Académique Documents

Professionnel Documents

Culture Documents

Venture Capital

Transféré par

Krinal ShahDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Venture Capital

Transféré par

Krinal ShahDroits d'auteur :

Formats disponibles

Venture Capital

CONTENT

Sr. No.

PARTICULARS

Page No.

CHAPTER I INTRODUCTION

1.1

Introduction

1.2

Concept

1.3

Meaning

1.4

Informal Market

CHAPTER II Methods of Venture Capital Financing

2.1

Factors to be considered in Investment Proposal

2.2

Stages of funding

2.3

Methods of Financing

2.4

Benefits

10

2.5

Cons.

11

CHAPTER III Private Equity Investing

3.1

Investing

12

3.2

Fund operation

12

3.3

Global & revenue based Finance

14

CHAPTER IV Venture Capitalists

4.1

Meaning

19

4.2

Types

20

4.3

Roles

20

4.4

Compensation

4.4

Structue

21

4.5

Alternative

22

4.6

5

Structure of investment funds

Case study

23

27

Venture Capital

APPENDIX

5.1

Conclusion

5.2

Bibliography

35

Venture Capital

Chapter-1

Venture capital

1.1 Introduction

1.2 Concept

1.3Meaning

1.4 Informal Market

1.1 Introduction

A number of technocrats are seeking to set up shop on their own and capitalize

onopportunities. In the highly dynamic economic climate that surrounds us today,

fewtraditional business models may survive. Countries across the globe are realizingthat it

is not the conglomerates and the gigantic corporations that fuel economicgrowth any more.

The essence of any economy today is the small and mediumenterprises. For example, in the

US, 50% of the exports are created by companieswith less than 20 employees and only 7%

are created by companies with 500 or moreemployees. This growing trend can be attributed

to rapid advances in technology inthe last decade. Knowledge driven industries like InfoTech,

health-care,entertainment and services have become the cynosure of bourses worldwide. In

these sectors, it is innovation and technical capability that are big business-drivers. This is a

paradigm shift from the earlier physical production and economies of scale model.

However, starting an enterprise is never easy. There are a number of parameters that

contribute to its success or downfall. Experience, integrity, prudence and a clear

understanding of the market are among the sought after qualities of a promoter. However,

there are other factors, which lie beyond the control of the entrepreneur. Prominent among

these is the timely infusion of funds. This is where the venture capitalist comes in, with

money, business sense and a lot more.

Venture Capital

1.2 The concept of Venture Capital

The venture capital investment helps for the growth of innovative entrepreneurships in India.

Venture capital has developed as a result of the need to provide nonconventional, risky

finance to new ventures based on innovative entrepreneurship. Venture capital is an

investment in the form of equity, quasi-equity and sometimesdebt - straight or conditional,

made in new or untried concepts, promoted by atechnically or professionally qualified

entrepreneur. Venture capital means riskcapital. It refers to capital investment, both equity

and debt, which carries substantialrisk and uncertainties. The risk envisaged may be very high

may be so high as toresult in total loss or very less so as to result in high gains

Venture capital means many things to many people. It is in fact nearly impossible tocome

across one single definition of the concept.Jane Kolinsky Morris, editor of the well known

industry publication, VentureEconomics, defines venture capital as 'providing seed, start-up

and first stagefinancing' and also 'funding the expansion of companies that have

alreadydemonstrated their business potential but do not yet have access to the

publicsecurities market or to credit oriented institutional funding sources.

The European Venture Capital Association describes it as risk finance forentrepreneurial

growth oriented companies. It is investment for the medium or longterm return seeking to

maximize medium or long term for both parties. It is apartnership with the entrepreneur in

which the investor can add value to the companybecause of his knowledge, experience and

contact base.

1.3 Meaning of venture capital:

Venture capital is money provided by professionals who invest alongsidemanagement in

young, rapidly growing companies that have the potential to developinto significant

economic contributors. Venture capital is an important source ofequity for start-up

companies.Professionally managed venture capital firms generally are private partnerships or

closely-held corporations funded by private and public pension funds, endowmentfunds,

foundations, corporations, wealthy individuals, foreign investors, and theventure capitalists

themselves.

Venture Capital

1.4 Informal venture capital market

Much less well known and documented because of its invisible nature is the informal venture

capitalmarket. This part of the venture capital market comprises private individuals -- often

termed businessangels -- who provide equity and near equity capital directly to unquoted

businesses with which theyhave no family connection. Business angels are typically selfmade, high net worth individuals, mostlysuccessful entrepreneurs, although some have a

background in business-related professions(e.g. accountancy, law, management consultancy)

or as senior executives in large companies. They ofteninvest alone, but many invest as part of

informal syndicates which typically comprise family, friends orbusiness associates. Business

angels are motivated by capital gains, but non-financial considerations suchas the fun of

investing in entrepreneurial companies and altruistic reasons are important secondary

considerations. Little is known about their exit routes, but the limited evidence available

suggests thattrade sales are the most likely exit route for successful investments and buybacks for less successfulinvestments.It is not clear the extent to which the operation of the

informal venture capital market differs amongcountries. The available evidence is limited to

North America and the United Kingdom, with some additional evidence for Sweden, Finland

and the Netherlands. Comparisons suggest surprisingly fewdifferences in the operation of the

market and the characteristics of business angels. However, thisconclusion may reflect the

close cultural similarities between these countries. The informal venture capitalmarket may

operate differently in culturally dissimilar countries. In the case of France, for example, it

appears that private investors generally invest as part of a larger group rather than on their

own.In the United States, business angels play a crucial role in providing the bulk of early

stage external equityfinance. Business angels have also been identified in some European

countries as playing a similar role.Indeed, business angels invest in precisely those situations

where the institutional venture capital market ismost reluctant to do so. Business angels

invest predominantly at the start-up and early stages, in bothtechnology and non-technology

businesses, providing small amounts of risk capital to enable ideas to betranslated into

commercial entities. Business angels also tend to be value-added investors, playing anactive

role in the businesses in which they invest, and because of this hands-on involvement they

tend toinvest in businesses located close to their home. Thus, the informal and formal venture

capital marketscan be thought of as playing complementary roles. This has been

conceptualised by a baseball metaphor,with the business angels acting as the farm system

Venture Capital

for the institutional venture capital industry,providing the start-up and early stage finance and

hands-on assistance to enable new firms to get to thestage where they might be of interest to

venture capital funds. The implication is that the institutionalventure capital industry benefits

from the existence of an active informal venture capital market.The informal venture capital

market is also of critical importance because of its size. It is the largestsingle source of

external risk capital for small companies. It has been estimated that in the United

States,business angels invest in 20 to 40 times the number of companies as the institutional

venture capitalindustry and that the amount invested by business angels in the SME sector

(i.e. excluding MBOs/MBIs)is five times greater than the institutional venture capital

industry. Estimates for the United Kingdomsuggest that the informal venture capital market

may be two to four times larger than the institutionalventure capital market in terms of the

amount invested in the SME sector. Furthermore, the informalventure capital market remains

largely untapped. The invisible and fragmented nature of the marketmeans that it is difficult

for business angels and entrepreneurs seeking finance to find one another. Theconsequence is

that most business angels say that they are unable to find sufficient investmentopportunities.

In addition, there is scope for considerable expansion of the population of business angels.

Venture Capital

Chapter-2

Methods Of Venture Capital Financing

2.1 Factors To Be Consider In Investment Proposal

2.2 Stages Of Funding

2.3 Methods Of Financing

2.4 Benifits

2.5 Cons

2.1 Factor to be considered by venture capitalist in selection of investment proposal:

There are basically four key elements in financing of ventures which are studied indepth by

the venture capitalists. These are:

1. Management:The strength, expertise & unity of the key people on the board

bringsignificant credibility to the company. The members are to be mature,

experiencedpossessing working knowledge of business and capable of taking potentially

highrisks.

