Académique Documents

Professionnel Documents

Culture Documents

SEBI (Substantial Acquisition of Shares and Takeovers) (Amendment) Regulations, 2015

Transféré par

Shyam SunderDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

SEBI (Substantial Acquisition of Shares and Takeovers) (Amendment) Regulations, 2015

Transféré par

Shyam SunderDroits d'auteur :

Formats disponibles

THE GAZETTE OF INDIA

EXTRAORDINARY

PART III SECTION 4

PUBLISHED BY AUTHORITY

NEW DELHI, MARCH 24, 2015

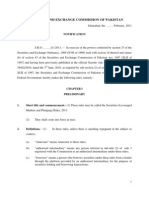

SECURITIES AND EXCHANGE BOARD OF INDIA

NOTIFICATION

Mumbai, the 24th March, 2015

SECURITIES AND EXCHANGE BOARD OF INDIA

(SUBSTANTIAL ACQUISITION OF SHARES AND TAKEOVERS)

(AMENDMENT) REGULATIONS, 2015

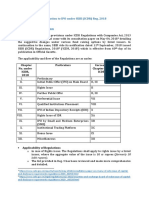

No. LAD-NRO/GN/2014-15/28/542. In exercise of the powers conferred under section 30

of the Securities and Exchange Board of India Act, 1992 (15 of 1992), the Board hereby

makes the following Regulations to amend the Securities and Exchange Board of India

(Substantial Acquisition of Shares and Takeovers) Regulations, 2011, namely:1.

These regulations may be called the Securities and Exchange Board of India

(Substantial Acquisition of Shares and Takeovers) (Amendment) Regulations, 2015.

2.

They shall come into force on the date of their publication in the Official Gazette.

3.

In the Securities and Exchange Board of India (Substantial Acquisition of Shares and

Takeovers) Regulations, 2011

(I) After regulation 5, the following regulation shall be inserted, namely:Delisting offer.

"5A.

(1)

Notwithstanding anything contained in these regulations, in

the event the acquirer makes a public announcement of an open offer for

acquiring shares of a target company in terms of regulations 3, 4 or 5, he may

delist the company in accordance with provisions of the Securities and

Exchange Board of India (Delisting of Equity Shares) Regulations, 2009:

Provided that the acquirer shall have declared upfront his intention

to so delist at the time of making the detailed public statement .

(2)

Where an offer made under sub-regulation (1) is not successful,1

Brought to you by http://StockViz.biz

(i)

on account of nonreceipt of prior approval of shareholders in terms

of clause (b) of sub-regulation (1) of regulation 8 of Securities and

Exchange Board of India (Delisting of Equity Shares) Regulations,

2009; or

(ii)

in terms of regulation 17 of Securities and Exchange Board of India

(Delisting of Equity Shares) Regulations, 2009; or

(iii)

on account of the acquirer rejecting the discovered price determined

by the book building process in terms of sub-regulation (1) of

regulation 16 of Securities and Exchange Board of India (Delisting

of Equity Shares) Regulations, 2009,

the acquirer shall make an announcement within two working days in respect

of such failure in all the newspapers in which the detailed public statement

was made and shall comply with all applicable provisions of these

regulations.

(3)

In the event of the failure of the delisting offer made under sub-

regulation (1), the acquirer, through the manager to the open offer, shall

within five working days from the date of the announcement under subregulation (2), file with the Board, a draft of the letter of offer as specified in

sub-regulation (1) of regulation 16 and shall comply with all other applicable

provisions of these regulations:

Provided that the offer price shall stand enhanced by an amount equal to a

sum determined at the rate of ten per cent per annum for the period between

the scheduled date of payment of consideration to the shareholders and the

actual date of payment of consideration to the shareholders.

Explanation: For the purpose of this sub-regulation, scheduled date shall be

the date on which the payment of consideration ought to have been made to

the shareholders in terms of the timelines in these regulations.

