Académique Documents

Professionnel Documents

Culture Documents

Caf-9 Aud

Transféré par

askermanTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Caf-9 Aud

Transféré par

askermanDroits d'auteur :

Formats disponibles

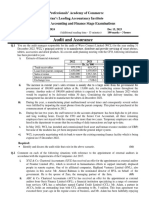

Certificate in Accounting and Finance Stage Examinations

2 March 2015

3 hours 100 marks

Additional reading time 15 minutes

The Institute of

Chartered Accountants

of Pakistan

Audit and Assurance

Q.1

(a)

State what is meant by risk at financial statement level and assertion level. Give one

example of risk at each level.

(03)

The audit engagement letter specifies objective and scope of audit, responsibilities of

auditor and management, applicable financial reporting framework and form and

contents of audit report. State any four additional matters that may be included in the

engagement letter.

(04)

The external auditors are normally appointed by the shareholders at the annual

general meeting (AGM) of the company. State the exceptions to this rule.

(03)

(d)

Describe deployment and opportunity flowcharts.

(04)

(e)

Identify the matters that need to be considered by the auditor at the time of designing

and performing substantive analytical procedures.

(04)

State the matters that auditor needs to consider where the written representation

provided by the management is inconsistent with other audit evidence.

(03)

What are the matters which the auditor should consider while designing an audit

sample, determining its size and selecting the sampling units?

(03)

(b)

(c)

(f)

(g)

Q.2

Comment on each of the following situations with reference to the appointment of external

auditors in accordance with the requirements of the Companies Ordinance, 1984.

(a)

(b)

Q.3

The auditor is required to identify and assess the risk of material misstatement at both

the financial statement and assertion levels.

ABC Limited and DEF Limited are associated companies on account of common

directorship. Salman and Company, Chartered Accountants (SCC) have received an

offer for appointment as the auditor in ABC. Salman, a partner in SCC is the spouse of

Naveen, who is an employee in DEF.

(02)

All the partners of Kashif Associates are Cost and Management Accountants. The

firm has received an offer for appointment as the auditor of Nihal (Private) Limited

(NPL). NPL has a paid-up capital of Rs. 500,000 and 30% of its shares are held by

Siyal Limited which is a public company.

(03)

While reviewing the final audit file of XYZ Limited for the year ended 30 June 2014, you

have identified that certain amendments were made in the final audit file after the date of the

auditors report.

Required:

Comment on the above situation in the light of International Standards on Auditing.

(07)

Audit and Assurance

Q.4

Page 2 of 3

Mineral Limited (ML) has incorporated a liability for gratuity payable to its employees on

the basis of actuarial valuation carried out by Professionals Limited (PL). As the audit

partner of ML you are not satisfied with the valuation report prepared by PL, and have

decided to appoint Experts Limited (EL) to carry out the valuation exercise again.

Required:

(a) State the matters that you would consider regarding:

(i)

The competence, capabilities and objectivity of EL.

(ii) Evaluation of the adequacy of ELs work.

(b)

Q.5

(03)

(03)

Briefly discuss the course of action in case you are not satisfied with the work

performed by EL.

(03)

The audit of Sehat Pharmaceutical Limited (SPL) is in progress. Based on the previous

experience with the client and the initial tests of control, the auditor has assessed a low risk

of material mis-statement in the area of debtors.

The debtors circularization summary depicts the following information:

Customer

segment

No. of

customers

Distributors

Wholesalers

Hospitals

and clinics

Retailers

12

105

Balance

Confirmations

Amount

Nature of Confirmations

received

outstanding

sent

covered

confirmations

---------------------------------- Rs. in 000 ---------------------------------75,200

8

70,500

Positive

7

52,500

30

12,500

Positive

28

250

31,200

75

20,300

Negative

130

12,500

50

7,000

Negative

12

Analysis of confirmations received is as follows:

3 out of 7 confirmations received from distributors did not agree with the amount

outstanding in SPLs ledger.

One of the distributors, Saleem Distributors (Private) Limited (SDPL) has gone into

winding up. The balance receivable from SDPL is outstanding since last one year.

Replies received from the hospitals did not agree with the balance outstanding in

SPLs records. However, the differences were reconciled by the audit staff.

All the 12 confirmations received from the retailers showed disagreement with the

records of SPL. However, only 2 could be reconciled.

Required:

(a) Evaluate the decision regarding sending of negative confirmations.

(b) Determine the course of action the auditor should consider in case of balances agreed,

balances not agreed and replies not received.

(c) State the procedures that need to be performed in case of amount due from SDPL.