2. Potential for Capital Gain : An above average rate of return of about 30 - 40% isrequired

by venture capitalists. The rate of return also depends upon the stage of thebusiness cycle

where funds are being deployed. Earlier the stage, higher is the riskand hence the return.

3. Realistic Financial Requirement and Projections::The venture capitalist requiresa

realistic view about the present health of the organization as well as futureprojections

regarding scope, nature and performance of the company in terms of scaleof operations,

operating profit and further costs related to product developmentthrough Research &

Development.

4. Owner's Financial Stake: The financial resources owned & committed by

theentrepreneur/ owner in the business including the funds invested by family, friendsand

relatives play a very important role in increasing the viability of the business. It isan

important avenue where the venture capitalist keeps an open eye.

Venture Capital

Venture capitalists generally:

Finance new and rapidly growing companies

Purchase equity securities

Assist in the development of new products or services

Add value to the company through active participation

Take higher risks with the expectation of higher rewards

Have a long-term orientation

When considering an investment, venture capitalists carefully screen the technicaland

business merits of the proposed company. Venture capitalists only invest in asmall percentage

of the businesses they review and have a long-term perspective.They also actively work with

the company's management, especially with contactsand strategy formulation.

Venture capitalists mitigate the risk of investing by developing a portfolio of youngcompanies

in a single venture fund. Many times they co-invest with otherprofessional venture capital

firms. In addition, many venture partnerships managemultiple funds simultaneously. For

decades, venture capitalists have nurtured thegrowth of America's high technology and

entrepreneurial communities resulting insignificant job creation, economic growth and

international competitiveness.Companies such as Digital Equipment Corporation, Apple,

Federal Express, Compaq,Sun Microsystems, Intel, Microsoft and Genetech are famous

examples of companiesthat received venture capital early in their development investor.

While this type of individual investment did not totally disappear, the modern venture firm

emerged as the dominant venture investment vehicle. However, in the last few years,

individuals have again become a potent and increasingly larger part of the early stage start-up

venture life cycle. These "angel investors" will mentor a company and provide needed capital

and expertise to help develop companies. Angel investors may either be wealthy people with

management expertise or retired business men and women who seek the opportunity for firsthand businessdevelopment.

Venture Capital

2.2 Stages of Venture Capital Funding

The Venture Capital funding varies across the different stages of growth of a firm.The various

stages are:

1. Pre seed Stage: Here, a relatively small amount of capital is provided to anentrepreneur to

conceive and market a potential idea having good future prospects.The funded work also

involves product development to some extent.

2. Seed Stage: Financing is provided to complete product development andcommence initial

marketing formalities.

3. Early Stage / First Stage: Finance is provided to companies to initiatecommercial

manufacturing and sales.

4. Second Stage: In the Second Stage of Financing working capital is provided forthe

expansion of the company in terms of growing accounts receivable and inventory.

5. Third Stage: Funds provided for major expansion of a company havingincreasing sales

volume. This stage is met when the firm crosses the break even point.

6. Bridge / Mezzanine Financing or Later Stage Financing: Bridge /Mezzanine Financing

or Later Stage Financing is financing a company just before itsIPO (Initial Public Offer).

Often, bridge finance is structured so that it can be repaid,from the proceeds of a public

offering.

Venture Capital

2.3 Methods of Venture Financing

Venture capital is typically available in three forms in India, they are:

1) Equity: All VCFs in India provide equity but generally their contribution does

notexceed 49 per cent of the total equity capital. Thus, the effective control and

majorityownership of the firm remains with the entrepreneur. They buy shares of an

enterprisewith an intention to ultimately sell them off to make capital gains.

2) Conditional Loan : It is repayable in the form of a royalty after the venture is ableto

generate sales. No interest is paid on such loans. In India, VCFs charge royaltyranging

between 2 to 15 per cent; actual rate depends on other factors of the venturesuch as

gestation period, cost-flow patterns, riskiness and other factors of theenterprise.

3) Income Note-It is a hybrid security which combines the features of bothconventional

loan and conditional loan. The entrepreneur has to pay both interest androyalty on

sales, but at substantially low rates.

Other Financing Methods : A few venture capitalists, particularly in theprivate sector, have

started introducing innovative financial securities likeparticipating debentures, introduced by

TCFC is an example.

10

Venture Capital

2.3.1 Venture Capital Fund (Limited Partnership)

Structure

Venture capital firms are typically structured as partnerships, the general partners of which

serve as the managers of the firm and will serve as investment advisors to the venture capital

funds raised. Venture capital firms in the United States may also be structured as limited

liability companies, in which case the firm's managers are known as managing members.

Investors in venture capital funds are known aslimited partners. This constituency comprises

both high net worth individuals and institutions with large amounts of available capital, such

as state and private pension funds, university financial endowments,

foundations, insurance companies, and pooled investment vehicles, called funds of funds.

11

Venture Capital

2.4 The Benefits of Venture Capital Funding

Venture capital funding is one such way of borrowing money from investors. But why is it a

more attractive option over other funding sources? Well discuss them below in the benefits

of venture capital funding:

1. It provides you with capital without selling equity. Venture capital funding is essentially

a debt that your company makes. That said, you should pay for that debt in whole plus

interest. This is beneficial to start up companies who would like extra capital without having

to sell off equity and retain total control over the company.

2. It provides you with alternative funding options. While venture capital funding can help

keep yourself from selling equity, you can also mix the two depending on your needs and

priorities. For example, you can sell equity in order to minimize your risk of loss in the

company, while, at the same time, apply for venture capital funding in order to acquire new

equipment such as computers for your office.

3. It provides you with more money with which to expand. This is the most obvious

benefit of getting money from venture capital funding. You do not necessarily have to be in

the red to ask for this type of funding. You can also use the capital in order to expand your

businessyou can buy new equipment, improve your research and development, or some

other aspect of your business with the extra capital. You may also choose to use the money as

a form of insurance just in case your company runs the risk of losing money somewhere

along the way.

There you have it, some of the most important benefits of venture capital funding. This way

of raising capital is especially attractive if you are just starting out your company. It can help

you with the much needed expansion thats critical at this stage of your companys growth

without having to sell equity. You also have the alternative of mixing venture capital funding

with other funding sources, which provides you with more flexibility on how you spend your

money.

Keep in mind, however, that the venture capital funding that youll get is only as good as the

financing institution youre working with. Therefore, make sure that you only work with

those with a proven track record and ideally work in the industry youre in.

12

Venture Capital

2.5 Cons Of Venture Capital Financing

Securing venture capital typically means that you have to give up something in exchange for

the funding. Most venture capital firms are not interested in merely receiving the capital that

they have invested along with a standard interest rate. In fact, there are some things that

venture capital firms may ask for that may surprise you. These include:

1) Management Position - In many cases, a venture capital firm will want to add a

member of their team to the start up company's management team. This is generally to

ensure that the company can be successful, though this can also create internal

problems.

2) Equity Position - Most venture capital firms require that the company give up an

equity position to them in return for their funding. This amount is not small, in many

cases it can be as much as 60 percent of the equity in the company. In effect, this

means that the entrepreneur is not controlling their business; it is being controlled by

the venture capital firm.

3) Decision Making - One of the biggest problems that many entrepreneurs face when

they agree to accept venture capital is they often are giving up many key decisions in

how their company will operate. Venture capital firms that have taken an equity

position want a "seat at the table" when any major decision is made and they often

have the power to override decisions.

