Académique Documents

Professionnel Documents

Culture Documents

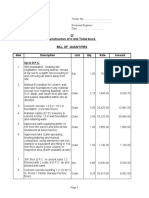

MiniCase06 Ch11

Transféré par

HamoodEder0 évaluation0% ont trouvé ce document utile (0 vote)

99 vues1 pagedsgdsaga

Titre original

MiniCase06_Ch11

Copyright

© © All Rights Reserved

Formats disponibles

DOC, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentdsgdsaga

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

99 vues1 pageMiniCase06 Ch11

Transféré par

HamoodEderdsgdsaga

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

Chapter 11 Mini-Case 6: Crystal Electronics

Crystal Electronics is a mid-sized electronics manufacturer located in Johannesburg.

The company CEO inherited the company. When it was started 70 years ago, the

company originally repaired radios and other household appliances. Over the years,

the company expanded into manufacturing and is now a reputable manufacturer of

various electronic items.

One of the major revenue producing items manufactured by Crystal is a

printed circuit board (PCB). Crystal currently has one model on the market and sales

have been excellent. However, as with any electronic item, technology changes

rapidly, and the current PCB has limited features in comparison with newer models.

Crystal spent R750 000 to develop a prototype for a new model that has all the

features of the existing board, but has spent a further R200 000 for a marketing study

to determine the expected sales figures for the new model.

Crystal can manufacture the new model for R86 each in variable costs. Fixed

costs for the operation are estimated to run R3 million per year. The estimated sales

volume is 70 000, 80 000, 100 000, 85 000 and 75 000 per each year for the next five

years, respectively. The unit price of the new model will be R250. The necessary

equipment can be purchased for R15 million and will be depreciated on a three-year

50:30:20 schedule. It is believed the value of the equipment in five years will be R3

million.

As previously stated, Crystal currently manufactures a PCB. Production of the

existing model is expected to be terminated in two years. If Crystal does not

introduce the new model, sales will be 80 000 units and 60 000 units for the next two

years, respectively. The price of the existing model is R240 per unit, with variable

costs of R68 each and fixed costs of R1 800 000 per year. If Crystal does introduce

the new PCB, sales of the existing model will fall by 15 000 units per year, and the

price of the existing units will have to be lowered to R220 each. Net working capital

for the PCBs will be 20 per cent of sales and will occur with the timing of the cash

flows for the year; for example, there is no initial outlay for NWC, but changes in

NWC will first occur in Year 1 with the first years sales. Crystal has a 29 per cent

corporate tax rate and a 12 per cent required return. The CEO has asked Pippa Ross,

an MBA graduate recently hired by the companys finance department to prepare a

report that answers the following questions:

1.

2.

3.

4.

5.

6.

7.

What is the payback period of the project?

What is the profitability index of the project?

What is the IRR of the project?

What is the NPV of the project?

How sensitive is the NPV to changes in the price of the new PCB?

How sensitive is the NPV to changes in the quantity sold?

Should Crystal produce the new PDA?

Vous aimerez peut-être aussi

- Finish Carpentry Contractors World Summary: Market Values & Financials by CountryD'EverandFinish Carpentry Contractors World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Case Study Making Capital Investment Decision-1Document1 pageCase Study Making Capital Investment Decision-1Endang HenniwatiPas encore d'évaluation

- 2017 International Comparison Program in Asia and the Pacific: Purchasing Power Parities and Real Expenditures—A Summary ReportD'Everand2017 International Comparison Program in Asia and the Pacific: Purchasing Power Parities and Real Expenditures—A Summary ReportPas encore d'évaluation

- Required:: Project A Would CostDocument10 pagesRequired:: Project A Would CostSad CharliePas encore d'évaluation

- Concrete Contractors World Summary: Market Values & Financials by CountryD'EverandConcrete Contractors World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Investment Decision 2Document1 pageInvestment Decision 2himanshu himanshuPas encore d'évaluation

- Practice Problems - Making Capital Investment DecisionsDocument2 pagesPractice Problems - Making Capital Investment DecisionsHello KittyPas encore d'évaluation

- NPV & Capital Budgeting QuestionsDocument8 pagesNPV & Capital Budgeting QuestionsAnastasiaPas encore d'évaluation

- Exercises (Capital Budgeting)Document2 pagesExercises (Capital Budgeting)bdiitPas encore d'évaluation

- Extra Questions For Mid Term Test 2 - MA2 - ACCADocument10 pagesExtra Questions For Mid Term Test 2 - MA2 - ACCANguyễn NgaPas encore d'évaluation

