Académique Documents

Professionnel Documents

Culture Documents

10 Key To Successful Real Estate Project From The Article Project Development Success or Failure? by Richard S Sorenson

Transféré par

ikeike82Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

10 Key To Successful Real Estate Project From The Article Project Development Success or Failure? by Richard S Sorenson

Transféré par

ikeike82Droits d'auteur :

Formats disponibles

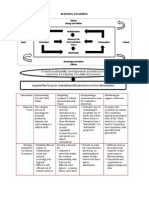

10 KEY TO SUCCESSFUL REAL ESTATE PROJECT FROM THE ARTICLE

PROJECT DEVELOPMENT; SUCCESS OR FAILURE? BY RICHARD

S

TOOLKIT

SORENSON

Location Analysis

Project managers should analyze existing competition,Data,

accessibility,

trafficResource

Work and

patterns, the desirability of the location, and ensure that the proposed use is

Management systems

compatible with the environment.

Site Analysis

Size, soil characteristics, topography, frontage, utilities, and zoning are

components of the site that must be considered when developing a project.

Improvement

Analysis

The improvement must meet the criteria for highest and best use; that is, they

must be physically possible, appropriately supported, legally permissible,

financially feasible, and embody the most profitable use.

Demand and Supply

Analysis

A market analysis is a study of market conditions for a specific type of property,

the purpose of which is to assess current and future demand and supply in the

particular trade area.

Feasibility

Analysis

Feasibility analysis involves both the financial operating statement and cost

analysis, and consists of a study of the cost-benefit relationship of an economic

endeavor.

Decision support &

continuous improvement 2

Goverment Approval

Process

Developers must not underestimate the number of procedures and the amount of

time required by the approval process. The outcome of any government approval

process is never certain, because hostile out side parties may be able to stop a

viable development by identifying a seemingly innocuous oversight.

Capital Market

Analysis

Rising interest rates often lead to declining or, at best, stable real estate values,

thereby removing the lenders loan-to-value and debt service ratio safety cushions.

Obviously, trends in real estate value are extremely sentitive to changes in capital

market.

Timing

Uneconomic

Purpose

Inept Ownership

[Type text]

Proper timing in real estate project development, as in all types of investment

activities, is an important element of success. Good timing, whether caused by

luck or superior economic forecasting skills, can make a success out of an

otherwise marginal or mediocre project. Poor timing, on the other hand, often

defeats an otherwise viable developments.

Fundamental real estate valuation principles must be respected, as must the

principles of anticipation, change, supply an demand, competitions, substitution,

opportunity costs, balance, and conformity.

Examples of the harm that can ensue from inept ownership: poor planning of a

project, weak administration, inexperienced management or leasing, poor

negotiating skills, internal conflicts, problems with partners, weak financial

structure, incompetent personnel, understaffed teams, inaccurate construction

estimates, and excessive cost overruns.

[Type text]

Vous aimerez peut-être aussi

- Credit Appraisal and AssessmentDocument8 pagesCredit Appraisal and Assessmentkinz7879Pas encore d'évaluation

- Lec 3Document16 pagesLec 3WEI JUN CHONGPas encore d'évaluation

- Common Factors: Environment Resources Cost ValueDocument4 pagesCommon Factors: Environment Resources Cost ValueDesiree HicksPas encore d'évaluation

- Design, Analysis, and Implementation of Development Projects: Guides for Bankers, Investors, Sponsors, and ImplementorsD'EverandDesign, Analysis, and Implementation of Development Projects: Guides for Bankers, Investors, Sponsors, and ImplementorsPas encore d'évaluation

- Project Finance2Document14 pagesProject Finance2HoriZonPas encore d'évaluation

- Fundamentals of Entrepreneurship RajDocument6 pagesFundamentals of Entrepreneurship RajSahil SinghPas encore d'évaluation

- The Feasibility StudyDocument4 pagesThe Feasibility StudyRobert FloresPas encore d'évaluation

- Project MGT Mod 3Document16 pagesProject MGT Mod 3rahulking219Pas encore d'évaluation

- Feasibility StudyDocument5 pagesFeasibility StudyInza NsaPas encore d'évaluation

- Feasibility StudyDocument2 pagesFeasibility StudyKenny Apas EstrellaPas encore d'évaluation

