Académique Documents

Professionnel Documents

Culture Documents

Best Practice FX

Transféré par

sritraderTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Best Practice FX

Transféré par

sritraderDroits d'auteur :

Formats disponibles

A Guide to Achieving

Best Practice in Foreign Exchange

Through Automation

Copyright 2004 FX Alliance, LLC. All rights reserved.

BEST PRACTICES USING FXALL |

Table of Contents

1. Introduction ................................................................................................... 3

1.1 Controlling Risk in Todays Environment................................................................................. 3

1.2 How Adoption of FXall Promotes Best Practice ....................................................................... 4

1.3 Summary of Key Operational & Compliance Benefits from using FXall.................................... 6

2. Introduction to FXall ...................................................................................... 7

3. Best Practices Review..................................................................................... 8

3.1 Pre-Trade Preparation and Documentation............................................................................. 8

3.2 Trade Capture ....................................................................................................................... 10

3.3 Confirmation & Netting ......................................................................................................... 12

3.4 Settlement ............................................................................................................................ 15

3.5 Accounting / Financial Control ............................................................................................. 17

3.6 General Practices.................................................................................................................. 19

4. FXalls Implementation of Best Practices ..................................................... 24

Appendix 1: How FXall Automates Customers Workflows............................... 26

A.1 How Does it Work? ............................................................................................................... 26

A.2 Front-Office .......................................................................................................................... 26

A.3 Middle & Back-Office ............................................................................................................ 27

A.4 Reducing Settlement Risk..................................................................................................... 27

Appendix 2: Complete Listing of Best Practices from the Foreign Exchange

Committee ........................................................................................................ 28

Appendix 3: List of Related Documents & Websites......................................... 30

Copyright 2004 FX Alliance, LLC. All rights reserved.

BEST PRACTICES USING FXALL |

1. Introduction

Operational risk is the risk of direct or indirect loss resulting from inadequate or failed

internal procedures, people, and systems, or from external events.1 Foreign Exchange

Committee, March 2003

Although thousands of dealers, in centres all over the world, are conducting their daily

business in a highly professional way and under the highest ethical standards, the

fraudulent actions of these individualshave cast a dark cloud over the entire industry.

ACI. From a statement to the press, 24th November 2003

Focus: Is there an honest man on Wall Street? FBI agents arrested 48 New York

currency traders last week in the lastest scandal to rock the financial world The Times,

London, 23rd November 2003

John McCarthy, director of foreign exchange trading at ING Capital Markets in New York

and a 24-year veteran of the industry, said, "In the long run, the foreign-exchange

market crosses every border and, as a consequence, regulating it would be a

monumental and probably impossible task. A further consequence of this might be to

move transactions to electronic platforms where transparency is more fully recognized."

Reuters, From Fraud Is Easy in Big, Lightly Regulated Forex Market, 19th November

2003

The pressure has never been greater on firms trading foreign exchange to ensure that

they operate to the highest standards. Clients and banks must move to tighten their

internal controls and procedures in order to ensure that they comply with local and

international governance and professional market standards.

1.1 Controlling Risk in Todays Environment

Controlling operational risk means knowing exactly the who, what, when, where and how

details regarding any individual transaction.

Reducing operational risk is a result of planning and implementation of procedures,

processes and systems to ensure that the proper controls are in place and can be

constantly monitored. Firms that trade FX must maintain confidence in the market by

implementing solutions that will provide the appropriate safeguards to control and

manage risk while at the same time preserving a fair, transparent and efficient

marketplace.2

1

The Foreign Exchange Committee, Management of Operational Risk in Foreign Exchange. (New York: March

2003), p.3

2

From a statement by the Foreign Exchange Committee (New York: 1st December 2003).

Copyright 2004 FX Alliance, LLC. All rights reserved.

BEST PRACTICES USING FXALL |

On 1st December 2003 the the Foreign Exchange Committee3 stated that the Committee

will examine what measures can be taken [that] might include enhanced controls,

contemporaneous time-stamping of trades and straight through processing. The

Committee also recommended that all market participants assess their own operations

with a view to strengthening internal controls and ethical standards where necessary4

Trading FX electronically on FXall provides risk control tools as built-in features. Users

find access to competitive rates with a full suite of professional dealing tools while

benefiting from efficiencies gained when trading in an automated environment. FXall

provides an automated process for trade execution and matching and confirmation while

carefully segmenting the front, middle & back office functions. In addition, FXall offers

QuickConnect, an automated tool providing full connectivity, or STP, for execution and

confirmation, as another means of minimising risk.

1.2 How Adoption of FXall Promotes Best Practice

The product suite provided by FXall can help firms implement Best Practices as put

forward by the Foreign Exchange Committee. This document will broadly explore those

Best Practices and set-out how FXall can assist with the implemenation of Best Practices

by providing the quality management and audit tools to ensure that your employees are

complying with your firms trading policies and mandates.

There are other Best Practice or Code of Conduct manuals published by the Bank of

England and the ACI (The Financial Markets Association) and where appropriate,

reference will be made to the recommendations of these organisations as well.

The Foreign Exchange Committee is convened by the Federal Reserve Bank of New York and is composed of

representatives from major financial institutions involved in the foreign exchange markets. The Foreign

Exchange Committee and the Federal Reserve Bank of New York do not endorse any particular automated

dealing system.

4

From a statement by the Foreign Exchange Committee (New York: 1st December 2003).

Copyright 2004 FX Alliance, LLC. All rights reserved.

BEST PRACTICES USING FXALL |

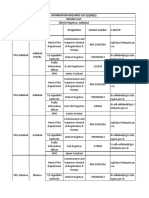

In the table below we list the specific Best Practices from the Foreign Exchange

Committee where FXall has a clear role in helping firms implement Best Practices. A

complete listing of Best Practices is available in Appendix 2.

Foreign

Exchange

Committee

Best Practice

No.

FXC no. 4

FXC no. 5

Pre-Trade Preparation and Documentation

Agree upon Trading and Operational Practices

Agree upon and Document Special Arrangements

FXC

FXC

FXC

FXC

FXC

FXC

FXC

Trade Capture

Enter Trades in a Timely Manner

Use Straight Through Processing

Use Real-Time Credit Monitoring

Use Standing Settlement Instructions

Operations Should Be Responsible for Settlement Instructions

Review Amendments

Closely Monitor Off-Market Transactions

no.

no.

no.

no.

no.

no.

no.

6

7

8

9

10

11

12

FXC no. 13

FXC no. 14

FXC no. 17

FXC

FXC

FXC

FXC

FXC

no.

no.

no.

no.

no.

18

19

21

23

24

FXC

FXC

FXC

FXC

no.

no.

no.

no.

25

26

27

28

Confirmation

Confirm and Affirm Trades in a Timely Manner

Be Diligent When Confirming by Non-secure Means

Institute Controls for Trades Transacted through Electronic Trading

Platforms

Verify Expected Settlement Instructions

Confirm All Netted Transactions

Confirm All Block Trades and Split Allocations

Automate the Confirmation Matching Process

Establish Exception Processing and Escalation Procedures

Netting

Use On-Line Settlement Netting Systems

Confirm Bilateral Net Amounts

Employ Timely Cut-offs for Netting

Establish Consistency between Operational Practices and

Documentation

FXC no. 31

FXC no. 34

Settlement

Use Automated Cancellation and Amendment Facilities

Understand the Settlement Process and Settlement Exposure

FXC

FXC

FXC

FXC

no.

no.

no.

no.