- Conch CaseDocument3 pagesConch Casesantosh kumar25% (4)

- FIN3101 Corporate Finance Practice Questions Topic: Capital BudgetingDocument3 pagesFIN3101 Corporate Finance Practice Questions Topic: Capital BudgetingKelly KohPas encore d'évaluation

- Capital Budgeting 2 Homework SS 22Document2 pagesCapital Budgeting 2 Homework SS 22buivunguyetminhPas encore d'évaluation

- Investment Decisions Problems 2Document5 pagesInvestment Decisions Problems 2MussaPas encore d'évaluation

- Financial Management Case StudyDocument1 pageFinancial Management Case StudyAin NadiaPas encore d'évaluation

- NPV Practice CompleteDocument5 pagesNPV Practice CompleteShakeel AslamPas encore d'évaluation

- Tutorial Problems - Capital BudgetingDocument6 pagesTutorial Problems - Capital BudgetingMarcoBonaparte0% (1)

- FDHDFGSGJHDFHDSHJDDocument8 pagesFDHDFGSGJHDFHDSHJDbabylovelylovelyPas encore d'évaluation

- Homework Financial MNGTDocument3 pagesHomework Financial MNGTArka Narayan DashguptaPas encore d'évaluation

- CBE - Corporate Finance - SPJG - FinalDocument16 pagesCBE - Corporate Finance - SPJG - FinalNguyễn QuyênPas encore d'évaluation

- Test 2Document2 pagesTest 2raaasaaPas encore d'évaluation

- Assignment 4Document2 pagesAssignment 4Cheung HarveyPas encore d'évaluation

- 3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsDocument3 pages3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsPham Ngoc VanPas encore d'évaluation

- PRQZ 2Document31 pagesPRQZ 2Yashrajsing LuckkanaPas encore d'évaluation

- Workshop Lecture 9 QsDocument4 pagesWorkshop Lecture 9 QsabhirejanilPas encore d'évaluation

- Tesla BotsDocument16 pagesTesla BotsSai Set NaingPas encore d'évaluation

- S 12Document15 pagesS 12AbhishekKumar0% (3)

- Questions For Group 1: S.B.Khatri-FM-AIMDocument6 pagesQuestions For Group 1: S.B.Khatri-FM-AIMAbhishek singhPas encore d'évaluation

- Questions For Group 1: S.B.Khatri-FM-AIMDocument6 pagesQuestions For Group 1: S.B.Khatri-FM-AIMAbhishek singhPas encore d'évaluation

- Question 1: Company Analysis (17 Marks Total) : Assignment 2Document5 pagesQuestion 1: Company Analysis (17 Marks Total) : Assignment 2Armeen Khan0% (1)

- Example: Majestic Mulch and Compost Company (MMCC)Document8 pagesExample: Majestic Mulch and Compost Company (MMCC)Franciska CiiPas encore d'évaluation

- PRQZ 2Document26 pagesPRQZ 2Hoa Long ĐởmPas encore d'évaluation

- Investment Appraisal: Required: (3 Marks)Document3 pagesInvestment Appraisal: Required: (3 Marks)billPas encore d'évaluation

- Modern Pharma Is Considering The Manufacture of A New Drug, Floxin, For Which The FollowingDocument7 pagesModern Pharma Is Considering The Manufacture of A New Drug, Floxin, For Which The FollowingbansalparthPas encore d'évaluation

- Conch Republic Electronics Is A Mid Sized Electronics Manufacturer Located in Key West - AnswerDocument2 pagesConch Republic Electronics Is A Mid Sized Electronics Manufacturer Located in Key West - AnswerTom LaughtonPas encore d'évaluation

- Assignment 2 - March - 2021Document3 pagesAssignment 2 - March - 2021Joseph SelasiePas encore d'évaluation

- Worldwide Paper CompanyDocument2 pagesWorldwide Paper Companyecineko100% (1)

- Shankara Building Products Concall Q4FY18Document3 pagesShankara Building Products Concall Q4FY18Vijay DosapatiPas encore d'évaluation

- FIN922 - Corporate Finance - : Dr. Kashif Saleem E-Mail: Kashifsaleem@uowdubai - Ac.ae Office: Room 105, 1st FloorDocument8 pagesFIN922 - Corporate Finance - : Dr. Kashif Saleem E-Mail: Kashifsaleem@uowdubai - Ac.ae Office: Room 105, 1st FloorHELENAPas encore d'évaluation

- Prep Quiz 8Document6 pagesPrep Quiz 8karol nicole valero melo100% (1)

