Académique Documents

Professionnel Documents

Culture Documents

Montgomery County TX Road Bonds Series 2003A

Transféré par

RENTAVOTER0 évaluation0% ont trouvé ce document utile (0 vote)

33 vues110 pages$24 million borrowed by Montgomery County Commissioners with principal payments deferred for 19.8 years. First balloon payment 3/1/2023

Titre original

Montgomery County Tx Road Bonds Series 2003A

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce document$24 million borrowed by Montgomery County Commissioners with principal payments deferred for 19.8 years. First balloon payment 3/1/2023

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

33 vues110 pagesMontgomery County TX Road Bonds Series 2003A

Transféré par

RENTAVOTER$24 million borrowed by Montgomery County Commissioners with principal payments deferred for 19.8 years. First balloon payment 3/1/2023

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 110

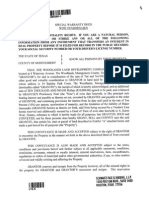

OFFICIAL STATEMENT DATED MARCH 31, 2003

IN THE OPINION OF BOND COUNSEL, INTEREST ON THE BONDS IS EXCLUDABLE FROM GROSS

INCOME FOR FEDERAL INCOME TAX PURPOSES UNDER EXISTING LAW AND THE BONDS ARE NOT

PRIVATE ACTIVITY BONDS. SEE “TAX MATTERS - TAX EXEMPTION” FOR A DISCUSSION OF THE

OPINION OF BOND COUNSEL, INCLUDING A DESCRIPTION OF ALTERNATIVE MINIMUM TAX

CONSEQUENCES FOR CORPORATIONS.

NEW ISSUES: BOOK-ENTRY-ONLY Ratings: Standard & Poor’s Ratings Group (Ambac) - “AAA”:

‘Moody's Investors Service (Ambac) - “Aaa”

$24,000,000 $10,000,000

MONTGOMERY COUNTY, TEXAS MONTGOMERY COUNTY, TEXAS

Unlimited Tax Road Bonds Limited Tax Library Bonds

Series 2003A. Series 2003B

Dated: April 1, 2003 Due; March 1, as shown on the inside cover page hereof

‘The $24,00,000 Montgomery County, Texas, Unlimited Tax Road Bonds, Series 20034 (the “Series A Bonds")

and the $10,000,000 Montgomery County, Texas, Limited Tax Library Bonds, Series 2003B (the “Series B

Bonds") (the Seties A Bonds and the Series B Bonds are referred to herein collectively as the “Bonds"), are

being issued by the Commissioners Court of Montgomery County (the “County”) pursuant to the terms of two

separate orders adopted by the Commissioners Court of the County. ‘The Series A Bonds are payable from an

‘nnual ad valorem tax on all taxable property in the County, without limit as to tate or amount. The Series B

Bonds are payable ftom an annual ad valorem fax on all taxable property in the County, within the limits

prescribed by law. See “THE BONDS - Source of Payment” and “TAXING PROCEDURES AND TAX BASE

ANALYSIS - Tax Rate Limitations.”

Interest on the Bonds will accrue from April 1, 2003, and will be payable March | and September | of each year,

commencing March 1, 2004. Principal of the Bonds is payable at Bunk One, N.A.. the paying agentregistrar (the

“Paying AgeatRegistrar”). The Bonds are initially registered ané delivered only to Cede & Co.. the nominee of

‘The Depository Trust Company (“DTC") pursuant to the Book-Entry-Only System described herein. Beneficial

‘ownership of the Bonds may be acquired in denominations of $5,000 or integral multiples thereof. No physical

‘livery of the Bonds will be made to the beneficial owners thereof. Principal of and interest on the Bonds

wrll be payable by the Paying Agent’Regisrar to Cede & Co,, which will make distribution of the amounts 90

paid to the beneficial owners of the Bonds. See “THE BONDS - Book-Entry-Only Systens” herein, Interest on

the Bonds is payable to the registered ovmers (initially Cede && Co.) appearing on the registration books of the

Paying Agent/Registrar on the 15th day of the month preceding each interest payment date (the “Record Date")

See “THE BONDS - General.”

Payment ofthe principal of end interest on the Bonds when due will be insured by 2 financial guaranty insurance

policy to be issued by Ambac Assurance Company simultaneously with the delivery ofthe Bonds.

Ambac

See Principal Amounts, Maturities, Interest Rates, and Prices on the Following Page

“The proceeds of the Series A Bonds will be used for road improvements within the County and payment of the

costs of issuance incurred in connection with the sale ofthe Series A Bonds. Proceeds of the Series B Bonds witl

bbe used to construct library improvements for the County and pay costs of issuance of the Series B Bonds. See

“THE BONDS - Purpose of the Bonds and Use of Proceeds.”

‘The Bonds are offered when, as and if issued by the County and accepted by the Underwriters, subject to the

approval of legality by the Attorney General of the State of Texas and by Vinson & Elkins L.L.P.. Houston,

Texas, Bond Counsel, Certain legal matters will be passed upon for the Underwriters by Fulbright & Jaworski

LLLP, Houston, Texas, Counsel for the Underwriters. It is expected that the Bonds will be delivered on or about

May 1, 2003,

‘UBS PAINEWEBBER INC.

FIRST SOUTHWEST COMPANY JPMORGAN

PRINCIPAL AMOUNTS, MATURITIES, INTEREST RATES AND PRICES

UNLIMITED TAX ROAD BONDS, SERIES 20034,

$24,000,000 Term Bonds Due March 1, 2026(b)(c) 5.00% Initial Reoffering Price 100.456%

LIMITED TAX LIBRARY BONDS, SERIES 2003B

$7,250,000 Serial Bonds

Initial Initial

Maturity Principal ‘Interest ~—-Reofiering «Maturity Principal ©—=—nterest_ © -Reoffering

(March 1) Amount Rate _Yield(@)_(March1)__Amount Rate Yield @)

2006 $100,000 1.95% 2015(6) $445,000 4.125% 422%

2007 30,000 240 2016() 460,000 4.250 432

2008 340,000 277 2017(b) 485,000 4375 442

2009 350,000 3.10 2018() 505,000 4.500 451

2010 365,000 342 2019() $30,000 4.500 4.60

2011 375,000 3.69 2020) $50,000 4.600 4.69

2012 395,000, 3.84 2021() $80,000 4.700 478

2013 410,000 397 2022() 605,000 4.750 485

201406) 425,000 410

@

)

©

$2,750,000 Term Bonds Due March 1, 2026(b) 5.00% Initial Reoffering Price 100.456%

The init yields will be established by and are the sole responsibility of the Underwriters (herein after

defined) and may subsequently be changed.

Subject to optional redemption as described herein. See “THE BONDS - Optional Redemption.”

Subject to mandatory redemption as described herein, See “THE BONDS - Mandatory Redemption.”

COUNTY OFFICIALS

Elected Officials

‘Commissioners’ Court

‘Alan B, Sadler County Judge

‘Mike Meador (Commissioner, Precinct 1

Craig Doyal (Commissioner, Precinct 2

Emest E. Chance Commissioner, Precinct 3

Ed Rinehart Commissioner, Precinct 4

Other Elected and Appointed Officials

Name osition

JR. Moore, I. Tax Assessor - Collector

Martha N. Gustavsen County Treasurer

Linda R, Breazeale County Auditor

‘Mark Bosma Purchasing Agent

David Walker County Attomey

Consultants and Advisors

Auditors Hereford, Lynch, Sellars & Kirkham, CPA.

Conroe, Texas

- Vinson & Elkins LLP.

Houston, Texas

Bond Counsel.

Disclosure Counsel. vw Andrews & Kurth LLP.

Houston, Texas

Financial Advisor «.... RBC Dain Rauscher Ine.

Houston, Texas

No dealer, broker, salesman or other person has been authorized by the County or the Underwriters to give any

information or to make any representation, other than those contained in this Official Statement, and, if given or

‘made, such other information or representations must not be relied upon as having been authorized by the County or

the Underwriters.

‘This Official Statement is not to be used in an offer to sel or the solicitation of an offer to buy in any state in which

such offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to

do 80 or to any person to whom it is unlawful to make such offer or solicitation,

IN CONNECTION WITH THE OFFERING OF THE BONDS, THE UNDERWRITERS MAY OVER-ALLOT OR

EFFECT TRANSACTIONS WHICH STABILIZE OR MAINTAIN THE MARKET PRICE OF THE BONDS AT

A LEVEL ABOVE THAT WHICH MIGHT OTHERWISE PREVAIL IN THE OPEN MARKET. SUCH

STABILIZING, IF COMMENCED, MAY BE DISCONTINUED AT ANY TIME.

