Académique Documents

Professionnel Documents

Culture Documents

Commodities: February 15 - MARKETS OUTLOOK

Transféré par

Milling and Grain magazineCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Commodities: February 15 - MARKETS OUTLOOK

Transféré par

Milling and Grain magazineDroits d'auteur :

Formats disponibles

MARKETS OUTLOOK

Wheat market absorbs Russian export curbs

by John Buckley

Prior to the export

curbs, Russia was

expected to supply

about 22m tonnes or

14% of the worlds wheat

import needs in 2014/15.

The lions share of this,

about 17-18m tonnes, has

already been shipped,

already more or less

matching Russias

bumper 2013/14 exports

- with half the current

season still to run

54 | Milling and Grain

GLOBAL wheat markets have spent most of 2015 to date in retreat from a steep run-up in

prices in the final weeks of last year. Many readers may be aware that the main element in

that upturn was the decision by fourth largest exporter Russia to curb the too-rapid flow of its

once-plentiful milling wheat onto world markets at a time when doubts were rising about the

size of its next harvest. As the rouble nosedived with the collapse in value of Russias crude oil

exports and Western sanctions keeping Russian exports cheap - there did seem a real risk, as

the year turned, that too much of its wheat would be snapped up by foreign buyers, leaving its

domestic market short and at risk of escalating costs for that most basic staple, bread. Russia is

also thought to need more wheat and other cereals for animal feed this seaso as it tries to boost

domestic livestock output to replace embargoed meat imports from Europe and the USA.

Mindful that it couldnt simply embargo exports without reneging on its WTO obligations,

Russia initially used various indirect measures to slow them down, led by stricter phytosanitary

(plant health and other rd tape. These certainly put the brakes on trade during the late December/

early January timeslot. However, theyve now been overtaken by the introduction of a more

direct instrument in the form of an export duty, recently equal to around E30/$40 per tonne,

applying from February 1. This has been effective in cutting off further Russian sales in recent

weeks, yet seems to have been absorbed by the markets without less fuss than the earlier indirect

measures.

Prior to the export curbs, Russia was expected to supply about 22m tonnes or 14% of the

worlds wheat import needs in 2014/15. The lions share of this, about 17-18m tonnes, has

already been shipped, already more or less matching Russias bumper 2013/14 exports - with half

the current season still to run.

That partly explains the muted market reaction, despite the latest news that neighbouring

Ukraines government had also agreed voluntary curbs with its exporters on its Feb/Mar wheat

sales. These could be loosened up somewhat if its own winter wheat crop emerges in reasonable

condition from what (for both countries) has been a fairly challenging winter to date (dry start,

poor crop establishment, some snow cover issues raising greater than usual risk of winterkill

etc). However, like Russia, Ukraine has already shipped out the bulk of what it intended to

export during 2014/15 so this doesnt leave a huge gap in the market. At worst, the CIS absence

means the floor price of wheat on world markets is a bit higher than it would have been, had both

continued selling freely (i.e. no longer rock-bottom).

Even if Russian sales fall 2m to 4m tonnes

short of the target 22m this season, there is

no shortage of contenders to take its place.

Top of the list has been the EU, which

has recently seen some of its best weekly

export sales of the season and now seems on

course to match, if not exceed last seasons

record 30m tonne total. It could sell even

more without leaving EU consumers short.

Even after consuming an extra 9m tonnes

in animal feeds, Europe is still expected to

finish with carryover stocks of about 17m

tonnes compared with just 10m when the

season started, thanks to last years massive

domestic crop.

However, what this good clearance of EU

wheat supplies has done, along with the

weakest euro/dollar exchange rate for 11-

years has been to lift internal wheat prices

off the 4-year floor they tumbled onto last September. As we

go to press, the European milling wheat futures market is trading

about 30% over those lows, if still about 9% below its 2014

highs. Feed wheat prices had also dropped with this seasons

larger low/middling grade soft wheat supplies in countries like

France. The UK market has frequently been even weaker than the

Continent due to the relative strength of sterling versus the euro.

