Académique Documents

Professionnel Documents

Culture Documents

Fundamental Analysis-BHEL - Equity Research Report

Transféré par

ChrisTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fundamental Analysis-BHEL - Equity Research Report

Transféré par

ChrisDroits d'auteur :

Formats disponibles

Fundamental analysis-BHEL -Equity research report

1 of 5

Free Zone

About

BSE Sensex

CNX Nifty 50

http://www.sanasecurities.com/BHEL-equity-research

BSE 100

Member Zone

BSE 200

Compare Financial Analysis

Blog

Research Panel

Ebooks

Previous Articles

Videos

Calculators

Home > BHEL

BHEL

About the Company

Stock Info

Bharat Heavy Electricals Limited (BHEL or the Company) is an integrated power plant

Current price BSE

255.75

Current price NSE

256.70

equipment manufacturer and one of the largest engineering and manufacturing companies in India in

terms of turnover.

62597.37

The Company manufactures a wide range of products and services for the core sectors of the

Market

Capitalisation

Rs.

Face value

Rs.

EPS (TTM)

27.03

Indian economy, including power, transmission, industry, transportation, renewable energy, oil & gas

and defence. The Company has been earning profits continuously since 1971-72 and paying

dividends since 1976-77. BHEL undertakes all jobs related to the construction, designing,

engineering and testing of its products all the way to commissioning and servicing. The Company

9.46

P/E

Engineering Heavy

Sector

currently operates at more than 150 project sites across India and abroad and has a wide

presence with 16 manufacturing divisions, 2 repair units, eight service centres, eight overseas

offices, 7 joint ventures and 15 regional centres.

2447600000

No of shares

BHEL accounts for 59% of the total installed capacity of around 1,80,000 MW in the utility sector

BSE 52 week high

291.50

BSE 52 week low

131.05

NSE 52 week high

291.50

NSE 52 week low

131.00

27865.83

BSE Sensex

across India as of 31 March 2012 and it accounted for approximately 69% of the total electricity

generated during the year 2011-12. BHELs global references are spread across 75 countries. The

cumulative overseas installed capacity of BHEL manufactured power plants exceeds 9,000 MW

across 21 countries including Malaysia, Oman, Iraq, the UAE, Bhutan, Egypt and New Zealand.

* The Equity Research Report presented below is based on a Fundamental Analysis of

BHEL.

Latest Shareholding Pattern

8322.20

Nifty

Average Volume

BSE

Average Volume

NSE

617917.00

5492232.00

500103

BSE Code

BHEL

NSE Symbol

Absolute returns

BHEL

SENSEX

1 Years

81.45%

31.66%

3 Years

-19.54%

57.39%

4 Years

-47.48%

39.10%

BHEL split its equity in the ratio of 1:5 on 3 October 2011. EPS and P/E numbers are adjusted to reflect the effect of split.

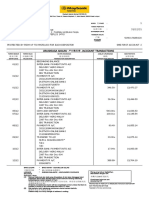

Key Financial Figures

Annually

(Rs. Cr)

Quarterly

Consolidated

Particulars

FY 2009

FY 2010

FY 2011

FY 2012

FY 2013

Total Income from Operations

27,144.04

33,870.66

42,787.28

48,355.22

48,915.84

Expenses

22,712.55

27,585.44

33,773.94

38,403.87

39,433.24

4,431.49

6,285.22

9,013.34

9,951.35

9,482.60

Earnings Before Other Income,

Interest, Tax and Depreciation

(Operating Profit)

Depreciation

343.07

460.26

546.37

803.24

957.18

Finance Costs

35.18

36.69

48.63

53.07

127.61

Other income

784.71

832.62

647.34

1,272.03

1,128.76

(0.16)

(4.14)

Exceptional items

11/3/2014 2:45 AM

Fundamental analysis-BHEL -Equity research report

2 of 5

http://www.sanasecurities.com/BHEL-equity-research

PBT

4,837.95

6,620.89

9,065.68

10,367.23

9,530.71

Tax

1,722.78

2,293.97

3,012.32

3,279.97

2,837.61

3,115.17

4,326.92

6,053.36

7,087.26

6,693.10

(0.18)

