Académique Documents

Professionnel Documents

Culture Documents

Tata Motors Fundamental Analysis

Transféré par

Rahul RaghwaniCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tata Motors Fundamental Analysis

Transféré par

Rahul RaghwaniDroits d'auteur :

Formats disponibles

TATA MOTORS

Tata Motors Limited is Indias largest automobile company, with consolidated revenues of

INR 2, 32, 834 crores (USD 38.9 billion) in 2013-14. It is the leader in commercial vehicles

in each segment, and among the top in passenger vehicles with winning products in the

compact, midsize car and utility vehicle segments. It is also the world's fifth largest truck

manufacturer and fourth largest bus manufacturer.

Financial Analysis of TATA Motors Ltd

RATIO ANALYSIS: - PROFITABILITY ANALYSIS

1) Profit Margin:

A higher profit margin indicates a more profitable company that has better control over its

costs compared to its competitors. Here, we calculate after-tax profit margin, given by:

Margin = PAT/Sales.

Profit Margin

2013-14

2012-13

2011-12

0.060090195

0.052399328 0.081594528

2010-11

0.07593366

Analysis: Profit Margin was increasing but saw a sudden dip in 2012-13 but is again on the

rise. This shows that the company is not having as good control over costs as it used to have

but this dip can be caused due to the losses prevalent in whole Indian automobile industry.

2) Return on Equity (ROE):

It is calculated as: ROE = Profit Available to Equity Shareholders/Shareholders Fund

ROE

2013-14

2012-13

2011-12

2010-11

0.213266528

0.262840586 0.407738418 0.483719819

Analysis: Company is giving good returns to the shareholders around 21%. Although ROE is

showing a similar pattern as Profit Margin which is justifiable as Automobile Industry is

facing a dip.

LEVERAGE RATIOS

Debt-Equity Ratio:

It is calculated as: D/E = Long term Borrowings / Shareholders Fund

D/E

2013-14

2012-13

2011-12

2010-11

0.689881553

0.854346353 0.843515507 0.900087474

Analysis: D/E ratio of the company is very high, but it is because TATA Motors has acquired

JLR in 2008-09 due to which it has taken a huge borrowing, but afterwards it is decreasing

constantly and has seen a sudden dip in this financial year.

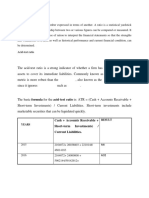

LIQUIDITY RATIOS

1) Current Ratio

It is calculated as: Current Ratio = Current Assets / Current Liabilities

Current Ratio

2013-14

2012-13

1.037779842

0.856814195

2011-12

2010-11

0.87980303 0.763507422

Analysis: Companys Current Ratio has been constantly increasing which shows that

company is increasing its current assets at a higher rate than current liabilities. Its a good

sign for liquidity in company. But we still need to check for quick ratio as current ratio can

have an increase due to high inventory.

2) Quick Ratio/Liquidity Ratio:

It is calculated as: Quick/Liquidity Ratio = (Current Assets Inventories)/ (Current

Liabilities Working Capital)

Quick Ratio

2013-14

2012-13

2011-12

2010-11

0.742500146

0.613742272 0.631181496 0.508262946

Analysis: Companys quick ratio is showing similar trend as current ratio. It means company

is having high liquidity to meet its short term obligations.

EFFICIENCY RATIOS

1) Asset Turnover Ratio:

Formula used: A/T Ratio = Sales / (Total Assets)

2013-14

2012-13

2011-12

2010-11

Assets Turnover

Ratio

1.0583429

1.108079823

1.1394379 1.209017585

Analysis: A/T ratio is decreasing which shows that companys need to work on that and

become more effective in using investment in assets to generate revenues.

2) Inventory Turnover Ratio:

It is calculated as: IT ratio = Raw material consumed / Average Raw Material Inventory

2013-14

2012-13

2011-12

2010-11

Inventory

Turnover Ratio

5.611942276

5.80092243 6.243931448 5.551353805

Analysis: IT ratio has been consistently decreasing but as we already know that sales has

decreased so this is not to worry about.