- Projeect Appraisal GimpaDocument53 pagesProjeect Appraisal GimpaSylvester PaintsilPas encore d'évaluation

- Proposals & Competitive Tendering Part 2: Managing Winning Proposals (Second Edition)D'EverandProposals & Competitive Tendering Part 2: Managing Winning Proposals (Second Edition)Pas encore d'évaluation

- How Internal Controls Help Construction ContractorsDocument7 pagesHow Internal Controls Help Construction ContractorsMike KarlinsPas encore d'évaluation

- International Project AppraisalDocument4 pagesInternational Project AppraisalMs. Anitharaj M. SPas encore d'évaluation

- Unit 2Document7 pagesUnit 2አያሙሔ ቲዩብPas encore d'évaluation

- Contract ManagementDocument22 pagesContract ManagementNeeraj SPas encore d'évaluation

- Capital Budgeting Process 1Document41 pagesCapital Budgeting Process 1Manjunatha Swamy VPas encore d'évaluation

- Module 1:planning Analysis &: Course Facilitator: Prof. RadhakrishnaDocument73 pagesModule 1:planning Analysis &: Course Facilitator: Prof. RadhakrishnaShrutit21Pas encore d'évaluation

- OOSE Lab Manual FinalDocument31 pagesOOSE Lab Manual FinalsandtPas encore d'évaluation

- Project Procurement Management: UJJWAL POUDEL (38860)Document10 pagesProject Procurement Management: UJJWAL POUDEL (38860)ujjwal poudelPas encore d'évaluation

- CRISILs Rating Criteria For Real Estate DevelopersDocument11 pagesCRISILs Rating Criteria For Real Estate DevelopersTay MonPas encore d'évaluation

- Analyze Your Business Requirements: 2. Search For A VendorDocument3 pagesAnalyze Your Business Requirements: 2. Search For A VendorAnkurPas encore d'évaluation

- Non Financial Criteria and Factors Affecting Project SelectionDocument18 pagesNon Financial Criteria and Factors Affecting Project SelectionreajithkumarPas encore d'évaluation

- Reaction Paper On The Said 4 TopicsDocument8 pagesReaction Paper On The Said 4 TopicsBjayPas encore d'évaluation

- Outlook Report Lipika NegiDocument29 pagesOutlook Report Lipika NegiLipika NegiPas encore d'évaluation

- FS StudyDocument5 pagesFS StudyPj TignimanPas encore d'évaluation

- Certified Project Finance Analyst (CPFA)Document9 pagesCertified Project Finance Analyst (CPFA)Oroma David FabianoPas encore d'évaluation

- PM Study NotesDocument21 pagesPM Study NotesRobincrusoePas encore d'évaluation

- Bain Report India Real EstateDocument40 pagesBain Report India Real Estatesudhansu_777Pas encore d'évaluation

- Capital Projects and ConstructionDocument0 pageCapital Projects and ConstructionbillpaparounisPas encore d'évaluation

- ICRA Rating Methodology: Construction CompaniesDocument11 pagesICRA Rating Methodology: Construction Companieshesham zakiPas encore d'évaluation

- Risk Management and Schedule Control On Mega-ProjectsDocument20 pagesRisk Management and Schedule Control On Mega-ProjectsMuthukumar VeerappanPas encore d'évaluation

- Balance Sheet. This Asset, Except in The of A Non-Depreciable Asset Like Land, IsDocument10 pagesBalance Sheet. This Asset, Except in The of A Non-Depreciable Asset Like Land, IsCharu ModiPas encore d'évaluation

- Chapter 1 OverviewDocument20 pagesChapter 1 Overviewmubasheralijamro0% (1)

- Procurement Best Practices in Mining - 7 Things You Need To KnowDocument4 pagesProcurement Best Practices in Mining - 7 Things You Need To KnowPRAMONO JATI PPas encore d'évaluation

- Fitch - Rating Criteria For Infrastructure and Project Finance 2011Document32 pagesFitch - Rating Criteria For Infrastructure and Project Finance 2011dungvt5Pas encore d'évaluation

- Flipping Houses 101: A Beginner's Guide to Real Estate ProfitsD'EverandFlipping Houses 101: A Beginner's Guide to Real Estate ProfitsPas encore d'évaluation

- Study of Feasibility Report of A New VentureDocument3 pagesStudy of Feasibility Report of A New VentureSudhir PandeyPas encore d'évaluation