Any information and expressions of opinion herein contained are subject to change without notice, and neither the

delivery of this Official Statement nor any sale made hereunder shall, under any circumstances, create any

implication that there hes been no change in the affairs of the County or other matters described herein since the date

hereof.

‘The Underwriters have provided the following sentence for inclusion in this Official Statement. The Underwriters

have reviewed the information in this Official Statement in accordance with, and as part of, their responsibilities to

investors under the federal securities laws as applied to the facts and circumstances of this transaction, but the

Underwriters do not guarantee the accuracy or completeness of such information.

‘TABLE OF CONTENTS

Page

INTRODUCTION, Legal Investments.

SALE AND DISTRIBUTION OF THE BONDS. Investment Policies

Sale of the Series A Bonds.

Sale of the Series B Bonds.

Prices and Marketability.

Securities Laws.

Ratings...

FINANCIAL GUARANTY INSURANCE.

Payment Pursuant to Financial Guaranty

Policy. a

“Ambac Assurance Corporatio

Available Information.

Incorporation of Certain Documents by Reference

OFFICIAL STATEMENT SUMMARY

THE BONDS

General ron

Book-Entry-Only System

Use of Certain Terms in Other Sections of this

Official Statement,

Optional Redemption,

‘Mandatory Redemption...

‘Notice of Redemption..

Source of Payment of the Bon

Purpose of the Bonds and Use of Proceed.

Authorization for the Series A Bonds.

‘Authorization ofthe Series B Bonds...

Future Borowing,

Registered Owners’ Ret

‘Legal Investments in Tex no

INVESTMENT AUTHORITY AND INVESTMENT

OBIECTIVES OF THE COUNTY, 4

DEBT SERVICE REQUIREMENTS...

COUNTY DEBT...

General ne

Indebtedness...

Estimated Overlapping Debt Statement

Debt Ratios.

Other Obligations...

‘TAXING PROCEDURES AND T.

ANALYSIS,

General

Property Tax Code and County Wide Appraisal

District non

Property Subject to Taxation bythe County onn<.20

Residential Homestead Exemptions.

Freeport Goods Exemption.

‘Tax Abatement...

Pollution Control...

‘Valuation of Property for Taxation.

‘County and Taxpayer Remedies.

Levy and Collection of Taxes,

County's Rights ine Event of Tax Deingences23

‘Tax Rate Limitations...

Historical Analysis of Tax Colleton.

Delinquent Tax Collection Procedures.

Tax Rate Distribution.

Analysis of Tax Base nn

‘Top Ten Principal Taxpayers

Tax Adequacy tet

SELECTED FINANCIAL DATA vss 02

Historical Operations ofthe County's Genet

Fund. .

Special Revenue Funds

Debt Service Funds.

Pension Fund,

Financial Statements.

THE COUNTY nn

‘Administration ofthe County.

Commissionsr’s Cour.

Consultants nance

LEGAL MATTERS

[Legal Opinions. we

No Materiel Adverse Change... 3

ginal Issue

Appendix A - Economic and Demographic Information

Discount Bonds eon. 32

CONTINUING DISCLOSURE OF INFORMATION 33

Annual Reports

Material Event Notices

Availability of Information from NRMSIR and

SD.

Limitations and Amendment...

Compliance with Prior Undertakings

OTHER CONSIDERATIONS.

‘Recent Management Initiatives

Environmental Regulations.

‘Air Quality...

Pending Legislative Session

GENERAL CONSIDERATIONS,

Sourees and Compilation of Information. 37

‘Updating of Oficial Statement...

‘CONCLUDING STATEMENT.

‘Appendix B - Excerpts from Comprehensive Annual Financial Report of Montgomery County, Texas for the

Fiscal Year Ended September 30, 2002

Appendix C - Form of Legal Opinions

Appendix D- Specimen of Financial Guaranty Insurance Policy

INTRODUCTION

Alt of the summaries of the statues, resolutions, order, policies, contacts, audits, engineering and other related

reports set forth in this Official Statement are made subject to all of the provisions of such documents. ‘These

summaries do not purport to be complete statements of such provisions, and reference is made to such documents,

copies of which are available from the County

This Official Statement contains, in part, estimates, assumptions and matters of opinion which are not intended as

statements of fact, and no representation is made as to the correctness of such estimates, assumptions or matters of

opinion, or as to the likelihood that they will be realized. However, the County has agreed to keep this Officiel

‘Statement current by amendment or sticker to reflect material changes in the affairs of the County and to the extent

that information actually comes to its atention, the other matters described in this Official Statement until delivery

of the Bonds to the Underwriters and thereafter omly 2s specified in “GENERAL CONSIDERATIONS - Updating

‘of Official Statement” and “CONTINUING DISCLOSURE OF INFORMATION.”

SALE AND DISTRIBUTION OF THE BONDS

Sale of the Series A Bonds

UBS PaineWebberInc., First Southwest Company, and JPMorgan (collectively, the “Underwriters”) have agreed to

ppurchase the Series A’ Bonds from the County pursuant to a bond purchase agreement with the County for

$23,955,840.00 (representing the par amount of the Bonds, plus a net premium of $109,440.00, tess an

Underuniters’ discount of $153,600.00) plus accrued interest on the Series A Bonds to the date of delivery. The

Underwriters’ obligation isto purchase all ofthe Series A Bonds if any ae purchased.

Sale of the Series B Bonds

UBS Paine Webber Inc., First Southwest Company, and JPMorgan (collectively, the “Underwriters”) have agreed to

purchase the Series B Bonds from the County pursuant to a bond purchase agreement with the County for

$9,920,009.25 (representing the par amount of the Bonds, phis a net premium of $3,009.25, less an Underwriters’

discount of $83,000.00) plus accrued interest on the Series B Bonds to the date of delivery. The Underwriters’

obligation isto purchase all of the Series B Bonds if any are purchased

Prices and Marketability

The delivery of the Bonds is conditioned upon the receipt by the County ofa certificate executed and delivered by

the Underuriters on or before the date of delivery of the Bonds stating the prices at which a substantial emount of

the Bonds of each maturity have been sold to the public. For this purpose, the term “public” shall not include any

person who is a bondhouse, broker or similar person acting in the capacity of underwriter or wholesaler. The

‘County has no control over trading ofthe Bonds after a bona fide offering of the Bonds is made by the Underwriters

at the yields specified on the inside cover page. Information conceming reoffering yields or prices is the

responsibility of the Underwriters.

“The prices and other terms respecting the offering and sale ofthe Bonds may be changed from time to time by the

Underwriters after the Bonds are released for sale, and the Bonds may be offered and sold at prices other than the

initial offering prices, including seles to dealers who may sell the Bonds into investment accounts. IN

CONNECTION WITH THE OFFERING OF THE BONDS, THE UNDERWRITERS MAY OVER-ALLOT OR

EFFECT TRANSACTIONS WHICH STABILIZE OR MAINTAIN THE MARKET PRICE OF THE BONDS AT

‘A LEVEL ABOVE THAT WHICH MIGHT OTHERWISE PREVAIL IN THE OPEN MARKET. SUCH

STABILIZING, IF COMMENCED, MAY BE DISCONTINUED AT ANY TIME.

Securities Laws

For purposes of compliance with Rule 152-12 of the Securities and Exchange Commission, this document, as may

be supplemented ot amended by the County ftom time to time, may be teated as an OFFICIAL STATEMENT with

respect to the Bonds described herein “deemed final” by the County es ofthe date hereof (or of any such supplement

‘or amendment) except for the omission of certain information referred to in the succeeding sentence. This

document, when further supplemented by adding information specifying the interest rates and certain other

information relating to the Bonds, shall constitute a “FINAL OFFICIAL STATEMENT” of the County with respect

to the Bonds, as such term is defined in Rule 1502-12.

[No registration statement relating to the Bonds has been filed withthe Securities and Exchange Commission under

tne Securities Act of 1933, as amended, in reliance upon the exemptions provided thereunder. The Bonds have not

been registered or qualified under the Securities Act of Texas i reliance upon various exemptions contained therein;

nor have the Bonds been registered or quslified under the securities laws of any other jurisdiction. The County

fssumes no responsibility for registration or qualification of the Bonds under the securities laws of any other

jurisdiction in which the Bonds may be offered, sold or otherwise wansferred. This disclaimer of responsibility for

‘etistration or qualification forsale or ether disposition of the Bonds shall not be construed as an interpretation of

‘any kind with regard to the availability of any exemption from securities registration or qualification provisions in

such other jurisdictions.

Ratings

Tn connection with the sale of the Bonds, the County has made application to Moody's Investors Service, In.

