Académique Documents

Professionnel Documents

Culture Documents

Performance Data and Analytics Dec-14: MUFAP Recommended Format

Transféré par

jibranqqTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Performance Data and Analytics Dec-14: MUFAP Recommended Format

Transféré par

jibranqqDroits d'auteur :

Formats disponibles

Performance data and analytics

Investment philosophy

Asset allocation (%)

JS KSE-30 Index Fund is an index fund that aims to track the performance of the

KSE-30 Index by investing in constituent companies of the index in proportion to

their weighting. The fund targets sophisticated investors who can time their

entry and exit from the fund in accordance with the expected performance of the

equity market or for investors who seek long term exposure to the equity

market.

Cash

Equity

Other including receivables

Total

Key information

Fund type

Category

Fund launch date

Net Assets (PKR mn)

NAV (PKR)

Benchmark

Management fee

Front-end Load

Back-end Load

Pricing mechanism

Trustee

Dealing Days & Cut-off time

Auditor

Risk profile

Listing

Leverage

Management Quality Rating

Entity Rating

Open end

Index Tracker Scheme

29 May, 2006

47.60

30.17

KSE30 Index

1.50% (Exclusive of Sindh Sales Tax)

2.00%

NIL

Forward

MCB Financial Services Ltd

(Monday to Friday) 3:00 p.m.

KPMG Taseer Hadi & Co.

High

LSE

NIL

AM2- by JCR-VIS

A+ (Long Term), A1 (Short Term) by PACRA

1M

2.20

2.16

0.04

1Y

11.94

10.43

1.51

2Y

48.92

50.91

-1.99

3Y

103.51

104.06

-0.55

Dec-14

5.11

94.51

0.39

Nov-14

3.67

95.51

0.82

100.00

100.00

Equity sector breakdown (%)

Commercial Banks

Oil and Gas

Chemicals

Electricity

Construction and Materials (Cement)

Others

Total

Dec-14

28.46

26.55

14.18

10.40

9.72

5.21

94.51

Nov-14

27.87

28.86

14.65

9.78

9.14

5.21

95.51

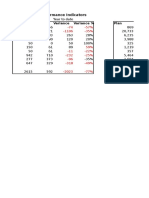

Top holding (%age of total assets)

Cumulative return1

Launch Avg. Ann.*

100.77

8.44

73.04

6.59

27.73

1.86

Performance (%)

Fund

Benchmark

Difference

Dec-14

MUFAP Recommended Format

MCB Bank Ltd.

Oil & Gas Development Co. Ltd.

United Bank Ltd.

Pakistan Petroleum Ltd.

Fauji Fertilizer Co. Ltd.

The Hub Power Co. Ltd.

Lucky Cement Ltd.

Engro Corporation Ltd.

Pakistan State Oil Co. Ltd.

Pakistan Oilfields Ltd.

10.96

10.80

6.99

6.91

6.59

5.41

5.19

4.06

3.72

3.34

* Average Annualized Return since inception as per Morning Star formula

Monthly performance (%)