- Studi Kelayakan Investasi Bidang Real EstateDocument25 pagesStudi Kelayakan Investasi Bidang Real EstateAbrizen Duha PerbanggaPas encore d'évaluation

- Chap 007Document19 pagesChap 007Lan NguyenPas encore d'évaluation

- Global Operations Strategy Design Deployment FKVDocument6 pagesGlobal Operations Strategy Design Deployment FKVEdwinsa Auzan HashfiPas encore d'évaluation

- Lab 2Document6 pagesLab 2TK Lý Nguyễn Tuấn KiệtPas encore d'évaluation

- Importance of Location PlanningDocument3 pagesImportance of Location PlanningCrispy IsaacPas encore d'évaluation

- Assignment 2 FileDocument7 pagesAssignment 2 FileXamra AliPas encore d'évaluation

- M&E Module 4 - 18CS51Document21 pagesM&E Module 4 - 18CS51HarshaPas encore d'évaluation

- Objectives of Credit Rating: Financial Statements CreditworthinessDocument6 pagesObjectives of Credit Rating: Financial Statements CreditworthinessvishPas encore d'évaluation

- MBADocument5 pagesMBAYawar AbbasPas encore d'évaluation

- Project Management Unit 2Document11 pagesProject Management Unit 2Ishu RanaPas encore d'évaluation

- Unit 2Document10 pagesUnit 2Vansh MishraPas encore d'évaluation

- CONM40016 Procurement CostDocument15 pagesCONM40016 Procurement Costirislin1986Pas encore d'évaluation

- 1j. OGC 2005 - Common Causes of Project FailureDocument8 pages1j. OGC 2005 - Common Causes of Project FailureAhmad Al-ZabatPas encore d'évaluation

- University of The PunjabDocument3 pagesUniversity of The PunjabManam SohailPas encore d'évaluation

- BASAK-G-Tuning Into Your ClientDocument6 pagesBASAK-G-Tuning Into Your ClientegglestonaPas encore d'évaluation

- Business Feasibility Study ReportDocument13 pagesBusiness Feasibility Study ReportPRAKASH BHOSALE100% (1)

- Process of Pricing Tenders and Determining Profit MarginsDocument8 pagesProcess of Pricing Tenders and Determining Profit MarginsRajendra TharmakulasinghamPas encore d'évaluation

- Icramid 11133Document8 pagesIcramid 11133Arun KumarPas encore d'évaluation

- Chapter 3 Project AppraisalDocument23 pagesChapter 3 Project Appraisaljonathan josiahPas encore d'évaluation

- Presentation Title: My Name Contact Information or Project DescriptionDocument3 pagesPresentation Title: My Name Contact Information or Project Descriptionikeike82Pas encore d'évaluation

- This Is Your Presentati On TitleDocument27 pagesThis Is Your Presentati On Titleikeike82Pas encore d'évaluation

- This Is Your Presentation TitleDocument27 pagesThis Is Your Presentation TitleSarah KemalasariPas encore d'évaluation

- AIV TCA Bridge Process InstructionsDocument11 pagesAIV TCA Bridge Process InstructionsfarathaPas encore d'évaluation

- Ekonomika PerkotaanDocument2 pagesEkonomika Perkotaanikeike82Pas encore d'évaluation

- Latihan Soal SoalDocument3 pagesLatihan Soal Soalikeike82Pas encore d'évaluation

- LatihanDocument3 pagesLatihanikeike82Pas encore d'évaluation

- Sem 2Document3 pagesSem 2ikeike82Pas encore d'évaluation

- 10 Key To Successful Real Estate Project From The Article Project Development Success or Failure? by Richard S SorensonDocument2 pages10 Key To Successful Real Estate Project From The Article Project Development Success or Failure? by Richard S Sorensonikeike82Pas encore d'évaluation

- Man AssetDocument2 pagesMan Assetikeike82Pas encore d'évaluation

- Cornish BoilerDocument3 pagesCornish BoilerDeepak KV ReddyPas encore d'évaluation

- HPSC HCS Exam 2021: Important DatesDocument6 pagesHPSC HCS Exam 2021: Important DatesTejaswi SaxenaPas encore d'évaluation

