Académique Documents

Professionnel Documents

Culture Documents

Director Real Estate Development in West Palm Beach FL Resume Carey O'Laughlin

Transféré par

CareyOLaughlinCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Director Real Estate Development in West Palm Beach FL Resume Carey O'Laughlin

Transféré par

CareyOLaughlinDroits d'auteur :

Formats disponibles

Carey A.

OLaughlin

Plymouth, MA 02360

Jupiter, FL 33458

(843) 304-3942

olaughlin.carey@gmail.com

Summary

Director of Real Estate Development

30 years combined experience in mortgage banking and real estate development. Successful, senior executive with

substantial contributions to corporate growth and profitability for companies in the financial services, professional

homebuilding, and development industries; underwriting, closing, developing, and building FHA, Fannie Mae, Freddie Mac,

and commercial bank offerings for project based single and multifamily real estate transactions.

Demonstrated ability to develop, create, execute, and teach well targeted, customer-centric sales and marketing programs

that deliver results; increased average selling price, thus creating higher P&L gross margins and creating business

development tools for long term growth.

Client driven; program development for creating new client, prospect pipeline; Strong work ethic; fast paced work

environment the norm. Creator of high performance, value-based, long term-customer relations built on trust and integrity

that identify and enhance client needs. Expert in determining current and future needs of target audience and diverse

customers within market dynamics. Comprehensive knowledge of industry best business practices, demographics, market

research, product and service offerings, and regulatory guidelines for medium sized businesses.

As a former Fortune 500 executive, was responsible for the development, building, and sale of over 10,000 residential

housing units.

SKILLS

Microsoft Office Suite, AUS DU, LP and FHA

Connection

Quality control

Appraisal and construction cost

HUD, Fannie Mae certified home buyer

educator, and MAP processing

Market and demographic research

Transaction feasibility, development, marketing,

sales, and construction

Areas of Expertise

Commercial Mixed Use, Single Family and Multifamily Project based FHA, Fannie Mae, Freddie Mac (GSE) DUS

underwriting and analysis; commercial bank offerings; Acquisition and Development loans; all phases of the

acquisition and development process for land or existing projects

Strategic marketing and valuation

Product and Market Identification, feasibility, and valuation

Construction, Development, and Sale of underwritten and valued projects (list available upon request), covering all

market price points; property management

LIHTC Tax Credits and Bond issuance expert

Business plan creation

Ability to identify the needs of low and moderate income (LMI) neighborhoods and assist investment clients in

identifying critical linkages to other community development funding sources

Critical Leadership Initiatives

Developed strategic marketing relationship for development of multifamily affordable housing community

development partnership with Freddie Mac in 3 MSAs; President, Applied Research Capital Corp. (ARCC)

Grew CDFI (Certified Development Financial Institution) by $200 million in 3 years; President, ARCC

Guided team to sustain and grow client pipeline relationships for HUD affordable housing program for non-profit

annually originating 750 clients for Applied Research Capital Corp. ($175 to $200 million annually); President,

National Housing Foundation, Inc. Schaumburg, IL

Owner, developer, and property manager of 1,300 multifamily affordable housing units; President, National

Housing Foundation, Inc. Schaumburg, IL

CRA credit service area analyst and provider for lenders needing low income CRA credits within given service area;

Senior Financial Advisor, America One Acceptance Corporation

Secured $60 million housing contract with Illinois Development Finance Agency totaling 300 housing units annually

for 3 years; bond issue; President, National Housing Foundation, Inc. Schaumburg, IL

Professional Experience

Founder | CEO

National Housing Capital, a MA Community Development Company

President Real Estate Developer

Senior FHA Direct Endorsement Underwriter; CHUMS ID # AZ03

LIHTC multifamily and single family project and feasibility underwriter and specialist

HUD MAP specialist

GSE DUS (Fannie Mae and Freddie Mac) regulatory and product specialist; using financial products as

socioeconomic revitalization and community development tools

National Non-Profit Technical Assistance Intermediary to community based local non-profits for loans and

development of affordable housing

Perform complicated financial modeling and spreadsheet analysis in Excel

Translate creative and complex financing solutions into financial models for presentations to clients as community

development tools

Prepare market analysis reports, including vacancy, absorption, and comparable rents and sales

