Académique Documents

Professionnel Documents

Culture Documents

AG. - Barr PDF FINAL PDF

Transféré par

sarge1986Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

AG. - Barr PDF FINAL PDF

Transféré par

sarge1986Droits d'auteur :

Formats disponibles

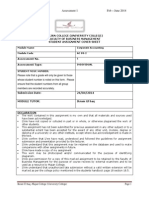

A.G.

Barr PLC (LSE: BAG)

A.G. BARR

(LSE: BAG)

Current Market Price: 553.00

Fair Price (Conservative): 632

Expected Return: 15%

Address

Website

Exchange

Industry

Market Cap

52 Week Range

Beta

Price/Book

Price/Earnings (Forward)

Price/Earnings

A.G. Barr PLC

Westfield House,

4 Mollins Road, Westfield,

Cumbernauld, G68, Scotland

Telephone: +44 1236852400

E-mail: info@agbarr.co.uk

http://www.agbarr.co.uk

London Stock Exchange (LSE)

Beverages - Soft Drinks

636.4 Mill

346.00-1,245.33

0.52

5.1

19.4

17.7

Fundamental Analysis

INDUSTRY ANALYSIS

The Beverage Industry is a fairly broad sector and includes companies that market nonalcoholic and alcoholic items.

Among the two segments the non-alcoholic especially soft drink has played a significant role in changing the

economics of beverage industry.

The soft drinks market consists of sale of bottled water, carbonates, concentrates, functional drinks, juices, RTD tea

and coffee, and smoothies. Strong population growth and higher disposable income are key factors to the growth of

the industry and prosperity. Despite the slowdown of the economy the industry has witnessed sharp growth in the

past few years with an expectation to reach $1,347 billion by 2017 with a 4.6 percent CAGR over 2012-2017.

The soft drink industry seems to have matured in the developed countries compelling companies to diversify their

product. Companies are finding new ways to combat the declining domestic market by focusing on exports to key

partner nations and emerging markets. The three main players, CocaCola, PepsiCo and Dr. Pepper Snapple Group,

account for over 80 percent of the domestic market share.

Recent research shows that consumer expenditure on soft drinks has risen by $138bn over the past five years in a

global market now worth $469bn. Despite economic pressures consumer appetite for soft drink refreshment shows

little signs of slowing.

He www.valuewalk.com

Page 1

A.G. Barr PLC (LSE: BAG)

According to an international research firm the volume of soft drink production is expected to increase 1.4 percent

per year to 22.1 billion gallons in 2014. The industry is expected to take a positive turn with an expansion of 27

percent by 2015.

While it is anticipated that the demand will soften as consumers become health conscious causing a change in the

behavior. While demand for carbonated soft drinks is slowing, and in certain markets in decline, energy drinks and

bottled water are fueling market growth as consumers seek drinks that not only deliver health benefits but also new

and exciting formats and flavors.

The global soft drinks industry will continue to straddle two different worlds: the mature developed markets where

growth has stagnated and developing markets where previously high growth rates have slowed, but still offer the

greatest upside.

He www.valuewalk.com

Page 2

A.G. Barr PLC (LSE: BAG)

INDUSTRY PEST ANALYSIS

Political

Strict adherence of Food and Drug regulation imposed by the government in every

nation.

Governments and laws are restricting ads directed towards children.

Any changes in the laws and regulations requires the company to change their

operations and procedures to avoid penalties and fines, or even worse to shut down.

Waste management mandates require every companiy to avoid any operations which

could negatively impact the environment.

Economical

Economic slowdown forced the companies to launched low priced product.

Consumers of soft drinks have continued to spend their money frugally over the past few

years.

Cost of raw materials can rise in case of weak econmy.

The industry is expected to take a positive turn with an expansion of 27% by 2015.

Social

Culture and lifestyle is one of the key positive driving forces for the Industry.

Age is the most important characteristic when evaluating consumer choice, the older

generation is more health conscious and tends to consider nutritional factors.

About one-third of Americans are considered obese and studies have shown a link

between soft drink consumption and obesity

Social media is one of the best platforms to keep the consumers connected with the

brands.

Technological

Technology is one of the key driving forces for the industry

New tech advancement in manufacturing and quality improvement concepts are

improving operations efficiency.

High product volume requires high levels of automation and advanced technologies in

manufacturing.

Technological advancement can enhance the supply chain and cut the distribution

costs.

High costs for new technology can be a barrier to entry for new competitors.

He www.valuewalk.com

Page 3

A.G. Barr PLC (LSE: BAG)

Key Revenue growth drivers of A.G. Barr PLC

A.G. BARR has delivered a strong financial performance in the last fiscal despite challenging markets. The business

has continued to focus on delivering the basics well. The efforts have driven strong revenue and volume growth and

have continued to build its market share across the soft drink industry. The key revenue drivers of the company are

designed to deliver long term sustainable growth in value and continues to focus on

Brands

The companys core group brands together with its franchise brand Rockstar, delivered total growth of 8.6

percent. The highest selling brand, IRN-BRU sales grew by 1.4 percent, with a strong second half growth of almost 5

percent. IRN-BRU is expected to grow in both Scotland and England despite the competition in the key take home

channel and difficult weather conditions across the year.