41

42

43

44

Accounting/Financial Control

Conduct Daily Position and P&L Reconciliation

Conduct Daily Position Valuation

Review Trade Prices for Off-Market Rates

Use Straight Through Processing of Rates and Prices

FXC

FXC

FXC

FXC

no.

no.

no.

no.

48

53

55

56

FXC

FXC

FXC

FXC

no.

no.

no.

no.

57

58

59

60

General Best Practices

Ensure Segregation of Duties

Control System Access

Use Internal and External Operational Performance Measures

Ensure That Service Outsourcing Conforms to Industry Standards

and Best Practices

Implement Globally Consistent Processing Standards

Maintain Records of Deal Execution and Confirmations

Maintain Procedures for Retaining Transaction Records

Develop and Test Contingency Plans

Copyright 2004 FX Alliance, LLC. All rights reserved.

BEST PRACTICES USING FXALL |

1.3 Summary of Key Operational & Compliance Benefits from using

FXall

Action

Online Trading

Telephone

Request for Quotes

Full audit trail of trade

requests. Reports monitor

quote performance of

providers which helps

demonstrate fulfillment of

fiduciary responsibility to

trade at best price.

Full audit trail of trade

execution, username, date &

time-stamped.

Immediate, accurate

update of trade details via

STP QuickConnect

facilitates real-time credit

monitoring.

STP QuickConnect

interface reduces manual

errors and provides full

audit trail. Allocation details

can be provided pre-trade to

minimize risk of fraud. Post

trade allocations are time

stamped.

Full audit trail of trade

amendment. Firms can

restrict access to these

post-trade functions by

username.

Use FXalls end-of-day rates

for Daily P&L valuation from

an unbiased source.

SWIFT based confirmation

and settlement messaging

with banks. Full audit trail

and STP functionality

available.

Automated Give-ups

between customer,

executing bank and prime

broker. Full audit trail and

STP functionality available.

SSIs automatically applied

to trades. Non-standard

SIs have full audit trail.

Taped conversations only.

F

R

O

N

T

O

F

F

I

C

E

Log all Completed Trades

Monitor Counterparty Credit

Limits

Trade Allocations

M

I

D

D

L

E

O

F

F

I

C

E

Post-trade amendments

Daily Mark-to-Market

Trade Confirmations

B

A

C

K

O

F

F

I

C

E

Prime Broker Give-ups

Standing Settlement Instructions

Database

3rd Party Confirmations

Fully automated via SWIFT

with full audit trail.

Copyright 2004 FX Alliance, LLC. All rights reserved.

Manual entry by trader into

deal capture system.

Delayed due to manual

booking of transaction.

Manual entry by trader into

deal capture system.

Potentially unsecure

methods of communicating

allocations.

Taped convesations only.

Manual entry by trader into

deal capture system.

3rd Party independent

provider required.

Taped conversations only.

Paper-based trade records.

Taped conversations only.

Paper-based trade records.

Paper-based data records

only. No automated

tracking of non-standard

SIs.

Paper-based trade records.

No audit trail.

BEST PRACTICES USING FXALL |

2. Introduction to FXall

Since its inception, FX Alliance (FXall) has worked closely with leading corporate, financial

institutions and asset management firms to develop functionality that encompasses their entire

workflow. Simultaneously, FXall has expanded its network to include most of the major FX and

custodian banks. FXall focuses on adding value throughout the entire dealing workflow with a full

suite of products offering an end-to-end solution for all users.

The FXall suite has three product lines that address trading and processing needs. Each product

addresses a key aspect of the trading workflow:

FXall Trading

QuickTrade - real-time competitive

quotes from multiple counterparties

simultaneously

QuickBatch trading for efficient execution

of complicated trades with multiple

allocations or legs

Choice of pre- or post-trade allocations

Settlement Center

Diagram 1: FXalls product suite

SWIFT based confirmation and settlement

messaging with banks

SWIFT based notifications to custodians

SSI Database simplifies settlement

administration

CLS compatible for customers using thirdparty settlement

Full automation for prime brokerage give

ups and reverse give ups

QuickConnect

Fully automated STP into front- and backoffice systems

Trading API allows customers to

incorporate execution directly into their

Treasury and Order Management Systems

The FXall Trading and Settlement Center products can be used independently. For example, an

asset manager can use FXall for execution, but continue to use its existing processes for

confirmation and settlement preparation. Or the asset manager can adopt Settlement Center to

streamline its middle and back-office, but continue to use a combination of execution methods

telephone, FXall, etc.

Role-based entitlements and a full audit trail for all FXall functions ensure that activities are

properly controlled with maker/checker functionality. The audit trail record includes winning and

losing quotes, changes in SSIs, and indicative prices.

However, the best synergies, controls and operational efficiencies are achieved when the customer

adopts both products.

To learn about how FXall automates customers workflows, please see Appendix 1.

Copyright 2004 FX Alliance, LLC. All rights reserved.

BEST PRACTICES USING FXALL |

3. Best Practices Review

This section reviews in detail how FXall can ensure that FX market participants can meet

the Best Practice guidelines as defined by the Foreign Exchange Committee.

3.1 Pre-Trade Preparation and Documentation

Best Practice no. 4: Agree Upon Trading and Operational Practices

From the FXC Guide

Trading and operational practices should be established with all

counterparties.

The amount of trading activity with fund managers and investment

advisors has escalated in recent years. These clients transact in block or

bulk trades, which are then split into smaller amounts and entered into

specific client accounts managed by fund managers or investment

advisors. Until a block or bulk trade is properly allocated to the specific

accounts of each fund entity, inaccurate credit risk management

information may exist. A bank should strongly encourage clients to

confirm bulk trades as soon as possible after the trade is executed.

How FXall Solves this

Issue

In addition, a bank should request that fund managers provide them with

the split information on the trade date for all trade types so that the

bank's credit information can be updated as soon as possible.

FXall has two types of automated block trading capabilities, pretrade and post-trade allocations. Both are optimized to ensure

implementation of Best Practice.

With automated pre-trade allocations, the trader can complete all the

executions by clicking a single button. From the counterparty banks

perspective, this is a more efficient method of processing block trades

and facilitates real-time credit checking before the deal is concluded.

Post-trade allocations are also available for trades executed over FXall or

the telephone. For phone trades, counterparties can agree to the spot

rate over the telephone, and then use Batch Trading to send the account

breakdown for the deal. The provider adds forward points if required

and, following review by the trader, the deal is booked electronically by

both parties. This method combines the relationship advantages of the

telephone with the straight through processing efficiencies of electronic

execution.

With either approach to automated allocations, all activities include a full

audit trail with each action stamped by time, date, and username.

Diagram 2: Batch Trading on FXall

Copyright 2004 FX Alliance, LLC. All rights reserved.

BEST PRACTICES USING FXALL |

Best Practice no. 5: Agree Upon and Document Special Arrangements

From the FXC Guide

If, in the course of the documentation set-up and establishment

of trade and operational practices, it becomes clear that a

counterparty requires special arrangementssuch as third-party

payments or prime brokerage servicethose arrangements

should be agreed upon and documented in advance of trading.

