Académique Documents

Professionnel Documents

Culture Documents

Sheep Grazing Accounting: This Form of Farm Accounting Was: 161 Zaid: Accounting Systems in Early Islamic State

Transféré par

hui1012Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Sheep Grazing Accounting: This Form of Farm Accounting Was: 161 Zaid: Accounting Systems in Early Islamic State

Transféré par

hui1012Droits d'auteur :

Formats disponibles

Zaid: Accounting Systems in Early Islamic State

161

not allow either raw material (gold and silver) or finished products (bullion and coins) to be held on premises for any length of

time. The requirement of immediate conversion, minting and

delivery would have been initiated for security reasons to prevent theft. Bullion and coins would have been delivered to the

equivalent of a contemporary public treasury. The mint accounting system required the use of three specialized journals. The

first was used for recording inventory, the second for recording

revenues, and the third for recording expenses. Purchases and

wages were examples of costs incurred by the mint authority. It

was also mandatory to record the terms and conditions of the

services provided by the mint authority in the expenses journal.

The revenue of the mint authority was calculated at either 5% of

the cost of gold or silver, or in accordance with a predetermined

amount. The criteria for the application of either calculation

was not mentioned by Al-Mazendarany or Al-Khawarizmy.

Sheep Grazing Accounting: This form of farm accounting was

initiated and implemented by government authorities in the Islamic state and its use by private entrepreneurs to measure the

profit or losses for the purpose of zakat is likely. Sheep grazing

accounting was different to Greek and Roman farm accounting

where the accounts did not purport to show any more than

movements of cash and kind, any dependence or fixation on the

accounting figures in forming ideas about profitability seems

much less likely [Macve, 1994, p. 78]. Under this system all

animals given to the grazier or shepherd were recorded in a

book designed for the purpose. Revenue received either in cash

or kind was also to be recorded. Revenue in kind received by the

grazier included animals and sheep products. It appears that

this system used a number of specialized books because of the

requirement to record animals given - assets - in a different

book from that used to record expenses. It is not clear whether

animals received were recorded as revenues or were capitalized

and recorded in the assets book. Neither Al-Mazendarany or AlKhawarizmy elaborated on this issue. Proper classification and

adequate disclosure was also a feature of farm accounting as it

required the separate classification of male sheep, female sheep,

goats and their offspring. It was also required to properly record

and classify sheep slaughtered and meat products distributed.

Once again, the relevant book or books were not specified by

either Al-Mazendarany or Al-Khawarizmy. Losses were also recorded in the books, including those due to natural disasters

such as drought.

Vous aimerez peut-être aussi

- Brokerage Business PlanDocument19 pagesBrokerage Business PlanMuhammad Ahmed50% (4)

- BookkeepingRegulationsRRV 1Document80 pagesBookkeepingRegulationsRRV 1Jeremy Kuizon Pacuan100% (1)

- MicroRate Technical GuideDocument64 pagesMicroRate Technical GuideGiancarlo CamperiPas encore d'évaluation

- LBC-STRATEGIC-PAPER - Rev.1 22021Document42 pagesLBC-STRATEGIC-PAPER - Rev.1 22021Dennis Alea100% (5)

- Oracle Apps Financial Interview Questions Answers GuideDocument7 pagesOracle Apps Financial Interview Questions Answers GuideJohn StephensPas encore d'évaluation

- DM Notes Mim Jbims 12 13Document56 pagesDM Notes Mim Jbims 12 13abigail.godinhoPas encore d'évaluation

- The Wages Question (Barnes & Noble Digital Library): A Treatise on Wages and the Wages ClassD'EverandThe Wages Question (Barnes & Noble Digital Library): A Treatise on Wages and the Wages ClassPas encore d'évaluation

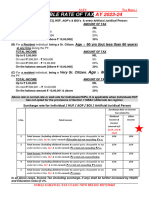

- Team PRTC FPB May 2023 TaxDocument8 pagesTeam PRTC FPB May 2023 TaxAra ara KawaiiPas encore d'évaluation

- TOPIC 9, Zakat AccountingDocument25 pagesTOPIC 9, Zakat AccountingFadli Sukor Sani100% (1)

- Financial & Managerial Accounting MbasDocument40 pagesFinancial & Managerial Accounting MbasHồng Long100% (1)

- Warehouse Accounting: Warehouse Accounting Appears To Have: Accounting Historians Journal, December 2004Document1 pageWarehouse Accounting: Warehouse Accounting Appears To Have: Accounting Historians Journal, December 2004hui1012Pas encore d'évaluation

- Acc - System Develop in Muslim SocietyDocument23 pagesAcc - System Develop in Muslim SocietyAinnur ArifahPas encore d'évaluation

