Académique Documents

Professionnel Documents

Culture Documents

Caf 2 Ief PDF

Transféré par

askermanDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Caf 2 Ief PDF

Transféré par

askermanDroits d'auteur :

Formats disponibles

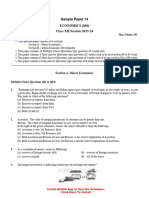

Certificate in Accounting and Finance Stage Examinations

4 September 2014

3 hours 100 marks

Additional reading time 15 minutes

The Institute of

Chartered Accountants

of Pakistan

Introduction to Economics and Finance

Instructions to candidates:

All the Questions from Section A are compulsory.

(i)

Attempt any FIVE out of SEVEN Questions from Section B.

(ii)

Section A

Q.1

(a)

(b)

Q.2

State the meaning of price elasticity of supply. Briefly discuss different types of

elasticity of supply.

Briefly explain the factors which determine the price elasticity of supply.

The following data refers to the revenue and costs (in million rupees) of a firm.

Output (units)

Total revenue

Total costs

(a)

(b)

(c)

0

110

1

50

140

2

100

162

3

150

175

4

200

180

5

250

185

Briefly discuss the important features of Islamic economic system.

Q.4

(a)

(b)

6

300

194

7

350

219

8

400

269

Briefly explain the concept of fixed costs with reference to the above data.

Determine the marginal revenue at each level of output and interpret the results.

What level of output will the firm aim to produce and what would be the amount of

profit that the firm will make at this level?

Q.3

Q.5

(05)

(05)

State the main features of monopoly and name any one organisation which operates

under monopoly.

Briefly explain the monopolists equilibrium with the help of a schedule.

Select the most appropriate answer from the options available for each of the following

Multiple Choice Questions (MCQs). Each MCQ carries ONE mark.

(i)

Which of the following is not an issue in macroeconomics?

(a) issues relating to balance of payment

(b) determination of prices in the agricultural sector

(c) relationship between inflation and unemployment

(d) possible effect of a budget deficit on the level of investment

(ii)

If peas and beans are substitutes of each other, an increase in the price of peas will:

(a) increase the quantity of beans demanded

(b) increase the price of beans and the quantity sold

(c) decrease the quantity of peas sold

(d) all of the above

(iii)

Period of a business cycle in which real GDP is increasing is called:

(a) recovery

(b) downturn

(c) recession

(d) trough

(02)

(04)

(04)

(08)

(03)

(04)

Introduction to Economics and Finance

Page 2 of 3

(iv)

ABC Limited employs 100 skilled workers at a wage rate of Rs. 2,800 per week. To

attract 10 more workers it raises the wage rate to Rs. 3,000 per week. The marginal

cost of employing the extra workers is:

(a) Rs. 20,000

(b) Rs. 30,000

(c) Rs. 50,000

(d) Rs. 200

(v)

The financial market which is used to raise short term finance is called:

(a) capital market

(b)

money market

(c) derivative market

(d)

bond market

(vi)

The main advantage of a mutual fund is that:

(a) it provides short term finance for investment in capital and money market

(b) it provides long term finance for investment in capital and money market

(c) it gives opportunity to investors to invest in a diversified portfolio

(d) none of the above

(vii)

An investor who acquires a put option:

(a) buys the right to buy shares at a particular price

(b) buys the right to sell shares at a particular price

(c) sells the right to buy shares at a particular price

(d) sells the right to sell shares at a particular price

(viii) A deflationary gap exists in an economy when:

(a) aggregate demand is less than the full employment level of income

(b) injections exceed withdrawals at the full employment level of income

(c) the government has a budget surplus

(d) none of the above

(ix)

The four main phases of business cycle are:

(a) boom, inflation, recession and recovery

(b) inflation, recession, recovery and boom

(c) recession, downturn, recovery and growth

(d) boom, downturn, recession and recovery

(x)

Fiscal deficit can be controlled by:

(a) increasing taxes

(c) reducing public expenditure

(xi)

(xii)

(b)

(d)

Demand curve slopes downward because of:

(a) consumer indifference

(b)

(c) inelastic demand

(d)

reducing subsidies

all of the above

elasticity of demand

law of diminishing marginal utility

Which of the following best defines marginal utility?

