Académique Documents

Professionnel Documents

Culture Documents

Cbseguess Sample Paper 2015 Class - Xii Subject - Accountancy

Transféré par

Ashish BatraTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Cbseguess Sample Paper 2015 Class - Xii Subject - Accountancy

Transféré par

Ashish BatraDroits d'auteur :

Formats disponibles

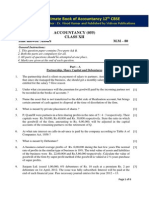

CBSEGuess.

com

CBSEGuess Sample Paper 2015

CLASS XII

SUBJECT ACCOUNTANCY (055)

--------------------------------------------------------------------------------------------------------------------------------------------------------------Time Allowed 3 Hours

Maximum Marks 80

--------------------------------------------------------------------------------------------------------------------------------------------------------------PART A

ACCOUNTING FOR PARTNERSHIP FIRMS AND COMPANIES

1.

2.

3.

4.

5.

6.

7.

A, B and C were partners sharing profits in the ratio of 2:2:1. On 1-4-2014, they decided to admit D for 1/6th

share in profits and on the same date, B retires from the firm. On that date General Reserve of Rs. 14,700

appeared in the Balance Sheet. Give necessary journal entry.

1

What is the average period in months for charging interest on Drawings for the same amount withdrawn at the

end of each quarter?

(a) 5.5 Months (b) 4.5 Months (c) 6 Months (d) 7.5 Months

1

Shankar Ltd. proposed to issue 10,000 equity shares of Rs. 10 each at a premium of 20%. The minimum amount

of application money to be collected per share:

(a) Rs. 2 (b) Rs. 5 (c) Rs. 3 (d) Rs. 12

1

Can a partner be exempted from sharing the losses in the firm? If yes, then under what circumstances?

1

What does negative super profit indicate?

1

What is Reserve Capital?

1

Rohan and Sohan are partners sharing profits in the ratio of 3:2. They admit Mohan into the firm on 1-4-2014

for 3/8th share. He brings Rs. 2,400 as his share of goodwill in cash. On the same date Sohan died. According to

Soha s ill, the e e utor should do ate his share to Natio al Bli d S hool . Ne profit shari g ratio of oha

and Mohan is 5:3. Goodwill A/c does not appear in the books of Rohan and Mohan.

(a) Pass journal entries.

(b) Identify the value involved.

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.indiaguess.com | www.magicsense.com | www.niosguess.com | www.iitguess.com |

www.aipmtguess.com

CBSEGuess.com

8.

9.

10.

11.

12.

13.

(c) Sho ours orki g learl .

3

Harish Ltd. issued 20,000 fully paid up equity shares of Rs. 100 each for the purchase of the following assets and

liabilities from Hema Ltd. Machinery Rs. 7,00,000; Debtors Rs. 2,50,000; Building Rs. 11,50,000; B/P Rs.

2,50,000. Pass necessary journal entries.

3

Vinod Ltd. has issued 20,000 9% debentures of Rs. 100 each of which half of the amount is due for redemption

on 31-3-2008. The company has in its Debentures Redemption Reserve Account a balance of Rs. 4,40,000.

Record the necessary entries as on 31-3-2008.

3

500 shares of Rs. 10 each, issued at a premium of Re. 1 per share, on which Rs. 8 (including premium) was called

and Rs. 6 (including premium) was paid, have been forfeited by the company. 400 of these shares were reissued as fully paid for Rs. 7. Journalise.

3

Nandan, John and Rosa were partners sharing profits in the ratio of 4:3:2. On 1-4-2014 John retires from the

firm. On the same date Nandu admits into the partnership. Nanadan, Rosa and nandu decided to share future

profits in the ratio of 1:1:1. The capital accounts of Nandan, John and Rosa after all adjustments (but before

adjustment of goodwill) showed a balance of Rs. 43,000; Rs. 91,000 and Rs. 80,500 respectively. The total

amount to be paid to John was Rs. 95,500. Nandan, Rosa and Nandu decided to provide hearing aids and

spectacles to the needy people.