- Construction Accounting: This System Was Used To Account ForDocument1 pageConstruction Accounting: This System Was Used To Account Forhui1012Pas encore d'évaluation

- Were Islamic Records Precursors To Accounting Book Based On The Italian MethodDocument35 pagesWere Islamic Records Precursors To Accounting Book Based On The Italian MethodIntan MunirahPas encore d'évaluation

- Programme: Ac110 Group: Jac1104A Lecturer'S Name: Azfar Hilmi Bin BaharudinDocument12 pagesProgramme: Ac110 Group: Jac1104A Lecturer'S Name: Azfar Hilmi Bin BaharudinAzyan AzharPas encore d'évaluation

- Taxation in Ancient World IndiaDocument12 pagesTaxation in Ancient World IndiaArsha SureshPas encore d'évaluation

- Assignment 2Document4 pagesAssignment 2Leslie RobertsPas encore d'évaluation

- Mughal Land Revenue SystemDocument15 pagesMughal Land Revenue SystemAnna KhawajaPas encore d'évaluation

- FSF Lecture 2Document111 pagesFSF Lecture 2Khushi AgarwalPas encore d'évaluation

- Kautilyas1 PDFDocument19 pagesKautilyas1 PDFsan_maniPas encore d'évaluation

- Ajay Kumar - Taxation in Mauryan Period PDFDocument5 pagesAjay Kumar - Taxation in Mauryan Period PDFAnkush GuptaPas encore d'évaluation

- Developing and Improving Your Farm RecordsDocument6 pagesDeveloping and Improving Your Farm RecordsJOHNRIC MANEJAPas encore d'évaluation

- Zakat Accounting For IFIDocument3 pagesZakat Accounting For IFIHanah11Pas encore d'évaluation

- Treasury Accounting: This Was Used by Government and RequiredDocument1 pageTreasury Accounting: This Was Used by Government and Requiredhui1012Pas encore d'évaluation

- Mcom Part2 FinalDocument45 pagesMcom Part2 FinalRahul SosaPas encore d'évaluation

- Compare The Characteristic of Islamic Accounting Versus ConventionalDocument13 pagesCompare The Characteristic of Islamic Accounting Versus ConventionalHafiz BajauPas encore d'évaluation

- The Biltmore Company v. The United States of America, 228 F.2d 9, 4th Cir. (1955)Document5 pagesThe Biltmore Company v. The United States of America, 228 F.2d 9, 4th Cir. (1955)Scribd Government DocsPas encore d'évaluation

- Prudential Arrangements For Stability and Development of Islamic FinanceDocument9 pagesPrudential Arrangements For Stability and Development of Islamic FinanceMuhammad Arslan UsmanPas encore d'évaluation

- International Islamic StandarDocument10 pagesInternational Islamic StandarAhmad MahmoodPas encore d'évaluation

- Islamic JurisprudenceDocument6 pagesIslamic JurisprudenceMunazza AkhtarPas encore d'évaluation

- Cash Receipts CycleDocument19 pagesCash Receipts CycleYenPas encore d'évaluation

- History of AccountingDocument16 pagesHistory of AccountingSai AlviorPas encore d'évaluation

- Mughal Land Revenue SystemDocument9 pagesMughal Land Revenue SystempihuPas encore d'évaluation

- Review of The Contemporary Zakat CollectDocument5 pagesReview of The Contemporary Zakat Collectkestar09Pas encore d'évaluation

- Money LaunderingDocument14 pagesMoney LaunderingsimranPas encore d'évaluation

- Islamic Economic System of PakistanDocument8 pagesIslamic Economic System of PakistanMohammad Farhan ShaikhPas encore d'évaluation

- Fundamentals of Islamic Economic System: CapitalDocument46 pagesFundamentals of Islamic Economic System: CapitalArciere JeonsaPas encore d'évaluation

- Some Forms of Al-Fadl IN Trade and Comimerce: Rib Ribn RibnDocument23 pagesSome Forms of Al-Fadl IN Trade and Comimerce: Rib Ribn RibnNasrullah QureshiPas encore d'évaluation

- Consolidated Mines V CTADocument40 pagesConsolidated Mines V CTAMikki ManiegoPas encore d'évaluation

- Bookkeeping and AccountingDocument2 pagesBookkeeping and AccountingGiico BorjaPas encore d'évaluation

- A1 - Parallel EconomyDocument18 pagesA1 - Parallel EconomyVignesh nayakPas encore d'évaluation

- Accounting SystemsDocument1 pageAccounting SystemsHafij UllahPas encore d'évaluation