The other major brand is Barr, which showed strong growth by 13 percent throughout the year. Early 2013 ad

campaigns and TV advertising should help the Barr brand grow and develop as a key part of consumers purchase

repertoire specifically in Scotland and increasingly in the rest of the U.K.

The launch of the new brands Love the Exotic and PET Rubicon pack targeting on the go" consumers delivered a

strong second half growth performance of 21.3 percent. Company is enormously spending in the marketing of their

newly launched brands to position itself in the market.

Market

The companys Scottish market grew by 4 percent, and the rest of the U.K. grew by 12 percent, reflecting both the

significant future growth opportunities and the relatively modest share of this geography currently enjoyed by the

companys brands. The company is relentlessly focus on developing and improving the execution capabilities across

each route to untapped market around Europe and other developing nations. It is constantly engaged in improving

the quality and commitment of the business to build long term profitable customer relationships.

Partnerships

Companys key partnership brand in 2012 has been strong, building on long term relationships and excellence in

marketplace execution. Brand partners like Rockstar has helped the company growth 10p percent, reflecting the

consumer acceptance of a strong mix of brand affinity and product acceptability.

The Orangina brand strategy is now well positioned following several years of re-alignment, moving from a volume

based strategy to the current successful value based approach which reflects the brands quality niche positioning.

Last year, Orangina outperformed the soft drinks market and grew revenues by a solid 6 percent. The outcome of this

effective partnership will allow the company to develop as a stronger core offering to international markets and to

successfully accelerate growth in the future.

Innovation

He www.valuewalk.com

Page 4

A.G. Barr PLC (LSE: BAG)

Innovation is one of the key drivers of growth in this sector. For A.G.Barr, innovation played an important role across

2012 in growing its business. The launch of Rubicon into the frozen category in 2012 was an exciting development for

the brand in the ice cream market. The sale of Rubicon is expected to grow in this sector across 2013, despite

challenging conditions in the ice cream sector.

Innovation across all of other core brands will continue to play a key role in the growth of the business by developing

and building the brands to meet constantly evolving consumer needs.

SWOT ANALYSIS OF A.G. BARR PLC

Strength

Strong brand position across

Scotland, labeled as other

national drink

Specialized in different flavors

and packages.

Low cost product.

Strong distribution channels

to route key markets..

Active participation in major

events such as 2012 London

Weaknesses

Poor personnel management

due to recent acquisitions.

Poor working conditions and

training program.

Weak economy raises the cost

of raw materials and chance

of currency volatility.

No alternatives offered for

increasing health conscious

segments.

Opportunities

Expansion of market across UK.

Diversify into tea and coffee

segments.

Opportunity to enter more

government sponsored events

for wide recognition of brands.

Rising demand of Health and

energy drinks offers another

huge market across USA.

Enter into developing countries

like India and Brazil.

He www.valuewalk.com

Threats

Health issues among the

consumers.

Environmental threats due to

improper waste management.

Increasing distribution costs.

Page 5

A.G. Barr PLC (LSE: BAG)

COMPANY ANALYSIS

A.G. Barr soft drink, headquartered in Cumbernauld, UK has been making and selling soft drinks for over 130 years.

The company has successfully developed its business through developing its range of brands in soft drinks and fruit

juice. The major brand includes IRN-BRU, Tizer, D'N'B, KA, Barr flavor range, Barr's Originals, Red Kola etc.

IRN-BRU was voted the Best Brand of the last 21 years at the 2007 Scottish Advertising Awards Ceremony in

Glasgow.

A.G. BARR has continued to grow in terms of revenue, volume and profit despite a difficult marketplace and

background of rising input costs. The company has grown in revenue and volume well ahead of the U.K. soft drinks

market.

The business performance was particularly pleasing in the second half of the FY2012, with double digit revenue

growth leading to full year sales of 237.6m, an increase of 6.6 percent compared to the previous year. The company

has continued to build upon its strong financial base leveraging its capacity for growth for the year ended Jan 2013.

The firm witnessed an EBT increase by 4.3 percent to 35.0m compared to previous fiscal year.

The company has delivered growth across both the carbonated and still drinks segments. Overall turnover increased

by 14.7m (6.6 percent), driven by strong growth in volume which increased by 5.6%.

The other brands of the company outperformed the market despite challenging conditions of the UK market.

IRN-BRU sales grew by 1.4%, with a strong second half growth of almost 5%.

Partner brands like Orangina outperformed the soft drinks market and grew revenue by a solid 6%.