Latest related news

Excise duty in automobile sector will be continued which will further back growth in this

sector.

With an eye on beefing up its share in the burgeoning intermediate light commercial vehicle

(ILCV) segment, Tata Motors has launched a new range of trucks christened ULTRA.

Claimed to be contemporary in style, design and feature, the new ULTRA range of vehicles, Tata

Motors believes, will provide buyers comfort in terms of driving and cost of ownership.

Vous aimerez peut-être aussi

- Management Accounting Group-8: Anuraag S.Shahapur-14021 SINDHU S.-14154 Pooja Chiniwalar-14099Document15 pagesManagement Accounting Group-8: Anuraag S.Shahapur-14021 SINDHU S.-14154 Pooja Chiniwalar-14099prithvi17Pas encore d'évaluation

- Alkyl Amines Chemicals LTD (Ratio)Document7 pagesAlkyl Amines Chemicals LTD (Ratio)Hardik BhanushaliPas encore d'évaluation

- A Study On Financial Analysis of Tata Motors: AbstractDocument5 pagesA Study On Financial Analysis of Tata Motors: AbstracthimanshuPas encore d'évaluation

- Appraisal - TCS - FinalDocument61 pagesAppraisal - TCS - FinalgetkhosaPas encore d'évaluation

- Performance Evaluation - A Study With Reference To Tata MotorsDocument6 pagesPerformance Evaluation - A Study With Reference To Tata MotorsRio HongKongPas encore d'évaluation

- FAC Thomas CookDocument11 pagesFAC Thomas CookAkshay UtkarshPas encore d'évaluation

- Ratio AnalysisDocument31 pagesRatio AnalysisnikenPas encore d'évaluation

- Submitted By: Moeez Ul Hassan FA19-BAF-068 Submitted To: Sir Hashim Khan Financial Statement Analysis Final ProjectDocument16 pagesSubmitted By: Moeez Ul Hassan FA19-BAF-068 Submitted To: Sir Hashim Khan Financial Statement Analysis Final ProjectMoeez KhanPas encore d'évaluation

- Ratio Analysis ITCDocument15 pagesRatio Analysis ITCVivek MaheshwaryPas encore d'évaluation

- Working Capital & Dividend PolicyDocument9 pagesWorking Capital & Dividend PolicyLipi Singal0% (1)

- Ratio ANALYSIS OF CEAT TYRESDocument37 pagesRatio ANALYSIS OF CEAT TYRESS92_neha100% (1)

- Working Capital ManagementDocument49 pagesWorking Capital ManagementAshok Kumar KPas encore d'évaluation

- Ratio AnalysisDocument10 pagesRatio AnalysisSandesha Weerasinghe0% (1)

- Amui Ind. Pvt. LTDDocument29 pagesAmui Ind. Pvt. LTDArpit McWanPas encore d'évaluation

- Fake PDFDocument15 pagesFake PDFAkshay AggarwalPas encore d'évaluation

- Zerodha FundamentalAnalysisPt2Document87 pagesZerodha FundamentalAnalysisPt2rajeshksm100% (2)

- Financial Statement Analysis With Ratio Analysis On: Glenmark Pharmaceutical LimitedDocument41 pagesFinancial Statement Analysis With Ratio Analysis On: Glenmark Pharmaceutical LimitedGovindraj PrabhuPas encore d'évaluation

- Eng Kah Corporation BerhadDocument5 pagesEng Kah Corporation BerhadNoel KlPas encore d'évaluation

- Unit TrustDocument23 pagesUnit TrustqairunnisaPas encore d'évaluation

- Anandam Group ProjectDocument14 pagesAnandam Group Project31211021560Pas encore d'évaluation

- Financial Statement Analysis - HulDocument15 pagesFinancial Statement Analysis - HulNupur SinghalPas encore d'évaluation

- Financial Analysis of GSK Consumer HealthcareDocument36 pagesFinancial Analysis of GSK Consumer Healthcareadnan424100% (1)