While consumers obviously wont cheer any cost increases,

most will probably recognise that farmers who last autumn faced

break-even or loss-making prices have to make a living too, to

ensure continuity of supply.

Summing up, world markets, where the value of wheat is

ultimately made, still appear to be amply supplied for the rest of

2014/15 to end June. The USDAs own global crop estimate has even

risen further since our last review, by about 3m to a new record 723m

tonnes, or about 8m more than last year. USDA has also edged up its

estimate of global wheat consumption although this remains about

10m under production which means end-season carryover stocks rise

by the same amount to a comfortable 196m tonnes about 27.5% of

projected consumption or 14 weeks supply.

56 | Milling and Grain

These extra stocks provide a cushion against an expected

smaller world wheat crop in 2015. Recent estimates suggest the

negative outlook for Russian and Ukrainian crops will knock

about 10m tonnes off their combined output this summer. That

might be offset somewhat if they plant more spring wheat but that

yields less than winter wheat. There is also much concern about

how both countries will finance their seed and input needs for

these crops (especially the significant imported portion of these)

as their currencies continue to tumble a factor that could take

another bite out of yields.

The EUs own 2015 wheat outlook is a bit of a mixed bag with

some countries apparently sowing a bit less, others more, some

in need of more rain, some at risk of possible frost damage etc.

One recent private estimate suggested output could be about 7m

tonnes down from last years crop based on yields also coming

off last years highs. However, it shouldnt be forgotten, that the

2014 crop was a record one at 155.5m tonnes, 12m more than in

2013 and 22m over 2012 so this would hardly be a disaster.

The USA has also had some weather issues affecting winter

wheat potential, lingering dryness in some areas, frost threats in

others and a general crop rating

below this time last years.

Even so, some analysts expect

a slightly larger crop based on

area increases.

Canadas crop is a bit of an

open book at this stage, the

bulk not sown until the spring

so much depends on weather

then and relative returns from

competing crops like rapeseed.

Current government thiking

there is that overall acreage will

increase by almost 800,000 acres

but the lions share of that gain

will be for duruym rather than

spring breadwheats.

Among the other big suppliers,

Australian and Argentine crops

(technically 2014/15 harvests

but the bulk marketed in 2015)

are both adequate. Australia is

currently expected to export at

least as much as last years 18m

tonnes while the USDA sees

Argentine trade exports soaring

from just 1.6m in 2013/14 to as

much as 6m tonnes. However,

that assumes a less restrictive

export policy, which may an be

optimistic hope, given that the

government has only recently

told exporters they wont get

permits unless they pass on a

fair share of the world prices to

farmers.

That said, the above export

potential is easily enough

to make up for any Russian

shortfall - albeit at a higher price

than if Russia had continued to

sell freely.

But the list doesnt end there.

To these regular exporters can

anything the experts could have imagined, market chatter has

be added other non-traditional potential wheat suppliers. India

begun to question not only the level of discretionary (voluntary)

burdened with huge stocks after three successive large harvests,

blending but the longer term viability of the mandate itself.

wants to export about 2m tonnes while neighbouring Pakistan,

There have even been some moves in Congress to challenge the

more frequently an importer, reportedly plans to put about 3m

mandate although current opinion suggests these are unlikely to

tonnes on world markets.

succeed at this stage.

Finally we should not rule out both Russia and Ukraine

Still, the fundamental question needs to be answered, what

returning to the market as exporters sooner than harvest time.

happens to ethanol demand in the longer term if the green fuel

It has happened before after past embargoes and both will want

cant be produced as cheaply as petrol? No one saw this coming

to do all they can to re-portray themselves as reliable suppliers,

and opinion is unsurprisingly split on how long it will last. Will

once their domestic needs appear to have been safeguarded.

crudes demise contain fracking and reduce less-economical

Overall then, there is nothing much in wheat supply/demand

fossil fuel production and, if so, over what timeframe? The irony

fundamentals to justify price rises and, depending how the CIS

is that US ethanol production was recently running at record

crops shape up, maybe even potential for cheaper wheat. This

levels, buoyed up by the collapse of maize feedstock costs over

isnt yet apparent on the US futures markets where the forward

the past two years.