Prime brokerage arrangementsmay also involve special occasions

for misunderstanding the respective rights and obligations of the various

parties. Such arrangements should be evidenced by written agreements

(prime broker and dealer, prime broker and customer, dealer and

customer) that have been reviewed and approved by legal counsel.

How FXall Solves this

Issue

FXall facilitates the systematizing of special arrangements

between counterparties relating to third-party payments, prime

brokerage or any other agreement. The customer can ensure

that only administrative staff have access to these hard-coded

functions to minimise risk.

As an example, FXall has both front and back-office capabilities

for prime brokerage arrangements:

FXall Trading allows entitled users to choose the prime broker when

conducting a trade via QuickTrade.

FXalls Settlement Center electronically manages prime broker give-ups

between the three parties in the relationship. The prime broker will be

asked to actively Accept or Reject a deal done between a client and

an executing bank.

Participants in a prime brokerage relationship may choose to mandate

the use of FXalls Settlement Center for communicating give-ups in their

trading documentation. FXall can provide a completely automated realtime give-up process that is agreed to by all parties as part of the prime

brokerage agreements.

Diagram 3: From the FXall Prime Broker Getting Started Guide

Copyright 2004 FX Alliance, LLC. All rights reserved.

BEST PRACTICES USING FXALL |

3.2 Trade Capture

Best Practice no. 7: Use Straight Through Processing

From the FXC Guide

When Sales & Trading and Operations use separate systems,

electronic feeds should automatically feed all deals, adjustments,

and cancellations from one system to the other. Ideally, the

transaction data should also be carried straight through for

posting to the general ledger, updating credit information,

generating money transfer instructions, and feeding nostro

reconciliation systems.

To ensure timely processing by Operations and eliminate potential errors

that can occur if trades are reentered into the Operations systems,

straight through processing should exist between Sales & Trading and

Operations. Such a link should move deals, adjustments, and

cancellations to the Operations system as soon as they are finalized by

Sales & Trading.

How FXall Solves this

Issue

See also Best Practice no. 8: Use Real-time Credit Monitoring.

STP facilitates real-time transfer of trade data to allow for counterparty

credit limits to be monitored. And, see also Best Practice no. 17:

Institute Controls for Trades Transacted through Electronic

Trading Platforms.

To gain the greatest benefits from electronic trading you need to

automate the flow of data between FXall and your own systems.

This eliminates the time consuming and inaccurate task of manual data

entry. To make this automation possible, FXall has developed

QuickConnect, a comprehensive straight through processing solution.

FXalls STP solution covers the full deal lifecycle, covering pretrade, through dealing, to confirmation and settlement

preparation. However, our solution is flexible, allowing you to choose

which processes to automate. This allows you to concentrate your

energy where your particular business will see the greatest return.

Finally, we offer several different technologies for the integrations

themselves, meaning that we can connect to almost any trading system,

from spreadsheets, through to proprietary and vendor supplied systems.

Diagram 4: System Integration using FXall QuickConnect

Copyright 2004 FX Alliance, LLC. All rights reserved.

10

BEST PRACTICES USING FXALL |

Best Practice no. 9: Use Standing Settlement Instructions

From the FXC Guide

Standing Settlement Instructions (SSIs) should be in place for all

counterparties. Market participants should issue new SSIs, as well

as any changes to SSIs, to each of their trading partners in a

secure manner. For banks, the preferable method is through an

authenticated medium such as SWIFT messages.

SSIs allow for complete trade details to be entered quickly, so that the

confirmation process can begin as soon after trade execution as possible.

In general, when SSIs are in place, it is possible to take full advantage of

straight through processing because Operations may not have to

manually intervene in the transaction during the settlement process. SSIs

also allow for payments to be formatted properly and for readable SWIFT

codes to be issued. If SSIs are not established, Operations must contact

the counterparty to obtain settlement instructions and the deal record

must subsequently be changed to reflect these settlement instructions.

The extra work involved in inputting, formatting, and

confirming settlement instructions increases the opportunity for errors in

settlement, making SSIs important for risk management and efficiency.

See also Best Practice no. 10: Operations Should be Responsible

for Settlement Instructions, Best Practice no. 11 Review

Amendments and Best Practice no. 18 Verify Expected Settlement

Instructions.

The Model Code ACI

the Financial Markets

Association

The use, where possible, of Standardised Settlement Instructions (SSIs),

helps to eliminate costly mistakes.

How FXall Solves this

Issue

FXall has developed a full SSI database that provides secure

instruction management for Operations staff. Features include:

Support of SSIs and ad-hoc instructions

Standard instructions can be automatically added

Confirm without settlement instructions and add them later

Creation of new settlement instructions is subject to supervisor

approval

Role-based entitlements and a full audit trail ensure that instructions are

properly controlled with maker/checker functionality. The audit trail

records all changes, approvals and applications of the instructions.

If your firm is already a user of FXall Trading, then you will already have

a person assigned as your internal Entitlements Manager. However, as

part of implementing Best Practices, FXall recommends that you

designate a separate individual as the Settlement Center Entitlements

Manager so as to keep the front and back-office functions separate.

Diagram 5: SSIs on FXall

Copyright 2004 FX Alliance, LLC. All rights reserved.

11

BEST PRACTICES USING FXALL |

3.3 Confirmation & Netting

Best Practice no. 13: Confirm and Affirm Trades in a Timely Manner

From the FXC Guide

Both parties should make every effort to send confirmations, or

positively affirm trades, within two hours after execution and in

no event later than the end of the day. This guideline applies to

trades executed with both external and internal

counterparties. Any exception to this rule should be clearly

documented and approved by Operations management and

compliance staff.

Prompt confirmations are key to the orderly functioning of the marketplace because they minimize market risk and minimize losses due to

settlement errors.

These procedures are meant as practices for executions directly between

two parties. In the case of prime brokerage relationships, (in which one

financial institution extends its credit to a third-party dealing with the

institutions customer), confirmations should be exchanged among the

three parties in addition to the fulfillment of other requirements for

exchanging information (see p. 9 for a review of FXalls Prime Brokerage

capabilities).

The Non-Investment

Products code Bank

of England

Also see Best Practice No. 21, Confirm All Block Trades and Split

Allocations, No. 23, Automate the Confirmation Matching Process,

No. 24, Establish Exception Processing and Escalation Procedures

and Best Practice No. 34 Understand the Settlement Process and

Settlement Exposure.

In all markets, the confirmation provides a necessary final

safeguard against dealing errors. The issue and checking of

confirmations is a back-office responsibility which should be

carried out independently from those who initiate deals.

A confirmation of each deal should be sent out without delay and where

possible electronically.

the prompt dispatch and checking of confirmations is of great

importance. Non-standard settlement instructions should be particularly

carefully checked, and any discrepancies identified promptly upon

receipt, and notified direct to the counterparty

The Model Code ACI

the Financial Markets

Association

The issue and checking of confirmations is a back office responsibility,

which should be carried out independently of those who initiate deals.

Confirmations should be sent out as quickly as possiblethrough and

efficient and secure means

How FXall Solves this

Issue

FXalls Settlement Center is a back-office solution for

electronically managing the deal confirmation lifecycle. FXall

facilitates the hard-coding of details relating to the settlement

process including SSIs and third-party payments.