(a) Pass necessary journal entries in the books of the firm for the above transactions.

(b) Identify the value involved in it.

(c) Sho ours orking clearly.

4

Riya and Jiya are partners in a firm. They decided to dissolve the firm. Pass necessary journal entries for the

following after various assets and liabilities have been transferred to realisation account:

(a) There was stock of Rs. 90,000. Riya took over 50% of the stock at 50% by paying cash and remaining stock

was realised at 20% loss.

(b) Out of the total debtors of Rs. 17,000; debtors of Rs. 2,000 turned out bad; one debtor of Rs. 5,000 became

insolvent and 40% is received from him and full recovery is made from the remaining debtors.

(c) The workmen compensation reserve appeared in the books of Rs. 10,000. A claim of Rs. 8,000 was valued

against it and was paid.

(d) Ji a s loa to the fir

as s. ,

. She a epted s. 9,500 in full settlement.

4

(a)

A firm earns a profit of Rs. 40,000 per year. In the same business 10% return is generally expected. The

total assets of the fir are s. , ,

. The alue of outsiders lia ilities is s. 40,000. Find the value of

goodwill.

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.indiaguess.com | www.magicsense.com | www.niosguess.com | www.iitguess.com |

www.aipmtguess.com

CBSEGuess.com

14.

(b)

X and Y are partners in a firm sharing profits and losses in the ratio of 3:2 with capitals of Rs. 10,00,000

and Rs. 5,00,000 respectively. As per the partnership deed, they are to be allowed interest on capital @ 8% p.a.

The profit for the year ended 31st March, 2014 before providing for interest on capital amounted to Rs. 45,000.

Show the distribution of profit.

6

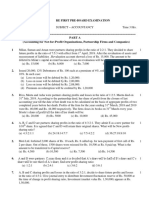

A and B are partners sharing profits in the ratio of 3:2. Their combined capital as on 1-4-2013 was Rs. 80,000.

Interest on capital is agreed @ 6% p.a. During 2013-14, the profits of the year prior to calculation of interest on

apital ut after hargi g B s salar a ou ted to s. ,5 . A pro isio of 5% of the profits is to be made in

respe t of a ager s o

issio . Fill i

issi g figures i the follo i g a ou ts

6

st

Profit and Loss Account for the year ending 31 March 2014

Particulars

Rs.

Particulars

Rs.

To a ager s o

issio

750

By Net Profit

---To profit transferred to P&L

Appropriation A/c

------------st

Profit and Loss Appropriation Account for the year ending 31 March 2014

Particulars

Rs.

Particulars

Rs.

To Interest on capital:

By P&L A/c

---A s Capital

,

B s Capital

1,800

4,800

To Salary:

B s Capital

----To Profit transferred to:

A s Capital

----B s Capital

---------------Part ers Capital A ou ts

Particulars

A

B

Particulars

A

B

To balance c/d

------By balance b/d

------By interest on capital

------By ------------By P&L Appropriation A/c

----------

----

----

----

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.indiaguess.com | www.magicsense.com | www.niosguess.com | www.iitguess.com |

www.aipmtguess.com

CBSEGuess.com

15. Mother Ltd. forfeited 100 equity shares of Rs. 10 each issued at a discount of 10% for non payment of first call

of Rs. 2 per share and the final call of Rs. 3 per share on 31st March 1995. 50 forfeited shares were reissued as

fully paid for Rs. 8 per share and balance of the shares was reissued on 30th June 1995 at Rs. 7 per share.

Give journal entries to record forfeiture and reissue of shares.

6

st

16. A and B were partners sharing profits and losses in the ratio of 7:3. On 1 April, 2013 they admitted C as a new

partner for share in the profits of the firm. C brought Rs. 4,00,000 as his capital and Rs. 20,000 as his share of

goodwill in cash. The balance sheet of A and B as on 1st April 2013 was follows:

Liabilities

Rs.

