Académique Documents

Professionnel Documents

Culture Documents

Aasia Properties Development Vs Juhu Beach Resorts Limited and On 19 September, 2006

Transféré par

com132Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Aasia Properties Development Vs Juhu Beach Resorts Limited and On 19 September, 2006

Transféré par

com132Droits d'auteur :

Formats disponibles

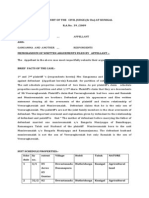

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ...

on 19 September, 2006

Company Law Board

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ... on 19 September, 2006

Equivalent citations: (2007) 1 CompLJ 315 CLB, 2007 74 SCL 153 CLB

Bench: S Balasubramanian

ORDER S. Balasubramanian, Chairman

1. The petitioner herein above, holding 1/3rd of the paid up capital of M/S Juhu Beach Resorts

Limited (the company) has filed this petition under Sections 397/398 of the Companies Act, 1956

(the Act) seeking for a declaration that certain transfer of shares registered in 1983 as null and void

and also that further transfers effected subsequently also as null and void and consequently offer all

these shares to the petitioner and for appointing a nominee of the petitioner on the board and also

for declaring that the management agreement entered into between the company and the 29th

respondent as null and void.

2. The facts in brief are: The company was incorporated as a private limited company in the year

1974. In 1978, the paid up capital of the company consisted of 1900 equity shares of Rs.l00/-each.

Poonamchand Shah group acquired 633 shares representing 1/3rd of the capital and K. Raheja

group acquired balance 1267 shares constituting 2/3rd of the paid up capital of the company. Shah

group had two directors and K. Raheja group had three directors. The company had a sub lease of a

large and valuable piece of land at Juhu Beach, Mumbai. In 1981, the director of the petitioner, Shri

Ashok P. Hinduja (Shri Ashok) was appointed as a director on 26.6.1981. The petitioner acquired

633 equity shares from K. Raheja group to become a 1/3rd shareholder. Since Shah group was not

interested in continuing with the company, it transferred their entire holding of 633 shares to B.

Raheja group (10th to 13th respondents). The main dispute raised in the petition relates to the dates

of transfer of shares from K. Raheja group to the petitioner and Shah group to B. Raheja group.

While the claim of the petitioner is that it became a shareholder on 30.8.1982 before B. Raheja

group became a shareholder on 15.1.2003, it is the contention of the respondents that B. Raheja

group became a shareholder only on 28.1.1983. Article 38 of AOA of the company provides for pre

emption rights to existing members in case of transfer of shares. Therefore, the dale of becoming a

shareholder becomes relevant for application of the provisions of this Article. On the basis that the

petitioner had become a shareholder earlier to B. Raheja group, the petitioner has staked a claim

that no shares could have been transferred to B. Raheja group without out offering to the petitioner

in terms of the preemption right and as such the petitioner has sought for cancellation of the

transfer of shares to B Raheja group and offering the same to the petitioner. Likewise, alleging that

subsequent transfer of shares without following the procedure of pre-emption rights, should be

declared to be invalid and offered to the petitioner. The petitioner has also alleged that its nominee

Shri P Ashok, who was appointed as a director, had been removed as a director and as the petitioner

holds 1/3 shares in the company, proportional representation should be directed.

3. Shri Dave, Senior Advocate, appearing for petitioner submitted: Initially, the paid up capital of

the company comprised of 1900 equity shares of Rs. 100/- each. The petitioner joined the company

on the understanding that the company would be managed in the guise of a quasi partnership and

that is why Shri Ashok was appointed as a director even earlier to the petitioner becoming a

Indian Kanoon - http://indiankanoon.org/doc/285889/

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ... on 19 September, 2006

shareholder. When the petitioner, which was then known as Mecca Properties, joined the company

as a shareholder, there were two groups, namely, Shah Group holding 633 shares, K. Raheja Group

holding 1267 shares. K. Raheja Group transferred 633 shares to the petitioner on the understanding

that each Group would continue to hold 1/3rd of the. paid up share capital of the company and that

they would jointly finance and participate in the business of the company. Thus the petitioner joined

the company with the legitimate expectation of equal shareholding and equal participation in the

management. The worth of the company is over Rs. 70 crores but the Rahejas in exclusion of the

petitioner, are enjoying the benefits. Induction of B. Raheja group was completely against the

original understanding and by committing frauds and manipulating the records, B. Raheja group

has been inducted as a shareholder. There was an oral agreement that if any of the original 3 groups

were to exist the company, the shares would be offered to the other group in line with Article 38 of

the Articles of Association and this agreement has been breached by inducting B. Raheja group. The

grievance of the petitioner is that even though it had become a shareholder on 30th August, 1982, as

is evident from the entries in the Share Transfer Register maintained in the company, yet, the

company has shown as if the petitioner became a shareholder only on 28.1.1983 in the Register of

Members. The manipulation done by the company is to deprive the petitioner of the pre-emption

right in respect of transfer of shares held by Shah Group of 633 shares to B. Raheja Group on

15.1.1983. Since the petitioner had actually become a shareholder on 30th August, 1982, when Shah

Group transferred their shares on 15.1.1983, in terms of the pre emptive rights in Article 38 of the

Articles of Association, the petitioner would have opted to buy out the entire shares of Shah Group

and thus would have been holding 2/3rd of the shares i.e. 66.66% shares in the company at that

time. If they had acquired the shares of Shah Group and had become holder of 66.66%, in view of

the subsequent allotment and transfer of shares impugned in the petition, the petitioner would now

be holding 88% shares in the company.

4. The learned Counsel further submitted: All along the petitioner believed that it had become a

shareholder only on 28.1.1983. Only when the petitioner carried out an inspection of the records of

the company sometime in September/October, 2004, it came to know that the respondents had

played a fraud on the petitioner by manipulation of share records. The company maintains a register

known as Shares Transfer Register as prescribed in Article 37 of the AOA. In that register, it is

indicated that the petitioner had become a member of the company on 30.8.1982 and that the

transfer was approved in a board meeting on the same day. In Folio 24 of Register of Members, it is

shown that Bindu Raheja who had transferred the shares to the petitioner had been shown to have

ceased to be a member on 30.8.1982. Likewsie, in Folio 26, Meena S. Raheja is shown to have

ceased to be a member on 2nd June, 1982. She had transferred 200 shares in favour of the

petitioner and 100 shares in favour of L. Raheja. While the name of L. Raheja has been entered in

the register as a member on 2nd June, 1982, the 200 shares transferred in favour of the petitioner is

shown as registered only on 28.1.1983. The register does not show any lodgment of transfer by Shri

Suresh L. Raheja on 2.6.1982 nor the minutes on 30th August, 1982 or 28th January, 1983 show any

approval of registration of the said transfer. Similarly, one Shri G.C.Nichani who had transferred the

shares to the petitioner is shown to have ceased to be a member on 30th August, 1982. If the

transferees had ceased to be members by 30.8.1982, then the petitioner should have become

member on that day as either the name of the transferee or the transferor should be in the register of

members on any day as in terms of Section 150 of the Act, every share should stand in the name of a

Indian Kanoon - http://indiankanoon.org/doc/285889/

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ... on 19 September, 2006

shareholder. The folio No. 29 in respect of the petitioner in the Register of Members shows erasure

marks on all the dates by which 30th August, 1982 has been changed to 28.1,1983. Similarly, the

folios relating to the transferors also show erasure marks on all the dates whereby 30th August,

1982 has been changed to 28.1.1983. The very fact that the folio number assigned to the petitioner is

preceding the folio numbers assigned to respondents 10 and 13 of B Raheja group would indicate

that they had become shareholders before these respondents. Further, in the Share Transfer

Register, the correct consideration paid by the petitioner of Rs. 100/-per share has been shown

against entries dated 30.8.1982, but the entries against transfer on 28.1.1983 show the very said

transfers at the rate of Rs. 200/- per share.