KA delivered a strong second half growth performance of 21.3%, with full year growth of over 7%.

Barr brands grew by over 13% across the year, benefiting from both new packaging and a highly relevant

value positioning in the market.

The Rockstar brand has almost doubled in the period, benefiting from market growth of 10%

The companys balance sheet has strengthened over the last year; its net assets increasing to 130.6m and the capital

expenditure associated with building new production and distribution facility has driven an increase in property,

plant and equipment of 14.6m.

The Return on capital employed (ROCE) has remained strong at 20.6 percent, reducing slightly from the reported

position last year (22.8 percent) due to the inclusion of 17m of assets relating to Milton Keynes. Capital expenditure

is anticipated to remain at similar levels as in 2012.

A free cash flow of 22.0m was generated in the period, representing an increase of 6.1m on the prior year. Shares

with a net value of 0.3m were purchased on behalf of various employee benefit trusts to satisfy the ongoing

requirements of the Group?s employee share schemes. The tax charge of 6.3m is 1.0m lower than the total charge

for the prior year and represents an effective tax rate of 19.7 percent.

He www.valuewalk.com

Page 6

A.G. Barr PLC (LSE: BAG)

The company merged with Britvic Plc and managed to become one of the leading soft drinks companies in Europe,

with a strong portfolio of market leading brands. It offers an opportunity for both companies to enhance their

industry position, and achieve significant synergies and shareholder value.

The company remains committed to its strategy of building brands for the long term and will continue to ensure

having an efficient asset base capable of supporting the companys future growth ambitions. The company is

improving its operating performance across its existing asset base and investment in new operational capacity at the

Crossley site in Milton Keynes is also making excellent progress. The U.K. economic outlook remains challenging.

However, A.G Barr seems quite optimistic and believes its future prospects are excellent. Overall, the business is

well positioned to deliver long term value for its shareholders. The balance sheet and finances are strong and will

continue to deliver growth across the brands through the implementation of 2013/14 operating plans.

Key Data

Revenue

Earnings

per

share (Basic)

Book Value

Share

Per

Operating Margin

Return on Equity

Return on Assets

Net Margin

Asset Turnover

Leverage

Year ended

Jan 13

Millions

Year ended

Jan 12

Millions

Year ended

Jan 11

Millions

237

222

201

0.24

0.20

0.16

1.09

1.00

0.86

14.9%

23.10%

14.13%

11.88%

1.19

1.55

14.2%

20.80%

11.46%

10.16%

1.13

1.73

13.1%

18.58%

9.48%

8.91%

1.06

1.91

DUPONT A NALYSIS

ROE=Net Profit Margin x Total Asset Turnover x Leverage

The firms revenue have significantly increased by 6.7 percent in FY2012 compared to FY2011resulting in rise of EPS

and eventually ROE. As mentioned above EPS rose by 0.2 percent and return on equity by 11.05 percent in FY2012

compared to FY2011.

The company has witnessed a significant growth in ROA in fiscal year 2012 compared to previous year. The net

margin is up 11.88 percent in FY2012 compared to 10.16 percent in FY2011. Asset turnover has increased slightly

evidencing efficient operations of the company.

He www.valuewalk.com

Page 7

A.G. Barr PLC (LSE: BAG)

The companys leverage dropped in the FY2012 compared to FY2011. The trend clearly allows the investor to expect a

positive growth of the stock in near future and days ahead.

Important Highlights FY 2012

Financial Highlights

The companys revenue increased by 6.7% from 222m (FY2011) to 237m (FY2012)

EBITDA (pre exceptional items) of 41.7m was generated in the period, representing an EBITDA margin of 17.6%.

EBIT figures in FY2012 up by 4.3% ( 35.00 Million) from previous fiscal year.

The tax charge of 6.3m lower than the total charge for the prior year representing an effective tax rate of 19.7%, a

reduction of 80 basis points from the prior year.

Earnings per share basic also increased 24.7 in FY2012 from 22 representing an increase of 10.9% on the prior

year.

The firms balance sheet has strengthened, with net assets increasing to 130.6m.

Return on capital employed has remained strong at 20.6%, reducing slightly from the reported position last year

(22.8%).

A free cash flow of 22.0m was generated in the period, representing an increase of 6.1m on the prior year.

Operational Highlights

Total operating expenses increased to 76 million in FY 2012 from 68 million reported in the same period of

previous fiscal.

Capex reached 21 Million in FY2012 compared to 6 million in FY2011 due to mergers and new construction of

operational sites.

Net debt reduced to 6.7M.

Net margin decreased by 21% in FY2012 compared to FY2011.

Dividends paid per share in FY2012 increased by 7.6% over the prior year.