("Moody's") and Standard & Poor's Ratings Group, 2 Division of the McGraw-Hill Companies, Inc. (“SAP”) for

ratings, andthe ratings of “Aaa” and “AAA", respectively, have been assigned to the Bonds. An explanation ofthe

significance of such ratings may be obtained fiom Moody's and S&P. The ratings reflect only the view of Moody’s

and S&P, and the County makes no representation as tothe appropriateness of such ratings

‘There is no assurance that such ratings will continue for any period of time or that they will not be revised

downward or withdrawn entirely if, inthe judgment of Moody's or S&P, circumstances so warrant. Any such

downward revision or withdrawal ofthe ratings may have an adverse effect on the market price ofthe Bonds.

FINANCIAL GUARANTY INSURANCE,

‘Payment Pursuant to Financial Guaranty Insurance Policy

‘Ambec Assurance Corporation ("Ambac Assurance") has made commitment to issue 2 financial guaranty

insurance policy (the “Financial Guaranty Insurance Policy”) relating to the Bonds effective as of the date of

‘issuance of the Bonds. Under the terms ofthe Financial Guaranty Insurance Policy, Ambac Assurance will pay to

‘The Bank of New York, in New York, New York or any successor thereto (the “Tnsurance Trustee") that portion of

the principal of and interest on the Bonds which shall become Due for Payment but shall be unpeid by reason of

‘Nonpayment by the Issuer (as such terms are defined in the Financial Guaranty Insurance Policy). Ambac Assurance

will make such payments to the Insurance Trustee on the later of the date on which such principal and interest

becomes Due for Payment or within one business day following the date on which Ambac Assurance shall have

received notice of Nonpayment from the Registrar. The insurance will extend for the tenm of the Bonds, and, once

isoued, cannot be canceled by Ambac Assurance.

‘The Financial Guaranty Insurance Policy will insure payment only on stated maturity dates and on mandatory

sinking fund installment dates, in the case of principal, and on stated dats for payment, inthe case of interest. Ifthe

Bonds become subject to mandatory redemption and insufficient fimds are available for redemption of all

outstanding Bonds, Ambec Assurance will main obligated to pay principe of end interest on outstanding Bonds on

the originally scheduled interest and prinipel payment dates including mandatory sinking fund redemption dates. In

the event of any acceleration ofthe principal of the Bonds, the insured payments will be made at such times and in

such amounts as would have been made bad there not been an acceleration.

In the event the Registrar has notice that any payment of principal of or interest on a Bond which has become Due

for Payment and which is made to a Bondholder by or on behalf ofthe Issuer has been deemed a preferential wansfer

and theretofore recovered from its registered owner pursuant to the United States Bankruptey Code in accordance

‘with a final, nonappealable order of a court of competent jurisdiction, such registered owner will be entitled to

payment from Ambac Assurance to the extent of such recovery if sufficient funds are not otherwise available.

‘The Financial Guaranty Insurance Policy does not insure any risk other than Nonpayment, as defined in the Policy.

Specifically, the Financial Guaranty Insurance Policy does not cover:

1 ‘payment on acceleration, as a result of a call for redemption (other than mandatory sinking fund

redemption) or as a result of any other advancement of maturity.

2. payment of any redemption, prepayment or acceleration premium.

3 nonpayment of principal or interest caused by the insolvency or negligence of any Registrar, if

any,

If it becomes necessary to call upon the Financial Guaranty Insurance Policy, payment of principal requires

surrender of Bonds to the Insurance Trustee together with an appropriate instrument of assignment so as to permit

ownership of such Bonds to be registered in the name of Ambac Assurance to the extent of the payment under the

Financial Guaranty Insurance Policy. Payment of interest pursuant to the Financial Guaranty Insurance Policy

‘requires proof of Bondholder entitlement to interest payments and an appropriate assignment of the Bondholder's

right to payment to Ambac Assurance.

‘Upon payment of the insurance benefits, Ambac Assurance will become the owner of the Bond, appurtenant coupon,

if any, or right to payment of principal or interest on such Bond and will be fully subrogated to the surrendering

Bondholder’s rights to payment.

Ambac Assurance Corporation

‘Ambac Assurance Corporation ("Ambac Assurance”) is a Wisconsin-domiciled stock insurance corporation

regulated by the Office of the Commissioner of Insurance of the State of Wisconsin and licensed to do business in

50 states, the District of Columbia, the Territory of Guam and the Commonwealth of Puerto Rico, with admitted

assets of approximately §6,115,000,000 (unaudited) and statutory capital of approximately $3,703,000,000

(anaudited) as of December 31, 2002. Statutory capital consists of Ambac Assurance’s policyholders’ surplus and

statutory contingency reserve. Standard & Poor's Credit Market Services, 2 Division of The McGraw-Hill

‘Companies, Moody's Investors Service and Fitch, Inc. have each assigned a triple-A financial strength rating to

‘Ambac Assurance.

‘Ambac Assurance has obtained a ruling from the Infernal Revenue Service to the effect that the insuring of an

obligation by Ambac Assurance will not affect the treatment for federal income tax purposes of interest on such

obligation and that insurance proceeds representing maturing interest paid by Ambac Assurance under policy

provisions substantially identical to those contained in its financisl guaranty insurance policy shall be treated for

federal income tax purposes in the same manner as if such payments were made by the Issuer of the Bonds.

‘Ambac Assurance makes no representation regarding the Bonds or the advisability of investing in the Bonds and

‘makes no representation regarding, nor has it participated in the preparation of, the Official Statement other than the

information supplied by Ambac Assurance and presented under the heading "FINANCIAL GUARANTY

INSURANCE" and in "APPENDIX D."

Available Information

‘The parent company of Ambac Assurance, Ambac Financial Group, Ine. (the “Company"), is subject to the

{informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act"), and in

accordance therewith files reports, proxy statements and other information with the Securities and Exchange

Commission (the "SEC". These reports, proxy statements and other information can be read and copied at the

SEC's public reference room at 450 Filth Street, N.W., Washington, D.C, 20549. Please call the SEC at 1-800-SEC-

(0330. for further information on the public reference room The SEC maintains an internet site at

Iitp/iwwwsee.gov that contains reports, proxy and information statements and other information regarding

companies that file electronically with the SEC, including the Company. These reports, proxy statements and other

information can also be read atthe offices of the New York Stock Exchange, Inc, (the *NYSE"), 20 Broad Sueet,

New York, New York 10005,

Copies of Ambac Assurance's financial statements prepared in accordance with statutory accounting standards are

available from Ambac Assurance. The address of Ambac Assurance’s administrative offices and its telephone

number are One State Street Plaza, 17th Floor, New York, New York, 10004 and (212) 668-0340,

Incorporation of Certain Documents by Reference

‘The following documents filed by the Company with the SEC (Fle No. 1-10777) ate incomporated by reference in

this Official Statement;

1) The Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2001 and filed

‘on March 26, 2002;

2) The Company's Current Report on Form &K dated April 17, 2002 and filed on April 18, 2002:

3) ‘The Company's Quarterly Report on Form 10-O for the fiscal quarterly period ended March 31, 2002 and

filed on May 13, 2002;

4a)

5)

9

n

3

%

10)

u)

12)

‘The Company's Current Report on Form §-K dated July 17, 2002, and filed on July 19, 2002;

"The Company's Current Report on Form §:K dated August 14, 2002 and filed on August 14, 2002;

‘The Company's Quarterly Report on Form 10-Q for the fiscal quarterly period ended June 30, 2002,

and filed on August 14, 2002;

‘The Company's Current Report on Form $-K dated October 16, 2002 and filed on October 17, 2002;

‘The Company's Quarterly Report oa Form 10-Q for the fiscal quarterly period ended September 30,

2002 and filed on November 14, 2002;

‘The Company's Current Report on Form 8-K dated November 18, 2002 and filed on November 20,

2002;

‘The Company's Current Report on Form 8-K dated January 23, 2003 and filed on January 24, 2003;

‘The Company's Current Report on Form 8K dated February 23, 2003 and filed on February 28, 2002;

and

‘The Company's Current Report on Form 8-K dated February 25, 2003 and filed on March 4, 2008.

All documents subsequently filed by the Company pursuant to the requirements of the Exchange Act after the date

of this Official Statement will be available for inspection in the same manner as described above in "Available

Information.”

OFFICIAL STATEMENT SUMMARY

The following material is a summary of certain information contained herein and is qualified in its entircty by the

derailed information and financial statements appearing elsewhere in this Official Statement. The reader should

refer particularly to sections that arc indicated for more complete information.

The Issuer .. .. Montgomery County, Texas, a political subdivision of the State of

‘Texas. See “THE COUNTY.”

The Series A Bonds swonneee $24,000,000 Unlimited Tax Road Bonds, Series 2003A. The Series A.

Bonds ate dated April 1, 2003 and mature March 1 in the year 2026.

‘See “THE BONDS - General.”

{$10,000,000 Limited Tax Library Bonds, Series 20038. ‘The Series B

‘Bonds are dated April 1, 2003 and mature March 1 in each of the years

2006 through 2022 and March 1, 2026. See “THE BONDS - General.”

