Académique Documents

Professionnel Documents

Culture Documents

What Are The Different Type of Cheques Issued in India - Your Finance Book

Transféré par

Sachin SahooTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

What Are The Different Type of Cheques Issued in India - Your Finance Book

Transféré par

Sachin SahooDroits d'auteur :

Formats disponibles

3/5/2015

Your Finance

Book

What are the different type of Cheques issued in India - Your Finance Book

How To Open An Offshore

List Of Investment Banks

Bank Acco

Internet Bank Account

Safest Online Banks

Personal B

Income Tax | Finance | Career | SAP

Search this site...

Browse: Home What are the different type of Cheques issued in India

WHAT ARE THE DIFFERENT TYPE OF

CHEQUES ISSUED IN INDIA

Finance

Cheque is a document which guarantees the payee or bearer to get paid for a specific

amount from the payers bank account. Your bank on demand from payee or bearer

pays the specified amount after cross checking your signature with banks database.

After opening your saving bank account or current account, you will be issued a

bunch of Cheque leaf. These leafs can be used for making payment to your vendor or

to pay your bills. There are different type of cheques which are defined based on how

Latest On Indian Taxation

you issue it, where as basic format remains same. In this article we will be discussing

6 verities of cheques that are issued in India.

Bearer Cheque

On your Cheque leaf you can find a

word Or Bearer. If you do not

strike out this word while issuing

then it becomes a bearer Cheque.

Bearer Cheque means the person

who is holding the instrument can

withdraw amount from your bank

account. Issuing these types of Cheque is risky as you never know when your payee

will misplace it. In such type of circumstances the finder can collect the payment from

Gross direct tax collection During

April-December FY 2014-2015 is

at Rs 546661 crores up by

12.93%

How to apply PAN card for a

partnership firm in India

CBI arrests an Income Tax

Officer For Accepting Bribe of

Rs. One Lakh

22 chartered accountants have

issued more than 400 tax audit

report for AY 2013-2014

When charitable trusts are

required to file income tax return

bank.

Crossed

Crossing a Cheque means you are instructing the bank to make payment to the

payees banks account only. You can cross it by adding two parallel lines on the top

left hand corner of the Cheque. Payment for this type of Cheque can not be obtained

from the cash counter of your bank account. After depositing it with a bank, the bank

http://yourfinancebook.com/different-type-cheques-issued-india/

1/4

3/5/2015

What are the different type of Cheques issued in India - Your Finance Book

will submit it to the nearest branch of payers bank and then you will be paid after

getting it paid from payers bank to your bank. You can also write A/c Payee in

between the crossed line.

Bank Account Balance

Personal Bank Account

Bank Debentures

Best Bank Account

5/3 Bank

Military Bank Online

Flushing Bank

Fifth Third Bank Online

Electronic Banking

Bank Account Apply

Virgin Bank

Uncrossed

While issuing if you do not cross the Cheque then it will be called Uncrossed Cheque.

How To Open An Offshore Ban

Internet Bank Account

Its also called open Cheque which is not required to be paid to payees bank

account.

Self

In self cheque, you can issue it in your own name or write self in the palace of writing

Payees name. The person who is holding the instrument can go to the payers bank

and withdraw the amount that is mentioned there in. Its a very risky instrument as the

List Of Investment Banks

Safest Online Banks

Latest On TDS

owner has not been defined in it. In case you misplace it, then the other party holding

TDS on Property Sale in India

Section 194IA

the instrument can claim his ownership. In such types of situation, you have to inform

Section 192 TDS on salary

the bank and payer to block it by giving the cheque number to them. This type if

Losses and other incomes that

can be disclosed to your

employer for TDS

instrument can only be paid by payers bank. You cannot get it paid from any other

banks.

Order Cheque

In case of order Cheque, the payee in whose favor the Cheque has been issued can

only withdraw the amount. If the payee wants then he or she can authorize someone

to collect the amount on his behalf. It will become an order cheque only when you

strike out the word OR BEARER part after writing the party name in it and have

not crossed it on the top left hand corner.

Section 194B and Section 194BB

TDS on Winning from lottery

or crossword puzzles or horse

race

Section 193 TDS from Interest

on Securities

Your bank account

Bill Payment

Latest On Finance

http://yourfinancebook.com/different-type-cheques-issued-india/

2/4

3/5/2015

What are the different type of Cheques issued in India - Your Finance Book

Post-dated

A cheque issued today will be valid for 3 months from the date of issue. In case

someone wants to take payment on a future date i.e. after 3 months time period or

the party has requested to have a higher validity period then you can issue a post

dated cheque by quoting a future date as per your convenience. In such type of

situations, it will be valid for 3 months from the future date that is mentioned on the

instrument. For example; on 16/12/2013, if you are issuing it dated 01.04.2014 then

it will be called a posted dated cheque and will be valid for 3 months from the date of

01.04.2014.

Cheque will change its functionality based on how its issued. You have to be very

careful while drafting a cheque or else there are chances of losing your hard earned

money.

