Académique Documents

Professionnel Documents

Culture Documents

Palamon

Transféré par

Ryan TeichmannCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Palamon

Transféré par

Ryan TeichmannDroits d'auteur :

Formats disponibles

Ryan Teichmann

Executive Summary

Should Palamon Capital Buy 51% of TeamSystems Equity for EUR 25.9 Million?

Palamon Capital, a generalist private equity fund, is based in the United Kingdom.

Palamon did not limit itself to investing in one specific country or to one industry. Instead,

Palamon focused on small to midsized European companies it could acquire a controlling stake

from between EUR 10 million and EUR 50 million. Palamon is interested in acquiring

TeamSystem, S.p.A Italys leading provider of accounting tax and payroll management software

for small to medium sized businesses. Palamon Capital is interested in acquiring 51% of

TeamSystems common shares for EUR 25.9 million, but is unsure how much 51% of equity is

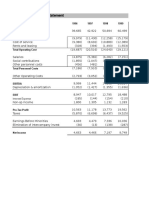

really worth. Using the discounted cash flow method, 51% of equity in TeamSystem is worth

EUR 30.69 million (exhibit 1) and using the multiple comparables method, 51% of equity is

worth EUR 69.14 million from comparing the revenue and EBIT multiple, and EUR 59.46

million from comparing the price to book multiple (exhibit 6).

In the discounted cash flow model, there are two calculations that might not be so obvious.

Change in NWC occurred after the cash restructuring that Palamon required of TeamSystems.

Because of this, current assets decreased causing the change in NWC be 14% of sales increase.

Capital expenditures are calculated by the change in end of the period noncurrent assets plus

depreciation. The tax rate of 48% seems very high but is within reason, according to Trading

Economics the average corporate tax rate for Italy is 38.52% from 1995 until 2014.

(http://www.tradingeconomics.com/italy/corporate-tax-rate). Exhibit 2 shows Italys corporate

tax rate from 1999 to 2007. From the discounted cash flow model, three sensitivity analysis

comparing the terminal growth rate to the discount rate (exhibit 3), the sales growth to the

Ryan Teichmann

discount rate (exhibit 4), and the tax rate to the discount rate (exhibit 5). The three sensitivity

analysis show that Palamons valuation of TeamSystem is very sensitive to the discount rate and

that there is not much margin for error in Palamons calculated WACC of 14%.

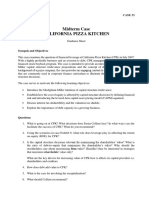

In the multiple comparables model, a revenue multiple valuation is chosen because it

incorporates the size of all of the firms in the comparable group. An EBIT multiple valuation is

also chosen because it incorporates the profitability of all of the firms in the comparable group.

The chosen comparable group is tier 2. This is because the group has similar equity market

value, similar debt and similar total assets compared to TeamSystem. The tier 2 group also offers

similar products as TeamSystem, middle market accounting software solutions. The median

multiple is chosen for both the revenue and the EBIT from the tier 2 group. The median is

chosen because there are some outlier multiples from some of the companies that are in the

comparables group. From the revenue and EBIT comparison, 51% of TeamSystem is worth

EUR 69.14 million. Comparing the price to book ratio of TeamSystem is another way to gauge

value. Again using the tier 2 comparable group and again using the median rather than the

average because of the outlier. From this, 51% of TeamSystems equity is worth EUR 59.46

million.

From both methods, it is obvious that acquiring 51% of TeamSystems equity for EUR

25.9 million is a very attractive deal. But this is in a perfect situation and does not account for

any of the risks involved. Some of these risks include an exchange rate risk between the Euro

and Lira, and also the risk of dealing with a foreign government. Italy has a very high tax rate

and is active in the payroll industry, which causes regulations to change several times a year.

Ryan Teichmann

With all of this active management, the Italian government might intervene slowing the deal or

preventing it from happening at all.