(a) satisfaction of a want that results from consuming a good or service

(b) change in total utility as a result of consuming an additional unit of a product

(c) ability to buy more of a product or service when real income increases

(d) change in average satisfaction that results from consuming an additional unit of

a product

(xiii) Under perfect market conditions, the supply curve of a firm is the same as:

(a) MC curve

(b) MR curve

(c) AR curve

(d) AC curve

(xiv) An option that protects profit after the underlying asset has experienced a significant

gain is called:

(a) forward

(b) collar

(c) swap

(d) call option

(xv)

An instrument whose price is dependent on one or more underlying asset(s) is called:

(a) share

(b)

certificate of deposit

(c) derivative

(d)

treasury bill

Introduction to Economics and Finance

Page 3 of 3

Section B

Q.6

(a)

Briefly explain with the help of suitable diagrams, how each of the above factors

affects the quantity of money demanded in an economy.

(06)

What is Keynesian liquidity trap? Identify any three policies which can help to break

out of the liquidity trap.

(04)

What do you understand by the terms floating exchange rate and fixed exchange

rate? List three advantages of each of the above types of exchange rates.

Identify the reasons why a government may want to influence exchange rate.

(07)

(03)

Analyse the effect of imposition / increase of indirect taxes on producers and consumers

and its relationship with the elasticities of demand and supply.

(10)

(b)

Q.7

(a)

(b)

Q.8

Q.9

An increase in GDP and financial innovation are the two important factors that

influence the total demand for money in an economy.

(a)

(b)

Explain what is meant by the term balance of payments deficit.

Discuss the difference between financing a balance of payments deficit and

correcting that deficit.

(07)

Q.10 (a)

(b)

(c)

Describe the four major objectives of a governments economic policy.

What role does monetary policy play in achievement of the above objectives?

List any four tools that a central bank may use to implement its monetary policy.

(06)

(02)

(02)

Q.11 (a)

(b)

Draw a diagram of Circular Flow of Income.

List three types of Withdrawals and Injections from/into the Circular Flow of

Income.

Explain the effect of an increase in household savings rate on an economy.

(04)

(03)

(03)

What is meant by the term Recession? What economic characteristics are commonly

observed during recessionary periods?

Briefly describe Demand deficient unemployment and Structural unemployment.

(06)

(04)

(c)

Q.12 (a)

(b)

(THE END)

(03)

Vous aimerez peut-être aussi

- Economic Indicators for East Asia: Input–Output TablesD'EverandEconomic Indicators for East Asia: Input–Output TablesPas encore d'évaluation

- Caf-2 IefDocument4 pagesCaf-2 IefaskermanPas encore d'évaluation

- Introduction To Economics and FinanceDocument4 pagesIntroduction To Economics and FinanceShaheer MalikPas encore d'évaluation

- Introduction To Economics and FinanceDocument4 pagesIntroduction To Economics and FinanceHaseeb AhmadPas encore d'évaluation

- Introduction To Economics and Finance: Mock Examination Certificate in Accounting and Finance StageDocument4 pagesIntroduction To Economics and Finance: Mock Examination Certificate in Accounting and Finance StageKaali CAPas encore d'évaluation

- Introduction To Economics and FinanceDocument4 pagesIntroduction To Economics and FinancesaimPas encore d'évaluation

- CAF 2 Past PapersDocument110 pagesCAF 2 Past PapersAaraiz Hassan BtPas encore d'évaluation

- Introduction To Economics and FinanceDocument4 pagesIntroduction To Economics and FinanceShaheer MalikPas encore d'évaluation

