Académique Documents

Professionnel Documents

Culture Documents

Lower Oil Prices Carry Big Geopolitical Consequences - MarketWatch

Transféré par

tenalkalCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Lower Oil Prices Carry Big Geopolitical Consequences - MarketWatch

Transféré par

tenalkalDroits d'auteur :

Formats disponibles

11/4/2014

Lower oil prices carry big geopolitical consequences - MarketWatch

Opinion: Lower oil prices carry big geopolitical

consequences

By Stratfor analysts

Published: Nov 4, 2014 6:05 a.m. ET

Any structural change in oil markets will create clear-cut winners and losers

Since mid-June, the price of Brent crude oil has fallen by nearly 25% from a high of $115 to about $87 a barrel and

structural factors are causing concern among global oil producers that oil prices will remain near current levels through at

least the end of 2015.

This concern has caused several investment banks to slash their oil price outlooks for the immediate future. Stratfor

believes that oil supplies will stay high as energy production in North America increases and OPEC countries remain

hesitant or unable to cut production significantly. Moreover, in the short term, the Chinese economic slowdown and

stagnant European economy will limit the potential for growth in oil demand. These factors could make it harder for global

oil prices to rebound to their previous levels.

Oil is the most geopolitically important commodity, and any structural change in oil markets will reverberate throughout the

world, creating clear-cut winners and losers. Countries that consume large amounts of energy have been coping with oil

prices above $100 per barrel since the beginning of 2011 as most of the developed world has been trying to emerge from

financial and debt crises.

A sustained period of lower oil prices could provide some relief to these countries. Major oil producers, on the other hand,

have grown accustomed to high oil prices, often using them to underpin their national budgets. Sustained low oil prices will

cause these oil producers to rethink their spending.

The amount of oil production that has come online over the last four months is staggering. The United States has

increased its production from 8.5 million barrels per day (bpd) in July to an estimated 9 million bpd. Libyan oil production

has increased from about 200,000 bpd to more than 900,000 bpd. Saudi Arabia, Nigeria and Iraq have all increased

production in recent months, and OPECs production is at the highest level in two years. To put this into perspective, the

International Energy Agencys projection for global oil demand growth for 2014 is only 700,000 bpd, roughly half of the

total production increase mentioned above.

Looking to 2015, the growth prospects for energy production in

North America continue to be positive. Even after production

grew by about 1 million bpd in 2012, 2013 and again in 2014, the

U.S. Energy Information Administration expects U.S. oil

production to increase by another 750,000 bpd in 2015.

Moreover, the Energy Information Administration consistently

has underestimated production growth from tight oil (oil

extracted from formations that are not naturally very permeable).

Production cuts remain unlikely: The only OPEC members

with enough flexibility to reduce oil production voluntarily are the

United Arab Emirates, Kuwait and Saudi Arabia. None of the

other members are in a financial position to take oil production offline. Libya, Algeria, Iraq, Iran, Nigeria and Venezuela all

need maximum oil output and high prices to finance their budgets and social spending programs. Notably, Libyas OPEC

governor called on the bloc to cut production by 500,000 bpd to buoy prices but made no mention that his country would

http://www.marketwatch.com/story/lower-oil-prices-carry-big-geopolitical-consequences-2014-11-04/print

1/3

11/4/2014

Lower oil prices carry big geopolitical consequences - MarketWatch

take part in such a cut. Saudi Arabia, meanwhile, seems to have taken the opposite position, prioritizing a greater market

share over higher prices.

Saudi Arabias status as OPECs swing producer has historically

meant that Saudi Aramco will reduce production to create higher

oil prices. But with U.S. production increasing so quickly and

prices that are still relatively high, Riyadh has little interest to do

so: A significant reduction in oil production might not increase the

price of oil enough to make forgoing the additional exports

worthwhile. Riyadh found itself in the same position in the 1980s

when it cut production only to discover that its control over

international oil prices was limited. The Saudis have been

hesitant to play the same card ever since, instead exerting a

small influence on prices while continuing to produce at high

levels. More broadly, during the last four decades the Saudis

as well as the Emiratis and Kuwaitis have amassed large

wealth funds, enabling them to simply sit back and weather a period of low oil prices.