Payment of Interest onsen vn Taterest on the Bonds accrues from April 1,2003, and is payable

‘March 1, 2004, and on each March 1 and September { therenfter until

‘maturity or upon prior redemption. See “THE BONDS - General.”

.. The Bonds maturing on March 1, 2014 and thereafter are subject to

‘optional redemption in whole, or from time to time in part, on March 1,

2013 or any date thereafter at par plus accrued interest to the date of

redemption, The Series 2003A ‘Term Bonds and the Series 20038

Term Bonds maturing March 1, 2026 are subject to mandatory

redemption as described herein. See “THE BONDS — Optional

Redemption,” and “Mandatory Redemption.”

Principal of and interest on the Series A Bonds are payable from the

proceeds of a continuing, direct anmual ad valorem tax levied, without

limit as to rate or emount, against all taxable property in the County.

Principal of and interest on the Scries B Bonds are payable from the

proceeds of 2 continuing, direct annual ad valorem tax levied, within

the limits prescribed by law, against taxable property in the County

See “THE BONDS - Source of Payment’ and “TAXING

PROCEDURES AND TAX BASE ANALYSIS ~ Tax Rate

Limitations.”

‘The proceeds of the Series A Bonds will be used for certain County

road improvements and to pay the costs of issuance of the Series A

Bonds. Proceeds of the Series Bonds will be used to construct

library improvements and to pay the cosis of issuance of the Series B

Bonds. See “THE BONDS - Purpose of the Bonds and Use of

Proceeds”

Payment Recotdnsnminesnn sven The County has never defaulted on the timely payment of principal of

and interest on any ofits outstanding debt

‘Ambac Assurance Corporation ("Ambac"). See "FINANCIAL,

GUARANTY INSURANCE.”

su Moody's Investors Service, Inc. (Ambac) “Aaa

Standard & Poor's Ratings Group (Ambac) ABA”

‘The Series B Bonds ..

Optional Redemption

Source of Payment...

Use of Proceed nnn i

Financial Guaranty Insurance.

Ratings

‘SELECTED FINANCIAL INFORMATION

(Unaudited)

2002 Certified Taxable Assessed Valuation... $16,341,436,074 (a)

(100% of Market Vale as of January 1, 2002)

‘See “TAXING PROCEDURES AND TAX BASE ANALYSIS”

Direct Debt:

‘Outstanding Direct Debt (as of March 15, 2003)... S 97,966,530

‘The Series A Bonds. : 24,000,000

‘The Series B Bonds 410,000,000

“The Series 2003 Certificates of Obligation von 11,600,000 (0)

Total Direct Debt. S_ 143,566,530

Estimated Overlapping Debt... 5,197

‘Total Direct and Estimated Overlapping Debt. SLAGLG2L727

Interest & Sinking Fund Balance (as of March 15, 2003)... $518,613

Ratio of Direct Debt to... 2002 Certified Taxable Assessed Valuation. (516341, 3607). 88%

2002 Estimated Population (320,000)... s 449

Ratio of Direct end Estimated

‘Overlapping Debt to......: 2002 Certified Taxable Assessed Valuation ($16,341,436,074)... 8.33 %

2002 Estimated Population (320,000) ner $4,255

Annual Debt

Service Requirements....: Average (2003-2026). $10,560,505

‘Maxirmum (2017) S 11,894,245

(& Centified by the Montgomery Central Appraisal District (the “Appraisal District”)

(b) Concurrently with the issuance of the Bonds, the County is issuing $11,600,000 Certificates of Obligation,

Series 2003 (the “Certificates”). See “COUNTY DEBT — Indebtedness” herein.

(OFFICIAL STATEMENT

Relating to

$24,000,000 $10,000,000

MONTGOMERY COUNTY, TEXAS MONTGOMERY COUNTY, TEXAS

UNLIMITED TAX ROAD BONDS LIMITED TAX LIBRARY BONDS

‘SERIES 20034, SERIES 20038

‘THE BONDS

General

The following isa description of some ofthe terms and contitions of the Bonds, which description is qualified in its

entirety by the form of the Bonds contained in the Orders authorizing the issuance of the Bonds (collectively, the

“Orders"). A copy of the Orders may be obtained upon request to the County. Certain tems not defined elsewhere

in this Official Statement are defined in the Orders,

‘The Bonds will be issuable in fully registered form (without coupons) and purchases of Bonds are required to be in

the denomination of $5,000, or any integral multiple thercof, The Bonds will bear interest at the respective rates

shown on the inside cover page of this Offical Statement, caleulated om the basis ofa 360-day year composed of 12

‘months of 30 days each, The Bonds will mature in the respective amounts and on the respective dates shown on the

inside cover page of this Official Statement. The Bonds will be dated and will bear interest from April 1, 2003,

Interest on the Bonds will be payable semiannually on each March 1 and September 1 (cach an “Interest Payment

Date”), commencing March 1, 2004. Interest on the Bonds is payable on each Interest Payment Date by the Paying

‘Agent/Registrar to registered owners as shown on the records of the Paying Agent/Registar as of the close of

business on the 15th day of the month next preceding the Interest Payment Date (the “Record Date”). The principal

of the Bonds will be payable upon surrender of the Bonds for payment at Bank One, N.A. (the “Paying

Agent/Registrar") at its principal payment office in Austin, Texas.

Inthe event ofa nonpayment of interest on the Bonds on a schediuled payment date and for 30 days thereafter, a new

record date (the “Special Record Date”) for such intrest payment willbe established by the Paying Agent/Registrar,

if and when finds for the payment of such interest have been received from or on belialf of the County. Notice of

the Special Record Date and of the scheduled payment date of the past due interest (svhich shall be 15 days after the

Special Record Date) shall be sent a last five business days prior to the Special Record Date by United States mal,

first-class postage prepaid, tothe address of each registered owner of a Bond appearing on the Register atthe close

of business on the last business day next preceding the date of mailing of such notice

Book-Entry-Only System

This section describes how ownership of the Bonds is to be transferred and how the principal of, premium, if any,

and interesi on the Bonds are to be paid to and eredited by The Depository Trust Company (“DIC”), New York,

‘New York, while the Bonds are registered in its nomince name. The information in thi section concerning DTC and

the Book Eniry-Only System has been provided by DTC for use in disclosure documents suck as this Official

Statement. The County believes the source of such information to be reliable, but takes no responsibility for the

accuracy or completeness thereof.

The County cannot and does not give any assurance that (I) DTC will distribute payments of debt service on the

Bonds, or redemption or other notices, to DIC Participants, (2) DTC Participants or others will distribute debt

service payments paid to DTC or is nominee (as the registered owner of the Bonds), or redemption or other notices,

fo the Beneficial Owmers, or that they will do so on a timely basis, or (3) DTC will serve and act inthe manner

described 1m this Official Statement. The curren! rules applicable to DTC are on file with the Securities and

Exchange Commission, and the current procedures of DTC to be followed in dealing with DTC Participants are on

{file with DTC.

‘The Depository Trust Company, New York, New York, will act as securities depository for the Bonds. The Bonds

vill be issued as fully-registered Bonds in the name of Cede & Co. (DTC’s partnership nominee) or such other name

‘as may be requested by an authorized representative of DTC. One fally-registered certificate will be issued for each

‘maturity of each series of the Bonds, in the aggregate principsl amount of such maturity, and will be deposited with

DIC.

DIC, the world’s largest depository, isa limited-purpose trust company organized under the New York Banking

Lave, a “banking organization” within the meaning of the New York Banking Law, « member of the Federal Reserve

System, a “clearing corporation” within the meaning of the New York Uniform Commercial Code, and a “clearing

agency” registered pursuant to the provisions of Section 17A of the Securities Exchange Act of 1934, DTC holds

tnd provides asset servicing for over 2 million issues of U.S. and non U.S. equity issues, corporate and municipal

debt issues, and money market instruments fom over 55 countries that DTC’s participants (“Direct Participants")

deposit with DTC. DTC also facilitates the post-rade settlement among Direct Participants of sales and other

securities transactions in deposited securities, through clectronic computerized book-entry transfers and pledges

between Direct Participants” accounts. This eliminates the need for physical movement of securities certificates.

Direct Participants include both U.S. and non-US. securities brokers and dealers, banks, trust companies, clearing

corporations, and certain other organizations. DTC is a wholly-owned subsidiary of The Depository Trust &

Clearing Corporation (“DTCC”). DTCC, in tum, is owned by a number of Direct Participants of DTC and Members

of the National Securities Clearing Corporation, Government Securities Clearing Corporation, MBS Clearing

Corporation, and Emerging Markets Clearing Corporation, (NSCC, GSCC, MBSCC, and EMCC, also subsidiaries

of DTCC), as well as by the New York Stock Exchange, Inc. the American Stock Exchange LLC, and the National

Association of Securities Dealers, Inc. Access to the DTC system is also available to others such as both U.S. and

non-US. Securities brokers and dealers, banks, trust companies, and clearing corporations that clear through or

‘maintain a custodial relationship with # Direct Participant, either directly or indirectly ( “Indirect Participants”).

