Académique Documents

Professionnel Documents

Culture Documents

Med Adv Season Coven Try

Transféré par

ackerman_danielleDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Med Adv Season Coven Try

Transféré par

ackerman_danielleDroits d'auteur :

Formats disponibles

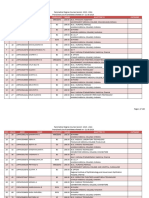

Medicare and Prescription Drug Plan Enrollment Periods

Coventry Health Care Medicare Products include: AdvantraRx Part D Prescription Drug Plans & Advantra Medicare Advantage

Coordinated Care Plans (CCP) network-based Plans (HMO/HMO-POS, PPO & SNP in FL). Not Private-Fee-for-Service.

Oct Nov Dec Jan Feb Mar Apr May June July Aug Sept Oct Nov Dec

AEP 11/15

Select Select Any Type of Plan

to 12/31

Switch OEP 1/1 to 3/31 Like Plan Switch: See below for qualified changes

After 4/1: Changes allowed Lock-in

Lock-In

for Special Election Periods 4/1 to 12/31

10/1/09

2009 Non-renewal

to

Special Enrollment Period

1/31/10

Special Enrollment Period (SEP); newly Medicare-eligible and other circumstances as mandated by CMS. (i.e., move to new service

areas; non-renewable plans; newly eligible for Medicaid; etc.)

Any

Time Initial Election Period (IEP for Part D) (ICEP for Part B) (OEP New): One per lifetime Beneficiaries newly eligible for Medicare Part A

1/1 to and Part B can make one Initial Coverage Period election during the period. The IEP begins three months before entitlement to Part A

12/31 and enrollment in Part B. If Part A and B are effective on the same date, then also the month of and three months after the effective date

of Part A and B, for a total of 7 months. If the beneficiary delays his or her Part B enrollment, the Initial Coverage Election Period is

only three months prior to the Part B date. Effective date can be no earlier than month of entitlement (such as the birth month).

• Annual Election Period (AEP): Beneficiary can make a new plan choice; during AEP all Medicare products are available to make a selection.

New Coverage begins January 1 of the following year (unless qualified under IEP or SEP).

• Open Enrollment Period (OEP): Beneficiary can make one election to switch to, from, or within an MA Plan to a “like-plan”; no OEP for Part D

and MSA. OEP for newly eligible individuals (OEP NEW; one per lifetime), or in accordance with SEP qualifications. Coverage effective first

day of the next month after date of receipt of the completed enrollment application.

• Lock-In: Beneficiary must remain with their last choice through the end of the year, unless they qualify for an SEP.

• Any Time: Qualifying beneficiaries can make changes anytime during the year in accordance with applicable CMS requirements

Open Enrollment Period (OEP) allows a beneficiary to switch to, from or within an MA Plan to a “like” plan.

During the OEP, Medicare beneficiaries are allowed to make one “like-to-like” plan switch. There is no OEP for Part D or Medicare Medical Savings

Account (MSA) plans. A switch is limited by the Part D portion of an individuals existing plan (i.e., enrollees cannot begin or discontinue Part D

coverage). The chart below shows the type of plan changes that Medicare allows 1/1 - 3/31.

NOTE: A beneficiary may qualify under a Special Election Period (SEP) or other individual elections available during OEP, according to CMS, that

would allow changes other than what are shown below.

Existing Plan Allowable Switch During OEP

MA-PD • Can switch to another MA-PD (HMO, POS, PPO, PFFS) with drug coverage included in the plan.

(HMO, POS, PPO, or PFFS with drug • Can switch to a PFFS Medical only plan and join in a PDP.

coverage included in the plan) • Can switch to Original Medicare and join a PDP.

MA Medical Only Plan • Can switch to another MA Medical only plan (HMO, POS, PPO, PFFS) but CANNOT join a PDP.

(HMO, POS, PPO, PFFS with no drug • Can switch to Original Medicare but CANNOT join a PDP.

coverage in the plan)

Original Medicare With a Separate PDP • Can switch to another MA-PD (HMO, POS, PPO, PFFS) with drug coverage included in the plan.

(with or without a Medicare Supplement) • Can switch to a PFFS Medical only plan but must keep the existing PDP.

• CANNOT switch existing PDP for a new PDP.

Original Medicare Without a PDP • Can remain with Original Medicare.

(with or without a Medicare Supplement) • Can switch to an MA Medical only plan (HMO, POS, PPO, PFFS) but CANNOT join an MA-PD or a PDP.

PFFS Plan With a Separate PDP • Can switch to another MA-PD (HMO, POS, PPO, PFFS) with drug coverage included in the plan.

• Can switch to Original Medicare but must keep the existing PDP.

• Can switch to an MA Medical only plan (HMO, POS, PPO, PFFS) but must keep existing PDP.

• CANNOT switch existing PDP for a new PDP.