Exhibit 1

Ryan Teichmann

Exhibit 2

Ryan Teichmann

Exhibit 3

Exhibit 4

Exhibit 5

Ryan Teichmann

Exhibit 6

Vous aimerez peut-être aussi

- Case 51 - SolDocument20 pagesCase 51 - SolArdian Syah75% (4)

- Palamon Capital PartnersDocument9 pagesPalamon Capital PartnersIngridHoernigCubillos0% (1)

- Case 51 Palamon Capital Partners Team System SPADocument10 pagesCase 51 Palamon Capital Partners Team System SPAcrs50% (2)

- Debt Policy at Ust Case SolutionDocument2 pagesDebt Policy at Ust Case Solutiontamur_ahan50% (2)

- AirThread G015Document6 pagesAirThread G015Kunal MaheshwariPas encore d'évaluation

- Linear Technology Payout Policy Case 3Document4 pagesLinear Technology Payout Policy Case 3Amrinder SinghPas encore d'évaluation

- Jetblue Airways Ipo ValuationDocument6 pagesJetblue Airways Ipo ValuationXing Liang HuangPas encore d'évaluation

- DC 51: Busi 640 Case 3: Valuation of Airthread ConnectionsDocument4 pagesDC 51: Busi 640 Case 3: Valuation of Airthread ConnectionsTunzala ImanovaPas encore d'évaluation

- California Pizza Kitchen Rev2Document7 pagesCalifornia Pizza Kitchen Rev2ahmed mahmoud100% (1)

- Section I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeDocument11 pagesSection I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeclendeavourPas encore d'évaluation

- California Pizza KitchenDocument4 pagesCalifornia Pizza KitchenMarvi Ahmad100% (2)

- SFM Wrigley JR Case Solution HBRDocument17 pagesSFM Wrigley JR Case Solution HBRHayat Omer Malik100% (1)

- Blaine SolutionDocument4 pagesBlaine Solutionchintan MehtaPas encore d'évaluation

- AirThread Class 2020Document21 pagesAirThread Class 2020Son NguyenPas encore d'évaluation

- Airthread Connections Work Sheet SelfDocument65 pagesAirthread Connections Work Sheet SelfkjhathiPas encore d'évaluation

- Airthread Connections NidaDocument15 pagesAirthread Connections NidaNidaParveen100% (1)

- UST Final CaseDocument4 pagesUST Final Casestrongchong0050% (2)

- Assessing Earnings Quality at NuwareDocument7 pagesAssessing Earnings Quality at Nuwaremyhellonearth0% (1)

- Caso TeuerDocument46 pagesCaso Teuerjoaquin bullPas encore d'évaluation

- Airthread Valuation Group#2Document24 pagesAirthread Valuation Group#2Himanshu AgrawalPas encore d'évaluation

- Case 45 American GreetingsDocument8 pagesCase 45 American GreetingsMustafa Ali100% (5)

- Mercuryathleticfootwera Case AnalysisDocument8 pagesMercuryathleticfootwera Case AnalysisNATOEEPas encore d'évaluation

- DuPont QuestionsDocument1 pageDuPont QuestionssandykakaPas encore d'évaluation

- Kohler Co. (A)Document18 pagesKohler Co. (A)Juan Manuel GonzalezPas encore d'évaluation

- M&A - Group 3 - AirThread ValuationDocument6 pagesM&A - Group 3 - AirThread ValuationPradeep Reddy BaddamPas encore d'évaluation

- Introduction To The CaseDocument48 pagesIntroduction To The CaseRohit Jain100% (5)

- Jetblue CaseDocument5 pagesJetblue Caseangecorin_52730226275% (4)

- AirThread ConnectionDocument26 pagesAirThread ConnectionAnandPas encore d'évaluation

- Seagate CaseDocument1 pageSeagate Casepexao87Pas encore d'évaluation

- Online AnswerDocument4 pagesOnline AnswerYiru Pan100% (2)

- Midterm Case California Pizza KitchenDocument2 pagesMidterm Case California Pizza KitchenAhmed El Khateeb100% (1)

- Airthread SolutionDocument30 pagesAirthread SolutionSrikanth VasantadaPas encore d'évaluation

- Diageo RefenceDocument7 pagesDiageo RefenceKenny HoPas encore d'évaluation

- Sampa Video Case SolutionDocument6 pagesSampa Video Case SolutionRahul SinhaPas encore d'évaluation

- BurtonsDocument6 pagesBurtonsKritika GoelPas encore d'évaluation

- LinearDocument6 pagesLinearjackedup211Pas encore d'évaluation

- Millions of Dollars Except Per-Share DataDocument14 pagesMillions of Dollars Except Per-Share DataVishal VermaPas encore d'évaluation

- Mergers & AcquisitionsDocument2 pagesMergers & AcquisitionsRashleen AroraPas encore d'évaluation