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

YTD

Benchmark

Difference

FY15

2.95

-6.00

2.70

-0.17

0.92

2.20

2.34

1.74

0.60

FY14

11.40

-5.17

-2.55

4.90

4.77

2.99

2.24

-2.54

3.22

4.84

1.34

0.09

27.46

25.96

1.50

FY13

5.23

5.28

-1.03

0.75

1.39

2.26

2.02

5.46

-2.46

2.70

10.16

-3.84

30.76

35.95

-5.19

FY12

-0.53

-8.19

6.71

1.32

-3.51

-5.22

9.05

6.86

4.48

0.72

-2.38

-0.34

7.75

2.90

4.85

JS KSE-30 Index Fund vs. KSE-30 Index

FY11

9.14

-5.76

0.77

5.22

6.46

7.04

3.24

-8.72

7.52

1.13

0.46

-0.62

27.12

21.24

5.88

Statistical analysis

Beta

Standard Deviation

Largest Month Gain

Largest Month Loss

% Positive Months

Fund

1.0

27.4%

25.5%

-43.9%

64.4%

Benchmark

1.0

27.7%

25.2%

-45.0%

60.6%

Investment Committee Members

Dr. Ali Akhtar Ali - Chief Executive Officer

Mr. Khawar Iqbal - Chief Financial Officer

Mr. Zohaib Pervez, CFA - Fund Manager

Mr. Suleman Rafiq Maniya - Head of Research

20%

Contact us

10%

JS Investments Limited

Toll Free: 0800 - 00887

E-mail: ir@jsil.com

Website: www.jsil.com

0%

-10%

Disclosure for WWF Liability under Circular 17 of 2012

-20%

Dec/11 May/12 Sep/12 Jan/13 May/13 Sep/13 Jan/14 May/14 Sep/14

JS KSE-30 Index Fund

KSE-30 Index

Cumulative return is based as per MUFAP stated methodology.

The Scheme has maintained provisions against Worker's Welfare Funds

liability to the tune of Rs. 1,971,033, if the same were not made the NAV

per unit/return of the Scheme would be higher by Rs. 1.25 / 4.1%. For

details investors are advised to read the Note 7.1 of the latest Financial

Statements of the Scheme.

Vous aimerez peut-être aussi

- Performance Data and Analytics Sep-13: Investment Philosophy Asset Allocation (%)Document1 pagePerformance Data and Analytics Sep-13: Investment Philosophy Asset Allocation (%)Jazib SoofiPas encore d'évaluation

- JM Emerging LeadersDocument1 pageJM Emerging LeadersSandeep BorsePas encore d'évaluation

- Long Term Equity Fund Performance and Recommendations as of Aug 2012Document2 pagesLong Term Equity Fund Performance and Recommendations as of Aug 2012Amit MalikPas encore d'évaluation

- Value Research Fundcard - Invesco India Growth Fund - 2018 Mar 24Document4 pagesValue Research Fundcard - Invesco India Growth Fund - 2018 Mar 24hotalamPas encore d'évaluation

- Invest in Undervalued Companies for Long Term GrowthDocument1 pageInvest in Undervalued Companies for Long Term GrowthSandeep BorsePas encore d'évaluation

- Reliance Equity Opportunities FundDocument1 pageReliance Equity Opportunities FundSandeep BorsePas encore d'évaluation

- Equity and Debt Fund Performance UpdateDocument8 pagesEquity and Debt Fund Performance Updatesamuel debebePas encore d'évaluation

- Value Research: FundcardDocument4 pagesValue Research: FundcardYogi173Pas encore d'évaluation

- Franklin India Flexicap FundDocument1 pageFranklin India Flexicap FundSandeep BorsePas encore d'évaluation

- Types of Mutual Fund 1Document14 pagesTypes of Mutual Fund 1Sneha BhuwalkaPas encore d'évaluation

- Study Of: Prof. Neeraj AmarnaniDocument20 pagesStudy Of: Prof. Neeraj Amarnanipankil_dalalPas encore d'évaluation

- Franklin India Taxshield FIT: PortfolioDocument1 pageFranklin India Taxshield FIT: PortfolioShekhar KapoorPas encore d'évaluation

- Full X-Ray Report - 20150313Document5 pagesFull X-Ray Report - 20150313Anand Mohan SinhaPas encore d'évaluation

- ValueResearchFundcard ICICIPrudentialDiscovery 2012may20Document6 pagesValueResearchFundcard ICICIPrudentialDiscovery 2012may20Dinanath DabholkarPas encore d'évaluation

- ValueResearchFundcard HDFCTaxsaverFund 2014jul23Document4 pagesValueResearchFundcard HDFCTaxsaverFund 2014jul23thakkarpsPas encore d'évaluation

- Value Research: FundcardDocument4 pagesValue Research: FundcardYogi173Pas encore d'évaluation

- Fidelity Equity FundDocument2 pagesFidelity Equity FundSandeep Borse100% (1)

- Axis Equity Fund: Investment Growth Trailing Returns Investment ObjectiveDocument1 pageAxis Equity Fund: Investment Growth Trailing Returns Investment Objectiveway2iimaPas encore d'évaluation