Assets

Rs.

Capitals:

Land and

2,50,000

A 8,00,000

Machinery

3,50,000

B 3,50,000

11,50,000 Investments

2,00,000

General Reserve

60,000 (Market Value Rs. 1,80,000)

Workmen Compensation Reserve

80,000 Debtors

2,20,000

Investment Fluctuation Reserve

60,000 Less: Provision

20,000

2,00,000

Creditors

1,50,000 Stock

3,50,000

Cash

1,50,000

15,00,000

15,00,000

It was agreed that:

(i)

The value of Land and Building will be appreciated by 20%.

(ii)

The value of Machinery will be depreciated by 10%.

(iii)

The liability of workmen compensation was determined at Rs. 50,000.

(iv)

Capitals of A and B will e adjusted o the asis of C s apital a d a tual ash to e rought i or to e

paid off as the case may be.

Prepare e aluatio A/ , Part er s Capital A ou ts a d the Bala e Sheet of the e fir .

8

Or

A, B and C were equal partners. Their Balance Sheet as at 31st March 2008 was as under:

Liabilities

Rs.

Assets

Rs.

Capitals:

Bank

20,000

A 60,000

Stock

20,000

B 40,000

Furniture

28,000

C 32,000

1,32,000 Debtors

45,000

30,000 Less: Prov.

5,000

40,000

General Reserve

P&L A/c

6,000 Land and Building

1,20,000

B/P

20,000

Creditors

40,000

2,28,000

2,28,000

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.indiaguess.com | www.magicsense.com | www.niosguess.com | www.iitguess.com |

www.aipmtguess.com

CBSEGuess.com

B retired on 1st April, 2008. A and C decided to continue the business sharing profits in the ratio of 3:2.

Following terms were agreed:

(a) Goodwill of the firm was valued at Rs. 57,600.

(b) Provision for bad and doubtful debts to be maintained at 10% on debtors.

(c) Land and building to be increased to Rs. 1,32,000.

(d) Furniture to be reduced by Rs. 8,000.

(e) Rent outstanding was Rs. 1,500.

Remaining partners decided to bring sufficient cash in the business to pay off B and to maintain a bank balance

of Rs. 24,800. They also decided to readjust their capitals as per their new profit sharing ratio.

Prepare necessary ledger accounts and balance sheet.

17. On October 1, 2008 SAI Ltd. offered 1,00,000 shares of Rs. 10 each payable as follows:

On application

Rs. 3 per share

On allotment (November 1, 2008)

Rs. 2 per share

On First Call (December 1, 2008)

Rs. 3 per share

On Second & Final Call (one month after first call)

Rs. 2 per share

Applications were received for 1,25,000 shares on October 15, 2008. Applications for 1,20,000 shares were

allotted 1,00,000 shares and the remaining applications were rejected.

Give journal entries assuming that all amounts have been received and the company maintains a combined

account for application and allotment.

8

Or

Vijay Ltd. invited applications for issuing 80,000 equity shares of Rs. 10 each at a discount of 10%. The amount

was payable as follows:

On application Rs. 4 per share

On allotment Rs. 3 per share

On first and final call Rs. 2 per share

Applications were received for 90,000 shares. Applications for 5,000 shares were rejected and pro-rata

allotment was made to the remaining applicants. Over payments received on application was adjusted towards

sums due on allotment.

All calls were made and were duly received except the allotment and call money on 1,600 shares allotted to

Neeraj. These shares were forfeited and the forfeited shares were re-issued for Rs. 14,200 as fully paid up.

Pass necessary journal entries in the books of the company.