- Valuation of AirThreadConnectionsDocument3 pagesValuation of AirThreadConnectionsmksscribd100% (1)

- JetBlue Case StudyDocument4 pagesJetBlue Case StudyXing Liang Huang100% (1)

- TN15 Teletech Corporation 2005Document8 pagesTN15 Teletech Corporation 2005kirkland1234567890100% (2)

- CasoDocument20 pagesCasoasmaPas encore d'évaluation

- KOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedDocument30 pagesKOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedmanjeetsrccPas encore d'évaluation

- Roche S Acquisition of GenentechDocument34 pagesRoche S Acquisition of GenentechPradipkumar UmdalePas encore d'évaluation

- TN33 California Pizza KitchenDocument8 pagesTN33 California Pizza KitchenChittisa CharoenpanichPas encore d'évaluation

- Exhibits of Blaine Kitchenware, Inc - CaseDocument6 pagesExhibits of Blaine Kitchenware, Inc - CaseSadam Lashari100% (3)

- Valuation of Airthread Connections Questions TraductionDocument2 pagesValuation of Airthread Connections Questions TraductionNatalia HernandezPas encore d'évaluation

- Airthread DCF Vs ApvDocument6 pagesAirthread DCF Vs Apvapi-239586293Pas encore d'évaluation

- DuPont Corporation Sale of Performance CoatingsDocument1 pageDuPont Corporation Sale of Performance Coatingsj2203950% (2)

- Paginas Amarelas Case Week 8 ID 23025255Document4 pagesPaginas Amarelas Case Week 8 ID 23025255Lesgitarmedit0% (1)

- Ameritrade Case SolutionDocument34 pagesAmeritrade Case SolutionAbhishek GargPas encore d'évaluation

- Case Analysis - Worldwide Paper Company: Finance ManagementDocument8 pagesCase Analysis - Worldwide Paper Company: Finance ManagementVivek SinghPas encore d'évaluation

- Quiz 1 FMDocument3 pagesQuiz 1 FMwaqar HaiderPas encore d'évaluation

- Tax Compliance and Firms' Strategic InterdependenceDocument24 pagesTax Compliance and Firms' Strategic InterdependenceSekar JagatPas encore d'évaluation

- Firm Valuation: Fama and French (Three Factor) ModelDocument3 pagesFirm Valuation: Fama and French (Three Factor) ModelwaliyaPas encore d'évaluation

- Investment Analysis Fleury MichonDocument5 pagesInvestment Analysis Fleury MichonERQA-Consulting100% (1)

- Financial Statement Analysis of Target and TescoDocument15 pagesFinancial Statement Analysis of Target and TesconormaltyPas encore d'évaluation

- Financial Statement Analysis Tesco TargetDocument6 pagesFinancial Statement Analysis Tesco Targetnormalty100% (3)

- Assignment Portfolio Analysis 2015 Masters in FinanceDocument7 pagesAssignment Portfolio Analysis 2015 Masters in FinanceSEPas encore d'évaluation

- Dupont Ratio AnalysisDocument22 pagesDupont Ratio Analysiszeeshan655100% (1)

- Carded RewriteDocument6 pagesCarded RewriteRyan TeichmannPas encore d'évaluation

- Carded RewriteDocument8 pagesCarded RewriteRyan Teichmann50% (2)

- Corporate Raider Criticizes One-Hurdle Rate Approach of TeletechDocument8 pagesCorporate Raider Criticizes One-Hurdle Rate Approach of TeletechRyan Teichmann0% (1)

- Finance Case Competition Team 8 Executive Report PDFDocument11 pagesFinance Case Competition Team 8 Executive Report PDFRyan TeichmannPas encore d'évaluation

- NODz To B5 Ocrv 0 EZhDocument9 pagesNODz To B5 Ocrv 0 EZhRajesh PanchalPas encore d'évaluation

- E0300MMPFDDocument2 pagesE0300MMPFDRISHAD P.PPas encore d'évaluation

- Management Lesson Learned Honda - Case - StudyDocument2 pagesManagement Lesson Learned Honda - Case - Studymarian obagPas encore d'évaluation

- DBC SagarDocument1 pageDBC Sagarsagar aroraPas encore d'évaluation

- Assignment 3 Questionnaire Unit 2 1st TryDocument6 pagesAssignment 3 Questionnaire Unit 2 1st TryDiego ArmandoPas encore d'évaluation