- (Polish Journal of Sport and Tourism) The Estimation of The RAST Test Usefulness in Monitoring The Anaerobic Capacity of Sprinters in AthleticsDocument5 pages(Polish Journal of Sport and Tourism) The Estimation of The RAST Test Usefulness in Monitoring The Anaerobic Capacity of Sprinters in AthleticsAfiziePas encore d'évaluation

- QF Jacket (Drafting & Cutting) - GAR620Document15 pagesQF Jacket (Drafting & Cutting) - GAR620abdulraheem18822Pas encore d'évaluation

- Support Vector Machine Master ThesisDocument7 pagesSupport Vector Machine Master Thesistammymajorsclarksville100% (2)

- (Bruno Bettelheim) Symbolic Wounds Puberty RitesDocument196 pages(Bruno Bettelheim) Symbolic Wounds Puberty RitesAmbrose66Pas encore d'évaluation

- Microsome S9 Prep ProtocolDocument22 pagesMicrosome S9 Prep ProtocolSAN912Pas encore d'évaluation

- Installation of Submarine PE PipesDocument84 pagesInstallation of Submarine PE Pipeswaseemiqbal133100% (2)

- Ims DB DCDocument90 pagesIms DB DCpvnkraju100% (1)

- Baby DedicationDocument3 pagesBaby DedicationLouriel Nopal100% (3)

- FIGMADocument22 pagesFIGMACessPas encore d'évaluation

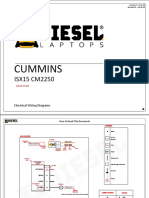

- Cummins: ISX15 CM2250Document17 pagesCummins: ISX15 CM2250haroun100% (4)

- Using Your Digital Assets On Q-GlobalDocument3 pagesUsing Your Digital Assets On Q-GlobalRemik BuczekPas encore d'évaluation

- AVEVA LFM - Data Summary v2Document6 pagesAVEVA LFM - Data Summary v2Joshua HobsonPas encore d'évaluation

- Operator's ManualDocument110 pagesOperator's ManualAdam0% (1)

- WD Support Warranty Services Business Return Material Authorization RMA Pre Mailer For ResellerDocument3 pagesWD Support Warranty Services Business Return Material Authorization RMA Pre Mailer For ResellerZowl SaidinPas encore d'évaluation

- LT3845ADocument26 pagesLT3845Asoft4gsmPas encore d'évaluation

- Lesson Plan 1Document3 pagesLesson Plan 1api-311983208Pas encore d'évaluation

- MCC333E - Film Review - Myat Thu - 32813747Document8 pagesMCC333E - Film Review - Myat Thu - 32813747Myat ThuPas encore d'évaluation

- Construction Drawing: Legend Notes For Sanitary Piping Installation General Notes NotesDocument1 pageConstruction Drawing: Legend Notes For Sanitary Piping Installation General Notes NotesrajavelPas encore d'évaluation

- Off Grid Solar Hybrid Inverter Operate Without Battery: HY VMII SeriesDocument1 pageOff Grid Solar Hybrid Inverter Operate Without Battery: HY VMII SeriesFadi Ramadan100% (1)

- Mossbauer SpectrosDocument7 pagesMossbauer SpectroscyrimathewPas encore d'évaluation

- Fellows (Antiques)Document90 pagesFellows (Antiques)messapos100% (1)

- Chromatographic Separation PDFDocument7 pagesChromatographic Separation PDFNicolle CletoPas encore d'évaluation

- Dummy 13 Printable Jointed Figure Beta FilesDocument9 pagesDummy 13 Printable Jointed Figure Beta FilesArturo GuzmanPas encore d'évaluation

- Lecture 7 - Friction - NptelDocument18 pagesLecture 7 - Friction - Nptels_murugan02Pas encore d'évaluation

- Midterm ReviewerDocument20 pagesMidterm ReviewerJonnafe IgnacioPas encore d'évaluation

- Book Chapter 11 SubmissionDocument18 pagesBook Chapter 11 Submissioncristine_2006_g5590Pas encore d'évaluation

- Swift As A MisanthropeDocument4 pagesSwift As A MisanthropeindrajitPas encore d'évaluation

- LP Pe 3Q - ShaynevillafuerteDocument3 pagesLP Pe 3Q - ShaynevillafuerteMa. Shayne Rose VillafuertePas encore d'évaluation