5. The learned Counsel further submitted: From the narration of facts, it is abundantly clear that

even though the petitioner had become shareholder on 30.8.1982, the respondents/company had

manipulated the records to show as if the petitioner became a shareholder only on 28.1.2003. The

reason for being so is obvious. In terms of Article 38 of AOA, no share can be transferred to a non

member so long as any member is willing to purchase the same at face value. In the present case, the

admitted position is that B. Raheja group became a shareholder only on 15.1.1983 by acquiring

shares from Shah group. Since the petitioner had become a shareholder on 30.8.1982, Shah group

could not have transferred their shares to B. Raheja group without offering the same to the

petitioner. Just to deprive the petitioner of its pre-emptive rights under Article 38, the

respondents/the company have manipulated the records to show as if the petitioner became a

shareholder subsequent to 15.1.1983. The petitioner came to know of the fraud only in October,

2004 when it took an inspection of the register of transfers. In Dhananjay Pandey v. Dr. Bias

Surgical and Medical Institute Pvt. Ltd.125 CC 626. this Board has held that a person can be a

shareholder even if he is not in a position to show any evidence of having become a shareholder in

the company, if the same could be established from the records of the company. In the present case,

since the petitioner has come to know of his having become a shareholder on 30.8.1982 only in

2004, it has every right to agitate against the fraudulent manipulation of the records of the

company. It is to be noted that even in the sur rejoinder, the respondents have not answered as to

how the transferor of shares to the petitioner had ceased to be members as recorded in the

members' register on 30.8.1982 and the petitioner became a shareholder of the same shares on

28.1.1983. This itself would indicate that there have been manipulation in the records of the

company to deprive the petitioner of its pre-emptive rights of the shares transferred to B. Raheja

group only on 15.1.1983.

6. The learned Counsel further submitted: The respondents in their letter dated 29.10.2004 at

paragraph 6, have admitted that there are clerical errors in the register of members. Actually they

are not clerical errors but fraudulent manipulation. Therefore when there is a fraud, the question of

delay or latches do not matter. In Bengal Luxmi Cotton case 35 CC 187, it has been held that delay

cannot be a ground for depriving grant of relief if facts otherwise warrant. The signature of Shri

Ashok in the instruments of transfers cannot bind the petitioner as many transfers had taken place

without offering the shares to the petitioner. In Syed Shah Gulam v. Syed Shah Ahmed , it has been

held that in terms of Section 18 of Limitation Act, the limitation would start from the time of

discovery of the fraud. Since in the present case, the petitioner discovered the fraud only in Oct.

2004 and has tiled the petition in December, 2005, the petition is not barred by limitation. In Smt.

Indian Kanoon - http://indiankanoon.org/doc/285889/

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ... on 19 September, 2006

Aparna Ghose v. Shri Sarup Chand 20051 CLJ Cal. it has been held that the pre-emption rights

cannot be defeated by fraud. In S.P. Chengalvaraya Naidu v. Jagannath , it has been held that a

person coming to court with a falsehood should be thrown out at any stage of litigation. In the

present case, having committed a fraud, the respondents have come with a plea of error, which

cannot be accepted. In Bank of India v. Avinash D. Mandivikar , it has been held that in case of

fraud, even reasonable period for initiating proceedings does not arise. In State of Orissa v.

Varindavan Sharma 1995 3 SCC 249, it has been held that even in case of delay of 27 years from the

date of a transaction which was shrouded with suspicious features, since proceedings were initiated

immediately on coming to know of the said transaction, the court set aside the transaction.

7. The exclusion of the petitioners from exercising the pre-emptive rights is not an isolated act

relating only to the transfer of shares from Shah group to B. Raheja group but there were 29 further

such transfers effected by Raheja groups to non members some which are corporate entities,

without offering the shares to the petitioner. Transfers to corporate entities even within the group is

not permissible in terms of Article 44 of the AOA. Thus, there have been series of illegal acts and in

terms of Needle Industries case, such series of illegal acts constitute oppression. Therefore, the

shares transferred to B. Raheja group and all subsequent share transfers should be cancelled and the

shares should be offered only to the petitioner and not to other respondent shareholders as they

have been parties to the fraud committed.

8. The learned Counsel further submitted: The company is in the nature of a quasi partnership and

the petitioner entered the company with legitimate expectations of being in management. Presently,

the value of the hotel is over Rs. 700 crores and to exclude one of the equal partners from the

management is highly oppressive. The petitioner entered the company with the clear understanding

that the petitioner will have a right in the management of the company. He was appointed as a

director in 1981. For claiming that the petitioner ceased to be a director from May, 1982, the

company has not established how Shri Ashok ceased to be a director- whether he was not elected in

the general meeting or whether he resigned from the board or whether he vacated his office in terms

of Section 283(1)(g) of the Act. Even though the petitioner is the largest single shareholder holding

1/3rd of the shares, yet, it has been completely kept out of the management without any

representation. Since the petitioner has an apprehension that the respondents are siphoning of

funds of the company, to have a proper check on the funds and also on the basis of understanding

that it would participate in the management of the company, proportionate representation should

be directed. Further, by handing over the management of the hotel which is the sole undertaking of

the company to Merriot without the approval "of the shareholders, the respondents have acted

against interests of the company and the shareholders. Even though, an agreement was entered into

with Merriot in 2001, the respondents are not disclosing the details of the said agreement.

Obviously, the respondents are siphoning of funds of the company through this agreement. In the

balance sheet, many transactions with the firms and companies in which the respondents are

directors have been indicated. These contracts have not been entered in the register of contracts

under Section 301 of the Act and by these contracts, the respondents are siphoning of funds of the

company. The respondents do not care for the shareholders. Shri Vijay v. Raheja 13th respondent,

was appointed as MD in the board meeting held on 31.12.2003 for the period from 1.1.2004 to

31.12.2004. No intimation was sent to the shareholders about this appointment till 8.9.2004 when

Indian Kanoon - http://indiankanoon.org/doc/285889/

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ... on 19 September, 2006

the company sent a notice for the AGM on 30.9.2004 which included the item for his appointment.

Even though the petitioner sought for details about Shri P.B. Raheja by a letter dated 24.9.2004,

since the explanatory statement did not contain required particulars about him, without any reply,

his appointment was approved by the respondent shareholders. Presently, there are two joint

managing directors, one from K. Raheja group and other from B. Raheja group while the petitioner

has no representation.

9. Summing up his arguments, Shri Dave submitted: The allegations of the petitioners relating to

fraud and manipulations are against K. Raheja group. However, it is B. Raheja group which has filed

a detailed reply while K. Raheja group has only adopted the same. In Lohia Properties Pvt Ltd. v.

Atma Ram Kumar, it has been held that every allegation of fact in the plaint, if not denied in the

written statement, shall be taken to be admitted by the defendant. In the present case, since K.

Raheja group has not specifically denied the allegations of fraud etc., they should be deemed to have

admitted the allegations. Since B. Raheja group was not in the picture in 1982, they would have no

personal knowledge and therefore their reply affidavit has to be ignored. In State of Bombay v.