(0.27)

3,115.17

4,326.92

6,053.36

7,087.44

6,693.37

PAT (before Minority Interest and share

of Associates)

Profit/ (loss) attributable to Minority

Interest

Share of profit / (loss) of Associates

Consolidated Profit / (Loss) for the

year

Standalone

Particulars

FY 2012 Q4

FY 2013 Q1

FY 2013 Q2

FY 2013 Q3

FY 2013 Q4

Total Income from Operations

19,588.94

8,439.01

10,561.55

10,219.71

19,204.38

Expenses

14,651.72

7,236.82

8,662.08

8,585.65

14,553.16

4,937.22

1,202.19

1,899.47

1,634.06

4,651.22

254.14

228.39

216.31

219.79

288.90

Earnings Before Other Income,

Interest, Tax and Depreciation

(Operating Profit)

Depreciation

Finance Costs

18.34

5.52

25.86

50.91

40.53

Other income

398.91

366.27

130.67

332.38

292.39

PBT

5,063.65

1,334.55

1,787.97

1,695.74

4,614.18

Tax

1,683.84

413.65

513.52

513.89

1,376.64

3,379.81

920.9

1,274.45

1,181.85

3,237.54

PAT (before Minority Interest and

share of Associates)

Profitability Analysis

Annually

(%)

Quarterly

Consolidated

FY 2009

FY 2010

FY 2011

FY 2012

FY 2013

Operating Profit Margin Ratio

Particulars

16.33

18.56

21.07

20.58

19.39

Net Profit Margin Ratio

11.48

12.77

14.15

14.66

13.68

Standalone

FY 2012 Q4

FY 2013 Q1

FY 2013 Q2

FY 2013 Q3

FY 2013 Q4

Operating Profit Margin Ratio

Particulars

25.20

14.25

17.98

15.99

24.22

Net Profit Margin Ratio

17.25

10.91

12.07

11.56

16.86

Operating profit margin is a measurement of the proportion of a companys revenue that is left over after paying for production costs such as raw materials, salaries and

administrative costs. Net profit margin is arrived at by deducting non operating expenses such as depreciation, finance costs and taxes out of operating profit and shows what

is left for the shareholders as a percentage of net sales. Together these ratios help in understanding the cost and profit structure of the firm and analysing business

inefficiencies.

Profitability Ratios

Key Balance Sheet Figures

(Rs. Cr)

Sources of Funds / Liabilities

Particulars

FY 2009

FY 2010

FY 2011

FY 2012

FY 2013

Share Capital

489.52

489.52

489.52

489.52

489.52

Reserves & Surplus

12,429.06

15,406.46

19,665.49

24,913.54

30,043.21

Net worth (shareholders funds)

12,918.58

15,895.98

20,155.01

25,403.06

30,532.73

4.97

4.70

Share application money pending allotment

Minority Interest

11/3/2014 2:45 AM

Fundamental analysis-BHEL -Equity research report

3 of 5

Long term borrowings

Current liabilities

Other long term liabilities and provisions

Total Liabilities

http://www.sanasecurities.com/BHEL-equity-research

166.56

148.30

102.40

282.07

2,623.57

28,568.74

32,656.09

25,257.47

29,155.38

29,591.12

14,102.91

12,584.8

9,000.58

41,653.88

48,700.37

59,617.79

67,430.28

71,752.70

(Rs. Cr)

Application of Funds / Assets

Particulars

FY 2009

FY 2010

FY 2011

FY 2012

FY 2013

Fixed Assets

2,821.78

4,143.05

5,366.34

6,282.06

7,035.92

5.94

5.94

11.30

5.94

5.94

36,985.16

43,022.76

43,588.45

49,090.37

49,084.37

8,486.53

10,502.43

15,626.47

1,841.00

1,528.62

2,165.17

1,549.48

41,653.88

48,700.37

59,617.79

67,430.28

71,752.70

Noncurrent Investments

Current assets

Long term advances and other noncurrent

assets

Deferred Tax Assets

Total assets

Efficiency Analysis

Particulars

(%)

