Académique Documents

Professionnel Documents

Culture Documents

(Juan Ramirez) Accounting For Atives Advance (BookFi - Org) (1) 18

Transféré par

JasmeetDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

(Juan Ramirez) Accounting For Atives Advance (BookFi - Org) (1) 18

Transféré par

JasmeetDroits d'auteur :

Formats disponibles

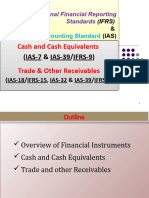

2

Accounting for Derivatives

IAS 39

Recognition

Recognition of

of

Financial

Financial Assets

Assets and

and

Financial

Financial Liabilities

Liabilities

- Classification and

measurement of

financial instruments

- Fair value

- Amortised cost

- Impairment

- Derecognition of

financial instruments

IAS 21

IAS 32

Derivatives

Derivatives and

and Hedge

Hedge

Accounting

Accounting

FX

FX Measurement

Measurement and

and

Net

Net Investment

Investment Hedge

Hedge

Recognition

Recognition of

of Equity

Equity

Instruments

Instruments

- Hedge accounting

- Discontinuance of

hedge accounting

- Embedded derivatives

- Functional currency

- Reporting foreign

currency transactions

- Translation and

disposals of foreign

operations

- Net investment

hedge

- Debt vs Equity

- Convertibles

- Preferred shares

- Treasury shares

- Dividends

Figure 1.1 Scope of IAS 21, IAS 32 and IAS 39.

weather derivatives, loans not settled in cash (or in another financial instrument), interests in

subsidiaries/associates/joint ventures, employee benefit plans, share-based payment transactions, contracts to buy/sell an acquiree in a business combination, contracts for contingent

consideration in a business combination, some financial guarantee contracts and some commodity contracts are outside the scope of IAS 39.

1.1.1 Financial Assets Categories

A financial asset is any asset that is cash, a contractual right to receive cash or another

financial asset, a contractual right to exchange financial instruments with another entity under

conditions that are potentially favourable, or an equity instrument of another entity. Financial

assets include derivatives with a fair value favourable to the entity.

IAS 39 considers four categories of financial assets:

1) Financial assets held-to-maturity are non-derivative financial assets with fixed or determinable payments and fixed maturity so that the entity has the positive intention and ability

to hold to maturity. The assets classified in this category are subject to severe restrictions,

so in reality entities are quite reluctant to include assets in this category.

This category includes: non-callable debt, callable debt (provided that if it is called

the holder would recover substantially all of debts carrying amount), mandatorily redeemable preferred shares, etc.

This category excludes: originated loans, equity securities (because of their indefinite

life), puttable debt (because the entity may not hold it to maturity if option is exercised),

perpetual debt (because of their indefinite life), etc. It also excludes financial assets that

the issuer has the right to settle at an amount significantly below its amortised cost.

The intention and ability to hold the asset to maturity is assessed at initial recognition

and at each balance sheet date.

Vous aimerez peut-être aussi

- Equity Investment for CFA level 1: CFA level 1, #2D'EverandEquity Investment for CFA level 1: CFA level 1, #2Évaluation : 5 sur 5 étoiles5/5 (1)

- IAS 39 Financial InstrumentsDocument9 pagesIAS 39 Financial InstrumentskwakyePas encore d'évaluation

- Bull's Eye- A stock market investment guide for beginnersD'EverandBull's Eye- A stock market investment guide for beginnersPas encore d'évaluation

- AE14 PAS 32 and 39Document3 pagesAE14 PAS 32 and 39Stellar ArchaicPas encore d'évaluation

- Accounting For Financial InstrumentsDocument40 pagesAccounting For Financial Instrumentssandun chamikaPas encore d'évaluation

- Financial AssetsDocument3 pagesFinancial AssetsAshik Uz ZamanPas encore d'évaluation

- Tute 11 - Asset AccountingDocument7 pagesTute 11 - Asset AccountingLakshani fernandoPas encore d'évaluation

- Fas133 FASB Derivatives Hedge Accounting RulesDocument22 pagesFas133 FASB Derivatives Hedge Accounting Rulesswinki3Pas encore d'évaluation

- International Accounting Standards: IAS 39 Final Instruments Recognition An MeasurementDocument49 pagesInternational Accounting Standards: IAS 39 Final Instruments Recognition An MeasurementMia CasasPas encore d'évaluation

- InvestmentDocument29 pagesInvestmentjanjuvene EguiaPas encore d'évaluation

- Chapter 1Document9 pagesChapter 1Trazy Jam BagsicPas encore d'évaluation

- Categorizing Financial AssetsDocument3 pagesCategorizing Financial AssetsAchmad ArdanuPas encore d'évaluation

