Académique Documents

Professionnel Documents

Culture Documents

E-Commerce Trends in Nigeria

Transféré par

FrancoisVertierDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

E-Commerce Trends in Nigeria

Transféré par

FrancoisVertierDroits d'auteur :

Formats disponibles

E-COMMERCE GROWTH IN NIGERIA

These days, Nigerians are not only surfing the web, but are also marketing and buying on the internet.

With the introduction of online retail stores like Konga, Alibaba, Jumia, and an endless list of

new stores, Nigerians though initially skeptical- are embracing online shopping.

For one, e-commerce and online retail provides four major solutions to Nigerians availability,

convenience, an array of options to choose from, and discounted prices compared to physical stores.

This industry is one of the most promising in the continent, reaching out to the whole world as an

attractive investment opportunity. Involvement in African ecommerce holds the promise of huge

potential results against little investment.

As the next frontier, Africa is seeing some good investment from credible investors, which is helping to

drive growth, says Daniel Guasco, Head of Groupon South Africa. He reckons that if you compare brick

and mortar as your starting point, an e-commerce company is easier and quicker. You dont need retail

space and shopping centers. (Featured in Venture Burn)

Nigerias e-commerce market was recently valued at 225 billion Naira, or US$1.3 billion due to the 25%

in e-commerce growth. The reason for this growth isnt far-fetched as Nigeria is the most populous

nation in Africa boasting of 48 million internet users.

In recent times, more than 32.88% of the Nigerian population already has access to the internet and the

rate of mobile phone usage increased to 87 million representing an attractive market for mobile

commerce. And regardless of 419, yahoo yahoo, and online scams, the industry will continue to

experience growth.

Below is the present statistics in relation to e-commerce in Nigeria.

E-commerce in Nigeria

Absolute market size

$ 210.08 million

Sales per inhabitant

$ 1.50

Growth

25%

Internet Users

67,101,452

Internet Market Penetration

37.59%

SEVEN TRENDS TO WATCH IN NIGERIAN ECOMMERCE

Growth of Online Malls

As the saying goes, when there is a gold rush, sell shovels.

Many of the early operators of online stores in Nigeria soon discovered that rather than being burdened

with inventory, they could set and provide ecommerce as a service to traders. And the growth of the

number of these online malls would have value if they are providing a useful service in helping traders to

go online.

Konga.com, an established local brand that is taking up this laudable business model is a clear model in

this regard. Banks, like UBA and GTB have also launched their own stores.

Ease of Payment Integration

As recently as five years ago, a major Nigerian payment switch was charging $1000 to integrate

merchant accounts. Now it costs about $450, but there are signs that prices are falling. Some banks even

waive integration fees all together. A new startup and license payment processor, SimplePay, is also

offering free website payment integration. What is still missing is the provision of payment extensions to

popular open source software like Magento, Oscommerce, PrestaShop and WordPress/WooCommerce.

Credit Easing

Easy credit, in the form of credit cards, is the grease that lubricates online commerce, allowing buyers to

act on impulse and buy now, pay later. A few years back, Ecobank introduced such a product but later

rolled it back. While the challenges of managing small credit is noted, this market is a whale sized

opportunity that perhaps small loan lenders like Ren Money, One Credit can address.

Beyond Lagos

While local tech press celebrates Lagos as a key hub, the opportunities for ecommerce are growing all

over the country, beyond the main cities of Abuja, Port Harcourt and Warri. Now, there are online stores

as far north as Maiduguri.

The trust deficit that hindered initial ecommerce growth plus customers demand to pay cash on delivery

is creating advantages for ecommerce stores beyond Lagos.

Outsourced Delivery

The greatest single factor affecting customer satisfaction is the timeliness of deliveries. While the bigger

ecommerce stores and malls are investing in their own vehicles, smaller ventures have to depend on

courier companies that are not very efficient and not designed to cope with the operations of

ecommerce. Additional services like accepting payment on delivery, expediting returns, insurance and

authenticating effected deliveries are late in coming.