RELATIVE VALUATION

Industr

y

He www.valuewalk.com

BAG

COCA

COLA

NICL

NRX

OLVAS

SPA

Page 8

A.G. Barr PLC (LSE: BAG)

Market

Cap

$ 2802

Million

636

Million

$8,235

Million

324

Million

461.1

Million

278.1

Million

Revenue

(2011)

Price/Earnin

gs TTM

Price/Book

237

Million

17.7

8,062

Million

$

16.9

108

Million

22.9

254

Million

31.2

285

Million

18.6

197

Million

38.5

5.1

3.9

8.4

1.9

2.9

2.9

Price/Sales

TTM

Rev Growth

(3 Yr Avg)

2.0

1.4

3.1

1.7

1.4

1.4

11.8

7.4

20.7

39.6

8.7

-1.7

EPS Growth

(3 Yr Avg)

18.3

9.8

64.9

18.4

2.1

Operating

Margin %

TTM

Net Margin

% TTM

14.0

11.5

18.5

11.1

9.0

4.8

11.2

8.4

13.7

5.5

7.4

3.7

ROE TTM

Debt/Equity

22.4

-

24.2

1.1

40.0

-

7.0

0.4

17.1

0.3

7.8

-

Price/Earnin

gs

17.7

16.9

22.9

31.3

18.6

38.5

Price/Book

5.1

3.9

8.4

1.9

2.9

2.9

Price/Sales

2.0

1.4

3.1

1.7

1.4

1.4

Price/Cash

Flow

24.9

12.1

21.7

37.2

7.7

41.2

Dividend

Yield %

1.8

1.8

2.0

0.2

2.0

0.9

(Data Source: www.morningstar.com)

A.G. Barr Plc is one of the leading company in soft drink and juice market after Coca Cola. The company has seen

considerably grown in the past few years bagging one of the bestselling brands in UK and Scotland.

He www.valuewalk.com

Page 9

A.G. Barr PLC (LSE: BAG)

Despite economic challenges company has witnessed excellent turnover, volume and profit growth. The group has

delivered performance ahead of a robust soft drinks market, increasing market penetration and continuing to build

brand equity. Looking at the trend of the industry and figures, the company should continue to outperform.

FAIR PRICE CALCULATION

PROFIT AND LOSS ESTIMATES

Fiscal year ends in January. Pounds in thousands

except per share data.

Projected

Full Year 2013

Jan-07

Revenues

Jan-08

Jan-09

Jan-10

Jan-11

Jan-12

Jan-13

Conservative

Optimistic

141,876

148,377

169,698

201,410

222,366

236,998

237,595

262,169

262,169

71,453

76,068

84,962

98,153

107,987

118,253

129,591

132,370

130,812

Costs and Expenses

Cost of revenue

Depreciation and amortization

5,814

6,901

7,358

7,885

7,717

7,301

6,772

9,888

8,076

46,275

45,019

54,194

69,044

75,124

76,219

69,444

84,023

84,314

2,761

468

Operating Income(Loss)

15,573

19,921

23,184

26,328

31,538

35,225

31,788

35,888

38,966

Other income (expense)

781

912

25

(1,878)

(1,102)

192

34

(57)

212

16,354

20,833

23,209

24,450

30,436

35,417

31,822

35,831

39,179

3,163

3,995

6,134

6,502

7,851

7,271

6,258

7,864

8,043

13,191

16,838

17,075

17,948

22,585

28,146

25,564

27,967

31,135

Basic (Pence)

69.95

86.75

89.12

46.84

58.84

73.43

22.06

24.13

26.87

Diluted (Pence)

68.15

85.65

88.16

46.49

58.51

73.03

22.04

24.11

26.85

Basic

18,939

19,409

19,158

38,318

38,385

38,328

115,884

115,884

115,884

Diluted

19,356

19,657

19,368

38,601

38,601

38,542

115,979

115,979

115,979

Total Operating Expenses

Exceptional Item

Income before taxes

Provision for income taxes

Net Income

Net earnings per share:

Weighted average shares

GROWTH RATES AND COST OF EQUITY CALCULATIONS

AT YEAR END

He www.valuewalk.com

Jan-07

Jan-08

Jan-09

Jan-10

Jan-11

Jan-12

Jan-13

Page 10

A.G. Barr PLC (LSE: BAG)