- Introduction To Economics and FinanceDocument4 pagesIntroduction To Economics and FinanceShaheer MalikPas encore d'évaluation

- Caf 02Document177 pagesCaf 02Exam DepartmentPas encore d'évaluation

- Introduction To Economics and Finance: The Institute of Chartered Accountants of PakistanDocument2 pagesIntroduction To Economics and Finance: The Institute of Chartered Accountants of PakistanadnanPas encore d'évaluation

- B3 IefDocument2 pagesB3 IefadnanPas encore d'évaluation

- 6 Caf 2 Ief Autumn 2018Document4 pages6 Caf 2 Ief Autumn 2018Shaheer MalikPas encore d'évaluation

- Rajeshwar Higher Secondary School, Mhow FIRST PRE-BOARD 2011-2012 Subject:-Economics Class:-Xii TIME:-3 HRS. M.M. 100Document3 pagesRajeshwar Higher Secondary School, Mhow FIRST PRE-BOARD 2011-2012 Subject:-Economics Class:-Xii TIME:-3 HRS. M.M. 100SachinPas encore d'évaluation

- EC Sample Paper 3 UnsolvedDocument8 pagesEC Sample Paper 3 Unsolvedsubasree803Pas encore d'évaluation

- Class Xii Economics 2008 Delhi Outside DelhiDocument21 pagesClass Xii Economics 2008 Delhi Outside DelhiSoniya Omir VijanPas encore d'évaluation

- Sample Paper 3Document8 pagesSample Paper 3scorpiondeathdrop115Pas encore d'évaluation

- 4 Caf 2 Ief Autumn 2019Document4 pages4 Caf 2 Ief Autumn 2019Shaheer MalikPas encore d'évaluation

- ECO-12 CBSE Additional Practice Questions 2023-24Document20 pagesECO-12 CBSE Additional Practice Questions 2023-24Sadjaap SinghPas encore d'évaluation

- Cbse Class 12 Economics - PQDocument21 pagesCbse Class 12 Economics - PQMurtaza JamaliPas encore d'évaluation

- Economics PQDocument9 pagesEconomics PQash kathumPas encore d'évaluation

- Practice Paper Class XII Eco PaperDocument12 pagesPractice Paper Class XII Eco PaperAarush100% (1)

- Practicepaper 3 Class XIIEconomics EMDocument6 pagesPracticepaper 3 Class XIIEconomics EMAvnish kumarPas encore d'évaluation

- KV MS PP 4-6Document21 pagesKV MS PP 4-6AADHYA KHANNAPas encore d'évaluation

- Economics Board Sample Paper 01 Questions 027c4698e8efdDocument5 pagesEconomics Board Sample Paper 01 Questions 027c4698e8efdaditi22032007Pas encore d'évaluation

- Introduction To Economics & FinanceDocument4 pagesIntroduction To Economics & Financeduniya t vPas encore d'évaluation

- 1364 EconomicsDocument3 pages1364 Economicsnikhilnu3878Pas encore d'évaluation

- Spec 2008 - Unit 2 - Paper 1Document11 pagesSpec 2008 - Unit 2 - Paper 1capeeconomics83% (12)

- ECO 112 (Test II, Set Paper I)Document4 pagesECO 112 (Test II, Set Paper I)Wisdom Thuso Sepepe Jr.Pas encore d'évaluation

- Delhi Public School, Durg: 1 Hour 30 MiDocument4 pagesDelhi Public School, Durg: 1 Hour 30 MiYuvraj ChoudharyPas encore d'évaluation

- 2 25 QuestionDocument3 pages2 25 Questionsharathk916Pas encore d'évaluation

- Ecovisionnaire Must Do QuestionsDocument6 pagesEcovisionnaire Must Do QuestionsAastha VermaPas encore d'évaluation

- Economics: Time Allowed: 3 Hours Maximum Marks: 100Document25 pagesEconomics: Time Allowed: 3 Hours Maximum Marks: 100Anonymous Ptxr6wl9DhPas encore d'évaluation