months carry a small premium. However, European new crop

Whether or not ethanol continues to account for about 40%

wheat is slightly cheaper than current months.

of US corn disposals, supplies of the coarse grain will remain

Maize crop estimate trimmed but still huge

in substantial surplus. Even after trimming the US 2014 crop

Like wheat, maize has been getting cheaper into the New Year

estimate by almost 5m tonnes in January, the USDA still has

after an earlier run-up in prices. The latter move reflected a

production at an all-time record high of 361m tonnes. That

combination of factors including better than expected domestic

and export demand for US maize,

ideas the latters 2014 crop had

been over-rated, forecasts that its

farmers would sow less in 2015

and some dry weather issues

overhanging prospects for the

South American harvests coming

on stream this spring.

Given the way some of these

fundamentals have shifted to a

more bearish slant in early 2015,

it seems mildly surprising that

the US market hasnt come down

more (Its lost about 9% from its

GRINDING

mid-December

DOSING

Probably the biggest

undermining influence has

A TAILOR MADE

been the 60% collapse in the

FEED PRODUCTION

international value of crude oil

PROCESS, DESIGNED

under the weight of the US shale

WITH A CLEAR FOCUS ON:

gas boom and OPECs (mainly

The optimal solution

for your process

Saudis) attempts to make up

in volume what its lost in unit

revenue (and by doing so, maybe

help drive its new competitors

out of business).

Its hard to over-state the impact

that ethanol has had on US maize

disposal and values and, to a

lesser extent total world grain use

in the fuel sector in recent years.

Ten years ago, US annual maize

use in this outlet was a mere 33m

tonnes. This season its expected

to exceed 130m.

When crude oil prices began

their collapse earlier last year,

it was assumed that usage

would remain protected by the

governments legally binding

minimum blending requirement

within the Renewable Fuel

Standard. But as crude prices

continued to fall far beyond

Lowest operational costs

Energy efficiency

Feed safety

MIXING

CONDITIONING

COATING

PELLETING

w w w. a a r s e n . c o m

February 2015 | 57

compares with US consumption of 301m and exports of 44.5m.

The surplus will allow the US to go into 2015/16 season with

48m tonnes of stock versus 31m this season and just 21m the

previous year.

Global maize output is meanwhile estimated at 988m tonnes

about 17m over consumption, resulting in stocks rising by that

amount to 189m. As in the USA, this is the highest stock for

some years. Its moderated somewhat by the fact that over 40% of

it is held in China, whose figures are often considered unreliable

and whose quality is usually thought questionable in comparison

with maize from the other big producers. Nonetheless, the market

must accept that maize on paper/in fact is in loose supply.

In recent weeks, maize markets have also been watching the

weather in South America, which seems to have improved

after a dry start in Brazil and some excess rain and flooding in

Argentina. Some Brazilian private estimates are running about

5m tonnes over the USDAs 75m tonne forecast (down about 4m

on last year). Argentina is expected to produce about 22m versus

last years 25m tonnes.

Although previously up-and-coming exporter Ukraines last

crop was also 4m tonnes lower than the previous years it is still

a big one by historical comparison. Its exports will be down by a

similar amount and have so far been a bit slower than expected.

However, as we go to press, it seems to be stepping up sales and

undercutting the dominant US exporter by about $8 to $10 per

tonne.

US exports have performed quite well so far this season,

58 | Milling and Grain

underpinning prices on the bellwether Chicago futures market to

some extent. However, with Ukrainian, then Lat-Am competition

expected to pick up later into first quarter 2015 and beyond,

export-based support for US prices will likely diminish. Although

US feed demand is thought to be expanding this season (helped

by lower maize costs amid higher meat prices) it may not be

enough to fend off bearish supply-side pressures if ethanol

demand does weaken.

Further forward, crop analysts have been expecting the US sow

less maize this spring but a predicted shift to soyabeans may be

smaller than earlier thought as soya prices are currently dropping

faster. As always, though, the weather at planting time will have a

huge influence on the mix of crops.

