Académique Documents

Professionnel Documents

Culture Documents

Miami Office Insight Q3 2013

Transféré par

Bea LorinczCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Miami Office Insight Q3 2013

Transféré par

Bea LorinczDroits d'auteur :

Formats disponibles

Office Insight

Miami . Q3 2013

35,684,219 sf

Direct vacancy rate

17.2%

Total vacancy rate

17.9%

Under construction (% preleased)

183,298 sf (19.3%)

Leasing activity 12 mo. % change

-56.6%

YTD net absorption

447,406 sf

12-month overall rent % change

Pricing

Outlook

Numerous cranes now dot the CBD horizon. On the ground, large swaths of

the urban core and parts of the outlying Midtown market resemble virtual

construction sites. Intense growth of commercial and residential product is

well underway with at least 40 projects in various stages of development.

Under construction office product remains confined to the suburbs at less

than 200,000 square feet. Near-term (late 2015) planned deliveries with

announced completion dates of new office inventory will be located in the

CBD, also totaling 200,000 square feet. Overall absorption has maintained

a positive motion for almost four years. Largely attributed to Class A

buildings, vacancy within this segment of the market has declined

consistently for the past 3.25 years. Among Class B assets, a slower trend

has decreased vacancy consistently for only the last 1.5 years. The pace of

leasing activity has subsided since 2011. For those known transactions now

under negotiation as of this writing, the volume of square footage is

anticipated to increase leasing activity levels. However, with a large

percentage comprised of renewals, relocations within existing submarkets

and/or space downsizing, this will not translate into positive absorption.

Demand

-1.6%

Class A overall asking rent

$35.13 psf

Class B overall asking rent

$25.12 psf

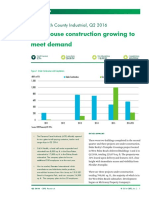

Net new supply, net absorption and total vacancy

Net new supply

s.f.

Market conditions

Year-to-date absorption was virtually evenly divided between the CBD and

the suburbs with the Class A sector dominating Miamis new occupancy by

a wide margin. The majority of Miamis inventory is comprised of Class A

buildings. The CBDs Class A vacancy was reduced by 2.1 percentage

points since year-end 2012. As such, both the Brickell and Downtown

sectors (which combined make up the CBD) are positioned to move into

more balanced/landlord favorable conditions sooner than their suburban

counterparts. During the same time period, the suburbs Class A vacancy

fell by 1.4 percentage points. Overall vacancy for every submarket,

however, remains in the double digits with the metro area still facing nearly

6.4 million square feet of direct and sublet vacant space.

Supply

Supply

Economy

National and statewide employment figures were below expectations with

the unemployment rate rising in the majority of states. Florida, however,

was not one of those states and at a seasonally adjusted 7.1 percent was

down from 8.7 percent 12 months ago. Miamis rate was likewise down, to

8.4 percent from last years 9.7 percent. Labor force participation in the

metro area, however, was down during the same period by 2.0 percent or

nearly 27,000 people. In terms of absolute numbers, Miamis top industry

gainers over the year were trade, transportation and utilities, retail trade and

leisure and hospitality. The highest percent increases were posted among

retail trade, leisure and hospitality and the financial activities sectors at 4.1,

4.0 and 3.1 percent, respectively. Constructions specialty trade contractors

subsector also posted a notable increase at 3.2 percent during this time.

12-month

forecast

Key market indicators

Net absorption

total vacancy

1,500,000

25%

1,000,000

20%

500,000

15%

0

10%

-500,000

5%

-1,000,000

-1,500,000

0%

2008

2009

2010

2011

2012

Q3 2013

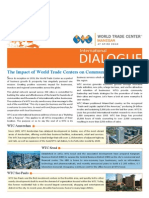

Leasing

Historical

activity

asking

vs. sublease

vs. effective

vacant rents

available space

YTD Leasing Activity

s.f.