- Q44 46 SolutionDocument7 pagesQ44 46 SolutiontaikhoanscribdPas encore d'évaluation

- HW1 NPVDocument4 pagesHW1 NPVLalit GuptaPas encore d'évaluation

- Strategic Change and Flexibility Case of Moser Baer: Submitted By: Padam Tewani Pravir Saxena Sumit Tyagi BhavikaDocument19 pagesStrategic Change and Flexibility Case of Moser Baer: Submitted By: Padam Tewani Pravir Saxena Sumit Tyagi Bhavikapadamtewani71Pas encore d'évaluation

- Capital Budgeting: Workshop Questions: Finance & Financial ManagementDocument12 pagesCapital Budgeting: Workshop Questions: Finance & Financial ManagementJuan SanguinetiPas encore d'évaluation

- Corporate Finance I: Home Assignment 2 Due by January 30Document2 pagesCorporate Finance I: Home Assignment 2 Due by January 30RahulPas encore d'évaluation

- Finance RTP Cap-II June 2016Document37 pagesFinance RTP Cap-II June 2016Artha sarokarPas encore d'évaluation

- Global Absolute Is One of The Few Research Based Brokerages World-Wide That Produces Bottom-UpDocument4 pagesGlobal Absolute Is One of The Few Research Based Brokerages World-Wide That Produces Bottom-UpAnkit JainPas encore d'évaluation

- Practice Question Unlimited ElectronicsDocument2 pagesPractice Question Unlimited ElectronicsUtkarsh SinhaPas encore d'évaluation

- Ex.C.BudgetDocument3 pagesEx.C.BudgetGeethika NayanaprabhaPas encore d'évaluation

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaPas encore d'évaluation

- Capital Budgeting PzfNff6tTADocument2 pagesCapital Budgeting PzfNff6tTARising ThunderPas encore d'évaluation

- Capbud Exercise - Electronics Unlimited - RevisedDocument2 pagesCapbud Exercise - Electronics Unlimited - RevisedManisha JhunjhunwalaPas encore d'évaluation

- Soal Latihan UASDocument2 pagesSoal Latihan UASGistima Putra JavandaPas encore d'évaluation

- CaseStudy HR MTDocument4 pagesCaseStudy HR MTkavesaPas encore d'évaluation

- Case Studies of Financial ModelingDocument11 pagesCase Studies of Financial ModelingM. Wasif ChauhdaryPas encore d'évaluation

- Finance Cap 2Document19 pagesFinance Cap 2Dj babuPas encore d'évaluation

- MagnachipDocument2 pagesMagnachiplugthesavagePas encore d'évaluation

- Bài Tập Buổi 4 (Updated)Document4 pagesBài Tập Buổi 4 (Updated)Minh NguyenPas encore d'évaluation

- Assigment 6 - Managerial Finance Capital BudgetingDocument5 pagesAssigment 6 - Managerial Finance Capital BudgetingNasir ShaheenPas encore d'évaluation

- Cost Management PaperDocument8 pagesCost Management PaperHashan DasanayakaPas encore d'évaluation

- 3 Year Plan of StudyDocument6 pages3 Year Plan of StudyHamoodEderPas encore d'évaluation

- Y 1092013 Syl Lab UsDocument5 pagesY 1092013 Syl Lab UsHamoodEderPas encore d'évaluation

- Y 1092013 Syl Lab UsDocument5 pagesY 1092013 Syl Lab UsHamoodEderPas encore d'évaluation

- Solution To Chapter 3 Case StudyDocument4 pagesSolution To Chapter 3 Case StudyAhmed Alnaqbi100% (2)

- Ss1169 - Telecom Frameworx l1TMFDocument65 pagesSs1169 - Telecom Frameworx l1TMFPrince SinghPas encore d'évaluation

- 01 RFI Technical Form BiodataDocument8 pages01 RFI Technical Form BiodataRafiq RizkiPas encore d'évaluation

- Type BOQ For Construction of 4 Units Toilet Drawing No.04Document6 pagesType BOQ For Construction of 4 Units Toilet Drawing No.04Yashika Bhathiya JayasinghePas encore d'évaluation

- Gowtham Kumar Chitturi - HRMS Technical - 6 YrsDocument4 pagesGowtham Kumar Chitturi - HRMS Technical - 6 YrsAnuPas encore d'évaluation

- Triplex (Triple Full Free Panoramic) Mast (5M15D To 5M35D) : Structure and FunctionDocument2 pagesTriplex (Triple Full Free Panoramic) Mast (5M15D To 5M35D) : Structure and FunctionMaz Ariez EkaPas encore d'évaluation