Currently, courier companies are making some of these arrangements on a bilateral, ad-hoc basis. In the

near future, we may see tailored products being rolled out that target ecommerce stores and offer

lower cost based on expected higher turnover volumes.

The Coming Legislation

Nigeria does not have a specific ecommerce law, although many sections of current legislation arguably

cover adequately most aspects of online business operations. As is often the case, the legislature is

taking a top down approach to work on a cyber-security bill with more inputs from foreign funded

NGOs and lobbyists than actual local operators.

Conclusively, it is apparent that E-commerce in Nigeria, and Africa as a whole, is experiencing

exponential growth. It is safe to also say e-commerce is here to stay and will undoubtedly experience

more growth. The Nigerian e-commerce industry, only second to South Africas on the continent, is

projected to take the top spot in the coming years.

Though Nigeria still struggles with ensuring safety on all online payment platforms, as well as proper

provision for global payments, E-commerce is definitely not just a fad but the future.

Content & Image Sources

Michael E. (2014) ECOMMERCE IN NIGERIA

NO COMMENTS http://streettoolz.com/blog/the-future-of-e-commerce-in-nigeria/

Leke A, (2014) SEVEN TRENDS TO WATCH IN NIGERIAN ECOMMERCE

http://techcabal.com/2014/03/18/coming-trends-nigerian-ecommerce/

Osasere ECOMMERCE TRENDS IN NIGERIA

http://citewire.com/e-commerce-trend-in-nigeria/

Vous aimerez peut-être aussi

- AP Research Survival Guide - RevisedDocument58 pagesAP Research Survival Guide - RevisedBadrEddin IsmailPas encore d'évaluation

- Cross Border Payments and Ecommerce Report 20202021Document119 pagesCross Border Payments and Ecommerce Report 20202021ngungo12345678Pas encore d'évaluation

- Case Study (DM)Document28 pagesCase Study (DM)Jai - Ho100% (1)

- Ecommerce in IndiaDocument24 pagesEcommerce in Indiaintellectarun100% (2)

- ARTICLE - Well Drilling & Completion Design and BarriersDocument34 pagesARTICLE - Well Drilling & Completion Design and BarriersNathan RamalhoPas encore d'évaluation

- Chapter 9 Screw ConveyorsDocument7 pagesChapter 9 Screw ConveyorsMarew Getie100% (1)

- Vietnam E-Commerce Industry Rises Despite ChallengesDocument25 pagesVietnam E-Commerce Industry Rises Despite ChallengesLan Anh NguyenPas encore d'évaluation

- Keb Combivis 6 enDocument232 pagesKeb Combivis 6 enhaithamPas encore d'évaluation

- Airbus Reference Language AbbreviationsDocument66 pagesAirbus Reference Language Abbreviations862405Pas encore d'évaluation

- Microscopes Open Up An Entire World That You Can't See With The Naked EyeDocument4 pagesMicroscopes Open Up An Entire World That You Can't See With The Naked EyeLouie Jane EleccionPas encore d'évaluation

- 2015 Nutrition Diagnosis Terminologi 2015Document9 pages2015 Nutrition Diagnosis Terminologi 2015Vivin Syamsul ArifinPas encore d'évaluation

- XDM-300 IMM ETSI B00 8.2.1-8.2.2 enDocument386 pagesXDM-300 IMM ETSI B00 8.2.1-8.2.2 enHipolitomvn100% (1)

- PACL Lodha Commette Final NOTICE of SALE With Property DetailsDocument4 pagesPACL Lodha Commette Final NOTICE of SALE With Property DetailsVivek Agrawal100% (2)

- SOF IEO Sample Paper Class 4Document2 pagesSOF IEO Sample Paper Class 4Rajesh RPas encore d'évaluation

- Me2U - Nigeria's First Online Gift Shopping MallDocument7 pagesMe2U - Nigeria's First Online Gift Shopping MallDeen SanwoolaPas encore d'évaluation