Pureshottam Jognaik 1952 SCR 674, it has been held that when a matter is deposed to is not based

on personal knowledge, the sources of information should be disclosed. In the present case, B.

Raheja group which has filed reply to the application has not done so. It is strange that beneficiaries

of fraud have defended the action while the committer of fraud has only adopted the said defence.

Since the petitioner has established oppression committed by the respondents by practicing fraud,

the relief sought for in the petition should be granted.

10.Shri Sundaram, appearing for Vijay Raheja group submitted: The admitted fact is that the

petitioner came as a 1/3rd shareholder and it continues to hold 1/3rd shares in the company.

Therefore, its claim for 88% shares in the company can never be accepted. Having accepted the

position of 1/3rd shareholder for over 20 years, and after the hotel has become operational, the

petitioner cannot challenge events that took place in 1982/83 on technical grounds. Such a claim

would be highly unjust and inequitable especially when it is the Rahejas who have nurtured the

company all the years including putting up a huge hotel on the vacant land. The sole claim of fraud

as alleged by the petitioner relates to B. Raheja group becoming a shareholder. In page 32 of the

petition, the petitioner has averred that sometime in 1989, the respondents informed the petitioner

that B. Raheja group had acquired the shares before the petitioner became a member of the

company on 28.1.1983. If the petitioner was aware of this in 1989, it should have sought for

enforcing its pre-emptive rights in 1989 but having failed to do so, it should be deemed to have

waived its right and cannot claim any right after 16 years. It is the petitioner's case that its name

should have been entered in the register of members on 30.8.1982 and when Shah group transferred

its shares on 15.1.1983, offer should have been given to the petitioner. Since its name was not in the

register of members on 15.1.1983(Exhibit -3), the question of making any offer to the petitioner did

not arise. Further, if the petitioner were to seek rectification of the register of members, it should

have filed a petition under Section 111 of the Act seeking for entry of its name in the register of

members as on 30.8.1982. Till such time such a rectification is made, the question of its exercising

pre-emptive rights does not arise. In other words, this petition itself is not maintainable as far as the

issues relating to shares are concerned. When shares were transferred from Shah group to B. Raheja

group, all the shareholders of K. Raheja group had given a no objection letter to the company in

Indian Kanoon - http://indiankanoon.org/doc/285889/

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ... on 19 September, 2006

terms of Article 38. Likewise, B Raheja group had also given a no objection letter to the company on

28.1.1983(Exhibit-7) when K. Raheja group transferred its shares to the petitioner. Therefore, no

shares could have been transferred in favour of the petitioner before 28.1.1983 without the content

of B, Raheja group. B. Raheja group signed the consent letter on 28.1.1983 after it became a

shareholder on 15.1.1983. The petitioner does not have any document or evidence to show that it

became a shareholder on 30.8.1982 other than basing its claim on errors in the register of

members/share transfer register. On. the contrary, its becoming a shareholder on 28.1.1983 is

evident from the instruments of transfers executed by Shri Ashok. The transfer forms at Exhibit -5

bear the stamp of ROC dated 8.1.1983 and therefore this instrument could not have been executed

earlier to this date. They were also signed on 28th January, 1983. The endorsement in the share

certificates bears the date of 28.1.1983 and the share certificates are in the possession of the

petitioner and as a matter of fact when the petitioner changed its name, the fact was also noted in

the share certificates. When the primary documents executed by the petitioner and the share

certificates bear the date of transfer as 28.1.1983 which is also reflected in the register of members,

the CLB cannot entertain the claim of the petitioner solely based on the incorrect entries in the share

transfer register. Therefore, there is absolutely no substance in the allegation that by fabricating the

date of its becoming a member to a later date, the petitioner had been deprived of the pre-emptive

rights. In so far as proportional representation on the board is concerned, the petitioner has relied

on legitimate expectation. For over 20 years the petitioner never tried to enforce the said

expectation. Further, the association of the petitioner now on the board would be completely against

the interest of the company as even without being on the board, the petitioner has been creating all

sorts of hurdles in the working of the company. Since neither any act of oppression nor

mismanagement has been established, this petition should be dismissed.

11. Shri Sarkar, Senior Advocate, appearing for Rajan Raheja group submitted: The foundation of a

petition under Section 397 is that the petitioners should hold undisputed shares. Further, according

to its own averment in page 7 of the petition, the petitioner was to have only 1/3rd shares in the

company which arrangement still continues even after further issue of shares. The proprietary rights

of a member start from the date of his becoming a member and cannot arise from an earlier date by

seeking for pre-dating his membership. When the instruments of transfers bear the date of

28.1.1983, the petitioner could never claim to have become a member prior to that date. In terms of

Section 108, the provisions of which are mandatory, the company could not have registered the

transfer without instruments of transfer in 1982 and even if had done so, the same would be void in

terms of Section 108. It is for the petitioner to prove that it had lodged requisite transfer

instruments to the company along with share certificates in 1982 and accordingly the company had

registered the transfer in his favour in 1982 and thereafter had fabricated the documents. The

petitioner has not done so while the company has produced instruments of transfer dated 28.1.1983.

In terms of Section 84 of the Act, it is the share certificate which shall be prima facie evidence of the

title of a member to such shares and since in the present case, the share certificates bear the date of

28.1.1983, the petitioner had become a shareholder only on that date. Even the register of members

indicates only that date as the date of the petitioner becoming a shareholder. Even though, in terms

of Articles, register of transfers has to be maintained by the company, no statutory presumption can

be raised in terms of the entries made therein. There is no prayer in the petition to put the name of

the petitioner as a shareholder in August, 1982 as against January, 1983. Without that prayer, and

Indian Kanoon - http://indiankanoon.org/doc/285889/

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ... on 19 September, 2006

granting of the same, no other direction can follow. Even for granting the said relief, there should be

supporting primary documents as per law. It is to be noted that the petitioner has not challenged the

date of 28.1.1983 as recorded in the transfer instruments and as a matter of fact, these instruments

have been signed by Shri Ashok himself as a director of the petitioner. Therefore, neither in law nor

in equity, he can claim that the petitioner had become a shareholder in August, 1982. Since it has

been held in Mannalal Khetan case AIR 1977 SCC 536 that the provisions of Section 108 are

mandatory, in the absence of any primary records, like instruments of transfers executed in 1982,

the petitioner cannot claim membership effective from 1982 even if the company had wrongly

entered the petitioner's name in the register of members as the same would void and the only course

available to this Board is to delete the illegal entry. In Vasudev Ramchandra Shelat v. Pranlal

Jayanand Thakar 1974 SC 728, it has been held that to claim antecedent rights, the transferee

should be in possession of share certificates along with signed blank transfer forms. In the present

case, the petitioner cannot claim the antecedent rights as the transfer instruments are dated only as

28.1.1983. In a petition under Section 397, one cannot ask for relief regarding shares already held.

In terms of Article 38, if members holding 2/3 of the shares approve the transfer to an outsider,

then there is no need to offer the shares to other members. Therefore, even assuming that the

petitioner had become a shareholder as claimed by him on 30.8.1982, for transfer of shares from

Shah group to B. Raheja group, there was approval from 2/3rd shareholders, namely Shah group

and K.Raheja group for transfer of shares to B. Raheja group and therefore, the petitioner could not

have sought for exercising the preemption rights. Further, in terms of Article 38, no vested right is

created in any shareholder in terms of the pre-emptive clause and the said transfer has to only be

cancelled and no other shareholder can ask for the shares as a matter of right. This Board has held

so in In Cruickshank Company Ltd. v. Stridewell Leathers Private Ltd. 86 CC 439.