Brought to you by http://StockViz.biz

(4)

Where a competing offer is made in terms of sub-regulation (1) of

regulation 20,(a)

the acquirer shall not be entitled to delist the company;

(b)

the acquirer shall not be liable to pay interest to the shareholders on

account of delay due to competing offer;

(c ) the acquirer shall comply with all the applicable provisions of these

regulations and make an announcement in this regard, within two

working days from the date of public announcement made in terms of

sub-regulation (1) of regulation 20, in all the newspapers in which the

detailed public statement was made.

(5) Shareholders who have tendered shares in acceptance of the offer made

under sub-regulation (1), shall be entitled to withdraw such shares tendered,

within 10 working days from the date of the announcement under subregulation (2) .

(6) Shareholders who have not tendered their shares in acceptance of the

offer made under sub-regulation (1) shall be entitled to tender their shares in

acceptance of the offer made under these regulations. "

(II)

After sub-regulation (6) of regulation 18, the following sub-regulation shall be

inserted:

"(6A) The acquirer shall facilitate tendering of shares by the shareholders and

settlement of the same, through the stock exchange mechanism as specified by

the Board."

(III)

In sub-regulation (1) of regulation 22, after the first proviso, the following

proviso shall be inserted, namely:"Provided further that in case of a delisting offer made under regulation 5A,

the acquirer shall complete the acquisition of shares attracting the obligation

3

Brought to you by http://StockViz.biz

to make an offer for acquiring shares in terms of regulations 3, 4 or 5, only

after making the public announcement regarding the success of the delisting

proposal made in terms of sub-regulation (1) regulation 18 of Securities and

Exchange Board of India (Delisting of Equity Shares) Regulations, 2009."

U.K. SINHA

CHAIRMAN

SECURITIES AND EXCHANGE BOARD OF INDIA

Footnote:

1. The SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 were

published in the Gazette of India on 23rd September, 2011 vide No. LAD-NRO/GN/201112/24/30181.

2. The Principal Regulations were subsequently amended on:

a.

March 26, 2013 by the SEBI (Substantial Acquisition of Shares and Takeovers)

(Amendment)Regulations, 2013 vide F. No. LAD-NRO/GN/2012-13/36/7368.

b.

May 23, 2014 by the Securities and Exchange Board of India (Payment of

Fees)(Amendment) Regulations, 2014 vide Notification No. LAD-NRO/GN/201415/03/1089

Brought to you by http://StockViz.biz

Vous aimerez peut-être aussi

- Merchant Banking RegulationsDocument30 pagesMerchant Banking RegulationsNiyati VaidyaPas encore d'évaluation

- 22 02 2018 PDFDocument4 pages22 02 2018 PDFDhruvPas encore d'évaluation

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersD'EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersPas encore d'évaluation

- Sebi Mergers andDocument13 pagesSebi Mergers andRahul AgrawalPas encore d'évaluation

- Page 1 of 66Document66 pagesPage 1 of 66Prithav BangPas encore d'évaluation

- Securities and Exchange Board of India (Merchant Bankers) Regulations, 1992 Contents: Chapter I: PreliminaryDocument30 pagesSecurities and Exchange Board of India (Merchant Bankers) Regulations, 1992 Contents: Chapter I: PreliminaryNaresh KumarPas encore d'évaluation

- Adjudication Order in respect of (1) E-Land Apparel Limited (Formerly known as Mudra Lifestyle Limited) (2) E-Land Asia Holding Pte Limited (3)Mr. Murari Bisheshwar Agarwal (4) Mr. Ravinder Bisheshwar Agarwal (5) Mr. Vishwambharlal Kanahiyalal Bhoot.Document27 pagesAdjudication Order in respect of (1) E-Land Apparel Limited (Formerly known as Mudra Lifestyle Limited) (2) E-Land Asia Holding Pte Limited (3)Mr. Murari Bisheshwar Agarwal (4) Mr. Ravinder Bisheshwar Agarwal (5) Mr. Vishwambharlal Kanahiyalal Bhoot.Shyam SunderPas encore d'évaluation

- Reverse Merger - SEBI CircularDocument13 pagesReverse Merger - SEBI CircularhimanshusabooPas encore d'évaluation