- Asc 202311014 20504Document1 pageAsc 202311014 20504Harendra BabuPas encore d'évaluation

- DWSAlphaEquityFund 2014jul07Document4 pagesDWSAlphaEquityFund 2014jul07Yogi173Pas encore d'évaluation

- NDTV Profit: NDTV Profit Khabar Movies Cricket Doctor Good Times Social Register Sign-InDocument30 pagesNDTV Profit: NDTV Profit Khabar Movies Cricket Doctor Good Times Social Register Sign-Inpriyamvada_tPas encore d'évaluation

- Reliance GrowthDocument2 pagesReliance GrowthRoseRose RosePas encore d'évaluation

- Asc 202311014 20505Document1 pageAsc 202311014 20505Harendra BabuPas encore d'évaluation

- ValueResearchFundcard ICICIPrudentialTop100 2012feb02Document6 pagesValueResearchFundcard ICICIPrudentialTop100 2012feb02Ahmed Ahmed AliPas encore d'évaluation

- Kaveri SeedsDocument5 pagesKaveri SeedsNandeesh KodimallaiahPas encore d'évaluation

- ValueResearchFundcard KotakTaxSaver DirectPlan 2019aug02Document4 pagesValueResearchFundcard KotakTaxSaver DirectPlan 2019aug02JoydeepSuklabaidyaPas encore d'évaluation

- Axis Long Term Equity FundDocument4 pagesAxis Long Term Equity FundChittaPas encore d'évaluation

- Six Yrs Per OGDCLDocument2 pagesSix Yrs Per OGDCLMAk KhanPas encore d'évaluation

- Mint Delhi Mint 17Document1 pageMint Delhi Mint 17Kedar KulkarniPas encore d'évaluation

- Asc 202311011 20501Document1 pageAsc 202311011 20501Harendra BabuPas encore d'évaluation

- Value Research: FundcardDocument4 pagesValue Research: FundcardYogi173Pas encore d'évaluation

- Fundcard: ICICI Prudential Bluechip FundDocument4 pagesFundcard: ICICI Prudential Bluechip FundChittaPas encore d'évaluation

- Fundcard: Axis Bluechip FundDocument4 pagesFundcard: Axis Bluechip FundChittaPas encore d'évaluation

- Value Research: JM Emerging LeadersDocument2 pagesValue Research: JM Emerging LeadersSandeep BorsePas encore d'évaluation

- Fundcard MiraeAssetEmergingBluechipRegular 2014feb26Document4 pagesFundcard MiraeAssetEmergingBluechipRegular 2014feb26Yogi173Pas encore d'évaluation

- Fundcard: HDFC Top 100 FundDocument4 pagesFundcard: HDFC Top 100 FundLahoty Arpit ArunkumarPas encore d'évaluation

- FMR - April 2014Document12 pagesFMR - April 2014faisaladeemPas encore d'évaluation

- Total Rate of Return Indexes Daily Returns - May Profile Settlement Date: May 22, 2006, Pricing Date: May 22, 2006Document25 pagesTotal Rate of Return Indexes Daily Returns - May Profile Settlement Date: May 22, 2006, Pricing Date: May 22, 2006Isobel KennedyPas encore d'évaluation

- Equity FundsDocument2 pagesEquity FundsMahesh SainiPas encore d'évaluation

- Asc 202311014 2050Document1 pageAsc 202311014 2050Harendra BabuPas encore d'évaluation

- Asc 202311011 2050Document1 pageAsc 202311011 2050Harendra BabuPas encore d'évaluation

- ValueResearchFundcard MiraeAssetLargeCapFund DirectPlan 2019nov19Document4 pagesValueResearchFundcard MiraeAssetLargeCapFund DirectPlan 2019nov19asddsffdsfPas encore d'évaluation

- Quantletter Q30Document3 pagesQuantletter Q30pareshpatel99Pas encore d'évaluation

- Fundcard: Axis Long Term Equity FundDocument4 pagesFundcard: Axis Long Term Equity FundARUN JACOB 1827606Pas encore d'évaluation