- Eco Set A XiiDocument6 pagesEco Set A XiicarefulamitPas encore d'évaluation

- Introduction To Economics and Finance: The Institute of Chartered Accountants of PakistanDocument2 pagesIntroduction To Economics and Finance: The Institute of Chartered Accountants of PakistanadnanPas encore d'évaluation

- Economics Ms PB 2 Set CDocument9 pagesEconomics Ms PB 2 Set CNirma SoniaPas encore d'évaluation

- Eco Set B XiiDocument7 pagesEco Set B XiicarefulamitPas encore d'évaluation

- XII - Economics - MOCK PAPERDocument7 pagesXII - Economics - MOCK PAPERRiyanshi MauryaPas encore d'évaluation

- Pb23eco02 QPDocument7 pagesPb23eco02 QPAfiya NazimPas encore d'évaluation

- Macro Modified FRQs For 2020 Exam No GraphsDocument17 pagesMacro Modified FRQs For 2020 Exam No GraphsShirin JPas encore d'évaluation

- T4 Business Economics Q&ADocument14 pagesT4 Business Economics Q&ABiplob K. SannyasiPas encore d'évaluation

- Quiz MCQDocument27 pagesQuiz MCQkartik100% (1)

- This Question Paper Contains Two PartsDocument17 pagesThis Question Paper Contains Two PartsRavikumar BalasubramanianPas encore d'évaluation

- Macro90: N Employed Labour ForceDocument10 pagesMacro90: N Employed Labour ForceGary LamPas encore d'évaluation

- Economics Nov TestDocument3 pagesEconomics Nov TestNadine DavidsonPas encore d'évaluation

- 4 MacroeconomicsDocument3 pages4 MacroeconomicsgmustafaijtPas encore d'évaluation

- Introduction To Economics and Finance: The Institute of Chartered Accountants of PakistanDocument2 pagesIntroduction To Economics and Finance: The Institute of Chartered Accountants of PakistanadnanPas encore d'évaluation

- MODEL EXAMINATION (2020 - 21) ECONOMICS (030) Class - Xii TIME: 3 Hours Max. Marks: 80 General InstructionsDocument7 pagesMODEL EXAMINATION (2020 - 21) ECONOMICS (030) Class - Xii TIME: 3 Hours Max. Marks: 80 General InstructionsAkshaya AkPas encore d'évaluation

- Waec Econs Theory Ques 11 15Document24 pagesWaec Econs Theory Ques 11 15timothyPas encore d'évaluation

- Assignment Year ThreeDocument11 pagesAssignment Year ThreeMohammed Abu ShaibuPas encore d'évaluation

- ImcfDocument64 pagesImcfHʌɩɗɘʀ AɭɩPas encore d'évaluation

- Macro Economics-Sheeba Tahir. B.com 3 (A) - 4 (A) - Ev. Hyderi.. Paper A.Document4 pagesMacro Economics-Sheeba Tahir. B.com 3 (A) - 4 (A) - Ev. Hyderi.. Paper A.Abdul SammadPas encore d'évaluation

- Unilag Past QuestionDocument12 pagesUnilag Past QuestionTemitayoPas encore d'évaluation

- Economics Important Mcqs From Past Papersof PPSC-2 PDFDocument18 pagesEconomics Important Mcqs From Past Papersof PPSC-2 PDFzuhaibPas encore d'évaluation

- EconomicsDocument9 pagesEconomicsSimha SimhaPas encore d'évaluation

- EC Sample Paper 14 UnsolvedDocument7 pagesEC Sample Paper 14 Unsolvedmanjotsingh.000941Pas encore d'évaluation

- Roll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 7Document7 pagesRoll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 7Akash GuptaPas encore d'évaluation