Despite lower leasing levels, new

occupancy gains lift most markets

Sublease space

4,200,000

3,500,000

2,800,000

2,100,000

1,400,000

700,000

0

2008

2009

2010

2011

2012

Q3 2013

Jones Lang LaSalle Americas Research Miami Office Insight Q3 2013 2

Tenant perspective

Landlords remain confident with concessions mildly tightening. For the

best positioned buildings/spaces, rates are shifting upwards. However,

overall pricing levels still remain favorable for the largest, crme of the

crop credit tenants. Within the CBD, challenges persist for the biggest

occupiers with high quality demand space requirements i.e., the waning

volume of large contiguous offices with premium views.

Class A tenant improvement allowance

CBD

$50

CBD

Suburbs

$ p.s.f.

$ .p.s.f.

Class A overall asking rents

Landlord perspective

Quarterly tour activity points to tenant expansion movement with a desire

to trade up to better quality space. Tenants opening new business lines,

at least from national users, indicate a desire for shorter terms i.e., two to

three year commitments. Landlord confidence momentum continues in

the Brickell, Downtown and increasingly the Coral Gables market. While

most pricing increases have been in place for the last year, bumps in

asking rates continue to implemented quarterly by both Trophy and Tier

II Class A landlords.

$45

$40

$35

Suburbs

$40

$30

$30

$25

$20

$20

$15

$10

$10

$5

$0

2009

2010

2011

2012

2008

Suburbs

CBD

2011

2012

Q3 2013

8

6

2

0

2009

2010

2011

2012

Suburbs

26

14

20,000 50,000 s.f.

45

40

35

30

25

20

15

10

5

0

8

2

2

3

0

> 20 0,000

s.f.

10

Full floor and larger

2010

100,000 200,000

s.f.

CBD

2008

2009

Class A blocks of contiguous space

# of blocks

months

Class A free rent

12

$0

Q3 2013

50,000 100,000

s.f.

2008

Q3 2013

Includes selected vacant existing blocks and available UC/UR blocks

Jones Lang LaSalle Americas Research Miami Office Insight Q3 2013 3

Submarket leverage market history and forecast

Property clock current market conditions

2013

Submarket*

2014

2015

2016

2017

Downtown - CBD

Peaking

market

Brickell,

Downtown

(CBD)

Rising

market

Tenant leverage

Landlord leverage

Brickell - CBD

Falling

market

Bottoming

market

Coral Gables - Suburban

Miami Airport - Suburban

*Major markets

Landlord-favorable

conditions

Balanced

conditions

Tenant-favorable

conditions

Miami Airport (Suburban)

Coral Gables

(Suburban)

Completed lease transactions

Tenant

Address

Submarket

s.f. Type

VITAS Innovative Hospice Care

Miami Center

Downtown CBD

31,000 Relocation

Resorts World Bimini/Miami (Genting)

The Omni Offices

Downtown - CBD

30,000 New

Molina Healthcare

Westside Plaza

Airport Suburban

27,000 New

Magellan Health Service

Airport Corporate Center

Airport Suburban

24,000 Relocation

Cable & Wireless

Columbus Center

Coral Gables Suburban

19,500 New

Regus (business centers)

Leroy Collins Building

Miami Lakes Suburban

15,000 New

Sedgwick Law Firm

One Biscayne Tower

Downtown CBD

14,000 New

Marcum

SunTrust International Center

Downtown CBD

10,000 Renewal

VS Brooks, Inc.

255 Alhambra

Coral Gables Suburban

8,300 Expansion

Completed sale transactions

Address

Submarket

Buyer / Seller

s.f.

$ p.s.f.