12. In so far as the claim of the petitioner for a representation on the board is concerned, the

petitioner cannot have any legitimate expectation as it had its nominee on the board even before it

became a shareholder. In other words, its acquiring shares being later in time, such acquisition

cannot create any legitimate expectation of being in management by virtue of the shareholding.

Since the petitioner had already a nominee on the board, it was requested to invest and accordingly

it did so. The nominee of the petitioner, Shri Ashok was appointed as an additional director on

26.6.1981 to hold office up to the date of next AGM. Since he was not elected as a director, he ceased

to be a director effective from 25.5.1982. In page 31 of the petition, it is stated that the petitioner

realized in 1989 that its nominee had been removed as a director. If the petitioner had this

knowledge in 1989, it cannot agitate this issue in 2005. It is on record, as stated by the petitioner in

page 34 of the petition, that disputes had started in 1989 and in spite of that the petitioner

subscribed to the right shares offered in 1990. Even then, in its letter dated 7th September,1989

Annexure A-9), the petitioner while asking for various documents on the ground that it had not

received any notices for any meetings after it had become shareholder of the company, did not raise

the issue of directorship. This letter was replied on 16.9.1989 by the 10th respondent who belongs to

B. Raheja group. Thus, the petitioner was aware that B. Raheja group had become a shareholder of

the company even at that time. If the petitioner had slept over its rights for over 15 years, it cannot

invoke equity in its favour. As a matter of fact, Shri Ashok entered into an understanding with the

10th respondent that the shares held by the petitioner would be transferred to the other

shareholders as is evident from Annexure A-11 and 12. In his letter dated 5.10.1989 (Annexure

Indian Kanoon - http://indiankanoon.org/doc/285889/

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ... on 19 September, 2006

A-12), Shri Ashok had questioned the claim of the 10th respondent that the former had agreed to

transfer the shares held by the petitioner, on the ground that Ashok had never been authorized by

the petitioner to negotiate for such a sale. If he had not been authorized, then, the question of any

oral agreement with him regarding participation in the management does not arise. Only in this

letter, Shri Ashok had voiced his grievance that he had not been receiving notices for meetings even

though he was a director of the company. However, in subsequent letters, there was no whisper

about directorship nor about B. Raheja group being a shareholder in the company. In paragraph 4 of

his letter dated 12th Oct. 1989 (Annexure A-14) to Shri Ashok, the 10th respondent had pointed out

that the two Rahejas being 2/3rd owners of the company, Shri Ashok P. Hinduja had agreed earlier

to transfer the shares held by the petitioner so that two Raheja groups could fully own the company.

Therefore, the petitioner was fully aware that B. Raheja group had become a shareholder and it

never enquired as to how and when B. Raheja group become a shareholder since Shri Ashok was

fully aware of the facts. In the same letter, the 10th respondent informed Ashok that the latter was

not entitled to be a director as he did not hold any qualification shares. In its letter dated 22.2.1990,

the petitioner had reiterated that it would continue to maintain 1/3rd shareholding in the company

(Annexure A-16).

13. Dr. Singhvi appearing for Chandu Raheja group submitted: It is for the petitioner to discharge

the burden of proving that it was the transferee of shares in 1982. It has only relied on the

company's non statutory, non prescribed register to claim the right of membership from August,

1982. The company never communicated to the petitioner that it was a shareholder in 1982 nor any

record in the ROC depicts likewise. Neither the respondents nor the company had acted on the basis

that the petitioner had become a shareholder in August, 1982 to claim estoppel against them. The

petitioner cannot claim that half of the entries in the register of transfer are correct while the other

half is wrong. In State of Bihar v. Radhakrishna Sinh , the Supreme Court has held that a petitioner

has to discharge his burden by proving the facts alleged by him, and that the defendants could not

be called upon to rebut the claim of the petitioner. Similarly, in Meenakshi Ammal v.

Chandersekharan wherein it was alleged that the Will had been executed under undue influence, the

Supreme Court held that the onus of proving undue influence is upon the person making such

allegation and mere presence of motive and opportunity are not enough. In the present case, while

alleging fraud, the petitioner has not given any proof or evidence to substantiate the same. The very

fact that the company has produced all the registers would indicate that it had nothing to hide. The

retention of the old registers alleged to have been fabricated itself is the best proof of the honesty of

the respondents. Further, the petitioner knew at least in 1989 that B. Raheja group had become a

shareholder. There is no explanation as to why the petitioner waited for so long to allege fraud etc.

Knowledge coupled with the silence and inaction would amount to latches, waiver and estoppel.

When one does not assert his right even when there was a fraud, he has no remedy. Third party

rights enjoyed for over 20 years cannot be undone on the plea of unsubstantiated fraud. In case of

bilateral relationship, latches will squarely apply and there is no larger public interest to ignore the

latches. Likewise, equitable consideration does not override latches and discretion should not be

exercised in favour of a person who has not asserted his alleged rights. In Ferro Alloys Corporation

Ltd. v. Union of India , the Supreme Court has held that once a party acquiesces and has consciously

waived its rights, the party can be non suited on the ground of estoppel.

Indian Kanoon - http://indiankanoon.org/doc/285889/

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ... on 19 September, 2006

14. Shri Devitre appearing for K. Raheja group submitted: To claim the principles of quasi

partnership, the petitioners have not produced any written agreement to that effect. The person who

has affirmed the petition joined the 1st petitioner company only in 2004 and as such he cannot

claim any oral agreement that the company would be managed in the guise of a quasi partnership

when the petitioner entered the company in 1982/1983. Even the subsequent-conduct that the

petitioner never asserted its right of joint management for over 20 years would indicate that even

the alleged oral agreement had never been insisted or acted upon. The very fact that in para 6.4 of

the petition it is averred that right from the beginning, the representative of the petitioner has been

kept out of the management would indicate that there could have been no agreement of joint

management. As a matter of fact, this averment itself could be destructive of the alleged oral

agreement. Shri Ashok was appointed as a director in June, 1981 and ceased to be so in May, 1982.

Thereafter, he never took any interest in the company even after being categorically informed in

1989 that he was not a director. The prayer of the petitioner at "L" at page 69 that his removal as a

director in 1982 should be declared as illegal cannot be granted in the year 2005. Therefore, the

petitioner cannot seek proportional representation and rejection of the same is not an act of

oppression. Further, there is no deadlock in the board and the company has been making profits

and it has also declared dividend which has been accepted by the petitioner. The very fact that the

petitioner's holding of 1/3ld right from the beginning has not been disturbed itself would show that

the respondents have been acting fairly. In so far as the alleged fraud relating to the entry of the

petitioner as a member is concerned, mere entry in the register of transfer de-hors the factual

aspects of the dates in the transfer forms/share certificates and register of members cannot give the

petitioner to right to claim membership effective from 30.8.1982. In terms of Section 164, entry in

the register of members in terms of Section 150 is prima facie evidence of the date on which a

person becomes a shareholder and in terms of Section 184, the share certificate shall be prima facie

evidence of the title of the member to such shares. In the present case, both the register of members

and the share certificates bear the date of 28.1.1983 which prima facie establishes that the petitioner

became a shareholder only on that date. Further, both the main allegations relating to date of entry

as a member and removal as a member are hopelessly time barred. In paragraph 6.6, the petitioner

