Académique Documents

Professionnel Documents

Culture Documents

GST in Malaysia

Transféré par

Izzuddin YussofCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

GST in Malaysia

Transféré par

Izzuddin YussofDroits d'auteur :

Formats disponibles

EPPE 6144 Public Finance

GST in Malaysia

Name: Izzuddin Bin Yussof

Registration No: P73499

Course: EPPE6144 Public Finance

Lecturer: 1) Dr. Riayati Ahmad

2) Prof. Md. Zyadi Md. Tahir

EPPE 6144 PUBLIC FINANCE

GST in Malaysia

Izzuddin Bin Yussof

P73499

1. Introduction

Malaysia, an emerging economy is currently on its way to one of the biggest tax reformation

ever faced by the country. The government of Malaysia is planning to substitute the current

Sales and Services Tax (SST) with Goods and Services Tax (GST) or more well known

internationally as Value Added Tax (VAT). However the public was outraged by this action,

fueled by negative sentiments and misunderstanding, lots of voices and anti-GST rally has been

conducted to push the government to retrace the idea. The Peoples Alliance, an informal

political coalition of three opposition parties had been leading rallies and spreading anti GST

sentiment to the people. However they are not totally against the idea of GST, they are making a

stand that now is not the right time to introduce GST.

However, there seems to be a lack of understanding among the majority member of the public

on the real structure of GST, particularly among those joining the anti-GST rally. As such, this

paper is intended to explain the reasons for GST implementation, the impact of GST to different

stakeholders, the process of GST and comparison between GST and SST.

GST, which is more commonly known internationally as VAT, was first introduced at national

level by a French economist Maurice Laur which was also Joint Director of the France Tax

Authority in 1954. However the origin of the idea was traced back to both German businessman

Wilhelm Von Siemens in 1918 and American economist Thomas S. Adams in his writing between

1910 and 1921.

As Cnossen (1998) wrote, the nearly universal introduction of the VAT should be considered the

most important event in the evolution of tax structure in the last half of the twentieth century.

To date, more than 160 countries are currently adapting the VAT as the main consumption tax.

However United States is one of the few developed countries without VAT. Out of 9 ASEAN

countries, currently only three countries which has yet to implement VAT namely Malaysia,

Brunei and Myanmar.

GST was first been announced to be put into implementation in Malaysia under the era of fifth

Prime Minister of Malaysia, Tun Abdullah Badawi in the 2005 budget. In the budget, it was said

that the GST will replace the current SST and was intended to eventually allow income tax to be

reduced. It was planned that the GST would be introduced in 1 January 2007. However in

February 2006, the plan was deferred since the government decided they would need more time

to get the opinion of the public.

EPPE 6144 PUBLIC FINANCE

GST in Malaysia

Izzuddin Bin Yussof

P73499

Later in November 2009, under the ruling of sixth Prime Minister Dato Seri Najib Abdul Razak,

the idea of GST was presented in Dewan Rakyat, a lower house of the Malaysian Parliament. It

was proposed that GST would be implemented 18 months after the second reading with an

expected rate of 4%. However the second reading never took place due to lack of input from the

general public.

The latest idea of GST was again announced in the 2014 budget, where the Prime Minister who

is also the Finance Minister of Malaysia, Dato Seri Najib Abdul Razak informed the public that

GST will replace SST with an expected rate of 6% in April 2015. This is confirmed in the latest

budget with expected additional revenue from GST being approximately RM5.6 billion.

The paper will proceed with a brief explanation of indirect tax system in Malaysia. Next the third

chapter will explain the reasons why GST was chosen to be implemented. Chapter four will be

the main finding where the process and impact towards consumers between the GST and SST

will be compared. The last chapter will conclude the finding of this paper.

EPPE 6144 PUBLIC FINANCE

GST in Malaysia

Izzuddin Bin Yussof

P73499

2. Indirect Taxation in Malaysia

In Malaysia, there are overall five indirect taxes currently being imposed. They are the import

and export duty, excise duty and sales and services tax. The last two are also considered as

consumption tax and will be replaced with GST effective 1 April 2015.

Import Duty

Import duty in Malaysia is levied in ad valorem basis with a rate ranging from 2% to 60%.