Also Read: 5 things to remember while filling out a cheque

S hare this:

Like

How employee stock option plan

or ESOP works

How network marketing or multi

level marketing scheme works

Worlds 8 biggest

scandals of all time

corporate

5 best free accounting software

for small and medium enterprises

Important features of Personal

Accident Insurance Policy in

India

Subscribe

By Email

Email Address

Subscribe

1

Share

Tw eet

Last Updated on March 29, 2014 by Editorial Staff

Articles To Read Next:How employee stock option plan or ESOP works

How network marketing or multi level marketing scheme works

Worlds 8 biggest corporate scandals of all time

5 best free accounting software for small and medium enterprises

Important features of Personal Accident Insurance Policy in India

http://yourfinancebook.com/different-type-cheques-issued-india/

3/4

3/5/2015

What are the different type of Cheques issued in India - Your Finance Book

Ads

1. What Are the different type of Cheques issued www.Answered-Questions.com

Top

answers for What Are the different type of Cheques issued in India

in India

2. Searching for What Are the different type of www.Answered-Questions.com

Discover

100+

answers

for What Are the different type of Cheques issued in India

Cheques

issued

in India?

3. What Are the different type of Cheques issued www.Answered-Questions.com

Top

answers for What Are the different type of Cheques issued in India

in India

4. Searching for What Are the different type of www.Answered-Questions.com

Discover

100+

answers

for What Are the different type of Cheques issued in India

Cheques

issued

in India?

Chitika | Opt out?

Leave a Reply

Name *

Email *

Post Comment

Now ATM PIN is mandatory for debit cards in merchant outlets

Prepayment of your home loan To prepay or not to prepay

Copyright 2015 Your Finance Book

About Us

Contact Us

Privacy Policy

Back to Top

Disclaimer

http://yourfinancebook.com/different-type-cheques-issued-india/

Sitemap

4/4

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Mark DistributionDocument1 pageMark DistributionSachin SahooPas encore d'évaluation

- EtcDocument3 pagesEtcSachin SahooPas encore d'évaluation

- Front CompressedDocument2 pagesFront CompressedSachin SahooPas encore d'évaluation

- Resident Certificate PDFDocument2 pagesResident Certificate PDFsandeep0% (1)

- Mpil Project TitleDocument5 pagesMpil Project TitleErik LopezPas encore d'évaluation

- Engineering Economics & Costing AssignmnetDocument1 pageEngineering Economics & Costing AssignmnetSachin SahooPas encore d'évaluation

- BANKING COMMITTEESDocument4 pagesBANKING COMMITTEESSachin SahooPas encore d'évaluation

- Kurukshetra June-14Document53 pagesKurukshetra June-14PranNath100% (1)

- Gsi NotesDocument66 pagesGsi NotesHexaNotesPas encore d'évaluation

- Selectes Study On Derivative Market: 1) Development of Financial Derivatives Market in India-A Case StudyDocument1 pageSelectes Study On Derivative Market: 1) Development of Financial Derivatives Market in India-A Case StudySachin SahooPas encore d'évaluation

- ApplicationForm PDFDocument2 pagesApplicationForm PDFkeerthiPas encore d'évaluation

- List of Steel Furnitures Industries in OrissaDocument3 pagesList of Steel Furnitures Industries in OrissaSachin SahooPas encore d'évaluation

- Bank Board BureauDocument10 pagesBank Board BureauSachin SahooPas encore d'évaluation

- DipikaDocument3 pagesDipikaSachin SahooPas encore d'évaluation

- 14 Fundamental Principles of Management Formulated by Henry FayoDocument11 pages14 Fundamental Principles of Management Formulated by Henry FayoSachin SahooPas encore d'évaluation

- Banking QuizDocument28 pagesBanking QuizSachin SahooPas encore d'évaluation

- MigrationsDocument14 pagesMigrationsSachin SahooPas encore d'évaluation

- Calculate BEP and analyze contingenciesDocument7 pagesCalculate BEP and analyze contingenciesSachin SahooPas encore d'évaluation

- EntrepreneurshipDocument1 pageEntrepreneurshipSachin SahooPas encore d'évaluation

- IBPS PO SyllabusDocument2 pagesIBPS PO SyllabusSachin SahooPas encore d'évaluation

- Migration TopicsDocument3 pagesMigration TopicsSachin SahooPas encore d'évaluation

- DR Rojalini SahooDocument5 pagesDR Rojalini SahooSachin SahooPas encore d'évaluation

- Ugc Net EconomicsDocument17 pagesUgc Net EconomicsSachin SahooPas encore d'évaluation

- Edp QBDocument113 pagesEdp QBSachin SahooPas encore d'évaluation

- ECON 201 12/9/2003 Prof. Gordon: Final ExamDocument23 pagesECON 201 12/9/2003 Prof. Gordon: Final ExamManicks VelanPas encore d'évaluation

- Multiple Choice Questions: Source: G. Mankiw, Principles of EconomicsDocument8 pagesMultiple Choice Questions: Source: G. Mankiw, Principles of EconomicsSachin Sahoo100% (4)