Review and analyze legal documents and third party reports as part of the due diligence process and closings

Real Estate Developer

02/11 6/13

Institutional Sabbatical

04/09 12/10

Worked on PhD Dissertation, " Karl Rahner, S.J. "A Conversion to the Phantasm"

University of Birmingham, Edgbaston, UK

President | CEO

Illinois Mortgage Bank Licensee

America One Acceptance Corporation

Ability to work closely with the senior credit team and originators on the structuring and underwriting of

transactions for DUS multifamily submittal

Analyzed, interpreted, and underwrote complex multifamily real estate transactions in compliance with respective

agency guidelines (Fannie Mae and FHA)

Conducted detailed economic and demographic research to determine feasibility of transactions

Prepared and presented comprehensive loan approval packages for credit committee

Conducted comprehensive inspections of physical real-estate assets

Performed commercial underwriting, specifically dealing with large loans GSE multifamily experience

Sustained highly developed analytical, research, and written and oral presentation skills

Maintained ability to problem-solve and exercise independent judgment while displaying a high degree of initiative

and accuracy on loan analysis and packaging

Successfully demonstrated ability to organize and prioritize projects; complete multiple tasks on schedule and with

minimal supervision

Individual Contributor

10/13 Present

Applied Research Capital Corp. (ARCC Mortgage)

06/95 09/08

Developed and managed full eagle FHA mortgage bank generating $175 to $200 million annually in loans

and closings

Obtained Community Development Financial Institution (CDFI) status

Established FHA Direct Endorsement and HUD multifamily approved mortgage bank

Created market research firm; contracted with Freddie Mac in three markets for market research projects

giving demographics and comparable for affordable, commercial, mixed use, and multifamily residential

projects to determine financial product for percentage of market share

Performed market research feasibility reports for community development partners

Established over 20 non-profit community partnerships for affordable housing programs using DUS

lenders for multifamily loans

Performed construction, development, property management, and administration of projects for

community development partners

Worked in mortgage bank as the Senior FHA Direct Endorsement Underwriter and commercial,

multifamily project underwriter

Founder | President | CEO

National Housing Foundation, Inc, an Illinois 501(c) 3 non- profit

Community, Single Family, and Multifamily Residential Developer

FHA Senior Direct Endorsement Underwriter; HUD and Fannie Mae Senior Home Buyer Educator. CHUMS ID. #

AZ03

National Technical Assistance Intermediary to other local community development non-profits

Entered into multiple (20) community development partnerships with local non-profit community

development corporations providing affordable housing

Based on Jobs, Jobs creation, socio economic revitalization participated in multiple, multifamily

community development projects. Focus was the use of section 8 housing vouchers for qualifying clients

for single family, project based homeownership. HUD pilot program

Initiated strategic socio-economic community revitalization programs for mixed use, commercial and

multifamily projects; helped our communities by empowering community residents

Acknowledged as an Illinois 501 (c) 3 corporation with group exemption capacity. HUD approved

Affordable Housing Programs

HUD approved, unlimited, non-recourse FHA multifamily (project) and single family borrower; 203b, 203k,

section 221(d) (4), 232/223(f). Developed and built community development projects. Largest

rehabilitation contractor in the City of Chicago for the years 2000 and 2001

Provided $19,000,000 in down payment assistance for entry level market rate buyers: single family and

multifamily

Senior Project Underwriter and Valuation

Capital Asset Research Corporation

09/94 09/95

Largest tax lien buyer in the U.S; underwrote projects nationally to FHA and GSE DUS (Fannie Mae) guidelines

$375 million in commercial and multifamily project valuation, underwriting, and development

Technical assistance to local community non-profit development corporations for acquisition and

development of Capital Asset Research Corp. valued and loan packaged multifamily residential assets for

affordable housing

Direct Endorsement Underwriter

Waters Mortgage Corp.