DTC has Standard & Poor's highest rating: AAA. The DTC Rules applicable to its Participants are on file with the

Securities and Exchange Commission. More information about DTC can be found at wwrw.dtec.com,

Purchases of Bonds under the DTC system must be made by or through Direct Participants, which will receive a

credit for the Bonds on DTC's records, The ownership interest of cach actual purchaser of each Bond (“Beneficial

Owner") isin tum to be recorded on the Direct and Indirect Participants’ records. Beneficial Owners will not receive

written confirmation from DTC of their purchase. Beneficial Owners are, however, expected to receive written

confirmations providing details ofthe transaction as well as periodic statements of their holdings, from the Direct or

Indirect Participant through which the Beneficial Owner entered into the transaction, Transfers of ownership

interests in the Bonds are to be accomplished by entries made on the hooks of Direct and Indirect Participants acting

on behalf of Beneficial Owners. Beneficial Owners will not receive certificates representing their ownership

interests in Bonds, except in the event that use of the book-entry system for the Bonds is discontinued.

To facilitate subsequent transfers, ll Bonds deposited by Direct Participants with DTC are registered in the name of

DTC's partnership nominee, Cede & Co, or such other name as may be requested by an authorized representative of

DTC. ‘The deposit of Bonds with DTC snd their registration in the name of Cede & Co, o such other DTC nominee

do not effect any change in beneficial ownership. DTC has no knowledge of the actual Bencfcial Owners of the

Bonds; DTC’s records reflect only the ientty ofthe Direct Participants to whose accounts such Bonds are credited,

which may or may not be the Beneficial Owners, Direct and Indirect Participants will remain responsible for

keeping account oftheir holdings on behalf oftheir customers.

Conveyance of notices and other communications by DTC to Direct Participants, by Direct Participants to Indirect

Participants, and by Direct Participants and Indirect Participants to Beneficial Owners will be govemed by

arrangements among them, subject to any statutory or regulatory requisements as may be in effect from time to time.

Beneficial Owners of Bonds may wish to take certain steps to augment the transmission to them of notices of

significant events with respect to the Bonds, such as redemptions, tenders, defaults, and proposed amendments to the

Bond documents. For example, Bencficial Owners of Bonds may wish to ascertain that the nominee holding the

Bonds for their benefit has agreed to obtain and transmit notices to Beneficial Owners. Jn the alternative, Beneficial

Owners may wish to provide their names and addresses to the registrar and request that copies of notices be

provided directly to them.

‘Redemption notices shall be sent to DTC. If less than all of the Bonds within « maturity are being redecmed, DTC's

practice isto determine by lot the amount ofthe interest of each Direct Participant in such issue to be redeemed.

‘Neither DTC nor Cede & Co. (nor any other DTC nominee) will consent or vote with respect to Bonds unless

authorized by a Direct Participant in accordance with DTC's Procedures. Under its usual procedures, DTC mails an

‘Omnibus Proxy to the County as soon as possible after the record date. The Omnibus Proxy assigns Cede & Co.'s

consenting or voting rights to those Direct Participants to whose accounts Bonds are credited on the record date

(identified in a listing attached to the Omnibus Proxy).

Prinefpal and interest payments on the Bonds will be made to Cede & Co., or such other nominee as may be

requested by an authorized representative of DIC. DTC's practice is to credit Direct Participants’ accounts upon

DIC’s receipt of funds and corresponding detail information from the County or Agent, on payable date in

‘ccordance with their respective holdings shown on DTC's records. Payments by Participants to Beneficial Owners

twill be governed by standing instructions and customary practices, as isthe cese with Bonds held for the accounts of

‘customers in bearer form or registered in “steet name,” and will be the responsibility of such Participant and not of

DIC, Paying Agent, or the County, subject to any statutory or regulatory requirements as may be in effect from time

to time, Payments of principal and interest to Cede & Co, (or such other nominee as may be requested by an

authorized representative of DTC) is the responsibility of the County or Paying Agent. Disbursement of such

payments to Direct Participants will be the responsibility of DTC, and reimbursement of such payments 10 the

Beneficial Owners will be the responsibilty of Direct and Indirect Participant.

DIC may discontinue providing its services as depository with respect to the Bonds at any time by siving

reasonable notice to the County or Paying Agent. Under such circumstances, in the event that a successor

4, ‘AMO LUO yuo} oaMos,

‘MonD9N10. xe. Jo sISKTeUY FEOHONSIEL

zo07

Delinquent Tax Collection Procedures

In addition to the legal procedures and penalties described under “County's Rights in the Event of Tax

Delinquencies,” the County has retained a Delinquent Tax Attorney on a contract basis to file suit to collect

dolinguent taxes due the County, The fees due such attomey for acting as Delinquent Tax Attomey are payable

fom an additional penalty imposed upon the delinquent taxpayer, not to exceed 20% of the tax due,

‘Tax Rate Distribution:

‘Tax Years 2002 2001 2000 1999 1998 1397

General Fund 80.3568 0.3509 90.3446 $0.3498 $0.3583, $0.3669

Special Revenue Fund 00525.-«=«O074G OHS TAG OTHG 074

Debt Service Fund 0.0617, 0.0455 0.0555, 0.0503 0.0568 0.0482

joao «Goo S07? Suea7 Maso] Sg.aa7

Analysis of Tax Base

- Tax Base Diseibution~

2002 Tax Rol 2001 Tax Ral 2000 Tax Ral!

Type of Popersy no = iam oust %

Residential sii2ss,s12e — s890% —-$ 9,795,263 580 8 8524587662 134%

Tats Tract Tooesae702 573 12944924 '33.721,605 $34

Acreage ss920382 458 869,066906 s5e.122085 69

Farm 8 Ranch 68275005 ORR ien087 49 12050629 083

Industrial & Commercial 154145580 1127 1,704 630.755 yalgosnens 974

Oi, Gas, Minerals Taezs2010 072 isades710 ‘s9s0340 089

Uiltie ar70sss8 281 sa6044969 2.58 ais.oi6236 3.07

Bisines Personal 1498714697785 1ate08s.764 8.68 1269498803 888

special Inventory aosigost = 032 Ssa7eo4 033 $5692.67 O38

Other Personal (2) osasoa38 050 8560265 033, 7aT39.00 (OS?

Exempt Property 1aResI83s3__ 6.74 106234526 _637 seisis.oos_— _6.62

ToalAscesed Value “SIS LORMISESS “TODO ~Sigaeis964a2 —“TOO.00% Sigase p16” 1000057

Lest Exemption 21768 569.759 21364,560,500 1981 s68.878

Total Tunable Value (6) TST6341 36078 314297235982 312.536.32518

G@) Includes personal propeny.

(b) Represents values initially certified by the Montgomery Central Appraisal District; may have been

subsequently adjusted.

2s

‘Top Ten Principal Taxpayers

Provided by the Montgomery Central Appraisal District, Certain of the top ten principal taxpayers may own

additional property thet is not included in the assessed value figures shown in this table as a result of the way such

property is accounted for on the Appraisal District tax ros.

2002 2001 2000

Taxpayer ‘Type of Property Tax Roll Tax Roll Tax Roll

“The Woodlands Companies Land Development 303,925,359 $331,655,255 _$342,377,806

Gulf States Utilities Electric Utility 149,768,280 148,171,247 135,978,380

Columbia Regional Medical

Center/Kingwood Medical Plaza Hospital 108,922,394 101,209,300 178,183,762

‘TXU Communications Telephone Telephone Utility 85,626,501, 80,375,477 76,672,400

Mitchell Resorts, Inc/Mitehell

Frey Land Development 85,081,835 78944911 41,6794

Wal-Mart Stores Ine. Retail Shopping Center 80,500,143 71379,967 @

Huntsman Petrochemical Corp. Chemical Productions 75,373,855 89,372,160 96,750,318,

Southwestem Bell Telephone Co. Telephone Utility 65,415,360 62,177,502 36,281,832

Eckerd Drugs/Distribution Center Retail Drug Distribution 52,798,015 155,767,590 59,761,504

‘Anadarko Petroleum Corp. OiVGas Exploration 47,130,190 @ @

Hughes Tool Company Manufacturer @ 34,630,779 35,616 819

Exxon Corp. it Properties (a) (a 53,752,951

Total SHGASSI GD “SUPER SRA TSS I776.965.219

Percentage of Respective Certified Assessed Valuation 642 1% LIN

{Gy Nota top tea principal wxpaye in such tx year according tothe Montgomery Central Appraisal District.

