Académique Documents

Professionnel Documents

Culture Documents

Presentazione Dei Dati Di Bilancio 2009 Del Gruppo Fiat

Transféré par

Vittorio PasterisDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Presentazione Dei Dati Di Bilancio 2009 Del Gruppo Fiat

Transféré par

Vittorio PasterisDroits d'auteur :

Formats disponibles

Older, Wiser and Ready to Re-engage

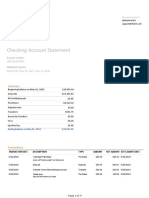

Q4 & FY ‘09 Results Review

January 25, 2010 Q4 & FY ‘09 Results Review 1

FY '09 highlights

Ahead of guidance results...

Group revenues at €50.1bn, down ~16% over record 2008 with steep declines in demand

experienced by all businesses in H1 (-23.8% Y-o-Y), substantially reduced in H2 (-6.6% Y-o-Y)

Automobiles at €28.4bn: flat unit sales at FGA yielding €26.3bn, recording highest Q4 ever

CNH at €10.1bn, down 21% on most severe decline on record in CE industry and tough comps vs. record high

2008 AG market

Iveco at €7.2bn, down 34% on a 46% decline in deliveries, especially in Europe & Heavy segment

Trading profit at €1.1bn (2.1% margin) with sequential quarter-by-quarter improvements in

trading margin primarily on the back of realignment of production levels & aggressive cost

containment

Automobiles at €719mn: FGA at €470mn in a notable mixed performance between passenger car & LCV

markets, especially WE; Ferrari at €238mn; Maserati positive despite 46% revenue shortfall

CNH at €337mn: rigorous cost containment and positive pricing partially offset revenue gap resulting from

drastic volume decline in CE and continued de-stocking for both AG & CE equipment

Iveco at €105mn: decisive cost reduction measures yielded positive trading result and margin increased

quarter-by-quarter

Net loss of €0.8bn, including unusuals of €0.6bn

Cash flow generation of €1.5bn driving drop in net industrial debt to €4.4bn, well below FY target

Realignment of production levels including significant de-stocking actions across all businesses and disciplined

management of Capex

January 25, 2010 Q4 & FY ‘09 Results Review 2

FY '09 highlights (cont’d)

...reinforced liquidity, positive outlook for 2010

Liquidity at €12.4bn, 3x higher than 2008 year-end level

Guaranteeing adequate resources to cover contractual maturities well beyond 2011 and significant financial

flexibility

Re-accessed European and US capital markets in H2, raising nearly €5bn through 4 highly successful bond

issues

Taking advantage of progressive restoration of ABS market in NA

Continuing to strengthen Group’s international identity, emerging stronger through a difficult year

Global strategic alliance with newly-formed Chrysler Group LLC

Framework agreement for production of cars and engines in China with GAC Group

Agreement with Kamaz to develop industrial & commercial alliance in AG&CE for Russian market

Cumulative dividends of €237mn proposed across all 3 classes of shares

2010 OUTLOOK

Top line growth of 3-6% in 2010, with trading profit of €1.5bn and net debt levels below €5bn

mark

Non renewal of eco-incentives scheme in WE to impact trading profit by €350 to €400 mn

January 25, 2010 Q4 & FY ‘09 Results Review 3

FY '09

Revenues and trading result by business

Revenues 10,327

(€mn)

(25.1)%

50,102 Automobiles

7,183 (5,866)

10,107 (34.1)% • FGA: cost containment measures and volume recovery in H2

28,351 (20.9)% partially compensating for drop in demand in H1 and less

FY’09 H2’09 H1’09 (15.9)% favorable product mix

FGA 26,293 11.8% -14.3%

(3.5)% Maserati 448 -48.0% -43.2% • Ferrari: efficiency gains partly offsetting lower volumes,

Ferrari 1,778 -6.8% -8.0% unfavorable product mix & currency movements

• Maserati: realignment of production levels and rigorous cost

Automobiles CNH Iveco Components Eliminations FY'09

& Others containment measures partly offsetting significant decline in

9.3

volumes

% chg H2

vs. ‘08 H1 H1 H2 H1 H2 H1 H2 H1 H2

(14.5)

(17.4)

(11)

(6.6)

CNH

(19.1)

(24.7) (23.8)

• Tight grip on cost and positive pricing partially offset decline in

(36.4)

(45.9)

both AG & CE volumes attributable to market conditions

Trading

result

105

1,058 Iveco

337 (87.5)%

(40)

(€mn)

(63) • Latin America, special vehicles business (seasonally stronger in

(70.0)%

719 latter part of year) and after-sales activities, continued to provide

margin support, in addition to realignment of production levels

FY’09 H2’09 H1’09 (68.5)% and rigorous cost containment measures to counter steep volume

FGA 470 35.3% -71.3%

(34.8)% Maserati 11 -88.0% -77.3%

decline

Ferrari 238 -34.9% -24.4%

Components

Automobiles CNH Iveco Components Eliminations FY'09

& Others • FPT: significant efficiency gains in overheads, manufacturing &

% chg

vs. ‘08 H1 (3.1) H1 H2 H1 H2 n.a. (5.8) H1 H2

purchasing partially offsetting sharp drop in I&M volumes and

unfavorable sales mix

(59.2)

(45.7)

• Magneti Marelli: reductions in overheads, increased production

(71.2)

(68.6) (73.1) and purchasing efficiencies contained impact of lower revenues

(86.2)

(98.7)

January 25, 2010 Q4 & FY ‘09 Results Review 4

Q4 & FY ‘09

From trading to net result

(€mn) Q4 FY

'09 '08 ∆ '09 '08 ∆

Trading profit 488 663 -175 1,058 3,362 -2,304

Unusual items, net (425) (407) -18 (699) (390) -309

Operating income 63 256 -193 359 2,972 -2,613

Financial charges, net (218) (345) +127 (753) (947) +194

Investment income, net 36 10 +26 27 162 -135

Pre-tax result (119) (79) -40 (367) 2,187 -2,554

Taxes (164) 259 -423 (481) (466) -15

Net result (283) 180 -463 (848) 1,721 -2,569

January 25, 2010 Q4 & FY ‘09 Results Review 5

Breakdown of unusual items

FY ‘09

(€mn)

Other

Fixed assets

Restructuring provisions, Total

write-downs

net

(312) (135) (252) (699)

Automobiles (54) (104) (88) (246)

CNH (87) - 1 (86)

Iveco (22) - (173) (195)

Others (149) (31) 8 (172)

of which c ash impact '09 (93) - (183) (276)

of which c ash impact '10 (160) - (98) (258)

of which c ash later years (32) - - (32)

Tax effects on unusual items of ~€120mn

January 25, 2010 Q4 & FY ‘09 Results Review 6

Financial charges breakdown

FY ‘09 vs. ‘08

Average Net Charges (€mn)

Rate/Spread

Outstanding

(%)

(€bn) 2008 2009 Chg

Net Industrial Debt 2009 (5.6) 5.5% (308)

(152)

Net Industrial Debt 2008 (2.4) 6.5% (156)

“Cost of Carry” 2009 (5.9) 3.5% (207)

(137)

“Cost of Carry” 2008 (3.5) 2.0% (70)

Equity Swap (hedging stock option plans) (263) 117 +380

IAS 19 (interest cost on pension & OPEB) (155) (160) (5)

Indirect taxes on banking transactions (30) (27) +3

(South America)

Others

(fees, FX, interest cost on long-term provisions, discount of (273) (168) +105

certain receivables...)

