Académique Documents

Professionnel Documents

Culture Documents

Principles of Economics Assignment 1

Transféré par

chelleCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Principles of Economics Assignment 1

Transféré par

chelleDroits d'auteur :

Formats disponibles

Running head: PRINCIPLES OF ECONOMICS

Michelle Bates

Principles of Economics

Professor: Christine Farias

Strayer University

Date: January 29, 2015

Economics 100

Running head: PRINCIPLES OF ECONOMICS

The article in question dwells upon the demand and supply correlation in the

commodity market in 2014. First, Sanderson and Hume (2014) note that demand for such

resources as iron ore, oil and others was quite significant in the 2014. Although there was

certain slow-down in development of markets in Asia and Europe, the demand did not

decrease dramatically during the year. However, the researchers also add another point. They

state that the supply increased significantly, as companies were willing to make more profits

and win larger markets.

Sanderson and Hume (2014) point out that the correlation between supply and

demand was violated. Thus, the authors note that supply grew by 12% in 2014 while demand

only increased by 9%. This led to the markets saturation and, as a result, to decrease in

prices. Finally, the authors conclude that demand is unlikely to return to the level of previous

years due to the slow-down in development of such markets as China.

This article can be seen as an example of the correlation between supply and

demand. It has been acknowledged that supply and demand are very close and they have a

significant impact on each other (Causevic, 2014). Thus, when supply for certain products are

decreasing, the demand is likely to decrease. Clearly, the right correlation between the two

concepts is important for products prices and producers (and sometimes governments) have

to undertake certain steps to affect prices. It is possible to note that there are numerous ways

to do that. Rahji and Adewumi (2008) state that the government should respond to the change

in correlation; when it comes to the grain market. Hence, the researchers note that the

government should restrict import of the product to increase the demand as well as prices

(Rahji & Adewumi, 2008).

Running head: PRINCIPLES OF ECONOMICS

The article also shows that the commodity market is highly elastic. The elastic

market is the one where the demand and supply correlation have a dramatic impact on prices

(Mankiw, 2014). The elasticity is determined by the fact that the products are essential or not

essential to consumers. Non-elastic markets are food or healthcare markets as people will still

buy these products irrespective of the price. Thus, if the prices go up, customers still buy the

products.

When it comes to commodities, these cannot be seen as essential products to

consumers as they are more important for producers. For instance, when the market is

saturated with these kinds of products, prices go down, as producers of consumer products

simply do not need so many resources. At the same time, when the demand is growing, the

price is also growing since the companies need resources to produce their products.

In conclusion, it is necessary to note that the article in question unveils the essence

of supply and demand correlation. The authors consider the commodity market and provide

substantial explanations of the reasons for the price decline at the end of 2014. I agree with

the authors that companies desire to produce more resources was one of the major reasons

for the decrease in process. Clearly, decreasing demand also played certain role in the

process. Nonetheless, companies desire to sell more and enter new markets was crucial in the

process. The article also helps understand one of the most important concepts of the market,

which has to be taken into account.

Running head: PRINCIPLES OF ECONOMICS

Reference List

Causevic, F. (2014). The global crisis of 2008 and Keyness general theory. New York, NY:

Springer.

Mankiw, N. (2014). Principles of economics. Stamford, CT: Cengage Learning.

Rahji, M.A.Y., & Adewumi, M.O. (2008). Market supply response and demand for local rice

in Nigeria: Implications for self-efficiency policy. Journal of Central European

Agriculture, 9(3), 567-574.