- Securities and Exchange Board of India (Settlement Proceedings) Regulations, 2018 (Last Amended On July 22, 2020)Document63 pagesSecurities and Exchange Board of India (Settlement Proceedings) Regulations, 2018 (Last Amended On July 22, 2020)Parag KabraPas encore d'évaluation

- Neelam Bhardwaj: Phone: +91 22 26449350 (D), EmailDocument8 pagesNeelam Bhardwaj: Phone: +91 22 26449350 (D), EmailjitumkPas encore d'évaluation

- Hapter Reliminary: Inserted by The SEBI (Self Regulatory Organizations) (Amendment) Regulations, 2013 W.E.F. 07.01.2013Document24 pagesHapter Reliminary: Inserted by The SEBI (Self Regulatory Organizations) (Amendment) Regulations, 2013 W.E.F. 07.01.2013Pratim MajumderPas encore d'évaluation

- SEBI (Depositories and Participants) Regulations, 2018Document62 pagesSEBI (Depositories and Participants) Regulations, 2018Pratik BanerjeePas encore d'évaluation

- 1569837887656Document32 pages1569837887656Prithav BangPas encore d'évaluation

- Order in The Matter of Taparia Tools LimitedDocument13 pagesOrder in The Matter of Taparia Tools LimitedShyam SunderPas encore d'évaluation

- APMCDocument38 pagesAPMCsunilat2014Pas encore d'évaluation

- Securities and Exchange Board of India (Merchant Bankers) Regulations, 1992 Contents: Chapter I: PreliminaryDocument33 pagesSecurities and Exchange Board of India (Merchant Bankers) Regulations, 1992 Contents: Chapter I: PreliminaryRavi kumar singhPas encore d'évaluation

- Financial Institutions' (Recovery of Finances) Rules, 2018Document4 pagesFinancial Institutions' (Recovery of Finances) Rules, 2018Syed AzharPas encore d'évaluation

- ICDR Regulations For SMEsDocument4 pagesICDR Regulations For SMEsShubham MundraPas encore d'évaluation

- M.Zafar (95001)Document15 pagesM.Zafar (95001)Syed Maisam RizviPas encore d'évaluation

- © The Institute of Chartered Accountants of IndiaDocument54 pages© The Institute of Chartered Accountants of IndiasaraswatkomalPas encore d'évaluation

- Page 1 of 35Document35 pagesPage 1 of 35Harshwardhan KakkarPas encore d'évaluation

- ICDR Guidelines - IGP - April 05 2019Document6 pagesICDR Guidelines - IGP - April 05 2019Srishti 2k22Pas encore d'évaluation

- SEBI (Settlement of Administrative and Civil Proceedings) Regulations, 2014Document37 pagesSEBI (Settlement of Administrative and Civil Proceedings) Regulations, 2014Parag KabraPas encore d'évaluation

- SEBI Circular - May 18 2010Document7 pagesSEBI Circular - May 18 2010Sanjeev Kumar ChoudharyPas encore d'évaluation

- Sebi Guidlines For BuybackDocument46 pagesSebi Guidlines For Buybacksonali bhosalePas encore d'évaluation

- Key Amendments in Relation To IPO Under SEBI (ICDR) Reg. 2018Document5 pagesKey Amendments in Relation To IPO Under SEBI (ICDR) Reg. 2018jayaram gPas encore d'évaluation

- Modification To Investor Protection Fund (IPF) / Customer Protection Fund (CPF) GuidelinesDocument2 pagesModification To Investor Protection Fund (IPF) / Customer Protection Fund (CPF) GuidelinesShyam SunderPas encore d'évaluation

- Sebi Stock Broker Regulation 1992Document49 pagesSebi Stock Broker Regulation 1992jagan kilariPas encore d'évaluation

- PMS Regulations, 2020Document64 pagesPMS Regulations, 2020devarshPas encore d'évaluation