- Bpo Business PlanDocument30 pagesBpo Business PlanColeen JumawanPas encore d'évaluation

- E-CommerceDocument14 pagesE-CommercemadhavagrawalvrmPas encore d'évaluation

- 1368811962wpdm E-Commerce Technology & Payment Systems Deployment Across AfricaDocument31 pages1368811962wpdm E-Commerce Technology & Payment Systems Deployment Across AfricaBunmi Adeyale AyindePas encore d'évaluation

- E-Commerce and The Future of Modern BusinessDocument8 pagesE-Commerce and The Future of Modern BusinessRitika RajPas encore d'évaluation

- Effect of Escrow Service On The Purchasing Behavior of Online Buyers in Nigeria Somtochukwu Lady-Diana OkoyeDocument23 pagesEffect of Escrow Service On The Purchasing Behavior of Online Buyers in Nigeria Somtochukwu Lady-Diana OkoyeSomtochukwu Lady-DianaPas encore d'évaluation

- Europe's Ecommerce Boom: ReportsDocument33 pagesEurope's Ecommerce Boom: Reportskabeerchawla100% (1)

- Major Assignment - HRM610 - 18164064Document11 pagesMajor Assignment - HRM610 - 18164064MD. MUNTASIR MAMUN SHOVONPas encore d'évaluation

- Dipali Pandey - R19bl021-It Law AssignmentDocument14 pagesDipali Pandey - R19bl021-It Law AssignmentDipali PandeyPas encore d'évaluation

- If You Are A Reader of ProfitDocument4 pagesIf You Are A Reader of ProfitMansoor HussainPas encore d'évaluation

- Ecommerce Present A IonDocument23 pagesEcommerce Present A IonAsad MazharPas encore d'évaluation

- Selling Trust Before BusinessDocument2 pagesSelling Trust Before BusinessAamera JiwajiPas encore d'évaluation

- Topic - Increasing Demand For E-Commerce and Online ShoppingDocument22 pagesTopic - Increasing Demand For E-Commerce and Online Shoppingsaanvi khannaPas encore d'évaluation

- E-Commerce Prospect and ChallengesDocument9 pagesE-Commerce Prospect and ChallengesMd Saidunnabi JohaPas encore d'évaluation

- E-commerce Growth Trends and Future in PakistanDocument5 pagesE-commerce Growth Trends and Future in PakistanRamlah EjazPas encore d'évaluation

- Major Ethical and Legal Issues of E-CommerceDocument8 pagesMajor Ethical and Legal Issues of E-CommerceSara AbidPas encore d'évaluation

- The Next Frontier A Global E-Commerce Report by PayUDocument35 pagesThe Next Frontier A Global E-Commerce Report by PayUdiana_silvia_sirghiPas encore d'évaluation

- Eng Writing AssignmentDocument3 pagesEng Writing AssignmentU2103227 STUDENTPas encore d'évaluation

- Scope of E-Commerce in PakistanDocument25 pagesScope of E-Commerce in PakistanWasif ShahzadPas encore d'évaluation

- Assessment: E-Commerce Is Curse or BlessingDocument5 pagesAssessment: E-Commerce Is Curse or BlessingMuhammad ShojibPas encore d'évaluation

- (Overview of E-Commerce) : Mohammad Imran Hossain Khandaker 2018511080043Document16 pages(Overview of E-Commerce) : Mohammad Imran Hossain Khandaker 2018511080043Ihk HimelPas encore d'évaluation

- The Growth of E-Commerce in BangladeshDocument8 pagesThe Growth of E-Commerce in BangladeshMuhammad ShojibPas encore d'évaluation

- Impact of COVID-19 on Ecommerce IndustryDocument4 pagesImpact of COVID-19 on Ecommerce Industrysona fathimaPas encore d'évaluation