Part B

FINANCIAL STATEMENT ANALYSIS

18. An example of cash flow from operating activity is:

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.indiaguess.com | www.magicsense.com | www.niosguess.com | www.iitguess.com |

www.aipmtguess.com

CBSEGuess.com

(a) Purchase of own debentures (b) sale of fixed assets (c) interest paid on term-deposits by a bank (d) Issue of

Equity share capital

1

19. When does a cash flow arise?

1

20. (a) Under what headings will you show the following items in the Balance Sheet of a Company:

(i)

Bank Overdraft

(ii)

Marketable Securities

(iii)

Calls in Advance

(iv)

Work in Progress

(b) Give any two limitations of Financial Statement Analysis.

4

st

21. From the following Balance Sheet of Sun Ltd. as at 31 March 2014, Prepare a Common Size Balance Sheet: 4

Sun Ltd.

Balance Sheet as at 31st March 2012

Particulars

Note No.

31-3-2014

I. EQUITY AND LIABILITIES:

. Shareholders Fu ds

(a) Share Capital

30,00,000

(b) Reserve & Surplus

4,00,000

2. Non-Current Liabilities

(a) Long-term Borrowings

10,00,000

3. Current Liabilities

(a) Trade Payable

6,00,000

TOTAL

50,00,000

II. ASSETS:

1. Non-Current Assets:

(a) Fixed Assets

(i) Tangible Assets

30,00,000

(ii) Intangible Assets

6,00,000

2. Current Assets:

(a) Inventories

10,00,000

(b) Cash and Cash Equivalents

4,00,000

TOTAL

50,00,000

22. Calculate Working Capital Turnover Ratio from the following:

Revenue from Operations

Rs. 12,00,000

Current Assets

Rs. 5,00,000

Total Assets

Rs. 8,00,000

Non-Current Liabilities

Rs. 4,00,000

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.indiaguess.com | www.magicsense.com | www.niosguess.com | www.iitguess.com |

www.aipmtguess.com

CBSEGuess.com

Shareholders Fu ds

Rs. 2,00,000

23. From the following Balance Sheets of X Ltd., you are required to prepare Cash Flow Statement:

Particulars

Note No. 31-3-2015

31-3-2014

I. EQUITY AND LIABILITIES:

. Shareholders Fu ds

(a) Share Capital

8,00,000

6,75,000

(b) Reserve & Surplus

1,70,000

91,000

2. Current Liabilities

1

(a) Short-term Borrowings

88,000

66,000

(b) Trade Payable

1,00,000

70,000

2

(c) Short-term Provisions

34,000

26,000

TOTAL

11,92,000

9,28,000

II. ASSETS:

1. Non-Current Assets:

(a) Fixed Assets

3

(i) Tangible Assets

3,75,000

5,00,000

2. Current Assets:

(a) Inventory

4,00,000

2,50,000

(b) Trade Receivables

3,82,000

1,55,000

(c) Cash and Cash Equivalents

10,000

3,000

(d) Other Current Assets

25,000

20,000

TOTAL

11,92,000

9,28,000

Notes to Accounts:

31-3-2015

31-3-2014

1. Short-term Borrowings:

Bank over draft

88,000

66,000

2. Short-term Provisions:

Provision for Tax

34,000

26,000

3. Tangible Assets:

Land

1,50,000

2,00,000

Plant

2,25,000

3,00,000

3,75,000

5,00,000

Additional Information:

(i)

Interim dividend paid during the year Rs. 60,000.

(ii)

Land was sold at a profit of Rs. 30,000.

(iii)

Plant costing Rs. 20,000 was sold during the year at a loss of Rs. 8,000.