- Bait Ul MalDocument9 pagesBait Ul Malaaksial01Pas encore d'évaluation

- Account PresentationDocument11 pagesAccount PresentationAtul KhotPas encore d'évaluation

- Small-Scale Dairy Farming Manual Vol. 6Document55 pagesSmall-Scale Dairy Farming Manual Vol. 6Muhammad WaseemPas encore d'évaluation

- United States v. Catto, 384 U.S. 102 (1966)Document13 pagesUnited States v. Catto, 384 U.S. 102 (1966)Scribd Government DocsPas encore d'évaluation

- Lecturer 2 (I) - Money LaunderingDocument28 pagesLecturer 2 (I) - Money LaunderingkhooPas encore d'évaluation

- Pengakuan, Pengukuran, Penyajian Dan Pengungkapan Dana Non Halal Pada Laporan Keuangan Lembaga Amil ZakatDocument28 pagesPengakuan, Pengukuran, Penyajian Dan Pengungkapan Dana Non Halal Pada Laporan Keuangan Lembaga Amil ZakatTiara DewiPas encore d'évaluation

- Cash 1. List The Five Primary Activities Involved in The Acquisition and Payment CycleDocument3 pagesCash 1. List The Five Primary Activities Involved in The Acquisition and Payment CycleJomer Fernandez100% (3)

- Understanding & Calculating Zaka-H: Your Gui de ToDocument8 pagesUnderstanding & Calculating Zaka-H: Your Gui de ToAnonymous nkrnbgoVGPas encore d'évaluation

- 1 Fundamentals of Islamic AccountingDocument14 pages1 Fundamentals of Islamic Accountingfidha Pa100% (1)

- Estate of Gerald L. Wallace, Deceased, Celia A. Wallace, and Celia A. Wallace v. Commissioner of Internal Revenue, 965 F.2d 1038, 11th Cir. (1992)Document23 pagesEstate of Gerald L. Wallace, Deceased, Celia A. Wallace, and Celia A. Wallace v. Commissioner of Internal Revenue, 965 F.2d 1038, 11th Cir. (1992)Scribd Government DocsPas encore d'évaluation

- Developing A Cash Flow Plan: Damona Doye Randy TrueDocument10 pagesDeveloping A Cash Flow Plan: Damona Doye Randy TrueLasyaPriyaVedamPas encore d'évaluation

- Islamic Banking and FinanceDocument42 pagesIslamic Banking and FinanceAwn AqdasPas encore d'évaluation

- Gupta College of Management and Technology: Assignment - 1 Origin of Taxation and Principles of TaxationDocument42 pagesGupta College of Management and Technology: Assignment - 1 Origin of Taxation and Principles of TaxationpadmajachithanyaPas encore d'évaluation

- Checks PDFDocument9 pagesChecks PDFAbubakkarPas encore d'évaluation

- Accounting For Zoo AnimalsDocument20 pagesAccounting For Zoo AnimalsAnonymous C722KPSPas encore d'évaluation

- Guide For Search CasesDocument11 pagesGuide For Search CasesAshish ShahPas encore d'évaluation

- Overview of Islamic AccountingDocument25 pagesOverview of Islamic AccountingNovi WulandariPas encore d'évaluation

- Foundation Course in Aml - IndiaDocument21 pagesFoundation Course in Aml - Indiadeepusandy7791100% (3)

- Exact Enterprises Backgruond (Diego)Document80 pagesExact Enterprises Backgruond (Diego)abner tangi nekotoPas encore d'évaluation

- CharacteristicsDocument4 pagesCharacteristicsKirubel FantuPas encore d'évaluation

- Islamic Accounting Need or FormalityDocument24 pagesIslamic Accounting Need or Formalityoma1100Pas encore d'évaluation

- 1995, C. Maxia, A Stick For Cooperation, in Europaea, I, 1, BruxellesDocument12 pages1995, C. Maxia, A Stick For Cooperation, in Europaea, I, 1, BruxellestopogrigioPas encore d'évaluation

- CH 13 UpdatedDocument14 pagesCH 13 UpdatedRayhanPas encore d'évaluation

- Money LaunderingDocument31 pagesMoney LaunderingjammuuuPas encore d'évaluation

- Whispers in the Auditing Room: Tales of Financial Protection and Personal SafetyD'EverandWhispers in the Auditing Room: Tales of Financial Protection and Personal SafetyPas encore d'évaluation

- Treasury Accounting: This Was Used by Government and RequiredDocument1 pageTreasury Accounting: This Was Used by Government and Requiredhui1012Pas encore d'évaluation