Q.6

(04)

(05)

(03)

You are the audit manager on the audit of a listed company, Kamil Limited (KL). Prior to

completion of audit, you came across a prospectus issued by Neelum Limited (NL)

according to which a director of KL is the chief executive of NL. However, the name of NL

was not included in the list of related parties provided by KL. On being confronted the

management has advised that the name was omitted inadvertently as the appointment took

place just two months prior to the year end.

Required:

Discuss your course of action in the above situation.

(07)

Audit and Assurance

Q.7

Discuss the categories of threats that may be involved in each of the following independent

situations and advise the partners of the concerned firm with regard to the possible course of

action that may be followed in each situation:

(a)

(b)

(c)

Q.8

Ahmed has recently joined a firm of Chartered Accountants. The firm intends to

depute him on the audit of Masoom (Private) Limited (MPL). Prior to joining the

firm, Ahmed had been providing accounting and taxation services to MPL for many

years, in the capacity of a consultant.

(04)

It has been discovered that father of one of the trainees posted on the audit of Chalak

Limited (CL), has a financial interest in CL.

(04)

Hoshiyar Limited (HL), an audit client of your firm has recently advertised certain

vacancies in its accounts department. The said positions have been applied for by

number of individuals including two staff members who are posted on the audit of HL.

(04)

You have been assigned to plan the test of controls in respect of receiving of goods and

invoices from suppliers of Bhurban Limited. In this regard, you are required to identify the

following:

(a)

(b)

(c)

Q.9

Page 3 of 3

The related risks

Controls that you expect to see to address the above risks

Audit procedures that you need to perform to test the controls

(03)

(04)

(03)

While reviewing the audit files of four different clients you confronted the following

situations:

(i)

Due to tough competition in the market, the company has been unable to increase the

prices of its products since last 5 years.

(ii) Addition to intangible assets, amounting to Rs. 500 million include research cost of

Rs. 10 million which is duly supported by invoices from suppliers.

(iii) During the last three years, the Chief Executive and higher management has been

earning handsome bonuses, based on the profitability of the company.

(iv) Physical stock take on 31 December 2014 included goods sold but not despatched

amounting to Rs. 52 million. The delivering of goods was stopped on the request of a

distributor. Upto 20 January 2015, the distributor has taken delivery of goods

amounting to Rs. 2 million.

Required:

(a) In each of the above situations, identify with justification whether it represents a risk

of fraud.

(b) Describe what actions are to be taken by an auditor on identifying a fraud risk factor.

(06)

(04)

Q.10 Controls over data transmission help to ensure that transmitted data is complete, secure and

unaltered.

Required:

State any five controls over data transmission which help to ensure that the data is secure

and unaltered.

(THE END)

(04)

Vous aimerez peut-être aussi

- Audit and Assurance Spring 2015Document6 pagesAudit and Assurance Spring 2015Piyal HossainPas encore d'évaluation

- Caf-9 Aud PDFDocument3 pagesCaf-9 Aud PDFRamzan AliPas encore d'évaluation

- ICAP Auditing Exam QuestionsDocument2 pagesICAP Auditing Exam QuestionsNafees AhmedPas encore d'évaluation

- D11 AudDocument2 pagesD11 AudaskermanPas encore d'évaluation

- AudDocument4 pagesAudaskermanPas encore d'évaluation

- Advanced Audit & Assurance: RequiredDocument4 pagesAdvanced Audit & Assurance: RequiredLaskar REAZPas encore d'évaluation

- Caf 8 Aud Spring 2022Document3 pagesCaf 8 Aud Spring 2022Huma BashirPas encore d'évaluation

- Auditing: Summer Exam-2014Document3 pagesAuditing: Summer Exam-2014NabeelPas encore d'évaluation

- Accounting and Finance Stage Exam QuestionsDocument4 pagesAccounting and Finance Stage Exam QuestionsKhawaja TaimoorPas encore d'évaluation

- Assessment Test 1Document3 pagesAssessment Test 1Arslan AhmadPas encore d'évaluation

- CAF 8 AUD Spring 2020Document5 pagesCAF 8 AUD Spring 2020Huma BashirPas encore d'évaluation

- D11 AudDocument2 pagesD11 AudadnanPas encore d'évaluation

- Audit Icap Chapterwise Past Paper With Solution Prepared by Fahad Irfan PDFDocument113 pagesAudit Icap Chapterwise Past Paper With Solution Prepared by Fahad Irfan PDFShaheryar Shahid100% (1)

- Financial AuditDocument3 pagesFinancial AuditgalaxystarPas encore d'évaluation

- AL Audit Assurance May Jun 2014Document3 pagesAL Audit Assurance May Jun 2014Bizness Zenius HantPas encore d'évaluation