Non-Profit, Multifamily Project Based 203b and 203k; Affordable, Multifamily Residential Properties

10/95 09/08

09/90 06/94

975 203K multifamily, single family residential loans; underwritten, developed, built, and closed; project based

Construction costing, 203k write ups, and contractor and sub-contractor approval

Not For Profit multifamily project lending and underwriting specialist; HUD pilot affordable housing

program

Education

Wesleyan University; B.A. Government (Honors College); Middletown, CT

University of Birmingham, Masters in Theology, PhD Research Candidate, Edgbaston, U.K.

Vous aimerez peut-être aussi

- Real Estate Development Project Manager in NYC Resume Brian HalusanDocument2 pagesReal Estate Development Project Manager in NYC Resume Brian HalusanBrianHalusan67% (3)

- Chad Humphrey ResumeDocument2 pagesChad Humphrey ResumeSeattleChadPas encore d'évaluation

- The Real Estate Developer's Handbook: How to Set Up, Operate, and Manage a Financially Successful Real Estate DevelopmentD'EverandThe Real Estate Developer's Handbook: How to Set Up, Operate, and Manage a Financially Successful Real Estate DevelopmentÉvaluation : 5 sur 5 étoiles5/5 (4)

- Megaproject Management: Lessons on Risk and Project Management from the Big DigD'EverandMegaproject Management: Lessons on Risk and Project Management from the Big DigPas encore d'évaluation

- Developing Single-Family Subdivisions: A Complete Overview of The Skills and Finances Needed To Run A Successful ProgramDocument28 pagesDeveloping Single-Family Subdivisions: A Complete Overview of The Skills and Finances Needed To Run A Successful Programabshell19Pas encore d'évaluation

- Project Finance Attorney in NYC Resume Cheryl OberdorfDocument2 pagesProject Finance Attorney in NYC Resume Cheryl OberdorfCherylOberdorf1Pas encore d'évaluation

- The Advisor’s Guide to Commercial Real Estate InvestmentD'EverandThe Advisor’s Guide to Commercial Real Estate InvestmentPas encore d'évaluation

- Gateway Framework: A Governance Approach for Infrastructure Investment SustainabilityD'EverandGateway Framework: A Governance Approach for Infrastructure Investment SustainabilityPas encore d'évaluation

- Residential Property Manager in Washington DC Resume Edwina DavisDocument3 pagesResidential Property Manager in Washington DC Resume Edwina DavisEdwinaDavisPas encore d'évaluation

- Marketing Business Development Senior Executive in Salt Lake City UT Resume Jeffrey ChiversDocument2 pagesMarketing Business Development Senior Executive in Salt Lake City UT Resume Jeffrey ChiversJeffreyChiversPas encore d'évaluation

- Compelling Returns: A Practical Guide to Socially Responsible InvestingD'EverandCompelling Returns: A Practical Guide to Socially Responsible InvestingPas encore d'évaluation

- Thomas Blaisdell CVDocument3 pagesThomas Blaisdell CVtjPas encore d'évaluation

- Land to Lots: How to Borrow Money You Don't Have to Pay Back and LAUNCH Master Planned CommunitiesD'EverandLand to Lots: How to Borrow Money You Don't Have to Pay Back and LAUNCH Master Planned CommunitiesPas encore d'évaluation

- Ross Career Services: Real EstateDocument9 pagesRoss Career Services: Real EstateNia SaransiPas encore d'évaluation

- Real Estate Development Manager in NYC Resume Timothy WhiteDocument3 pagesReal Estate Development Manager in NYC Resume Timothy WhiteTimothyWhitePas encore d'évaluation

- VP Construction Real Estate Development in NY NJ Resume Edward CondolonDocument4 pagesVP Construction Real Estate Development in NY NJ Resume Edward CondolonEdwardCondolonPas encore d'évaluation

- Community Development Relationship Manager in San Francisco CA Resume Michael ManigaultDocument1 pageCommunity Development Relationship Manager in San Francisco CA Resume Michael ManigaultMichaelManigaultPas encore d'évaluation