- MOL Breaker 20 TonDocument1 pageMOL Breaker 20 Tonaprel jakPas encore d'évaluation

- Charlemagne Command ListDocument69 pagesCharlemagne Command ListBoardkingZeroPas encore d'évaluation

- Fammthya 000001Document87 pagesFammthya 000001Mohammad NorouzzadehPas encore d'évaluation

- Grace Strux Beton PDFDocument33 pagesGrace Strux Beton PDFmpilgirPas encore d'évaluation

- Bs en 1991-1-5 2003 + 2009 Thermal Actions (Unsecured)Document52 pagesBs en 1991-1-5 2003 + 2009 Thermal Actions (Unsecured)Tan Gui SongPas encore d'évaluation

- SVPWM PDFDocument5 pagesSVPWM PDFmauricetappaPas encore d'évaluation

- Software Testing Notes Prepared by Mrs. R. Swetha M.E Unit I - Introduction at The End of This Unit, The Student Will Be Able ToDocument30 pagesSoftware Testing Notes Prepared by Mrs. R. Swetha M.E Unit I - Introduction at The End of This Unit, The Student Will Be Able ToKabilan NarashimhanPas encore d'évaluation

- Mutual Fund Insight Nov 2022Document214 pagesMutual Fund Insight Nov 2022Sonic LabelsPas encore d'évaluation

- COVID Immunization Record Correction RequestDocument2 pagesCOVID Immunization Record Correction RequestNBC 10 WJARPas encore d'évaluation

- AdvertisingDocument2 pagesAdvertisingJelena ŽužaPas encore d'évaluation

- CPM W1.1Document19 pagesCPM W1.1HARIJITH K SPas encore d'évaluation

- Tekla Structures ToturialsDocument35 pagesTekla Structures ToturialsvfmgPas encore d'évaluation

- Optimization of Crude Oil DistillationDocument8 pagesOptimization of Crude Oil DistillationJar RSPas encore d'évaluation

- Introduction To Radar Warning ReceiverDocument23 pagesIntroduction To Radar Warning ReceiverPobitra Chele100% (1)

- Prepositions Below by in On To of Above at Between From/toDocument2 pagesPrepositions Below by in On To of Above at Between From/toVille VianPas encore d'évaluation

- Chapter 1.4Document11 pagesChapter 1.4Gie AndalPas encore d'évaluation

- 19-2 Clericis LaicosDocument3 pages19-2 Clericis LaicosC C Bờm BờmPas encore d'évaluation

- SCHEDULE OF FEES - FinalDocument1 pageSCHEDULE OF FEES - FinalAbhishek SunaPas encore d'évaluation

- Cinnamon Peelers in Sri Lanka: Shifting Labour Process and Reformation of Identity Post-1977Document8 pagesCinnamon Peelers in Sri Lanka: Shifting Labour Process and Reformation of Identity Post-1977Social Scientists' AssociationPas encore d'évaluation

- Sikkim Manipal MBA 1 SEM MB0038-Management Process and Organization Behavior-MQPDocument15 pagesSikkim Manipal MBA 1 SEM MB0038-Management Process and Organization Behavior-MQPHemant MeenaPas encore d'évaluation

- Black BookDocument28 pagesBlack Bookshubham50% (2)

- Failure of A Gasket During A Hydrostatic TestDocument7 pagesFailure of A Gasket During A Hydrostatic TesthazopmanPas encore d'évaluation

- Invoice Acs # 18 TDH Dan Rof - Maret - 2021Document101 pagesInvoice Acs # 18 TDH Dan Rof - Maret - 2021Rafi RaziqPas encore d'évaluation

- MML3 Journal To CapcomDocument103 pagesMML3 Journal To CapcomFer BarcenaPas encore d'évaluation

- WPGPipingIndex Form 167 PDFDocument201 pagesWPGPipingIndex Form 167 PDFRaj AryanPas encore d'évaluation

- Spark: How to Lead Yourself and Others to Greater SuccessD'EverandSpark: How to Lead Yourself and Others to Greater SuccessÉvaluation : 4.5 sur 5 étoiles4.5/5 (132)

- Summary of Noah Kagan's Million Dollar WeekendD'EverandSummary of Noah Kagan's Million Dollar WeekendÉvaluation : 5 sur 5 étoiles5/5 (1)

- The First Minute: How to start conversations that get resultsD'EverandThe First Minute: How to start conversations that get resultsÉvaluation : 4.5 sur 5 étoiles4.5/5 (57)