Coconut Grove Bank HQ

Coconut Grove

(Suburban)

Terra Group JV Related Group/

Coconut Grove Bank

75,000

$733

Atrium at Coral Gables

Coral Gables

(Suburban)

Baptist Health Enterprises/

TA Realty

161,000

$273

Four Seasons Office Tower

Brickell (CBD)

Jamestown Properties/

Millennium Partners

258,767

$200

*Partial interest

(23.62%)

Methodology: Inventory includes all Class A and Class B office properties > 30,000 square feet,

excluding most condo and all medical, government owned and owner occupied buildings

About Jones Lang LaSalle

Jones Lang LaSalle (NYSE:JLL) is a professional services and investment management firm offering specialized real estate services to clients

seeking increased value by owning, occupying and investing in real estate. With annual revenue of $3.9 billion, Jones Lang LaSalle operates in 70

countries from more than 1,000 locations worldwide. On behalf of its clients, the firm provides management and real estate outsourcing services to

a property portfolio of 2.6 billion square feet and completed $63 billion in sales, acquisitions and finance transactions in 2012. Its investment

management business, LaSalle Investment Management, has $46.3 billion of real estate assets under management. For further information, visit

www.jll.com.

About Jones Lang LaSalle Research

Jones Lang LaSalles research team delivers intelligence, analysis, and insight through market-leading reports and services that illuminate todays

commercial real estate dynamics and identify tomorrows challenges and opportunities. Our 300 professional researchers track and analyze

economic and property trends and forecast future conditions in over 60 countries, producing unrivalled local and global perspectives. Our research

and expertise, fueled by real-time information and innovative thinking around the world, creates a competitive advantage for our clients and drives

successful strategies and optimal real estate decisions.

Steven J. Medwin, SIOR, CCIM

Managing Director

South Florida

+1 (305) 416-5105

Roberta C. Steen

Senior Research Analyst

+1 305 728-7390

www.us.am.joneslanglasalle.com/research

2013 Jones Lang LaSalle IP, Inc. All rights reserved. No part of this publication may be reproduced by any means, whether graphically, electronically, mechanically or otherwise

howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission

of Jones Lang LaSalle. The information contained in this document has been compiled from sources believed to be reliable. Jones Lang LaSalle or any of their affiliates accept no

liability or responsibility for the accuracy or completeness of the information contained herein and no reliance should be placed on the information contained in this document.

Licensed Real Estate Broker

Vous aimerez peut-être aussi

- Cost of Doing Business Study, 2012 EditionD'EverandCost of Doing Business Study, 2012 EditionPas encore d'évaluation

- BaltimoreOfficeSnapshot Q42012Document2 pagesBaltimoreOfficeSnapshot Q42012Anonymous Feglbx5Pas encore d'évaluation

- Tenant Report 3Q 2011 DC - FINAL-LetterDocument4 pagesTenant Report 3Q 2011 DC - FINAL-LetterAnonymous Feglbx5Pas encore d'évaluation

- Q3 2012 OfficeSnapshotDocument2 pagesQ3 2012 OfficeSnapshotAnonymous Feglbx5Pas encore d'évaluation

- Marketbeat: Office SnapshotDocument1 pageMarketbeat: Office Snapshotapi-150283085Pas encore d'évaluation

- Ho Chi Minh City Q4 2012 ReportDocument27 pagesHo Chi Minh City Q4 2012 ReportQuin Nguyen PhuocPas encore d'évaluation

- Office Market Snapshot: Washington, DCDocument2 pagesOffice Market Snapshot: Washington, DCAnonymous Feglbx5Pas encore d'évaluation

- MD Market ReportDocument24 pagesMD Market ReportWilliam HarrisPas encore d'évaluation

- CCNKF Northbay Office Q2 2012Document10 pagesCCNKF Northbay Office Q2 2012mark_carrington_5Pas encore d'évaluation

- Source: Grubb and Ellis CB Richard Ellis Spaulding and Slye Economics R Ha ItDocument45 pagesSource: Grubb and Ellis CB Richard Ellis Spaulding and Slye Economics R Ha ItOffice of PlanningPas encore d'évaluation