However beginning 1 April 2008, Malaysia implemented tariff rate quota (TRQ) on selected

agricultural products such as chicken, milk, sugar and cabbage. Imports within the quota will

enjoy a lower tariff rate while imports with volume higher than the quota will be imposed. As an

example in for 2015, the annual quota volume for chicken eggs would be approximately 83

million eggs. As long as the import does not exceed the limit, the in-quota tariff would be 10%.

Going above the limit would lead to an out-quota tariff of 50%. Firms who would like to import

these TRQs product would have to first apply for import license from the authority. The quota is

decided by the Department of Veterinary Services.

Manufacturers may apply for exemption for certain type of goods which are eligible to claim.

Among the exempted goods are:

i)

Raw materials and components used directly for the manufacture of goods for export and

domestic markets.

ii)

Dutiable machinery and equipment which are used directly in the manufacturing process.

Raw materials, machinery, essential foodstuffs and pharmaceutical products are generally nondutiable or subject to lower rates.

Export Duty

Export duties are generally imposed on the countrys main commodities such as crude

petroleum and palm oil for revenue purposes. The rate is an ad valorem form but dependent on

the price of the commodity in the market. As an example for crude palm oil, if the CPO price in

the market is at RM3,450 per tonne, the export duty will be at 8.5%. However if it is below

RM2,250 per tonne as in at the end of 2014, the commodity will be exempted from export duty.

EPPE 6144 PUBLIC FINANCE

GST in Malaysia

Izzuddin Bin Yussof

P73499

Excise Duty

Excise duties are imposed on goods which are manufactured in Malaysia or imported into

Malaysia. Excise duties vary from a composite rate of 10 cent per litre and 15% for certain type

of spirituous beverages to as high as 105% for motorcars. Goods which are subject to excised

duty include beer, rice wine, cigarettes, motor vehicles and playing cards. In general, duty is

payable at the time the goods leave the place of manufacture. However for a predefined list of

motor vehicles, the duty is payable once the vehicle is registered with Road Transport

Department, up to a maximum of 4 years from the date of removal from the factory. No excise

duty is payable on dutiable goods that are exported.

Sales Tax

Sales tax is a single-stage tax imposed on certain locally manufactured goods and on similar

imported goods. Although being a consumption tax, the tax is actually paid to government at

the manufacturing level. It is assumed that the manufacturer will then collect the tax from the

customer via increased price. In the case of imported goods, the tax is collected from the

importer at the time the goods are released from customs control. The sales tax is inapplicable

at free zone area such as Labuan, Langkawi and Tioman.

The current rates are as follows:

Goods

Rate

Fruits, certain foodstuff, timber and building material

5%

Cigarettes and Tobacco

25%

Liquor and Alcoholic Drinks

20%

All other goods except petroleum and goods not

specifically exempted

10%

Live animals and essential food items

Medical, educational and sports equipment

Photographic equipment and films

Motorcycles below 201 cc and bicycles for adult use

including parts and accessories

Machinery for selected industry

Primary commodities (e.g. cocoa, rubber) and their

related products

Naturally occurring mineral substances, chemical, etc.

Helicopters, aircraft, ships and other vessels

Exempted

EPPE 6144 PUBLIC FINANCE

GST in Malaysia

Izzuddin Bin Yussof

P73499

Service Tax

Service tax is levied and charged on any taxable services provided by any taxable person. The

rate is set at 6% ad valorem effective from 1 January 2011, a 1% increase compared to the

previous rate. However for the provision and issuance of charge or credit card, the service tax

will be RM50 per year on the principal card RM25 per year on the supplementary card. The tax

for charge or credit card will be chargeable on the date of the issuance or renewal of the card

and every 12 months thereafter.

Any taxable person who carries on business of providing taxable service must apply for a

license. No fee is payable for the issuance of a license. A summary of taxable person and taxable

services are as follows:

Taxable Person

Minimum Annual

Sales Turnover

Operator of hotels with more than 25 rooms

N/A

Operators providing food, drinks and tobacco products wholly eat-in or

N/A

partly take-away located in hotels with more than 25 rooms

Operators providing food, drinks and tobacco products wholly eat-in or

RM300,000

partly take-away located in hotels with less than 25 rooms (with some

exclusion)