Within the EU, maize demand is expected to edge up by about

1m tonnes to a new peak of 77m but with the domestic crop up

by almost 10m tonnes, Europea consumers will be able to slash

their dependence on imports from 16m to perhaps 6m or 7m

tonnes. With demand from other importers expected to be down

by a similar amount, maize looks more and more like a buyers

than a sellers market. As in the wheat market, then, there is not

much in the fundamentals to support higher prices going forward

- despite US futures markets quoting new crop up to 10% dearer

than current months.

Soya supply glut looms

If Europe were growing more soyabeans, rather than importing

the bulk of its 13.5m tonne crush, meal costs might be falling

with the global trend amid the largest surplus on record.

However, while dollar-quoted meal prices have dropped by about

25% this season, the euro has tumbled to its lowest in 11 years

versus the US currency, keeping prices on the Continent more

expensive than in the autumn of 2014. Even UK consumers

cushioned by relatively stronger sterling versus the euro, are not

doing so well when dollars are turned to pounds, robbing them of

much of the benefit of the sliding US price.

That said, European meal costs are at least being restrained

somewhat by the supply glut and, as the largest ever South

American soya harvests crank up, this could yet exert more

downward price pressure on both sides of the channel.

Most of the increase in this seasons global oilseed and meal

production is in soyabeans, for which world output has recently

been estimated at 314.5m tonnes up by about 2m since our

last review and a hefty 30m tonnes over last years crop. That

increase would equal about 24m tonnes more meal if all were

crushed. In fact, only about half the extra beans will be used for

feed, creating about 11.5m tonne more meal which roughly

equals the expected rise in this seasons global meal demand.

The high end-season stocks of soyabeans (a record 91m tonnes

versus last years 66m and about 55m in the previous two

seasons) provide an ample cushion against any supply shortfalls

from coming soya crops. Over the past two months, weather has

steadily improved for South American oilseed crops, confirming

record output to be marketed over coming months. A weak

Brazilian currency should help ensure good exports from the

major supplier to cash in on the strong dollars in which beans

are traded. Estimates have recently been raised for Argentinas

coming crop, which should ensure very large exports from this

supplier too. Argentina crushes two thirds of its crop to export as

meal, for which it is far and away the worlds largest supplier.

In a couple of months time, the US will start planting its own

soya crop which some analysts think will expand by about 2m

acres to cover a new record area. Even if yields dip from last

years record highs closer to the long-term trend, that would

deliver another mega crop, currently seen around 104/105m

OVER 50 YEARS OF ENGINEERING SOLUTIONS

Sukup Manufacturing Co. continues to Engineer Solutions to meet the challenges of

the grain industry. As the worlds fastest-growing bin company we offer commercial bins

with clear span roofs and holding capacities up to 1.5 million bushels. We also have

a complete line of drying, storage, and material handling products, as well as steel

buildings - all engineered to revolutionize grain processing and storage, making it

easier, more efficient, and more profitable.

Sukup Manufacturing Co. www.sukup.com info@sukup.com Sheffield, Iowa 50475-0677 641-892-4222

tonnes below last years record 108m but far more than the

normal 85m/90m tonnes of recent years.

Of course, we have yet to see what weather will accompany

the US sowing and growing season up to September. But if

conditions are normal, it is hard to see how this supply outlook

can point to anything but flat to weaker prices. The futures

markets currently show only small discounts on forward soya

beans and meal. However, some analysts see leeway for bean

prices (already down 37% from last summers highs) to drop by a

further 10-15% under this scenario, As soya is so protein-rich and

usually a reliable quality leader, pricing of other oilmeals will, as

usual, have to broadly follow the soya price trend.

The European feed industry is expected to use about 1m tonnes

more soya meal this season. The rest of the increase is spread

over China (+5m), the USA (+1m), Brazil (+0.4m) and a number

of small/moderate-sized consuming countries.