- Financial ReportingDocument18 pagesFinancial ReportingGen AbulkhairPas encore d'évaluation

- IAS 32 - NotesDocument30 pagesIAS 32 - NotesJyPas encore d'évaluation

- ("Valstybės Žinios" (Official Gazette), 2004, No. 180-6699 2006, No. 37-1328 2007, No. 1-55)Document8 pages("Valstybės Žinios" (Official Gazette), 2004, No. 180-6699 2006, No. 37-1328 2007, No. 1-55)Jenus KhanPas encore d'évaluation

- Indian Accounting Standard (Ind AS) 32 Financial Instruments: PresentationDocument12 pagesIndian Accounting Standard (Ind AS) 32 Financial Instruments: PresentationGnana PrasunaPas encore d'évaluation

- Financial InstrumentsDocument65 pagesFinancial InstrumentsFarooq Vahidy67% (3)

- Iv. Definitions/ Terminologies: I. AssetsDocument16 pagesIv. Definitions/ Terminologies: I. AssetsAhmad NazeerPas encore d'évaluation

- Chapter 6 Accounting and Reporting of Financial InstrumentsDocument24 pagesChapter 6 Accounting and Reporting of Financial InstrumentsMahendra Kumar B RPas encore d'évaluation

- 19331sm Finalnew cp6Document24 pages19331sm Finalnew cp6Naveen HRPas encore d'évaluation

- FR14 - Financial Instruments (Stud) RDocument42 pagesFR14 - Financial Instruments (Stud) Rduong duongPas encore d'évaluation

- IFRS 9 - What Is A Financial InstrumentDocument4 pagesIFRS 9 - What Is A Financial InstrumentMuhammad Moin khanPas encore d'évaluation

- Lecture 5 Financial InstrumentsDocument31 pagesLecture 5 Financial InstrumentsBrenden KapoPas encore d'évaluation

- Financial Reporting Notes SummaryDocument62 pagesFinancial Reporting Notes SummarylucitaevidentPas encore d'évaluation

- MFRS 132 Financial InstrumentDocument3 pagesMFRS 132 Financial InstrumentThineswaran David BillaPas encore d'évaluation

- Classification of Financial InstrumentsDocument18 pagesClassification of Financial InstrumentsElena Hernandez100% (2)

- Chapter 4 - Review QuestionsDocument17 pagesChapter 4 - Review QuestionsNicole AgostoPas encore d'évaluation

- Tagamabja-Cfas Activity Set 2FDocument10 pagesTagamabja-Cfas Activity Set 2FBerlyn Joy TagamaPas encore d'évaluation

- In Audit Ind As 32 and Ind 109 Financial Instruments NoexpDocument44 pagesIn Audit Ind As 32 and Ind 109 Financial Instruments Noexpsa_mishraPas encore d'évaluation

- Week 01 - 03 - Module 03 - Introduction To Financial InstrumentsDocument9 pagesWeek 01 - 03 - Module 03 - Introduction To Financial Instruments지마리Pas encore d'évaluation

- PAS 39 Financial Instruments Recognition and MeasurementsDocument51 pagesPAS 39 Financial Instruments Recognition and MeasurementsSherry Mae Malabago93% (14)

- Financial InstrumentDocument22 pagesFinancial InstrumentMd Zaber NoorPas encore d'évaluation

- Topic 3 - Financial Instruments - IfRSDocument29 pagesTopic 3 - Financial Instruments - IfRSLinh HoangPas encore d'évaluation

- FR AssDocument14 pagesFR AssMohamed Samba BahPas encore d'évaluation

- FE - Financial Assets and SecuritiesDocument7 pagesFE - Financial Assets and SecuritiesJUAN BERMUDEZPas encore d'évaluation

- Ifrs 9 Cash and ReceivablesDocument50 pagesIfrs 9 Cash and ReceivablesHagere EthiopiaPas encore d'évaluation

- PFRS 9Document7 pagesPFRS 9MamabetPas encore d'évaluation

- INVESTMENTSDocument7 pagesINVESTMENTSJhon Eljun Yuto EnopiaPas encore d'évaluation

- Ifrs at A Glance: IAS 39 Financial InstrumentsDocument8 pagesIfrs at A Glance: IAS 39 Financial InstrumentsvivekchokshiPas encore d'évaluation

- L6a - MFRS 9 Financial InstrumentsDocument55 pagesL6a - MFRS 9 Financial InstrumentsandyPas encore d'évaluation

- FAC1502 - Study Unit 12 - 2021Document9 pagesFAC1502 - Study Unit 12 - 2021Ndila mangalisoPas encore d'évaluation

- International Financial Reporting StandardsDocument23 pagesInternational Financial Reporting StandardsAneela AamirPas encore d'évaluation