Every action has a full audit trail and changes to the hard-coded

data cannot be made without supervisor approval.

Settlement Center provides back-office processing used by customers to:

1. Automatically confirm trades with their providers (both on and off

platform)

2. Send settlement instructions

3. Notify custodians and other third parties, and

4. Agree netted settlements.

Copyright 2004 FX Alliance, LLC. All rights reserved.

12

BEST PRACTICES USING FXALL |

Settlement Center sits centrally in the matching and settlement process,

using SWIFT industry standard communication to keep all parties fully in

the picture.5 Depending on your firms capabilities and deal volumes,

your firm has a variety of choices as to the level of automation you can

implement.

Typically the higher the deal volumes (numbers of tickets), the greater

the need is to automate the confirmation and settlement process so as to

eliminate the scope for errors.

However, as an alternative to automated matching, customers can

choose to review and affirm confirmation messages sent in by their

Providers via SWIFT.

FXall currently sends and receives the following SWIFT message types on

behalf of clients using Settlement Center:

MT300

MT304

MT202

MT210

Foreign Exchange Confirmation

Advice/Instruction of a 3rd Party deal

General Financial Institution funds transfer

Notice to Receive

MT320 (Money Market) and MT305 (Plain Vanilla Options) message types

will be added in early 2004.

Settlement Center helps firms formalise their processes and also has a

number of reports available for monitoring each point of the settlement

process. These reports are particularly valuable when managing

settlement risk and understanding which trades may be unresolved at

any given moment in time.

Diagram 6: From the FXall Settlement Center Getting Started Guide

FX Alliance is a member of the SWIFT network and operates its own BIC code.

Copyright 2004 FX Alliance, LLC. All rights reserved.

13

BEST PRACTICES USING FXALL |

Best Practice no. 19: Confirm all Netted Transactions

From the FXC Guide

All transactions, even those that will be netted, should be

confirmed individually.

Netting trades for settlement is an important operational function

because it allows a bank to reduce settlement risk and operational cost.

However, it is still necessary to confirm all transactions individually. If

netted trades are not confirmed individually, trades may be mistakenly

added or removed from the net agreement, which will be difficult to

detect on settlement day. Incorrect netting will distort credit and

settlement risk.

The confirmation of these deals should be performed as it would be in

any other transaction or with the aid of a netting service provider.

The Model Code ACI

the Financial Markets

Association

How FXall Solves this

Issue

See also Best Practice No. 25 Use On-Line Settlement Netting

Systems and No. 26 Confirm Bilateral Net Amounts.

The Model Code recommends the use of netting systems to reduce

settlement and credit risk.

FXalls Settlement Center allows counterparties to combine

multiple payments arising from different deals into a single,

equivalent payment. It calculates bilateral netted amounts and records

agreement with provider for the netted amounts.

Only deals that have been individually matched can be included in

Netting totals. Once net confirmations have been created, they are

then submitted to the counterparty bank for approval.

The default action is for all deals to be netted at once. Clients may

however, choose particular accounts, banks, or currency combinations to

net on an ad-hoc basis.

See also Best Practice No. 27 Employ Timely Cut-offs for Netting

and Best Practice No. 28 Establish Consistency Between

Operational Practices and Documentation. Using a system for

netting is the best way to ensure that your processes are in line with

your documented procedures. Automation of calculated netted totals

and agreement between counterparties of netted amounts facilitates

timely completion of the netting process.

Diagram 7: From the FXall Settlement Center Getting Started Guide

Copyright 2004 FX Alliance, LLC. All rights reserved.

14

BEST PRACTICES USING FXALL |

3.4 Settlement

Best Practice no. 31: Use Automated Cancellation and Amendment Facilities

From the FXC Guide

A bank [or customer] should establish a real-time communication

mechanism . to process the cancellation and amendment of

payment instructions.

A bank [or customer] may need to change or cancel payment

instructions after they have been released to nostro banks. Problems

may arise if this information is not processed in a timely manner.

Amendments occur when an error in the original instruction has been

identified or a counterparty has made a last minute change. Because

execution of the erroneous payment instruction will certainly create an

improper settlement, the bank needs to be sure the amendment is acted

upon so that its nostro balance predictions are accurate. More

importantly, a bank may wish to cancel a payment instruction if it is

reasonably confident that a counterparty may not fulfill its obligation to

pay the counter-currency.

An automated feed from the Operations system will make

communication of amendments and cancellations easier. Such a link

also decreases the chance that a bank will miss the payment deadline

and should prevent incorrect payments from being released.

See also Best Practice No. 14 Be Diligent When Confirming by

Nonsecure Means. Authenticated electronic messaging is the most

secure means of transmitting confirmations. See also Best Practice

No. 12 Closely Monitor Off-Market Transactions

How FXall Solves this

Issue

With FXall, post-trade amendments are processed in the most

secure environment every action is time, date and username

stamped with only authorised users having access to this

functionality. And the full audit trail can be monitored by

compliance staff in real-time.

Customers and liquidity providers can negotiate five different

types of post-trade amendments to deals executed on FXalls

trading platform:

1.

Post Trade Allocations The customer can split a trade across

multiple accounts.

2.

Value Date to Follow The customer can split the trade across

multiple value dates.

3.

Rebook at Average Rate The customer executes a number of

transactions with the same provider. These are then cancelled and

rebooked as a single deal (at the provider-calculated weighted

average execution rate).

4.

Cancel and Rebook The customer submits a general amendment

request to the provider; if agreed, the counterparties potentially

negotiate a new price. The original deal is then cancelled and

replaced by the amended deal.

Back-office Amendments or Cancellations: As discussed in a

previous section, FXall Settlement Center provides the greatest

benefit when full STP is achieved from trade initiation through to

settlement. However, dealers (people) do make mistakes and

upon occasion deals need to be amended or cancelled altogether.

Copyright 2004 FX Alliance, LLC. All rights reserved.

15

BEST PRACTICES USING FXALL |

If the trade has been done off-platform but Settlement Center is being

used for confirmations, then counterparties can amend and cancel within

the back-office environment.

All amendments and cancellations whether done manually or via SWIFT

messaging are captured with a full audit trail and if required, maker /

checker functionality is available.

Diagram 8: Audit Trail detail on Settlement Center

Copyright 2004 FX Alliance, LLC. All rights reserved.

16

BEST PRACTICES USING FXALL |

3.5 Accounting / Financial Control

Best Practice no. 41: Conduct Daily Position and P&L Reconciliation

From the FXC Guide

Daily P&L and position reconciliations should take place between

the Sales & Trading and Operations systems.

Banks that maintain a single system for trade capture data should ensure

that the data source is properly controlled.

See also Best Practice No. 42, Conduct Daily Position Valuation.

Position valuation should be checked against independent price

sources (such as brokers or other banks).

See also Best Practice No. 43 Review Trade Prices for Off-Market

Rates. Trade prices should be independently reviewed to ensure

reasonableness within the market prices that existed on the

trade date.

See also Best Practice No. 44, Use Straight Through Processing of

Rates and Prices. Rates and prices should be fed electronically

from source systems. To eliminate the errors associated with

collecting and rekeying the required rates and prices, a bank [or

customer firm] should establish electronic links from the systems that

source the rates and price information to the position valuation systems.