This means that if oil prices continue dropping, it will fall largely to U.S. producers to slow production expansion. North

Americas tight oil production costs vary considerably from basin to basin, but so long as oil prices do not continue falling

and they appear to have bottomed out in the mid-$80 per barrel range almost all tight oil production will remain

profitable, and drilling will continue to increase. The U.S. oil rig count, a rough indicator of impending oil production,

remains near record levels, indicating that the recent downturn in oil prices has not dampened interest in drilling.

In fact, in the short- to mid-term, production prospects outside North America will be rather bleak. Most of the recent

production increases elsewhere around the globe were due to one-off events, such as the revival of Libyas production.

There are only a few other changes such as Iranian exports becoming unconstrained or Saudi Aramco dipping into its

spare production capacity that could put significant volumes of oil back on the market. In fact, it is more likely that largescale production will go offline in places such as Nigeria and Libya. All of these possibilities limit the potential of a more

drastic decline in oil prices.

Low demand is likely to linger: On the demand side, a bullish oil market is unlikely. North American oil consumption is

structurally in decline and has been since the mid 2000s. Electric vehicles, natural gas and other alternatives will continue

to penetrate the North American oil market, albeit very slowly. The European oil market exhibits the same patterns seen in

North America, but in Europe the structural decline is occurring amid slowing economic growth; many of Europes more

developed economies, such as that of France, are at effectively zero growth.

Meanwhile, Chinas economy will continue to descend from the peaks of its post-2008 investment and construction boom.

The decline of housing markets and related industries nationwide is at the heart of Chinas economic slowdown and will in

large part determine Chinas overall economic health during the next one to two years. Although a collapse in Chinas

housing market in the next 12 to 18 months is not expected, should one occur, it would send Chinas economy into a

tailspin and subsequently dampen demand for oil.

However, Stratfor does not anticipate that Beijing would allow this to happen. The central government will likely enact more

stimulus similar to previous economic measures, such as large-scale public infrastructure projects driven by state-led

investment.

Chinas demand for oil could remain relatively strong in the absence of economic collapse, but Chinas increases in

demand are likely to be more moderate than usual at an estimated 400,000 bpd over the course of the year. Increases in

demand in the rest of the world combined will likely be no more than that figure. Meanwhile, global oil supplies do not

appear likely to decline in the coming months. Therefore, there is every reason to believe that oil prices will stay lower than

$100 per barrel for much of 2015, unless Saudi Arabia and OPEC change their minds about production cuts.

All eyes watching oil markets will turn to OPECs semiannual meeting Nov. 27 to look for any shifts. If there are none, the

lower price of oil will continue to have significant geopolitical consequences for consumer and producer countries alike.

This story was published with permission by Stratfor, an Austin, Texas-based geopolitical firm.

http://www.marketwatch.com/story/lower-oil-prices-carry-big-geopolitical-consequences-2014-11-04/print

2/3

11/4/2014

Lower oil prices carry big geopolitical consequences - MarketWatch

Copyright 2014 MarketWatch, Inc. All rights reserved.

By using this site you agree to the Terms of Service, Privacy Policy, and Cookie Policy.

Intraday Data provided by SIX Financial Information and subject to terms of use. Historical and current end-of-day data provided by SIX

Financial Information. Intraday data delayed per exchange requirements. S&P/Dow Jones Indices (SM) from Dow Jones & Company, Inc.

All quotes are in local exchange time. Real time last sale data provided by NASDAQ. More information on NASDAQ traded symbols and

their current financial status. Intraday data delayed 15 minutes for Nasdaq, and 20 minutes for other exchanges. S&P/Dow Jones Indices

(SM) from Dow Jones & Company, Inc. SEHK intraday data is provided by SIX Financial Information and is at least 60-minutes delayed. All

quotes are in local exchange time.

http://www.marketwatch.com/story/lower-oil-prices-carry-big-geopolitical-consequences-2014-11-04/print

3/3

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- DD2711 1 10Document10 pagesDD2711 1 10paul heberth areche conovilcaPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- F3 9000 EngDocument7 pagesF3 9000 Engjohn_kyrPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Leroy SomerDocument86 pagesLeroy SomerSimón Klein100% (1)