has averred that in a meeting held on 27.8.1989, Shri Ashok came to know that Shah group had

exited and Rahejas had taken over the estates. Further, it is also stated in the last line of that

paragraph that the respondents had misled the petitioner that he would not succeed in obtaining

legal redress and therefore had to remain silent and continuously subscribe to the shares offered to

maintain its share in the venture and appreciation of value in the assets. This itself would show that

the petitioner had acquiesced to the state of things and remained content with 1/3rd shares in the

company. There were 5 subsequent right issues which were all subscribed to by the petitioner

knowing frilly well that Raheja group as a whole held 2/3rd shares in the company. The very fact

that the petitioner never took interest in the company would indicate that it is nothing but an

investor and it is Rahejas who had all along nurtured the company to build a 5 Star Hotel. In spite of

the fact that in terms of Article 9 of the AOA, the board has full powers to allot shares, the

respondents never varied the shareholding of the petitioner and were offering right shares all the

time. This itself would show the bonafide of the respondents. One another important aspect to be

noted is that the authorized representative of the petitioner took inspection of various records of the

company in 1993, including the register of members and obtained a copy of the same and therefore

the petitioner was aware that B. Raheja group had become a shareholder. Further, the affidavit filed

Indian Kanoon - http://indiankanoon.org/doc/285889/

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ... on 19 September, 2006

by the deponent of the petitioner is not in conformity with the CLB Regulations. The very fact that

the deponent has relied on an alleged oral agreement to which he could not have been a party since

he joined the company only in 2004, on this sole ground that the petition deserves to be dismissed.

The petitioner has not established discovery of any new material which was not available in

1989/1993 to file the petition belatedly in 2005. This undue delay has actually prejudiced the

respondents in the sense that they are not in a position to provide any relevant evidence to

substantiate their stand. Further, as held in Sangram Sink P. Gaekwad v. Shantadevi P. Gaekwad

and Bagri Cereals case 105 CC 465, the petitioner should establish that the company deserves to be

wound up on just and equitable grounds.

15. Shri S.N. Mookherjee, Sr. Advocate for A. Raheja group submitted: On the basis of the averments

of the petitioner in the petition itself, the petition deserves to be dismissed with cost. From the

averments of the petitioner in paragraph 6.3.2 to 6.3.6, it is evident that the petitioner knew that the

transfer to its name was effected on 28.1.2003 at which time Shah group was not a shareholder. If

the claim of quasi partnership was with Raheja group and Shah group, then, he should have

protested at that time itself. Therefore, the petitioner has not come with clean hands. In the petition,

the petitioner conveniently omitted to disclose the share certificates. The petitioner deliberately

withheld the document. Further, when the transfer instrument bears ROC stamp as of 8.1.1982, no

transfer could have been effected before that date. Therefore, the claim of the petitioner that there

was delay in registering the transfer of shares is baseless. In Needles case AIR 1981 SC 1898 the

Supreme Court has held that a person who comes to equity must come with clean hands and if he

does not, he cannot ask for relief on the ground that the other man's hands are unclean. Likewise, in

S.P. Chemgalvaraya Naidu v. Jagannath, it has beenheld that non disclosure of relevant and

material documents with a view to obtain advantage amounts to fraud. The aim of the petitioner, on

the basis of entries in the share transfer register that he should have been entered as a member in

August, 1982 cannot be accepted in view of primary documents indicating otherwise. In terms of the

entries in share certificates, the petitioner became a shareholder only on 28.1.1983. In Satish

Chandra Sanwarka v. Tinplate Dealers Assn. Pvt. Ltd. 1998 2 CLJ 354, this Board has held that even

in case of dispute between the entries in the share certificate and the share register, the prima facie

evidence through share certificates under Section 84 gets precedence over prima facie evidence of

register of members under Section 164 for the reason that the register of members being under the

control, of the company is susceptible to manipulations. In Maneckji v. Wadilal AIR 1926 PC 38, it

has been held that the title to get on the register consists in the possession of a certificate together

with a transfer instrument signed by the registered holder. In the present case, the instrument of

transfer has been signed only on 28.1.1983 and therefore the petitioner could get the right to get into

the register of member on that day or later and not before. Having all along exercised rights as a

1/3rd shareholder, he cannot claim anything higher now on flimsy grounds. It is to be noted that

even after carrying out inspection in September, 2004, in the letter dated 20.5.2005 (Annexure

A-55), the petitioner has sought for a representation on the board on the ground that it was holding

33% shares in the company. In other words, even after finding out the alleged fraud in September,

2004, the petitioner did not assert its alleged right. Even when dividend was declared in accordance

with entries in the register of members, the petitioner never protested. It is not in dispute that it is

the respondents who have nurtured the company and have given personal guarantees. No

mismanagement has been alleged. Presently, the hotel has been given on management contract to

Indian Kanoon - http://indiankanoon.org/doc/285889/

10

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ... on 19 September, 2006

Marriot and none of the directors is getting any remuneration.

16. In rejoinder, Shri Dave submitted: When the petitioner entered the company, it was with certain

understanding and expectation. Therefore, when the understanding has been breached and the

expectation has not been fulfilled, the petitioners can always allege oppression and mismanagement.

Even in the register of members, the transferors of the shares transferred to the petitioner had been

shown to have ceased to be members on 30.8.1982. If so, then, the petitioner being the transferee

should also have been entered as a member on that date. There is no explanation from the

respondents as to how the shares could be in limbo during this period. However, its name has been

entered in the register of member only on 28.1.1983 notwithstanding the fact that in the share

transfer register the transfer is shown to have been effected on 30.8.1982. Whether it is a fraudulent

manipulation as claimed by the petitioner or a mistake as claimed by the respondent has to be

decided on the basis of the motive of the respondents. It is to be noted that neither the K. Raheja

group nor the company in the affairs of which the allegations have been made has filed any reply. In

Charanjit Lal Choudhary v. Union of India , it has been held that in case of allegations against the

company, it should defend.. In Dhananjay Pande v. Dr. Bias Surgical & Medical Institute Pvt. Ltd.

125 CC 626, this Board has held that even when the petitioner was not in a position to establish that

he had been allotted shares by producing any documentary proof, yet, the Board on the basis of the

circumstances held that there was a pre- ponderance of probabilities that shares had been allotted to

the petitioner. When the share records indicate that the petitioner had become a shareholder on

30.1.1982, the same should be taken as conclusive proof of the petitioner having become a share

holder on that date. In a quasi partnership, directors owe duty to all the members. Since the

petitioner is an outsider, with a view to grab the control of the company by way of manipulation of

the records, the shares held by Shah group had been transferred to other Raheja group. In terms of

Article 2(o) of AOA, shareholder or members mean duly registered holders from time to time of the

shares of the company. In view of the entry in the shares transfer register indicating the date of

transfer as 30.8.1982, the petitioner had become registered holder on that day and therefore

pre-emptive rights in respect of all subsequent transfers vest in the petitioner. The contention of the

respondents that if shareholders holding not less than 2/3rd of the share capital approves the

transfer, there is no need for offering to other shareholders cannot be accepted as transferor cannot

be a party to such an approval. The 2/3rd approval would arise only when no other member willing

to purchase the shares. The Raheja groups have subsequently transferred substantial number of

shares to entities within their control which could not have been done without making an offer to

the petitioner as in terms of Article 44, the transfer could be among close relations and individuals

and not to corporate entities. Since fraud has been established beyond doubt, even though petitioner

would be entitled to 88% shares in the company, yet, the petitioner is prepared to accept 50% shares

so that there is equality between Rahejas and the petitioner. Similarly, the petitioner should also get

equal representation on the board.