- Attention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Document9 pagesAttention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Dharnis123Pas encore d'évaluation

- F MauditDocument4 pagesF MauditPaulomee JhaveriPas encore d'évaluation

- Aplication Level Audit Assurance Nov Dec 2013Document2 pagesAplication Level Audit Assurance Nov Dec 2013Noman_TufailPas encore d'évaluation

- Auditing Set 2Document7 pagesAuditing Set 2cleophacerevivalPas encore d'évaluation

- Audit, Assurance and Related Services: Certified Finance and Accounting Professional Stage ExaminationDocument3 pagesAudit, Assurance and Related Services: Certified Finance and Accounting Professional Stage Examinationmunira 22Pas encore d'évaluation

- The Professionals’ Academy of Commerce Pakistan's Leading Accountancy Institute Certificate in Accounting and Finance Stage Examinations June 17, 2020Document36 pagesThe Professionals’ Academy of Commerce Pakistan's Leading Accountancy Institute Certificate in Accounting and Finance Stage Examinations June 17, 2020ShehrozSTPas encore d'évaluation

- Audit and Assurance: Certificate in Accounting and Finance Stage ExaminationDocument3 pagesAudit and Assurance: Certificate in Accounting and Finance Stage ExaminationSYED ANEES ALIPas encore d'évaluation

- 2023 AFRM1 Question BankDocument8 pages2023 AFRM1 Question BankKieu Anh Bui LePas encore d'évaluation

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument12 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The Restritz meshPas encore d'évaluation

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument12 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestshankitPas encore d'évaluation

- Audit Mid Spring 24 (V-2)Document3 pagesAudit Mid Spring 24 (V-2)Nouman ShamasPas encore d'évaluation

- May 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeDocument19 pagesMay 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeVonniePas encore d'évaluation

- Audit and Assurance: Certificate in Accounting and Finance Stage ExaminationDocument4 pagesAudit and Assurance: Certificate in Accounting and Finance Stage ExaminationHamid MahmoodPas encore d'évaluation

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The Restritz meshPas encore d'évaluation

- Ca Final May 2012 Exam Paper 3Document4 pagesCa Final May 2012 Exam Paper 3Asim DasPas encore d'évaluation

- Audit 2 QDocument21 pagesAudit 2 QG IPas encore d'évaluation

- Audit Mtp2 DoneDocument11 pagesAudit Mtp2 Donegaurav gargPas encore d'évaluation

- Tsa Audit TestsDocument8 pagesTsa Audit TestsMunira SheraliPas encore d'évaluation

- Past Paper AuditDocument82 pagesPast Paper AuditUsama RajaPas encore d'évaluation

- Risk management and audit key pointsDocument2 pagesRisk management and audit key pointsMuhammad Zahid FaridPas encore d'évaluation

- Pe2 Auditing Nov05Document14 pagesPe2 Auditing Nov05api-3825774Pas encore d'évaluation

- 2007 Summer QuestionsDocument4 pages2007 Summer QuestionsUmer AbdullahPas encore d'évaluation

- Caf-9 Aud PDFDocument3 pagesCaf-9 Aud PDFRamzan AliPas encore d'évaluation

- Term Test 1Document3 pagesTerm Test 1Hassan TanveerPas encore d'évaluation

- Audit and Assurance Exam QuestionsDocument3 pagesAudit and Assurance Exam QuestionsIssa BoyPas encore d'évaluation

- CHARTERED ACCOUNTANTS EXAM P4: AUDIT AND ASSURANCEDocument23 pagesCHARTERED ACCOUNTANTS EXAM P4: AUDIT AND ASSURANCEtwizas3926Pas encore d'évaluation

- AuditDocument3 pagesAuditJiya RajputPas encore d'évaluation

- Certificate in Accounting and Finance Stage Exam Audit and Assurance QuestionsDocument3 pagesCertificate in Accounting and Finance Stage Exam Audit and Assurance QuestionsAdil AfridiPas encore d'évaluation

- Audit report drafting and auditor independence issuesDocument4 pagesAudit report drafting and auditor independence issuesAsim JavedPas encore d'évaluation

- Test-3 Obtaining An Engagement EthicsDocument2 pagesTest-3 Obtaining An Engagement EthicsDawar Hussain (WT)Pas encore d'évaluation

- Audit and Assurance Exam QuestionsDocument5 pagesAudit and Assurance Exam QuestionsIan Bob WilliamsPas encore d'évaluation

- RTP - May 2022 - Paper 3Document26 pagesRTP - May 2022 - Paper 3SSRA ARTICALSPas encore d'évaluation

