Académique Documents

Professionnel Documents

Culture Documents

Banking

Transféré par

Sunny IslamDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Banking

Transféré par

Sunny IslamDroits d'auteur :

Formats disponibles

BANKING

Alternative Banking

Channels

By Adi Kohali and Adi Sheleg

Weighing up the options

Recent economic turmoil and

increasing market complexity has

placed unprecedented pressure on

financial institutions. The demand for

a digital lifestyle and the

technological revolution it brings to

homes and the workplace, coupled

with a sig-nificant demographic shift

and a new regulatory framework, are

subjecting the finance sector to a host

of new challenges in a time of severe

market uncertainty. However, it is in

times such as these that opportunities

arise for companies to step outside

their comfort zones, fueling innovation

on the financial services landscape.

In an attempt to optimize services and

minimize costs, banks are frequently

migrating towards a 24-7 service and

customers are enjoying the

28 Tefen Tribune | Spring Issue, 2011

greater sense of freedom that this

creates. Avail-ability is the name of

the game as we demand instant

access to loans, deposits and our

ac-count status.

So what is the next step? In a bid

to drive

even greater differentiation from

the competition, financial services

institutes are now exploring

alternative banking channels,

including the inter-net, telebanking,

self-service halls, cell-phone and

fax banking.

interface with customized shortcuts to

reflect individual user requirements.

Telebanking: the first call center

Despite this trend, the call for

branch services still remains

significant although, as we will see,

the type of service demanded there

has changed considerably.

Evolving technology

The world banking sector has been

revolution-ized over the past 30 to

40 years by an on-slaught of new

technologies and a widespread

change in the regulations

governing the use of this

technology.

As a result, many banks have started

adapting their distribution channels

and shifting from fron-tal personal

service to direct sales and marketing

via phone, email or electronic

transactions. The general

understanding is that this creates

value both for the organization and

its clients.

was launched in 1983 in the U.S.

by MCI. This marked a shift by

many organizations towards

centralized customer service

centers, often with an automatic

reply service (IVR) incorporating

voice recognition systems.

However, despite these efforts

away from personal interaction, the

majority of call center activities still

involve human representatives,

particularly when dealing with

transactions.

Online banking: another channel

to emerge in the 1990s but one which

still showed low pen-etration by the

end of the decade. Initially used to

present an institutes marketing

platform, the

BANKING

Development of main channels:

ATM: During the 1990s, the

number of ac-tive units in Europe

rose by a staggering 50%. Originally

only used to withdraw cash, the ATM

has evolved to support a wide variety

of services, including deposits and

account details. To coun-teract the

impersonal impression of the socalled hole in the wall, the Spanish

bank BBVA has developed its future

ATM, an innovative touch screen

websites are now enjoying a new

lease of life as a door to the world

of 24-hour online transactions.

Some countries even prefer the

instant access to online account

information and transactions to that

offered by traditional banking, as

confirmed in a survey conducted at

the end of 2009 by the American

Bankers Association (ABA).

Mobile banking: this channel is

relatively new but is already

showing steady growth. Used in its

early stages as a push/pull tool for

information text messages, cell

phone banking now sup-ports

personal account access and is

forecasted to become the new

mobile payment method or digital

wallet of the future.

Tefen Tribune | Spring Issue, 2011

29

BANKING

Social media: recent years have

seen social media creeping up

alongside cell phone banking. Banks

feel the need to counteract the

impersonal-ity of our digital age by

offering customers greater contact on

a perceived one-to-one level.

Although most social media

platforms still rely heavily on

marketing content, the trend is firmly

set towards development of more

interactive services.

On September 2010, the New

Zeeland bank ASB opened its first

virtual branch on Facebook. This

offers personal banking-related

advice from 10 am to 6 pm, MondayFriday but does not support actual

transactions. While the options on

this channel are still limited, this is

indeed the first step towards utilizing

a high potential and increasingly

popular platform.

Segmentation

Strategy

The strategy-defining process can be

broken down into three stages:

segmentation, channel-ing and

service matrix. The challenge is to

find out which customer groups the

organization wishes to address and

through which channels and services

it aims to accomplish this.

Defining the right channel

strategy

When considering alternative

channels, custom-ers generally fall

into four main groups: those who

prefer human interaction; those

who are open to new channels;

those who are unsure and

therefore undecided and those

who have differing preferences,

depending on the individual

services in question.

Before a company adds alternative

channels to its overall portfolio, it is

essential that it defines a common

channel strategy to avoid conflicts or

confusion when dealing with the

customer.

This channel strategy must support

the banks corporate strategy and

create value for both the organization

and the customer. Furthermore, since

banking services are generally similar

be-tween the institutions, the strategy

must ensure that each channel is

intelligently positioned to optimize its

contribution to the banks differentiation from the competition.