- Unleashing E-commerce Potential : Harnessing the Power of Digital MarketingD'EverandUnleashing E-commerce Potential : Harnessing the Power of Digital MarketingPas encore d'évaluation

- BD Insider - The Yin and Yang of Digitising Africa's Informal Retail SectorDocument8 pagesBD Insider - The Yin and Yang of Digitising Africa's Informal Retail SectorAvi AswaniPas encore d'évaluation

- E-Commerce Applications and History in BangladeshDocument9 pagesE-Commerce Applications and History in BangladeshEMONPas encore d'évaluation

- FinalDocument7 pagesFinalimehmood88Pas encore d'évaluation

- Running Head: E-Commerce in PakistanDocument10 pagesRunning Head: E-Commerce in PakistanKawishMalikPas encore d'évaluation

- Unit - 5 5.1. Introduction To E CommerceDocument44 pagesUnit - 5 5.1. Introduction To E Commercemutheeul haqPas encore d'évaluation

- PSP - Adyen - Country Fact Sheet South East Asia - OnlineDocument18 pagesPSP - Adyen - Country Fact Sheet South East Asia - OnlinekamaludeencrmPas encore d'évaluation

- Status of Ecommerce in NepalDocument4 pagesStatus of Ecommerce in NepalSuraj Thapa100% (1)

- Business Assign2 (Final)Document30 pagesBusiness Assign2 (Final)Maruf A SiddiquePas encore d'évaluation

- E Commarce AssignmentDocument39 pagesE Commarce AssignmentMuhammad A IsmaielPas encore d'évaluation

- E-Commerce in Morocco - Soukaina LabiadDocument11 pagesE-Commerce in Morocco - Soukaina LabiadSoukaina LabiadPas encore d'évaluation

- Ecommerce in Pakistan Specail ProbleDocument8 pagesEcommerce in Pakistan Specail Problezunair khalidPas encore d'évaluation

- E-commerce Growth and Benefits in Developing CountriesDocument3 pagesE-commerce Growth and Benefits in Developing Countriesअश्मिता महर्जनPas encore d'évaluation

- Mismis 4Document9 pagesMismis 4EMONPas encore d'évaluation

- Présentation2 (Enregistrement Automatique)Document12 pagesPrésentation2 (Enregistrement Automatique)ahlem aiouazPas encore d'évaluation

- Why E-Commerce For BangladeshDocument9 pagesWhy E-Commerce For BangladeshEMONPas encore d'évaluation

- Retail Marketing AssignmentDocument7 pagesRetail Marketing Assignmentguna maariPas encore d'évaluation

- Individual Assigment E-CommerceDocument11 pagesIndividual Assigment E-CommerceIkhmal HamidPas encore d'évaluation

- E-COMMERCE CHANGING PHASE OF RETAIL INDIADocument6 pagesE-COMMERCE CHANGING PHASE OF RETAIL INDIASaloni GoyalPas encore d'évaluation

- E-commerce Evolution : Navigating Trends and Innovations in Digital MarketingD'EverandE-commerce Evolution : Navigating Trends and Innovations in Digital MarketingPas encore d'évaluation

- Chap.2.elements of E.com &Document6 pagesChap.2.elements of E.com &Mukesh PawaraPas encore d'évaluation

- History of E-Commerce: Report On Future and Scope of Electronic CommerceDocument5 pagesHistory of E-Commerce: Report On Future and Scope of Electronic CommerceHina AfzalPas encore d'évaluation

- E Commerce PresentationDocument22 pagesE Commerce PresentationRachel Evans100% (1)

- Ecommerce ReportDocument25 pagesEcommerce Reportpankaj100% (1)

- Module 9Document31 pagesModule 9Joanne Michelle B. DueroPas encore d'évaluation

- Amoo Samuel BS4S14 A1Document24 pagesAmoo Samuel BS4S14 A1Samuel AmooPas encore d'évaluation

- Digital ShowroomingDocument15 pagesDigital ShowroomingPavithra KPas encore d'évaluation