4) Business Plans - When a business plan is written and submitted for financing

considerations, most finance companies will agree to sign a non-disclosure agreement.

This is not the case in most venture capital firms. Venture capital firms will nearly

always refuse to sign a non-disclosure agreement due to the legal ramifications of

doing so. This can put ideas from an entrepreneur at risk.

5) Funding Plan - If an entrepreneur writes their business plan and determines they

need $500,000 to get the business launched, they may be lulled into thinking that

these funds will come up front. This is simply not the case. Venture capital firms

almost always set goals and milestones for releasing funds. Funding from venture

capital firms is typically done in stages with an eye on the expansion of the business.

13

Venture Capital

These are only a few of the possible problems an entrepreneur could face when they

secure venture capital funding. It is important that they carefully review all

agreements and have them reviewed by an attorney as well.

Chapter-3

Private Equity Investing

3.1 Investing

3.2Fund Operation

3.3 Global & Revenue Based Finance

3.1 Investing

Venture capital investing has grown from a small investment pool in the 1960s andearly

1970s to a mainstream asset class that is a viable and significant part of theinstitutional and

corporate investment portfolio. Recently, some investors have beenreferring to venture

investing and buyout investing as "private equity investing." Thisterm can be confusing

because some in the investment industry use the term "privateequity" to refer only to buyout

fund investing. In any case, an institutional investorwill allocate 2% to 3% of their

institutional portfolio for investment in alternativeassets such as private equity or venture

capital as part of their overall asset allocation.Currently, over 50% of investments in venture

capital/private equity comes frominstitutional public and private pension funds, with the

balance coming fromendowments, foundations, insurance companies, banks, individuals and

other entitieswho seek to diversify their portfolio with this investment class.

3.2 Venture Capital Fund Operation

Venture capitalists are very selective in deciding what to invest in. A common figureis that

they invest only in about one in four hundred ventures presented to them.They are only

interested in ventures with high growth potential. Only ventures withhigh growth potential

are capable of providing the return that venture capitalistsexpect, and structure their

businesses to expect. Because many businesses cannotcreate the growth required having an

exit event within the required timeframe,venture capital is not suitable for everyone.Venture

capitalists usually expect to be able to assign personnel to key managementpositions and also

to obtain one or more seats on the company's board of directors.

14

Venture Capital

This is to put people in place, a phrase that has sometimes quite unfortunateimplications as it

was used in many accounting scandals to refer to a strategy ofplacing incompetent or easily

bypassed individuals in positions of due diligence andformal legal responsibility, enabling

others to rob stockholders blind. Only a tinyportion of venture capitalists, however, have been

found liable in the large scalefrauds that rocked American (mostly) finance in 2000 and 2001.

Venture capitalists expect to be able to sell their stock, warrants, options,convertibles, or

other forms of equity in three to ten years: this is referred to asharvesting. Venture capitalists

know that not all their investments will pay-off. Thefailure rate of investments can be high;

anywhere from 20% to 90% of the enterprisesfunded fail to return the invested capital.

Many venture capitalists try to mitigate this problem through diversification. Theyinvest in

companies in different industries and different countries so that thesystematic risk of their

total portfolio is reduced. Others concentrate their investmentsin the industry that they are

familiar with. In either case, they work on the assumptionthat for every ten investments they

make, two will be failures, two will be successful,and six will be marginally successful. They

expect that the two successes will pay forthe time given to, and risk exposure of the other

eight. In good times, the funds thatdo succeed may offer returns of 300 to 1000% to

investors.Venture capital partners (also known as "venture capitalists" or "VCs") may be

former chief executives at firms similar to those which the partnership funds.Investors in

venture capital funds are typically large institutions with large amounts ofavailable capital,

such as state and private pension funds, university endowments,insurance companies and

pooled investment vehicles.Most venture capital funds have a fixed life of ten yearsthis

model was pioneeredby some of the most successful funds in Silicon Valley through the

1980s to invest intechnological trends broadly but only during their period of ascendance, to

cutexposure to management and marketing risks of any individual firm or its product.In such

a fund, the investors have a fixed commitment to the fund that is "calleddown" by the VCs

over time as the fund makes its investments. In a typical venturecapital fund, the VCs receive

an annual "management fee" equal to 2% of thecommitted capital to the fund and 20% of the

net profits of the fund. Because a fundmay run out of capital prior to the end of its life, larger

VCs usually have severaloverlapping funds at the same timethis lets the larger firm keep

specialists in allstage of the development of firms almost constantly engaged. Smaller firms

tend tothrive or fail with their initial industry contactsby the time the fund cashes out,

anentirely new generation of technologies and people is ascending, whom they do notknow

15

Venture Capital

well, and so it is prudent to re-assess and shift industries or personnel ratherthan attempt to

simply invest more in the industry or people it already knows

16

Venture Capital

3.3 Global Venture Capital And Revenue Based Finance

The United States has a problem: entrepreneurs and venture capitalists are having trouble

getting funded. Less than 1% of startups attract equity-based venture capital in the US.

Making matters worse, the US venture capital industry posted negative 10-year returns as of

2010, with a 31% decline in first quarter dollars raised by VC firms (compared with the first

quarter of 2009). Times are hard.

What about other countries? Does the US have it better? Worse? How do venture capital

environments compare in BRIC nations, and how can revenue-based finance help?

1. Entrepreneurial Environment. US startups bemoan excessive regulation, procedure and

bureaucracy that add cost and generally frustrate innovation. Its a huge pain. Yet painful as

it may be, others have it worse. As a rough proxy for national bureaucratic-ness, the time

and procedure required to set up a foreign-owned business compare as follows:

At one extreme, it takes more than 15 times longer to set up a foreign-owned business in

Brazil (vs US). Another proxy for government-imposed burden is tax, for which Brazil gets

more poor marks with taxes at a whopping 38.8% of GDP.

17

Venture Capital

While China, India and Brazil have made varied strides to improve their business climates in

recent years, Russia registered an actual decline in the 2009-10 Global Competitiveness

Report. Russia dropped 12 places to 63rd, largely because of a perceived lack of government

efficiency, judicial independence and property rights.

2. Venture Capital Volatility. The Great Recession vaporized almost a third of invested VC

dollars in the US, with devastating effects for startups and fund managers. Even today the

effects of this funding volatility plague the economy. However volatility was around three

times worse in Russia, and twice as bad in India.

Compounding the issue, IPOs from Russian companies dried up in 2008 and 2009 while

Indias IPO market crashed around 97% from Rs 922.18 billion to Rs 20.33 billion.

Venture capital has always had its challenges in emerging markets, even in the good times

before the 2007 collapse. For example, 20 venture capital funds investing in 74 Brazilian

firms between 2003 2006 posted negative overall returns. While overall US venture capital

returns over the past decade have also been negative, one 2005 study showed that private

equity funds across emerging markets (including a mix of venture capital and larger private

equity transactions) similarly produced an IRR of negative 0.3% over 5- and 10-year

horizons.

There are a number of reasons equity-based venture investing has taken such a beating

throughout the world. However when you ask VCs themselves, there is strong consensus

around the single most challenging factor: a lack of exits. Startups can be invested in easily

enough, but monetizing that investment (i.e. turning it into cash) is another matter entirely.

18

Venture Capital

3. Future Outlook. With thicker bureaucracies, greater volatility and historically

challenging environments, one might expect the future of BRIC venture capital to be gloomy

at least gloomier than that of the US. However, oddly enough, the exact opposite seems

true.

In a recent survey of over 500 global venture capitalists, an overwhelming percentage of VCs

predicted venture investing growth in Brazil, China and India (Russia was not sampled) over

the next five years. Meanwhile 85% of respondents predicted declines in US venture capital

over the same period.