The second group is generally made

up of younger, wealthier and highly

educated clients, who have less time

to visit a branch (a situa-tion often

exasperated by a lack of branches in

their vicinity) and who feel at home

with the new technologies used in

the alternative channels. The

anywhere, anytime availability and

acces-sibility of alternative channels,

coupled with the time saving and

lower costs involved, makes life

easier for them and therefore

increases their customer loyalty.

The customers from the other three

groups tend to focus on the risks

posed by the alternative channels

and therefore need to be reassured

by

30 Tefen Tribune | Spring Issue, 2011

It is important that the bank

addresses each group of customers

with the channels they require and

then actively sell these alternatives to

those customers. This process is

made easier if the organization

already has a good reputa-tion for

handling its various channels and is

well trusted by its customers. The

technology employed should also be

perceived as reliable and simple to

use. Indeed, customer perception of

the channel is a key success factor.

the banks before they will feel happy

using these channels. The

complexity of some services and the

technology used make them worried

about possible mistakes and the

problems these may cause. This is

where the banks need to emphasize the security safety net behind

such transac-tions and the

continued availability of human

interaction when necessary.

BANKING

Channeling

tomers attribute to it, the greater their

reserva-tions will be and the more

likely they are to prefer human

interaction and a personal meeting

with a consultant. It is one thing to

view your investment status online

and quite another thing to enter into

a perceived high-risk, long-term

commit-ment without professional

Before a channel is added to the

portfolio, its po-tential must be

measured. Despite the expecta-tion

of banks that alternative channels will

reduce costs and generate additional

income, the high investment costs

and fixed running costs of

establishing new channels are not

guaranteed

advice and support. Services such as

mortgages or life insurance therefore

tend to remain a branch activity or at

least one requiring some form of

greater human interaction.

Once the strategy is in place and

we know which percent of our

activities are to be directed at individual channels, customers and

services, we can move on to

designing the operational process

used to realize our vision.

Operational design

to have a positive effect on the

bottom line, although the cost of

individual transactions may be lower.

This must be taken into account

when selecting channels and

weighed up against labor cost

savings due to reduced branch

activity at rush hours. Banks should

also investigate how to lever

synergies between the channels.

Service matrix

Once the customer segmentation

and channeling procedures have

been completed, the individual

services to be provided by different

channels can be defined. Some

services lend themselves eas-ily to

alternative channels. For example,

custom-ers seem to have few qualms

about ordering a credit card or a

short-term loan online or even about

renewing already established

insurance policies. However, the

more complex a service is and the

more importance, risk or cost that

cus-

Tefen Tribune | Spring Issue, 2011

31

It is now time to translate the strategy

into an organizational structure which

reflects the individual roles,

responsibilities and interfaces

involved in an operational concept.

The volume of business for each

channel needs to be fore-casted,

the required investment planned

and the resources made available.

The overall benefits to be achieved

also form a key part of the planning

stage. When all this is in place, a

test run with a pilot scheme will

prove whether the concept is

watertight.

Realization

Once the roadmap is in place,

actual implemen-tation can begin.

Some of the practical steps this

involves include:

BANKING

A detailed plan of action with individual

activities

Training & guidance to support these

activities

they are given at a branch.

However, the form and

function of physical

branches will need to

change over time if they are

to remain economi-cally

viable.

So how do we reduce branch

costs without losing the

proximity to the customer?

Blanket closures are not the

answer. One solution could

be the development of socalled dedicated branches.

These focus on a small range

of core services targeted at a

specific customer segment

and provided by a minimum

of staff.

KPIs to track progress and highlight the

benefits achieved

Change management Support management

Subsequent fine tuning of activities.

However, it is important not to make the

mistake of assuming that the specific

channel portfolio which has been

implemented is a rigid structure which will

remain valid permanently. Banking

institutions must continue to closely monitor

market developments and regularly review

their range of services and channels to

ensure that they keep pace with new trends

and still provide for all customer needs.

Balancing offline and online

So we have seen that, although the

convenience factor of online transactions

boosts the activity volume of those

channels, consumers still greatly value the

service experience and the reassurance

The key to success

therefore seems to be correctly balancing the access

and availability of online

channels with the personal

service and ad-vice of the

offline choice. The

overriding mission will

always be to achieve high

satisfaction levels in the

customer base.