KEY FACTORS AHEAD

WHEAT

Concern persists over the state of Russian winter sown wheat

crops, a larger percentage than normal described as in poor

condition. A better picture will be available when plants

emerge from dormancy in the spring. The outcome could have

considerable influence on wheat prices going forward at this

stage seen more bullish than bearish.

Ukraine has also had some over-wintering problems tha will

become clearer in a few weeks time. Its massive currency

devaluation during February (in addition to an earlier long

slide) augurs ill for spring crop finance and yields although

maybe it will get some financial help fro western aid packages.

Russia also faces problems of spring crop finance at a time

when it needs to boost sowings on failed winter crop lands.

Crop ratings have continued to deteriorate for US winter wheat

for harvest 2015 but some timely rains could yet allow some

recovery. This has not emerged as a major factor yet because

60 | Milling and Grain

the most affected crop has been soft red wheat, for which

export demand remains poor amid hefty foreign competition

for this class.

European crops have had a generally unchallenging, mild

winter but lack of hardening off leaves them exposed to frost

damage from late cold snaps.

World stocks of wheat carried into 2015/16 remain hefty, a

cushion against any crop weather problems in the months ahead.

The drop in wheat values close to or, for some farmers below,

cost of production remains an issue that may affect future

sowing plans.

Decent quality premiums will continue to merited for milling/

bread wheats as feed wheat prices remain under pressure from

large, cheap supplies of coarse grains.

Global feed consumption of wheat is still expected to rise by

about 10m tonnes this season but remain below the high levels

of three years ago. But will ethanol use of wheat hold up at

expected levels in Europe under the low oil-price scenario?

COARSE GRAINS

How much maize will the US sow in 2015? Current forecasts

suggest a cutback but still enough for another large crop which,

with large carryover stocks from this season, will keep this

market well-supplied.

Ukrainian and Russia spring sowing of maize may face

financing challenges caused by their lack of access to credit,

weak currencies pushing up imported input prices. A clearer

picrure may be available on this factor within the next couple

of months

Ample maize supplies from Latin America and the CIS

countries will continue to compete at discounts to US exports

in Asia, Europe and other markets, restraining CBOT maize

futures prices and global prices.

The EU has been well supplied with its own maize crop this

season, enabling it to slash imports the main factor in a lower

global maize trade. Will it sow as much for 2015?

Competition for coarse grain customers continues from larger

than usual feed wheat and adequate barley supplies, helping to

contain livestock feeders costs

Will the US ethanol industry continue to use as much maize if

the price of conventional petrol stays down/gets cheaper still?

Declaring its policy to move to a more market-oriented plan,

China could draw down more of its own massive reserve stocks

rather than imports - to fill its ongoing annual gap between

domestic crops and growing consumption. That would removes

a potential bullish influence for world maize export markets

OILMEALS/PROTEINS

Large US and Lat-Am soyabean crop surpluses continue

to offer potential for cheaper global oilmeal costs as 2015

progresses

Lower oilmeal costs and ample supplies may yet spur greater

than expected demand in countries developing livestock

production systems China, India, Indonesia etc. Developed

consumers like the USA may also use more as high meat prices

contribute to profitability.

Rapeseed and sunflower expansions have slowed down or

reversed in the past year but as oil-rich oilseeds these will

have less impact on the meal sector.

One result is that soya will raise its already dominant share

of the protein market. As the high-protein, reliable quality

and most voluminous product, its price trend will have to be

followed across the meal sector.

Wishing the team at

Milling and Grain

the best of luck with the new title ...

... and a

to all of its readers!

from everyone at

PNEUMATIC OR MECHANICAL SHIP LOADERS & UNLOADERS

PORT EQUIPMENT - TURNKEY PROJECTS

VIGAN ENGINEERING S.A. RUE DE LINDUSTRIE, 16 1400 NIVELLES (BELGIUM)