Operators providing food, drinks and tobacco products wholly eat-in or

RM3 million

partly take-away

Operators of food courts

RM300,000

Operators of night-clubs, dance halls and cabarets

N/A

Operators of approved health-centres and massage parlours

N/A

Operators of 1st, 2nd and 3rd class public house and 1st or 2nd class beer

N/A

house

Operators of private clubs

Operators of golf course or gold driving range

Licensed private hospitals

RM300,000

N/A

RM300,000

Insurance companies

N/A

Communication service provider

N/A

Agent for import and export activity

N/A

Agent for import and export activity that is stored in the licensed

N/A

warehouse or inland clearance depot

EPPE 6144 PUBLIC FINANCE

GST in Malaysia

Izzuddin Bin Yussof

P73499

Operators of parking space for motor vehicle

RM150,000

Courier-services companies

RM150,000

Operators of motor vehicle service and/or repair centres

RM150,000

Licensed private agencies

RM150,000

Employment agencies

RM150,000

Hire-and-drive car and hire-car service companies

RM300,000

Advertising companies

RM300,000

Public accountants

N/A

Advocates and solicitors

N/A

Professional engineers

N/A

Architects

N/A

Licensed or Registered Surveyors / Registered Valuers, Appraisers and

N/A

Estate Agents

Consultants (subject to some exclusion)

N/A

Management companies

N/A

Provider of charge and credit card services

N/A

EPPE 6144 PUBLIC FINANCE

GST in Malaysia

Izzuddin Bin Yussof

P73499

3. Reasons for GST by Government

Amid mounting criticisms and voice of the public against the idea of GST, the current

government is keen towards its implementation. There are overall 10 reasons provided by the

government on why GST is a better tax system compared to the current system. However it

needs to be mentioned that any comparison between GST and SST is purely on the structure

without taking into account the rates imposed.

The first reason given by the government is through GST implementation, the citizen will have an

improved standard of living overall. The revenue from GST could be used for development

purposes in all areas such as education, healthcare, public transport etc. However this will also

mean that the GST planned by the government will have a higher tax collection which is a

burden to the citizen. Higher collection of revenue is considered the main purpose of GST as

government is currently in the process of reducing their budget deficit to gain investors

confidence. Whether the additional tax collection will bring a better standard of living is highly

dependent on the efficiency of the government in managing their projects.

The second argument provided by the government is lower cost of doing business. Under the

current system, some business may end up facing cascading tax, which result in them paying the

tax multiple times. This may occur when an input of the company is already taxed by the

government and they are again taxed for their output. However under GST, the business will be

able to claim for the tax of their inputs. As such, cascading tax will not occur under GST. However

it needs to be mentioned that GST covers a wider range of goods and services compared to the

current SST, particularly in the services sector. Whether the overall cost will actually be lower for

business remains to be seen.

The third reasoning provided is GST will enable government to build the nation to become a high

income nation. Once again, it was claimed that the higher revenue due to GST implementation

will help the government financially which will lead to more projects and development being

done for the nation. The weakness of this proposition is again whether the higher revenue will

be used efficiently to neutralize the loss of real income due to higher tax collection.

Fairness and equality is one of the arguments from the side of the government. The method of

SST particularly the services tax is all services will not be imposed tax except stated otherwise. As

such, there are significant number of services which are not subject to SST such as the financial

industry. On the other hand, GST will in general be imposed on all type of goods and services

except stated otherwise. As a result, taxes are levied fairly among all the businesses involved,

EPPE 6144 PUBLIC FINANCE

GST in Malaysia

Izzuddin Bin Yussof

P73499

whether they are in the manufacturing, wholesaling, retailing or service sector. However this will

also mean that the overall cost of living will increase particularly in the service industry since

services which is not subject to SST previously will be imposed tax under GST.

Another advantage of GST is it will increase global competitiveness. This may be achieved as

business which involves in export will be able to claim back the taxed they have paid for their

inputs while no GST will be imposed in exporting the goods. On the other hand as the current

SST possesses no such rebate, the export price has already absorbed the cost of taxation.

The government said that the current SST has many inherent weaknesses making administration

difficult. On the other hand, GST system has in-built mechanism to make the tax administration

self-policing and therefore will enhance compliance.

GST will also reduce red tape, which is bureaucratic system that is present in the current SST. For

example, in order to be exempted from tax, businesses must apply for approval to get tax-free

materials and also for special exemption for capital goods. However the rebate system where

the business is responsible to claim back the tax input from the government is yet to be known

whether it will be less bureaucratic than SST.

As mentioned previously, as GST will avoid cascading tax issue, it will eventually lead to fair

pricing to consumers. Although consumers may be able to avoid paying the price of goods plus

twice the tax, the overall consumer price may increase due to the broader range of goods and

services subject to GST.

