Académique Documents

Professionnel Documents

Culture Documents

Financial Risk Management A Prket and Credit Risk - 2 Edition 65

Transféré par

Jasmeet0 évaluation0% ont trouvé ce document utile (0 vote)

10 vues1 pageMany of the controls for nondeliberate incorrect information are similar to the controls for fraud. Separation of responsibilities is effective in spotting inadvertent errors. Front offices should produce daily projections of closing positions and P&L moves.

Description originale:

Titre original

Financial Risk Management a Prket and Credit Risk- 2 Edition 65

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentMany of the controls for nondeliberate incorrect information are similar to the controls for fraud. Separation of responsibilities is effective in spotting inadvertent errors. Front offices should produce daily projections of closing positions and P&L moves.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

10 vues1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 65

Transféré par

JasmeetMany of the controls for nondeliberate incorrect information are similar to the controls for fraud. Separation of responsibilities is effective in spotting inadvertent errors. Front offices should produce daily projections of closing positions and P&L moves.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

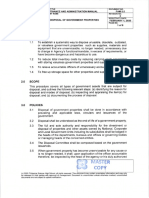

Operational Risk

35

control personnel the proper backing and try to explain to traders the

motivation for such investigations. The careful documentation of major

incidents of fraud and the difficulty in detecting them can provide trading managers with tools to use in making this case.

3.1.2 The Risk of Nondeliberate Incorrect Information

It is far more common to have incorrect P&L and position information due

to human or systems error than incorrect P&L and position information

due to fraud. Many of the controls for nondeliberate incorrect information

are similar to the controls for fraud. The separation of responsibilities is effective in having several sets of eyes looking at the entry of a trade, reducing

the chance that a single individuals error will impact positions. Checking

confirmations and payment instructions against position entries, P&L and

cash reconciliation, and the investigation of offmarket trades are just as

effective in spotting inadvertent errors as they are in spotting fraudulent

entries. Equally close attention needs to be paid to making sure customers

have posted collateral required by contracts to avoid inadvertently taking

unauthorized credit risk. (For further discussions of the role of collateral in

managing credit risk, see Sections 4.1.1, 10.1.4, 14.2, and 14.3.3.)

It is every bit as important to have frontoffice personnel involved in

reconciliation (to take advantage of their superior market knowledge and

intuitive feel for the size of their P&L and positions) as it is to have support

personnel involved (to take advantage of their independence). Frontoffice

personnel must be held responsible for the accuracy of the records of their

P&L and positions, and cannot be allowed to place all the blame for incorrect reports on support personnel, in order to ensure that they will

place sufficient importance on this reconciliation. Front offices should be

required to produce daily projections of closing positions and P&L moves

based on their own informal records, prior to seeing the official reports of

positions and P&L, and should reconcile significant differences between

the two.

To prevent incorrect P&L and position information, it is important to

ensure that adequate support personnel and system resources are available,

both in quantity and in quality, relative to the size and complexity of trading. Careful attention needs to be paid to planning staff and system upgrades to anticipate growth in trading volume. Management needs to be

ready to resist premature approval of a new business if support resources

cannot keep pace with frontoffice development.

Should model risk be regarded as an operations risk issue? The viewpoint of this book is that model risk is primarily a market risk issue, since

the proper selection and calibration to market prices of models and the

Vous aimerez peut-être aussi

- Financial Risk Management A Prket and Credit Risk - 2 Edition 90Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 90JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 87Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 87JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 89Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 89JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 83Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 83JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 84Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 84JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 88Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 88JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 85Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 85JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 81Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 81JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 73Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 73JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 79Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 79JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 82Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 82JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 74Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 74JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 77Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 77JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 80Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 80JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 76Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 76JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 68Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 68JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 75Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 75JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 72Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 72JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 62Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 62JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 71Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 71JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 70Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 70JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 60Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 60JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 64Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 64JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 69Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 69JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 67Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 67JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 66Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 66JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 63Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 63JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 59Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 59JasmeetPas encore d'évaluation

- Financial Risk Management A Prket and Credit Risk - 2 Edition 61Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 61JasmeetPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Maru Batting CaseDocument10 pagesMaru Batting CasePerpetual LearnersPas encore d'évaluation

- Framework of INTOSAI Government Auditing StandardsDocument21 pagesFramework of INTOSAI Government Auditing StandardssukandePas encore d'évaluation

- Dispose Obsolete Government AssetsDocument8 pagesDispose Obsolete Government AssetsDEPED RO XIPas encore d'évaluation