The Non-Investment

Products code Bank

of England

The Model Code ACI

the Financial Markets

Association

How FXall Solves this

Issue

Principals who engage in trading should undertake regular prudent and

consistent valuation of their mark-to-market trading positions. For many

such positions, quoted prices will be the best guide to a fair valuation.

Screen services, brokers and other third-party providers can all be useful

sources of data.

Ensure timely and accurate risk measurement. Trading positions should

be marked to market on a daily basis by a function independent of

trading. Valuations should be verified against independent sources

wherever possible.

Use FXalls end-of-day rates for daily P&L valuation from an

unbiased source. The FXall Hourly Rates are derived from the FXall

Indicative Quotes feed. FXall's fully integrated liquidity providers deliver

streaming quotes directly from their rate engines to the FXall platform.

FXall uses a proprietary algorithm to blend the contributions into a

single, real-time quote stream. The algorithm identifies and eliminates

out-of-range data to ensure that the FXall real-time quote stream is

accurate and reliable. FXalls rates are market neutral; meaning they

are not biased towards the commercial interest of any single provider

bank.

The FXall Hourly Rates provide a useful tool to members of FXall's global

trading community who perform daily mark-to-market processes

throughout the trading day. FXall posts Hourly Rates for all of the major

market closings to ensure that all customers can benefit from this service

regardless of their location.

Subscribers to FXall's Premium Information Services package can access

a comprehensive list of Hourly Rates for all currency pairs and tenors

that are currently available through the FXall Indicative Quotes Panel. In

addition, subscribers will have access to a full search and download

facility for retrieving historical rates.

Copyright 2004 FX Alliance, LLC. All rights reserved.

17

BEST PRACTICES USING FXALL |

Premium Information Services subscribers can also use FXall's

QuickConnect integration services to automatically download the FXall

Hourly Rates directly into their portfolio management systems for use in

marking to market and P&L valuations.

In addition to using FXall rates for valuations, each FXall trade ticket

includes the current market FX rate from the blended quotes facility with

the trade P&L calculated against that market rate. This allows firms to

monitor their providers for rate reasonableness.

Diagram 9: FXall Hourly Rates Screen

Copyright 2004 FX Alliance, LLC. All rights reserved.

18

BEST PRACTICES USING FXALL |

3.6 General Practices

Best Practice no. 48: Ensure Segregation of Duties

From the FXC Guide

The reporting line for Operations personnel should be

independent of the reporting line for other business lines (Sales

& Trading, credit, accounting, audit, and so on). For key areas,

Operations management should ensure that an appropriate

segregation of duties exists within Operations and between

Operations and other business lines.

Examples of good practices include:

Precluding individuals from having both trading and confirmation /

settlement responsibilities concurrently

Precluding Sales & Trading personnel from issuing and authorizing

payments

Not allowing established procedures to be overridden without

Operations management's consent

Separate database functions between Sales & Trading and Operations

How FXall Solves this

Issue

FXall has been designed to ensure a complete segregation

between front, middle and back-office duties. FXall recommends

that you have two entitlements managers designated one for managing

front and middle-office trading / support functions and one for backoffice settlement and confirmation functions.

The process of setting up users is controlled by the customer. The FXall

administrator will set up a customer entitlements manager, who is a

customer employee responsible for setting up additional users with

appropriate entitlements in the application. The front-office customer

entitlements manager also entitles specific sub-accounts to trade with

specific banks. The trading application incorporates these account-level

entitlements in the aggregation, netting and RFQ functions.

The Settlement Center entitlements manager will be in charge of all the

administrative set-up functions relating to the use of Settlement Center.

Responsibilities include assigning roles to SC users (e.g., maker,

checker) and creating / maintaining mapping between accounts and bank

branches (Settlement Entity mapping).

Diagram 10: Full Maker / Checker capabilities built in for compliance

Copyright 2004 FX Alliance, LLC. All rights reserved.

19

BEST PRACTICES USING FXALL |

Best Practice no. 53: Control System Access

From the FXC Guide

Users of a system (for example, Operations, Sales & Trading)

should not be able to alter the functionality of production

systems. Developers should have limited access to production

systems, and only in a strictly controlled environment. Each

system should have access controls that allow only authorized

individuals to alter the system and/or gain user access. Functionspecific user access "profiles" are suggested.

Access to production systems should only be allowed for those

individuals who require access in order to perform their job function.

When creating user access profiles, system administrators should tailor

the profile to match the user's specific job requirements, which may

include "view only" access. System access and entitlements should be

periodically reviewed, and users who no longer require access to a

system should have their access revoked. Under no circumstance should

Operations or Sales & Trading have the ability to modify a production

system for which they are not authorized.

The Model Code ACI

the Financial Markets

Association

Specific and stringent access controls should also cover treasury IT

systems equipment and confidential information.

How FXall Solves this

Issue

Application Security: Each FXall user has a single FXall user ID

and password. FXall also uses IP address filtering to ensure

message traffic occurs between known entities.

The process of setting up users is controlled by the customer organisation (see Best Practice no 48 above, Ensure Segregation of

Duties).

During the onboarding process, each user sets up an authentication

phrase (e.g., mother's maiden name) that is used to authenticate the

user with the FXall customer service desk. When a user first logs into

FXall, they are forced to change their password.

Five consecutive invalid password authentication attempts in 24 hours

results in a user account being locked out. The FXall administrator must

reset accounts that have been locked out.

Confidentiality and Encryption:

The Secure Socket Layer (SSL) protocol is used to encrypt network

communication for all sensitive traffic. 128-bit encryption key lengths

are the standard key length for critical applications, including login,

trading and reporting. VeriSign global site certificates are used for all of

these applications, which allow all supported browsers to use 128-bit

encryption, regardless of whether they support 128-bit encryption

natively.

Security Audit: SAS 70

FXall has received from its independent auditors an American Institute of

Certified Public Accountant's (AICPA) Statement on Auditing Standards

No. 70 (SAS 70) report. The internationally-recognized SAS 70 report

examines, through an independent third-party assessment process, the

adequacy of controls surrounding the FXall Trading environment.

The SAS 70 is the industry standard for security competency for financial

e-commerce websites.

Security Monitoring:

FXall deploys a variety of monitoring tools and actions to further protect

trading. Intrusion detection tools provide real-time and historical

Copyright 2004 FX Alliance, LLC. All rights reserved.

20

BEST PRACTICES USING FXALL |

monitoring to foil any known attack. Ongoing security auditing and

assessment tools ensure FXall systems remain properly configured to

identify and correct evolving marketplace vulnerabilities.

FXall engages independent security consultants to perform extensive

ethical hacking tests of the FXall network, systems and applications.

Best Practice no.55: Use Internal & External Operational Performance Measures

From the FXC Guide

Operational performance reports should be established to clearly

measure and report on the quality of both internal and external

(outsourced) operational performance. The report measurements

should focus on operational efficiency and controls, and be

reviewed on a regular basis by both Operations and Sales &

Trading management.

Operational performance reporting should contain quantifiable

performance metrics at the levels of detail and summary, and indicate

the status of operational activities. These reports should serve to control

and proactively monitor risk and performance.

How FXall Solves this

Issue

See also Best Practice no. 56: Ensure That Service Outsourcing

Conforms to Industry Standards and Best Practices.