NET FINANCIAL CHARGES (947) (753) +194

January 25, 2010 Q4 & FY ‘09 Results Review 7

Q4 & FY ‘09 Cash Flow

Well exceeding year-end target

(€mn)

Q4 '09 FY '08 FY '09

(5,832) Net Industrial (Debt)/Cash beginning of period 355 (5,949)

Strong cash

generation in a

(283) Net Income 1,721 (848) difficult year

607 D&A (excl. Vehicle Buybacks) 2,802 2,667 Performance

588 Change in Funds & Others (769) 118 driven by working

capital (partial

912 Cash Flow from Op. Activities bef. Chg. in W.C. 3,754 1,937 reversal of 2008

absorption)

1,700 Change in W orking Capital (3,604) 2,564

Particularly strong

2,612 Cash Flow from Operating Activities 150 4,501 contribution from

(1,235) Tangible & Intangible Capex (excl. Vehicle Buybacks) (4,973) (3,382) inventories with a

€2.9bn reduction

1,377 Cash Flow from Operating Activities net of Capex (4,823) 1,119 (€1bn in Q4)

46 Change in Investments, Scope & Other (942) 525 Disciplined Capex

1,423 Net Industrial Cash Flow (5,765) 1,644 management at

below €3.4bn

- Capital Increase / Share Repurchases / Dividends (770) (20)

Reflecting low

(9) FX Translation Effect 231 (93) market demand

and postponement

1,414 Change in Net Industrial Debt (6,304) 1,531 of certain projects

(4,418) Net Industrial (Debt)/Cash end of period (5,949) (4,418)

January 25, 2010 Q4 & FY ‘09 Results Review 8

2009 operational highlights & industry forecast

1. Demand conditions

2. Input cost

3. Cost structure & manufacturing capacity

January 25, 2010 Q4 & FY ‘09 Results Review 9

1.1 Industry outlook & sales volume

Fiat Group Automobiles

Q4 ‘09

FY ‘09 FY ‘10E Strong finish (+23.2%) for passenger car registrations,

(change vs. prior

year)

(change vs. prior year) outperforming WE market

WE 0.5% (12)% / (16)%* Share gain (0.6 p.p.) in a record quarter for overall Brazilian

EE (26.6)% Flat market

ITA (0.2)% (5)% / (20)%* Robust order intake

Passenger cars

BRA 12.6% 2-3% FY ‘09

WE (27.4)% (5)% / (7)%*

Western Europe

EE (50.7)% Flat

Passenger cars: consistent quarterly share gains year-over-

ITA (21.4)% Flat / (10)%* year since 2005 with share up 0.6 p.p. (2.2 p.p. in 4 years) to

LCVs BRA 12.3% 2-3% 8.8% driven by gains in Italy (+0.9 p.p.), Germany (+1.5

p.p.), France (+0.1 p.p.) & UK (+0.6 p.p.)

LCVs: share gain (+0.3 p.p.) in a steeply declining market

All brands up both in WE & EU27

Highest share in WE since 2001 for Fiat (at 7.1%) and Lancia

2,151 2,100 / 1,930* (at 0.9%)

Alfa share up 0.1 p.p. at 0.8%, awaiting Giulietta in H1 ‘10

653 Italy

Brazil: a sales record in its 33rd year; leadership maintained

Passenger cars

1,085

WE ex-Italy with a 24.5% share in an overall booming market, topping

432 healthy 2008 level

LA

RoW FY ‘10 expectations

675 WE+EE

LCVs

Passenger cars: market decline expected to be ~12% mainly

84

driven by Germany. Non renewal of eco-incentives schemes to

307 Unit Sales (x000) decrease demand for an additional 4%

2009 2010E LCVs: market flat or slightly down, targeting share increase

driven by new products

* in absence of incentives scheme renewal in Italy Brazil: growth in line with market increase

January 25, 2010 Q4 & FY ‘09 Results Review 10

1.2 Succeeding in an uneven 2009 WE market

Fiat Group Automobiles

Structural shift moving market towards lower

Main benefits

segments with incentives accelerating process

Up to 10% increase in max power

Coherent product portfolio and effective life-cycle

management Up to 15% increase in low-rpm torque

Panda: breaking record year-over-year since launch in 2003 Up to 10% reduction in fuel

(~310k FY registrations) consumption and CO2 emissions (up to

25% in combination with turbo-

500: 190k FY registrations charging & downsizing)

Punto family: increased penetration to 8.1% (+0.3 p.p.) in B- Lower noxious emissions (CO/HC/NOx)

Segment also thanks to Punto Evo (85k orders at year-end), 1.4 Fire MultiAir turbo – Euro 5

broadening spectrum to include high-end customers Improved driveability 1st application on

Alfa Romeo MiTo (Sep ‘09)

MiTo driving Alfa brand registrations up 8% vs. last year

A wide array of environmentally-friendly product

offerings

Expanded offering of leading-edge engines with introduction in Main benefits

both gas (MultiAir) & diesel (MultiJet II)

Digital injection rate shaping bringing

~60% of FGA’s registrations ≤130 CO2 g/km (>50% for ≤120

CO2 g/km) in ‘09 in Europe CO2 emissions up to 3% lower

Fiat brand offering widest range of CNG & LPG powered NOx emissions up to 20% lower

vehicles in market (200k FY registrations) Greater accuracy in fuel injection

LPG available on key products of Lancia quantity control

1.3 MultiJet II – Euro 5 Noise and driveability improvement

After 2 years of leadership, lowest level of CO2 emissions in 1st application on

EU with Fiat brand ranked #1 again in Sep ‘09 Fiat Punto Evo (Oct ‘09)

Healthier and strengthened dealer network supporting

market penetration

~290 new dealer appointments after completion last year of Main benefits

network gap closure plan

Up to 20-25% CO2 emissions reduction

Lean organization and prompt decision-making compared to equivalent gas engine

enabled rapid response to take full advantage of Very low noxious emissions (NMHC…)

emerging opportunities

January 25, 2010 Q4 & FY ‘09 Results Review 11

1.3 Inventory trend by quarter

Fiat Group Automobiles

Total inventory

reduction of 63k

units or ~20%

compared to 2008

year end

Healthy months-of-

supply ratio both for

dealer and company

inventory

2008 2009

Months of Supply (as per average of latest 3 months)