19

Venture Capital

[viii]

While growing investment in BRIC nations is encouraging (at least for those BRIC nations),

there is cause for concern. If the migration of capital takes the same form as in the past (i.e.

equity-based venture capital), what reason is there to believe that future outcomes will

significantly differ from the past? If we keep doing the same thing, how can we expect a

different result?

4. Revenue-Based Finance. These global trends underscore the urgency and importance of

revenue-based finance on a global scale. Without revenue capital and other alternatives to

traditional equity-based venture investing, entrepreneurs and VCs are increasingly subject to

the familiar challenges, volatility and speculation that all too often thwart economic growth.

Revenue capital is not theoretically immune from boom and bust cycles, yet it contains two

key substantive differences from equity investment that can buffer it from extreme volatility:

(1) Unlike equity-based investing and IPO markets, which derive venture valuations

from perceptions of market value (i.e. valuation is driven by a companys estimated

potential), revenue-based investments are determined by actual market value (i.e. the actual

revenue generated by a venture). In other words, revenue capital is based on cash, not

perception. It is therefore more stable over time as market revenues tend to fluctuate less

than market moods.

(2) Unlike equity-based investing, revenue-based finance does not depend on exits. As

investor returns come from a percentage of a ventures revenue rather than the sale of its

stock, revenue capital can profitably fund start ups regardless of exit volatility. No exits, no

problem.

The past few years have been tough for everyone. As such, going forward BRIC nations and

the US would be well advised to avoid mechanically replicating VC behaviours of the past.

While revenue-based finance does not solve every problem and there will always be a critical

place for equity-based investing, revenue capital is essential to the global dialogue.

20

Venture Capital

Otherwise investors and start ups alike may be doomed to repeat past failures, no matter

where they happen to be.

This is a cruel irony on poetic justice, depending on ones view point the past few years have

been tough for everyone,especially BRIC nation. However going forward ,BRIC nations may

have a light of hope at the end of their venture capital tunnel. As for the US, unless significant

steps are taken the light at the end of its tunnel may turn out to be an oncoming train.

21

Venture Capital

Chapter-4

Venture Capitalist

4.1 Meaning

4.2 Types

4.3 Roles

4.4 Structure

4.5 Compensation

4.6 Alternatives

4.7 Supply Of Investment Funds

4.1 Meaning

The typical person-on-the-street depiction of a venture capitalist is that of a wealthy financier

who wants to fund start-up companies. The perception is that a person who develops a brand

new change-the-world invention needs capital; thus, if they cant get capital from a bank or

from their own pockets, they enlist the help of a venture capitalist.

In truth, venture capital and private equity firms are pools of capital, typically organized as a

limited partnership that invests in companies that represent the opportunity for a high rate of

return within five to seven years. The venture capitalist may look at several hundred

investment opportunities before investing in only a few selected companies with favourable

investment opportunities. Far from being simply passive financiers, venture capitalists foster

growth in companies through their involvement in the management, strategic marketing and

planning of their investee companies. They are entrepreneurs first and financiers second.

Even individuals may be venture capitalists. In the early days of venture capital investment,

in the 1950s and 1960s, individual investors were the archetypal venture

22

Venture Capital

4.2 Types

Venture Capitalist firms differ in their approaches. There are multiple factors, and each firm

is different.

Some of the factors that influence VC decisions include:

Business situation: Some VCs tend to invest in new ideas, or fledgling companies.

Others prefer investing in established companies that need support to go public or grow.

Some invest solely in certain industries.

Some prefer operating locally while others will operate nationwide or even globally.

VC expectations often vary. Some may want a quicker public sale of the company or

expect fast growth. The amount of help a VC provides can vary from one firm to the next.

4.3 Roles

Within the venture capital industry, the general partners and other investment professionals of

the venture capital firm are often referred to as "venture capitalists" or "VCs". Typical career

backgrounds vary, but, broadly speaking, venture capitalists come from either an operational

or a finance background. Venture capitalists with an operational background (operating

partner) tend to be former founders or executives of companies similar to those which the

partnership finances or will have served as management consultants. Venture capitalists with

finance backgrounds tend to have investment banking or other corporate finance experience.

Although the titles are not entirely uniform from firm to firm, other positions at venture

capital firms include:

Venture partners Venture partners are expected to source potential investment

opportunities ("bring in deals") and typically are compensated only for those deals with

which they are involved.

Principal This is a mid-level investment professional position, and often

considered a "partner-track" position. Principals will have been promoted from a senior

23

Venture Capital

associate position or who have commensurate experience in another field, such

as investment banking, management consulting, or a market of particular interest to the

strategy of the venture capital firm.

Associate This is typically the most junior apprentice position within a venture

capital firm. After a few successful years, an associate may move up to the "senior

associate" position and potentially principal and beyond. Associates will often have

worked for 12 years in another field, such as investment banking or management

consulting.

Entrepreneur-in-residence (EIR) EIRs are experts in a particular domain and

perform due diligence on potential deals. EIRs are engaged by venture capital firms

temporarily (six to 18 months) and are expected to develop and pitch startup ideas to their

host firm although neither party is bound to work with each other. Some EIRs move on to

executive positions within a portfolio company.

4.4 Structure of the funds

Most venture capital funds have a fixed life of 10 years, with the possibility of a few years of

extensions to allow for private companies still seeking liquidity. The investing cycle for most

funds is generally three to five years, after which the focus is managing and making followon investments in an existing portfolio. This model was pioneered by successful funds

in Silicon Valley through the 1980s to invest in technological trends broadly but only during

their period of ascendance, and to cut exposure to management and marketing risks of any

individual firm or its product.

In such a fund, the investors have a fixed commitment to the fund that is initially unfunded

and subsequently "called down" by the venture capital fund over time as the fund makes its

investments. There are substantial penalties for a limited partner (or investor) that fails to

participate in a capital call.

It can take anywhere from a month or so to several years for venture capitalists to raise

money from limited partners for their fund. At the time when all of the money has been

raised, the fund is said to be closed, and the 10-year lifetime begins. Some funds have partial

24

Venture Capital

closes when one half (or some other amount) of the fund has been raised. The vintage

year generally refers to the year in which the fund was closed and may serve as a means to

stratify VC funds for comparison. This shows the difference between a venture capital fund

management company and the venture capital funds managed by them.

From investors' point of view, funds can be: (1) traditionalwhere all the investors invest

with equal terms; or (2) asymmetricwhere different investors have different terms.

Typically the asymmetry is seen in cases where there's an investor that has other interests

such as tax income in case of public investors.

4.5 Compensation

Venture capitalists are compensated through a combination of management fees and carried

interest (often referred to as a "two and 20" arrangement):

Management fees an annual payment made by the investors in the fund to the

fund's manager to pay for the private equity firm's investment operations. In a typical

venture capital fund, the general partners receive an annual management fee equal to up

to 2% of the committed capital.

Carried interest a share of the profits of the fund (typically 20%), paid to the

private equity funds management company as a performance incentive. The remaining

80% of the profits are paid to the fund's investors Strong limited partner interest in toptier venture firms has led to a general trend toward terms more favorable to the venture

partnership, and certain groups are able to command carried interest of 2530% on their

funds.

Because a fund may run out of capital prior to the end of its life, larger venture capital firms

usually have several overlapping funds at the same time; doing so lets the larger firm keep

specialists in all stages of the development of firms almost constantly engaged. Smaller firms

tend to thrive or fail with their initial industry contacts; by the time the fund cashes out, an

entirely-new generation of technologies and people is ascending, whom the general partners

may not know well, and so it is prudent to reassess and shift industries or personnel rather

than attempt to simply invest more in the industry or people the partners already know.