17.Shri Sarkar, in rejoinder, submitted: It is strange that having agreed to be 1/3'd shareholder and

thereafter claiming 88% shares in the company and now the petitioner claims 50% shares. The

petitioner has not produced any evidence that there was an agreement that if one group were to go

out of the company, the other two groups would have equal shares. Even assuming that the claim of

the petitioner that it had become a shareholder on 30.8.1982, in the absence of any instrument of

Indian Kanoon - http://indiankanoon.org/doc/285889/

11

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ... on 19 September, 2006

transfer, the entry in the register would be void in terms of Section 108 of the Act. Right to title to

property has to be in accordance with law and any lapses or mistake or even assuming fraud on the

part of the company cannot give a title to the petitioner. Since the petitioner derives his title from

the transferor, only the date on which the transferor signs the instruments of transfer, the petitioner

could get title from that date. It is on record that the transfer instruments bear the stamp of ROC as

8.1.1983 and the instruments could have been signed by the transferors only on that day or

thereafter. In so far as the allegation relating to entries in the minutes book is concerned, the person

writing the minutes expired in 1992 and therefore, it is not possible to ascertain the reasons for the

difference. Further, the minutes book is a bound one and not maintained in loose leaf form which

could be manipulated/fabricated. Article 38 refers to 2/3r shareholder and does not exclude the

transferor in computing the 2/3rd shares.

18. I have considered the pleadings, arguments and written submissions. After the conclusion of the

hearing on 12.4.2006, the petitioner filed an application CA 138 of 2006 dated 8.5.2006 pointing

out that the photocopies of page numbers 99 and 100 of the minutes book were got verified from a

handwriting expert who has given the opinion that the writings in the two pages are not of the same

person clearly indicating that there has been manipulation. In the written submission, it has been

submitted that in page No. 99 it is recorded that the notice calling for the meeting was read and in

page No. 100, the minutes record the termination of the meeting. No meeting would be called

without having some business to transact. When in the register of members, it is recorded that the

transfer of shares to the petitioner was approved in the board meeting held on 30 th August, 1982

and when the minutes do not show any business having been transacted, it is quite obvious

considering the fact that page No. 99 and 100 are not in the same handwriting and that page No. 101

has been scored out would indicate that the business transacted on that day approving the transfer

has been erased. It is also submitted in the application that if necessary, this Board should obtain a

handwriting expert opinion afresh to ascertain whether the handwriting in page No. 99 and 100 are

of the same person. In the reply to this application, the respondents have contended that the

petitioner has not made out any case of manipulation of records and that the allegation relating to

the minutes are inconsequential and incorrect and does not amount to "tampering" and that even

the hand writing experts opinion only shows difference in the hand writing and it does not even

whisper of "tampering."

19. Before I deal with the merits of the case, the issue of limitation raised by the respondents has to

be dealt with. It is contended that since Shri Ashok himself has admitted that in 1989, he was

informed of the entry of B. Raheja group as members and he had also been corresponding with the

10th respondent who is a member of B.Raheja group, the petitioner cannot challenge admission of

the B.Raheja group now after a delay of over 15 years. It is also contended that the petitioner had

taken inspection of the records of the company in 1993 and therefore must have been aware of the

alleged manipulation of records and therefore, its silence during all these years, would amount to

waiver, acquiescence and would act as estoppel. As against this, the petitioner contends that it came

to know of the manipulations in the share records of the company only in 2004 and therefore, there

is no delay in approaching this Board. In paragraph 6.6 of the petition, the petitioner has averred It

also transpired at this meeting that Shah group has exited and the Raheja group had taken over

their shares and effective control over the company contrary to and in breach of the agreement and

Indian Kanoon - http://indiankanoon.org/doc/285889/

12

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ... on 19 September, 2006

understanding referred to above. Mr. Ashok P. Hinduja was also informed by the said respondents

that the shares of Shah group have been transferred and registered in favour of Raheja group even

prior to transfer and registration of even a single share in favour of the petitioner and that, in view

thereof, the petitioner has no remedy in view of the restrictive provisions regarding transfer of

shares contained in the Articles of Association of the respondent company. The petitioner was

misled by the statement of the said respondents and was misled into believing that the petitioner

will not succeed in obtaining legal redress and therefore had no choice but to remain silent and to

continuously subscribe to the rights offer to maintain its shares in the venture and appreciation of

the value in assets . According to the respondents, this averment would indicate that the petitioner

was aware of the entry of B. Raheja group as members of the company and since it had not

challenged the same for over 15 years, it would amount to waiver, acquiescence and estoppel. I am of

the view that this averment would in no way prejudice the right of the petitioner to file this petition

as only after inspection of the share records of the company in 2004, he has alleged that B. Raheja

group had entered the company by manipulation of records which knowledge the petitioner did not

definitely have in the year 1989. Further, I have seen the report of the inspection carried out by the

petitioner in January, 1993. While the report shows that register of members had been inspected,

neither the share transfer register nor the board minutes had been inspected which are the primary

records on the basis of which, after taking inspection of the same in 2004, the petitioner alleges

fraudulent manipulation. Therefore in so far as the challenge to the transfer of shares to B. Raheja

group is concerned, I do not find that this petition is time barred as the cause of action for the

petitioner to file this petition has arisen only after inspection in 2004. The cases cited by the learned

Counsel for the petitioner viz Syed Shah Gulam, Bank of India and State of Orissa (supra) are

applicable, while the case of Fero Alloys Corporation Ltd. cited by the respondents is not applicable.

20. Before dealing with the main allegations, I consider it proper to deal with certain peripheral

issues raised by the petitioner. According to the petitioner, the company could not have entered into

a contract with Marriott without the approval of the members in a general meeting as in terms of

Section 293(1)(a), the approval of the shareholders is necessary. Provisions of Section 293 are

attracted only in cases of sale, lease or otherwise disposal of an undertaking. In hotel industry, it is

common to enter into a management contract with reputed international hotel chains, which uses

its expertise in manning and managing the hotel for an agreed consideration as management fees.

The entire revenue accrues to the company. The property does not vest in the hotel chain. Therefore,

in such contracts, no sale or lease is involved to apply the provisions of Section 293(1)(a). From the

balance sheets of the company for the past two years, I find that the hotel has done exceptionally

well under the management contract, which enabled the company to declare handsome dividends.

Except expressing an apprehension that that by this contract, the respondents might be siphoning of

funds of the company, no other instances of mismanagement is alleged except that certain statutory

records are not maintained property. In so far as the allegation that the petitioner is not allowed

access to records of the company is concerned, from the documents attached with the petition itself,

I find that the petitioner has been repeatedly asking for information and on every occasion, the

company has provided the same. The petitioner has also complained that since it had made

allegations of fraud etc against K.Raheja group and the company, they have not filed any counter but

the counter has been filed only by B.Raheja group. It is to be noted that the entire petition is based

on an understanding with Shri Ashok, but, he has not filed the petition, but the petition has been

Indian Kanoon - http://indiankanoon.org/doc/285889/

13

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ... on 19 September, 2006

filed by an employee who has joined the petitioner only in the recent past, who would have no

personal knowledge of the alleged oral agreement. Thus the decision in Purshotam Jognath, cited by

the learned Counsel against the K.Raheja group is squarely applicable to the petitioner also.