- Deconstructing Roe: Improving Efficiency An Important Parameter While Investing in CompaniesDocument5 pagesDeconstructing Roe: Improving Efficiency An Important Parameter While Investing in CompaniesAkshit GuptaPas encore d'évaluation

- Financial Report Dutch LadyDocument55 pagesFinancial Report Dutch Ladymed11dz87% (23)

- Data Analysis and Interpretation Calculation and Interpretation of RatiosDocument27 pagesData Analysis and Interpretation Calculation and Interpretation of RatiosGGUULLSSHHAANNPas encore d'évaluation

- Tata Motors Ratio AnalysisDocument12 pagesTata Motors Ratio AnalysisVasu AgarwalPas encore d'évaluation

- Ratio Analysis of Dangote Cement PLCDocument8 pagesRatio Analysis of Dangote Cement PLCnoemaguma970Pas encore d'évaluation

- Cognizant Accounts. FinalDocument9 pagesCognizant Accounts. FinalkrunalPas encore d'évaluation

- An Analysis of The Financial Statement of Godrej India LTDDocument8 pagesAn Analysis of The Financial Statement of Godrej India LTDSachit MalikPas encore d'évaluation

- Nilesh Dandawate Project ReportDocument84 pagesNilesh Dandawate Project ReportNehul PatelPas encore d'évaluation

- Toyota Motor Corporation: Manegerial Economics AssignmentDocument11 pagesToyota Motor Corporation: Manegerial Economics AssignmentNatashaPas encore d'évaluation

- Massias Teddy 2011: Assignment Submission SheetDocument9 pagesMassias Teddy 2011: Assignment Submission SheetTeddy MassiasPas encore d'évaluation

- Assignment 2: Company Name: Tata Consultancy ServicesDocument15 pagesAssignment 2: Company Name: Tata Consultancy ServicesPooja talrejaPas encore d'évaluation

- Financial Ratio Analysis of Dabur India LTDDocument11 pagesFinancial Ratio Analysis of Dabur India LTDHarshit DalmiaPas encore d'évaluation

- Ratio AnalysisDocument8 pagesRatio AnalysisikramPas encore d'évaluation

- Liquidity Ratios AssignmentDocument6 pagesLiquidity Ratios AssignmentNoor Hidayah Binti Taslim0% (1)

- Data, Analysis and Findings: Tata MotorsDocument24 pagesData, Analysis and Findings: Tata MotorsAjoy MahajanPas encore d'évaluation

- Maple Leaf Cement CompanyDocument35 pagesMaple Leaf Cement CompanyHira Mustafa ShahPas encore d'évaluation

- Assignment of Financial AccountingDocument15 pagesAssignment of Financial AccountingBhushan WadherPas encore d'évaluation

- Acc CompilationDocument89 pagesAcc CompilationMehedi Hasan DurjoyPas encore d'évaluation

- Tata Motors PresentationDocument39 pagesTata Motors PresentationSarita GoelPas encore d'évaluation

- Ratio Analysis HyundaiDocument12 pagesRatio Analysis HyundaiAnkit MistryPas encore d'évaluation

- Financial Analysis Report of Raymond FinalDocument14 pagesFinancial Analysis Report of Raymond FinalAnkit prakashPas encore d'évaluation

- Series 1: 1. Profit Margin RatioDocument10 pagesSeries 1: 1. Profit Margin RatioPooja WadhwaniPas encore d'évaluation

- Assignment FIN 501Document14 pagesAssignment FIN 501MmeraKiPas encore d'évaluation

- Tesla Inc. ReportDocument28 pagesTesla Inc. ReportJoel FernandesPas encore d'évaluation

- Financial Ratio Analysis of Indus Motor Company LTDDocument40 pagesFinancial Ratio Analysis of Indus Motor Company LTDAurang ZaibPas encore d'évaluation

- ETL ProcessDocument6 pagesETL ProcessMd MotalebPas encore d'évaluation

- Project ArticleDocument12 pagesProject ArticleAkash SPas encore d'évaluation

- AXIS Bank AnalysisDocument44 pagesAXIS Bank AnalysisArup SarkarPas encore d'évaluation