FXall provides a Relationship Management Advisor (RMA) report

which allows firms to monitor their FXall statistics. The RMA

provides:

A summary of a firms volume done on FXAll over any time

period

A breakdown by requests (RFQs) sent, answered and dealt in

total

How much business the bank has the opportunity to win and how

much it is actually given

The average time it takes for each bank to make a quote

Provider banks and client firms can use the RMA to monitor activity and

ensure that quality performance is reached.

Diagram 11: Example of the Relationship Management Advisor Report

Copyright 2004 FX Alliance, LLC. All rights reserved.

21

BEST PRACTICES USING FXALL |

Best Practice no. 58: Maintain Records of Deal Execution and Confirmations

From the FXC Guide

Banks [and counterparties] should maintain documentation

supporting the execution of foreign exchange trades. Such documentation should provide a sufficient audit trail of the events

throughout the deal execution, trade, and validation process. This

documentation may be in the form of written or electronic

communication, a tape recording, or other forms evidencing the

agreement between the parties.

The length of time that a bank keeps records (which may be left to

management's discretion) depends on the type of business they transact

and may also be subject to local regulations.

It is important to note that trades conducted over the telephone pose

particular risks. The phone conversation is the only bilateral record of

the trade details, at least until the trade is validated through the

traditional confirmation process. Until this confirmation process is

completed, market participants should establish close controls to

minimize the exposure inherent in such trades.

How FXall Solves this

Issue

See also Best Practice No. 59 Maintain Procedures for Retaining

Transaction Records.

Trade Confirmations:

Every deal is logged instantly, as completed. Once the trade is

executed on FXall, the customer and the liquidity provider confirm and

settle the trades in accordance with current practices either via FXalls

Settlement Center or off-platform. Using Settlement Center, customers

can implement a fully automated confirmation procedure that not only

records and saves a record of the confirmation, but also includes the full

audit trail of every action taken by individual users.

Trade Records:

The system is designed to retain records of a large volume of trades.

Currently, trade history for FXall trade recaps and Settlement

Center confirmations conform to best industry practice; up to

seven years in some jurisdictions.

Reports:

The FXall Reporting module offers clients and providers key reports to

support and enhance their internal processes. Customers have the

ability to access reports from the FXall Portal independently from the

Trading applet to provide greater flexibility on queries and to support

compliance management controls. Reports are available in html, pdf and

csv formats and the frequency can be real time or via scheduler with

notifications upon completion. The type of customer reports include

Daily Activity, Audit Trail and Liquidity Provider Summary reports, with

performance benchmark reporting planned for the future.

Diagram 12: Reports on FXall

Copyright 2004 FX Alliance, LLC. All rights reserved.

22

BEST PRACTICES USING FXALL |

Best Practice no. 60: Develop and Test Contingency Plans

From the FXC Guide

Operations and Sales & Trading should develop plans for

operating in the event of an emergency. Contingency plans

should be periodically reviewed, updated, and tested. These

contingency plans should cover both long-term and short-term

incapacitation of a trading or Operations site, the failure of a

system, the failure of a communication link between systems, or

the failure of an internal/external dependency. These plans

should include informing, monitoring, and coordinating

personnel.

Backup sites that can accommodate the essential staff and systems of

Operations and Sales & Trading should be set up, maintained, and tested

on a regular basis. Particularly for Operations, market participants should

consider developing a backup site that relies on a separate infrastructure

(electricity, telecommunications, etc.) and an alternative workforce.

Backup sites should be able to access critical confirmation and netting

systems, key liquidity providers, and other industry utilities.

How FXall Solves this

Issue

See also Best Practice No. 57 Implement Globally Consistent

Processing Standards.

Customers have the full benefit of FXalls substantial Continuity

of Business (COB) investment: in the event of having to deploy staff

to your own back-up operations center, access to FXall for critical FX

trading and settlement functions can still be maintained via a secure

internet connection so that normal processing can still take place.

FXall has established a business continuity plan with procedures to

address intra-day outages as well as loss of data center capability.

FXall has a full secondary technology infrastructure to ensure there is no

single point of failure. In the event of a disaster that eliminates or

significantly degrades processing capability at the primary site in New

Jersey, USA, FXall can move primary processing to Virginia. FXall has

24-hour customer support when markets are open and can function from

any of its global locations.

Recovery plans are tested and updated at least annually to mitigate the

effects of an outage to any portion of FXall operations. These outages

can be a result of natural causes (weather, fire etc.) or infrastructure

issues at the FXall location (flooding, power outage, system failure etc).

FXall will aim to contact its clients and providers about any outages in a

timely manner, informing them of any system interruptions and

alternative contacts and procedures to be used.

The UK SFA (the predecessor to the FSA) reviewed FXalls Business

Continuity Plan as part of FXalls registration application. The application

was approved.

Copyright 2004 FX Alliance, LLC. All rights reserved.

23

BEST PRACTICES USING FXALL |

4. FXalls Implementation of Best Practices

FXall has implemented its own corporate governance policies and guidelines for its staff

to ensure that the business meets or exceeds all regulations and Best Practices.

FXall is an independent company with its own board of directors and management team.

Regulatory review

FXall has been reviewed by the UK Securities and Futures Authority and has received

their authorization to conduct business in the UK. This authority has been passported to

other European Union countries under the EUs Investment Services Directive.

FXall has also been approved by the Hong Kong Monetary Authority as a money broker

under the Banking Ordinance with effect from 31st August, 2001.

FXall complies with applicable legal and regulatory requirements in each jurisdiction in

which we operate. In most jurisdictions, including the United States, exemptions from

registration are available for FX activity with institutional customers. We continue to

review the regulatory requirements in additional jurisdictions; the current list of

jurisdictions from which customers may trade is available on our website at

http://www.fxall.com/about/locations.html.

Risk management at FXall

The CFO is responsible for overall risk management. The FXall Security Committee is

responsible for the approval of the Information Security Policy and Programs. The FXall

Security Committee consists of the CTO, the Information Security Officer, General

Counsel, the CFO and the COO.

The FXall Information Security Officer, under the direction of the CFO, supports

information security strategic planning, risk assessment, the development of policy,

programs, mechanisms, metrics, monitoring, and change management. FXall

Information Security is additionally responsible for the physical protection of all FXall

assets, including FXall information, employees, facilities, and equipment. It is FXalls

policy to review and test its security policies and procedures and the security of its

infrastructure and applications periodically, and at least once per year.

FXall does not take any market risk. FXall is not counterparty to any market transactions.

FXall does not maintain any trading accounts for itself or for customers. FXall employees

may not trade FX for their personal accounts.

Support

The trading capabilities are supported by comprehensive reporting and multi-lingual

customer support centers that are staffed 24-hours when markets are open with IT and

FX professionals.

Strongest Industry Backing

FXall enjoys the broadest and deepest industry backing of any FX portal:

FXall was founded by fourteen major international banks (and now has 17 equity

partners) whose substantial equity funding and contributions of liquidity,

marketing support and technical resources represent significant long-term

commitment to FXalls success.

Copyright 2004 FX Alliance, LLC. All rights reserved.

24

BEST PRACTICES USING FXALL |

FXalls comprehensive functionality and proven technology have attracted more

than 46 (and growing) liquidity providers, the vast majority of whom are fully

integrated to the platform.