- Morningstar® Portfolio X-Ray: H R T y UDocument5 pagesMorningstar® Portfolio X-Ray: H R T y UVishal BabutaPas encore d'évaluation

- Finance Key Performance Indicators: Plan Actual Variance Variance % PlanDocument4 pagesFinance Key Performance Indicators: Plan Actual Variance Variance % Planapi-324294392Pas encore d'évaluation

- Sbi Annual Report 2012 13Document190 pagesSbi Annual Report 2012 13udit_mca_blyPas encore d'évaluation

- Fundcard: SBI Bluechip FundDocument4 pagesFundcard: SBI Bluechip FundSachin JawalePas encore d'évaluation

- ValueResearchFundcard SBIBluechipFund 2019aug30 PDFDocument4 pagesValueResearchFundcard SBIBluechipFund 2019aug30 PDFSachin JawalePas encore d'évaluation

- Daily Report 20141009Document3 pagesDaily Report 20141009Joseph DavidsonPas encore d'évaluation

- SEO Balanced Fund ResearchDocument4 pagesSEO Balanced Fund ResearchYogi173Pas encore d'évaluation

- Axis Focused 25 Fund - Direct Plan Rating: Average Risk, High ReturnDocument4 pagesAxis Focused 25 Fund - Direct Plan Rating: Average Risk, High ReturnChittaPas encore d'évaluation

- Fundcard: Axis Long Term Equity FundDocument4 pagesFundcard: Axis Long Term Equity FundprashokkumarPas encore d'évaluation

- ValueResearchFundcard ICICIPrudentialFocusedBluechipEquityFund 2017dec18Document4 pagesValueResearchFundcard ICICIPrudentialFocusedBluechipEquityFund 2017dec18santoshk.mahapatraPas encore d'évaluation

- Financial Performance Evaluation of Indian Rare Earths LimitedDocument27 pagesFinancial Performance Evaluation of Indian Rare Earths LimitedNitheesh VsPas encore d'évaluation

- Boost savings and returns with Axis Long Term Equity FundDocument2 pagesBoost savings and returns with Axis Long Term Equity FundAmandeep SharmaPas encore d'évaluation

- ValueResearchFundcard SBIBluechipFund 2017jan27 PDFDocument4 pagesValueResearchFundcard SBIBluechipFund 2017jan27 PDFcaptjas9886Pas encore d'évaluation

- Weekly ReportDocument8 pagesWeekly Reportvorahh79Pas encore d'évaluation

- Mutual Funds in India: Structure, Performance and UndercurrentsD'EverandMutual Funds in India: Structure, Performance and UndercurrentsPas encore d'évaluation

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsD'EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsPas encore d'évaluation

- IMF conditionality and Pakistan's energy subsidiesDocument1 pageIMF conditionality and Pakistan's energy subsidiesjibranqqPas encore d'évaluation

- Nordic ModelDocument13 pagesNordic ModeljibranqqPas encore d'évaluation

- Nordic ModelDocument13 pagesNordic ModeljibranqqPas encore d'évaluation

- Sampling techniques advantages disadvantagesDocument2 pagesSampling techniques advantages disadvantagesAvadhesh ChundawatPas encore d'évaluation

- Revised Syllabus CE-2016 10 Jul 2015Document158 pagesRevised Syllabus CE-2016 10 Jul 2015Muhammad Faisal TahirPas encore d'évaluation

- Karl Polanyi CompilationDocument46 pagesKarl Polanyi CompilationjibranqqPas encore d'évaluation

- Title: Anarchism: From Theory To Practice Author: Topics: Source: Retrieved On October 26, 2009 FromDocument68 pagesTitle: Anarchism: From Theory To Practice Author: Topics: Source: Retrieved On October 26, 2009 FromjibranqqPas encore d'évaluation

- Toward DemocracyDocument15 pagesToward DemocracyjibranqqPas encore d'évaluation

- Hilosopher Faceoff: Rousseau vs. Mill: "On Liberty"Document8 pagesHilosopher Faceoff: Rousseau vs. Mill: "On Liberty"jibranqqPas encore d'évaluation