25

Venture Capital

26

Venture Capital

4.6 Main alternatives to venture capital

Because of the strict requirements venture capitalists have for potential investments, many

entrepreneurs seek seed funding from angel investors, who may be more willing to invest in

highly speculative opportunities, or may have a prior relationship with the entrepreneur.

Furthermore, many venture capital firms will only seriously evaluate an investment in a startup company otherwise unknown to them if the company can prove at least some of its claims

about the technology and/or market potential for its product or services. To achieve this, or

even just to avoid the dilutive effects of receiving funding before such claims are proven,

many start-ups seek to self-finance sweat equity until they reach a point where they can

credibly approach outside capital providers such as venture capitalists or angel investors. This

practice is called "bootstrapping".

There has been some debate since the dot com boom that a "funding gap" has developed

between the friends and family investments typically in the $0 to $250,000 range and the

amounts that most VC funds prefer to invest between $1 million to $2 million. This funding

gap may be accentuated by the fact that some successful VC funds have been drawn to raise

ever-larger funds, requiring them to search for correspondingly larger investment

opportunities. This gap is often filled by sweat equity and seed funding via angel investors as

well as equity investment companies who specialize in investments in startup

companies from the range of $250,000 to $1 million. The National Venture Capital

Association estimates that the latter now invest more than $30 billion a year in the USA in

contrast to the $20 billion a year invested by organized venture capital funds.

Crowd funding is emerging as an alternative to traditional venture capital. Crowd funding is

an approach to raising the capital required for a new project or enterprise by appealing to

large numbers of ordinary people for small donations. While such an approach has long

precedents in the sphere of charity, it is receiving renewed attention from entrepreneurs such

as independent film makers, now that social media and online communities make it possible

to reach out to a group of potentially interested supporters at very low cost. Some crowd

funding models are also being applied for start-up funding such as those listed at Comparison

of crowd funding services. One of the reasons to look for alternatives to venture capital is the

problem of the traditional VC model. The traditional VCs are shifting their focus to laterstage investments, and return on investment of many VC funds have been low or negative.

27

Venture Capital

In Europe and India, Media for equity is a partial alternative to venture capital funding.

Media for equity investors are able to supply start-ups with often significant advertising

campaigns in return for equity.

In industries where assets can be securitized effectively because they reliably generate future

revenue streams or have a good potential for resale in case of foreclosure, businesses may

more cheaply be able to raise debt to finance their growth. Good examples would include

asset-intensive extractive industries such as mining, or manufacturing industries. Offshore

funding is provided via specialist venture capital trusts, which seek to utilise securitization in

structuring hybrid multi-market transactions via an SPV (special purpose vehicle): a

corporate entity that is designed solely for the purpose of the financing.

In addition to traditional venture capital and angel networks, groups have emerged, which

allow groups of small investors or entrepreneurs themselves to compete in a privatized

business plan competition where the group itself serves as the investor through a democratic

process.

Law firms are also increasingly acting as an intermediary between clients seeking venture

capital and the firms providing it.

28

Venture Capital

4.7 Increasing the supply of investment funds

Venture capital activity can only grow if investors allocate more capital and if more long-term

sources of finance become available. A key requirement is the encouragement of sources of

long-term capital to invest in venture capital. Banks, which are major providers of venture

capital in many countries, tend tohave short-term investment horizons which have the effect

of pushing venture capital into safer and moremature investment opportunities. It is therefore

important that longer-term investors, such as pensionfunds (which are the dominant investors

in US venture capital funds) and life insurance companies, areencouraged to consider venture

capital as a legitimate asset class. This requires a range of initiatives, onlysome of which can

be delivered by governments:

- Accounting regulation -- to ensure meaningful financial disclosure to encourage investors

to haveconfidence in companies in which they might invest.

- Performance measurement -- the development of widely accepted performance

measurement andvaluation methods for investments in unquoted companies.

- Legal structures -- the creation of appropriate legal structures for funds to minimise legal

and taxrisks.

- Investment rules -- rules on the proportion of their assets that pension funds are permitted

to investin venture capital and how they should value such investments.

- Transparency -- regarding the taxation of income and capital gains to avoid double

taxation.

- Stock market -- to provide liquidity for venture capital investments and enable investee

companiesto raise further finance.

- Interest rates -- low-interest rates make equity valuable and reward growth; investing in

venturecapital is less attractive when interest rates are high.

However, European experience indicates that even though such initiatives may achieve some

success, byno means all parts of the venture capital industry will benefit. Specifically,

institutional investors have notbeen attracted to venture capital funds that specialise in

investing in seed, start-up and early stagesituations and in technology sectors. One of the

reasons is that investors have been discouraged by thelow returns achieved by such funds.

Governments must therefore consider more direct initiatives whichseek to increase the

returns of early stage and technology funds in order to encourage institutionalfunds to

invest in such funds. The key requirement is that the funds which are created as a result of

29

Venture Capital

suchinitiatives should operate to high professional standards, maximise investment returns

and beself-sustaining. Possibilities include the following:

- Seed financing schemes (such as the European Unions European Seed Capital Fund

Network) thatcontribute to the capital of such funds (e.g. on a matching basis with private

funds raised) and loansto cover their operating costs.

- Exit routes -- Government role as exit of the last resort to enable seed funds to recycle

andreinvest their investment funds (e.g. the BJTU scheme in Germany).

- Loss coverage -- Government equity guarantee for a proportion of the funds losses in

order toincrease the upside potential.

30

Venture Capital

Case study

1)Independent assessment of mortgage servicers compliance with

consent order

June 27, 2013

Challenge

In 2011, our client and certain other major residential mortgage servicers entered into

consent orders with the Board of Governors of the Federal Systems (the Fed) and

other regulators, requiring them to improve their governance, foreclosure process and

other areas of their residential mortgage business. The consent order required an

independent validation consultant to be engaged by the client to test their

compliance. Grant Thornton was selected based on strong banking credentials,

independence and experience managing large, complex projects.

Solution

The client developed a number of action plans to address the requirements of the

consent order. The action plans varied by section, but generally included improved

policies, procedures and internal controls to address weaknesses cited by regulators.

We assembled a separate partner-led team to gain an understanding of each applicable

action plan (10 total) within the scope of the validation project and to develop a

testing program that was subject to Fed approval. The engagement was managed by a

strong project management office that coordinated the Grant Thornton teams,

provided regular updates to the client and the Fed, and facilitated consultations by the

teams with Grant Thornton Bank Regulatory and other subject matter experts.

Results

Within six months of being engaged, Grant Thornton completed over 14,900 hours of

work and submitted a report under budget and by the stipulated deadline

documenting its findings to the Fed.

31

Venture Capital

2)Assisting with an automotive retailers $200 million international acquisition

September 04, 2013

Challenge

A U.S.-based, public Fortune 500 automotive retailer sought to acquire over 25 auto

dealerships in Brazil, where it had limited resources. The $200 million international

acquisition required tangible, intangible and global resources. The company, a leading

operator in the $1 trillion automotive retailing industry, required local and

international financial reporting and tax expertise to execute on and coordinate the

valuation.

Solution

To meet ASC 805 Business Combination financial reporting requirements, the

client hired Grant Thornton LLPs Forensic and Valuation Services (FVS) team. The

FVS team had successfully advised the client on previous annual ASC 350

impairments tests and navigated the review process with the clients Big Four external

auditor.

Working closely with the client in the U.S., with assistance from affiliates in our Brazil

office, Grant Thornton:

Provided assistance performing the fair value analysis for the purchase price

allocations, as required by U.S. GAAP Accounting.