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.indiaguess.com | www.magicsense.com | www.niosguess.com | www.iitguess.com |

www.aipmtguess.com

CBSEGuess.com

Gulshan Hans

H.O.D. Commerce (Rawal International School, Faridabad)

Contact No. 9910811665

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.indiaguess.com | www.magicsense.com | www.niosguess.com | www.iitguess.com |

www.aipmtguess.com

Vous aimerez peut-être aussi

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Document7 pagesCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsPas encore d'évaluation

- Accountancy Model QuestionsDocument19 pagesAccountancy Model QuestionsSunil Kumar AgarwalaPas encore d'évaluation

- Sample Paper Class XII Subject-Accountancy Part ADocument5 pagesSample Paper Class XII Subject-Accountancy Part AKaran BhatnagarPas encore d'évaluation

- Accounts XiiDocument12 pagesAccounts XiiTanya JainPas encore d'évaluation

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Document20 pagesClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatPas encore d'évaluation

- 12 Accountancy Sample Paper 2014Document26 pages12 Accountancy Sample Paper 2014Rachit JainPas encore d'évaluation

- Class 12 Accountancy Solved Sample Paper 2 - 2012Document37 pagesClass 12 Accountancy Solved Sample Paper 2 - 2012cbsestudymaterialsPas encore d'évaluation

- Accountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Document7 pagesAccountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Bhoj SinghPas encore d'évaluation

- AccountancyDocument0 pageAccountancyJaimangal RajaPas encore d'évaluation

- CBSE Class 12 Accountancy Sample Paper-03 (For 2014)Document17 pagesCBSE Class 12 Accountancy Sample Paper-03 (For 2014)cbsestudymaterialsPas encore d'évaluation

- Class 12 Accountancy Solved Sample Paper 1 - 2012Document34 pagesClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsPas encore d'évaluation

- Class XII Accountancy Paper For Half Yearly PDFDocument13 pagesClass XII Accountancy Paper For Half Yearly PDFJoshi DrcpPas encore d'évaluation

- Accountancy: Time Allowed: 3 Hours Maximum Marks: 80Document50 pagesAccountancy: Time Allowed: 3 Hours Maximum Marks: 80Sidharth NahataPas encore d'évaluation

- CBSE Class 12 Accountancy Sample Paper-02 (For 2012)Document20 pagesCBSE Class 12 Accountancy Sample Paper-02 (For 2012)cbsesamplepaperPas encore d'évaluation

- Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsDocument8 pagesSample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General Instructions9chand3Pas encore d'évaluation

- Sample Paper (Cbse) - 2009 Accountancy - XiiDocument5 pagesSample Paper (Cbse) - 2009 Accountancy - XiiJanine AnzanoPas encore d'évaluation

- Accountancy EngDocument8 pagesAccountancy EngBettappa Patil100% (1)

- Financial ReportingDocument7 pagesFinancial ReportingDivyesh TrivediPas encore d'évaluation

- Corporate Accounting QUESTIONSDocument4 pagesCorporate Accounting QUESTIONSsubba1995333333100% (1)

- Accountancy For Class XII Full Question PaperDocument35 pagesAccountancy For Class XII Full Question PaperSubhasis Kumar DasPas encore d'évaluation

- Pccquestionpapers (2008)Document20 pagesPccquestionpapers (2008)Samenew77Pas encore d'évaluation

- 12 2006 Accountancy 4Document5 pages12 2006 Accountancy 4Akash TamuliPas encore d'évaluation

- WBHSCMock 2Document4 pagesWBHSCMock 2Smita AdhikaryPas encore d'évaluation

- Accountancy: Time Allowed: 3 Hours Maximum Marks: 80Document58 pagesAccountancy: Time Allowed: 3 Hours Maximum Marks: 809chand3Pas encore d'évaluation

- Accountancy Unit Test 1 Paper Shalom 2ndDocument4 pagesAccountancy Unit Test 1 Paper Shalom 2ndTûshar ThakúrPas encore d'évaluation

- Accountancy June 2008 EngDocument8 pagesAccountancy June 2008 EngPrasad C MPas encore d'évaluation

- Sample Paper 4Document6 pagesSample Paper 4Ashish BatraPas encore d'évaluation

- TH TH STDocument3 pagesTH TH STsharathk916Pas encore d'évaluation

- XII - Accy. QP - Revision-15.2.14Document6 pagesXII - Accy. QP - Revision-15.2.14devipreethiPas encore d'évaluation