Total assets

118,631

123,699

186,912

191,869

202,174

196,250

214,838

47,254

38,921

94,247

91,360

85,467

69,230

84,190

Debt Ratio

71,377

0.40

84,778

0.31

92,665

0.50

100,509

0.48

116,707

0.42

127,020

0.35

130,648

0.39

Debt/Equity

0.66

0.46

1.02

0.91

0.73

0.55

0.64

Return on Assets

11.12%

13.61%

9.14%

9.35%

11.17%

14.34%

11.90%

Return on Equity

18.5%

19.9%

18.4%

17.9%

19.4%

22.2%

19.6%

13,000

15,000

11,349

5,358

9,840

6,937

21,166

Change in Non Cash Working Capital

5,718

-1,591

13,324

7,606

5,616

-7,708

2,872

-2,744

8,486

5,614

12,645

4,159

15,984

3,339

ROA

11.46%

Retention Ratio

70%

Debt/equity

0.71

Interest rate

6.00%

Tax Rate

20%

Fundamental Growth Rate

11.3%

Total Liabilities

Total Stockholders equity

Capital Expenditure

Non Cash Working Capital

Income Growth Rates Forecast High Growth

Period

Analysts (Source) FT.com

Weight

14%

0.2

Last Year Growth Rate

7%

0.3

Fundamental Growth Rate

11%

0.5

Weighted Average Forecasted Growth Rates

10.34%

Expected Debt Ratio

0.41

Beta

0.524

Risk Free Rate

4.20%

Return from Market

13.00%

Cost of equity

9%

3 Yr Avg

S&P500

Return

FREE CASH FLOW TO EQUITY AND FAIR PRICE CALCULATION

Conservative

All Figures in '000s except per share data

Year

He www.valuewalk.com

High Growth

2013 E

2014 E

Stable

2015 E

2016 E

2017 Onwards

Page 11

A.G. Barr PLC (LSE: BAG)

Growth in Revenue

10.34%

10.34%

10.34%

10.34%

4.0%

Net Sales

262,169

289,285

319,205

352,220

366,309

Depreciation

9,888

10,911

12,039

13,284

13,816

Net Income

27,967

30,859

34,051

37,573

39,076

CAPEX

16,809

18,548

20,466

22,583

23,486

Change in Non Cash Working Capital

(3,391)

1,303

1,437

1,586

677

Cash Flow to equity

30,045

36,121

39,857

43,979

45,166

9%

9%

9%

9%

9%

Cost of Equity

Terminal value

Present value of cash flows

938,761

27,612

FCFE (In '000)

733,330

No of shares (In '000

115,979

30,508

30,937

644,274

Share price per share acc to valuation

Conservative

632

Current Market Price

549

Return

15%

Optimistic

All Figures in '000s except per share data

High Growth

Stable

Year

2013 E

2014 E

2015 E

2016 E

2017 Onwards

Growth in Revenue

10.34%

10.34%

10.34%

10.34%

4.0%

Net Sales

262,169

289,285

319,205

352,220

366,309

Depreciation

8,076

10,911

12,039

13,284

13,816

Net Income

31,135

30,859

34,051

37,573

39,076

CAPEX

16,809

18,548

20,466

22,583

23,486

1,343

1,303

1,437

1,586

677

37,065

36,121

39,857

43,979

45,166

9%

9%

9%

9%

9%

Change in Non Cash Working Capital

Cash Flow to equity

Cost of Equity

He www.valuewalk.com

Page 12

A.G. Barr PLC (LSE: BAG)

Terminal value

Present value of cash flows

938,761

34,064

FCFE (In '000)

739,782

No of shares (In '000

115,979

30,508

30,937

644,274

Share price per share acc to valuation

Conservative

638

Current Market Price

549

Return

16%

He www.valuewalk.com

Page 13

Vous aimerez peut-être aussi

- Starbucks PDFDocument32 pagesStarbucks PDFGilang MatriansyahPas encore d'évaluation

- Impact of Global Environment On International Marketing StrategyDocument4 pagesImpact of Global Environment On International Marketing StrategyKrasimiraPas encore d'évaluation

- Coca Cola HBC-sourcing ReportDocument3 pagesCoca Cola HBC-sourcing ReportAravind100% (1)

- Haier Case Analysis - Group 2Document15 pagesHaier Case Analysis - Group 2FIZZA ZAIDI-IBM 21IN616Pas encore d'évaluation

- Market Segmentation & ExpansionDocument4 pagesMarket Segmentation & ExpansionPratik ShresthaPas encore d'évaluation

- Dossier Marketfinal-2Document30 pagesDossier Marketfinal-2Tiri WuPas encore d'évaluation

- Pest Analysis of SingaporeDocument34 pagesPest Analysis of SingaporeFelice LeePas encore d'évaluation

- 4564-2469-13-00-40 - SQA IMM Assignment Only V3 Turnatin FileDocument36 pages4564-2469-13-00-40 - SQA IMM Assignment Only V3 Turnatin FileHussain K.JamalPas encore d'évaluation

- Assignment of Marketing Management: Topic: Porters 5 Forces Analysis For Soft Drink IndustryDocument6 pagesAssignment of Marketing Management: Topic: Porters 5 Forces Analysis For Soft Drink Industryanshu169Pas encore d'évaluation

- 7 SDocument5 pages7 SBishal KarkiPas encore d'évaluation

- Leadership Skills of Satya NadellaDocument3 pagesLeadership Skills of Satya NadellaSai PrasannaPas encore d'évaluation