- Question Paper Set-1, Foreign 2016 CBSE Class 12th EconomicsDocument6 pagesQuestion Paper Set-1, Foreign 2016 CBSE Class 12th EconomicsAshish GangwalPas encore d'évaluation

- 12 Economics Sp02Document21 pages12 Economics Sp02devilssksokoPas encore d'évaluation

- Class 12 CBSE Sample Paper EconomicsDocument8 pagesClass 12 CBSE Sample Paper Economicsyazhinirekha4444Pas encore d'évaluation

- E 14 - AafrDocument5 pagesE 14 - AafraskermanPas encore d'évaluation

- E13 ItmacDocument3 pagesE13 ItmacaskermanPas encore d'évaluation

- E 16 - BMGDocument3 pagesE 16 - BMGaskermanPas encore d'évaluation

- E13Document2 pagesE13askermanPas encore d'évaluation

- E 15 - CLSDocument3 pagesE 15 - CLSaskermanPas encore d'évaluation

- E-13 ItmacDocument3 pagesE-13 ItmacaskermanPas encore d'évaluation

- D11 AudDocument2 pagesD11 AudaskermanPas encore d'évaluation

- Information Technology: T I C A PDocument2 pagesInformation Technology: T I C A PaskermanPas encore d'évaluation

- E 13 - ItmacDocument3 pagesE 13 - ItmacaskermanPas encore d'évaluation

- D12 CacDocument6 pagesD12 CacaskermanPas encore d'évaluation

- Information Technology: Continued On Next Page...Document2 pagesInformation Technology: Continued On Next Page...askermanPas encore d'évaluation

- Caf-9 AudDocument3 pagesCaf-9 AudaskermanPas encore d'évaluation

- Information Technology: T I C A PDocument3 pagesInformation Technology: T I C A Papi-3838998Pas encore d'évaluation

- Information Technology: T I C A PDocument2 pagesInformation Technology: T I C A PaskermanPas encore d'évaluation

- Corporate Laws2008Document3 pagesCorporate Laws2008askermanPas encore d'évaluation

- CLWDocument2 pagesCLWapi-3838998Pas encore d'évaluation

- D11 AudDocument3 pagesD11 AudaskermanPas encore d'évaluation

- D9 CLWDocument2 pagesD9 CLWaskermanPas encore d'évaluation

- D10 CaDocument4 pagesD10 CaaskermanPas encore d'évaluation

- D10 CaDocument4 pagesD10 CaaskermanPas encore d'évaluation

- Company LawDocument2 pagesCompany LawaskermanPas encore d'évaluation

- Company LawDocument3 pagesCompany LawaskermanPas encore d'évaluation

- ClsDocument3 pagesClsaskermanPas encore d'évaluation

- D10 CacDocument4 pagesD10 CacaskermanPas encore d'évaluation

- T I C A P: HE Nstitute of Hartered Ccountants of AkistanDocument2 pagesT I C A P: HE Nstitute of Hartered Ccountants of AkistanaskermanPas encore d'évaluation

- Caf-8 CmaDocument4 pagesCaf-8 CmaaskermanPas encore d'évaluation

- Caf-4 BMBDocument2 pagesCaf-4 BMBaskermanPas encore d'évaluation

- Caf-6 TaxDocument4 pagesCaf-6 TaxaskermanPas encore d'évaluation

- Caf-5 Far1Document5 pagesCaf-5 Far1askermanPas encore d'évaluation

- Final Ibf ProjectDocument11 pagesFinal Ibf Projectchoco_pie_952Pas encore d'évaluation

- Structure of Indian Financial SystemDocument34 pagesStructure of Indian Financial SystemmoqimPas encore d'évaluation

- Retail Lending Schemes at Canara BankDocument56 pagesRetail Lending Schemes at Canara BankJyot Sidhu100% (1)

- Chapter 2 The Security MarketDocument66 pagesChapter 2 The Security MarketAbdiPas encore d'évaluation