- IPCC MTP2 AccountingDocument7 pagesIPCC MTP2 AccountingBalaji SiddhuPas encore d'évaluation

- Vidya Sagar: Foundation Major Test - 1 (Series - 3) Nov - 20 "Principles and Practice of Accounting"Document5 pagesVidya Sagar: Foundation Major Test - 1 (Series - 3) Nov - 20 "Principles and Practice of Accounting"sonubudsPas encore d'évaluation

- 3hr Paper 4feb 2010Document3 pages3hr Paper 4feb 2010Bhawna BhardwajPas encore d'évaluation

- XII Accts Re First Board Exam 20-21Document9 pagesXII Accts Re First Board Exam 20-21Sagar SharmaPas encore d'évaluation

- Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsDocument11 pagesSample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsSikha KaushikPas encore d'évaluation

- CBSE Class 12 Accountancy Sample Paper With Marking Scheme 2013Document5 pagesCBSE Class 12 Accountancy Sample Paper With Marking Scheme 2013Manish SahuPas encore d'évaluation

- Accounts Preliminary Paper No 9 PDFDocument6 pagesAccounts Preliminary Paper No 9 PDFAMIN BUHARI ABDUL KHADERPas encore d'évaluation

- Data 0001Document50 pagesData 0001Deepak SindhuPas encore d'évaluation

- 12 Acc 1 ModelDocument11 pages12 Acc 1 ModeljessPas encore d'évaluation

- Class 12 Cbse Accountancy Sample Paper 2013-14Document24 pagesClass 12 Cbse Accountancy Sample Paper 2013-14Sunaina RawatPas encore d'évaluation

- Accountancy Sample Question PaperDocument20 pagesAccountancy Sample Question PaperrahulPas encore d'évaluation

- Accounts Preliminary Paper No 8Document6 pagesAccounts Preliminary Paper No 8AMIN BUHARI ABDUL KHADERPas encore d'évaluation

- Accountancy Test-40 MarkDocument2 pagesAccountancy Test-40 MarkCharming CutePas encore d'évaluation

- Accountancy Set-1 Time Allowed: 3 Hours Maximum Marks: 90 General InstructionsDocument8 pagesAccountancy Set-1 Time Allowed: 3 Hours Maximum Marks: 90 General InstructionsVijayPas encore d'évaluation

- SAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80Document6 pagesSAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80AcHu TanPas encore d'évaluation

- 12 Accountancy Sample Paper 2014 04Document6 pages12 Accountancy Sample Paper 2014 04artisingh3412Pas encore d'évaluation

- XII AccountancyDocument4 pagesXII AccountancyAahna AcharyaPas encore d'évaluation

- FR (Old) MTP Compiler Past 8Document122 pagesFR (Old) MTP Compiler Past 8Pooja GuptaPas encore d'évaluation

- Cbse Sample Papers For Class 12 Accountancy With Solution PDFDocument24 pagesCbse Sample Papers For Class 12 Accountancy With Solution PDFVicky PawarPas encore d'évaluation

- Suraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Document5 pagesSuraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Shalini SharmaPas encore d'évaluation

- Retirement QuestionDocument2 pagesRetirement QuestionshubhamsundraniPas encore d'évaluation

- ADL 03 Ver2+Document6 pagesADL 03 Ver2+DistPub eLearning SolutionPas encore d'évaluation

- Delhi Public School: ACCOUNTANCY - (Subject Code: 055)Document4 pagesDelhi Public School: ACCOUNTANCY - (Subject Code: 055)AbhishekPas encore d'évaluation

- New Model Test Paper 1Document8 pagesNew Model Test Paper 1Harry AryanPas encore d'évaluation

- CBSE Class 12 Accountancy Sample Paper 2018Document19 pagesCBSE Class 12 Accountancy Sample Paper 2018Mitesh SethiPas encore d'évaluation