FY 2009

FY 2010

FY 2011

FY 2012

FY 2013

ROCE

33.87

39.17

44.49

38.74

29.11

ROE / RONW

24.11

27.22

30.03

27.90

21.92

Return on Capital Employed (ROCE) measures a companys profitability from its overall operations by calculating the return generated on the total capital invested in the

business (i.e. equity + debt). Return on Equity (ROE) or Return on Net Worth (RONW) measures the amount of profit which the company generates on money invested by the

equity shareholders. In short, ROE draws attention to the return generated by the shareholders on their investment in the business. Together these ratios can be used in

comparing the profitability of the company with other companies in the same industry.

Efficiency Ratios

Valuation Analysis

Annually

Quarterly

Consolidated

Particulars

FY 2010

FY 2011

FY 2012

FY 2013

FY 2014

Total Income from Operations (Rs. Cr.)

33,870.66

42,787.28

48,355.22

48,915.84

39,569.41

Growth (%)

24.78 %

26.33 %

13.01 %

1.16 %

(19.11 %)

PAT (Rs. Cr.)

4,326.92

6,053.36

7,087.26

6,693.10

3,502.86

Growth (%)

38.90 %

39.90 %

17.08 %

(5.56 %)

(47.66 %)

Earnings Per Share Basic (Rs. )

17.68

24.73

28.96

27.35

14.31

Earning Per Share - Diluted (Rs. )

17.68

24.73

28.96

27.35

14.31

Price to Earnings

26.98

16.67

8.87

6.47

17.38

FY 2013 Q1

FY 2013 Q2

FY 2013 Q3

FY 2013 Q4

19,204.38

Standalone

Particulars

Total Income from Operations

FY 2012 Q4

19,588.94

8,439.01

10,561.55

10,219.71

Growth (%)

82.34 %

(56.92 %)

25.15 %

(3.24 %)

87.92 %

PAT

3,379.81

920.9

1,274.45

1,181.85

3,237.54

Growth (%)

135.92 %

(72.75 %)

38.39 %

(7.27 %)

173.94 %

Earnings Per Share Basic

13.81*

3.76*

5.21*

4.83*

13.23*

Earning Per Share - Diluted

13.81*

3.76*

5.21*

4.83*

13.23*

11/3/2014 2:45 AM

Fundamental analysis-BHEL -Equity research report

4 of 5

Price to Earnings

http://www.sanasecurities.com/BHEL-equity-research

* Not annualised

Price Earnings Ratio

Dividend History

Rate of dividend (of face value)

Rs.

Closing price*

Date*

FY 2008

152.5 %

3.05

344.38

01 September 2008

FY 2009

170 %

3.40

452.24

01 September 2009

FY 2010

233 %

4.66

484.62

01 September 2010

FY 2011

311.5 %

6.23

500.21

10 August 2011

FY 2012

320 %

6.40

201.35

06 September 2012

FY 2013

271 %

5.42

141.55

06 September 2013

FY 2014

142 %

2.83

223.90

08 September 2014

Year

* Closing Price as on the date of declaration of final (or last) dividend for the Financial Year.

The Company has maintained an average dividend yield of 1.40 % over the last 5 financial years.

Liquidity and Credit Analysis

Current Ratio

Higher current ratio implies healthier short term liquidity comfort level. A current ratio below 1 indicates that the company may not be able to meet its obligations in the short

run. However, it is not always a matter of worry if this ratio temporarily falls below 1 as many times companies squeeze out short term cash sources to achieve a capital

intensive plan with a longer term outlook. BHELs average current ratio over the last 5 financial years has been 1.50 times which indicates that that the Company is comfortably

placed to pay for its short term obligations.

Long Term Debt to Equity Ratio

Companies operating with high debt to equity on their balance sheets are vulnerable to economic cycles. In times of slowdown in economy, companies with high levels of debt

find it increasingly difficult to service the interest on their borrowings as profit margins decline. We believe that long term debt to equity ratio higher than 0.6 - 0.8 could affect

the business of a company and its results of operations.