- Zachary Dragone Resume (MS)Document1 pageZachary Dragone Resume (MS)Kyle WardPas encore d'évaluation

- Kim Kolzow Resume2023Document2 pagesKim Kolzow Resume2023api-439504451Pas encore d'évaluation

- Treasurer VP Finance CFO in Nashville TN Resume Robert VottelerDocument2 pagesTreasurer VP Finance CFO in Nashville TN Resume Robert VottelerRobertVottelerPas encore d'évaluation

- CFO in Denver Colorado Resume Bruce PeeleDocument2 pagesCFO in Denver Colorado Resume Bruce PeeleBruce PeelePas encore d'évaluation

- Real Estate Development and Investment: A Comprehensive ApproachD'EverandReal Estate Development and Investment: A Comprehensive ApproachPas encore d'évaluation

- Development Partner - San Antonio, TexasDocument2 pagesDevelopment Partner - San Antonio, Texasapi-165019624Pas encore d'évaluation

- Director Commercial Real Estate in Columbus OH Resume Richard WolneyDocument2 pagesDirector Commercial Real Estate in Columbus OH Resume Richard WolneyRichardWolneyPas encore d'évaluation

- Mastering the Art of Investing Using Other People's MoneyD'EverandMastering the Art of Investing Using Other People's MoneyPas encore d'évaluation

- 2018 Corporate Real Estate ResumeDocument2 pages2018 Corporate Real Estate ResumeSher FrenchPas encore d'évaluation

- Hud Dasp RTC v15Document11 pagesHud Dasp RTC v15Foreclosure FraudPas encore d'évaluation

- President CEO Multi-Family Property Management in Dallas TX Resume Jeffrey CarpenterDocument5 pagesPresident CEO Multi-Family Property Management in Dallas TX Resume Jeffrey CarpenterJeffreyCarpenterPas encore d'évaluation

- CB&C Summarized Business PlanDocument5 pagesCB&C Summarized Business PlanMuhammad ZakiPas encore d'évaluation

- Sales Account Manager Business Development in Washington DC Resume Pete JahelkaDocument2 pagesSales Account Manager Business Development in Washington DC Resume Pete JahelkaPeteJahelkaPas encore d'évaluation

- CEO or COO or EVP or SVP or Managing DirectorDocument3 pagesCEO or COO or EVP or SVP or Managing Directorapi-122055211Pas encore d'évaluation

- Investor Relations Communications Director in USA Resume Brad MillerDocument3 pagesInvestor Relations Communications Director in USA Resume Brad MillerBradMillerPas encore d'évaluation

- Real Estate Asset Manager in Washington DC Resume Meaghen MurrayDocument2 pagesReal Estate Asset Manager in Washington DC Resume Meaghen MurrayMeaghenMurrayPas encore d'évaluation

- Manager Real Estate ROW in Chicago IL Resume Andrew ViolaDocument3 pagesManager Real Estate ROW in Chicago IL Resume Andrew ViolaAndrewViolaPas encore d'évaluation

- May 22,2009Document10 pagesMay 22,2009anhdincPas encore d'évaluation

- Mixed Use DevelopmentDocument7 pagesMixed Use DevelopmentIsabella BeatrixPas encore d'évaluation

- Factors Affecting Capitalization Rate of US Real EstateDocument41 pagesFactors Affecting Capitalization Rate of US Real EstatemtamilvPas encore d'évaluation

- Project Financing: Asset-Based Financial EngineeringD'EverandProject Financing: Asset-Based Financial EngineeringÉvaluation : 4 sur 5 étoiles4/5 (2)

- Phil Timson RESUMEDocument2 pagesPhil Timson RESUMEPhil TimsonPas encore d'évaluation

- VP Business Development in Minneapolis ST Paul MN Resume Marc AndersonDocument1 pageVP Business Development in Minneapolis ST Paul MN Resume Marc AndersonMarcAnderson1Pas encore d'évaluation