Sanderson, H., & Hume, N. (2014, December 22). Supply is key to commodities volatile

year. Financial Times. Retrieved from http://www.ft.com/intl/cms/s/0/f837f0188542-11e4-a06e-00144feabdc0.html#axzz3Q0xCSAiM

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Chapter 11Document16 pagesChapter 11RamrajPas encore d'évaluation

- Externalities, Public Goods, Imperfect Information, and Social ChoiceDocument35 pagesExternalities, Public Goods, Imperfect Information, and Social ChoiceLukas PrawiraPas encore d'évaluation

- Elasticity of Demand-3Document25 pagesElasticity of Demand-3vismayPas encore d'évaluation

- Chap 13 Inventory ManagementDocument43 pagesChap 13 Inventory ManagementAcyslz50% (2)

- Economics NotesDocument4 pagesEconomics NotesThe Multi-Ninja GuyPas encore d'évaluation

- ECO 561 Final Exam Latest University of Phoenix Final Exam Study GuideDocument13 pagesECO 561 Final Exam Latest University of Phoenix Final Exam Study GuideEmma jonsPas encore d'évaluation

- MBA Revised Syllabus 2008Document60 pagesMBA Revised Syllabus 2008Pinak GoswamiPas encore d'évaluation

- Supply and Demand Crossword - WordMint - AnswerDocument2 pagesSupply and Demand Crossword - WordMint - Answercharmaine fosPas encore d'évaluation

- Chapter 6Document43 pagesChapter 6Minh Thu TranPas encore d'évaluation

- Chapter 13 - Applied Problem SolutionsDocument10 pagesChapter 13 - Applied Problem SolutionsZoha KamalPas encore d'évaluation

- Final Quiz WartonDocument13 pagesFinal Quiz WartonAleksandraMadžoski27% (11)

- Demand Forecasting and Its TechniquesDocument5 pagesDemand Forecasting and Its TechniquesKumar RahulPas encore d'évaluation

- What Is DemandDocument16 pagesWhat Is DemandUsman zafarPas encore d'évaluation

- Class Notes For ECON1002Document14 pagesClass Notes For ECON1002James & Jessica ScullyPas encore d'évaluation

- Black Book - BmsDocument63 pagesBlack Book - BmsdeepakPas encore d'évaluation

- Unit One The Interaction of Demand and Supply. Market PriceDocument29 pagesUnit One The Interaction of Demand and Supply. Market PriceИрина ЗвольскаяPas encore d'évaluation

- Managerial Economics 1 Solved MCQs (Set-3)Document8 pagesManagerial Economics 1 Solved MCQs (Set-3)Rajeev TripathiPas encore d'évaluation

- Chapter 4Document21 pagesChapter 4Isaac MachaculePas encore d'évaluation

- Ap Micro Problem Set 2Document2 pagesAp Micro Problem Set 2api-244986640Pas encore d'évaluation

- MicroEconomics Practice TestDocument7 pagesMicroEconomics Practice TestDavid BurfordPas encore d'évaluation

- C.A Accounting Project HindiDocument27 pagesC.A Accounting Project HindiVicky SinghPas encore d'évaluation

- Inventory Management: Dr. Anurag Tiwari IIM RohtakDocument68 pagesInventory Management: Dr. Anurag Tiwari IIM RohtakBinodini SenPas encore d'évaluation

- Macro Economics: National Income Fiscal Policy Monetary Policy Trade CyclesDocument48 pagesMacro Economics: National Income Fiscal Policy Monetary Policy Trade Cyclesusne902Pas encore d'évaluation

- Vendor Managed Inventory - Project ReportDocument11 pagesVendor Managed Inventory - Project ReportTauheedalHasan100% (2)

- Global Business Strategy Group AssignmentDocument33 pagesGlobal Business Strategy Group Assignmentquỳnh anh lươngPas encore d'évaluation

- 312 MKT B2B MCQ 2019Document7 pages312 MKT B2B MCQ 2019Pratik PatilPas encore d'évaluation

- s5 Economics - InflationDocument18 pagess5 Economics - InflationHasifa KonsoPas encore d'évaluation

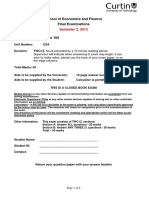

- S2 2013 Final Exam (+ MCQ Answers)Document8 pagesS2 2013 Final Exam (+ MCQ Answers)shikha ramdanyPas encore d'évaluation

- Airline Industry ReportDocument42 pagesAirline Industry ReportManash Verma67% (3)