BHELs average long term debt to equity ratio over the last 5 financial years has been 0.008 times which indicates that the Company operates with a low level of debt and is

well placed to pay for its obligations.

Interest Coverage ratio

Interest coverage ratio indicates the comfort with which the company may be able to service the interest expense (i.e. finance charges) on its outstanding debt. Higher interest

coverage ratio indicates that the company can easily meet the interest expense pertaining to its debt obligations. In our view, interest coverage ratio of below 1.5 should raise

doubts about the companys ability to meet the expenses on its borrowings. Interest coverage ratio below 1 indicates that the company is just not generating enough to service

its debt obligations.

BHELs average interest coverage ratio over the last 5 financial years has been 167.53 times which indicates that the Company has been generating enough for the

shareholders after servicing its debt obligations.

Liquidity & Credit Ratios

Ownership pattern

Shareholding

(%)

March 2010

March 2011

March 2012

March 2013

March 2014

Promoter

67.72

67.72

67.72

67.72

63.06

FIIs

15.21

12.90

13.48

14.75

16.14

DIIs

11.05

12.72

12.85

12.42

16.47

6.02

6.66

5.95

5.11

4.33

Others

11/3/2014 2:45 AM

Fundamental analysis-BHEL -Equity research report

5 of 5

http://www.sanasecurities.com/BHEL-equity-research

In its latest stock exchange filing dated 31 March 2014, BHEL reported a promoter holding of 63.06 %. Large promoter holding indicates conviction and sincerity of the

promoters. We believe that a greater than 35 % promoter holding offers safety to the retail investors.

At the same time, institutional holding in the Company stood at 32.61 % (FII+DII). Large institutional holding indicates the confidence of seasoned investors. At the same time, it

can also lead to high volatility in the stock price as institutions buy and sell larger stakes than retail participants.

Final Score Based on Fundamental Analysis of BHEL

Is this the right time to buy / sell BHEL ?

Useful Links

Usage Guidelines

Products

Need Help?

Careers

Privacy Policy

Blue Chip Stocks in India

Frequently Asked Questions

Terminology

Terms & Conditions

Midcap Stocks in India

(FAQs)

Free Investment Newsletter

Legal Disclaimer

Multibagger Ideas

Our Purpose

Our Track Record

How we started

Investing Portfolio

Contact

Advertise with us

Connect With Us!

Trading Portfolio

Pay online securely with

We accept

Cash | Debit Card | Credit Card

Net Banking | Cheque | DD

BSE & NSE Data delayed by 5 minutes

Copyright 2014 Sana Securi es | All Rights Reserved.

11/3/2014 2:45 AM

Vous aimerez peut-être aussi

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosD'EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosPas encore d'évaluation

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosD'EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosPas encore d'évaluation

- Cairn India: Performance HighlightsDocument10 pagesCairn India: Performance HighlightsAngel BrokingPas encore d'évaluation

- Rs 203 BUY: Key Take AwayDocument6 pagesRs 203 BUY: Key Take Awayabhi_003Pas encore d'évaluation

- Bajaj Electrical Q1 FY2012Document4 pagesBajaj Electrical Q1 FY2012Tushar DasPas encore d'évaluation

- Nestle India: Performance HighlightsDocument9 pagesNestle India: Performance HighlightsAngel BrokingPas encore d'évaluation

- Accounts AssignmentDocument7 pagesAccounts AssignmentHari PrasaadhPas encore d'évaluation

- TVS Motor Result UpdatedDocument12 pagesTVS Motor Result UpdatedAngel BrokingPas encore d'évaluation

- Ratio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDDocument10 pagesRatio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDShubham DikshitPas encore d'évaluation

- TVS Motor: Performance HighlightsDocument11 pagesTVS Motor: Performance HighlightsAngel BrokingPas encore d'évaluation

- Assignments Semester IDocument13 pagesAssignments Semester Idriger43Pas encore d'évaluation