Performed tangible asset valuation by bringing tangible, intangible and global

expertise/resources into one location so the client did not need to contract out to different

vendors either locally or internationally.

Worked with the client locally and through the Grant Thornton affiliates in Brazil to

set up the valuation for U.S. Tax and Brazil Tax authorities.

Results

Effective communication with the Grant Thornton FVS team in the U.S. and Brazil

throughout the process enabled the client to focus its efforts on integrating the new

business successfully. Rather than using its resources to work on valuation

requirements for U.S. financial reporting and tax, and particularly for meeting

Brazilian requirements where company resources were limited, the client reduced its

risk of delaying or derailing the acquisition and business integration process.

32

Venture Capital

3)CARS assists with development of China market entry strategy

Challenge

Given the size and growth of the Chinese market and the rapidly expanding consumer base in

China and throughout the Asia-Pacific region, a privately held home furnishings manufacturer

and supplier of window fashions with $600 million in annual revenue, sought to establish a

market position in China. Earlier, the company had considered acquisitions as a market entry

strategy, but was concerned by the high acquisition multiples requested by potential targets.

The company retained Grant Thornton LLP as an advisor to senior management to develop a

fully-integrated financial model and facilitate and draft a business plan focused on a

Greenfield entry into China. This plan would help the company compare entry strategies and

understand, evaluate and manage the risks associated with the investment.

Solution

Grant Thornton professionals in the United States and China worked with the companys

management to develop the financial model and business plan. The Grant Thornton team

verified assumptions and researched local business practices.

Grant Thornton analyzed industry, competitor and company trends, performing a thorough

review of the home furnishings market in China, foreign and domestic competitors' China

strategies, and their respective track records. Using market research, the team developed and

validated customer demand assumptions.

Grant Thornton developed cost assumptions by analyzing historical company results at the

most comparable manufacturing facilities and interviewing key personnel at those companies.

The team also determined capital requirements and timing.

Results

The financial model projected revenue results based on market size and penetration. The

business plan included operational and macroeconomic risks, tax and regulatory

considerations, and next steps.

Grant Thornton helped the company finalize an integrated financial model and an actionable

business plan for presentation to the board of directors. Aided by those deliverables, the

company was able to make a better-informed decision. Given the results of the financial

model and business plan, the company ultimately decided that an acquisition strategy was most

prudent.

33

Venture Capital

34

Venture Capital

4)Publisher with declining revenue files for bankruptcy

Challenge

Idearc Inc. (the company) was the exclusive publisher of Verizon print directories,

including the yellow pages and white pages directories, along with owning several

leading industry electronic directories, including Superpages.com, Switchboard.com

and LocalSearch.com. The company was under economic pressure as revenue from

print media continued to decline at a faster rate than the offsetting increase in

electronic media revenue. The company was too highly leveraged with total debt of

$9 billion compared to revenue of $3.4 billion.

Solution

Grant Thornton LLP was hired in December 2008 to prepare the company, including

nine of its 10 subsidiaries companies for a Chapter 11 bankruptcy filing. The

company, a spinoff from Verizon Communications, sought Chapter 11 protection in

federal bankruptcy court in Dallas on March 31, 2009. The only subsidiary company

excluded from the bankruptcy filing was the Idearc Inceptor LTD, located in the

United Kingdom.

The companys executive leadership team along with the companys bankruptcy attorneys,

Fulbright &Jaworski, relied broadly on Grant Thorntons professionals to assist the

companys management team with all financial and operational bankruptcy preparation

activities.

We worked closely with the companys management team, taking a key role in assembling all

the data from each of the companys subsidiaries, their more than 100 offices and distribution

center locations, outsourcers of data, and multiple internal databases, as described below:

Marshaled information from several enterprise databases including all subsidiaries

into a collective repository for assembly into the Court-required Statements and Schedules,

which included more than 800,000 executory contracts.

Working closely with company management, Grant Thornton constructed the crucial

information for all of the First Day Motions including, the critical vendors motion, utilities

motion, ordinary course professionals, motion to pay prepetition wages and benefits for more

than 6,000 employees and lease rejection analysis.

Worked closely with the companys management team to develop communications

related to the preparation of the bankruptcy filing.

35

Venture Capital

Worked with company management to establish processes and procedures for

managing and tracking pre- petition and post-petition accounts payable and accounts

receivable.

Provided expert testimony on matters concerning pre-petition claims, accounts

payable and other matters of significance.

Assisted the company with the preparation and review of monthly operating reports

for the bankruptcy process.

Provided an integrated team of accounting, information technology, valuation, and tax

professionals to address bankruptcy, emergence from bankruptcy, and reporting associated

with the requirements of fresh start accounting and reporting.

Results

Idearc Inc. emerged from bankruptcy on December 31, 2009, renamed SuperMedia

Inc., and began trading on the Nasdaq Global Market under the symbol SPMD.

36

Venture Capital

5)Anatomy of the 100 cent+ case

Recovery to common equity holders in a bankruptcy is rare. Yet there have been numerous

bankruptcies where equity holders obtained not only a recovery, but a substantial one. These

were cases in which all creditors and preferred shareholders recovered 100 cents on the

dollar. More importantly, common equity holders received a substantial ownership interest in

the reorganized entity. We call these the 100 cent+ cases a black swan in the world

of corporate bankruptcies. So whats different about these cases? Are they merely random

events, or is there more to it?

This topic has always been of great interest, not only to academics and professionals in the

field of bankruptcy and restructuring, but also to investors. Distressed investors often buy

stock in bankrupt companies in hopes of a windfall, while incumbent activist investors do

everything possible to retain their interests. When General Growth Properties (GGP) filed for

bankruptcy in early 2009, Pershing Square Capital Management, a deep-value and activistoriented hedge fund1 that owned 25% of GGP, tried to make a case as to why that was not a

typical bankruptcy in which existing equity gets wiped out. It did so primarily by drawing

parallels to three other large public company bankruptcies in which equity holders kept

substantial ownership interests.2

i)Attributes of 100 cent+ cases

So what are the attributes of a 100 cent+ case? To arrive at a clear picture, we did three

things. First, we defined a 100 cent+ case as one in which equity holders were awarded more

than one-third of the reorganized entitys equity. We ignored cases where equity holders

received only warrants and/or cash payouts, because these are often de minimis. We also

limited the scope to bankruptcies filed during or after 2005. Second, we developed a shortlist

of 100 cent+ cases based on our knowledge, input from industry professionals and results

from news and database3 searches. Last, we analyzed the seven bankruptcies that met our

100 cent+ criteria to determine common key attributes. We found that these 100 cent+ cases

consistently shared the following three attributes:

The debtors had a strong underlying core business prior to filing for bankruptcy.

Bankruptcy was caused in part by a shift in an external value driver.

37

Venture Capital

There was at least one shareholder advocate throughout the course of the bankruptcy

proceeding.

Its important to stress that we are not trying to claim that these three attributes have a causal

relationship with a 100 cent+ recovery. We made no effort to isolate these attributes from

other possible influencing factors such as the macroeconomic environment, the attractiveness

of different industries, the quality of management, or luck.

ii)Strong underlying core business prior to filing

Even without adjusting for potential value erosion from noncore businesses or unfavorable

one-time events, almost all of the debtors on our list had a positive tangible book value (i.e.,

equity) and a positive or break-even cash flow before debt service in the year immediately

preceding the bankruptcy filing. But there was something else that really set these 100 cent+

cases apart. In all cases, the debtors had a core business that was a leader in an industry or

had a specific industry niche. ASARCO had a 109-year history as a leading producer of

copper. Hancock was the second-largest fabric retailer in a highly fragmented market.4 Blast

had a niche in satellite communication services to oil and gas producers. Flying J had a

thriving retail truck stop business. GGP was the second- largest operator of shopping malls,

with occupancy ranking among the top of its peer group. Pilgrims Pride was one of the

largest producers of chicken in the United States, Mexico and Puerto Rico. Finally, Saratoga

Resources had valuable oil and gas reserves.