- CF Project Group 10Document14 pagesCF Project Group 10Divam AroraPas encore d'évaluation

- Accnts Projest - BajajDocument24 pagesAccnts Projest - BajajAprajita SaxenaPas encore d'évaluation

- Accounts AssignmentDocument5 pagesAccounts AssignmentVatsal MagajwalaPas encore d'évaluation

- Strategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Document40 pagesStrategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Rupesh KadamPas encore d'évaluation

- Financial Report Analysis UtsDocument14 pagesFinancial Report Analysis UtsRahma Yulia PrastiwiPas encore d'évaluation

- Ratio Analysis of Shinepukur Ceremics Ltd.Document0 pageRatio Analysis of Shinepukur Ceremics Ltd.Saddam HossainPas encore d'évaluation

- Financial Management Assignment: Du Pont Analysis On HERO MOTO CORP. and HONDA MotorsDocument7 pagesFinancial Management Assignment: Du Pont Analysis On HERO MOTO CORP. and HONDA MotorsSidharth AnandPas encore d'évaluation

- Pravin ChoudharyDocument14 pagesPravin Choudharypravinchoudhary740Pas encore d'évaluation

- Effect of Investor Relation On Corporate Bond Credit RatingDocument12 pagesEffect of Investor Relation On Corporate Bond Credit RatingRahul RaghwaniPas encore d'évaluation

- Corporate Bonds PDFDocument168 pagesCorporate Bonds PDFRahul RaghwaniPas encore d'évaluation

- NISM Series V-A Mutual Fund Distributors Final Feb 2017Document303 pagesNISM Series V-A Mutual Fund Distributors Final Feb 2017Hardik ParikhPas encore d'évaluation

- NISM Series V-A Mutual Fund Distributors Final Feb 2017Document303 pagesNISM Series V-A Mutual Fund Distributors Final Feb 2017Hardik ParikhPas encore d'évaluation

- Capital Market and ParticipantsDocument21 pagesCapital Market and ParticipantsRahul RaghwaniPas encore d'évaluation

- Capital Market and ParticipantsDocument21 pagesCapital Market and ParticipantsRahul RaghwaniPas encore d'évaluation

- 01 EthicsDocument230 pages01 EthicsRahul RaghwaniPas encore d'évaluation

- ImcDocument45 pagesImcRahul RaghwaniPas encore d'évaluation

- Energy Price and Demand Annual Long-Term Forecast RevisedDocument148 pagesEnergy Price and Demand Annual Long-Term Forecast RevisedseedpowerPas encore d'évaluation

- Automobile August 2014Document47 pagesAutomobile August 2014Rahul RaghwaniPas encore d'évaluation

- Ketan Parekh ScamDocument4 pagesKetan Parekh Scamsumeetnikam26Pas encore d'évaluation

- CRISIL Aptitude Test: Sample QuestionsDocument4 pagesCRISIL Aptitude Test: Sample Questionsatish785% (26)

- Aviation IndiaDocument40 pagesAviation Indiassuresh314Pas encore d'évaluation

- Paper 7 CmaDocument16 pagesPaper 7 CmaRama KrishnaPas encore d'évaluation

- Banco Filipino Vs NavarroDocument2 pagesBanco Filipino Vs NavarroAnonymous GMUQYq8100% (1)

- Principle CH 8 Ed.23 Oxley Internal Control, and Cash)Document8 pagesPrinciple CH 8 Ed.23 Oxley Internal Control, and Cash)Heri SiringoringoPas encore d'évaluation

- Sfti TT Bandwidth Guideline b2bDocument27 pagesSfti TT Bandwidth Guideline b2bcvfPas encore d'évaluation

- Muhammad Aslam - JulyDocument1 pageMuhammad Aslam - JulyNajma KanwalPas encore d'évaluation

- ADVANCED FA Chap IIIDocument7 pagesADVANCED FA Chap IIIFasiko Asmaro100% (1)