- SGX-ST Listing Manual Amendments - Effective 1 January 2011: Listing Rules For Secondary Fund Raising (Catalist)Document5 pagesSGX-ST Listing Manual Amendments - Effective 1 January 2011: Listing Rules For Secondary Fund Raising (Catalist)John HowardPas encore d'évaluation

- Reg LiqDocument79 pagesReg LiqArvind kumar SaxenaPas encore d'évaluation

- Section 42, The Companies Act, 2013Document4 pagesSection 42, The Companies Act, 2013Damon SalvatorePas encore d'évaluation

- Liquidation Regulations (Upto September 16, 2022)Document75 pagesLiquidation Regulations (Upto September 16, 2022)Umang ShirodariyaPas encore d'évaluation

- Insolvency-Vol III Issue I PDFDocument30 pagesInsolvency-Vol III Issue I PDFJyoti SinghPas encore d'évaluation

- Clause 40ADocument13 pagesClause 40AcspravinkPas encore d'évaluation

- FINAL Securities RulesDocument37 pagesFINAL Securities RulesAli ShamsheerPas encore d'évaluation

- Securities and Exchange Board of IndiaDocument8 pagesSecurities and Exchange Board of IndiaDebashis DeyPas encore d'évaluation

- Foreign Exchange Management (Non-Debt Instruments) Rules, 2019Document72 pagesForeign Exchange Management (Non-Debt Instruments) Rules, 2019JeetSoniPas encore d'évaluation

- Securities & Exchange Board of India (SEBI) Guidelines & Regulation ForDocument11 pagesSecurities & Exchange Board of India (SEBI) Guidelines & Regulation Forrohanthokale08Pas encore d'évaluation

- India Feb6 2013no2Document0 pageIndia Feb6 2013no2dasarp85Pas encore d'évaluation

- SEBI/CFD/DIL/LA/1/2009/24/04 April 24, 2009: Neelamb@sebi - Gov.inDocument9 pagesSEBI/CFD/DIL/LA/1/2009/24/04 April 24, 2009: Neelamb@sebi - Gov.inSaket RaoPas encore d'évaluation

- Securities and Exchange Board of India (Stock Brokers and Sub-Brokers) (Amendment) Regulations, 2014Document7 pagesSecurities and Exchange Board of India (Stock Brokers and Sub-Brokers) (Amendment) Regulations, 2014Shyam SunderPas encore d'évaluation

- SEBI Cirular-Manner of Public Shareholding - 30112015Document2 pagesSEBI Cirular-Manner of Public Shareholding - 30112015AdityaPas encore d'évaluation

- Cci Procedure in Regard To The Transaction of Business Relating To Combinations Regulations 20111652175569Document50 pagesCci Procedure in Regard To The Transaction of Business Relating To Combinations Regulations 20111652175569Saqib AliPas encore d'évaluation

- SEBI PMS Regulations 2020Document61 pagesSEBI PMS Regulations 2020Kajal JainPas encore d'évaluation

- 1514978804579Document3 pages1514978804579Prithav BangPas encore d'évaluation

- Uganda Stock Exchange Market ListingDocument10 pagesUganda Stock Exchange Market Listingdamasmart841Pas encore d'évaluation

- Order in Respect of Southern Fuel LimitedDocument10 pagesOrder in Respect of Southern Fuel LimitedShyam SunderPas encore d'évaluation

- Insurance Regulatory and Development Authority of India (Lloyd's India) Regulations, 2016Document33 pagesInsurance Regulatory and Development Authority of India (Lloyd's India) Regulations, 2016Srishti JainPas encore d'évaluation

- SEBI (Delisting of Equity Shares) (Amendment) Regulations, 2015Document11 pagesSEBI (Delisting of Equity Shares) (Amendment) Regulations, 2015Shyam SunderPas encore d'évaluation

- Amendment NotesDocument5 pagesAmendment NotesAbhishek ChauhanPas encore d'évaluation

- CST - Delhi - Rules 2005 - DelhiDocument11 pagesCST - Delhi - Rules 2005 - DelhiRakesh SinghPas encore d'évaluation