- Paper 1: AccountingDocument30 pagesPaper 1: Accountingsuperdole83Pas encore d'évaluation

- CBSE Class 12 Accountancy Sample Papers 2014 - 15Document7 pagesCBSE Class 12 Accountancy Sample Papers 2014 - 15Karthick KarthickPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionPas encore d'évaluation

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesD'EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesPas encore d'évaluation

- Case Studies in Not-for-Profit Accounting and AuditingD'EverandCase Studies in Not-for-Profit Accounting and AuditingPas encore d'évaluation

- 1Document1 page1Ashish BatraPas encore d'évaluation

- CohoDocument1 pageCohoAshish BatraPas encore d'évaluation

- Exporter Importer DirectoryDocument3 pagesExporter Importer DirectoryAshish Batra100% (1)

- Cotton PriceDocument2 pagesCotton PriceAshish BatraPas encore d'évaluation

- 2307 PDFDocument1 page2307 PDFAshish BatraPas encore d'évaluation

- 1 LicDocument1 page1 LicAshish BatraPas encore d'évaluation

- Group Presentations: Assessment Structure ForDocument1 pageGroup Presentations: Assessment Structure ForAshish BatraPas encore d'évaluation

- Idea Payment ReceiptDocument1 pageIdea Payment ReceiptAshish BatraPas encore d'évaluation

- Marks & Spencer PLCDocument9 pagesMarks & Spencer PLCSha D ManPas encore d'évaluation

- Group Presentations: Assessment Structure ForDocument1 pageGroup Presentations: Assessment Structure ForAshish BatraPas encore d'évaluation

- Healthcare: India Sector NotesDocument29 pagesHealthcare: India Sector NotesGaurav Singh RanaPas encore d'évaluation

- Group Presentations: Assessment Structure ForDocument1 pageGroup Presentations: Assessment Structure ForAshish BatraPas encore d'évaluation

- Marks & Spencer PLCDocument9 pagesMarks & Spencer PLCSha D ManPas encore d'évaluation

- Brand Goal: Ubc Brand Communications PlanDocument4 pagesBrand Goal: Ubc Brand Communications PlanMohammad BarakatPas encore d'évaluation

- Sample Paper 4Document6 pagesSample Paper 4Ashish BatraPas encore d'évaluation

- Strategy Topics CoveredDocument3 pagesStrategy Topics CoveredAshish BatraPas encore d'évaluation

- Insights On Mobile Consumption From Nielsen ResearchDocument21 pagesInsights On Mobile Consumption From Nielsen ResearchSumit RoyPas encore d'évaluation

- Structure of The ReportDocument1 pageStructure of The ReportAshish BatraPas encore d'évaluation

- Invitation For The EventDocument2 pagesInvitation For The EventAshish BatraPas encore d'évaluation

- Top Export Products of IndiaDocument8 pagesTop Export Products of IndiaAshish BatraPas encore d'évaluation

- Project Planning and Scheduling TopicsDocument1 pageProject Planning and Scheduling TopicsAshish BatraPas encore d'évaluation

- Carrier OptionsDocument1 pageCarrier OptionsAshish BatraPas encore d'évaluation

- Stevens Upper Division Research WritingDocument20 pagesStevens Upper Division Research WritingMuhammad Hammad JavedPas encore d'évaluation

- Pulse of Indian Retial Market 2014Document3 pagesPulse of Indian Retial Market 2014Ashish BatraPas encore d'évaluation

- PriyankaDocument9 pagesPriyankaAshish BatraPas encore d'évaluation

- Summer Internship ReportDocument1 pageSummer Internship ReportAshish BatraPas encore d'évaluation

- Project ContentsDocument22 pagesProject ContentsAshish BatraPas encore d'évaluation

- Disclosure StatementDocument1 pageDisclosure StatementBernadel MendozaPas encore d'évaluation

- Add'l Problems - Lessee AccountingDocument14 pagesAdd'l Problems - Lessee AccountingPoru Senpii100% (1)