- Retail: ResearchDocument4 pagesRetail: ResearchAnonymous Feglbx5Pas encore d'évaluation

- Toronto: OntarioDocument8 pagesToronto: Ontarioapi-26443221Pas encore d'évaluation

- Q4 2012 OfficeSnapshot-NewDocument2 pagesQ4 2012 OfficeSnapshot-NewAnonymous Feglbx5Pas encore d'évaluation

- Global Ma h1 LeagDocument39 pagesGlobal Ma h1 LeagSohini Mo BanerjeePas encore d'évaluation

- CT DC 2Q14 SnapshotDocument2 pagesCT DC 2Q14 SnapshotWilliam HarrisPas encore d'évaluation

- Office Market Snapshot: Suburban Maryland Fourth Quarter 2013Document2 pagesOffice Market Snapshot: Suburban Maryland Fourth Quarter 2013Anonymous Feglbx5Pas encore d'évaluation

- Emerging Markets Commercial Real EstateDocument37 pagesEmerging Markets Commercial Real EstatessuttoniiPas encore d'évaluation

- BizjrnlNov 2013B PDFDocument8 pagesBizjrnlNov 2013B PDFThe Delphos HeraldPas encore d'évaluation

- Q2 2012 OfficeSnapshotDocument2 pagesQ2 2012 OfficeSnapshotAnonymous Feglbx5Pas encore d'évaluation

- Miami NAR12Document1 pageMiami NAR12citybizlist11Pas encore d'évaluation

- Philadelphia 3Q11 RetDocument4 pagesPhiladelphia 3Q11 RetAnonymous Feglbx5Pas encore d'évaluation

- Global Financial Advisory Mergers & Acquisitions Rankings 2013Document40 pagesGlobal Financial Advisory Mergers & Acquisitions Rankings 2013Ajay SamuelPas encore d'évaluation

- Openland (Formerly Statecraft) - YC Interview AnswersDocument7 pagesOpenland (Formerly Statecraft) - YC Interview AnswersDevansh SharmaPas encore d'évaluation

- BaltimoreOfficeSnapshot Q32013Document2 pagesBaltimoreOfficeSnapshot Q32013Anonymous Feglbx5Pas encore d'évaluation

- Steady Leasing Pushed Down Vacancy For The Seventh Consecutive QuarterDocument5 pagesSteady Leasing Pushed Down Vacancy For The Seventh Consecutive QuarterAnonymous Feglbx5Pas encore d'évaluation

- 1CO1800A1016Document1 page1CO1800A1016Jotham SederstromPas encore d'évaluation

- (1Q13) Suburban ReportDocument8 pages(1Q13) Suburban ReportBryan ColePas encore d'évaluation

- PhiladelphiaDocument1 pagePhiladelphiaAnonymous Feglbx5Pas encore d'évaluation

- ProjDocument46 pagesProjRafi KhanPas encore d'évaluation

- Cbre Office List HCMC q4 2011Document25 pagesCbre Office List HCMC q4 2011Hai Dang NguyenPas encore d'évaluation

- Marketbeat: Office SnapshotDocument1 pageMarketbeat: Office Snapshotapi-150283085Pas encore d'évaluation

- United States Skyline Review 2013Document60 pagesUnited States Skyline Review 2013Anonymous Feglbx5Pas encore d'évaluation

- CMBS Weekly 011212Document15 pagesCMBS Weekly 011212sanhemyPas encore d'évaluation

- Q4 2011 OfficeSnapshotDocument2 pagesQ4 2011 OfficeSnapshotAnonymous Feglbx5Pas encore d'évaluation

- Corporate FinanceDocument39 pagesCorporate FinanceAbhishek BiswasPas encore d'évaluation

- HoustonDocument1 pageHoustonAnonymous Feglbx5Pas encore d'évaluation

- Palm Beach County Office MarketView Q1 2016Document4 pagesPalm Beach County Office MarketView Q1 2016William HarrisPas encore d'évaluation