- Afar 02 P'ship Operation QuizDocument4 pagesAfar 02 P'ship Operation QuizJohn Laurence LoplopPas encore d'évaluation

- Lira District Report of The Auditor General 2015 PDFDocument59 pagesLira District Report of The Auditor General 2015 PDFlutos2Pas encore d'évaluation

- Hyperin Ation in Venezuela: Research Question, Aim and GoalDocument2 pagesHyperin Ation in Venezuela: Research Question, Aim and GoalMilica NikolicPas encore d'évaluation

- Payment InstructionDocument2 pagesPayment Instructionjiachendu.caPas encore d'évaluation

- Comparative Balance Sheet: MeaningDocument64 pagesComparative Balance Sheet: MeaningRahit MitraPas encore d'évaluation

- 12th Balance of Payment MCQsDocument41 pages12th Balance of Payment MCQsrimjhim sahuPas encore d'évaluation

- ATC List 2017 Updated 5517Document47 pagesATC List 2017 Updated 5517Varinder AnandPas encore d'évaluation

- Moody's Financial Metrics KeyDocument48 pagesMoody's Financial Metrics KeyJoao SilvaPas encore d'évaluation

- Suggested Solutions/ Answers Fall 2016 Examinations 1 of 8: Business Taxation (G5) - Graduation LevelDocument8 pagesSuggested Solutions/ Answers Fall 2016 Examinations 1 of 8: Business Taxation (G5) - Graduation LevelQadirPas encore d'évaluation

- Pas 26Document2 pagesPas 26AnnePas encore d'évaluation

- A Primer For Investment Trustees: Jeffery V. Bailey, CFA Jesse L. Phillips, CFA Thomas M. Richards, CFADocument120 pagesA Primer For Investment Trustees: Jeffery V. Bailey, CFA Jesse L. Phillips, CFA Thomas M. Richards, CFANiraj VishwakarmaPas encore d'évaluation

- Risk Capital Management 31 Dec 2011Document181 pagesRisk Capital Management 31 Dec 2011G117Pas encore d'évaluation

- (Sarvesh Dhatrak) Derivatives in Stock Market and Their Importance in HedgingDocument79 pages(Sarvesh Dhatrak) Derivatives in Stock Market and Their Importance in Hedgingsarvesh dhatrakPas encore d'évaluation

- The Paddington Place - Studio 23.67sqmDocument14 pagesThe Paddington Place - Studio 23.67sqmGenki DayouPas encore d'évaluation

- Assign 2 Cash Flow Basic Sem 1 13 14Document2 pagesAssign 2 Cash Flow Basic Sem 1 13 14Sumaiya AbedinPas encore d'évaluation

- Audit of Wasting Assets Learning ObjectivesDocument3 pagesAudit of Wasting Assets Learning ObjectivesTrisha Mae RodillasPas encore d'évaluation

- Tax Issues in M A PDFDocument56 pagesTax Issues in M A PDFKhushboo GuptaPas encore d'évaluation

- Engineering Competency IndicatorsDocument23 pagesEngineering Competency IndicatorsSyed Muhammad JahangeerPas encore d'évaluation

- PXP Energy Corporation (Formerly Philex Petroleum Corporation) ("PXP" or "The Company"), Is ADocument2 pagesPXP Energy Corporation (Formerly Philex Petroleum Corporation) ("PXP" or "The Company"), Is ABERNA RIVERAPas encore d'évaluation

- Merchandising Reviewer 2Document5 pagesMerchandising Reviewer 2Sandro Marie N. ObraPas encore d'évaluation

- Mcq-Income TaxesDocument7 pagesMcq-Income TaxesRandy Manzano100% (1)

- Review Notes in Corporation Law 2023Document13 pagesReview Notes in Corporation Law 2023Se'f BenitezPas encore d'évaluation

- As Unnit 5 Class NotesDocument38 pagesAs Unnit 5 Class NotesAlishan VertejeePas encore d'évaluation

- Recently Asked KYC Interview Questions and AnswersDocument21 pagesRecently Asked KYC Interview Questions and AnswersChika Novita PutriPas encore d'évaluation