FXall has been recognized many times by FX market participants and its peers by having

won numerous awards including the Euromoney 2003 award for Best Multibank Portal

and #1 Multibank Portal from Global Investor 2003 FX Survey. For more information,

see http://www.fxall.com/about/awards.html .

Copyright 2004 FX Alliance, LLC. All rights reserved.

25

BEST PRACTICES USING FXALL |

Appendix 1: How FXall Automates Customers Workflows

A.1 How Does it Work?

The diagram below shows how these products and processes combine to deliver a

workflow that eliminates manual keying and largely automates processing.

Diagram 13: The FXall Workflow

A.2 Front-Office

Through QuickConnect integration, trade requirements are automatically uploaded from

the clients Treasury or Order Management System to FXall.

Depending on the clients operating procedures, trade requirements can be uploaded as

locked orders, ready for execution and flagged with a list of credit-checked banks.

Alternatively these decisions can be left to the trading team.

The trader can choose between different styles of execution to seek the desired balance

of execution speed and price efficiency:

1. Use the competitive trading system to send a Request for Quote (RFQ) to

multiple providers simultaneously. The trader reviews the prices returned and

chooses the winning broker.

2. To quickly execute a large number of deals, use the Batch Trading system to

send several orders simultaneously to a single broker. The trader can complete

all the executions by clicking a single button.

3. Agree the spot rate for the deal over the telephone, and then use the Send

Details function in Batch Trading to send the account breakdown for the deal.

The broker prices any forward points required and, following review by the

trader, the deal is booked electronically by both parties. This method combines

the relationship advantages of the telephone with the straight through processing

efficiencies of electronic execution.

Copyright 2004 FX Alliance, LLC. All rights reserved.

26

BEST PRACTICES USING FXALL |

Traders can mix and match these methods as desired, selecting the best approach for

each individual deal.

And via the same QuickConnect integration, completed trade details can be

automatically returned back to the client and banks systems to allow for real-time

booking, credit monitoring and trader limit supervision.

A.3 Middle & Back-Office

Trade details are then sent to Settlement Center to await confirmation from the bank.

Usually, this is performed using a QuickConnect integration from the clients Treasury

or Order Management System. Alternatively, trades executed on FXall can be fed

directly into Settlement Center with no integration required.

The winning bank confirms the deal information by sending an MT300 message to FXall

over the SWIFT network. FXall interprets the banks particular SWIFT format by filtering

the data and matches the details against the customers deal. Once the two sides of the

deal have been matched, the deal is confirmed.

Following confirmation, the next step is to identify settlement instructions for the deal

the physical bank accounts in which the FX will be settled. Settlement Center includes an

SSI Database to streamline this process. And banks maintain their own settlement

instructions in the database, freeing customers of this responsibility.

Using the information in the database, Settlement Center can also send an industry

standard MT304 message over SWIFT network on behalf of an asset manager. This

contains full details of the economic and settlement details of the trade.

A.4 Reducing Settlement Risk

Settlement Center allows the customer to choose between gross settlement, bilateral

netting and CLS by supporting the transition from legacy settlement methods.

Diagram 14: FXall Reducing Settlement Risk

For CLS participants, FXall provides

seamless messaging by sending third-party

notifications for all customers, not just

asset managers. FXall supports the CLS

Custody Mapping (the C- trigger) and

adds settlement instructions to the

confirmation and notification messages.

Matching is available on the settlement

instructions as well as the economic

details.

Finally, for clients that perform net settlement, the netting module in Settlement Center

allows counterparties to combine multiple payments arising from different deals into a

single, equivalent payment. The benefits of netting include the simplification of the

settlement process and the reduction of settlement costs and risk exposure.

Copyright 2004 FX Alliance, LLC. All rights reserved.

27

BEST PRACTICES USING FXALL |

Appendix 2: Complete Listing of Best Practices from the

Foreign Exchange Committee

This document has only detailed some of the 60 Best Practices for managing Operational

Risk in Foreign Exchange. As a reference, please find below the complete listing.

In summary, a firm implementing FXall into its workflow will benefit significantly with

regard to the best practices highlighted in bold below:

Pre-Trade Preparation and Documentation

Best Practice no. 1: Know Your Customer

Best Practice no. 2: Determine Documentation Requirements

Best Practice no. 3: Use Master Netting Agreements

Best Practice no. 4: Agree upon Trading and Operational Practices

Best Practice no. 5: Agree upon and Document Special Arrangements

Trade Capture

Best Practice no.

Best Practice no.

Best Practice no.

Best Practice no.

Best Practice no.

Best Practice no.

Best Practice no.

6: Enter Trades in a Timely Manner

7: Use Straight Through Processing

8: Use Real-Time Credit Monitoring

9: Use Standing Settlement Instructions

10: Operations Should Be Responsible for Settlement Instructions

11: Review Amendments

12: Closely Monitor Off-Market Transactions

Confirmation

Best Practice no. 13: Confirm and Affirm Trades in a Timely Manner

Best Practice no. 14: Be Diligent When Confirming by non-secure Means

Best Practice no. 15: Be Diligent When Confirming Structured or Non-standard Trades

Best Practice no. 16: Be Diligent When Confirming by Telephone

Best Practice no. 17: Institute Controls for Trades Transacted through Electronic

Trading Platforms

Best Practice no. 18: Verify Expected Settlement Instructions

Best Practice no. 19: Confirm All Netted Transactions

Best Practice no. 20: Confirm All Internal Transactions

Best Practice no. 21: Confirm All Block Trades and Split Allocations

Best Practice no. 22: Review Third-Party Advice

Best Practice no. 23: Automate the Confirmation Matching Process

Best Practice no. 24: Establish Exception Processing and Escalation

Procedures

Netting

Best Practice no.

Best Practice no.

Best Practice no.

Best Practice no.

Documentation

25:

26:

27:

28:

Use On-Line Settlement Netting Systems

Confirm Bilateral Net Amounts

Employ Timely Cut-offs for Netting

Establish Consistency between Operational Practices and

Settlement

Best Practice no. 29: Use Real-Time nostro Balance Projections

Best Practice no. 30: Use Electronic Messages for Expected Receipts

Best Practice no. 31: Use Automated Cancellation and Amendment Facilities

Best Practice no. 32: Implement Timely Payment Cut-offs

Best Practice no. 33: Report Payment Failures to Credit Officers

Best Practice no. 34: Understand the Settlement Process and Settlement Exposure

Best Practice no. 35: Prepare for Crisis Situations Outside Your Organization

Copyright 2004 FX Alliance, LLC. All rights reserved.