- Hilosopher Faceoff: Rousseau vs. Mill: "On Liberty"Document8 pagesHilosopher Faceoff: Rousseau vs. Mill: "On Liberty"jibranqqPas encore d'évaluation

- Illustrator ShortcutDocument5 pagesIllustrator ShortcutjibranqqPas encore d'évaluation

- David Hume, Sceptic PDFDocument139 pagesDavid Hume, Sceptic PDFjibranqqPas encore d'évaluation

- Expenditure Changing Switching RE - HI PDFDocument10 pagesExpenditure Changing Switching RE - HI PDFjibranqqPas encore d'évaluation

- Chapter 1 The Dynamics of Power Military, Bureaucracy, and The PeopleDocument35 pagesChapter 1 The Dynamics of Power Military, Bureaucracy, and The Peopleamirq4Pas encore d'évaluation

- The Works of John LockeDocument1 pageThe Works of John LockejibranqqPas encore d'évaluation

- FF 112Document153 pagesFF 112Sau CyPas encore d'évaluation

- Military rule and democratization in PakistanDocument17 pagesMilitary rule and democratization in PakistanjibranqqPas encore d'évaluation

- vB10 Fiji PDFDocument652 pagesvB10 Fiji PDFjibranqqPas encore d'évaluation

- Crystal Ball User ManualDocument414 pagesCrystal Ball User ManualKamelMahdy100% (5)

- Is Religious Freedom IrrationalDocument29 pagesIs Religious Freedom IrrationaljibranqqPas encore d'évaluation

- Manual in Come Tax Returns 2016Document40 pagesManual in Come Tax Returns 2016harrisshoaibPas encore d'évaluation

- vB10 Fiji PDFDocument652 pagesvB10 Fiji PDFjibranqqPas encore d'évaluation

- Risk AnalysisDocument4 pagesRisk AnalysisjibranqqPas encore d'évaluation

- Official Rules-1 PDFDocument21 pagesOfficial Rules-1 PDFjibranqqPas encore d'évaluation

- Presentation VariationDocument5 pagesPresentation VariationjibranqqPas encore d'évaluation

- Tarullo, Obradovic, Gunnar (2009, 0-3) Self-Control and The Developing BrainDocument7 pagesTarullo, Obradovic, Gunnar (2009, 0-3) Self-Control and The Developing BraingratzybahPas encore d'évaluation

- UTOPIAN INVESTMENTS: AMBITIOUS EXPANSION PLANSDocument29 pagesUTOPIAN INVESTMENTS: AMBITIOUS EXPANSION PLANSjibranqqPas encore d'évaluation

- Teaching and Learning Brochure PDFDocument32 pagesTeaching and Learning Brochure PDFjibranqqPas encore d'évaluation

- Religion&Society PDFDocument17 pagesReligion&Society PDFjibranqqPas encore d'évaluation

- 7614 23072 1 PB PDFDocument23 pages7614 23072 1 PB PDFjibranqqPas encore d'évaluation

- IFT2day OLIVER VALEZ PDFDocument315 pagesIFT2day OLIVER VALEZ PDFMohamedKeynan100% (23)

- Amrut Export LTD.: Particulars YEAR ENDED ON 31/3/2015 Amount (RS) IncomeDocument9 pagesAmrut Export LTD.: Particulars YEAR ENDED ON 31/3/2015 Amount (RS) IncomeDipak KashyapPas encore d'évaluation

- Pension Fund Regulatory and Development AuthorityDocument11 pagesPension Fund Regulatory and Development AuthorityParitosh ChaudharyPas encore d'évaluation

- Bluehouse Capital - Property XpressDocument4 pagesBluehouse Capital - Property XpressProperty XpressPas encore d'évaluation

- WACC, Beta, Levered Beta, and Company Financial AnalysisDocument12 pagesWACC, Beta, Levered Beta, and Company Financial AnalysisAnandPas encore d'évaluation

- Barron's May 2001 Erin Arvedlund Story Re Bernard MadoffDocument3 pagesBarron's May 2001 Erin Arvedlund Story Re Bernard MadoffAnonymousPas encore d'évaluation