- IRDA (Registration of Indian Insurance Companies) Regulations2000Document27 pagesIRDA (Registration of Indian Insurance Companies) Regulations2000ShantanuPas encore d'évaluation

- VAT Complete Rules 05.02.10Document116 pagesVAT Complete Rules 05.02.10CA Ashish BochiaPas encore d'évaluation

- CMSL AMENDMENTS JUNE 2021-Executive-RegularDocument23 pagesCMSL AMENDMENTS JUNE 2021-Executive-RegularNishantPas encore d'évaluation

- PAGCOR Site Regulatory ManualDocument4 pagesPAGCOR Site Regulatory Manualstaircasewit4Pas encore d'évaluation

- Spectrum Electrical Industries Limited: Part B General Information Document For Investing in Public IssuesDocument20 pagesSpectrum Electrical Industries Limited: Part B General Information Document For Investing in Public Issuesmealokranjan9937Pas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderPas encore d'évaluation

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- SEC Complaint - CKBDocument40 pagesSEC Complaint - CKBjmaglich1Pas encore d'évaluation

- Shri Sisir Adhikari Minister of State For Rural DevelopmentDocument6 pagesShri Sisir Adhikari Minister of State For Rural DevelopmentNetwork18Pas encore d'évaluation

- Stock SplitDocument4 pagesStock SplitNiño Rey LopezPas encore d'évaluation

- CGI For IndiaDocument43 pagesCGI For IndiaSarfraz AliPas encore d'évaluation

- Kevin Haggerty - Trading With The Generals 2002Document233 pagesKevin Haggerty - Trading With The Generals 2002SIightly75% (4)

- Fe 9 Reviewer: Sir Xerez Singson InvestmentDocument10 pagesFe 9 Reviewer: Sir Xerez Singson InvestmentJennelyn LaranoPas encore d'évaluation

- Trojan Investing Newsletter Volume 2 Issue 2Document6 pagesTrojan Investing Newsletter Volume 2 Issue 2AlexPas encore d'évaluation

- All Economics Notes by Dinesh Bakshi PDFDocument205 pagesAll Economics Notes by Dinesh Bakshi PDFAdithya ShettyPas encore d'évaluation

- International AccountingDocument118 pagesInternational AccountingThao ViPas encore d'évaluation

- Unit 1 Business and Its EnvironmentDocument28 pagesUnit 1 Business and Its EnvironmentMaham ButtPas encore d'évaluation

- 2021 GIS Newsky PH - Amended - July PDFDocument10 pages2021 GIS Newsky PH - Amended - July PDFjalefaye abapoPas encore d'évaluation

- SDM The Final ProjectDocument29 pagesSDM The Final ProjectravirajranaPas encore d'évaluation

- Test Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDeepak YadavPas encore d'évaluation

- Chapter 2: Structure of Options MarketsDocument6 pagesChapter 2: Structure of Options MarketsPhan Nguyễn Diệu PhướcPas encore d'évaluation

- Cochin PDFDocument8 pagesCochin PDFdarshanmadePas encore d'évaluation

- Trend Analysis of ACI Ltd. & Renata Ltd.Document22 pagesTrend Analysis of ACI Ltd. & Renata Ltd.sabbir_amPas encore d'évaluation

- The Covered CallDocument8 pagesThe Covered CallpilluPas encore d'évaluation

- BKM 10e Ch03Document41 pagesBKM 10e Ch03kenPas encore d'évaluation

- Banking Full Detailed ProjectDocument53 pagesBanking Full Detailed ProjectYellapu Poojitha PoojaPas encore d'évaluation

- Joseph Stevens IndictmentDocument114 pagesJoseph Stevens IndictmentBrian WillinghamPas encore d'évaluation

- Berk Prob AnswersDocument7 pagesBerk Prob AnswersMarjorie PagsinuhinPas encore d'évaluation

- Art - Cultural Capital - Throsby - 1999Document10 pagesArt - Cultural Capital - Throsby - 1999María Julia SolovitasPas encore d'évaluation

- Capstone StrategiesDocument13 pagesCapstone Strategiesrns116Pas encore d'évaluation