Company Inventory

Dealer Inventory

January 25, 2010 Q4 & FY ‘09 Results Review 12

1.4 Industry outlook & sales volume

CNH Agricultural Equipment

FY ‘09

Global industry down 7% (down 10% in quarter,

decline slowed from Q3 ‘09)

NA: increasing strength in 4WD tractor markets where

FY ‘09 FY ‘10E CNH is strong

Industry CNH Industry WE: market demand still hindered by weak commodity

(change vs. (performance (change vs. prices and general economic outlook

prior year) relative to mkt) prior year)

LA: Brazilian market up, other countries down against

WW (7)% (5-10)% high comparisons vs. 2008

NA (21)% (5-10)% RoW: tractor industry up in Asian markets where CNH

has limited presence, dropped in African and CIS

<40hp (20)% (5-10)%

Tractors markets where CNH is strong; combine market

40+hp (22)% ~(10)% collapsed in CIS states where CNH is top player

WE (14)% (10-15)% CNH market share

LA (17)% ~5% Share gains in NA 40+hp tractor market with flat

share everywhere else except RoW where market

RoW 8% ~(5)%

share eroded as demand in fast growing markets

WW (19)% (5-10)% mainly satisfied by local, low-range products

NA 15% (10-15)% Combine share gains in LA offset by declines in NA

WE

where CNH dropped share despite strong performance

Combines (12)% (15-20)%

on higher-end products

LA (36)% 5-10%

FY ‘10 expectations

RoW (45)% ~(10)%

Global market demand decline

NA softening as industry passes peak farm income

WE remains slow on economy concerns

LA strong on high commodity prices

January 25, 2010 Q4 & FY ‘09 Results Review 13

1.5 Industry outlook & sales volume

CNH Construction Equipment

FY ‘09

FY ‘09 FY ‘10E

Decline 38% in all regions

Industry CNH Industry Overall industry down only 4% in quarter as market

(change vs. (performance (change vs.

prior year) relative to mkt) prior year) decline slows

WW (45)% 0-5% Market share up in LA for both Light & Heavy

NA (49)% (0-5)%

equipment and stable in NA

Light RoW: strongest growth in markets where CNH has

WE (49)% Flat

limited presence

LA (54)% 15-20%

Highly competitive environment based on

RoW (36)% ~10%

aggressive de-stocking actions drove down market

WW (30)% 5-10% share in WE

NA (47)% (0-5)%

WE (56)% Flat

Heavy

FY ‘10 expectations

LA (56)% 20-25%

Construction activity in LA & RoW regions should

RoW (14)% ~10%

lead to moderate global industry growth

Worldwide industry demand for Light & Heavy

Equipment up 5–10% as industry rebalances and

renews fleet levels in market

January 25, 2010 Q4 & FY ‘09 Results Review 14

1.6 Leveraging strengths in diverse markets

CNH (AG & CE Equipment)

Managing better pricing as AG products Deployment of Case IH CVT

drive profit

Magnum 180,190,210,225

Leverage higher-end products to increase pricing

Improved efficiency and performance

in easing markets

Core strength in AG products New Holland T7000 Tractor Series; most

NA combines awarded line of tractors in 13-year history of

this award

Tractors 100+hp

2007 Agritechnica -- T7060 Power Command

“Tractor of the Year”

Manage slowdown in CE with tight

inventory control “Golden Tractor for Design” for 2008

2009 Agritechnica -- T7070 Auto Command

Inventories reduced to low levels

“Tractor of the Year”

Focus on Parts & Service to support dealers and

customers “Golden Tractor for Design” for 2010

Deliver superior performance on Parts &

Service

2 new environmentally-efficient parts centers

opened using latest in RF radio tracking

technology

Shortened order-to-delivery & service times

January 25, 2010 Q4 & FY ‘09 Results Review 15

1.7 Inventory trend by quarter

CNH (AG & CE Equipment)

FY production levels 12% below retail FY underproduction at targeted levels

sales; production expected to (under-produced retail sales by 51%),

return to more normal pattern 2010 still to be characterized by tight

inventory control

January 25, 2010 Q4 & FY ‘09 Results Review 16

1.8 Industry outlook & sales volume

Iveco (Trucks)

FY ‘09

Industry: poor WW Truck & Commercial Vehicle

market conditions with significant drop in all

segments and most regions, especially Europe

WE: Light (-32%); Medium (-33%); Heavy (-44%)

EE (-55%) & LA (-12%)

Light Medium Heavy Iveco: overall share in ≥2.8T WE market down 0.7

p.p. vs. last year heavily impacted by unfavorable

market mix for Heavy, with improved performance

in all segments in latter part of year

De-stocking for new and used vehicles mostly

completed. Disciplined price management

Industry (≥2.8T)

(change vs. prior year)

FY ‘09 FY ‘10E FY ‘10 expectations

WE (34.5)% Flat / 5%

Industry: H1 ‘10 substantially flat in line with H2 ‘09

with signs of recovery expected in H2 ‘10

EE (54.5)% Flat Iveco: Trucks and CV sales targeted to grow faster

than market registrations

LA (12.1)% ~5%

January 25, 2010 Q4 & FY ‘09 Results Review 17

1.9 Consolidated presence in China

Iveco (Trucks)

Iveco trucks unit sales by region (including JVs) A single, strong partner

Strategy for trucks with SAIC

Competitive advantage over peers

First-mover advantage

Up-to-date manufacturing systems

Fully localized range, including engines

Iveco strategy

Serving domestic market

Exporting to international markets

Leveraging supplier base for global

sourcing

Iveco JV sales in China Full market coverage

107k Light, Medium & Heavy range

92k

China Truck Of

The Year 2009

award

18k

2005 2008 2009

January 25, 2010 Q4 & FY ‘09 Results Review 18

1.10 Inventory trend by quarter

Iveco (Trucks)

WE+EE Trucks & Commercial Vehicles

Overall dealer & company

inventory down ~20% vs.

previous quarter

FY company de-stocking target

achieved

-41%

-42%

Dealer inventory (units) Company inventory (units)

January 25, 2010 Q4 & FY ‘09 Results Review 19

2 Group purchasing

Direct materials savings

Q4 ‘08 Average FY ’09 net savings at

~€0.5bn or 2.3%, with

FY performance

slightly above target

Continued efficiency

Dec ‘07=100

actions on commercial

& technical savings

FY ‘08 Average = -0.6%

expected to bring

positive net savings in

FY ‘10 despite some

raw material price

increase

FY ‘09 Average = -2.9%

Q4 ‘09 Average

Q1 ‘08 Q2 ‘08 Q3 ‘08 Q4 ‘08 Q1 ‘09 Q2 ‘09 Q3 ‘09 Q4 ‘09

January 25, 2010 Q4 & FY ‘09 Results Review 20

3 Firm grasp on costs and production levels

FY update

Managing World Class Manufacturing

the downturn program

Right-sized global ...optimized ...tight grip on …and ready for 2009 achievements

workforce... production overhead costs... 2010

• Average Group FY savings at 7.4% of

systems to align

Reduction of workforce • Temporary lay-offs and • Strict balance of transformation cost, well above ~7% FY

by ~8,300 or 4.2% vs. with market utilization of remaining production levels with target