- Advanced Audit and AssuranceDocument7 pagesAdvanced Audit and AssurancePrasad DilrukshanaPas encore d'évaluation

- Certificate in Accounting and Finance Stage Exam Audit and AssuranceDocument3 pagesCertificate in Accounting and Finance Stage Exam Audit and AssuranceHuma BashirPas encore d'évaluation

- Tutorial On AuditingDocument6 pagesTutorial On AuditingSyazliana KasimPas encore d'évaluation

- AUDITING - CUAC 202 ASSIGNMENT 1-12Document18 pagesAUDITING - CUAC 202 ASSIGNMENT 1-12Joseph SimudzirayiPas encore d'évaluation

- D11 AudDocument3 pagesD11 Audawan1962Pas encore d'évaluation

- I1.4 Auditing QPDocument8 pagesI1.4 Auditing QPjbah saimon baptistePas encore d'évaluation

- Caf 8 Aud Autumn 2021Document5 pagesCaf 8 Aud Autumn 2021Huma BashirPas encore d'évaluation

- Basic ConceptsDocument5 pagesBasic Conceptshaziquehussain8959Pas encore d'évaluation

- Advanced Auditing: T I C A PDocument4 pagesAdvanced Auditing: T I C A PDanish KhanPas encore d'évaluation

- Audit & Assurance Engagement RisksDocument3 pagesAudit & Assurance Engagement RisksFakhrul IslamPas encore d'évaluation

- CFAP 6 AARS Summer 2019Document3 pagesCFAP 6 AARS Summer 2019shakilPas encore d'évaluation

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018D'EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Pas encore d'évaluation

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19D'EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19Pas encore d'évaluation

- E13 ItmacDocument3 pagesE13 ItmacaskermanPas encore d'évaluation

- E-13 ItmacDocument3 pagesE-13 ItmacaskermanPas encore d'évaluation

- E13Document2 pagesE13askermanPas encore d'évaluation

- Information Technology: T I C A PDocument2 pagesInformation Technology: T I C A PaskermanPas encore d'évaluation

- Information Technology: T I C A PDocument2 pagesInformation Technology: T I C A PaskermanPas encore d'évaluation

- E 16 - BMGDocument3 pagesE 16 - BMGaskermanPas encore d'évaluation

- E 15 - CLSDocument3 pagesE 15 - CLSaskermanPas encore d'évaluation

- Information Technology: T I C A PDocument3 pagesInformation Technology: T I C A Papi-3838998Pas encore d'évaluation

- E 14 - AafrDocument5 pagesE 14 - AafraskermanPas encore d'évaluation

- E 13 - ItmacDocument3 pagesE 13 - ItmacaskermanPas encore d'évaluation

- D12 CacDocument6 pagesD12 CacaskermanPas encore d'évaluation

- Information Technology: Continued On Next Page...Document2 pagesInformation Technology: Continued On Next Page...askermanPas encore d'évaluation

- D9 CLWDocument2 pagesD9 CLWaskermanPas encore d'évaluation

- CLWDocument2 pagesCLWapi-3838998Pas encore d'évaluation

- D11 AudDocument3 pagesD11 AudaskermanPas encore d'évaluation

- D10 CacDocument4 pagesD10 CacaskermanPas encore d'évaluation

- ClsDocument3 pagesClsaskermanPas encore d'évaluation

- D10 CaDocument4 pagesD10 CaaskermanPas encore d'évaluation

- T I C A P: HE Nstitute of Hartered Ccountants of AkistanDocument2 pagesT I C A P: HE Nstitute of Hartered Ccountants of AkistanaskermanPas encore d'évaluation

- D10 CaDocument4 pagesD10 CaaskermanPas encore d'évaluation

- Corporate Laws2008Document3 pagesCorporate Laws2008askermanPas encore d'évaluation

- Caf-8 CmaDocument4 pagesCaf-8 CmaaskermanPas encore d'évaluation

- Company LawDocument2 pagesCompany LawaskermanPas encore d'évaluation

- Caf-6 TaxDocument4 pagesCaf-6 TaxaskermanPas encore d'évaluation

- Company LawDocument3 pagesCompany LawaskermanPas encore d'évaluation

- Caf-5 Far1Document5 pagesCaf-5 Far1askermanPas encore d'évaluation

- Caf-4 BMBDocument2 pagesCaf-4 BMBaskermanPas encore d'évaluation

- My Tax Espresso Newsletter Feb2023Document21 pagesMy Tax Espresso Newsletter Feb2023Claudine TanPas encore d'évaluation