TL.: +32 67 89 50 41 FAX : +32 67 89 50 60 WWW.VIGAN.COM INFO@VIGAN.COM

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- How To Maximise The Life of Your Flaking RollsDocument4 pagesHow To Maximise The Life of Your Flaking RollsMilling and Grain magazine100% (1)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Combustible Dust Control - Part 2Document4 pagesCombustible Dust Control - Part 2Milling and Grain magazinePas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Milling and GRain Magazine - November 2016 - FULL EDITIONDocument116 pagesMilling and GRain Magazine - November 2016 - FULL EDITIONMilling and Grain magazine100% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Rotary Batch Mixer - Achieving Precise Ratios For Feed SupplementsDocument2 pagesRotary Batch Mixer - Achieving Precise Ratios For Feed SupplementsMilling and Grain magazinePas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Enzymatic Flour StandardisationDocument4 pagesEnzymatic Flour StandardisationMilling and Grain magazine100% (1)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Commodities - MARKETS OUTLOOKDocument6 pagesCommodities - MARKETS OUTLOOKMilling and Grain magazinePas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Industry Profile: GRANDS MOULINS DE PARISDocument2 pagesIndustry Profile: GRANDS MOULINS DE PARISMilling and Grain magazinePas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- STORAGE - Bentall Rowlands Storage Systems Limited Talks Grain StorageDocument4 pagesSTORAGE - Bentall Rowlands Storage Systems Limited Talks Grain StorageMilling and Grain magazinePas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Balance of PowerDocument4 pagesThe Balance of PowerMilling and Grain magazinePas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Combustible Dust Control - Part 1Document4 pagesCombustible Dust Control - Part 1Milling and Grain magazinePas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Milling and Grain Magazine - September 2016 - FULL EDITIONDocument116 pagesMilling and Grain Magazine - September 2016 - FULL EDITIONMilling and Grain magazinePas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Storage - Si-LowDocument4 pagesStorage - Si-LowMilling and Grain magazinePas encore d'évaluation

- Millet - Feeding The FutureDocument4 pagesMillet - Feeding The FutureMilling and Grain magazinePas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Industry Profile: NOVUSDocument4 pagesIndustry Profile: NOVUSMilling and Grain magazinePas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- STORAGE: Aerating Stored GrainDocument4 pagesSTORAGE: Aerating Stored GrainMilling and Grain magazinePas encore d'évaluation

- Lsems Tour - Part 2 - Campden BriDocument4 pagesLsems Tour - Part 2 - Campden BriMilling and Grain magazinePas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Milling and Grain Magazine - August 2016Document112 pagesMilling and Grain Magazine - August 2016Milling and Grain magazine100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- Online Brochure 0713Document34 pagesOnline Brochure 0713doc_abdullah100% (1)

- G. Scanes. Poultry Science, 5th Edition (VetBooks - Ir)Document490 pagesG. Scanes. Poultry Science, 5th Edition (VetBooks - Ir)Nanang Haryadi100% (1)

- Anatomy and Physiology of PoultryDocument51 pagesAnatomy and Physiology of PoultryRia Mae Espenida GurayPas encore d'évaluation

- Yilmana DensaDocument23 pagesYilmana DensaJames Wiggins100% (1)

- 132642555Document139 pages132642555Mariam SharifPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Home Mane Animal Feed Concentrate - FAO - PTG PDFDocument12 pagesHome Mane Animal Feed Concentrate - FAO - PTG PDFjacjiPas encore d'évaluation

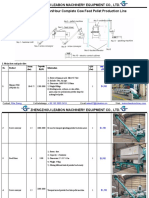

- Quotation of 1.5TH Cow Feed Pellet Production Line-Rita (LEABON) 2022.12.12Document5 pagesQuotation of 1.5TH Cow Feed Pellet Production Line-Rita (LEABON) 2022.12.12Erde ErdenePas encore d'évaluation

- Page I098 - Macropod PelletsDocument1 pagePage I098 - Macropod Pelletsapi-250224420Pas encore d'évaluation

- Cat Fight in The Pet Food Industry (A) StudentDocument14 pagesCat Fight in The Pet Food Industry (A) StudentPedro José ZapataPas encore d'évaluation

- Feedipedia: Copra Meal and Coconut By-ProductsDocument15 pagesFeedipedia: Copra Meal and Coconut By-ProductsSteven GoewinPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Swine Handbook Swine Handbook Nutrition & Feeds Nutrition & FeedsDocument3 pagesSwine Handbook Swine Handbook Nutrition & Feeds Nutrition & FeedsWilki SantanderPas encore d'évaluation