- Analysis of Vodafone Group PLC Sustainability ReportDocument19 pagesAnalysis of Vodafone Group PLC Sustainability Reportvinayarun100% (1)

- Indian Chocolate IndustryDocument76 pagesIndian Chocolate IndustryPrateek Kr Verma50% (2)

- Precision Turned Products World Summary: Market Values & Financials by CountryD'EverandPrecision Turned Products World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Tradebulls Report-FinalDocument74 pagesTradebulls Report-FinalNayan AswaniPas encore d'évaluation

- Accenture Basel III HandbookDocument64 pagesAccenture Basel III HandbookSara Humayun100% (2)

- SWOT Analysis of CocaDocument3 pagesSWOT Analysis of CocaJannat AhmedPas encore d'évaluation

- Marketing Across BoundariesDocument15 pagesMarketing Across Boundariesfadi713Pas encore d'évaluation

- PGMB136: International Human Resource Management Assessment Student Name Student IdDocument12 pagesPGMB136: International Human Resource Management Assessment Student Name Student IdasadPas encore d'évaluation

- Pestel Analysis of Coca ColaDocument4 pagesPestel Analysis of Coca Colatejaskamble450% (1)

- Coca Cola International Business Study For GlobalizationDocument31 pagesCoca Cola International Business Study For GlobalizationSaima TasnimPas encore d'évaluation

- Porter Five Forces MorisonDocument3 pagesPorter Five Forces MorisonAsad SyedPas encore d'évaluation

- Baiju Radhakrishnan Assignment 5 Force On Pepsico PDFDocument6 pagesBaiju Radhakrishnan Assignment 5 Force On Pepsico PDFSree IyerPas encore d'évaluation

- Fresh-Soybean-Oil-of-Meghna-group of IndustriesDocument26 pagesFresh-Soybean-Oil-of-Meghna-group of IndustriesSharmin SultanaPas encore d'évaluation

- Operations Mangement AssignmentDocument21 pagesOperations Mangement AssignmentsherazPas encore d'évaluation

- Digital Marketing Communicaton - Summative Brief CW2Document12 pagesDigital Marketing Communicaton - Summative Brief CW2cyrax 3000Pas encore d'évaluation

- A Study On Market Analysis On Tropicana With Reference To Chennai, TamilnaduDocument13 pagesA Study On Market Analysis On Tropicana With Reference To Chennai, Tamilnadusubbu2raj3372Pas encore d'évaluation

- Coca Cola External Facto Evaluation Matrix (EFE Matrix) : External Strategic Factor Weight Rating Weighted Score CommentsDocument3 pagesCoca Cola External Facto Evaluation Matrix (EFE Matrix) : External Strategic Factor Weight Rating Weighted Score CommentsNaoman ChPas encore d'évaluation

- BIG Rock International Expansion PlanDocument20 pagesBIG Rock International Expansion PlanAly Ihab GoharPas encore d'évaluation

- HK1020 - Customer Experience Strategy Summative 7097Document22 pagesHK1020 - Customer Experience Strategy Summative 7097Swarnali Dutta ChatterjeePas encore d'évaluation

- Porter Analysis of CCDDocument4 pagesPorter Analysis of CCDvidhu devadharPas encore d'évaluation

- 1CENEO1 - Cameroon Coffee Supply Chain Risk AssessmentDocument34 pages1CENEO1 - Cameroon Coffee Supply Chain Risk AssessmentRomir ChatterjeePas encore d'évaluation

- Comparative Analysis of Integrated Marketing Communications Mix Strategy For Laptop ManufacturersDocument9 pagesComparative Analysis of Integrated Marketing Communications Mix Strategy For Laptop ManufacturerskristokunsPas encore d'évaluation

- Market Entry Strategies of StarbucksDocument14 pagesMarket Entry Strategies of StarbucksImraan Malik50% (2)

- Coca Cola CaseDocument8 pagesCoca Cola CaseSharif Mohammad SabbirPas encore d'évaluation

- Global Brand Management Summative Assessment: Word Count 3,750Document18 pagesGlobal Brand Management Summative Assessment: Word Count 3,750Uzair Iftikhar100% (1)

- Pepsi Strategic Management Project ReportDocument57 pagesPepsi Strategic Management Project ReportABUBAKAR100% (1)

- Ajeeth Pingle Brand Extention PlanDocument17 pagesAjeeth Pingle Brand Extention PlanAjeeth PinglePas encore d'évaluation

- 2a Pillars of Marketing STPDDocument69 pages2a Pillars of Marketing STPDMilind RaghuvanshiPas encore d'évaluation

- HaldiramDocument72 pagesHaldiramGuman SinghPas encore d'évaluation

- Company Analysis ReportDocument16 pagesCompany Analysis ReportEr HarshaPas encore d'évaluation