2008 to ~190,000 demand through vacation banks demand

includes a difficult 2009... • 114 Group plants involved (6 plants

• Discretionary SG&A • Businesses to continue now at “Silver” level & 17 at “Bronze”)

• All actions designed to cost curtailment above implementation of cost

minimize social impact • Production stoppages

~15% FY target reduction actions and

through temporary lay-

review of

• Achieved 13% salaried offs and utilization of

organizational 2010 targets

personnel reductions at vacation banks in Italy,

structure

CNH France, Germany &

Spain • Average year-over-year Group savings

• “Change-in-scope” projected to ~6% of transformation

mostly due to Bertone • Effectively managed cost

acquisition temporary increase in

demand in Brazil & • Enlargement of scope and plant level

Poland through upgrading

utilization of overtime

• Consolidation of WCM program with top

suppliers

Strategic decision in Italy

FGA: termination of car production CNH: ongoing shift of loader backhoe & compact wheel loader

at Termini Imerese plant production from Imola to Lecce Plant. Planned shift of

in 2011 remaining production to San Mauro plant

January 25, 2010 Q4 & FY ‘09 Results Review 21

2010 outlook

After uneven trading conditions in ‘09, a year of transition & stabilization

All sectors to improve performance over prior year, with Automobiles business dependent on continued availability

of reliable eco-incentives programs to underpin demand in WE

Forecasts include a continuation of rigorous cost containment action initiated as early as latter part of 2008, implemented

vigorously throughout 2009

Contraction in Capex programs expected to ease in 2010, with resumption of a normalized level of capital

commitments across all sectors, yielding a 30% to 35% rise in expenditures over 2009

Capital expenditures programs, forming part of 2007-10 industrial plan, underwent a severe contraction in 2009, in

response to uncertainty of demand function for our various businesses and tightening of credit markets

2010 targets

Revenues in €52-€53bn range, up between 3% and 6%

Trading profit of ~€1.5bn

Positive net income of €200 to €300mn

Net debt levels below €5bn

Targets subject to continued availability of eco-incentives in European automotive market, ex Germany where non-renewal of

2009 incentive scheme assumed. If incentives not available in 2010, European demand for automobiles would be negatively

impacted. In Italy alone volumes would decrease by ~20% impacting all car producers, more importantly those particularly

active in A & B segments, and Fiat in particular holding ~30% share

In such a case

Revenues would be €2.5bn lower

Trading profit for both Automobiles and Components would drop by €350-400mn

Shortfall in profits would impact net income on a 100% basis due to unavailability of tax relief, and would balloon debt

disproportionately, pushing overall levels above €5bn mark

Even in these circumstances, Fiat able to post a trading profit in excess of €1bn and have more than adequate financial

resources to transition to 2011 and later years, when a normalized trading environment expected

If eco-incentive schemes extended into ‘10, Automobiles & Components sectors expected to improve performance over ‘09

January 25, 2010 Q4 & FY ‘09 Results Review 22

Save the date

Fiat 2010-14 Business Plan

January 25, 2010 Q4 & FY ‘09 Results Review 23

2010 financial calendar

March 26, 2010 July 21, 2010

Annual General Q2 & H1 Results

Meeting

January February March April May June July August September October November December

April 21, 2010 October 21, 2010

Q1 Results and Q3 Results

Fiat Investor Day

January 25, 2010 Q4 & FY ‘09 Results Review 24

Appendix

January 25, 2010 Q4 & FY ‘09 Results Review 25

Fiat Group Automobiles

Closed a challenging 2009 recording highest Q4 revenues ever

Revenues (€mn)

Q4 5,702 +27.1% Unit Sales (x000)

7,247

Q3 6,636 -1.4%

6,541

Q2 7,770 -11.1%

6,905

Q1 6,829 -18.0%

5,600

FY ‘08 FY’02 FY’03 FY’04 FY’05 FY’06 FY’07 FY’08 FY’09

FY ‘09

Trading Profit (€mn)

FY revenues down 2.4% to €26.3bn (substantially

unchanged on constant currency)

Passenger cars up 5.7% to 1,843k units

Q4 65 +192.3%

Q3 190 LCVs down 24.8% to 307k units

-18.4%

190 Key markets leading volume increase

Q2 243

-36.2% 155 Germany: 149k cars, nearly 2x ‘08 levels

Q1 193 155 Italy: +6.2% to 653k cars

n.a.

(30) Brazil: 12.6% to 750k units, including LCV

FY ‘08 FY ‘09

January 25, 2010 Q4 & FY ‘09 Results Review 26

Fiat Group Automobiles

Trading profit variance & margin

(€mn)

Volume increase driven by

passenger cars (+100k

691

(3)

units) totally offset by LCVs

300

(-102k units)

Price/Mix negative effect

mainly due to reduced LCV

470

230

(130)

volumes in WE

Purchasing savings

proceeding apace

6

2.6% (168) WCM efficiencies partly

1.8% offsetting uneven absorption

(456)

across factories

SG&A cost reduction at FY

target

Other mainly relates to FX

Purchasing

Production translation effect

FY '08 Volume Price Mix Cost R&D SG&A Other FY '09

Net Absorp.

January 25, 2010 Q4 & FY ‘09 Results Review 27

Fiat Group Automobiles

Registrations & market share

Passenger cars

(market share; %)

Italy WESTERN EUROPE

32.8

+0.9 p.p.

Passenger cars

WE

8.8 Fiat brand share at 7.1% (+0.5 p.p.); Lancia

+0.6 p.p. share at 0.9% (+0.1 p.p.); Alfa Romeo share at

0.8% (+0.1 p.p.)

FGA at 8.8% in WE (+0.6 p.p.)

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Italy +0.9 p.p.

2005 2006 2007 2008 2009 FY ‘09 Germany +1.5 p.p.

UK +0.6 p.p.

WE ex-Italy: +0.5 p.p.

LCVs

LCVs

(market share; %) WE market share at 12.6% (+0.3 p.p.)

Share in Italy down to 39.9.% driven by phase-out of

Doblò (new model available in market in early 2010)

Italy

and a sharp drop in camper segment, where Fiat

Professional has a lion’s share of market

39.9 BRAZIL

-3.4 p.p.