- ACTION TRACKERDocument6 pagesACTION TRACKERShubham ChaudharyPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- E-10 Storage Batteries - 1465729800 - E-10Document10 pagesE-10 Storage Batteries - 1465729800 - E-10nicolas.travailPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Energies 14 04876 v2Document15 pagesEnergies 14 04876 v2FlogamagPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Training Manual Operations: July 1999-Rev.0Document110 pagesTraining Manual Operations: July 1999-Rev.0FharishPutraPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Plant Floor Safety Fall 2020 PDFDocument54 pagesPlant Floor Safety Fall 2020 PDFPravivVivpraPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Design and Application of A Spreadsheet-Based ModelDocument7 pagesDesign and Application of A Spreadsheet-Based ModelPassmore DubePas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Client List - Arvind Corrotech Ltd.Document2 pagesClient List - Arvind Corrotech Ltd.Ricardo Javier Cotamo De la espriellaPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Solution of The Graetz-Brinkman Problem With The Laplace Transform Galerkin MethodDocument9 pagesSolution of The Graetz-Brinkman Problem With The Laplace Transform Galerkin MethodDeny Arief RusamsiPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Operations Manual 18WDocument137 pagesOperations Manual 18Wto_john100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Sandvik 533: Technical Specification 533-Revision 2 1/9Document9 pagesSandvik 533: Technical Specification 533-Revision 2 1/9ricardoPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Automation Direct - An Industry Guide To Control System EngineeringDocument93 pagesAutomation Direct - An Industry Guide To Control System EngineeringCesar CamachoPas encore d'évaluation

- Primer On Wood Biomass For Energy PDFDocument10 pagesPrimer On Wood Biomass For Energy PDFSTEFANIAPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- 00.00.005Document2 992 pages00.00.005Maulana BirrwildanPas encore d'évaluation

- 35D MD Dual Mast 2 Stage Full Free Lift: Arts ManualDocument59 pages35D MD Dual Mast 2 Stage Full Free Lift: Arts ManualХелфор УкраинаPas encore d'évaluation

- Process Instruction Technical Data Sheet: Ardrox 800/3Document2 pagesProcess Instruction Technical Data Sheet: Ardrox 800/3antonioPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Activities On AC Motors in 2007Document22 pagesActivities On AC Motors in 2007CarlosPas encore d'évaluation

- Renewable and Sustainable Energy Reviews: MD Maruf Hossain, Mohd. Hasan AliDocument9 pagesRenewable and Sustainable Energy Reviews: MD Maruf Hossain, Mohd. Hasan AliJuan MPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Asic Lectrical Echnology: Parallel Magnetic CircuitsDocument10 pagesAsic Lectrical Echnology: Parallel Magnetic CircuitsShivangPas encore d'évaluation

- ABC Dry Chemical - WikipediaDocument4 pagesABC Dry Chemical - WikipediaMohamed Abou El hassanPas encore d'évaluation

- Dd311 Specification Sheet EnglishDocument4 pagesDd311 Specification Sheet EnglishJose Antonio Sanchez SegoviaPas encore d'évaluation

- Instruction Manual Directional Overcurrent Protection Relay Grd140 - XXXDDocument438 pagesInstruction Manual Directional Overcurrent Protection Relay Grd140 - XXXDEpsp MedPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- 1.1.1.2 The Four-Stroke-Cycle Spark-Ignition (Petrol) EngineDocument1 page1.1.1.2 The Four-Stroke-Cycle Spark-Ignition (Petrol) EngineFuad AnwarPas encore d'évaluation

- Harsh Environment Series Connection Systems 2014-05-05 PDFDocument8 pagesHarsh Environment Series Connection Systems 2014-05-05 PDFSicein SasPas encore d'évaluation

- Create and Customize Your Physical ModelsDocument30 pagesCreate and Customize Your Physical Modelsraul19rsPas encore d'évaluation

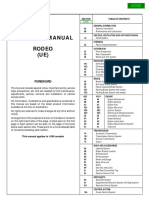

- 1999 Isuzu Rodeo UE US Version Service ManualDocument2 613 pages1999 Isuzu Rodeo UE US Version Service ManualRichard Tani100% (7)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- SteamTurbineGenerator Datasheet 500MWDocument8 pagesSteamTurbineGenerator Datasheet 500MWParantap RahaPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)