- Coursera - Marketing ResearchDocument1 pageCoursera - Marketing Researchutkarsh bhargavaPas encore d'évaluation

- Full Download Strategic Management Concepts and Cases Competitiveness and Globalization 11th Edition Hitt Test BankDocument36 pagesFull Download Strategic Management Concepts and Cases Competitiveness and Globalization 11th Edition Hitt Test Bankowen4ljoh100% (31)

- ERP ImplementationDocument14 pagesERP ImplementationUmer UsmaniPas encore d'évaluation

- Chapter 2 - A Further Look at Financial StatementsDocument18 pagesChapter 2 - A Further Look at Financial StatementsCông Hoàng ĐìnhPas encore d'évaluation

- Chapter 6 - Global Information Systems and Market ResearchDocument27 pagesChapter 6 - Global Information Systems and Market Researchaqiilah subrotoPas encore d'évaluation

- Bengkalis MuriaDocument10 pagesBengkalis Muriareza hariansyahPas encore d'évaluation

- KL Avante Unit Plan Brochure - v1 - Low ResDocument56 pagesKL Avante Unit Plan Brochure - v1 - Low ResPavan KumarPas encore d'évaluation

- 2021 Modern Banking Practices: (Major/General) Paper: 603Document7 pages2021 Modern Banking Practices: (Major/General) Paper: 603KHALNAYAKPas encore d'évaluation

- Case Study No 16Document1 pageCase Study No 16AndreeaRaducuPas encore d'évaluation

- Management Thsis On Rajasthan PatrikaDocument94 pagesManagement Thsis On Rajasthan Patrikasubhashicfai100% (3)

- Development and Change - 2005 - Dasgupta - Will Services Be The New Engine of Indian Economic GrowthDocument23 pagesDevelopment and Change - 2005 - Dasgupta - Will Services Be The New Engine of Indian Economic GrowthIdhant ChowdhuryPas encore d'évaluation

- International MarketingDocument19 pagesInternational MarketingDenza Primananda AlfurqanPas encore d'évaluation

- Ninjacart - Indian Company - Company ProfileDocument23 pagesNinjacart - Indian Company - Company ProfileebePas encore d'évaluation

- HNB Report-2Document37 pagesHNB Report-2Samith GurusinghePas encore d'évaluation

- AC530 Accounting Theory Module 6 AssignmentDocument3 pagesAC530 Accounting Theory Module 6 AssignmentMCPas encore d'évaluation

- Lost in Time: Intergenerational Succession, Change, and Failure in Family BusinessDocument19 pagesLost in Time: Intergenerational Succession, Change, and Failure in Family BusinessGrupo de PesquisaPas encore d'évaluation

- Timesheet - 01 - 09 - 2021 To 05 - 09 - 2021Document1 pageTimesheet - 01 - 09 - 2021 To 05 - 09 - 2021dileep dudiPas encore d'évaluation

- 2-Minutes Noodle S: Presented By: - Meghna P - Goldy Hirawat - Manish Negi - Ashis Kyal - Deepak Rai - Poonam MishraDocument16 pages2-Minutes Noodle S: Presented By: - Meghna P - Goldy Hirawat - Manish Negi - Ashis Kyal - Deepak Rai - Poonam MishraShubham SinghPas encore d'évaluation

- Assessment and Proposal Writeshop For Peoples Organization Under Biodiversity Friendly EnterpriseDocument3 pagesAssessment and Proposal Writeshop For Peoples Organization Under Biodiversity Friendly EnterpriseCirilo Jr. LagnasonPas encore d'évaluation

- XXX eWOM Via The TikTok ApplicationDocument11 pagesXXX eWOM Via The TikTok ApplicationDuy KhánhPas encore d'évaluation

- PMG Note Chapter 5Document15 pagesPMG Note Chapter 5Nur Alisa FatinPas encore d'évaluation

- 10 International AcquisitionsDocument6 pages10 International Acquisitionsbk gautamPas encore d'évaluation

- Managers - We Are Katti With You - DarpanDocument2 pagesManagers - We Are Katti With You - DarpanDarpan ChoudharyPas encore d'évaluation

- INDUSTRIAL ENGINEERING Assignment 1Document21 pagesINDUSTRIAL ENGINEERING Assignment 1AmanPas encore d'évaluation