- BaqarahDocument1 pageBaqarahhui1012Pas encore d'évaluation

- Amel, Mubasher, Al-Kateb, or Kateb Al-Mal Were The CommonDocument1 pageAmel, Mubasher, Al-Kateb, or Kateb Al-Mal Were The Commonhui1012Pas encore d'évaluation

- Hijri'iah Refers To The Islamic Calendar, Which Began With The EstablishmentDocument1 pageHijri'iah Refers To The Islamic Calendar, Which Began With The Establishmenthui1012Pas encore d'évaluation

- Accounting Historians Journal, December 2004Document1 pageAccounting Historians Journal, December 2004hui1012Pas encore d'évaluation

- Accounting Systems and Recording Procedures in The Early Islamic StateDocument1 pageAccounting Systems and Recording Procedures in The Early Islamic Statehui1012Pas encore d'évaluation

- 151 Zaid: Accounting Systems in Early Islamic StateDocument1 page151 Zaid: Accounting Systems in Early Islamic Statehui1012Pas encore d'évaluation

- Et Al., 1993, P. 132) - It Will Be Shown That The Accounting SystemsDocument1 pageEt Al., 1993, P. 132) - It Will Be Shown That The Accounting Systemshui1012Pas encore d'évaluation

- Topic 5: Profitability AnalysisDocument1 pageTopic 5: Profitability Analysishui1012Pas encore d'évaluation

- FlowchartsDocument37 pagesFlowchartsalemnew_yimam100% (2)

- Accounting For A Service CompanyDocument9 pagesAccounting For A Service CompanyAnnie RapanutPas encore d'évaluation

- AbsorptionDocument28 pagesAbsorptionJenika AtanacioPas encore d'évaluation

- Trading Account PDFDocument9 pagesTrading Account PDFVijayaraj Jeyabalan100% (1)

- APRIL Sal Slip PDFDocument1 pageAPRIL Sal Slip PDFGaurav KapahiPas encore d'évaluation

- Working Capital ManagementDocument2 pagesWorking Capital ManagementAnkit ThakkarPas encore d'évaluation

- True Wealth & Savings: W I M T B WDocument61 pagesTrue Wealth & Savings: W I M T B WDonna Franciledo-Acero0% (1)

- Session 1 Stratagic MGTDocument22 pagesSession 1 Stratagic MGTNathan MontgomeryPas encore d'évaluation

- Annual Report 2020-21Document73 pagesAnnual Report 2020-21ChaviPas encore d'évaluation

- Business Plan Guide Only Complete SampleDocument42 pagesBusiness Plan Guide Only Complete SampleJitter GromiaPas encore d'évaluation

- Foreword: A Manual of Pension ProceduresDocument194 pagesForeword: A Manual of Pension ProceduresKhurram ShehzadPas encore d'évaluation

- PRTC HOs ListDocument4 pagesPRTC HOs ListArianne May AmosinPas encore d'évaluation

- 1h DT Revision Short Notes Selected Chapters Cma Inter Dec 2023Document109 pages1h DT Revision Short Notes Selected Chapters Cma Inter Dec 2023Vaheed AliPas encore d'évaluation

- Calculation of PF ESI Damages & IntrestDocument5 pagesCalculation of PF ESI Damages & IntrestDeepak DasPas encore d'évaluation

- Chapter 7 SolutionsDocument8 pagesChapter 7 SolutionsAustin LeePas encore d'évaluation

- Company Law Ii PDFDocument95 pagesCompany Law Ii PDFNYAMEKYE ADOMAKOPas encore d'évaluation

- Paper 10Document111 pagesPaper 10Muralidhar SusvaramPas encore d'évaluation

- 14 Bbma3203 T10 PDFDocument27 pages14 Bbma3203 T10 PDFHarianti HattaPas encore d'évaluation

- Actual Income & ExpendituresDocument5 pagesActual Income & Expendituressan nicolas 2nd betis guagua pampangaPas encore d'évaluation

- New Capex Plan of Nestle LTDDocument13 pagesNew Capex Plan of Nestle LTDnandeeppatel5159Pas encore d'évaluation

- Midterm Requirement in Income TaxationDocument5 pagesMidterm Requirement in Income Taxationkaji cruzPas encore d'évaluation

- Eng111 Summer Hw2 Solutions PDFDocument4 pagesEng111 Summer Hw2 Solutions PDFAnandita0% (1)

- A Crtical Analysis of The Role of Uganda Revenue Authority in The Administration of Taxes in Uganda by Magomu NasuruDocument68 pagesA Crtical Analysis of The Role of Uganda Revenue Authority in The Administration of Taxes in Uganda by Magomu Nasuruunasuru100% (16)