However, even though the main counter has been filed by B.Raheja group, yet all other respondents

have filed affidavits adopting the said counter and all of them were also represented during the

hearing. Therefore, the decision in Lohia Properties Ltd. that if allegations are not denied by the

persons against whom the same are made, then the allegations should be taken as admitted, is not

applicable. The petitioner has made allegations against the appointment of MD, which I do not

consider necessary to deal with as the said appointment has been approved in a general meeting

attended by the representative of the petitioner.

21. In so far as the merits are concerned, the entire claim of the petitioner in regard to shares rests

on two premises. One is that in terms of Article 38, the petitioner had pre-emption rights and the

second is that to deprive the petitioner of the said pre-emptive rights, the respondents had

fraudulently manipulated the share records. Article 38 reads A share may be transferred by the

member or other persons entitled to transfer the same to any member selected by the transferor or a

person approved by the holders of not less than 2/3rd of the issued capital of the company, but save

as aforesaid, and save as provided by Articles 42 to 45 hereof, no share shall be transferred to a

person who is not a member so long as any member is willing to purchase the same at the face value.

From this Article, it is apparent that shares could be transferred by a member to another member

selected by him and that unless shareholders holding not less than 2/3rd of the issued capital

approve, shares cannot be transferred to a non member but has to be offered to a willing existing

member. In other words, except in case of transfer of shares from a member to another member and

transfer to an outsider with the approval of holders of 2/3r of the shares, no transfer can be

transferred without offering the shares to the existing members. In other words, the existing

members have a right of pre-emption and if the procedure prescribed under Article 39 and 40 is not

followed in terms of the pre-emption right, any transfer effected shall be invalid.

22. Now, the claim of the petitioner relating to pre-emption right in respect of shares transferred

from Shah Group to B Raheja Group. This claim is based on the allegation that there had been

fraudulent manipulation in the share records of the company i.e. share transfer register and register

of members. Additionally it is also claimed that the minutes of the board meeting on 30.8.1982 have

been fabricated by removing/erasing the decision of the board approving the registration of transfer

of shares in favour of the petitioner on that date. Four shareholders belonging to L. Raheja group

had transferred their shares to the petitioner. A perusal of the share transfer register shows that

there are two different sets of entries in respect of the shares transferred by that Group to the

petitioner. On 30.8.1982,there are three entries indicating transfer of shares to the petitioner noting

the consideration at Rs. 100/- per share. The serial numbers of these transfers are 22,23 and 24. It is

also indicated against these entries that the board had approved the registration on 30.8.1982.

However, there is no entry relating to transfer of 33 shares from Ms Kaushlya Raheja to the

petitioner on 30.8.1982. In serial numbers 35 to 38 of the share register, again entries are found

relating to transfer of the same shares on 28.1.1983 with consideration noted at Rs. 200/- per share.

The transfer of 33 shares from Ms Kaushalya Raheja to the petitioner also finds a place. Similarly, as

pointed out by the petitioner, in the members' register, the transferors of the shares to the petitioner

Indian Kanoon - http://indiankanoon.org/doc/285889/

14

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ... on 19 September, 2006

have been shown to have ceased to be the members on 30.8.1982. In the register of members, in

Folio number 29 relating to the petitioner, the corrections, in the dates of transfer are clear and

distinct. From the photo copy of the minutes of the board meeting held on 30.8.1982, it is seen that

the handwritings in page 99 and 100 are apparently different and no Board would meet to transact

"NIL" business. In other words, the petitioner has established that there are discrepancies in the

nature of corrections, additions, alterations, deletions and omission in the register of members,

share transfer register as also in the minutes. The respondents do not contest these discrepancies.

The only difference in the stand of the petitioner and that of the respondents is that the petitioner

claims fraudulent manipulation of records while the respondents contend that they are correction of

errors. Errors could occur by mistake on one or two occasions and in one record or two records but

multiple corrections in many records like register of members, share transfer register and the

minutes of the Board meeting etc could justifiably give rise to the claim of fraud as alleged by the

petitioner.

23. Whether the respondents have made the changes in the share records fraudulently is the issue to

be considered. Fraud means cheating or deceiving a person to his injury and it aims at the

disadvantage of another. Likewise, to defraud means to deprive one of his some rights, interests in

or of property by deceitful devices. Therefore, in the present case, to claim fraud on the part of the

respondents, the petitioner has to establish that it had been deprived of certain rights or interests

which it had and which has been affected by the alleged fraudulent manipulation of records.

24.The entire case of the petitioner regarding its rights is based on the share records of the

company. To rely on the share records of the company that the petitioner had become a shareholder

on 30.8.1982, it has to establish, if not categorically, atleast prima facie, that the original share

records reflected the true state of affairs on that date i.e. the petitioner was entitled to be a member

on that date and therefore, the records reflected the same. In other words, it has to corroborate this

fact independently of the share records. When a person alleges the existence of a particular state of

affairs, it is for him to establish the same by proper material/evidence and the burden to do so is on

that person. Radhakrlshna Sinh case- supra Legally a person is entitled to become a shareholder on

transfer only if he has paid the consideration for the shares and is in possession of share scripts

together with instrument of transfer and has lodged the same with the company. In the present case,

the petitioner has not established any of the above as on 30.8.1982. It has not even averred in the

pleadings that it had paid the consideration on or before 30.8.1982 or that it had received the share

scripts from the transferors or that the transferors had executed transfer instruments in favour of

the petitioner before that date and they were lodged with the company. Unless and until its

entitlement to the shares on 30.8.1982 is established, it can not allege fraudulent manipulation of

records since this alleged manipulation of records has not deprived the petitioner of its rights or

interests in the shares to which the petitioner has not established that it was entitled to on

30.8.1982. On the contrary, the details available in the instruments of transfer indicate that the

petitioner could not have become a shareholder earlier than 8.1.1983, since the ROC seal as found

on all the four instruments of transfer bears the said date. In other words, transfer instruments

could not have been executed before that date. The date of execution is shown as 28.1.83 and it has

been signed by Shri Ashok on behalf of the petitioner as the transferee. The share scripts as available

with the petitioner bear the date of transfer as 28.1.1983. Further, even though in the petition, it has

Indian Kanoon - http://indiankanoon.org/doc/285889/

15

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ... on 19 September, 2006

been averred that the correct consideration pain for the shares was Rs. 100/- per share, the

instrument of transrer indicate that the consideration paid was Rs. 200/- per share and the same

has been noted in the register of transfer on 28,1,1993. Thus, how the petitioner has averred in

paragraph 6.3.6 of the petition that there was a deliberate time lag in completion of formalities for

transfer and registration of the shares in the name of the petitioner and intimation thereof came in

January 1983 is not clear. Even though no statutory pre-emption is provided in the Companies Act

in respect of entries in the register of transfers, assuming that since Article 37 provides for

maintenance of a register of transfer, this Board has taken a decision in Tinplate Dealers Association

case (supra) that in case of disputes in relation to entries in the register of members and share

certificates, the prima-facie evidence in respect of share certificates under Section 84 gets

precedence over prima-facie evidence of register of members under Section 164 for the reason that

the register of members being under the control of the company is susceptible to manipulation. In

the present case, admittedly the share certificates indicate the date 28.1.1983 as the date of entry of

the petitioner as a member. If the petitioner were to challenge that the share certificates should bear

the date of its entry as 30.8.1982, then, as I have already pointed out, it should establish the same

with proper 'evidence with independent materials, which the petitioner has not done. Even

assuming that the Board had in fact approved the transfer on 30.8.1982 and accordingly entries

were made in the register of transfers on that day, in the. absence of any proof that the petitioner

had lodged the transfer instruments along with the share scripts, even the approval by the Board

would be void in terms of Section 108. The main contention of the petitioner is that it had been

deprived of preemption rights. There is nothing in record to show that when the entries were made

in the register of members on 30.8.1982 indicating that the petitioner had become a shareholder on

that date, Shah group, being the other shareholders on that day, had given a no objection as it would

been entitled for the pre-emptive rights. However, in respect of the transfer on 28.1.1983, B Raheja

Group had given a no objection for transfer of shares by L Raheja Group to the petitioner. The

petitioner has relied on the decision of this Board in Dr. Bais case, wherein, even though the

petitioner was not a registered member of the company, yet, this Board treated him as a share

holder for the purposes of maintaining the petition in terms of Section 399, when his locus standi

was challenged. It was a case of allotment of shares and the petitioner had paid application money of

Rs 148 lakhs and the dispute was whether he had become a member by allotment of shares or not.