It is true that bankruptcy provided the debtors with the ability to shed noncore assets and

improve their strategic and financial position. We would argue that this was possible only

because each had a solid core business to begin with and therefore a reason to exist.

iii)Shift in an external value driver

In the seven 100 cent+ cases we studied, bankruptcy was caused partly by a shift in an

external value driver that was beyond the debtors direct control.5 Significant unfavorable

shifts in commodity prices-be it the low price of copper in the case of ASARCO, the decrease

in the price of oil and gas in the case of Flying J, or the increase in corn and soybean meal

prices for Pilgrims Pride-moved companies to the brink. In the case of Saratoga Resources,

the drop in the price of oil, exacerbated by the damage and interruptions in production after

Hurricanes Gustav and Ike, necessitated the filing. GGP was negatively influenced by

plummeting commercial property cash flows, and hence, falling asset values in a tight credit

38

Venture Capital

environment. Hancocks core value driver was customer demand for fabric, which had

declined considerably in the years leading up to the companys bankruptcy so much so

that even Wal-Mart started phasing out fabric from its stores around the time Hancock filed

for bankruptcy.

It is important to note that since these shifts in external value drivers were beyond the

debtors control, a successful reorganization hinged on one of two things. Either the

unfavorable shift reversed over time, or the debtors had a credible plan to quickly deal with

the shift. In all cases except Hancock and to some extent GGP, the core value drivers showed

signs of improvement over the course of the bankruptcy process. For example, because of

improved cash flow resulting from higher copper prices, ASARCO did not even draw on its

debtor-in-possession facility. Hancock closed its unprofitable stores, unlocked liquidity from

favorable leases on those stores, remodeled many of its other stores, and enhanced its online

presence. GGP was able to spin off its noncore holdings, which were made up primarily of

master-planned communities and development parcels, to focus on its core regional mall

business.

iv)Shareholder advocacy

Shareholder advocacy was a critical feature in the seven 100 cent+ cases we studied. In four

of them, an Official Committee of Equity Holders was appointed. In the other three cases,

equity holders remained in control and assisted with the restructuring. With or even without

an Official Committee of Equity Holders, key shareholder advocates participated actively and

vigorously in all cases to maintain ownership and control of the entity upon its emergence.

Pershing Square Capital Management was not only an ardent shareholder advocate, but also a

major equity contributor to the reorganized GGP. ASARCOs parent, Grupo Mexico,

displayed the same level of fervor, putting forth a competing plan of reorganization that was

ultimately approved by thecourt. In the Flying J case, the equity owners worked tirelessly to

sell key assets in order to repay creditors and retain important assets around which to

reorganize. In the Saratoga Resources case, an Official Committee of Equity Holders

negotiated with management, lenders and the Official Committee of Unsecured Creditors to

find a resolution that the court could approve.

39

Venture Capital

Conclusion

The realization of a 100 cent+ outcome in any bankruptcy case is a rare achievement.

Undoubtedly, such success does not happen by accident. Many factors may influence the

outcome in a bankruptcy case. They may include the ability to restructure debt or obtain

additional financing, the presence of an active Official Committee of Unsecured Creditors,

successful outcomes of negotiations with labour unions or the favourable settlement of

significant litigation or environmental liabilities. Taken in isolation, the presence of one of

these factors may lead to a successful result in a bankruptcy case and, if multiple such factors

are present, the result may be quite favourable.

Although correlation does not imply causation, our research suggests that the outcome of a

100 cent+ recovery is really the product of more than just the random occurrence of any of

the factors listed above. A strong underlying core business is vital for the realization of such a

positive outcome, particularly in this last restructuring cycle where asset values have been

extraordinarily depressed. Shifting external factors can either cause or assist the recovery

from financial distress. We certainly noticed these in each of the cases referenced here. The

bigger factor was the skill and agility with which management of such business responded to

such shifts in the external operating environment. Finally, advocating shareholders, being

either existing management or external equity holders, are usually the driving forces behind a

100 cent+ recovery. Many cases have realized substantial recoveries of less than 100 cents,

because there was not an active advocate driving that final 5 to 10 % recovery. The existence

of such a catalyst seems to be required in achieving such an extraordinary result.

40

Venture Capital

Bibliography

1)JOURNALS

i)APPLIED FINANCE VENTURE STAGE INVESTMENT

PREFERENCE IN INDIA, VINAY KUMAR, MAY, 2004.

ii) ICFAI JOURNAL OF APPLIED FINANCE MAY- JUNE

VIKALPA VOLULMLE 28, APRI L- JUNE 2003

iii) ICFAI JOURNAL OF APPLIED FINANCE, JULY- AUG.

2)BOOKS

I.M. Panday- venture capital development process in India

I. M. Panday- venture capital the Indian experience.

3)VARIOUS NEWS PAPERS

4)INTERNET

i) www.indiainfoline.com

ii) www.vcapital.com

iii)www.investopedia.com

41

Venture Capital

42

Vous aimerez peut-être aussi

- Private Equity Unchained: Strategy Insights for the Institutional InvestorD'EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorPas encore d'évaluation

- Venture CapitalDocument71 pagesVenture CapitalSmruti VasavadaPas encore d'évaluation

- Venture CapitalDocument75 pagesVenture CapitalNagireddy Kalluri100% (1)

- Healthtech Venture CapitalDocument28 pagesHealthtech Venture CapitalFelipe Hernan Herrera SalinasPas encore d'évaluation

- Demystifying Venture Capital Economics - Part 1Document9 pagesDemystifying Venture Capital Economics - Part 1KarnYoPas encore d'évaluation

- Mudit Saxena - Genpact SeedDocument2 pagesMudit Saxena - Genpact SeedParas SatijaPas encore d'évaluation

- LABF - Fund of FundsDocument6 pagesLABF - Fund of FundsdavidsirotaPas encore d'évaluation

- VC Handbook PDFDocument91 pagesVC Handbook PDFRahul BirlaPas encore d'évaluation

- Venture Capital Q2 2016Document1 pageVenture Capital Q2 2016BayAreaNewsGroup100% (2)

- Venture CapitalDocument16 pagesVenture CapitalAditya100% (1)

- The Single Family Office Funds in IndiaDocument4 pagesThe Single Family Office Funds in IndiagandhiannexPas encore d'évaluation

- A Guide To Venture Capital in The Middle East and North Africa1Document40 pagesA Guide To Venture Capital in The Middle East and North Africa1moemikatiPas encore d'évaluation

- Potential Investors H2 21022022Document13 pagesPotential Investors H2 21022022guptan1911Pas encore d'évaluation

- Barron 100 HedgefundsDocument2 pagesBarron 100 Hedgefundskcchan7Pas encore d'évaluation

- A Guide To Venture CapitalDocument4 pagesA Guide To Venture CapitalgargramPas encore d'évaluation

- First Round Capital Original Pitch DeckDocument10 pagesFirst Round Capital Original Pitch DeckJessi Craige ShikmanPas encore d'évaluation

- Venture Investing - Rules of SuccessDocument100 pagesVenture Investing - Rules of SuccessSrikrishna Sharma KashyapPas encore d'évaluation

- 2Q 15 Vcsurvey PDFDocument11 pages2Q 15 Vcsurvey PDFBayAreaNewsGroupPas encore d'évaluation