Lastly, GST will allow greater transparency compared to SST. As GST is imposed at every level

albeit the rebate for input tax, each buyer will be able to see exactly the amount of tax theyre

paying from the receipt. Consumers will also be able to know if the goods or services they are

paying for is exempted or zero rated.

In a nutshell, compared to the current SST, GST will be less bureaucratic for the firms and the

issue of cascading tax will be avoided. However the impact to the government and consumer is

dependent on the rate imposed. From analysis made by the government, GST will provide higher

revenue for the government which will be able to be used for development purposes and other

financial responsibilities including debt payment. On the other hand for consumers, there will be

higher tax overall need to be paid which will result in higher prices and hence lower real income.

Therefore it can be said that the current planning for GST will help both firms and government

but may cause an additional burden to the citizen.

EPPE 6144 PUBLIC FINANCE

GST in Malaysia

Izzuddin Bin Yussof

P73499

4. Goods and Services Tax

4.1. Process of GST

One of the main advantages of GST / VAT compared to SST is the ability to avoid cascading

tax. As the name implies, VAT will only tax the additional value imposed by the respective

business and will provide a rebate paid for the input tax. As such, there will be no risk of

double taxation as long as each firms claim their input tax from the government.

Under GST, all goods and services will be divided into three categories i.e. standard rated,

zero rated and exempted. Standard rated supplies are taxable supplies of goods and

services which are subject to the standard rate. Zero rated supplies are taxable supplies

which are subject to a zero rate, that is not liable to GST at the output or input stage.

Exempt supplies are non taxable supplies which are not subject to GST at the output stage

that is, when supplied to the consumer. However, the GST paid on input by the businesses

cannot be claimed as tax credit.

All businesses with turnover of more than RM150,000 per year is compulsory to register for

GST. Businesses with turnover lower than the said threshold may register for GST

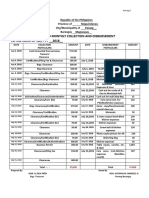

voluntarily. An illustration of the GST process is provided as below.

For the goods and services previously taxed at 6% rate under SST:

EPPE 6144 PUBLIC FINANCE

GST in Malaysia

For the goods and services previously taxed at 10% rate under SST

For the goods and services previously not taxed under SST

Izzuddin Bin Yussof

P73499

EPPE 6144 PUBLIC FINANCE

GST in Malaysia

Izzuddin Bin Yussof

P73499

4.2. List of zero rated and exempted supply under GST

Below is the list of zero rated and exempted supply under GST. As mentioned previously,

the zero rated supply are supplies which are not liable to taxation for both input and output

while the exempted supply are supplies which are not liable to taxation for output but is

liable for input. However businesses are allowed to claim for tax input.

Zero Rated Supply

Exempted Supply

Live animals, animal products, vegetable Land and building used for residential,

products and some prepared food.

agricultural, burial and religious purposes.

Goods supplied to Labuan, Langkawi and The operation of any current, deposit or

Tioman

Goods

savings account*

supplied

in

connection

with The provision of any loan, advance or credit

international shipping and air services

or other similar facility*

Supply of treated water (unlimited) to The transfer of derivatives/securities*

domestic consumers

First 200 units of electricity to domestic Unit trust transactions*

household

Supply of raw materials and components for Life insurance*

approved toll manufacturing scheme

Services and spare parts in connection with Islamic financial services will be given the

shipping and aircraft (excluding private use)

same treatment as conventional financial

services*

International transportation of passenger Education services

and goods

Leasing of goods outside of Malaysia

Childcare services

Services rendered in connection with goods Healthcare services

or land outside Malaysia

Services rendered to a person outside Rental

Malaysia

of

residential

accommodation (more than 28 days)

Specified services provided in Malaysia to a Public transport

person (in his business capacity) who

belongs outside Malaysia

Insurance relating to export of goods; Toll

services connected with the export of

goods; Insurance of risk outside Malaysia

properties

and

EPPE 6144 PUBLIC FINANCE

GST in Malaysia

Izzuddin Bin Yussof

P73499

Telecommunication services provided to Funeral, burial, and cremation services

outside Malaysia

Services supplied relating to location of Qualifying

supplies

by

societies

and

computer servers in Malaysia belonging to a associations

person outside Malaysia

Advertising services made available outside

Malaysia

International mail

Qualifying inbound/outbound tour services

Lease of air or sea containers

*It is to be noted that any fee, commission, or similar charges associated with the above

services will be treated as a taxable supply.