- Global Corporate Communications Director in Chicago IL Resume Kim WrightDocument4 pagesGlobal Corporate Communications Director in Chicago IL Resume Kim WrightKimWright2Pas encore d'évaluation

- CEI Website Build RFP FY22Document5 pagesCEI Website Build RFP FY22Muhammad ZeeshanPas encore d'évaluation

- Sales Manager Business Development in Phoenix AZ Resume John LadnerDocument3 pagesSales Manager Business Development in Phoenix AZ Resume John LadnerJohnLadnerPas encore d'évaluation

- Profit from Property: Your Step-by-Step Guide to Successful Real Estate DevelopmentD'EverandProfit from Property: Your Step-by-Step Guide to Successful Real Estate DevelopmentPas encore d'évaluation

- Glover Lawrence Full Resume For HBRDocument3 pagesGlover Lawrence Full Resume For HBRat3mail100% (1)

- Business Planning for Affordable Housing Developers: Version 2.2D'EverandBusiness Planning for Affordable Housing Developers: Version 2.2Pas encore d'évaluation

- The Handbook of Financing Growth: Strategies, Capital Structure, and M&A TransactionsD'EverandThe Handbook of Financing Growth: Strategies, Capital Structure, and M&A TransactionsPas encore d'évaluation

- Beth Mason's ResumeDocument4 pagesBeth Mason's ResumecreatingdigitalPas encore d'évaluation

- Investment BankingDocument3 pagesInvestment Bankingapi-79126043Pas encore d'évaluation

- Value: The Four Cornerstones of Corporate FinanceD'EverandValue: The Four Cornerstones of Corporate FinanceÉvaluation : 4.5 sur 5 étoiles4.5/5 (18)

- Project Control: Integrating Cost and Schedule in ConstructionD'EverandProject Control: Integrating Cost and Schedule in ConstructionPas encore d'évaluation

- Enterprise Project Governance: A Guide to the Successful Management of Projects Across the OrganizationD'EverandEnterprise Project Governance: A Guide to the Successful Management of Projects Across the OrganizationPas encore d'évaluation

- Communication Essentials for Financial Planners: Strategies and TechniquesD'EverandCommunication Essentials for Financial Planners: Strategies and TechniquesPas encore d'évaluation

- 06/07 - Present John Hancock Investment Services Boston, MADocument2 pages06/07 - Present John Hancock Investment Services Boston, MAapi-86443652Pas encore d'évaluation

- Clinton Bonner: Professional SummaryDocument3 pagesClinton Bonner: Professional Summaryclinton.bonner8105Pas encore d'évaluation

- Creative Financing for Real Estate Agents: Maximizing Profits with Smart StrategiesD'EverandCreative Financing for Real Estate Agents: Maximizing Profits with Smart StrategiesPas encore d'évaluation

- Resume of Ron6673Document2 pagesResume of Ron6673api-28531821Pas encore d'évaluation

- VP Equity Analyst CVDocument5 pagesVP Equity Analyst CVZolo ZoloPas encore d'évaluation

- Kimberly J. Correia: 205 Washington Street Unit 1 - Somerville Ma 02143Document1 pageKimberly J. Correia: 205 Washington Street Unit 1 - Somerville Ma 02143api-86443652Pas encore d'évaluation

- Kewajiban Pejabat Pembuat Akta Tanah Untuk Menyampaikan Pemberitahuan Tertulis Mengenai Telah Disampaikannya Akta Ke Kantor PertanahanDocument26 pagesKewajiban Pejabat Pembuat Akta Tanah Untuk Menyampaikan Pemberitahuan Tertulis Mengenai Telah Disampaikannya Akta Ke Kantor PertanahanNeng Tita WidatiPas encore d'évaluation

- Methods of Selecting ArchitectsDocument1 pageMethods of Selecting ArchitectsSandie FloresPas encore d'évaluation

- (Ontario) 123 - WaiverDocument1 page(Ontario) 123 - Waiveralvinliu725Pas encore d'évaluation