WE Leadership maintained with a 24.5%

12.6 share in an overall booming market,

+0.3 p.p. topping healthy 2008 level

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 FY ‘09

2005 2006 2007 2008 2009

January 25, 2010 Q4 & FY ‘09 Results Review 28

Luxury Auto Brands

(€mn)

Revenues Trading Profit Revenues Trading Profit

1,921

1,778

825

448

339

238 72

11

FY ‘08 FY ‘09 FY ‘08 FY ‘09 FY ‘08 FY ‘09 FY ‘08 FY ‘09

Revenues down ~7% on lower sales volumes and Revenues down ~46% over last year

unfavorable sales mix 4,489 units sold, with 48.7% decline attributable to

6,235 units sold, down 4.5% with reference market significant drop in company’s reference markets

down ~40% globally

Overall market share maintained, with improvement in

Deliveries of 8-cylinder vehicles up, driven by success Quattroporte’s segment

of California

Trading profit underpinned by realignment of

Trading margin at 13.4% production levels and rigorous cost containment

measures partly offsetting significant decline in

Efficiency gains partly offsetting negative impact of

volumes

volumes and product mix (both particularly favorable

in ‘08) in addition to unfavorable currency movements

GranTurismo Convertible

Presented at Detroit Motorshow

458 Italia for US market

January 25, 2010 Q4 & FY ‘09 Results Review 29

Agricultural and Construction Equipment

Focus on cash and tight cost controls, disciplined management

Revenues (€mn)

Q4 3,051 FY revenues down ~21% to €10.1bn impacted by most

-22.0%

severe decline on record in CE markets and tough comps

2,381

vs. exceptionally strong 2008 AG levels, particularly for

Q3 3,122

-27.4% combines

2,268

Target company & dealer inventory levels achieved

Q2 3,631 -21.2%

2,860 Progressive slowdown of global demand in AG from peak

highs in 2008

Q1 2,977 Total combine unit deliveries down 20%; total tractor unit

-12.7% 2,598

deliveries down 25%

FY ‘08 FY ‘09 NA revenues down slightly due to network de-stocking

actions and softening tractor sales partially offset by

strength in combines

Trading Profit (€mn)

Slowdown in remaining regions attributable to overall

Q4 241 industry decline, network de-stocking actions & tight credit

-58.9%

markets

Q3 284 Worldwide CE industry retail volume down 38%

-76.8%

Overall wholesales decline in both Light & Heavy equipment

in all regions impacted also by de-stocking actions

Q2 399 99

-69.2% 66 Light equipment FY unit deliveries down 63% (down 46%

123 in Q4)

Q1 198 -75.3%

49 Heavy equipment FY unit deliveries down 55% (down

FY ‘08 FY ‘09 22% in Q4)

January 25, 2010 Q4 & FY ‘09 Results Review 30

Agricultural and Construction Equipment

Trading profit variance & margin

(€mn)

Lower industry volumes,

de-stocking and

unfavorable product mix

1,122

Positive AG & CE pricing,

despite market conditions

Targeted headcount

reduction and SG&A cost

358 containment programs

67

8.8% 148 Reduced R&D include

impact of synergies with

337 FPT on Tier IV development

(266)

(265) Other includes lower

(827)

3.3% earnings at CNH Capital

FY '08 Volume/Mix Pricing, Net Production SG&A R&D Other FY‘09

Cost

January 25, 2010 Q4 & FY ‘09 Results Review 31

Trucks and Commercial Vehicles

Tight cost management yielding 1.5% FY trading margin

Revenues (€mn)

Q4 2,361 -8.0%

FY revenues down 34.1% to €7.2bn mainly

Q3 2,441 -29.7% due to lower sales volumes in a poor

2,172 European market, softened by more resilient

Q2 3,122 -43.2%

1,715 after-sales and special vehicles businesses

Q4 positively impacted by strong seasonality of

1,773

Q1 2,970 -48.7% special vehicles & LA

1,523

Overall wholesale volumes down 45.9% to

FY ‘08 FY ‘09

104k units

Sales by geographic area

Trading Profit (€mn) WE down 47% to 67k units with sharp declines in

all key markets: Italy -31%, Germany -43%,

France -46%, Spain -60% & UK -73%

Q4 187

EE down 73%

-11.0%

Q3 181 LA down 19% in an improved market in latter part

of year

-87.8%

Q2 248 Sales by segment

-92.7% Light down 42%

Q1 222 77 Medium down 41%

n.a.

22

18

Heavy down 62%

(12)

FY ‘08 FY ‘09

January 25, 2010 Q4 & FY ‘09 Results Review 32

Trucks and Commercial Vehicles

Trading profit variance & margin

(€mn)

838 Volume drop in all

business segments

Pricing impacted by

de-stocking actions in

Europe, partially

offset by LA & after

7.7%

sales margins

Purchasing savings &

174

improved

105 manufacturing

(63) efficiency through

1.5%

62

WCM and labor

36

(905)

28 - flexibility

(65)

Overhead costs cut by

FY '08

Volume/

Price Purchasing

Production

BB/used R&D SG&A Other FY '09 20+% from ongoing

Mix Cost

actions

January 25, 2010 Q4 & FY ‘09 Results Review 33

Trucks and Commercial Vehicles

Market shares by region

WE market share ≥3.5T

at 13.6% (9.2% ≥2.8T),

with slight decline in

Light share reflecting

Medium Heavy unfavorable market mix

(3.5-6T)

Continued strong

competition in Light

WE market share 14.1%1 24.3% 9.3%

segment from car-based

FY ’09 vehicles

Improved penetration in Q4

Change vs. FY ‘08 -1.1 p.p. -0.7 p.p. -1.0 p.p. in all segments vs. previous

quarter

EE market share 13.2%2 30.1%2 11.0%2 Brazil

FY ’09

Market share ≥3.5T at

8.3%; Q4 share up 0.4 p.p.

Change vs. FY ‘08 -2.0 p.p. -3.6 p.p. -0.2 p.p.

vs. last year

Market share loss in Heavy

Brazil market share segment due to margin

FY ’09

27.0% 3.7% 11.9% protection and excess

manufacturing capacity in

Change vs. FY ‘08 +1.9 p.p. +1.4 p.p. -3.3 p.p. market

1 2.8-6T at 7.9% (-0.5 p.p.) vs. last year

2 Estimates

January 25, 2010 Q4 & FY ‘09 Results Review 34

Components

FPT Powertrain Technologies

Revenues (€mn)

Other & Elim. Passenger & Commercial Vehicles

€(8) mn 7,000

Revenues down ~8%: ~2.3mn engines (down 63k or ~3%,

-29%

Other & Elim. with third-party sales declining 50+%) and ~2.2mn

P&CV 3,650 4,952 €-mn

transmissions (+9%)

3,372

Industrial & Marine

Revenues down 53%: engine sales at 268k (-51%),

I&M 3,358 gearboxes at 53k (-50%) & axles at 105k (-62%)