- 2012 Top 100 ExportersDocument6 pages2012 Top 100 ExportersMinh ThúyPas encore d'évaluation

- Regulated-Imports-2015-04-06-Version-3-Sorted-by-Regulating-Agency 2 PDFDocument206 pagesRegulated-Imports-2015-04-06-Version-3-Sorted-by-Regulating-Agency 2 PDFMaleen SiaPas encore d'évaluation

- Pilot Plant Production of LysineDocument5 pagesPilot Plant Production of LysineMartha GamalPas encore d'évaluation

- A Safer Way To Feed Fodder - Mold Guard TechnologyDocument3 pagesA Safer Way To Feed Fodder - Mold Guard Technologyjaydip zalaPas encore d'évaluation

- An Investor Brief On Impacts That Drive Business RisksDocument22 pagesAn Investor Brief On Impacts That Drive Business RisksLuisPérezPas encore d'évaluation

- Arbor Acres Nutrional GuideDocument20 pagesArbor Acres Nutrional GuidePetre Marius100% (1)

- PNAAT662Document309 pagesPNAAT662Ganesh KashinathPas encore d'évaluation

- Japfa LTD Annual Report 2015 PDFDocument169 pagesJapfa LTD Annual Report 2015 PDFpearl1803Pas encore d'évaluation

- Atijaiya@futminna - Edu.ng: Coturnix Japonica) - Japanese Quails Are Suited For Commercial Rearing, Egg and MeatDocument5 pagesAtijaiya@futminna - Edu.ng: Coturnix Japonica) - Japanese Quails Are Suited For Commercial Rearing, Egg and MeatNaeem IqbalPas encore d'évaluation

- Rice Sorghum CornDocument18 pagesRice Sorghum CornJermaine Robediso TallorinPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 2-2014 9.03biological and Microbiological Evaluation of Aquafeeds and feedstuffs-MBT PDFDocument96 pages2-2014 9.03biological and Microbiological Evaluation of Aquafeeds and feedstuffs-MBT PDFGail AidPas encore d'évaluation

- DBE Presentation in English FinalisedDocument65 pagesDBE Presentation in English Finalisedbekele abrahamPas encore d'évaluation

- Potential of Earthworm Eisenia Foetida As Dietary Protein Source For Rohu Labeo Rohita Advanced Fry PDFDocument13 pagesPotential of Earthworm Eisenia Foetida As Dietary Protein Source For Rohu Labeo Rohita Advanced Fry PDFNarasimha MurthyPas encore d'évaluation

- UNSPSCDocument1 530 pagesUNSPSCElmer Soto DextrePas encore d'évaluation

- Feeds and Feedings - Margie EranDocument29 pagesFeeds and Feedings - Margie EranAlliah Dela RosaPas encore d'évaluation

- L e A R N e R G U I D eDocument56 pagesL e A R N e R G U I D eFaisal MohommadPas encore d'évaluation

- Project Proposal For Setting Up Poultry Feed UnitDocument45 pagesProject Proposal For Setting Up Poultry Feed UnitSoundararajan Seerangan73% (33)

- The Poultry Industry: Dr. Michael SmithDocument27 pagesThe Poultry Industry: Dr. Michael SmithRahul AroraPas encore d'évaluation

- Factors Affecting Pellet QualityDocument5 pagesFactors Affecting Pellet QualityCande EscobedoPas encore d'évaluation

- The Fabric of Civilization: How Textiles Made the WorldD'EverandThe Fabric of Civilization: How Textiles Made the WorldÉvaluation : 4.5 sur 5 étoiles4.5/5 (58)

- The Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaD'EverandThe Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (12)

- Prisoners of Geography: Ten Maps That Explain Everything About the WorldD'EverandPrisoners of Geography: Ten Maps That Explain Everything About the WorldÉvaluation : 4.5 sur 5 étoiles4.5/5 (1147)