- Rental Agreement TemplateDocument4 pagesRental Agreement TemplateadityaPas encore d'évaluation

- CE 316 Lec 4Document14 pagesCE 316 Lec 4PLABON SENPas encore d'évaluation

- Deed of Extrajudicial SettlementDocument3 pagesDeed of Extrajudicial SettlementEarl CalingacionPas encore d'évaluation

- Water TankDocument1 pageWater TankProject ManagerStructuresPas encore d'évaluation

- Asuncion Report-No.3Document3 pagesAsuncion Report-No.3Alyssa Marie AsuncionPas encore d'évaluation

- Al-Alamiah Ready Mixer Costs. K150 - K350Document1 pageAl-Alamiah Ready Mixer Costs. K150 - K350Mohammed Abd ElazizPas encore d'évaluation

- Colliers International - Matching OpeningsDocument2 pagesColliers International - Matching OpeningsSanti Maggio SavastaPas encore d'évaluation

- Deed of Sale With Assumption of MortgageDocument3 pagesDeed of Sale With Assumption of MortgageEarnswell Pacina TanPas encore d'évaluation

- Form - Assignment and Assumption of LeasesDocument4 pagesForm - Assignment and Assumption of Leasesholly millsPas encore d'évaluation

- Design of SlabDocument14 pagesDesign of Slabابراهيم المبيضينPas encore d'évaluation

- Real EstateDocument4 pagesReal EstateVyshnavi KarthicPas encore d'évaluation

- REB Mock Exam Part 2Document40 pagesREB Mock Exam Part 2Alexandro Desio100% (4)

- MC 2021-2297Document1 pageMC 2021-2297Ernest Mendoza100% (1)

- Commercial Real Estate Investing 101Document4 pagesCommercial Real Estate Investing 101Madhurima Guha RoyPas encore d'évaluation

- Contract of Lease: Know All Men by These PresentsDocument2 pagesContract of Lease: Know All Men by These Presentsmichelle escabelPas encore d'évaluation

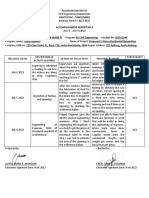

- SNNPR South Omo Zone Construction Departement: Certificate of Payment No. / First PaymentDocument38 pagesSNNPR South Omo Zone Construction Departement: Certificate of Payment No. / First PaymentIbrahim Dawud100% (1)

- SM Land Commercial Properties Group Leasing GuidelinesDocument2 pagesSM Land Commercial Properties Group Leasing GuidelinesDarwin CañetePas encore d'évaluation

- Latent DefectDocument7 pagesLatent DefectprasagnihotriPas encore d'évaluation

- Land RegistrationDocument14 pagesLand Registrationlaine cruz100% (1)

- Paradigma Manajemen Sumberdaya LahanDocument74 pagesParadigma Manajemen Sumberdaya LahanDita SeptyanaPas encore d'évaluation

- Deed of TrustDocument7 pagesDeed of TrustAdrienne DuBosePas encore d'évaluation

- Mortgage Loan Residence EditedchrsitDocument13 pagesMortgage Loan Residence EditedchrsitWinnie NgPas encore d'évaluation

- Land Titles & Deeds-SyllabusDocument10 pagesLand Titles & Deeds-SyllabusRomar John M. GadotPas encore d'évaluation

- 14 RECTIFICATION DEED Mamatha Ramesh LR of Sellers MistakeDocument3 pages14 RECTIFICATION DEED Mamatha Ramesh LR of Sellers MistakeSwati PednekarPas encore d'évaluation

- Haryana Stamp ActDocument4 pagesHaryana Stamp ActRupali SamuelPas encore d'évaluation

- Republic Act No. 4726 The Condominium Act: What Is A Condominium?Document4 pagesRepublic Act No. 4726 The Condominium Act: What Is A Condominium?Vic CajuraoPas encore d'évaluation

- Bill of Quantities: Two-Classrooms ADocument6 pagesBill of Quantities: Two-Classrooms AjazmontzPas encore d'évaluation