From the list, it can be said that most of the zero rated supplies are the ones relating to

international relationship, except for the foods and utilities up to a certain threshold.

Although there is a long list of exempted supplies which give direct effect to the consumers,

the exempted supplies are only non-taxable on the output, not on the input. As such, it is

most likely that consumers will still face a rising price for the overall goods and services.

Despite that, it needs to be mentioned that Malaysia has one of the longest zero rated and

exempted list of goods and services for its GST.

EPPE 6144 PUBLIC FINANCE

GST in Malaysia

Izzuddin Bin Yussof

P73499

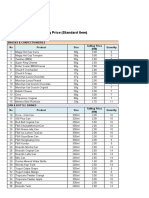

4.3. Comparison on the price of goods and services

Not all price of goods and services will be heading towards the same direction. There are

some goods and services will face a price increase, no effect and some may decrease after

GST implementation. This is because although GST covers a wider range of supplies, the

sales tax for manufacturing products actually falls from 10% to 6%. As a result, as long as

the business did not incur a higher cost due to GST, the price of the supplies should

decrease.

Below are the price direction for some goods and services provided by the Malaysian

Custom

Decrease

No GST

Increase

Television

Bread, white and wholemeal

Mobile phone

Refrigerator

Cooking oil

Computer

Air-Conditioner

Beef, mutton, lamb, chicken iPad and Tablet

and pork

Spark plug, brake pad and Local and imported fruit

Photocopy machine

car battery

Home theatre system

Diesel

Digital photo printing

Hair dryer

Petrol unleaded 95

Transportation of goods

Electric fan and toaster

Rice

Drinking water

Gas cooker double burner

Fresh vegetable

Magazines

Electric iron

Fresh fish and prawns

Fish balls

Cotton bath towel

Powdered-milk for infant

Canned sardine & tuna

Colour pencil

Chicken and duck eggs

Lipstick

Toothbrush

Public transport

Nail colour

Dettol, antiseptic

Motor oil

Motorcycle 110cc

Dining set (6 chairs)

Engine oil

Watches

Diapers

Private-clinic x-ray

Ice cream

Car 850cc

Toll

Cheese

Toothpaste

Chilli

Oats and cereals

Soft drink

Plastic mat

Imported fruits

Chilli sauce, oyster sauce etc

EPPE 6144 PUBLIC FINANCE

GST in Malaysia

Izzuddin Bin Yussof

P73499

5. Conclusion and Recommendation

As a conclusion, GST system by itself may prove to be a better tax system compared to the

current SST. However as government is expecting additional revenue from GST, it would only

mean that the government is planning to increase consumption tax collection along with the

introduction of GST. The government is currently forced to collect higher revenue to reduce the

level of government debt and to convince international investors that Malaysia remains an

attractive investment destination.

In order for GST to be successful, the government needs to ensure that there is full compliance

among all businesses and make sure no businesses will take advantage of GST and raises the

price irresponsibly. Besides that, it is also the task of the authority to minimize the risk of

confusion among stakeholders especially consumers and businesses upon GST implementation.

Furthermore, close observation need to be done on the impact of GST on low-income

household. This is important to guarantee the well-being of the group, which is most likely to be

highly affected by GST.

6. References

Cnossen, S. (1998). Global Trends and Issues in Value Added Taxation. 5 International Tax and

Public Finance 399

GST in Malaysia. [ONLINE] Available at:

http://savemoney.my/gst-in-malaysia-how-the-goods-and-services-tax-affects-you

[Accessed 24 January 2015].

James, K. (2011). Exploring the Origins and Global Rise of VAT. Tax Analysts, 15-22

Malaysia, (2004, 2013 and 2014). Budget Speech, Ministry of Finance.

Royal Malaysian Customs Department . [ONLINE] Available at:

http://www.customs.gov.my/en/cp/Pages/cp_abt.aspx. [Accessed 24 January 2015].