28

BEST PRACTICES USING FXALL |

Nostro Reconciliation

Best Practice no. 36: Perform Timely nostro Account Reconciliation

Best Practice no. 37: Automate nostro Reconciliations

Best Practice no. 38: Identify non-receipt of Payments

Best Practice no. 39: Establish Operational Standards for nostro Account Users

Accounting/Financial Control

Best Practice no. 40: Conduct Daily General Ledger Reconciliation

Best Practice no. 41: Conduct Daily Position and P&L Reconciliation

Best Practice no. 42: Conduct Daily Position Valuation

Best Practice no. 43: Review Trade Prices for Off-Market Rates

Best Practice no. 44: Use Straight Through Processing of Rates and Prices

Unique Features of Foreign Exchange Options and non-Deliverable Forwards

Best Practice no. 45: Establish Clear Policies and Procedures for the Exercise of Options

Best Practice no. 46: Obtain Appropriate Fixings for non-standard Transactions

Best Practice no. 47: Closely Monitor Option Settlements

General Best Practices

Best Practice no. 48: Ensure Segregation of Duties

Best Practice no. 49: Ensure That Staff Understand Business and Operational Roles

Best Practice no. 50: Understand Operational Risks

Best Practice no. 51: Identify Procedures for Introducing New Products, New Customer Types

or New Trading Strategies

Best Practice no. 52: Ensure Proper Model Signoff and Implementation

Best Practice no. 53: Control System Access

Best Practice no. 54: Establish Strong Independent Audit/Risk Control Groups

Best Practice no. 55: Use Internal and External Operational Performance Measures

Best Practice no. 56: Ensure That Service Outsourcing Conforms to Industry

Standards and Best Practices

Best Practice no. 57: Implement Globally Consistent Processing Standards

Best Practice no. 58: Maintain Records of Deal Execution and Confirmations

Best Practice no. 59: Maintain Procedures for Retaining Transaction Records

Best Practice no. 60: Develop and Test Contingency Plans

Copyright 2004 FX Alliance, LLC. All rights reserved.

29

BEST PRACTICES USING FXALL |

Appendix 3: List of Related Documents & Websites

References

Foreign Exchange Committee

Management of Operational Risk in Foreign Exchange March 2003

http://www.newyorkfed.org/fxc/2003/fxc033103.pdf

ACI The Financial Markets Association

The Model Code October 2002

http://www.aciforex.com/mktpractice/model_code.htm

Bank of England

The Non-Investment Products code May 2003

http://www.bankofengland.co.uk/markets/nipscode.pdf

Recent amendment to the NIPs code:

http://www.bankofengland.co.uk/pressreleases/2003/058.htm

http://www.bankofengland.co.uk/markets/forex/fxjsc/

Copyright 2004 FX Alliance, LLC. All rights reserved.

30

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Human Anatomy Physiology Laboratory Manual Fetal Pig Version 12th Edition Marieb Solution ManualDocument5 pagesHuman Anatomy Physiology Laboratory Manual Fetal Pig Version 12th Edition Marieb Solution Manualsritrader90% (10)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- AGR ProfileDocument26 pagesAGR ProfilesritraderPas encore d'évaluation

- PHY Holiday Homework 8 (2017)Document1 pagePHY Holiday Homework 8 (2017)sritraderPas encore d'évaluation

- MATH-CLASS 8 Holiday HWDocument2 pagesMATH-CLASS 8 Holiday HWsritraderPas encore d'évaluation

- Advocate Fee Schedule.7122Document10 pagesAdvocate Fee Schedule.7122sritraderPas encore d'évaluation

- Mathematics Worksheet Class 8Document1 pageMathematics Worksheet Class 8sritraderPas encore d'évaluation

- 01 Circular UniformDocument2 pages01 Circular UniformsritraderPas encore d'évaluation

- Tenders - BPP - Clay Ganesha Idol Distribution CentresDocument1 pageTenders - BPP - Clay Ganesha Idol Distribution CentressritraderPas encore d'évaluation

- Yogi Ashwini: Fo Nda Ion ATI ATI Radeon HDDocument1 pageYogi Ashwini: Fo Nda Ion ATI ATI Radeon HDsritraderPas encore d'évaluation

- Software at or CallDocument8 pagesSoftware at or CallsritraderPas encore d'évaluation

- There'S A Tomorrow.: Trade Futures LikeDocument6 pagesThere'S A Tomorrow.: Trade Futures LikesritraderPas encore d'évaluation

- V25 C07 135sarkDocument11 pagesV25 C07 135sarksritraderPas encore d'évaluation

- Corporate OfficeDocument6 pagesCorporate OfficesritraderPas encore d'évaluation

- District LevelDocument6 pagesDistrict Levelsritrader100% (1)

- Man Dal LevelDocument74 pagesMan Dal LevelsritraderPas encore d'évaluation

- Change in Account Type - RequestDocument1 pageChange in Account Type - RequestsritraderPas encore d'évaluation

- Office Quality Grade MatrixDocument3 pagesOffice Quality Grade MatrixleninamoPas encore d'évaluation

- ABSL Report en E-VerzeDocument76 pagesABSL Report en E-VerzezinouPas encore d'évaluation

- Assignment 2Document9 pagesAssignment 2Esclet PHPas encore d'évaluation

- Jacque Fresco EssaysDocument18 pagesJacque Fresco EssaysDarklaykPas encore d'évaluation

- 2019 Corporate BrochureDocument8 pages2019 Corporate Brochureabul abbasPas encore d'évaluation

- Home Automation Based On IoT Using Google AssistantDocument6 pagesHome Automation Based On IoT Using Google AssistantIJARTETPas encore d'évaluation

- Cim SyllabusDocument2 pagesCim SyllabusHarish HPas encore d'évaluation

- Lesson 1-Introduction To STSDocument8 pagesLesson 1-Introduction To STSLance CasasPas encore d'évaluation

- Data Communication Between A S7-1200 and Telecontrol ServerDocument2 pagesData Communication Between A S7-1200 and Telecontrol ServerTran Phi HuynhPas encore d'évaluation

- SSRN Id3429842Document8 pagesSSRN Id3429842Ritchell Mae MalolotPas encore d'évaluation

- Vent. DaikinDocument42 pagesVent. DaikinDaniela BarbuPas encore d'évaluation

- Water Source Unit Model WS-43Document2 pagesWater Source Unit Model WS-43Paul DanielPas encore d'évaluation

- Powerflex 750-Series Ac Drives: Programming ManualDocument514 pagesPowerflex 750-Series Ac Drives: Programming Manualchevy572Pas encore d'évaluation

- MEDUSA4 Brochure CAD Software enDocument8 pagesMEDUSA4 Brochure CAD Software endobridorinPas encore d'évaluation

- The Nine Elements of Digital TransformationDocument9 pagesThe Nine Elements of Digital TransformationNaveen SgPas encore d'évaluation

- IDC - Business - Value - of - Stripe - Platform - Full StudyDocument21 pagesIDC - Business - Value - of - Stripe - Platform - Full StudyPanagiotis AlexandrisPas encore d'évaluation

- Pfeiffer Cement MillDocument11 pagesPfeiffer Cement Millgrupa2904Pas encore d'évaluation

- Promotion For Globally Competitive Industry in Indonesia: Summary of Study ReportDocument42 pagesPromotion For Globally Competitive Industry in Indonesia: Summary of Study ReportmirzaPas encore d'évaluation

- Xarios 150: Superior Versatility and Reliability For Small-Sized Delivery VehiclesDocument2 pagesXarios 150: Superior Versatility and Reliability For Small-Sized Delivery VehiclesOtman OthmanPas encore d'évaluation

- PL-900-Microsoft Power Platform FundamentalsDocument3 pagesPL-900-Microsoft Power Platform FundamentalssunnydcePas encore d'évaluation

- PC VRF SystemsDocument27 pagesPC VRF SystemsJulian pinerosPas encore d'évaluation

- TF600C PastaOneDocument14 pagesTF600C PastaOneAshrafPas encore d'évaluation