- Bhel Financial AnalysisDocument10 pagesBhel Financial Analysisashish_verma_22Pas encore d'évaluation

- Cairn India: Performance HighlightsDocument10 pagesCairn India: Performance HighlightsAngel BrokingPas encore d'évaluation

- Coal India: Performance HighlightsDocument10 pagesCoal India: Performance HighlightsAngel BrokingPas encore d'évaluation

- Nestle India: Performance HighlightsDocument9 pagesNestle India: Performance HighlightsAngel BrokingPas encore d'évaluation

- Aditya Birla Nuvo: Consolidating Growth BusinessesDocument6 pagesAditya Birla Nuvo: Consolidating Growth BusinessesSouravMalikPas encore d'évaluation

- Wind Turbines SectorDocument35 pagesWind Turbines SectorDylan SlhtPas encore d'évaluation

- East African Breweries Ltd. (EABL) - A Business & Financial AnalysisDocument16 pagesEast African Breweries Ltd. (EABL) - A Business & Financial AnalysisPatrick Kiragu Mwangi BA, BSc., MA, ACSIPas encore d'évaluation

- Alok Industries LTD: Q1FY12 Result UpdateDocument9 pagesAlok Industries LTD: Q1FY12 Result UpdatejaiswaniPas encore d'évaluation

- Research: HDFC Bank LTDDocument5 pagesResearch: HDFC Bank LTDPankaj MishraPas encore d'évaluation

- Profitability Atlas - ExideDocument16 pagesProfitability Atlas - ExidekrkamranpPas encore d'évaluation

- Eicher Motors: Gearing Up For The Next LevelDocument11 pagesEicher Motors: Gearing Up For The Next LevelumaganPas encore d'évaluation

- KSL Ongc 29jul08Document7 pagesKSL Ongc 29jul08srinivasan9Pas encore d'évaluation

- Wyeth - Q4FY12 Result Update - Centrum 22052012Document4 pagesWyeth - Q4FY12 Result Update - Centrum 22052012SwamiPas encore d'évaluation

- A Project On "Economic Value Added" in Kirloskar Oil Engines LTDDocument19 pagesA Project On "Economic Value Added" in Kirloskar Oil Engines LTDPrayag GokhalePas encore d'évaluation

- Equity Valuation: Capital and Money Markets AssignmentDocument5 pagesEquity Valuation: Capital and Money Markets AssignmentSudip BainPas encore d'évaluation

- A Report On Financial Analysis of Next PLC 3Document11 pagesA Report On Financial Analysis of Next PLC 3Hamza AminPas encore d'évaluation

- Alok Result 30 Sept 2011Document24 pagesAlok Result 30 Sept 2011Mohnish KatrePas encore d'évaluation

- AirThread G015Document6 pagesAirThread G015sahildharhakim83% (6)

- Airthread DCF Vs ApvDocument6 pagesAirthread DCF Vs Apvapi-239586293Pas encore d'évaluation

- Oil and Natural Gas Corporation: Income StatementDocument10 pagesOil and Natural Gas Corporation: Income StatementpraviskPas encore d'évaluation

- IVRCL Infrastructure: Performance HighlightsDocument12 pagesIVRCL Infrastructure: Performance HighlightsAngel BrokingPas encore d'évaluation

- Unit 08 - Financial Statement AnalysisDocument31 pagesUnit 08 - Financial Statement Analysisqwertyytrewq12Pas encore d'évaluation

- CMM Assignment - 2Document36 pagesCMM Assignment - 2Mithilesh SinghPas encore d'évaluation

- Subros Result UpdatedDocument10 pagesSubros Result UpdatedAngel BrokingPas encore d'évaluation

- Thermax Limited (THERMA) : Healthy ExecutionDocument6 pagesThermax Limited (THERMA) : Healthy Executionnikhilr05Pas encore d'évaluation

- Shree Cement: Performance HighlightsDocument10 pagesShree Cement: Performance HighlightsAngel BrokingPas encore d'évaluation

- Apollo Hospitals Enterprise LTD: Q4FY11 First CutDocument7 pagesApollo Hospitals Enterprise LTD: Q4FY11 First CutVivek YadavPas encore d'évaluation