- Consumer Satisfaction On Biscuit in Bangladesh MarketDocument18 pagesConsumer Satisfaction On Biscuit in Bangladesh MarketKaziTanvirAhmedPas encore d'évaluation

- Chap006 Internal AnalysisDocument30 pagesChap006 Internal AnalysisĐinh Đức TâmPas encore d'évaluation

- Launching A New ProductDocument22 pagesLaunching A New ProductNayomi EkanayakePas encore d'évaluation

- Keywords: 1. Supply Chain ManagementDocument6 pagesKeywords: 1. Supply Chain Managementmushtaque61Pas encore d'évaluation

- Independent University of Bangladesh: An Assignment OnDocument18 pagesIndependent University of Bangladesh: An Assignment OnArman Hoque SunnyPas encore d'évaluation

- Coca Cola Porter S Five Forces Analysis and Diverse Value Chain Activities in Different Areas PDFDocument33 pagesCoca Cola Porter S Five Forces Analysis and Diverse Value Chain Activities in Different Areas PDFLouise AncianoPas encore d'évaluation

- Enterprise SystemsDocument11 pagesEnterprise SystemsumairaleyPas encore d'évaluation

- IBM in The 21s CenturyDocument39 pagesIBM in The 21s CenturyIftikhar JanPas encore d'évaluation

- MIS ProjectDocument27 pagesMIS ProjectPallav MowkePas encore d'évaluation

- Gymshark Annotation FinalDocument8 pagesGymshark Annotation FinalIrfan IbrahimPas encore d'évaluation

- Term Paper On Partex Beverage LTDDocument29 pagesTerm Paper On Partex Beverage LTDRakibul Hasan80% (5)

- Sealed Air Diversey Merger Acquisition Presentation Slides Deck PPT June 2011Document40 pagesSealed Air Diversey Merger Acquisition Presentation Slides Deck PPT June 2011Ala BasterPas encore d'évaluation

- ElectroCaseDocument4 pagesElectroCaseRana IjazPas encore d'évaluation

- Supply Chain Management of Coca Cola CompanyDocument28 pagesSupply Chain Management of Coca Cola Companymuhammad qasimPas encore d'évaluation

- Beltone UAE Banking Sector Review For BEDocument75 pagesBeltone UAE Banking Sector Review For BEMunia R. BadhonPas encore d'évaluation

- TOWS Matrix: Sachin UdhaniDocument12 pagesTOWS Matrix: Sachin Udhaniamittaneja28Pas encore d'évaluation

- Rationale Behind The Project: CocofreshDocument24 pagesRationale Behind The Project: Cocofreshchintan27Pas encore d'évaluation

- Saurabh Pepsico Project Part 1Document95 pagesSaurabh Pepsico Project Part 1Aditya GuptaPas encore d'évaluation

- Business Plan TemplateDocument12 pagesBusiness Plan TemplateJoseph100% (1)

- Berkeley Solution 2014Document32 pagesBerkeley Solution 2014sarge1986Pas encore d'évaluation

- Full Text 02Document91 pagesFull Text 02sarge1986Pas encore d'évaluation

- Business Presentation: Gulf AirDocument7 pagesBusiness Presentation: Gulf Airsarge1986Pas encore d'évaluation

- Information System & Competitive AdvantageDocument9 pagesInformation System & Competitive Advantagesarge1986Pas encore d'évaluation

- MBA713 Recruiting and RetentionDocument1 pageMBA713 Recruiting and Retentionsarge1986Pas encore d'évaluation

- CH 17Document19 pagesCH 17sarge1986Pas encore d'évaluation

- Corporate Strategies I: Moses Acquaah, Ph.D. 377 Bryan Building Phone: (336) 334-5305 Email: Acquaah@uncg - EduDocument34 pagesCorporate Strategies I: Moses Acquaah, Ph.D. 377 Bryan Building Phone: (336) 334-5305 Email: Acquaah@uncg - Edusarge1986Pas encore d'évaluation

- Study Guide HandbookDocument26 pagesStudy Guide Handbooksarge1986Pas encore d'évaluation

- Practice Questions (CAPM) : FIN 350 Global Financial ManagementDocument2 pagesPractice Questions (CAPM) : FIN 350 Global Financial Managementsarge19860% (1)

- Corporate Accounting Assessment 1 Feb - June 2014Document5 pagesCorporate Accounting Assessment 1 Feb - June 2014sarge1986Pas encore d'évaluation

- Corporate Entrepreneurship: Small Business ManagementDocument32 pagesCorporate Entrepreneurship: Small Business Managementsarge1986Pas encore d'évaluation

- A Case Study of Acquisition of Spice Communications by Isaasdaddea Cellular LimitedDocument13 pagesA Case Study of Acquisition of Spice Communications by Isaasdaddea Cellular Limitedsarge1986Pas encore d'évaluation

- Tobacco Industry and Product SafetyDocument9 pagesTobacco Industry and Product Safetysarge1986Pas encore d'évaluation