‘Tax Adequacy

Average Annual Debt Service Requirements (2003/2026).

81.069 Tax Rate on the 2002 Cerifed Taxable Assessed Vahtion @ 95%

collection produces..

Maxirmum Annual Debt Service Requirement (2017).

$0.07 Tax Rete on the 2002 Certified Taxable Assested Valuation oe 95%

collection produces...

26

$10,560,505

$10,711,811

$11,894,245

$11,953,760

REVENUES:

Taxes

Licenses and Permits

Fees

Intergovernmental

Changes for Services

Interest

Contract Reimbursements

Inmate Housing

Fines and Forfeitures

Miscellaneous

Total Revennes

EXPENDITURES:

Current Operating

General Administration

Judicial

Legal Services

Elections

Financial Administration

Public Fecilities

Public Safety

Hialth and Welfare

Conservation

Miscellaneous

‘Total Expenditures

Revenues Over (Under)

Expenditures

OTHER FINANCING

‘SOURCES (USES)

‘Operating Transfers In

Operating Transfers Out

Capital Lease Financing

Total Other Financing

Sources (Uses)

Excess (Deficiency) of Revenues

‘& Other Sources Over

Expenditures & Other Uses

Fund Balance, October 1

Prior Period Adjustment

Fund Balance, September 30

@

&)

SELECTED FINANCIAL DATA

Historical Operations of the County’s General Fund

‘The following is a condensed statement of revenues and expenditures ofthe County's General Fund for the past five

fiscal years. ‘The inclusion ofthe following table is not intended to imply that any revenues of the County, other

than receipts from ad valorem taxes provided in the Orders, ae pledged to pay principal and interest on the Bonds,

2002

$51,699,023 $45,085,824

1,008,293 836,716

8,424,846 7,864,483

3,142,936 2.987.471

43,641 46,704

526,280 976,658

7,351,963 6,160,532

448,159 375,313

268,176 85,772

1,236,497

$64,955,970

lst86.967_

sre 00.284

$12,483,544 $7,836,648,

71193,141 6,248,769

1,256,805 1,293,004

588,836 450,201

3,464,350 3,151,028,

5,418,380 5,055,180,

36,576,664 32,832,981

3,090,614 2,980,563

496,430 330,751

6,427.786(a)

$76,996550 $64,116,173,

8(2,896,266) $839,797

§ 4358590 $3,164,957

(7]049,597) (6,889,609)

5,943,007 33,203

$3,252,000 $3,691,449)

$355,734 — $(2,851,652)

1,097,068 5,703,369

-0-__(0.754,659(b)

STM «$1,097,068

with year-end salary and benefits

27

$40,538,799

930,023,

7,071,332

1,847,699

43.415

1,237,869

5,647,519

1,356,444

101,070

2.173.758

360,947,928

$ 7,357,810

5,071,310

1,564,559

441,851

2,749,449

4,092,645

30,419,689

2,876,932

299,612

2,352,687

357,226,548

§ 3,721,384

$513,716

(7,128,768)

403,300

$(6.211,752)

(2,490,368)

8,193,737

$5,703,369,

$37,960,190

863,748

6,513,476

1,802,522

44,990

1,331,702

5,435,479,

2,777,248

93,370

£666,960

358,489,685

5 7,973,044

4921769

1asi.658

330,022

2,686,189

3,651,170

28,050,258

2749,366

"72,788

3,017,333,

354993557

$ 3,496,128

s 0

(4,918,647)

86,998

$(4,831,649

$1,335,521)

9,529,258

0

Sea

1998

$35,558,675

757,348

5,528,613

1,633,717

37,356

1,279,417

5368.916

2/890,089

95,676

3,127,051

26,528,964

2.376495

264,074

1,820,432

550272,

8 4,148,273

8 472,066

(5,016,705)

1,209,800

$0334.83)

S(_ 813,434)

8,715,824

oe

$9,529,258

‘See Notes the Financial Satement ~ Nove 17 in APPENDIX B ~ Financial Statements ofthe County

‘Adjustment represents the accumulated effect of non-ecorded expenditures on the fund balnce associated

Special Revenue Funds

‘The Special Revenue Funds are the funding source for annual road and bridge construction and maintenance, The

County is divided into four precincts, each of which is provided with a seperate, annual Road and Bridge Fund

Budget. Each precinct Road and Bridge Budget is administered by the County Commissioner elected from that

precinct, subject to approval of the Commissioners’ Court. The primary sources of revenues for the Special

Revenue Funds include ad valorem taxes and auto registration licenses and grants. The table below summarizes the

revenues and expenditures of the Special Revenue Funds for the past five fiscal years, including the Road and

Bridge Fund, as reported in the County's Annual Financial Reports. The Special Revenue Funds are not available to

pay debt service on the Bonds.

Fiscal Year Ended September 30,

2002 2001 2000

REVENUES:

‘Taxes $10,929,103 $ 9,685,592 $ 8,591,101 § 7,872,827 $ 7,230,736

Licenses and Permits 5,839,958 5,297,922 5,273,694 «4,994,424 4,668,745.

Fees 736,880 302,108 282,684 191,074 185,957

Intergovernmental 2,983,643 2,801,193 2,289,541 2,556,161 1,444,040

‘Charges for Services 1,035,153 ‘901,792 "740,504 772,264 716,623,

Interest 96,254 338,997 370,721 310,629 281,106

Fines and Forfeitures 1,302,043 1,550,884 «1,558,364 1,454,280 1,051,293

Miscellaneous 539,882, 336,494 557.763, 602,817 270,663,

Total Revenues $H962916 FI Ais.982 F19,664372 “$1G, 754,476 "815,849,163

EXPENDITURES:

Current Operating

General Administration § 146408 $131,098 $145,563 $168,164 $155,229

Judicial 3,101,705 2,830,131 2,679,160 1,979,076 1,846,106

Legal Services 195,995, 175,201 143,643, 142,172 110,837

Public Safety 441,745, 405,693 437574 511,176 565,489

Health and Welfare 3,221,639 4,005,031. 2,130,690 2,201,593, 1,375,542

Culture and Recreation «4,281,759 4,253,302 3,615,564 317301 2,829,968

Conservation 113,216 48,500 oe 0 0

Public Transportation 19,224)885 16,353,845 16,606,255 14,823,006 12,551,584

DSS. Issuance Cost 0 10,456 -0-

SHO7IT Ss 828200798. F0S,773,.905, S3.144BS “$19.43

Revenues Over (Under)

Expenditures $(7,764.437) $(6,787,816) $6,109,533) $ (4,388,012) $13,585,597)

OTHER FINANCING

‘SOURCES (USES)

Operating TransfersIn $9,532,372 $6,880,609 $ 5.623428 $ 4.918647 § 4,813,611

Operating Transfers Out (4.358.590) G,164,799) (953,637) 0 (363,050)

‘Capital Lease Financing __2.287,507__2.364.393_1,256,892 102,716 350,838

‘Total Other Financing

Sources (Uses) $ 7461287 _ $6,089,203 $ 5,926,683 $ 5,021,363 _$ 4,801,399

Excess (Deficiency) of Revenues

& Other Sources Over

Expenditures & Other Uses § (303,148) $ (698,613) $ (182,850) $633,351 1,215,802

Fund Balance, October | $ 5047343 $5,745,956 § 6,041,139 § 5,407,788 $4,191,986

Prior Period Adjustment o 0. (112333) 0. o

Fund Balance, September 30 "S4744,195_ $5,047,343 33407,

35,745.956 “S$ 6041139

28

Debt Service Funds

‘The Debt Service Funds are the funding source for annual payments of principal and interest on the County's

outstanding debt. The primary source of fevenue for the Debt Service Funds are ad valorem taxes. The table below

summarizes the revenues and expenditures of the Debt Service Funds, which includes debt service funds for South

Montgomery County Road District No, 1, 28 reported in the year-end financial reports for the past five years,

REVENUES:

Taxes

Interest

‘Total Revenue

EXPENDITURES:

Debt Service

Principal Retirement

Interest and Fiscal Charges

Issuance Costs

Capital Leases

Total Expenditures

Revenues Over (Under)

Expenditures

OTHER FINANCING

SOURCES (USES)

Operating Transfer In

Proceeds of Refunding Bonds

Payment to Refunded Bond

Escrow Agent

‘Total Other Financing

Sources (Uses)

Excess (Deficiency) Revenues

‘& Other Sources Over

Expenditures & Other Uses

Fund Balances, October |

Residual Equity Transfer

Fund Balances, September 20

Pension Fund

2003

$ 6,537,150

180,697,

ven 807

5 3,013,999

4,375,933

52,036

671,807

Ens

$ (1,396,826)

8 0.