- VC Handbook 2012Document41 pagesVC Handbook 2012Sanjeev ChaudharyPas encore d'évaluation

- Accelerator / Incubator Website CountryDocument561 pagesAccelerator / Incubator Website CountryАсхат ЖанабайPas encore d'évaluation

- Venture Capital Funding, Fourth Quarter 2015Document10 pagesVenture Capital Funding, Fourth Quarter 2015BayAreaNewsGroupPas encore d'évaluation

- Sparkline Venture CapitalDocument17 pagesSparkline Venture CapitallycancapitalPas encore d'évaluation

- Wharton Resume Advice Private Equity Venture CapitalDocument2 pagesWharton Resume Advice Private Equity Venture CapitalpersianoPas encore d'évaluation

- Ai - AuDocument42 pagesAi - AuPanache ZPas encore d'évaluation

- Indian Unicorns With Chinese InvestorsDocument1 pageIndian Unicorns With Chinese InvestorsThe WirePas encore d'évaluation

- EMPEA Emerging Markets Mezzanine Report May 2014 WEBDocument32 pagesEMPEA Emerging Markets Mezzanine Report May 2014 WEBJurgenPas encore d'évaluation

- Private Equity, FOF OperatorsDocument5 pagesPrivate Equity, FOF Operatorspeplayer1Pas encore d'évaluation

- Sequoia Capital India FinalDocument14 pagesSequoia Capital India FinalPallavi TirlotkarPas encore d'évaluation

- If I Would Like To Protect My Downside, How Would I Structure The Investment?Document7 pagesIf I Would Like To Protect My Downside, How Would I Structure The Investment?helloPas encore d'évaluation

- A91 Partners JDDocument2 pagesA91 Partners JDJohn DoePas encore d'évaluation

- Investment Managers ListDocument4 pagesInvestment Managers ListKnightspagePas encore d'évaluation

- Investment Process at VC FirmsDocument60 pagesInvestment Process at VC FirmsEvgeniy Shlieffier100% (1)

- Guide To Venture Capital 2011Document35 pagesGuide To Venture Capital 2011graceenggint8799Pas encore d'évaluation

- Venture ListsDocument8 pagesVenture ListsRavi Singh BishtPas encore d'évaluation

- Private Equity Funds Case StudyDocument13 pagesPrivate Equity Funds Case StudyJaimin VasaniPas encore d'évaluation

- Venture Investing After The Bubble: A Decade of EvolutionDocument10 pagesVenture Investing After The Bubble: A Decade of Evolutionsweber7079Pas encore d'évaluation

- 47 Most Active Venture Capital Firms in India For StartupsDocument21 pages47 Most Active Venture Capital Firms in India For StartupsfinvistaPas encore d'évaluation

- Venture Capital Directory of Silicon Valley Venture Capital FirmsDocument10 pagesVenture Capital Directory of Silicon Valley Venture Capital FirmsSnr Owusu Achiaw KwasiPas encore d'évaluation

- A Study On Private Equity in IndiaDocument21 pagesA Study On Private Equity in IndiaPrabakar NatrajPas encore d'évaluation

- PitchBook 2H 2014 VC Valuations and Trends ReportDocument16 pagesPitchBook 2H 2014 VC Valuations and Trends ReportsunnypankajPas encore d'évaluation

- Venture Capital Example in IndiaDocument21 pagesVenture Capital Example in Indiakool ashish100% (2)

- Handbook & Directory On Venture Capital in India - Venture IntelligenceDocument81 pagesHandbook & Directory On Venture Capital in India - Venture IntelligencePri BPas encore d'évaluation

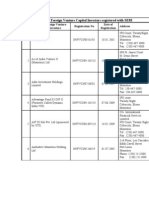

- A-List of Foreign Venture Capital Investors Registered With SEBIDocument24 pagesA-List of Foreign Venture Capital Investors Registered With SEBIVipul ParekhPas encore d'évaluation

- Zodius Capital II Fund Launch 070414Document2 pagesZodius Capital II Fund Launch 070414avendusPas encore d'évaluation

- Venture Capital in IndiaDocument14 pagesVenture Capital in IndiaRemy HerbiePas encore d'évaluation

- Brazil Guide To Venture Capital and Private Equity Term SheetsDocument48 pagesBrazil Guide To Venture Capital and Private Equity Term Sheetsinttraveler1Pas encore d'évaluation

- Private Credit Solutions:: A Closer Look at The Opportunity in Emerging MarketsDocument48 pagesPrivate Credit Solutions:: A Closer Look at The Opportunity in Emerging MarketsAljon Del Rosario100% (1)

- 1 Sequoia Capital Pitch Deck From Info Presented atDocument10 pages1 Sequoia Capital Pitch Deck From Info Presented atGaurav PantPas encore d'évaluation

- Funding SaaS StartupsDocument2 pagesFunding SaaS StartupsRoshan D'SilvaPas encore d'évaluation

- Ecommerce & Marketplace VC Panels & Pitches HandoutDocument6 pagesEcommerce & Marketplace VC Panels & Pitches HandoutAndrew BottPas encore d'évaluation

- Venture Capital Mena ReportDocument50 pagesVenture Capital Mena ReportBala SubramanianPas encore d'évaluation

- Venture Capital - MithileshDocument88 pagesVenture Capital - MithileshTejas BamanePas encore d'évaluation

- IAVC - Venture Capital Training PDFDocument77 pagesIAVC - Venture Capital Training PDFvikasPas encore d'évaluation

- Venture Capital AssignmentDocument10 pagesVenture Capital Assignmentraveena_jethaniPas encore d'évaluation

- Sri Gowri Degree & P.G College: State Bank of IndiaDocument77 pagesSri Gowri Degree & P.G College: State Bank of IndiaRaghavendra LovePas encore d'évaluation

- Blowing Up The Venture Capital ModelDocument11 pagesBlowing Up The Venture Capital ModelAbhinav AgrawalPas encore d'évaluation

- Private EquityDocument26 pagesPrivate EquityinaPas encore d'évaluation

- Getting A Job in VCDocument9 pagesGetting A Job in VCKristie GanPas encore d'évaluation

- Venture Capital FundingDocument20 pagesVenture Capital FundingSanchit TaksaliPas encore d'évaluation

- NRI BankingDocument33 pagesNRI BankingKrinal Shah0% (1)

- Nri BankingDocument48 pagesNri BankingKrinal Shah100% (1)

- Online Trading: A Project Report OnDocument64 pagesOnline Trading: A Project Report OnKrinal ShahPas encore d'évaluation

- Sun-Ranbaxy Investor PresentationDocument20 pagesSun-Ranbaxy Investor PresentationKrinal ShahPas encore d'évaluation

- Business Responsibility Report 2012-13Document9 pagesBusiness Responsibility Report 2012-13Krinal ShahPas encore d'évaluation

- Black Book Samsung FinalDocument69 pagesBlack Book Samsung FinalKrinal Shah60% (15)

- Money Market PPTZZZZDocument18 pagesMoney Market PPTZZZZKrinal ShahPas encore d'évaluation

- BSBFIM601 Manage FinancesDocument5 pagesBSBFIM601 Manage FinancesCindy Huang0% (2)

- PREPA Revenue Bonds Series BBBDocument188 pagesPREPA Revenue Bonds Series BBBMarisol SantiagoPas encore d'évaluation

- Answers For Tutorial Chapter 4Document8 pagesAnswers For Tutorial Chapter 4AdilahPas encore d'évaluation

- Law of Agency CasesDocument10 pagesLaw of Agency CasesAndrew Lawrie75% (4)

- CH 16Document28 pagesCH 16Michelle LindsayPas encore d'évaluation