- Guide Lines - CF - Assgn - Sep-13Document2 pagesGuide Lines - CF - Assgn - Sep-13sarge1986Pas encore d'évaluation

- Alia AlmandhariDocument30 pagesAlia Almandharisarge1986Pas encore d'évaluation

- DL Corporate Finance AssessmentDocument2 pagesDL Corporate Finance Assessmentsarge1986Pas encore d'évaluation

- DominosDocument10 pagesDominossarge19860% (1)

- Interest Payment For The Month of August 2013Document1 pageInterest Payment For The Month of August 2013sarge1986Pas encore d'évaluation

- 2Q22 Alcoa Financial ResultsDocument16 pages2Q22 Alcoa Financial ResultsRafa BorgesPas encore d'évaluation

- FIN221: Lecture 2 Notes Securities Markets: - Initial Public Offerings Versus Seasoned New IssuesDocument6 pagesFIN221: Lecture 2 Notes Securities Markets: - Initial Public Offerings Versus Seasoned New Issuestania_afaz2800Pas encore d'évaluation

- Vanguard VWODocument144 pagesVanguard VWORaka AryawanPas encore d'évaluation

- ARMY - Annual Report - 2017 PDFDocument149 pagesARMY - Annual Report - 2017 PDFjamaluddinPas encore d'évaluation

- Managing Finances With Mutual Fund-2Document11 pagesManaging Finances With Mutual Fund-2kishor_more47Pas encore d'évaluation

- How To Define Your Brand and Determine Its Value.: by David Haigh and Jonathan KnowlesDocument7 pagesHow To Define Your Brand and Determine Its Value.: by David Haigh and Jonathan KnowlesMahesh SavanthPas encore d'évaluation

- Commodity AssignmentDocument7 pagesCommodity Assignment05550Pas encore d'évaluation

- Venture Capital in INDIADocument83 pagesVenture Capital in INDIAnawaz100% (2)

- 1600 Tax RatesDocument2 pages1600 Tax RatesmelizzePas encore d'évaluation

- Unit 1Document19 pagesUnit 1Kunal MakodePas encore d'évaluation

- Underwriting Essentials C120 Flashcards - QuizletDocument3 pagesUnderwriting Essentials C120 Flashcards - Quizletmagggab0% (1)

- Solution Manual For Financial Reporting, Financial Statement Analysis and Valuation, 9th Edition, James M. Wahlen, Stephen P. Baginski Mark BradshawDocument42 pagesSolution Manual For Financial Reporting, Financial Statement Analysis and Valuation, 9th Edition, James M. Wahlen, Stephen P. Baginski Mark Bradshawbrandonfowler12031998mgj100% (43)

- Assignment - Sources of CapitalDocument14 pagesAssignment - Sources of Capitalabayomi abayomiPas encore d'évaluation

- Quantifi - OIS and CSA Discounting PDFDocument2 pagesQuantifi - OIS and CSA Discounting PDFSanket PatelPas encore d'évaluation

- MODEC, Inc. 2019 Half-Year Financial Results Analysts PresentationDocument16 pagesMODEC, Inc. 2019 Half-Year Financial Results Analysts Presentationfle92Pas encore d'évaluation

- STATADocument58 pagesSTATARiska GrabeelPas encore d'évaluation

- Soal Bab 1Document4 pagesSoal Bab 1Wido Fiverz FabregasPas encore d'évaluation

- 6058 Barclays ObjectionDocument80 pages6058 Barclays ObjectionTroy UhlmanPas encore d'évaluation

- Preference SharesDocument7 pagesPreference Sharesmayuresh bariPas encore d'évaluation

- FM LMSDocument36 pagesFM LMSJuliana Waniwan100% (1)

- Techcombank - The Leading Joint Stock Bank in VietnamDocument17 pagesTechcombank - The Leading Joint Stock Bank in VietnamkimishiPas encore d'évaluation

- IASB Project ForSMEDocument27 pagesIASB Project ForSMEAlexandre ValcazaraPas encore d'évaluation

- Interest Rate SwapsDocument29 pagesInterest Rate SwapsSAKINAMANDSAURWALAPas encore d'évaluation

- Certificate in Insurance: Unit 1 - Insurance, Legal and RegulatoryDocument29 pagesCertificate in Insurance: Unit 1 - Insurance, Legal and RegulatorytamzPas encore d'évaluation

- Sapm - Fifth (5) Sem BBIDocument156 pagesSapm - Fifth (5) Sem BBIRasesh ShahPas encore d'évaluation

- L3 The Arbitrage Approach of Bond PricingDocument52 pagesL3 The Arbitrage Approach of Bond PricingVy HàPas encore d'évaluation

- PrinciplesofFinance WEBDocument643 pagesPrinciplesofFinance WEBGLADYS JAMES100% (2)