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverD'EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverÉvaluation : 4.5 sur 5 étoiles4.5/5 (186)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0D'EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Évaluation : 5 sur 5 étoiles5/5 (1)

- Coach the Person, Not the Problem: A Guide to Using Reflective InquiryD'EverandCoach the Person, Not the Problem: A Guide to Using Reflective InquiryÉvaluation : 5 sur 5 étoiles5/5 (64)

- The 7 Habits of Highly Effective PeopleD'EverandThe 7 Habits of Highly Effective PeopleÉvaluation : 4 sur 5 étoiles4/5 (2564)

- How to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobD'EverandHow to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobÉvaluation : 4.5 sur 5 étoiles4.5/5 (36)

- Transformed: Moving to the Product Operating ModelD'EverandTransformed: Moving to the Product Operating ModelÉvaluation : 4 sur 5 étoiles4/5 (1)

- Billion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsD'EverandBillion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsÉvaluation : 4.5 sur 5 étoiles4.5/5 (52)

- Leadership Skills that Inspire Incredible ResultsD'EverandLeadership Skills that Inspire Incredible ResultsÉvaluation : 4.5 sur 5 étoiles4.5/5 (11)

- Only the Paranoid Survive: How to Exploit the Crisis Points That Challenge Every CompanyD'EverandOnly the Paranoid Survive: How to Exploit the Crisis Points That Challenge Every CompanyÉvaluation : 3.5 sur 5 étoiles3.5/5 (122)

- How to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersD'EverandHow to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersÉvaluation : 4.5 sur 5 étoiles4.5/5 (95)

- The Little Big Things: 163 Ways to Pursue ExcellenceD'EverandThe Little Big Things: 163 Ways to Pursue ExcellencePas encore d'évaluation

- 25 Ways to Win with People: How to Make Others Feel Like a Million BucksD'Everand25 Ways to Win with People: How to Make Others Feel Like a Million BucksÉvaluation : 5 sur 5 étoiles5/5 (36)

- The 7 Habits of Highly Effective People: 30th Anniversary EditionD'EverandThe 7 Habits of Highly Effective People: 30th Anniversary EditionÉvaluation : 5 sur 5 étoiles5/5 (337)

- The Effective Executive: The Definitive Guide to Getting the Right Things DoneD'EverandThe Effective Executive: The Definitive Guide to Getting the Right Things DoneÉvaluation : 4.5 sur 5 étoiles4.5/5 (469)

- The 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsD'EverandThe 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsÉvaluation : 4.5 sur 5 étoiles4.5/5 (411)

- Radical Candor by Kim Scott - Book Summary: Be A Kickass Boss Without Losing Your HumanityD'EverandRadical Candor by Kim Scott - Book Summary: Be A Kickass Boss Without Losing Your HumanityÉvaluation : 4.5 sur 5 étoiles4.5/5 (40)

- Work the System: The Simple Mechanics of Making More and Working Less (4th Edition)D'EverandWork the System: The Simple Mechanics of Making More and Working Less (4th Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (23)

- 7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthD'Everand7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthÉvaluation : 5 sur 5 étoiles5/5 (52)

- Management Mess to Leadership Success: 30 Challenges to Become the Leader You Would FollowD'EverandManagement Mess to Leadership Success: 30 Challenges to Become the Leader You Would FollowÉvaluation : 4.5 sur 5 étoiles4.5/5 (27)

- Transformed: Moving to the Product Operating ModelD'EverandTransformed: Moving to the Product Operating ModelÉvaluation : 4 sur 5 étoiles4/5 (1)

- The Introverted Leader: Building on Your Quiet StrengthD'EverandThe Introverted Leader: Building on Your Quiet StrengthÉvaluation : 4.5 sur 5 étoiles4.5/5 (35)

- The Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceD'EverandThe Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceÉvaluation : 5 sur 5 étoiles5/5 (22)

- Work Stronger: Habits for More Energy, Less Stress, and Higher Performance at WorkD'EverandWork Stronger: Habits for More Energy, Less Stress, and Higher Performance at WorkÉvaluation : 4.5 sur 5 étoiles4.5/5 (12)

- Escaping the Build Trap: How Effective Product Management Creates Real ValueD'EverandEscaping the Build Trap: How Effective Product Management Creates Real ValueÉvaluation : 4.5 sur 5 étoiles4.5/5 (71)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andD'EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andÉvaluation : 4.5 sur 5 étoiles4.5/5 (709)

- The 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsD'EverandThe 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsÉvaluation : 4.5 sur 5 étoiles4.5/5 (90)