

- Transformation of Indian Capital MarketDocument25 pagesTransformation of Indian Capital Marketanilnair88Pas encore d'évaluation

- Report The ContributionDocument21 pagesReport The Contributionanilnair88Pas encore d'évaluation

- Crisil Rating Default Study 2011Document28 pagesCrisil Rating Default Study 2011anilnair88Pas encore d'évaluation

- Learning Outcomes: 1. Letters of CreditDocument4 pagesLearning Outcomes: 1. Letters of Creditanilnair88Pas encore d'évaluation

- Banking March 2014Document44 pagesBanking March 2014Umesh WablePas encore d'évaluation

- Management Consulting Ebook PDFDocument927 pagesManagement Consulting Ebook PDFanilnair88100% (1)

- National List of Essential Medicine - Final PDFDocument123 pagesNational List of Essential Medicine - Final PDFGopal KarvaPas encore d'évaluation

- TIC GuidelineDocument76 pagesTIC GuidelineNemanja MarijanPas encore d'évaluation

- Group 1 GroupDocument7 pagesGroup 1 Groupanilnair88Pas encore d'évaluation

- Hindustan Lever: Case 15-4Document11 pagesHindustan Lever: Case 15-4anilnair88100% (1)

- Bangladesh Bank - Comparative Scenarios of FIDocument13 pagesBangladesh Bank - Comparative Scenarios of FIanilnair88Pas encore d'évaluation

- Labour Migration From Bangladesh 2012Document18 pagesLabour Migration From Bangladesh 2012anilnair88Pas encore d'évaluation

- FXCM - Online Currency Trading Free $50,000 Practice AccountDocument3 pagesFXCM - Online Currency Trading Free $50,000 Practice Accountanilnair88Pas encore d'évaluation

- 14-2 Williamson and OliverDocument5 pages14-2 Williamson and Oliveranilnair880% (1)

- Dena Bank Recruitment 2013Document4 pagesDena Bank Recruitment 2013Vishwa Nath D RPas encore d'évaluation

- The AMul STory So Far in IndiaDocument25 pagesThe AMul STory So Far in IndiaShahid_onlyPas encore d'évaluation

- 14 Chapter 2 Capital StructureDocument15 pages14 Chapter 2 Capital StructureAkshay AggarwalPas encore d'évaluation

- History of The Hedge Fund.)Document2 pagesHistory of The Hedge Fund.)anilnair88Pas encore d'évaluation

- Analyze Cash Flow The Easy WayDocument2 pagesAnalyze Cash Flow The Easy Wayanilnair88Pas encore d'évaluation

- Central BankingDocument84 pagesCentral Bankinganilnair88Pas encore d'évaluation

- Analyzing Chart PatternsDocument31 pagesAnalyzing Chart PatternsNitesh Kumar SinghPas encore d'évaluation

- Important Abbreviations - ComputersDocument2 pagesImportant Abbreviations - Computersanilnair88Pas encore d'évaluation

- Fixed IncomDocument17 pagesFixed Incomanilnair88Pas encore d'évaluation

- Introduction To Infrastructure in IndiaDocument61 pagesIntroduction To Infrastructure in Indiaanilnair88Pas encore d'évaluation

- India Make or BreakDocument18 pagesIndia Make or Breakabhishek355Pas encore d'évaluation

- BrittanicaDocument4 pagesBrittanicaanilnair88Pas encore d'évaluation

- Piramal Abbott WhartonDocument5 pagesPiramal Abbott Whartonanilnair88Pas encore d'évaluation

- The Seven Principles of InsuranceDocument8 pagesThe Seven Principles of Insuranceanilnair88Pas encore d'évaluation

- The Changing Face of World SecurityDocument9 pagesThe Changing Face of World Securitybruno.berrones9864Pas encore d'évaluation

- 01 The CorporationDocument10 pages01 The CorporationWesPas encore d'évaluation

- Analysis of Section 139 A IT Act 1961Document13 pagesAnalysis of Section 139 A IT Act 1961padam jainPas encore d'évaluation

- BD20303 Topic 4 Risk and Return IDocument42 pagesBD20303 Topic 4 Risk and Return IVanna Chan Weng YeePas encore d'évaluation

- Generalized PaySlip For EmployeeDocument1 pageGeneralized PaySlip For EmployeePalash NaskarPas encore d'évaluation