- Assignment 1: Course Name & Code: Assignment Title: Student Name: Student ID: Submitted To: Date of SubmissionDocument7 pagesAssignment 1: Course Name & Code: Assignment Title: Student Name: Student ID: Submitted To: Date of Submission4basilalhasaniPas encore d'évaluation

- CH IndiaPost - Final Project ReportDocument14 pagesCH IndiaPost - Final Project ReportKANIKA GORAYAPas encore d'évaluation

- Itc PPT 1Document10 pagesItc PPT 1nikhil18202125Pas encore d'évaluation

- Nepal COSDocument45 pagesNepal COSLeo KhkPas encore d'évaluation

- An Agile Organization in A Disruptive EnvironmentDocument14 pagesAn Agile Organization in A Disruptive EnvironmentPreetham ReddyPas encore d'évaluation

- Strategic Plan 2016-2019: A Place for People to ProsperDocument20 pagesStrategic Plan 2016-2019: A Place for People to ProsperKushaal SainPas encore d'évaluation

- Form 26AS Annual Tax StatementDocument4 pagesForm 26AS Annual Tax StatementAnish SamantaPas encore d'évaluation

- Ass6 10Document1 pageAss6 10Kath LeynesPas encore d'évaluation

- TR0101 Automobiles Industry BriefDocument38 pagesTR0101 Automobiles Industry BriefDiogo Palheta Nery da SilvaPas encore d'évaluation

- Tata Motors - Corporate Governance PolicyDocument6 pagesTata Motors - Corporate Governance PolicyAnthony D'souza100% (1)

- Inventory Management 21 PankajDocument34 pagesInventory Management 21 PankajPankaj Tadaskar TadaskarPas encore d'évaluation

- Dabba WalaDocument16 pagesDabba Walarobin70929Pas encore d'évaluation

- Introduction To Oil Company Financial Analysis - CompressDocument478 pagesIntroduction To Oil Company Financial Analysis - CompressRalmePas encore d'évaluation

- Chapter 1: Hospitality Spirit. An OverviewDocument26 pagesChapter 1: Hospitality Spirit. An OverviewKhairul FirdausPas encore d'évaluation

- TRINIDAD MUNICIPAL COLLEGE OFC AD 8: SALES LAWDocument3 pagesTRINIDAD MUNICIPAL COLLEGE OFC AD 8: SALES LAWLaura RodriguezPas encore d'évaluation

- Apple Production Facilities ShiftDocument2 pagesApple Production Facilities ShiftSamarth GargPas encore d'évaluation

- BAIN REPORT Global Private Equity Report 2017Document76 pagesBAIN REPORT Global Private Equity Report 2017baashii4Pas encore d'évaluation

- The Chocolate Cake CompanyDocument3 pagesThe Chocolate Cake CompanySheikh TalhaPas encore d'évaluation

- From Beds, To Burgers, To Booze - Grand Metropolitan and The Creation of A Drinks GiantDocument13 pagesFrom Beds, To Burgers, To Booze - Grand Metropolitan and The Creation of A Drinks GiantHomme zyPas encore d'évaluation

- ProspectingDocument40 pagesProspectingCherin Sam100% (1)

- Scholarship Application 2024 1Document3 pagesScholarship Application 2024 1Abeera KhanPas encore d'évaluation

- Government of Karnataka's Chief Minister's Self-Employment Program DetailsDocument4 pagesGovernment of Karnataka's Chief Minister's Self-Employment Program DetailsHajaratali AGPas encore d'évaluation

- General Profile: CanadaDocument3 pagesGeneral Profile: CanadaDaniela CarauşPas encore d'évaluation

- Benifits Iso99901Document6 pagesBenifits Iso99901Jesa FyhPas encore d'évaluation

- Calculating outstanding arrears for civil servantsDocument5 pagesCalculating outstanding arrears for civil servantsAdnanRasheedPas encore d'évaluation

- Managerial Accounting Sia PDFDocument176 pagesManagerial Accounting Sia PDFManpreet Singh61% (28)

- Ifrs at A Glance IFRS 7 Financial Instruments: DisclosuresDocument5 pagesIfrs at A Glance IFRS 7 Financial Instruments: DisclosuresNoor Ul Hussain MirzaPas encore d'évaluation

- Job Desc - Packaging Dev. SpecialistDocument2 pagesJob Desc - Packaging Dev. SpecialistAmirCysers100% (1)

- Urban Liveability in The Context of Sustainable Development: A Perspective From Coastal Region of West BengalDocument15 pagesUrban Liveability in The Context of Sustainable Development: A Perspective From Coastal Region of West BengalPremier PublishersPas encore d'évaluation