- Sub Accountancy: Class XIDocument3 pagesSub Accountancy: Class XIJanvi Singh RajputPas encore d'évaluation

- (041621) Nike, Inc. - Cost of CapitalDocument8 pages(041621) Nike, Inc. - Cost of CapitalPutri Alya RamadhaniPas encore d'évaluation

- Marketing Consulting Business PlanDocument33 pagesMarketing Consulting Business PlanMohamed Salah El Din100% (1)

- Format of Financial StatementsDocument11 pagesFormat of Financial StatementssarlagroverPas encore d'évaluation

- MM5 Financial - Economic FeasibilityDocument39 pagesMM5 Financial - Economic FeasibilityC-K88Pas encore d'évaluation

- Financial Reporting (United Kingdom) : Wednesday 13 June 2012Document10 pagesFinancial Reporting (United Kingdom) : Wednesday 13 June 2012Huệ LêPas encore d'évaluation

- 000463Document238 pages000463Del Farai BalenguPas encore d'évaluation

- Vipul2 PDFDocument39 pagesVipul2 PDFNeeraj Singh RainaPas encore d'évaluation

- Inflation Accounting New CourseDocument11 pagesInflation Accounting New CourseAkshay Mhatre100% (1)

- Accounting For Special Transactions:: Corporate LiquidationDocument28 pagesAccounting For Special Transactions:: Corporate LiquidationKim EllaPas encore d'évaluation

- Laaaaaafarge 1st Quarter Report 2021Document24 pagesLaaaaaafarge 1st Quarter Report 2021Ahm FerdousPas encore d'évaluation

- Christian Paul D. Legaspi Easy Problem 1, CCEDocument16 pagesChristian Paul D. Legaspi Easy Problem 1, CCELyca Mae CubangbangPas encore d'évaluation

- Accounting 2301 (Chapter 1-4)Document3 pagesAccounting 2301 (Chapter 1-4)Fabian NonesPas encore d'évaluation

- HRUM - Laporan Keuangan Tengah Tahun 2022Document115 pagesHRUM - Laporan Keuangan Tengah Tahun 2022Irfan RosihanPas encore d'évaluation

- PRELIMINARY EXAMINATION Acctg 339Document2 pagesPRELIMINARY EXAMINATION Acctg 339Liza Magat MatadlingPas encore d'évaluation

- Quiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFDocument3 pagesQuiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFSamuel BandibasPas encore d'évaluation

- Flash Memory Case Study SolutionDocument8 pagesFlash Memory Case Study SolutionRohit Parnerkar57% (7)

- Consolidation Question Solution PDFDocument3 pagesConsolidation Question Solution PDFjoannejose2011100% (2)

- Inventory ErrorsDocument8 pagesInventory ErrorsAnonymous LC5kFdtc100% (1)

- Master Fuel 1957Document2 pagesMaster Fuel 1957namrvora072504Pas encore d'évaluation

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaPas encore d'évaluation

- SOALDocument2 pagesSOALjwtrmdhnPas encore d'évaluation

- Mba Sem 4 Mergers and Acquisitions Sum 2017Document5 pagesMba Sem 4 Mergers and Acquisitions Sum 2017MANSIPas encore d'évaluation

- (KELOMPOK 4) Latihan Soal Cash FlowDocument5 pages(KELOMPOK 4) Latihan Soal Cash FlowꧾꧾPas encore d'évaluation

- Preparing SFP of Single Propriertorship BusinessDocument18 pagesPreparing SFP of Single Propriertorship Businessjudith100% (2)

- Partnership Termination and LiquidationDocument29 pagesPartnership Termination and LiquidationTrinidad Cris Gerard67% (3)

- MARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesMARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaPas encore d'évaluation

- Financing Entrepreneurial VentureDocument34 pagesFinancing Entrepreneurial VentureAmos SylvesterPas encore d'évaluation