In a civil suit against the company, the petitioner claimed the money invested by him as share

application money but the company contested the same on the ground that since shares had been

allotted to the petitioner, he could not seek refund of his investment. In the present case, there is

nothing on record to show that either the respondents or the company had treated petitioner as a

shareholder before 28.1.1983. Therefore, the decision in that case has no application. Thus, on an

over all assessment of the facts, I find that the allegation of the petitioner that there had been

fraudulent manipulation of share records of the company with a view to deprive of the petitioner of

its pre-emption rights has not been established. Even otherwise, transfer of shares in breach of the

pre-emption clause would only invalidate the transfer, and the shares transferred shall revert back

to the transferor and no other shareholder, as a matter of right, can seek for acquiring the shares

unless the transferor once again makes an offer. In other words, no vested interest is created in any

member to seek for acquisition of shares, the transfer which has been declared to be bad due to

non-compliance with the provisions of the pre-emption Clause (Cruickshank casesupra).

Indian Kanoon - http://indiankanoon.org/doc/285889/

16

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ... on 19 September, 2006

25.In this connection, I may only point out that in the petition itself, other than discrepancies in

relation to the impugned shares, the petitioner has also pointed out various other deficiencies both

prior to and after the transfer of the impugned shares and in relation to transfer of shares to other

members also. This would only indicate that the records maintenance in the company isnot up to

the mark.

26. Assuming, that the contention of the petitioner that it had become a shareholder on 30.8.1982 is

correct, the next issue for determination is whether it would have got the entire 633 shares

transferred by Shah group in exercise of the pre-emptive rights. In the matter of transfer of shares,

the provisions of the Articles have to be strictly followed. In terms of Article 39, the transferor has to

issue a transfer notice to the company and in terms of Article 40, the company has to find a

purchasing member. It would mean, that to find out a purchasing member, the company has to

issue notices to all the existing members. The Articles do not specify the modalities to be adopted if

there were more than one willing/purchasing member. This being the case, an equitable way of

distribution would be to offer the shares in proportion to the shares applied for. It is on record that

even after K. Raheja group had transferred 633 shares to the petitioner, 3 other shareholders

belonging to K. Raheja group continued to hold shares as on 15.1.1983 when Shah group transferred

their shares. They are Kausalya Raheja, Sheela Raheja and Joyti Raheja. Since group concept has

not been provided in the Articles, everyshareholder, irrespective of the group, would have to be

treated as a member for the purposes of pre-emptive rights, as, in the matter of transfer of shares

the provisions in the Articles override any private agreement regarding the same. (V.B. Rangaraj

case73 CC 201). If all the thred had applied, then, the petitioner would have been entitled to only

1/4th of the shares transferred by Shah group. Therefore, to consider that the petitioner was entitled

to all the shares, it has to be presumed that the petitioner alone would have applied for all the shares

and that the other three shareholders would not have applied for any share. No one can claim a right

on the basis of assumptions and presumptions. Therefore the foundation on which the petitioner

has staked its claim that if its name had been entered in the register of members on 30.8.1982, it

would have acquired the entire shares of Shah group, is not only very weak but also unsustainable.

27. One important aspect which I would like to mention is that it is the averment of the petitioner

itself that before it became a shareholder, it was K. Raheja Group which held 66% of the shares of

the company and it had agreed to transfer 33% shares to the petitioner so that it could have 1/3r

shares in the company. Presently also, the petitioner holds 1/3rd shares and Raheja group as a

whole holds 2/3rd shares. At every time, when further shares were issued, the petitioner was offered

and allotted shares on a right basis to ensure that it continues to hold 1/3rd shares in the company.

In other words, the respondents have not acted in any manner prejudicial to the shareholding

interests of the petitioner and as per the understating as claimed by the petitioner, it continues to

hold 1/3rd shares. Therefore, its prayer during the hearing that both the petitioner and the Rahejas'

should hold 50% shares each is not supported either by the alleged oral understanding or in terms of

the Articles.

28. The petitioner has also challenged subsequent transfers of shares by both the Raheja groups

alleging that the provisions of Article 38 had not been followed and therefore all these shares should

be offered to the petitioner after declaring these transfers as invalid. The stand of the respondents is

Indian Kanoon - http://indiankanoon.org/doc/285889/

17

Aasia Properties Development ... vs Juhu Beach Resorts Limited And ... on 19 September, 2006

that all these transfers were within among the Raheja groups and not to any outsiders and therefore

covered under the provisions of Article 44. This Article reads Any share may be transferred by a

member to any child or their issue, father or mother of such member and any share of a deceased

member may be transferred by his executor or administrators or other legal representatives subject

to the approval of directors to any child or other issue, father or mother of such deceased member to

whom such deceased member may have specifically bequeathed the same and where there has been

no bequeathal of his share by a deceased member, such shares may be transferred to the legal

representative of such member From this Article, it is evident that a living member can transfer his

shares only to his child, father or mother without attracting the pre-emptive provision. No transfer

is permissible to any other non member without offering the shares to other existing members in

terms of Article 38 and following the procedure prescribed in Articles 39 and 40. There have been a

number of transfers within Rahejas group including transfers to a number of companies under their

control. A strict application of Article 44 would result in a declaration that transfers other than to

the children of the members or their father or mother are invalid resulting in the shares reverting

back to the original transferors. As I have already held, the petitioner would not have a vested right

in acquiring those shares declared as invalidly transferred. Considering the fact that the shares

would continue to be within Rahejas group even after declaring the transfers as invalid, such a

declaration and reversion back to the original transferors would be a fruitless exercise and therefore

I do not propose to do so as the petitioner is not going to be in any way benefited by declaring these

transfers as invalid. In this connection, I note that the respondents have contended that holders of

not less than 2/3rd of the issued capital can approve the transfer to a non member in terms of

Article 38, and since Raheja group as a whole holding 2/3rd of the issued capital have approved the

transfer, the transfers cannot be declared as invalid. Even though it is only academic since I have

already held that I do not propose to cancel the transfers, I am to point out that there is nothing on

record in writing that the Raheja group had given their consent in writing for such transfers, as they

did in the case of transfer of shares to the petitioner and to B. Raheja group. Thus, in so far as the

allegations relating to the shares and the consequent relief sought, I do not find any scope to support

the petitioner.

29.In so far as the claim of the petitioner to have a representation on the Board of the company on

the ground that it had entered the company with an understanding and legitimate expectation of

being in joint management, is concerned, I do not find any substantive material to establish the