- United States Court of Appeals, First CircuitDocument9 pagesUnited States Court of Appeals, First CircuitScribd Government DocsPas encore d'évaluation

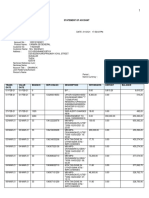

- Statement of AccountDocument5 pagesStatement of Accountmutaia pandian100% (1)

- Modes of Extinguishment of ObligationDocument20 pagesModes of Extinguishment of ObligationJohn Kayle BorjaPas encore d'évaluation

- The Tradition of Spontaneous Order: A Bibliographical Essay by Norman BarryDocument12 pagesThe Tradition of Spontaneous Order: A Bibliographical Essay by Norman BarryAnonymous ORqO5yPas encore d'évaluation

- About Mpower Financing.Document3 pagesAbout Mpower Financing.sumitkumtha123Pas encore d'évaluation

- Solution Practice 9 Business Combinations and ImpairmentDocument8 pagesSolution Practice 9 Business Combinations and ImpairmentGuineverePas encore d'évaluation

- ASBADocument2 pagesASBAAryan MahawarPas encore d'évaluation

- " Money and Its History": AboutDocument13 pages" Money and Its History": AboutHarsha ShivannaPas encore d'évaluation

- Prepared By:: Sakia Sultana ID: EB143221Document83 pagesPrepared By:: Sakia Sultana ID: EB143221Naomii HoneyPas encore d'évaluation

- FAC3761 - Exam Prep - Mock Question Paper - Suggested SolutionDocument9 pagesFAC3761 - Exam Prep - Mock Question Paper - Suggested SolutionRene EngelbrechtPas encore d'évaluation

- SleazyDocument1 pageSleazygokulksaravananPas encore d'évaluation

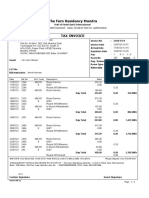

- The Fern Residency Mundra: MR - Yash VithalaniDocument2 pagesThe Fern Residency Mundra: MR - Yash VithalaniPREM KUMAR KUSHAWAHAPas encore d'évaluation

- Chapter 7 - 18may 2022Document51 pagesChapter 7 - 18may 2022Hazlina HusseinPas encore d'évaluation

- Sap Fi End User Practice Work: AR AP Asset AccountingDocument19 pagesSap Fi End User Practice Work: AR AP Asset AccountingHany RefaatPas encore d'évaluation

- A Project Report On Technical Analysis at Share KhanDocument105 pagesA Project Report On Technical Analysis at Share KhanBabasab Patil (Karrisatte)100% (3)

- T Code SAPDocument4 pagesT Code SAPGaparPas encore d'évaluation

- Financial Statements-Schedule-III - Companies Act, 2013 PDFDocument13 pagesFinancial Statements-Schedule-III - Companies Act, 2013 PDFCA Ujjwal KumarPas encore d'évaluation

- CH 03Document61 pagesCH 03Muhammad RamzanPas encore d'évaluation

- We The Sheeple vs. The BankstersDocument177 pagesWe The Sheeple vs. The BankstersLAUREN J TRATAR100% (6)

- Agreement Umair Fauziah Abdi - Farheen - Nadeem Briquette Coal 1mar23 Final PDFDocument2 pagesAgreement Umair Fauziah Abdi - Farheen - Nadeem Briquette Coal 1mar23 Final PDFgiri yudhaPas encore d'évaluation

- Kabbalah) - The Illuminati Today - The Brotherhood & The Manipulation of SocietyDocument61 pagesKabbalah) - The Illuminati Today - The Brotherhood & The Manipulation of SocietyMarkus CaroPas encore d'évaluation

- 1 30 2012 4Document546 pages1 30 2012 4Dante FilhoPas encore d'évaluation

- Assignment 4Document2 pagesAssignment 4Cheung HarveyPas encore d'évaluation

- Lembar Kerja Salon CantikDocument26 pagesLembar Kerja Salon CantikFanisa CantickaPas encore d'évaluation

- Report Myanmar Financial Sector - A Challenging Environment For Banks Nov2013Document56 pagesReport Myanmar Financial Sector - A Challenging Environment For Banks Nov2013THAN HANPas encore d'évaluation

- The Yamuna Syndicate Limited: Ratings Upgraded Summary of Rating ActionDocument8 pagesThe Yamuna Syndicate Limited: Ratings Upgraded Summary of Rating ActionSandy SanPas encore d'évaluation