- LedgerDocument4 pagesLedgerஒப்பிலியப்பன்Pas encore d'évaluation

- AFAR 0106. Joint Arrangement - CPARTC.MyDocument3 pagesAFAR 0106. Joint Arrangement - CPARTC.MyApolinar Alvarez Jr.Pas encore d'évaluation

- Lowes Q3 Earnings Call InfographicDocument1 pageLowes Q3 Earnings Call Infographictoloc03Pas encore d'évaluation

- Test Bank For Entrepreneurial Finance 5th Edition By-Leach Part 1Document7 pagesTest Bank For Entrepreneurial Finance 5th Edition By-Leach Part 1Christian Villahermosa ToleroPas encore d'évaluation

- The Corporation Code Revised 2019 - The Philippines PDFDocument57 pagesThe Corporation Code Revised 2019 - The Philippines PDFRosemarie EspinaPas encore d'évaluation

- City of Busselton - Adopted Budget 2016-2017Document314 pagesCity of Busselton - Adopted Budget 2016-2017NeenPas encore d'évaluation

- Aditya Jain NotesDocument55 pagesAditya Jain NotesVijayaPas encore d'évaluation

- CH 11 Exam PracticeDocument20 pagesCH 11 Exam PracticeSvetlanaPas encore d'évaluation

- Finance Theory, Financial Instruments, Financial Markets: PRM Self Study GuideDocument24 pagesFinance Theory, Financial Instruments, Financial Markets: PRM Self Study GuidePatrickPas encore d'évaluation

- UBS Business Plan - Stategic Planning and Financing Basis - Model For Generating A Business Plan - (UBS AG) PDFDocument26 pagesUBS Business Plan - Stategic Planning and Financing Basis - Model For Generating A Business Plan - (UBS AG) PDFQuantDev-MPas encore d'évaluation

- University of Mindanao Panabo CollegeDocument2 pagesUniversity of Mindanao Panabo CollegeJessa Beloy100% (1)

- The Art of The Variance SwapDocument5 pagesThe Art of The Variance SwapMatt Wall100% (1)

- Merger Remedies Guide - 2nd Edition 06 48 04Document284 pagesMerger Remedies Guide - 2nd Edition 06 48 04BazchackoPas encore d'évaluation

- Series 7 Investment Company Products OverviewDocument4 pagesSeries 7 Investment Company Products OverviewdgnyPas encore d'évaluation

- Pre Operating Cash FlowDocument43 pagesPre Operating Cash FlowCamille ManalastasPas encore d'évaluation

- Picking Stocks The Warren Buffett Way Understanding ROEDocument4 pagesPicking Stocks The Warren Buffett Way Understanding ROEprintulPas encore d'évaluation

- Ross W Jardine - Build Wealth in Any MarketDocument178 pagesRoss W Jardine - Build Wealth in Any MarketJoseph Kuratana100% (3)

- Major Online Brokers in India ComparedDocument5 pagesMajor Online Brokers in India ComparedSurbhi RastogiPas encore d'évaluation

- Golden Opportunity?: Tom Fitzpatrick 1-212-723-1344 Shyam Devani 44-207-986-3453 Jim Zhou 1-212-723-3469Document6 pagesGolden Opportunity?: Tom Fitzpatrick 1-212-723-1344 Shyam Devani 44-207-986-3453 Jim Zhou 1-212-723-3469bibhash7521Pas encore d'évaluation

- Ap-50-97 Road in The Community Part 2 Towards Better Practice PDFDocument378 pagesAp-50-97 Road in The Community Part 2 Towards Better Practice PDFuntung CahyadiPas encore d'évaluation

- Yuanta Morning Journal 18 Jan 17Document8 pagesYuanta Morning Journal 18 Jan 17Sitanur BuanaPas encore d'évaluation

- Financial Report Analysis of Ultratech Cements Ltd. AND ACC Cements Ltd.Document101 pagesFinancial Report Analysis of Ultratech Cements Ltd. AND ACC Cements Ltd.Viral Bhogaita75% (4)