- E-business in Bangladesh: Current Situation and Future OpportunitiesDocument7 pagesE-business in Bangladesh: Current Situation and Future OpportunitiesHimalay HimuPas encore d'évaluation

- Final Project On E-CommerceDocument82 pagesFinal Project On E-CommerceAniket Choughule25% (4)

- Marketing Management (Marketing Plan Part 1)Document38 pagesMarketing Management (Marketing Plan Part 1)Julianna GomezPas encore d'évaluation

- Consumer Perception Toward Online ShoppingDocument11 pagesConsumer Perception Toward Online ShoppingJIGNESH125Pas encore d'évaluation

- Evolving E-Commerce Market DynamicsDocument16 pagesEvolving E-Commerce Market DynamicsloveasonePas encore d'évaluation

- Digital Gold: Mastering E-Commerce Strategy for Maximum Business SuccessD'EverandDigital Gold: Mastering E-Commerce Strategy for Maximum Business SuccessPas encore d'évaluation

- Emerging Trends in McommerceDocument6 pagesEmerging Trends in McommercePrabhuPas encore d'évaluation

- Texas LS Notes 19-20Document2 pagesTexas LS Notes 19-20Jesus del CampoPas encore d'évaluation

- JVW 110Document2 pagesJVW 110Miguel Leon BustosPas encore d'évaluation

- Cambridge IGCSE: Computer Science 0478/12Document16 pagesCambridge IGCSE: Computer Science 0478/12Rodolph Smith100% (2)

- Sonochemical Synthesis of NanomaterialsDocument13 pagesSonochemical Synthesis of NanomaterialsMarcos LoredoPas encore d'évaluation

- Building MassingDocument6 pagesBuilding MassingJohn AmirPas encore d'évaluation

- Chapter 20: Sleep Garzon Maaks: Burns' Pediatric Primary Care, 7th EditionDocument4 pagesChapter 20: Sleep Garzon Maaks: Burns' Pediatric Primary Care, 7th EditionHelen UgochukwuPas encore d'évaluation

- UEME 1143 - Dynamics: AssignmentDocument4 pagesUEME 1143 - Dynamics: Assignmentshikai towPas encore d'évaluation

- Self-Learning Home Task (SLHT) : Describe The Impact ofDocument9 pagesSelf-Learning Home Task (SLHT) : Describe The Impact ofJeffrey FloresPas encore d'évaluation

- Polygon shapes solve complex mechanical problemsDocument6 pagesPolygon shapes solve complex mechanical problemskristoffer_mosshedenPas encore d'évaluation

- Communication in Application: WhatsappDocument18 pagesCommunication in Application: WhatsappNurul SuhanaPas encore d'évaluation

- MRI Week3 - Signal - Processing - TheoryDocument43 pagesMRI Week3 - Signal - Processing - TheoryaboladePas encore d'évaluation

- Water 07 02314Document36 pagesWater 07 02314Satyajit ShindePas encore d'évaluation

- Rozgar Sutra EnglishDocument105 pagesRozgar Sutra EnglishRisingsun PradhanPas encore d'évaluation

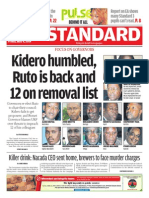

- The Standard 09.05.2014Document96 pagesThe Standard 09.05.2014Zachary Monroe100% (1)

- High Volume InstrumentDocument15 pagesHigh Volume Instrumentcario galleryPas encore d'évaluation

- The Meaning of Solar CookerDocument4 pagesThe Meaning of Solar CookerJaridah Mat YakobPas encore d'évaluation

- Reg OPSDocument26 pagesReg OPSAlexandru RusuPas encore d'évaluation

- Hics 203-Organization Assignment ListDocument2 pagesHics 203-Organization Assignment ListslusafPas encore d'évaluation

- Nozzle F Factor CalculationsDocument5 pagesNozzle F Factor CalculationsSivateja NallamothuPas encore d'évaluation