1,580

Start of production of F1C engines

FY '08 FY '09

Offering of leading-edge powertrains compliant with

strictest emissions standards expanded across

businesses

Trading Profit variance (€mn) & margin Technobest 2009-awarded Fire MultiAir

166 Euro 5 1.3-liter Small Diesel Engine with MultiJet II injection

system technology

Small off-road engines available to meet Tier IV interim

2,4%

requirements

Range of 5 EEV compliant diesel engines for Iveco New

63 6 13 -0.5% EcoDaily, also available in twin-stage turbo version, CNG,

(25)

(2) bi-fuel (gas & CNG)

52

62 Small trading loss for FY (€59mn profit in H2)

Significant efficiency gains in overheads, manufacturing &

purchasing partially offsetting sharp drop in I&M volumes &

(385) unfavorable sales mix

FY '08 Volume Price Purchasing Production SG&A R&D Other FY '09

/Mix Net Cost

January 25, 2010 Q4 & FY ‘09 Results Review 35

Components

Teksid, Marelli, Comau

Revenues (€mn) Teksid

FY revenues down ~31% with ~27% volume decline in

837 Cast Iron business and ~6% volume drop in Aluminum

business

1,123

578 Teksid Trading result reflected significant contraction in

728 Comau volumes

5,447 Magneti Marelli

4,528 Marelli

FY revenues down ~17% (down 14% on a comparable

basis) primarily attributable to fall in volumes in H1,

slowing in H2

FY '08 FY '09 Most significant volume declines in Europe (ex Poland) and US

Growth of Engine Control Units in China & India, strong sales

performance for Exhaust Systems in Brazil (both third-party sales

& Fiat)

Trading Result (€mn)

Notwithstanding lower volumes, a trading profit of €25mn

posted on the back of reductions in overheads, increased

41 production and purchasing efficiencies

21

Comau

174 FY revenues down ~35% (down 31% on a comparable

basis) mainly driven by Body Welding

25 Marelli

(12) Services growth in Mercosur unable to offset order decline in EU

Teksid

(28) Comau Trading result primarily attributable to lower business

FY '08 FY '09 volumes for Body Welding and Die-cutting

January 25, 2010 Q4 & FY ‘09 Results Review 36

Q4 ‘09

Revenues & trading result

(€mn) Q4 '09 Change 2009/2008

Cons. Industrial Financial Cons. Industrial Financial

Revenues

Fiat Group 13,601 13,323 369 +468 +504 -41

of which

Automobiles 7,815 7,773 49 +1,482 +1,488 -9

FGA 7,247 7,213 43 +1,545 +1,556 -9

Ferrari 491 483 6 -11 -16

Maserati 129 129 -100 -100

CNH 2,381 2,164 267 -670 -639 -49

Iveco 2,172 2,127 53 -189 -204 +15

Components 2,872 2,872 +118 +118

Others & Elim. (1,639) (1,613) -273 -259 +2

CNH ($) 3,540 3,216 396 -451 -448 -22

Trading result

Fiat Group 488 445 43 -175 -141 -34

of which

Automobiles 257 245 12 +55 +53 +2

FGA 190 180 10 +125 +123 +2

Ferrari 62 60 2 -34 -34

Maserati 5 5 -36 -36

CNH 99 60 39 -142 -123 -19

Iveco 77 86 (9) -110 -91 -19

Components 77 77 +45 +45

Others & Elim. (22) (23) 1 -23 -25 2

CNH ($) 144 87 57 -166 -148 -18

January 25, 2010 Q4 & FY ‘09 Results Review 37

FY ‘09

Revenues & trading result

(€mn) FY Change 2009/2008

Cons. Industrial Financial Cons. Industrial Financial

Revenues

Fiat Group 50,102 48,917 1,467 -9,462 -9,518 -68

of which

Automobiles 28,351 28,190 190 -1,029 -1,042 +16

FGA 26,293 26,151 168 -644 -649 +8

Ferrari 1,778 1,759 22 -143 -151 +8

Maserati 448 448 -377 -377

CNH 10,107 9,165 1,129 -2,674 -2,649 -98

Iveco 7,183 7,052 151 -3,711 -3,793 +14

Components 10,327 10,327 -3,466 -3,466

Others & Elim. (5,866) (5,817) (3) 1,418 1,432

CNH ($) 14,097 12,783 1,574 -4,700 -4,593 -230

Trading result

Fiat Group 1,058 890 168 -2,304 -2,148 -156

of which

Automobiles 719 678 41 -383 -382 -1

FGA 470 435 35 -221 -216 -5

Ferrari 238 232 6 -101 -105 +4

Maserati 11 11 -61 -61

CNH 337 184 153 -785 -673 -112

Iveco 105 131 (26) -733 -689 -44

Components (40) (40) -442 -442

Others & Elim. (63) (63) +39 +38 +1

CNH ($) 470 257 213 -1,180 -1,003 -177

January 25, 2010 Q4 & FY ‘09 Results Review 38

Fiat Group Automobiles

Q4 ‘09 market & market share (ex Ferrari & Maserati)