- Abbott India: Performance HighlightsDocument11 pagesAbbott India: Performance HighlightsAngel BrokingPas encore d'évaluation

- Anand Rathi Research India EquitiesDocument13 pagesAnand Rathi Research India EquitiesVijay KundetiPas encore d'évaluation

- UtkarshVikramSinghChauhan TATASTEELDocument12 pagesUtkarshVikramSinghChauhan TATASTEELUtkarsh VikramPas encore d'évaluation

- PI Industries Q1FY12 Result 1-August-11Document6 pagesPI Industries Q1FY12 Result 1-August-11equityanalystinvestorPas encore d'évaluation

- Inter Company AnalysisDocument32 pagesInter Company AnalysisWaqas Ali BabarPas encore d'évaluation

- Chapter Fifteen Full-Information Forecasting, Valuation, and Business Strategy AnalysisDocument56 pagesChapter Fifteen Full-Information Forecasting, Valuation, and Business Strategy AnalysisRitesh Batra100% (4)

- Current Ratio (Amount in RS.)Document10 pagesCurrent Ratio (Amount in RS.)Balakrishna ChakaliPas encore d'évaluation

- Ibf AfsDocument26 pagesIbf AfsRaza AliPas encore d'évaluation

- B11066 Long Term Financing, EVA & MVA: Dewan Housing Finance LimitedDocument7 pagesB11066 Long Term Financing, EVA & MVA: Dewan Housing Finance LimitedAmit JindalPas encore d'évaluation

- Keynote: Adlabs Films Ltd.Document3 pagesKeynote: Adlabs Films Ltd.nitin2khPas encore d'évaluation

- Alok - Performance Report - q4 2010-11Document24 pagesAlok - Performance Report - q4 2010-11Krishna VaniaPas encore d'évaluation

- BIMBSec-Digi 20120724 2QFY12 Results ReviewDocument3 pagesBIMBSec-Digi 20120724 2QFY12 Results ReviewBimb SecPas encore d'évaluation

- Analysis of Earnings and Dividend LevelDocument6 pagesAnalysis of Earnings and Dividend Leveldeveshr25Pas encore d'évaluation

- Performance Highlights: CMP '203 Target Price '248Document10 pagesPerformance Highlights: CMP '203 Target Price '248Angel BrokingPas encore d'évaluation

- Aptech Equity Research: Key Financial FiguresDocument7 pagesAptech Equity Research: Key Financial FiguresshashankPas encore d'évaluation

- Siyaram Silk MillsDocument9 pagesSiyaram Silk MillsAngel BrokingPas encore d'évaluation

- Company NameDocument6 pagesCompany NameAnamul HaquePas encore d'évaluation

- Automotive Axles Result UpdatedDocument10 pagesAutomotive Axles Result UpdatedAngel BrokingPas encore d'évaluation

- Oman Cement Company (OCC) : Global Research Result Update Equity - Oman Cement Sector 29 May, 2012Document5 pagesOman Cement Company (OCC) : Global Research Result Update Equity - Oman Cement Sector 29 May, 2012Venkatakrishnan IyerPas encore d'évaluation

- Ultratech 4Q FY 2013Document10 pagesUltratech 4Q FY 2013Angel BrokingPas encore d'évaluation

- BaiduDocument29 pagesBaiduidradjatPas encore d'évaluation

- Siyaram Silk Mills Result UpdatedDocument9 pagesSiyaram Silk Mills Result UpdatedAngel BrokingPas encore d'évaluation

- Rguhs Dissertation Titles 2015Document5 pagesRguhs Dissertation Titles 2015PaySomeoneToWriteAPaperForMeSingapore100% (1)

- Fmi Unit 2Document86 pagesFmi Unit 2Pranav vigneshPas encore d'évaluation

- DRP Grade 4 Skill A2Document17 pagesDRP Grade 4 Skill A2Meredith Casignia Paccarangan100% (2)