3,800,000

97,248

$ (1,299,578)

2,860,746

19.793

Fiscal Yes

2001

$7,010,079

85,061

37,095,140.

$3,335,000

3,191,279

0-

0-

SE SA6279

$548,861

1,500,000

0

$2,048,861

811,885

0.

S230 TIS

Ended September 30,

Bi 1995.

$ 6465227 — § 6,766,997

29.071 54,033

¥Ga94298 $6,821,080,

$ 3,123,227 § 3,031,236

3,564,820 3,849,657

o-

De

$ (193,749) $ (59,863)

$ 0 8 o

0. a

oe

38

S (193,749) S$ (59,863)

1,005,634 1,065,497

- An

Saws ToS

36,380,893,

TE

35,780,936

104042

$2,589,398

3,074,921

O-

0

S5GG19

S$ 220,659

8 0.

0

0.

$ o

$220,659

844,838

—t

$1,065,497

‘The County provides pension, disability, and death bencfits for all of its full-time employees through a

nontraditional, joint contributory, defined contribution plan in the state-wide Texas County and District Retirement

‘System (TCDRS)

Under the state law governing TCDRS, the contribution rate of the County is adopted annually based on an

actuarially determined rate. The contribution rates for calendar 2002 are 8.78% for the employer and 6.0% for the

employee. The County's total payroll in fiscal year 2002 was $49,043,952, and the County's contributions of

$4,143,325 were based on a covered payroll of $46,879,876, For more information, refer to Note 14 of Appendix B

- Excerpts from Comprehensive Annual Financial Report of the County.

In 1997, the County approved the implementation of a deferred compensation plan pursuant to Section 457 of the

Intemal Revenue Code. A third party administrator (Diversified investment Advisors, Ine.) and a plan trustee

(investors’ Bank and Trust Company) were chosen to administer the benefit plan.

Financial Statements

Excerpts from the County's Comprehensive Annual Financial Report for the fiscal year ended September 30, 2002

are attached hereto in Appendix B. The entire Comprehensive Annual Financial Report for 2002 and preceding

years are available, for a fee, upon request of the County.

‘THE COUNTY

Administration of the County

‘The officials having responsibilty for the administration of the County are the County Judge and the four County

Commissioners who comprise the Commissioners’ Court. Among its duties as the governing body of the County,

Commissioners’ Court approves the County's budget, determines the County's tax rates, approves contracts, calls

elections, and determines when to issue bonds or other obligations. Each Commissioner represents one of the four

precincts into which the County is divided and is elected by the voters of such Commissioner Precinct for a four-

‘year term.

‘The County Judge isthe presiding officer of the Commissioners’ Court and is elected for a four-year term by the

voters of the County, Other officials having responsiblity for the financial administration of the County are the

County Tax Assessor-Collector, County Treasurer, County Auditor and Purchasing Agent.

‘The County Tax Assessor/Colleetor, J. R. Moore, Jr, was appointed County Tax Assessor/Collector in April 1987,

and elected to such post in 1988, 1992, 1996 and again in 2000 to serve a four-year term. Mr. Moore attended Nosth

Texas State University and the University of Houston, majoring in Political Science/Government. Mr. Moore

received his sate certification as a Professional Tax-Assessor Collector in 1991.

‘The County Treasurer, Martha N, Gustavsen, was elected County Treasurer in 1987, 1991, 1995, and again in 1999

to serve a four-year term. She attended Alvin Junior College, majoring in Accounting,

‘The County Auditor, Linda R. Breazcale, was first appointed County Auditor in October 1986, She has been

reappointed for two year terms since 1986. She attended Sam Honston State University, majoring in accounting,

and bas plans to pursue an MBA.

‘The Purchasing Agent, Mark Bosma, was appointed in May 1992 to a two-year term as Purchasing Agent and

reappointed for two year terms since 1992, He is a graduate of Sem Houston State University.

Commissioner's Court

Years ‘Terms Expire

Commissioner Position Seed December 31

‘Alan B, Sadler ‘County Judge R 2006

Mike Meador Commissioner Precinct 1 7 2004

Craig Doyal Commissioner - Precinet2 1 2006

Eamest E. Chance Comnnissioner - Precinct 3 4 2004

Bd Rinehart, Commissioner - Precinct 4 4 2006

Consultants

Bond Counsel Vinson & Elkins L.L.P,

Houston, Texas

Financial Advisor... 5 [RBC Dain Rauscher Ine

Houston, Texas

‘Auditors (Certified Public Accountants) Hereford, Lynch, Sellars & Kirkham, PC

Conroe, Texas

Disclosure Counsel. wowAndrews & Kurth LLP.

Houston, Texas

30

LEGAL MATTERS

Legal Opinions

‘The County will furnish the Underwriters a transcript of certain certified proceedings incident to the authorization

and issuance of each series of the Bonds, including a certified copy of the unqualified approving opinion of the

‘Attomey General of Texas, as recorded inthe register of the Comptroller of Public Accounts ofthe State of Texas,

to the effect that such Bonds, which the Attomey General will have examined, are valid and binding obligations of

the County under the Constitution and laws of the State of Texas. The County also will furnish the approving legel

opinion of Vinson & Elkins LL.P., Bond Counsel foreach series, in substantially the forms attached as Appendix C

to this Official Statement,

No Material Adverse Change

‘The obligations of the Underwriters to accept delivery and pay for the Bonds, and of the County to deliver the Bonds

tare subject to the condition that, up to the time of delivery of and receipt of payment for the Bonds, there shall have

been no material adverse change in the condition (financial or otherwise) of the County subsequent to the date of

sale from that set forth or contemplated in the Official Statement, as it may have been supplemented or amended

through the date of sale.

LITIGATION

‘According to the County, there are currently a number of Iawsuits pending against the County, but none of such

actions are expected to result in recovery against the County for an amount outside the applicable insurance policy

limits and County-held reserves. The County believes that none of the currently outstanding lawsuits, if decided

adversely to the County, would have ¢ material adverse effect on the financial condition of the County.

‘TAX MATTERS

‘Tax Exemption

In the opinion of Vinson & Elkins L.LP., Bond Counsel, (i interest on the Bonds is excludable from gross income

for federal income tax purposes under existing law (i) certain “original issue discount” on the Bonds ts excludable

from gross income for federal income tax purposes under existing law as described more fully in "Tax Accounting

‘Treatment of Original Issue Discount Bonds,” and (ii) the Bonds are not “private activity bonds” under the Internal

Revenue Code of 1986, 25 amended (the “Code”), within the meaning of the Code and interest on the Bonds will not

‘be subject to the alternative minimum tax on individuals and corporations, except as described below in the

discussion regarding the adjusted current earnings adjustment for corporations.

‘The Code imposes « number of requirements that must be satisfied for interest on state or local obligations, such as

the Bonds, to be excludable from gross income for federal income tax purposes. These requirements include

limitations on the use of proceeds and the source of repayment, limitations on the investment of proceeds prior to

expenditure, a requirement that excess arbitrage carned on the investment of proceeds be paid periedicaly to the

United States, and a requirement that the County file an information report with the Internal Revenue Service, The

County has covenanted in the Orders that it will comply with these requirements.

Bond Counsel's opinion will assume continuing compliance with the covenants of the Orders pertaining 10 those

sections of the Code thet affect the exclusion from gross income of interest on the Bonds for federal income tax

purposes and, in addition, will rely on representations by the County, the County's financial advisor and the

Underwriters with respect to matters solely within the knowledge of the County, the County's financial advisor and

the Underwriters, respectively, which Bond Counsel has not independently verified. If the County should fil to

comply with the Covenants in the Orders or if the foregoing representations should be determined to be inaccurate or

incomplete, interest on the Bonds could become taxable fom the date of delivery of the Bonds, regardless of the

date on which the event causing such taxability occuss.

‘The Code also imposes a 20% altemative minimum tax on the “alternative minimum taxable income” of &

corporation if the amount of such alternative minimum tax is greater than the amount of the corporation's regular

income tax. Generally, the alternative minimum taxable income of a corporation (other than any S corporation,

regulated investment company, REIT, REMIC or FASIT), includes 75% of the amount by which its “adjusted

current earings” exceeds its othet “alternative minimum taxable income.” Because interest on tax-exempt

‘obligations, such as the Bonds, is included in a corporation’s “adjusted current earnings,” ownership of the Bonds

could subject « corporation to alternative minimum tax consequences.

31

Under the Code, taxpayers are required to report on their retums the amount of tax-exempt interest, such as interest

‘on the Bonds, received or acerued during the year

Except as stated above and as stated below in “Tax Accounting Treatment of Original Issue Discount Bonds” Bond

‘Counsel will express no opinion as to any federal, state or local tax consequences resulting from the ownership of,

receipt or accrual of interest on, ot disposition of, the Bonds.