Passenger Cars Light Commercial

Q4 Unit % Q4 Unit %

Vehicles

Units 000 2009 2008 Change Change Units 000 2009 2008 Change Change

WE Market 3,322.9 2,733.9 589.0 21.5% WE Market 362.1 410.2 -48.0 -11.7%

Registrations 279.7 226.9 52.7 23.2% Registrations 43.6 51.2 -7.6 -14.8%

Mkt Share % 8.4% 8.3% 0.1 Mkt Share % 12.0% 12.5% -0.5

Italy Market 545.5 450.2 95.3 21.2% Italy Market 51.8 55.0 -3.1 -5.7%

Registrations 171.9 142.6 29.3 20.5% Registrations 20.5 23.8 -3.4 -14.1%

Mkt Share % 31.5% 31.7% -0.2 Mkt Share % 39.5% 43.3% -3.8

Germany Market 816.4 718.6 97.8 13.6% Germany Market 58.5 74.2 -15.7 -21.1%

Registrations 27.9 20.9 7.0 33.7% Registrations 5.3 7.3 -2.0 -27.6%

Mkt Share % 3.4% 2.9% 0.5 Mkt Share % 9.1% 9.9% -0.8

France Market 655.2 474.5 180.7 38.1% France Market 103.5 108.1 -4.6 -4.3%

Registrations 26.6 20.7 5.8 28.1% Registrations 7.4 7.8 -0.4 -5.6%

Mkt Share % 4.1% 4.4% -0.3 Mkt Share % 7.1% 7.2% -0.1

U.K. Market 478.0 337.4 140.6 41.7% U.K. Market 45.8 52.6 -6.8 -13.0%

Registrations 20.0 9.5 10.5 110.0% Registrations 1.6 2.1 -0.6 -26.0%

Mkt Share % 4.2% 2.8% 1.4 Mkt Share % 3.5% 4.1% -0.6

Spain Market 276.2 213.3 62.9 29.5% Spain Market 30.0 27.9 2.2 7.7%

Registrations 7.0 7.3 -0.3 -3.5% Registrations 2.6 2.4 0.2 7.8%

Mkt Share % 2.6% 3.4% -0.8 Mkt Share % 8.7% 8.7% 0.0

Poland Market 81.0 85.0 -4.0 -4.7% Poland Market 10.3 15.2 -4.9 -32.4

Registrations 7.4 7.8 -0.5 -6.0% Registrations 3.0 3.7 -0.7 -19.0%

Mkt Share % 9.1% 9.2% -0.1 Mkt Share % 29.0% 24.2% 4.8

Brazil Market 657.0 473.2 183.8 38.8% Brazil Market 140.8 102.1 38.7 37.9%

Registrations 161.5 112.0 49.5 44.2% Registrations 32.8 24.8 8.0 32.3%

Mkt Share % 24.6% 23.7% 0.9 Mkt Share % 23.3% 24.2% -0.9

January 25, 2010 Q4 & FY ‘09 Results Review 39

Fiat Group Automobiles

FY ‘09 market & market share (ex Ferrari & Maserati)

Passenger Cars Light Commercial

Full Year Unit % Full Year Unit %

Vehicles

Units 000 2009 2008 Change Change Units 000 2009 2008 Change Change

WE Market 13,632.9 13,561.2 71.7 0.5% WE Market 1,416.6 1,950.2 -533.6 -27.4%

Registrations 1,194.0 1114.2 79.8 7.2% Registrations 178.9 240.4 -61.5 -25.6

Mkt Share % 8.8% 8.2% 0.6 Mkt Share % 12.6% 12.3% 0.3

Italy Market 2,158.0 2,161.7 -3.7 -0.2% Italy Market 181.1 230.6 -49.4 -21.4%

Registrations 707.1 688.6 18.5 2.7% Registrations 72.2 99.8 -27.6 -27.6

Mkt Share % 32.8% 31.9% 0.9 Mkt Share % 39.9% 43.3% -3.4

Germany Market 3,807.2 3,090.0 717.1 23.2% Germany Market 239.5 318.4 -78.9 -24.8%

Registrations 179.4 99.3 80.1 80.7% Registrations 28.6 37.0 -8.4 -22.7%

Mkt Share % 4.7% 3.2% 1.5 Mkt Share % 11.9% 11.6% 0.3

France Market 2,268.7 2,050.3 218.4 10.7% France Market 381.5 469.8 -88.3 -18.8%

Registrations 98.9 88.6 10.3 11.6% Registrations 33.8 38.0 -4.2 -11.0%

Mkt Share % 4.4% 4.3% 0.1 Mkt Share % 8.9% 8.1% 0.8

U.K. Market 1,995.0 2,131.8 -136.8 -6.4% U.K. Market 194.4 301.2 -106.8 -35.5%

Registrations 69.4 61.3 8.1 13.3% Registrations 7.1 12.7 -5.6 -44.2%

Mkt Share % 3.5% 2.9% 0.6 Mkt Share % 3.7% 4.2% -0.5

Spain Market 952.8 1,161.2 -208.4 -17.9 Spain Market 105.7 164.2 -58.5 -35.6%

Registrations 23.8 41.7 -17.8 -42.8% Registrations 9.1 14.9 -5.8 -39.0%

Mkt Share % 2.5% 3.6% -1.1 Mkt Share % 8.6% 9.1% -0.5

Poland Market 320.1 319.9 0.2 0.1% Poland Market 40.1 56.6 -16.5 -29.1%

Registrations 33.0 30.1 2.9 9.8% Registrations 10.3 12.1 -1.9 -15.3%

Mkt Share % 10.3% 9.4% 0.9 Mkt Share % 25.6% 21.4% 4.2

Brazil Market 2,520.2 2,237.3 283.0 12.6% Brazil Market 489.9 436.4 53.5 12.3%

Registrations 619.0 557.2 61.8 11.1% Registrations 118.0 100.5 17.4 17.3%

Mkt Share % 24.6% 24.9% -0.3 Mkt Share % 24.1% 23.0% 1.1

January 25, 2010 Q4 & FY ‘09 Results Review 40

Fiat Group Automobiles

Worldwide unit sales by region, Cars+LCVs (unit/000)*

-7.6% +30.1% -0.1%

1,725 556 2,153 2,151

RoW 1,595 -34.5%

- 39.4%

-16.2%

WE ex

428

-0.7%

Italy -8.1%

+28.4%

+0.5%

Italy -5.9%

+25.9%

Brazil +2.7% +55.8% +12.6%

* Incl. sales w/buyback, excl. JVs and Ferrari & Maserati

January 25, 2010 Q4 & FY ‘09 Results Review 41

Fiat Group Automobiles

Worldwide unit sales by brand, Cars+LCVs (unit/000)*

-7.6% +30.1% -0.1%

556 2,153 2,151

1,725

-1.0%

Alfa 1,595

-2.0%

+2.0%

428

Fiat +5.9%

-1.9% +39.0%

Lancia +9.2%

+1.8% +37.9%

LCV

-32.9% +5.6% -24.8%

* Incl. sales w/buyback, excl. JVs and Ferrari & Maserati

January 25, 2010 Q4 & FY ‘09 Results Review 42

Fiat Group Automobiles

Production volumes, sales volume & registrations

WW Passenger Cars & LCV

(‘000 units)

Production

2005 2006 2007 2008 2009

Registrations & Sales

Registrations

Units sold

January 25, 2010 Q4 & FY ‘09 Results Review 43

Net debt breakdown

(€bn)

Sept. 30, ‘09 Dec. 31, ‘09

Cons. Ind. Fin. Cons. Ind. Fin.

25.9 13.2 12.7 Gross Debt* 28.5 15.6 12.9

(0.1) (0.1) - Derivatives M-to-M, Net (0.2) (0.2) -

(8.4) (7.3) (1.1) Cash & Mktable Securities (12.4) (11.0) (1.4)

17.4 5.8 11.6 Net Debt 15.9 4.4 11.5

* Net of intersegment receivables

January 25, 2010 Q4 & FY ‘09 Results Review 44

Gross debt

(€bn)

Outstanding Outstanding

Sept. 30, '09 Dec. 31, '09

19.3 Cash Maturities 21.3

8.2 Bank Debt 8.4

9.8 Capital Market* 11.6

1.3 Other Debt 1.3

6.5 Securitization and Sale of Receivables (on book) 7.1

4.0 ABS / Securitization 4.9

0.9 Warehouse Facilities 0.6

1.6 Sale of Receivables 1.6

0.1 Adjust. for Hedge Accounting on Fin. Payables 0.1

25.9 Gross Debt 28.5

8.4 Cash & Mktable Securities 12.4

0.1 Derivatives Fair Value 0.2

17.4 Net Debt 15.9

0.0 Available Committed Lines 0.0

* Excluding Bond fair value, including interest accruals

January 25, 2010 Q4 & FY ‘09 Results Review 45

Debt maturity schedule

(€bn)