- Josephine Morrow: Guided Reflection QuestionsDocument3 pagesJosephine Morrow: Guided Reflection QuestionsElliana Ramirez100% (1)

- 1001 Books I Must Read Before I DieDocument44 pages1001 Books I Must Read Before I DiemamaljPas encore d'évaluation

- Solution pdf-51Document68 pagesSolution pdf-51Tanmay GoyalPas encore d'évaluation

- 08.08.2022 FinalDocument4 pages08.08.2022 Finalniezhe152Pas encore d'évaluation

- 2017 Ecatalogue Howtim Exit SignDocument38 pages2017 Ecatalogue Howtim Exit SignSatish Phakade-PawarPas encore d'évaluation

- Two Dimensional Flow of Water Through SoilDocument28 pagesTwo Dimensional Flow of Water Through SoilMinilik Tikur SewPas encore d'évaluation

- PRTC Tax Final Preboard May 2018Document13 pagesPRTC Tax Final Preboard May 2018BonDocEldRicPas encore d'évaluation

- Ozone Therapy - A Clinical Review A. M. Elvis and J. S. EktaDocument5 pagesOzone Therapy - A Clinical Review A. M. Elvis and J. S. Ektatahuti696Pas encore d'évaluation

- Peer Pressure and Academic Performance 1Document38 pagesPeer Pressure and Academic Performance 1alnoel oleroPas encore d'évaluation

- 2012 Fall TSJ s03 The Mystery of The Gospel PT 1 - Stuart GreavesDocument5 pages2012 Fall TSJ s03 The Mystery of The Gospel PT 1 - Stuart Greavesapi-164301844Pas encore d'évaluation

- The Impact of Social Media: AbstractDocument7 pagesThe Impact of Social Media: AbstractIJSREDPas encore d'évaluation

- Elevex ENDocument4 pagesElevex ENMirko Mejias SotoPas encore d'évaluation

- Composition Notes Essay C1 and C2Document7 pagesComposition Notes Essay C1 and C2Γιάννης ΜατσαμάκηςPas encore d'évaluation

- Sibeko Et Al. 2020Document16 pagesSibeko Et Al. 2020Adeniji OlagokePas encore d'évaluation

- Cat Enclosure IngDocument40 pagesCat Enclosure IngJuan Pablo GonzálezPas encore d'évaluation

- Products of Modern BiotechnologyDocument23 pagesProducts of Modern BiotechnologyZ M100% (1)

- Kangar 1 31/12/21Document4 pagesKangar 1 31/12/21TENGKU IRSALINA SYAHIRAH BINTI TENGKU MUHAIRI KTNPas encore d'évaluation

- Bennett Et Al 2019 Towards A Sustainable and Equitable Blue EconomyDocument3 pagesBennett Et Al 2019 Towards A Sustainable and Equitable Blue Economynaomi 23Pas encore d'évaluation

- JawabanDocument12 pagesJawabanKevin FebrianPas encore d'évaluation

- TWC AnswersDocument169 pagesTWC AnswersAmanda StraderPas encore d'évaluation

- Alliance Manchester Business SchoolDocument14 pagesAlliance Manchester Business SchoolMunkbileg MunkhtsengelPas encore d'évaluation

- Chapter One: China Civil Engineering Construction Coorperation (Ccecc) WasDocument24 pagesChapter One: China Civil Engineering Construction Coorperation (Ccecc) WasMoffat KangombePas encore d'évaluation

- Becg Unit-1Document8 pagesBecg Unit-1Bhaskaran Balamurali0% (1)

- BBS of Lintel Beam - Bar Bending Schedule of Lintel BeamDocument5 pagesBBS of Lintel Beam - Bar Bending Schedule of Lintel BeamfelixPas encore d'évaluation

- Fila 1Document4 pagesFila 1Karolina Sanchez83% (6)

- Sand Cone Method: Measurement in The FieldDocument2 pagesSand Cone Method: Measurement in The FieldAbbas tahmasebi poorPas encore d'évaluation

- Business Law Term PaperDocument19 pagesBusiness Law Term PaperDavid Adeabah OsafoPas encore d'évaluation