Vous aimerez peut-être aussi

- Itemized Monthly Collection & DisbursementDocument25 pagesItemized Monthly Collection & DisbursementCyrus John VelardePas encore d'évaluation

- 40221390-Dehydrated-Onion - MarketDocument13 pages40221390-Dehydrated-Onion - MarketGourav TailorPas encore d'évaluation

- Chapter 2 Corporate TaxDocument50 pagesChapter 2 Corporate TaxNgPas encore d'évaluation

- Basis of Malaysia Income TaxDocument17 pagesBasis of Malaysia Income TaxhelenxiaochingPas encore d'évaluation

- Production Sharing AgreementsDocument106 pagesProduction Sharing AgreementsAl Hafiz Ibn HamzahPas encore d'évaluation

- Taxes and Duties at A Glance 2023-2024Document33 pagesTaxes and Duties at A Glance 2023-2024Jacob SangaPas encore d'évaluation

- Basis of Malaysian Income TaxDocument19 pagesBasis of Malaysian Income TaxMalabaris Malaya Umar SiddiqPas encore d'évaluation

- AP Cars SDN BHD - QuestionsDocument1 pageAP Cars SDN BHD - Questionsnadia0% (1)

- Business Plan - Pigger ProjectDocument19 pagesBusiness Plan - Pigger ProjectChiremba100% (1)

- CRG660-04-Lecture notes-COmpany Secretary-Sept 2018 - LatestDocument23 pagesCRG660-04-Lecture notes-COmpany Secretary-Sept 2018 - Latestauni fildzahPas encore d'évaluation

- Taxation Suggested Solution: LessDocument9 pagesTaxation Suggested Solution: LesskannadhassPas encore d'évaluation

- Al-Halal Wal Haram Fil IslamDocument380 pagesAl-Halal Wal Haram Fil IslamIzzuddin Yussof0% (1)

- Malaysian TaxationDocument19 pagesMalaysian Taxationsyahirah7767% (3)

- The Acceptance Level On GST Implementation in Malaysia: Gading Journal For The Social Sciences Vol 1 No 2 (2016)Document6 pagesThe Acceptance Level On GST Implementation in Malaysia: Gading Journal For The Social Sciences Vol 1 No 2 (2016)Harshini RamasPas encore d'évaluation

- Strategic Management PresentationDocument35 pagesStrategic Management Presentationrishuchaudhary100% (1)

- Polytechnic University of The Philippines-SurveyDocument1 pagePolytechnic University of The Philippines-SurveyCristina DanezPas encore d'évaluation

- Hydroponics SWOT AnalysisDocument21 pagesHydroponics SWOT AnalysisDPas encore d'évaluation

- Case Study 4 Papa JohnDocument9 pagesCase Study 4 Papa JohnLekha GuptaPas encore d'évaluation

- 10 Principle of FinanceDocument7 pages10 Principle of FinanceJessicaPas encore d'évaluation

- PepsiDocument107 pagesPepsiJuan Pablo Albarracin67% (3)

- Mis Applications in The F&B ServiceDocument14 pagesMis Applications in The F&B ServiceGil Teodosip100% (7)

- Tax ComputationDocument13 pagesTax ComputationEcha Sya0% (1)

- Chap-3 Company SecretaryDocument21 pagesChap-3 Company SecretaryElya Mulis100% (1)

- Research Paper On VATDocument60 pagesResearch Paper On VATjtesh2020100% (1)

- PPTDocument33 pagesPPTanis solihah0% (1)

- 03FM SM Ch3 1LPDocument6 pages03FM SM Ch3 1LPjoebloggs18880% (1)

- History of Ethiopian TaxationDocument4 pagesHistory of Ethiopian Taxationsara woldeyohannes100% (1)

- Taxation in BangladeshDocument6 pagesTaxation in BangladeshSakibPas encore d'évaluation

- Eco 415Document4 pagesEco 415Verne Skeete Jr.100% (1)

- Lecture Tutorial - P, CL and CA (A)Document3 pagesLecture Tutorial - P, CL and CA (A)yym cindyy100% (1)

- Alia Syazwani Practical Training ReportDocument22 pagesAlia Syazwani Practical Training ReportAli Hisham GholamPas encore d'évaluation

- BOP AssignmentDocument20 pagesBOP AssignmentSajid Karbari0% (1)

- A Study On Self-Assessment Tax System Awareness in MalaysiaDocument8 pagesA Study On Self-Assessment Tax System Awareness in Malaysiaaiman100% (1)

- 3.0 Principles of Effective AccountabilityDocument10 pages3.0 Principles of Effective AccountabilityNor Ashqira KamarulPas encore d'évaluation

- Pad 240 PDFDocument10 pagesPad 240 PDFFais Aiman MustaphaPas encore d'évaluation