- BostonDocument4 pagesBostonAnonymous Feglbx5Pas encore d'évaluation

- Palm BeachDocument5 pagesPalm BeachAnonymous Feglbx5Pas encore d'évaluation

- Baltimore I-95 South PDFDocument3 pagesBaltimore I-95 South PDFAnonymous Feglbx5Pas encore d'évaluation

- Office OverviewDocument22 pagesOffice OverviewAnonymous Feglbx5Pas encore d'évaluation

- OfficeDocument6 pagesOfficeAnonymous Feglbx5Pas encore d'évaluation

- Commercial Construction Business PlanDocument13 pagesCommercial Construction Business Plan2010misc67% (3)

- 1 - 2013 Futures Report: New York Tech Scene - OverviewDocument4 pages1 - 2013 Futures Report: New York Tech Scene - OverviewAnonymous Feglbx5Pas encore d'évaluation

- DLF Case StudyDocument10 pagesDLF Case StudyBharat SinghPas encore d'évaluation

- Harbor Point $107M Tax Deal Gets Final OK After Months of ControversyDocument3 pagesHarbor Point $107M Tax Deal Gets Final OK After Months of ControversyAnonymous Feglbx5Pas encore d'évaluation

- Midyear Report 2007Document4 pagesMidyear Report 2007Missouri Netizen NewsPas encore d'évaluation

- Market Report 2020 Q2 Full ReportDocument18 pagesMarket Report 2020 Q2 Full Reportcitybizlist11Pas encore d'évaluation

- Impact 2018Document2 pagesImpact 2018Mitch RyalsPas encore d'évaluation

- WTC Manesar NewsletterDocument3 pagesWTC Manesar Newsletterapi-255318024Pas encore d'évaluation

- CIBC: Demographics and SMEsDocument3 pagesCIBC: Demographics and SMEsEquicapita Income TrustPas encore d'évaluation

- Atlanta Office Market Report Q3 2011Document2 pagesAtlanta Office Market Report Q3 2011Anonymous Feglbx5Pas encore d'évaluation

- HE Usiness Imes: Housing Market Shows Classic Recovery SignsDocument1 pageHE Usiness Imes: Housing Market Shows Classic Recovery SignsbernicetsyPas encore d'évaluation

- DLF LTD.: Dr. Trilochan Tripathy, Faculty, IBS, HyderabadDocument26 pagesDLF LTD.: Dr. Trilochan Tripathy, Faculty, IBS, Hyderabadsumitsabharwal17Pas encore d'évaluation

- Dallas FortWorth NAR12Document1 pageDallas FortWorth NAR12Anonymous Feglbx5Pas encore d'évaluation

- 2013 Q3 Market UpdateDocument1 page2013 Q3 Market UpdateJeffHoffman8Pas encore d'évaluation

- CAE Q1 2013 Market ReportsDocument8 pagesCAE Q1 2013 Market ReportsColliersIntlSCPas encore d'évaluation

- HoustonDocument1 pageHoustonAnonymous Feglbx5Pas encore d'évaluation

- Office Market Report: Baltimore Metro Economic Outlook (A Little) BrighterDocument4 pagesOffice Market Report: Baltimore Metro Economic Outlook (A Little) BrighterAnonymous Feglbx5Pas encore d'évaluation

- CAN Toronto Office Insight Q2 2018 JLL PDFDocument4 pagesCAN Toronto Office Insight Q2 2018 JLL PDFMichaelPas encore d'évaluation

- Asia Pacific Property Digest 4q 2016Document76 pagesAsia Pacific Property Digest 4q 2016Bea LorinczPas encore d'évaluation

- 2012 Houston Economic Outlook PDFDocument13 pages2012 Houston Economic Outlook PDFBea LorinczPas encore d'évaluation