- Advert SingDocument3 pagesAdvert SingSachin SahooPas encore d'évaluation

- NCERT Class XI Accountancy Part IIDocument333 pagesNCERT Class XI Accountancy Part IInikhilam.com67% (3)

- Ugc Net Economics PrintDocument11 pagesUgc Net Economics PrintSachin SahooPas encore d'évaluation

- Insurance Digest - V3Document88 pagesInsurance Digest - V3Sachin SahooPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Quiz #3 Q1) Q2) : Qandeel Wahid Sec BDocument60 pagesQuiz #3 Q1) Q2) : Qandeel Wahid Sec BMuhammad AreebPas encore d'évaluation

- Government Sanctions 27% Interim Relief for PensionersDocument4 pagesGovernment Sanctions 27% Interim Relief for PensionersThappetla SrinivasPas encore d'évaluation

- Germany Vs Singapore by Andrew BaeyDocument12 pagesGermany Vs Singapore by Andrew Baeyacs1234100% (2)

- Daily LogDocument14 pagesDaily Logdempe24Pas encore d'évaluation

- Internship Report On An Analysis of Marketing Activities of Biswas Builders LimitedDocument45 pagesInternship Report On An Analysis of Marketing Activities of Biswas Builders LimitedMd Alamin HossenPas encore d'évaluation

- Partnership Dissolution and Liquidation ProcessDocument3 pagesPartnership Dissolution and Liquidation Processattiva jadePas encore d'évaluation

- DocxDocument11 pagesDocxKeir GaspanPas encore d'évaluation

- YMCA 2010 Annual Report - RevisedDocument8 pagesYMCA 2010 Annual Report - Revisedkoga1Pas encore d'évaluation

- Macro and Micro AnalysisDocument20 pagesMacro and Micro AnalysisRiya Pandey100% (1)

- Sample Project AbstractDocument2 pagesSample Project AbstractJyotiprakash sahuPas encore d'évaluation

- Aviation EconomicsDocument23 pagesAviation EconomicsAniruddh Mukherjee100% (1)

- Building Economics Complete NotesDocument20 pagesBuilding Economics Complete NotesManish MishraPas encore d'évaluation

- Practice Problems For Mid TermDocument6 pagesPractice Problems For Mid TermMohit ChawlaPas encore d'évaluation

- Dissertation NikhilDocument43 pagesDissertation NikhilSourabh BansalPas encore d'évaluation

- Myths and Realities of Eminent Domain AbuseDocument14 pagesMyths and Realities of Eminent Domain AbuseInstitute for JusticePas encore d'évaluation

- Final EA SusWatch Ebulletin February 2019Document3 pagesFinal EA SusWatch Ebulletin February 2019Kimbowa RichardPas encore d'évaluation

- Inflation Title: Price Stability Definition, Causes, EffectsDocument20 pagesInflation Title: Price Stability Definition, Causes, EffectsSadj GHorbyPas encore d'évaluation

- Tao Wang - World Bank Experience On Carbon Finance Operations in BiogasDocument20 pagesTao Wang - World Bank Experience On Carbon Finance Operations in BiogasEnergy for AllPas encore d'évaluation

- Kobra 260.1 S4Document1 pageKobra 260.1 S4Mishmash PurchasingPas encore d'évaluation

- Arjun ReportDocument61 pagesArjun ReportVijay KbPas encore d'évaluation

- Current Org StructureDocument2 pagesCurrent Org StructureJuandelaCruzVIIIPas encore d'évaluation

- COCO Service Provider Detailed Adv. Madhya PradeshDocument5 pagesCOCO Service Provider Detailed Adv. Madhya PradeshdashpcPas encore d'évaluation

- Introduction To Macroeconomics: Unit 1Document178 pagesIntroduction To Macroeconomics: Unit 1Navraj BhandariPas encore d'évaluation

- Minnesota Property Tax Refund: Forms and InstructionsDocument28 pagesMinnesota Property Tax Refund: Forms and InstructionsJeffery MeyerPas encore d'évaluation

- MCQs On Transfer of Property ActDocument46 pagesMCQs On Transfer of Property ActRam Iyer75% (4)

- CH North&south PDFDocument24 pagesCH North&south PDFNelson Vinod KumarPas encore d'évaluation

- Spence's (1973) Job Market Signalling GameDocument3 pagesSpence's (1973) Job Market Signalling GameKhanh LuuPas encore d'évaluation

- Compiled Midterm Study GuideDocument9 pagesCompiled Midterm Study GuideHaseeb MalikPas encore d'évaluation

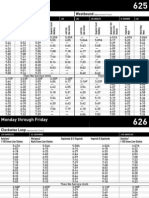

- LA Metro - 625-626Document4 pagesLA Metro - 625-626cartographicaPas encore d'évaluation

- Rab 7x4 Sawaludin Rev OkDocument20 pagesRab 7x4 Sawaludin Rev Ok-Anak Desa-Pas encore d'évaluation