- Intermediate Accounting Cash and Cash Equivalents Reviewer For 1st YearDocument10 pagesIntermediate Accounting Cash and Cash Equivalents Reviewer For 1st YearGUNDA, NICOLE ANNE T.Pas encore d'évaluation

- Reporting Ifrsfactsheet Financial Instruments PresentationDocument8 pagesReporting Ifrsfactsheet Financial Instruments PresentationAmanda7Pas encore d'évaluation

- Lecture 4 FSADocument36 pagesLecture 4 FSAvuthithuylinh9a007Pas encore d'évaluation

- Intermediate Accounting 1 Lecture NotesDocument16 pagesIntermediate Accounting 1 Lecture NotesAnalyn Lafradez100% (2)

- CL2022 - 29 Annex ADocument38 pagesCL2022 - 29 Annex AElyssa MendozaPas encore d'évaluation

- Financial Instruments: Embedded DerivativesDocument82 pagesFinancial Instruments: Embedded Derivativesajaykumarr122Pas encore d'évaluation

- Wealth Management and Personal Financial Planning 8-10 1.PptmDocument86 pagesWealth Management and Personal Financial Planning 8-10 1.PptmHargobind CoachPas encore d'évaluation

- Conceptual Framework QuizDocument31 pagesConceptual Framework QuizHannah RodulfoPas encore d'évaluation

- IA Downloaded From GoogleDocument5 pagesIA Downloaded From Googlearnold espiniliPas encore d'évaluation

- FABM 2 - Lesson1 5Document78 pagesFABM 2 - Lesson1 5Sis HopPas encore d'évaluation

- CH 2Document13 pagesCH 2LIKENAWPas encore d'évaluation

- Financial Instruments Ifrs 9Document29 pagesFinancial Instruments Ifrs 9chalojunior16Pas encore d'évaluation

- Definition of 'Qip': Basel Capital AccordDocument7 pagesDefinition of 'Qip': Basel Capital AccordRISHABH GUPTAPas encore d'évaluation

- Ifrs Investment Funds Issue 3 6248Document0 pageIfrs Investment Funds Issue 3 6248xuhaibimPas encore d'évaluation

- Financial Instruments (2021)Document17 pagesFinancial Instruments (2021)Tawanda Tatenda Herbert100% (1)

- Chapter 7 Acctg For Financial InstrumentsDocument32 pagesChapter 7 Acctg For Financial InstrumentsjammuuuPas encore d'évaluation

- Chapter 6 Financial InstrumentsDocument15 pagesChapter 6 Financial InstrumentsEtsegenet TafessePas encore d'évaluation

- 41 As 30 31 32 FormattedDocument82 pages41 As 30 31 32 FormattedTarandeep Singh BhatiaPas encore d'évaluation

- Remedy MidTier Guide 7-5Document170 pagesRemedy MidTier Guide 7-5martin_wiedmeyerPas encore d'évaluation

- Flip The Coin - EbookDocument306 pagesFlip The Coin - EbookAjesh Shah100% (1)

- JBF Winter2010-CPFR IssueDocument52 pagesJBF Winter2010-CPFR IssueakashkrsnaPas encore d'évaluation

- Garments Costing Sheet of LADIES Skinny DenimsDocument1 pageGarments Costing Sheet of LADIES Skinny DenimsDebopriya SahaPas encore d'évaluation

- Controlador DanfossDocument2 pagesControlador Danfossfrank.marcondes2416Pas encore d'évaluation

- The Beauty of Laplace's Equation, Mathematical Key To Everything - WIRED PDFDocument9 pagesThe Beauty of Laplace's Equation, Mathematical Key To Everything - WIRED PDFYan XiongPas encore d'évaluation

- Cocaine in Blood of Coca ChewersDocument10 pagesCocaine in Blood of Coca ChewersKarl-GeorgPas encore d'évaluation

- Business Plan: Muzammil Deshmukh, MMS From Kohinoor College, MumbaiDocument6 pagesBusiness Plan: Muzammil Deshmukh, MMS From Kohinoor College, MumbaiMuzammil DeshmukhPas encore d'évaluation

- Cosmic Handbook PreviewDocument9 pagesCosmic Handbook PreviewnkjkjkjPas encore d'évaluation

- Anthony Robbins - Time of Your Life - Summary CardsDocument23 pagesAnthony Robbins - Time of Your Life - Summary CardsWineZen97% (58)

- MN Rules Chapter 5208 DLIDocument24 pagesMN Rules Chapter 5208 DLIMichael DoylePas encore d'évaluation

- Auditory Evoked Potentials - AEPs - Underlying PrinciplesDocument19 pagesAuditory Evoked Potentials - AEPs - Underlying PrinciplesMansi SinghPas encore d'évaluation