- 2 Q 13 Office Market ReportDocument4 pages2 Q 13 Office Market ReportBea LorinczPas encore d'évaluation

- Edinburgh City Index: Stock Levels Rise Ahead of Tax Rate ChangeDocument2 pagesEdinburgh City Index: Stock Levels Rise Ahead of Tax Rate ChangeBea LorinczPas encore d'évaluation

- The Facebook ExperimentDocument17 pagesThe Facebook ExperimentBea LorinczPas encore d'évaluation

- Chennai Retail 2q14Document1 pageChennai Retail 2q14Bea LorinczPas encore d'évaluation

- Marketbeat: Industrial SnapshotDocument1 pageMarketbeat: Industrial SnapshotBea LorinczPas encore d'évaluation

- Bangkok Retail 4q13Document1 pageBangkok Retail 4q13Bea LorinczPas encore d'évaluation

- Madrid Aag Logistics q1 2014 EngDocument2 pagesMadrid Aag Logistics q1 2014 EngBea LorinczPas encore d'évaluation

- UK Office Market Report Q4 2013Document16 pagesUK Office Market Report Q4 2013Bea LorinczPas encore d'évaluation

- Bangkok Ind 4q13Document1 pageBangkok Ind 4q13Bea LorinczPas encore d'évaluation

- 2Q14 Atlanta Industrial Market ReportDocument4 pages2Q14 Atlanta Industrial Market ReportBea LorinczPas encore d'évaluation

- Ice Shells For Temporary Event ArchitectureDocument3 pagesIce Shells For Temporary Event ArchitectureAmi FloreiPas encore d'évaluation

- Top 10 Sustainable CitiesDocument5 pagesTop 10 Sustainable CitiesBea LorinczPas encore d'évaluation

- To Have and To Hold: Gratitude Promotes Relationship Maintenance in Intimate BondsDocument18 pagesTo Have and To Hold: Gratitude Promotes Relationship Maintenance in Intimate BondsBea LorinczPas encore d'évaluation

- Employment Standards Poster - June 2015Document1 pageEmployment Standards Poster - June 2015evaluvPas encore d'évaluation

- Final Project (1) DaburDocument114 pagesFinal Project (1) Daburvarun50% (2)

- Groupno5 Compensation ManagementDocument21 pagesGroupno5 Compensation Managementsumit87rajPas encore d'évaluation

- 6th Pay Commission CalculatorDocument5 pages6th Pay Commission CalculatorS. KamalPas encore d'évaluation

- Chapter-1: "A Study On 360 Degree Performance Appraisal On Human Resource at Medopharm, Malur"Document87 pagesChapter-1: "A Study On 360 Degree Performance Appraisal On Human Resource at Medopharm, Malur"Cenu RomanPas encore d'évaluation

- Burnout Syndrome - in NursingDocument5 pagesBurnout Syndrome - in NursingIOSRjournalPas encore d'évaluation

- Flow, Space and Activity RelationshipsDocument43 pagesFlow, Space and Activity RelationshipsMichael Smith86% (7)

- Appe Goal SheetDocument3 pagesAppe Goal SheetShirish PandaPas encore d'évaluation

- Time-Driven Activity-Based Costing (TDABC), An InitialDocument20 pagesTime-Driven Activity-Based Costing (TDABC), An InitialFelipe Nato AcostaPas encore d'évaluation

- Emerging Issues in Organisational BehaviorDocument2 pagesEmerging Issues in Organisational Behaviorunwaz50% (2)

- Ch.2 SECTORS OF INDIAN ECONOMYDocument16 pagesCh.2 SECTORS OF INDIAN ECONOMYMiten shahPas encore d'évaluation

- Dami SB Agrinutrition ProposalDocument14 pagesDami SB Agrinutrition ProposalGianluca LucchinPas encore d'évaluation