PFFS Plan Without Drug Coverage • Can switch to an MA Medical only plan (HMO, POS, PPO, PFFS) but CANNOT join an MA-PD or a PDP.

• Can return to Original Medicare but CANNOT join a PDP.

2009 Coventry Health Care - Broker & Agent Use Only.

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- ANC Guidelines - 18 July 2022 - Final-3 (6942)Document238 pagesANC Guidelines - 18 July 2022 - Final-3 (6942)Sara YehiaPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Level 1 Hospital - FGL GRP 2Document6 pagesLevel 1 Hospital - FGL GRP 2KRIZIA CORRINE CAINGCOY SAN PEDROPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- الانتداب في تشريع الوظيفة العمومية الجزائريDocument20 pagesالانتداب في تشريع الوظيفة العمومية الجزائريilham kessiraPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Canadian Personal Care Provider Canadian 1st Edition by Wolgin ISBN Test BankDocument6 pagesCanadian Personal Care Provider Canadian 1st Edition by Wolgin ISBN Test Bankrobert100% (24)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- VT - Pharm Programs Handbook - 2019 - Final-2 (Somali) PDFDocument21 pagesVT - Pharm Programs Handbook - 2019 - Final-2 (Somali) PDFnimco haamud100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The ILO Convention NoDocument2 pagesThe ILO Convention NoHarsh DixitPas encore d'évaluation

- VISA INVITATION LetterDocument1 pageVISA INVITATION Letteristiuktushar2Pas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Sydney Matteotti Resume Updated 2Document1 pageSydney Matteotti Resume Updated 2api-663718862Pas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- OMAR Series Urdu Hindi Dubbed LinksDocument28 pagesOMAR Series Urdu Hindi Dubbed LinksSyed Muhammad Hasan Bilal100% (1)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Employment Standards Poster - June 2015Document1 pageEmployment Standards Poster - June 2015evaluvPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Letter PeoDocument3 pagesLetter PeoVobbin Jay CariasPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Report On The High Healthcare Costs in IndiaDocument3 pagesReport On The High Healthcare Costs in IndiaSydkoPas encore d'évaluation

- Sankara College of Science and Commerce Coimbatore: Lesson PlanDocument3 pagesSankara College of Science and Commerce Coimbatore: Lesson PlanSindhuja AnnPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- N5 Entrepreneurship Module 6 Labour RelationsDocument18 pagesN5 Entrepreneurship Module 6 Labour RelationsDonald Cobra Pako-MoremaPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- SC 2Document2 pagesSC 2Carol Buckley0% (1)

- Comparing The Policy of Aboriginal AssimilationDocument302 pagesComparing The Policy of Aboriginal AssimilationmichelmbouePas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Directory WilmingtonDocument5 pagesDirectory WilmingtonDaniel RODRIGUEZ SERNAPas encore d'évaluation

- HR Interview Questions Based On IndustrialDocument7 pagesHR Interview Questions Based On IndustrialRANG28120% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Sno Grank Arno Name Community T.Mark Allotted To CategoryDocument180 pagesSno Grank Arno Name Community T.Mark Allotted To CategorykkalpanaseenuPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- His Tuberculosis Fish Bone Diagram FinalDocument1 pageHis Tuberculosis Fish Bone Diagram FinalJadekookinPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Health Service Management Group AssigentDocument23 pagesHealth Service Management Group AssigentTayech TilahunPas encore d'évaluation

- Lecture 1 Social Policy and The Social Production of Welfare - 2023 - 24 - Student 2Document37 pagesLecture 1 Social Policy and The Social Production of Welfare - 2023 - 24 - Student 2kayiwong1125Pas encore d'évaluation

- List of Labour Laws in Khyber PakhtunkhwaDocument1 pageList of Labour Laws in Khyber PakhtunkhwaabrarPas encore d'évaluation

- Musicroom BookingDocument13 pagesMusicroom BookingDani Simón ColomarPas encore d'évaluation

- SKRIPSI TANPA BAB PEMBAHASAN PKHDocument78 pagesSKRIPSI TANPA BAB PEMBAHASAN PKHkopiPas encore d'évaluation

- Healthcare in The Philippines SeatworkkDocument5 pagesHealthcare in The Philippines SeatworkkDM ElisesPas encore d'évaluation

- Provider DirectoryDocument5 pagesProvider Directoryfreelib123Pas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Welcome To Your International: Medical and Travel Assistance ServiceDocument2 pagesWelcome To Your International: Medical and Travel Assistance ServiceAntoinePas encore d'évaluation

- Ava Khubani, Homework, Saturday 11 - 30AM, Winter - Spring 2023, MS PF JV - VARDocument12 pagesAva Khubani, Homework, Saturday 11 - 30AM, Winter - Spring 2023, MS PF JV - VARAvaKhubani 20291028Pas encore d'évaluation

- Welfare and Party Politics in Latin America PDFDocument234 pagesWelfare and Party Politics in Latin America PDFAlberto AnayaPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)