- MGT162 Individual AssignmentDocument17 pagesMGT162 Individual AssignmentMEOR HAMIZAN MEOR MOHAMMAD FAREDPas encore d'évaluation

- Drafting Financial Statements (International Stream) : Monday 1 December 2008Document9 pagesDrafting Financial Statements (International Stream) : Monday 1 December 2008salaam7860Pas encore d'évaluation

- Ways of Curbing InflationDocument3 pagesWays of Curbing InflationPooja EkkaPas encore d'évaluation

- Appeal Tax Procedure (Malaysia)Document2 pagesAppeal Tax Procedure (Malaysia)Zati TyPas encore d'évaluation

- ACC 4041 Tutorial - Corporate Tax 2Document3 pagesACC 4041 Tutorial - Corporate Tax 2Atiqah DalikPas encore d'évaluation

- Tutorial 5 Eco 415Document7 pagesTutorial 5 Eco 415ZhiXPas encore d'évaluation

- Assignment 2Document16 pagesAssignment 2Mandy OwxPas encore d'évaluation

- Tutorial 1 3Document5 pagesTutorial 1 3Faiz MohamadPas encore d'évaluation

- Constitutional Validity (Excise Duties, Custom Duties & Service Taxes)Document19 pagesConstitutional Validity (Excise Duties, Custom Duties & Service Taxes)07anshuman100% (2)

- 2014 Perodua Improving Customer SatisfaDocument16 pages2014 Perodua Improving Customer Satisfanusra_t100% (1)

- LiabilityDocument4 pagesLiabilityNor Karmila Roslan0% (1)

- 5 Social ContractDocument23 pages5 Social ContractShuq Faqat al-FansuriPas encore d'évaluation

- Eco211 210 164 219Document10 pagesEco211 210 164 219Ana MuslimahPas encore d'évaluation

- A162 Answer Tutorial 1 and Answer Siti NorlizaDocument13 pagesA162 Answer Tutorial 1 and Answer Siti NorlizaXiao Yun Yap0% (2)

- Taxation AnswerDocument13 pagesTaxation AnswerkannadhassPas encore d'évaluation

- E2MDocument2 pagesE2MEdward JohnPas encore d'évaluation

- Exam Docs Dipifr 2012Document2 pagesExam Docs Dipifr 2012aqmal16Pas encore d'évaluation

- Planning For Change in A Company Riddled With ProblemsDocument10 pagesPlanning For Change in A Company Riddled With ProblemsSasiram RajasekaranPas encore d'évaluation

- Fin430 - Dec2019Document6 pagesFin430 - Dec2019nurinsabyhahPas encore d'évaluation

- Workshop 6 (Students) ADM657Document7 pagesWorkshop 6 (Students) ADM657Khairi N WaniePas encore d'évaluation

- Far210 Topic 2 Malaysian Conceptual FrameworkDocument79 pagesFar210 Topic 2 Malaysian Conceptual FrameworkSamurai Hut100% (1)

- Topic 4 - Time Value of MoneyDocument64 pagesTopic 4 - Time Value of MoneyHisyam SeePas encore d'évaluation

- Define National Income Eco415Document3 pagesDefine National Income Eco415aishahPas encore d'évaluation

- Tutorial 2e Residence StatusDocument2 pagesTutorial 2e Residence StatusnatlyhPas encore d'évaluation

- Question AIS AssignmentDocument4 pagesQuestion AIS Assignmentfaris ikhwanPas encore d'évaluation

- Chapter 3 - Agriculture AllowancesDocument3 pagesChapter 3 - Agriculture AllowancesNURKHAIRUNNISA100% (2)

- Sme CorpDocument13 pagesSme CorpFaridz RahimPas encore d'évaluation

- Business Taxation Notes Income Tax NotesDocument303 pagesBusiness Taxation Notes Income Tax NotesIkra MalikPas encore d'évaluation

- The Industrial Training Experience Accounting EssayDocument14 pagesThe Industrial Training Experience Accounting Essayrajes2301Pas encore d'évaluation

- Export Import and EXIM PolicyDocument27 pagesExport Import and EXIM PolicyAmit JainPas encore d'évaluation

- PTX - AssignmentDocument15 pagesPTX - AssignmentNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)Pas encore d'évaluation

- A Study On The Importance of Corporate Restructuring Approches in MalaysiaDocument13 pagesA Study On The Importance of Corporate Restructuring Approches in MalaysiaValerie SintiPas encore d'évaluation