- DLI Watchman®: Vibration Screening Tool BenefitsDocument2 pagesDLI Watchman®: Vibration Screening Tool Benefitssinner86Pas encore d'évaluation

- Agm 1602W-818Document23 pagesAgm 1602W-818Daniel BauerPas encore d'évaluation

- Level Swiches Data SheetDocument4 pagesLevel Swiches Data SheetROGELIO QUIJANOPas encore d'évaluation

- Ankle Injury EvaluationDocument7 pagesAnkle Injury EvaluationManiDeep ReddyPas encore d'évaluation

- 2011-11-09 Diana and AtenaDocument8 pages2011-11-09 Diana and AtenareluPas encore d'évaluation

- Nature of Science-Worksheet - The Amoeba Sisters HWDocument2 pagesNature of Science-Worksheet - The Amoeba Sisters HWTiara Daniel25% (4)

- San Mateo Daily Journal 01-28-19 EditionDocument28 pagesSan Mateo Daily Journal 01-28-19 EditionSan Mateo Daily JournalPas encore d'évaluation

- Integrator Windup and How To Avoid ItDocument6 pagesIntegrator Windup and How To Avoid ItHermogensPas encore d'évaluation

- Corporate Restructuring Short NotesDocument31 pagesCorporate Restructuring Short NotesSatwik Jain57% (7)

- Functions PW DPPDocument4 pagesFunctions PW DPPDebmalyaPas encore d'évaluation

- XU-CSG Cabinet Minutes of Meeting - April 4Document5 pagesXU-CSG Cabinet Minutes of Meeting - April 4Harold John LabortePas encore d'évaluation

- Modified Airdrop System Poster - CompressedDocument1 pageModified Airdrop System Poster - CompressedThiam HokPas encore d'évaluation

- Learning TheoryDocument7 pagesLearning Theoryapi-568999633Pas encore d'évaluation

- Case Study On Goodearth Financial Services LTDDocument15 pagesCase Study On Goodearth Financial Services LTDEkta Luciferisious Sharma0% (1)

- MQXUSBDEVAPIDocument32 pagesMQXUSBDEVAPIwonderxPas encore d'évaluation

- Effect of Plant Growth RegulatorsDocument17 pagesEffect of Plant Growth RegulatorsSharmilla AshokhanPas encore d'évaluation

- FDD Spindle Motor Driver: BA6477FSDocument12 pagesFDD Spindle Motor Driver: BA6477FSismyorulmazPas encore d'évaluation

- DevOps Reference CardDocument2 pagesDevOps Reference CardIntizarchauhanPas encore d'évaluation

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSND'Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Creating Shareholder Value: A Guide For Managers And InvestorsD'EverandCreating Shareholder Value: A Guide For Managers And InvestorsÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 3.5 sur 5 étoiles3.5/5 (8)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthD'EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthÉvaluation : 4 sur 5 étoiles4/5 (20)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursD'EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisD'EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisÉvaluation : 5 sur 5 étoiles5/5 (6)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamD'EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamPas encore d'évaluation

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialÉvaluation : 4.5 sur 5 étoiles4.5/5 (32)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingD'EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingÉvaluation : 4.5 sur 5 étoiles4.5/5 (17)

- Financial Risk Management: A Simple IntroductionD'EverandFinancial Risk Management: A Simple IntroductionÉvaluation : 4.5 sur 5 étoiles4.5/5 (7)

- Finance Basics (HBR 20-Minute Manager Series)D'EverandFinance Basics (HBR 20-Minute Manager Series)Évaluation : 4.5 sur 5 étoiles4.5/5 (32)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsD'EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Mind over Money: The Psychology of Money and How to Use It BetterD'EverandMind over Money: The Psychology of Money and How to Use It BetterÉvaluation : 4 sur 5 étoiles4/5 (24)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelD'Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelPas encore d'évaluation

- Value: The Four Cornerstones of Corporate FinanceD'EverandValue: The Four Cornerstones of Corporate FinanceÉvaluation : 4.5 sur 5 étoiles4.5/5 (18)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetD'EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetÉvaluation : 5 sur 5 étoiles5/5 (2)

- The Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsD'EverandThe Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsPas encore d'évaluation

- Product-Led Growth: How to Build a Product That Sells ItselfD'EverandProduct-Led Growth: How to Build a Product That Sells ItselfÉvaluation : 5 sur 5 étoiles5/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistD'EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistÉvaluation : 4.5 sur 5 étoiles4.5/5 (73)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistD'EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistÉvaluation : 4 sur 5 étoiles4/5 (32)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)D'EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Évaluation : 4 sur 5 étoiles4/5 (5)