- Global Insurance+ Review 2012 and Outlook 2013 14Document36 pagesGlobal Insurance+ Review 2012 and Outlook 2013 14Harry CerqueiraPas encore d'évaluation

- Investor Demand For Sell-Side Research: Lawrence@haas - Berkeley.eduDocument57 pagesInvestor Demand For Sell-Side Research: Lawrence@haas - Berkeley.eduBhuwanPas encore d'évaluation

- Ch. 6 (Are Financial Markets Efficient) FMI (Mishkin Et Al) (8th Ed.) PDFDocument47 pagesCh. 6 (Are Financial Markets Efficient) FMI (Mishkin Et Al) (8th Ed.) PDFSanil KhemaniPas encore d'évaluation

- Senate Hearing, 111TH Congress - Financial Services and General Government Appropriations For Fiscal Year 2010Document238 pagesSenate Hearing, 111TH Congress - Financial Services and General Government Appropriations For Fiscal Year 2010Scribd Government DocsPas encore d'évaluation

- 5011 Merchant Banking and Financial Services: Iii Semester/Ii Year BaDocument18 pages5011 Merchant Banking and Financial Services: Iii Semester/Ii Year Bas.muthuPas encore d'évaluation

- Assignment - Financial MarketsDocument9 pagesAssignment - Financial MarketsTaruntej Singh100% (3)

- Basic Interest Rates Day 1Document15 pagesBasic Interest Rates Day 1Jovan SsenkandwaPas encore d'évaluation

- Indian Banking SystemDocument57 pagesIndian Banking Systemsamadhandamdhar6109100% (1)

- About London Stock ExchangeDocument24 pagesAbout London Stock ExchangeNabadeep UrangPas encore d'évaluation

- MainDocument57 pagesMainNagireddy KalluriPas encore d'évaluation

- NotesDocument49 pagesNotesMatthew MullalyPas encore d'évaluation

- Financial Markets: Departmental Notes Business Department 0752818204Document12 pagesFinancial Markets: Departmental Notes Business Department 0752818204kimuli FreddiePas encore d'évaluation

- Financial Markerts: An OverviewDocument9 pagesFinancial Markerts: An OverviewArly Kurt TorresPas encore d'évaluation

- Loan Schemes and Car Recovery Procedure of HDFC Bank - 2011Document98 pagesLoan Schemes and Car Recovery Procedure of HDFC Bank - 2011rohitkh28100% (2)

- Comparative Study On Share Market & Mutual FundDocument66 pagesComparative Study On Share Market & Mutual Fundpushprashantpa80% (35)

- Determinants of Corporate Financial PerformanceDocument17 pagesDeterminants of Corporate Financial PerformanceIulia Balaceanu100% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document13 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliPas encore d'évaluation

- BBA Extra TopicsDocument5 pagesBBA Extra TopicsRishabPas encore d'évaluation

- Top SecretDocument45 pagesTop SecretkrisnaPas encore d'évaluation

- 2229 - Investments - S1 - G.ottonelloDocument4 pages2229 - Investments - S1 - G.ottonelloNeal EricksonPas encore d'évaluation

- Fis-Balaji Mba College - KadapaDocument97 pagesFis-Balaji Mba College - KadapaBhuvana AnalapudiPas encore d'évaluation

- ECN 111 Chapter 9 Lecture NotesDocument3 pagesECN 111 Chapter 9 Lecture NoteswaynePas encore d'évaluation

- Financial Imst &mark Unit - 2Document57 pagesFinancial Imst &mark Unit - 2KalkayePas encore d'évaluation

- Finance Management 6th Edition Timothy Gallagher FullDocument640 pagesFinance Management 6th Edition Timothy Gallagher FullPhương Linh NguyễnPas encore d'évaluation

- FIMDocument20 pagesFIMVIVEK SHARMAPas encore d'évaluation

- Syllabus Trading StrategiesDocument3 pagesSyllabus Trading StrategiesDenise CruzPas encore d'évaluation