Adi Kohali, Associate Partner, Tefen

Israel Adi Sheleg, Senior Consultant,

Tefen Israel

32 Tefen Tribune | Spring Issue, 2011

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Affidavit of SeparationDocument1 pageAffidavit of SeparationRaysunArellano100% (9)

- Docu69346 Unity Hybrid and Unity All Flash Configuring Converged Network Adaptor PortsDocument11 pagesDocu69346 Unity Hybrid and Unity All Flash Configuring Converged Network Adaptor PortsAmir Majzoub GhadiriPas encore d'évaluation

- Metsec Steel Framing SystemDocument46 pagesMetsec Steel Framing Systemleonil7Pas encore d'évaluation

- Mass Effect 1 WalkthroughDocument143 pagesMass Effect 1 Walkthroughandyt10Pas encore d'évaluation

- Soal Dan Pembahasan Grammar Lat TOEP 1Document6 pagesSoal Dan Pembahasan Grammar Lat TOEP 1Abdur100% (2)

- Assignment # (02) : Abasyn University Peshawar Department of Computer ScienceDocument4 pagesAssignment # (02) : Abasyn University Peshawar Department of Computer ScienceAndroid 360Pas encore d'évaluation

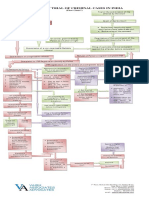

- Process of Trial of Criminal Cases in India (Flow Chart)Document1 pageProcess of Trial of Criminal Cases in India (Flow Chart)Arun Hiro100% (1)

- Jee Mathmatic PaperDocument16 pagesJee Mathmatic PaperDeepesh KumarPas encore d'évaluation

- Investment ChecklistDocument3 pagesInvestment ChecklistArpan chakrabortyPas encore d'évaluation

- Making A Spiritual ConfessionDocument2 pagesMaking A Spiritual ConfessionJoselito FernandezPas encore d'évaluation

- Sara Lee: A Tale of Another Turnaround: Case Analysis - Strategic ManagementDocument6 pagesSara Lee: A Tale of Another Turnaround: Case Analysis - Strategic ManagementKeerthi PurushothamanPas encore d'évaluation

- Huawei Videoconferencing MCU VP9600 Series Data SheetDocument2 pagesHuawei Videoconferencing MCU VP9600 Series Data SheetIsaac PiresPas encore d'évaluation

- The Funny AlphabetDocument12 pagesThe Funny Alphabetmarianne_giulianoPas encore d'évaluation

- Nclex PogiDocument8 pagesNclex Pogijackyd5Pas encore d'évaluation

- 9701 w19 QP 21 PDFDocument12 pages9701 w19 QP 21 PDFFaiza KhalidPas encore d'évaluation

- Righeimer ComplaintDocument45 pagesRigheimer ComplaintSarah BatchaPas encore d'évaluation

- Preparatory Surface Cleaning of Architectural Sandstone: Standard Practice ForDocument2 pagesPreparatory Surface Cleaning of Architectural Sandstone: Standard Practice Fors.swamyPas encore d'évaluation

- 77-105 Victoria Road, Landscape PlansDocument2 pages77-105 Victoria Road, Landscape PlansAndrew CostiPas encore d'évaluation

- Kanne Gerber Et Al Vineland 2010Document12 pagesKanne Gerber Et Al Vineland 2010Gh8jfyjnPas encore d'évaluation

- Swift Case Study Mapping A Path To Iso 20022 With Swift Translator Jan2022Document3 pagesSwift Case Study Mapping A Path To Iso 20022 With Swift Translator Jan2022Bolaji EsanPas encore d'évaluation

- แบบฝึกหัด subjuctiveDocument6 pagesแบบฝึกหัด subjuctiveรัฐพล ทองแตงPas encore d'évaluation

- OMCDocument37 pagesOMCyurie_ameliaPas encore d'évaluation

- Clarifications IntraDocument2 pagesClarifications Intrapm278Pas encore d'évaluation

- ECAT STD 2 Sample Question PaperDocument7 pagesECAT STD 2 Sample Question PaperVinay Jindal0% (1)

- Filed: Patrick FisherDocument12 pagesFiled: Patrick FisherScribd Government DocsPas encore d'évaluation

- Owners Manual Goodman GPC GPHDocument49 pagesOwners Manual Goodman GPC GPHJuan José SanchezPas encore d'évaluation

- Natural Resources of Arunachal PradeshDocument7 pagesNatural Resources of Arunachal PradeshshivarathordiviyapurPas encore d'évaluation

- Dragon Is The Fifth in The 12Document3 pagesDragon Is The Fifth in The 12Waylon CahiligPas encore d'évaluation

- Csa Case Scenario Stressed GP 2020Document5 pagesCsa Case Scenario Stressed GP 2020pgzhxqscjxciejmpfPas encore d'évaluation

- 2020 DepEd English Proficiency Test (EPT) Reviewer - TeacherPHDocument205 pages2020 DepEd English Proficiency Test (EPT) Reviewer - TeacherPHAlron GAmboa100% (1)