- Sspusadv PDFDocument1 pageSspusadv PDFKIMPas encore d'évaluation

- Licensure Examination For OCCUPATIONAL THERAPY: 4TH Seat NoDocument5 pagesLicensure Examination For OCCUPATIONAL THERAPY: 4TH Seat NoNonoyTaclinoPas encore d'évaluation

- Swapnil Raut Om Sip 2022Document39 pagesSwapnil Raut Om Sip 2022Sandesh GajbhiyePas encore d'évaluation

- Physicians Assistants in Cardiothoracic Surgery: A 30-Year Experience in A University CenterDocument6 pagesPhysicians Assistants in Cardiothoracic Surgery: A 30-Year Experience in A University Centerfluid_man_brazilPas encore d'évaluation

- BUS 520 AssignmentDocument9 pagesBUS 520 Assignmentmigire kennedyPas encore d'évaluation

- Fall 2023 - N498 Extern Information SessionDocument22 pagesFall 2023 - N498 Extern Information SessionHye KyoPas encore d'évaluation

- Home Depot Case Study From DocshareDocument37 pagesHome Depot Case Study From DocsharesyedatiqrocketmailcomPas encore d'évaluation

- 68 Dynamic Action Verbs To Enhance Your Resume (Examples List Included)Document6 pages68 Dynamic Action Verbs To Enhance Your Resume (Examples List Included)Anonymous 1b3ih8zg9Pas encore d'évaluation

- ML Inter - Revisions PDFDocument16 pagesML Inter - Revisions PDFArielle Mae LopezPas encore d'évaluation

- Air IndiaDocument66 pagesAir IndiaAkash RanaPas encore d'évaluation

- Markscheme: November 2016Document25 pagesMarkscheme: November 2016api-529669983Pas encore d'évaluation

- Remote Working A Dream Job?: Warm-UpDocument4 pagesRemote Working A Dream Job?: Warm-UpDavid CostaPas encore d'évaluation

- Management Theory and Practice Dec 2022Document12 pagesManagement Theory and Practice Dec 2022Rajni KumariPas encore d'évaluation

- 1865 22934 2 PBDocument10 pages1865 22934 2 PBBELAJAR BERSAMA. NETPas encore d'évaluation

- Business Plan For The Small Construction FirmDocument31 pagesBusiness Plan For The Small Construction FirmAlvie Borromeo Valiente100% (1)

- Investigating CommitteeDocument2 pagesInvestigating CommitteeDenny Crane100% (1)

- SMEs in UzbekistanDocument22 pagesSMEs in Uzbekistanapi-3861718Pas encore d'évaluation

- High-Risers: Cabrini-Green and the Fate of American Public HousingD'EverandHigh-Risers: Cabrini-Green and the Fate of American Public HousingPas encore d'évaluation

- When Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfD'EverandWhen Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfÉvaluation : 5 sur 5 étoiles5/5 (36)

- Not a Crime to Be Poor: The Criminalization of Poverty in AmericaD'EverandNot a Crime to Be Poor: The Criminalization of Poverty in AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (37)

- The Meth Lunches: Food and Longing in an American CityD'EverandThe Meth Lunches: Food and Longing in an American CityÉvaluation : 5 sur 5 étoiles5/5 (5)

- Life at the Bottom: The Worldview That Makes the UnderclassD'EverandLife at the Bottom: The Worldview That Makes the UnderclassÉvaluation : 5 sur 5 étoiles5/5 (30)

- Nickel and Dimed: On (Not) Getting By in AmericaD'EverandNickel and Dimed: On (Not) Getting By in AmericaÉvaluation : 3.5 sur 5 étoiles3.5/5 (197)

- Workin' Our Way Home: The Incredible True Story of a Homeless Ex-Con and a Grieving Millionaire Thrown Together to Save Each OtherD'EverandWorkin' Our Way Home: The Incredible True Story of a Homeless Ex-Con and a Grieving Millionaire Thrown Together to Save Each OtherPas encore d'évaluation