- Quickstart Kit PDFDocument96 pagesQuickstart Kit PDFVishal Pooran90% (10)

- Efficient Market Hypothesis kadsjdklaskdka;kdka;ls;dlk;lasd;lks;lkd;lak;dk;lalka;lk;ka;kd;lakldklakd;lkas;kd;lak;ldk;laskd;ka;lkd;laskd;lask;dks;lakd;a;lkdl;alkd;a;ldk;ska;lkd;lsak;dlkas;kd;lsalkd;lka;daslkd;laskd;lka;ldkakd;lk;kd;laskdas;lkds;lakdas;lkd;lask;ldkas;lkd;aslkd;laskd;laskd;lask;ldksa;ldk;askd;laskd;l;akd;askd;laskd;lkas;ldk;aslkd;lkaslkdas;kdas;lkd;laskd;lask;ldka;lskd;laksl;kDocument12 pagesEfficient Market Hypothesis kadsjdklaskdka;kdka;ls;dlk;lasd;lks;lkd;lak;dk;lalka;lk;ka;kd;lakldklakd;lkas;kd;lak;ldk;laskd;ka;lkd;laskd;lask;dks;lakd;a;lkdl;alkd;a;ldk;ska;lkd;lsak;dlkas;kd;lsalkd;lka;daslkd;laskd;lka;ldkakd;lk;kd;laskdas;lkds;lakdas;lkd;lask;ldkas;lkd;aslkd;laskd;laskd;lask;ldksa;ldk;askd;laskd;l;akd;askd;laskd;lkas;ldk;aslkd;lkaslkdas;kdas;lkd;laskd;lask;ldka;lskd;laksl;kVikas RockPas encore d'évaluation

- Tilson GoogDocument33 pagesTilson GoogPhil WeissPas encore d'évaluation

- Caed102: Financial MarketsDocument2 pagesCaed102: Financial MarketsXytusPas encore d'évaluation

- BMO - Research Highlights Mar 22Document32 pagesBMO - Research Highlights Mar 22smutgremlinPas encore d'évaluation

- Stock Transfer Between Plants in One StepDocument5 pagesStock Transfer Between Plants in One StepRahul JainPas encore d'évaluation

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorD'EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorÉvaluation : 4.5 sur 5 étoiles4.5/5 (132)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingD'EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingÉvaluation : 4.5 sur 5 étoiles4.5/5 (97)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsD'EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsPas encore d'évaluation

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooD'EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooÉvaluation : 5 sur 5 étoiles5/5 (2)

- Public Finance: Legal Aspects: Collective monographD'EverandPublic Finance: Legal Aspects: Collective monographPas encore d'évaluation

- Introduction to Negotiable Instruments: As per Indian LawsD'EverandIntroduction to Negotiable Instruments: As per Indian LawsÉvaluation : 5 sur 5 étoiles5/5 (1)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersD'EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersPas encore d'évaluation

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorD'EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorÉvaluation : 4.5 sur 5 étoiles4.5/5 (63)

- Contract Law in America: A Social and Economic Case StudyD'EverandContract Law in America: A Social and Economic Case StudyPas encore d'évaluation

- The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseD'EverandThe Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorsePas encore d'évaluation

- Indian Polity with Indian Constitution & Parliamentary AffairsD'EverandIndian Polity with Indian Constitution & Parliamentary AffairsPas encore d'évaluation

- The Streetwise Guide to Going Broke without Losing your ShirtD'EverandThe Streetwise Guide to Going Broke without Losing your ShirtPas encore d'évaluation

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsD'EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsÉvaluation : 5 sur 5 étoiles5/5 (24)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementD'EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementÉvaluation : 4.5 sur 5 étoiles4.5/5 (20)

- International Business Law: Cases and MaterialsD'EverandInternational Business Law: Cases and MaterialsÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersD'EverandThe Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersPas encore d'évaluation

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessD'EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessÉvaluation : 5 sur 5 étoiles5/5 (1)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseD'EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CasePas encore d'évaluation