Prospective purchasers of the Bonds should be aware that the ownership of tax-exempt obligations may result in

collateral federal income tax consequences to financial institution, life insurance and property and casualty insurance

companies, certain S corporations with Subchapter C earnings and profits individual recipients of Social Security or

Railroad Retirement benefits, taxpayers who may be deemed to have incurred or continued indebtedness to

purchase or carry tax-exempt obligations, taxpayers owning an interest in 2 FASIT that holds tax-exempt

obligations, and individuals otherwise qualifying for the eared income credit. In addition, certain foreign

corporations doing business in the United States may be subject to the “branch profits tax” on their effectively

connected earnings and profits, including tax-exempt interest such as interest on the Bonds. These categories of

prospective purchasers should consult their own tax advisors as to the applicability of these consequences,

Bond Counsel's opinions are based on existing law, which is subject to change. Such opinions are further based on

Bond Counsel's knowledge of facts as of the date thereof, Bond Counsel assumes no duty to update or supplement

its opinions to reflect any facts of circumstances that may thereafter come to Bond Counsel's attention or to reflect,

‘any changes in any law that may theresfter occur or become effective. Moreover, Bond Counsel’s opinions are not @

(guarantee of result and are not binding on the Internal Revenue Service (the “Serviee"); rather, such opinions

represent Bond Counsel's legal judgment based upon its review of existing law and in reliance upon the

representations and covenants referenced above that it deems relevant to such opinions. The Service has an ongoing

‘udit program to determine compliance with rules that relate to whether interest on state or local obligations is

includable in gross income for federal income tax purposes. No assurance can be given whether or not the Service

‘will commence an audit of the Bonds. If an audit is commenced, in accordance with its current published

poceclures the Service is likely to teat the Issuer as the taxpayer and the Owners may not have a right to participate

in such audit, Public awareness of any future audit of the Bonds could adversely affect the value and liquidity of the

‘Bonds during the pendency of the audit regardless ofthe ultimate outcome of the audit,

‘Tax Accounting Treatment of Original Issue Discount Bonds

‘The initial public offering price for certain of the Bonds may be less than the principal amount thereof (the “Original

Issue Discount Bonds”) In the opinion of Bond Counsel, under existing law and based upon the assumptions

hereinafter stated:

(a) The difference between (i) the amount payable atthe maturity of each Original Issue Discount Bond

and (i) the initial offering price to the public of such Original Issue Discount Bonds constitutes original issue

discount with respect to such Original Issue Discount Bond in the hands of any owner who has purchased such

‘Original Issue Discount Bond inthe initial public offering of the Bonds; end

(©) Such initial owner is entitled to exclude from gross income (as defined in Section 61 of the Code) an

amount of income with respect to such Original Issue Discount Bond equal to that portion of the amount of such

original issue discount allocable to the period that such Original Issue Discount Bond continues to be owned by such.

owner.

In the event ofthe redemption, sale or other taxable disposition of such Original Issue Discount Bond prior to stated

maturity, however, the amount reslized by such owner in excess of the basis of such Original Issue Discount Bond

in the hands of such owner (adjusted upward by the portion of the original issue discount atlocable to the period for

‘which such Original Issue Discount Bond was beld by such inital owner is includable in gross income, Becsuse

original issue discount is treated as imeret for federal income tax purposes, the discussion regarding interest on the

Bonds under the caption “Tax Exemption” generally applies, except as otherwise provided below, to original isoue

discount on an Original Issue Discount Bond held by an owner who purchased such Bond at the intial offering price

in the intiel public offering of the Bonde, and should be considered in connection with the discussion in this portion

of the Official Statement.

In rendering the foregoing opinion, Bond Counsel will assume, in reliance upon certain representations of the

Underwriters that (a) the Underwriters have purchased the Bonds for contemporaneous sale to the public and (b) all

of the Original Issue Discount Bonds have been initially offered, and a substantial amount of each maturity thereof

32

has been sold to the general public in arm’s-length transactions for a cash price (and with no other consideration

being included) equal to the initial offering prices thereof. Neither the County nor Bond Counsel warrants that the

Original Issue Discount Bonds will be offered and sold in accordance with such assumptions.

Under existing law, the original issue discount on each Original Issue Discount Bond is accrued daily to the stated

maturity thereof (in amounts calculated as described below for each six-month period ending on the date before the

semi-annual anniversery dates of the date of the Bonds and ratably within each such six-monti period) and the

accrued amount is added to an inital owner’s basis for such Original Issue Discount Bond for purposes of

determining the amount of gain or loss recognized by such ovmer upon the redemption, sale or other disposition

tBereof, The eroount to be added to bass foreach accrual period is equal to (a) the sum of the issue price and the

‘amount of original issue discount accrued in prior periods mulplied by the yield to stated maturity determined on

the basis of compounding at the close of each accrual period and properly adjusted for the length of the acenisl

period) Iess (b) the amouuts payable as current intrest during such accrual period on such Bond.

“The federal income tax consequences of the purchase, owmership and redemption, sale or other disposition of

Griginal Issue Discount Bonds which are not purchased in the initial offering atthe initial offering price may be

determined according to rules which differ from those described above. All owners of Original Issue Discount

Bonds should consult their own tax advisors with respect tothe determination for federal, state and local income tax

purposes of interest acerued upon redemption, sale or other disposition of such Bonds and with respect to the

federal, state, local and foreign tax consequences of the purchase, ownership, redemption, sale or other disposition

of such Bonds.

CONTINUING DISCLOSURE OF INFORMATION

In the Orders, the County has made the following agreement for the benefit of the holders and beneficial owners of

the Bonds. The County is required to observe the agreement for so long as it remains obligated to advance funds to

pay the Bonds. Under the agreement, the County will be obligated to provide certain updated financial information

‘and operating data annually, and timely notice of specified material events, to certain information vendors. This

information will be available to securities brokers and others who subscribe to receive the information from

the vendors,

1n order to provide certsin continaing disclosure with respect to the Bonds in accordance with Rule 152-12 of the

United States Securities and Exchange Commission under the Securities Exchange Act of 1934, as the same may be

amended from time to time (Rule 15e2-12"), the County has entered into a Disclosure Dissemination Agent

‘Agreement (“Disclosure Dissemination Agreement”) for the benefit of the Holders of the Bonds with Digital

‘Assurance Certification, L.L.C. ("DAC"), under which the County has designated DAC as Disclosure Dissemination

‘Agent.

‘The Disclosure Dissemination Agent has only the duties specifically set forth in the Disclosure Dissemination

‘Agreement. The Disclosure Dissemination Agent's obligation to deliver the information at the times and with the

contents described in the Disclosure Dissemination Agreement is limited to the extent the County has provided such

information to the Disclosure Dissemination Agent as required by this Disclosure Dissemination Agreement. The

Disclosure Dissemination Agent has no duty with respect to the content of any disclosures or notice made pursuant

to the terms of the Disclosure Dissemination Agreement. The Disclosure Dissemination Agent has no daty or

obligation to review or verify any information in the Annual Report, Audited Financial Statements, notice of Notice

Event or Voluntary Report or any other information, disclosures or notices provided to it by the County and shall

rot be deemed to be acting in any fiduciary capacity for the County, the Holders of the Bonds or any other party

‘The Disclosure Dissemination Agent has no Tesponsibiity for the County's failure to report to the Disclosure

Dissemination Agent a Notice Event or a duty to determine the materiality thereof, The Disclosure Dissemination

‘Agent shall have no duty to determine or liability for failing to determine whether the County has complied with the

Disclosure Dissemination Agreement. The Disclosure Dissemination Agent may conclusively rely upon

certifications of the County at all times.

Annual Reports

‘The County will annually provide certain updated financial information and operating data to all NRMSIRs and any

SID as defined below. The information to be updated includes all quantitative financial information and operating

date with respect to the County as follows: (j) annual audited financial etatements of the County set forth in

APPENDIX B of this Official Statement and (i) information of the general type included in this Official Statement

tnder the headings “INVESTMENT AUTHORITY AND INVESTMENT OBJECTIVES OF THE COUNTY,”

33

“DEBT SERVICE REQUIREMENTS,” “COUNTY DEBT” (except “Estimated Overlapping Debt Statement”),

“TAXING PROCEDURES AND TAX BASE ANALYSIS” and “SELECTED FINANCIAL DATA.” The County

‘will update and provide this information within six months after the end of each fiscal year. The County will

provide the updated information to each nationally recognized municipal securities information repository

(NRMSIR") and to the Texas Municipal Advisory Council, the state information depository (“SID”) designated by

the State of Texas and approved by the staff of the SEC.

“The County may provide updated information in fll text or may incorporate by reference certain other publicly