Outstanding

2010 2011 2012 2013 2014 Beyond

Dec. 31, '09

8.4 Bank Debt 3.5 2.1 1.6 0.7 0.2 0.3

11.6 Capital Market * 1.5 2.6 1.4 1.7 1.6 2.8

1.3 Other Debt 0.9 0.1 - 0.1 - 0.2

21.3 Total Cash Maturities 5.9 4.8 3.0 2.5 1.8 3.3

12.4 Cash & Mktable Securities

0.5 of which ABS related

4.6 Sale of Receivables (IFRS de-recognition compliant)

3.0 of which receivables sold to financial services JVs (FGA Capital, Iveco Finance Holding Ltd)

* Excluding Bond fair value, including interest accruals

January 25, 2010 Q4 & FY ‘09 Results Review 46

Safe Harbor Statement

January 25, 2010 Q4 & FY ‘09 Results Review 47

Contacts

Fiat Investor Relations team

Marco Auriemma phone: +39-011-006-3290 Vice President

Federico Donati phone: +39-011-006-2756

Alexandra Deschner phone: +39-011-006-2380

Maristella Borotto phone: +39-011-006-2709

fax: +39-011-006-3796

email: investor.relations@fiatgroup.com

website:

www.fiatgroup.com

January 25, 2010 Q4 & FY ‘09 Results Review 48

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Team Energy Corporation, V. Cir G.R. No. 197770, March 14, 2018 Cir V. Covanta Energy Philippine Holdings, Inc., G.R. No. 203160, January 24, 2018Document5 pagesTeam Energy Corporation, V. Cir G.R. No. 197770, March 14, 2018 Cir V. Covanta Energy Philippine Holdings, Inc., G.R. No. 203160, January 24, 2018Raymarc Elizer AsuncionPas encore d'évaluation

- Strategies For Managing Large-Scale Mining Sector Land Use Conflicts in The Global SouthDocument9 pagesStrategies For Managing Large-Scale Mining Sector Land Use Conflicts in The Global Southamerico centonPas encore d'évaluation

- 39 1 Vijay KelkarDocument14 pages39 1 Vijay Kelkargrooveit_adiPas encore d'évaluation

- GLInqueryDocument36 pagesGLInquerynada cintakuPas encore d'évaluation

- Day Balance Daily % Growth Daily Profit Goal TP: Necessary Lot Size Based On One Trade Per Daynecessary Lot Size Based On One Trade Per DayDocument8 pagesDay Balance Daily % Growth Daily Profit Goal TP: Necessary Lot Size Based On One Trade Per Daynecessary Lot Size Based On One Trade Per DayVeeraesh MSPas encore d'évaluation

- Chicago 'Buycks' Lawsuit PlaintiffsDocument6 pagesChicago 'Buycks' Lawsuit PlaintiffsThe Daily CallerPas encore d'évaluation

- New Economic Policy of IndiaDocument23 pagesNew Economic Policy of IndiaAbhishek Singh Rathor100% (1)

- Informal Sectors in The Economy: Pertinent IssuesDocument145 pagesInformal Sectors in The Economy: Pertinent IssuesshanPas encore d'évaluation

- Etoro Aus Capital Pty LTD Product Disclosure Statement: Issue Date: 31 July 2018Document26 pagesEtoro Aus Capital Pty LTD Product Disclosure Statement: Issue Date: 31 July 2018robert barbersPas encore d'évaluation

- Example of A Project CharterDocument9 pagesExample of A Project CharterHenry Sithole100% (1)

- Political Economy of Media - A Short IntroductionDocument5 pagesPolitical Economy of Media - A Short Introductionmatthewhandy100% (1)

- Revised Analyst's Dilemma Analysis Pallab MishraDocument2 pagesRevised Analyst's Dilemma Analysis Pallab Mishrapalros100% (1)

- CH 13 Measuring The EconomyDocument33 pagesCH 13 Measuring The Economyapi-261761091Pas encore d'évaluation

- Salary Slip Template V12Document5 pagesSalary Slip Template V12Matthew NiñoPas encore d'évaluation

- Participatory Governance - ReportDocument12 pagesParticipatory Governance - ReportAslamKhayerPas encore d'évaluation

- Company Analysis - Applied Valuation by Rajat JhinganDocument13 pagesCompany Analysis - Applied Valuation by Rajat Jhinganrajat_marsPas encore d'évaluation

- Commissioner of Internal Revenue vs. Primetown Property Group, Inc.Document11 pagesCommissioner of Internal Revenue vs. Primetown Property Group, Inc.Queenie SabladaPas encore d'évaluation

- Pasamuros PTD 308 - PentairDocument5 pagesPasamuros PTD 308 - PentairJ Gabriel GomezPas encore d'évaluation

- Middle East June 11 Full 1307632987869Document2 pagesMiddle East June 11 Full 1307632987869kennethnacPas encore d'évaluation

- Economics Environment: National Income AccountingDocument54 pagesEconomics Environment: National Income AccountingRajeev TripathiPas encore d'évaluation

- Bank - A Financial Institution Licensed To Receive Deposits and Make Loans. Banks May AlsoDocument3 pagesBank - A Financial Institution Licensed To Receive Deposits and Make Loans. Banks May AlsoKyle PanlaquiPas encore d'évaluation

- A Brief Analysis On The Labor Pay of Government Employed Registered Nurses (RN) in The PhilippinesDocument3 pagesA Brief Analysis On The Labor Pay of Government Employed Registered Nurses (RN) in The PhilippinesMary Joy Catherine RicasioPas encore d'évaluation

- Effect of Vishal Mega Mart On Traditional RetailingDocument7 pagesEffect of Vishal Mega Mart On Traditional RetailingAnuradha KathaitPas encore d'évaluation

- A Renewable WorldDocument257 pagesA Renewable WorldMiguel MendoncaPas encore d'évaluation

- E417Syllabus 19Document2 pagesE417Syllabus 19kashmiraPas encore d'évaluation

- Anser Key For Class 8 Social Science SA 2 PDFDocument5 pagesAnser Key For Class 8 Social Science SA 2 PDFSoumitraBagPas encore d'évaluation

- Maruti SuzukiDocument17 pagesMaruti SuzukiPriyanka Vaghasiya0% (1)

- Radisson BluDocument4 pagesRadisson BluDhruv BansalPas encore d'évaluation

- MKT 465 ch2 SehDocument51 pagesMKT 465 ch2 SehNaimul KaderPas encore d'évaluation

- Extracted Pages From May-2023Document4 pagesExtracted Pages From May-2023Muhammad UsmanPas encore d'évaluation