- Service Quality and Customer Satisfaction in The Pay TV Industry: A Case Study of Multichoice Zambia LimitedDocument6 pagesService Quality and Customer Satisfaction in The Pay TV Industry: A Case Study of Multichoice Zambia LimitedNowshin FarhinPas encore d'évaluation

- Key Concepts of Logistics ManagementDocument3 pagesKey Concepts of Logistics ManagementMia KhalifaPas encore d'évaluation

- Pinoy Management StylesDocument2 pagesPinoy Management StylesJohnPas encore d'évaluation

- Albert Langga Ak Jonathan Simbing - ResumeDocument3 pagesAlbert Langga Ak Jonathan Simbing - Resumerooftop6717Pas encore d'évaluation

- Merits and demerits of capital budgeting techniquesDocument3 pagesMerits and demerits of capital budgeting techniquesBitta Saha HridoyPas encore d'évaluation

- SAP-QM Quality Management MCQDocument7 pagesSAP-QM Quality Management MCQJagadish JaganPas encore d'évaluation

- ORGANOGRAMSSamsons Group of CompaniesDocument14 pagesORGANOGRAMSSamsons Group of CompaniesSaad MasoodPas encore d'évaluation

- Associate Analytics Sample PaperDocument9 pagesAssociate Analytics Sample PaperKakeKmPas encore d'évaluation

- The Throughput Diagram - A General, Realistic - Wiendahl1995Document39 pagesThe Throughput Diagram - A General, Realistic - Wiendahl1995Cibelle LimaPas encore d'évaluation

- GP01 Description of FSC CoC Certification Process 11 1Document16 pagesGP01 Description of FSC CoC Certification Process 11 1DiegoPas encore d'évaluation

- Standard Ground Handling Agreement SGHA SLA Effective Negotiations 1 DayDocument3 pagesStandard Ground Handling Agreement SGHA SLA Effective Negotiations 1 DayОразмурад ОразмурадовPas encore d'évaluation

- Sartorius Stedim India: Bioprocess Solutions 5S JourneyDocument53 pagesSartorius Stedim India: Bioprocess Solutions 5S JourneyChethan Nagaraju KumbarPas encore d'évaluation

- Audit PlanDocument28 pagesAudit Planiris LadridoPas encore d'évaluation

- PMG 320 ReflectionDocument4 pagesPMG 320 Reflectionapi-672516350Pas encore d'évaluation

- Sheri Sherman - Accounts Payable ClerkDocument2 pagesSheri Sherman - Accounts Payable ClerkSheri SheriPas encore d'évaluation

- At The Hotel - BusuuDocument5 pagesAt The Hotel - BusuuAida TeskeredžićPas encore d'évaluation

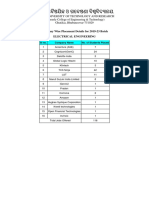

- Placement RecordDocument30 pagesPlacement RecordRajeswar KumarPas encore d'évaluation

- CAEs evaluations of whistleblower reportsDocument13 pagesCAEs evaluations of whistleblower reportsTiarasi BerlianaPas encore d'évaluation

- Time Management & Productivity: A Practical 8-Step GuideDocument16 pagesTime Management & Productivity: A Practical 8-Step GuideERMIYAS TARIKUPas encore d'évaluation

- Managing Demand and CapacityDocument21 pagesManaging Demand and CapacityheeyaPas encore d'évaluation

- Chapter 5 Thesis ExampleDocument12 pagesChapter 5 Thesis ExampleAure MengoPas encore d'évaluation

- S.No. Term Description Units Agreed Term: Text Text Text TextDocument2 pagesS.No. Term Description Units Agreed Term: Text Text Text TextArbind Kumar BhagatPas encore d'évaluation

- Cleopatra Wall Tiles CatalogueDocument151 pagesCleopatra Wall Tiles CatalogueHussain ElarabiPas encore d'évaluation

- Solution For Case Study 11-Process ManagementDocument3 pagesSolution For Case Study 11-Process ManagementArpita SahuPas encore d'évaluation

- Iso 9001 SeatamholdingDocument1 pageIso 9001 SeatamholdingrichardPas encore d'évaluation

- In StarDocument32 pagesIn StarnitalekarPas encore d'évaluation

- Soap Noodles Shipped from Malaysia to VenezuelaDocument256 pagesSoap Noodles Shipped from Malaysia to VenezuelaDaisy, Roda,JhonPas encore d'évaluation