- Heartland: A Memoir of Working Hard and Being Broke in the Richest Country on EarthD'EverandHeartland: A Memoir of Working Hard and Being Broke in the Richest Country on EarthÉvaluation : 4 sur 5 étoiles4/5 (188)

- The Great Displacement: Climate Change and the Next American MigrationD'EverandThe Great Displacement: Climate Change and the Next American MigrationÉvaluation : 4.5 sur 5 étoiles4.5/5 (32)

- Same Kind of Different As Me Movie Edition: A Modern-Day Slave, an International Art Dealer, and the Unlikely Woman Who Bound Them TogetherD'EverandSame Kind of Different As Me Movie Edition: A Modern-Day Slave, an International Art Dealer, and the Unlikely Woman Who Bound Them TogetherÉvaluation : 4 sur 5 étoiles4/5 (686)

- When Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfD'EverandWhen Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfÉvaluation : 4 sur 5 étoiles4/5 (126)

- Hillbilly Elegy: A Memoir of a Family and Culture in CrisisD'EverandHillbilly Elegy: A Memoir of a Family and Culture in CrisisÉvaluation : 4 sur 5 étoiles4/5 (4284)

- Fucked at Birth: Recalibrating the American Dream for the 2020sD'EverandFucked at Birth: Recalibrating the American Dream for the 2020sÉvaluation : 4 sur 5 étoiles4/5 (173)

- Poor Economics: A Radical Rethinking of the Way to Fight Global PovertyD'EverandPoor Economics: A Radical Rethinking of the Way to Fight Global PovertyÉvaluation : 4.5 sur 5 étoiles4.5/5 (263)

- Analyzing Urban Poverty: GIS for the Developing WorldD'EverandAnalyzing Urban Poverty: GIS for the Developing WorldÉvaluation : 3.5 sur 5 étoiles3.5/5 (2)

- A World of Three Zeroes: the new economics of zero poverty, zero unemployment, and zero carbon emissionsD'EverandA World of Three Zeroes: the new economics of zero poverty, zero unemployment, and zero carbon emissionsÉvaluation : 4 sur 5 étoiles4/5 (16)

- Same Kind of Different As Me Movie Edition: A Modern-Day Slave, an International Art Dealer, and the Unlikely Woman Who Bound Them TogetherD'EverandSame Kind of Different As Me Movie Edition: A Modern-Day Slave, an International Art Dealer, and the Unlikely Woman Who Bound Them TogetherÉvaluation : 4 sur 5 étoiles4/5 (645)

- The Locust Effect: Why the End of Poverty Requires the End of ViolenceD'EverandThe Locust Effect: Why the End of Poverty Requires the End of ViolenceÉvaluation : 4.5 sur 5 étoiles4.5/5 (31)

- How the Poor Can Save Capitalism: Rebuilding the Path to the Middle ClassD'EverandHow the Poor Can Save Capitalism: Rebuilding the Path to the Middle ClassÉvaluation : 5 sur 5 étoiles5/5 (6)

- The Great Displacement: Climate Change and the Next American MigrationD'EverandThe Great Displacement: Climate Change and the Next American MigrationÉvaluation : 4 sur 5 étoiles4/5 (21)

- Nickel and Dimed: On (Not) Getting By in AmericaD'EverandNickel and Dimed: On (Not) Getting By in AmericaÉvaluation : 4 sur 5 étoiles4/5 (186)

- Dark Days, Bright Nights: Surviving the Las Vegas Storm DrainsD'EverandDark Days, Bright Nights: Surviving the Las Vegas Storm DrainsPas encore d'évaluation

- This Is Ohio: The Overdose Crisis and the Front Lines of a New AmericaD'EverandThis Is Ohio: The Overdose Crisis and the Front Lines of a New AmericaÉvaluation : 4 sur 5 étoiles4/5 (37)