- Source: (Extracted From An Overview of GST MalaysiaDocument9 pagesSource: (Extracted From An Overview of GST MalaysiaYeehui HayleyPas encore d'évaluation

- Malawi DeloitteDocument14 pagesMalawi DeloitteMwawiPas encore d'évaluation

- An Overview of GST MalaysiaDocument23 pagesAn Overview of GST MalaysiaParimalar RajindranPas encore d'évaluation

- VAT Reform in BangladeshDocument28 pagesVAT Reform in BangladeshhossainmzPas encore d'évaluation

- Product Price List (Standard Item)Document1 pageProduct Price List (Standard Item)Izzuddin YussofPas encore d'évaluation

- BQDocument2 pagesBQIzzuddin YussofPas encore d'évaluation

- Week 1 Update Foundations of Monetary EconomicsDocument15 pagesWeek 1 Update Foundations of Monetary EconomicsIzzuddin YussofPas encore d'évaluation

- Joomla1.5 Installation Manual Version 0.5Document52 pagesJoomla1.5 Installation Manual Version 0.5Ivan_Obillos_5435Pas encore d'évaluation

- Kitchen ToolsDocument12 pagesKitchen ToolsZie BeaPas encore d'évaluation

- Presentation JBSDocument34 pagesPresentation JBSJBS RIPas encore d'évaluation

- Anil Kumar Singh Archana Pawar Bharti Gyanchandani Sohit Kadwey Sonam Seth Srashti SuneriyaDocument13 pagesAnil Kumar Singh Archana Pawar Bharti Gyanchandani Sohit Kadwey Sonam Seth Srashti SuneriyaSrashti SuneriyaPas encore d'évaluation

- B1 25.7Document11 pagesB1 25.7Hoàng Dương TrịnhPas encore d'évaluation

- Pizza Report PDFDocument7 pagesPizza Report PDFjuhi agarwalPas encore d'évaluation

- Oil and Gas Sector Research in Uganda - Constraints and Opportunities For SMEsDocument61 pagesOil and Gas Sector Research in Uganda - Constraints and Opportunities For SMEsGyagenda Kenneth100% (1)

- Math 3 LM Draft 4.10.2014Document367 pagesMath 3 LM Draft 4.10.2014Golden SunrisePas encore d'évaluation

- Lamp Color Temperature GuideDocument2 pagesLamp Color Temperature GuidesvmrPas encore d'évaluation

- Indiana DOR, Letter of Findings Number 04-2010069 (Nov. 4, 2011)Document2 pagesIndiana DOR, Letter of Findings Number 04-2010069 (Nov. 4, 2011)Paul MastersPas encore d'évaluation

- Chick-Fil-A EvaluationDocument4 pagesChick-Fil-A Evaluationapi-450935011Pas encore d'évaluation

- Gender Agricultural InnovationDocument31 pagesGender Agricultural InnovationAPPROCenterPas encore d'évaluation

- Kentucky Fried ChickenDocument5 pagesKentucky Fried ChickenShraddha SuvarnaPas encore d'évaluation

- Being Matt BaumgartnerDocument1 pageBeing Matt BaumgartnerErin PihlajaPas encore d'évaluation

- Red ProjectDocument30 pagesRed ProjectApoorva SrivastavaPas encore d'évaluation

- Full Text Lamb To SlaughterDocument10 pagesFull Text Lamb To SlaughterFakhrurrazi OppaPas encore d'évaluation

- FijiTimes - Dec 14 2012 WebDocument48 pagesFijiTimes - Dec 14 2012 WebfijitimescanadaPas encore d'évaluation

- Slickables Marketing ResearchDocument23 pagesSlickables Marketing ResearchJessa Kali ShortPas encore d'évaluation

- Wine Tasting EtiquetteDocument1 pageWine Tasting EtiquetteCellarsWineClubPas encore d'évaluation

- Chapter 1 - The Business of AgribusinessDocument17 pagesChapter 1 - The Business of AgribusinessBill ALPas encore d'évaluation

- Tugas Artikel Beserta Tenses Astri Armaya HasibuanDocument2 pagesTugas Artikel Beserta Tenses Astri Armaya HasibuanL-LILANZZPas encore d'évaluation

- Sheel Dele2goDocument8 pagesSheel Dele2goAnonymous vWFDPWPas encore d'évaluation