Académique Documents

Professionnel Documents

Culture Documents

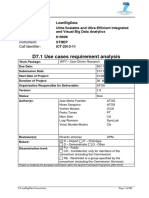

Use Case Specification

Transféré par

Farhan AliCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Use Case Specification

Transféré par

Farhan AliDroits d'auteur :

Formats disponibles

Example Use Case Specification:

Level 1 Identified

Use Case Name:

Withdraw Cash

Actor(s):

Any Bank Customer (primary)

Banking System (secondary)

Other Stakeholders:

All Banks (ATM owner and account owner)

LINK (communication between banks)

FSA (bank regulation)

Summary Description:

Allows any bank customer to obtain cash from their bank account.

Priority:

Must Have

Risk Level:

High

Status:

Identified

Use Case Specification - 1

Hippo Software Limited 2011

Example Use Case Specification:

Level 2 High Level

Use Case Name:

Withdraw Cash

Actor(s):

Any Bank Customer (primary)

Banking System (secondary)

Other Stakeholders:

All Banks (ATM owner and account owner)

LINK (communication between banks)

FSA (bank regulation)

Summary Description:

Allows any bank customer to obtain cash from their bank account.

Priority:

Must Have

Risk Level:

High

Status:

High Level

Pre-Condition:

The ATM is operational

The bank customer has a card to insert into the ATM

Post-Contition:

The bank customer has received their cash (and optionally a receipt)

The bank has debited the customers bank account and recorded

details of the transaction

Basic Path:

1. The customer enters their card into the ATM

2. The ATM verifies that the card is a valid bank card

3. The ATM requests a PIN code

4. The customer enters their PIN code

5. The ATM validates the bank card against the PIN code

6. The ATM presents service options including Withdraw

7. The customer chooses Withdraw

8. The ATM presents options for amounts

9. The customer selects an amount or enters an amount

10. The ATM verifies that it has enough cash in its hopper

11. The ATM verifies that the customer is below withdraw limits

12. The ATM verifies sufficient funds in the customers bank account

13. The ATM debits the customers bank account

14. The ATM returns the customers bank card

15. The customer takes their bank card

16. The ATM issues the customers cash

17. The customer takes their cash

Use Case Specification - 2

Hippo Software Limited 2011

Alternative Paths:

(identified only)

2a

2b

5a

5b

10a

10b

11a

12a

14a

15a

16a

17a

*a

*b

Business Rules:

(identified only)

B1:

B2:

B3:

B4:

B5:

Non-Functional

Requirements:

Invalid card

Card upside down

Stolen card

PIN invalid

Insufficient cash in the hopper

Wrong denomination of cash in the hopper

Withdrawal above withdraw limits

Insufficient funds in customers bank account

Bank card stuck in machine

Customer fails to take their bank card

Cash stuck in machine

Customer fails to take their cash

ATM cannot communicate with Banking System

Customer does not respond to ATM prompt

Format of PIN

Number of PIN retries

Service options

Amount options

Withdraw limits

(identified only)

NF1:

NF2:

NF3:

NF4:

NF5:

Time for complete transaction

Security for PIN entry

Time to allow collection of card and cash

Language support

Blind and partially blind support

Use Case Specification - 3

Hippo Software Limited 2011

Example Use Case Specification:

Level 3 Fully Detailed

Use Case Name:

Withdraw Cash

Actor(s):

Any Bank Customer (primary)

Banking System (secondary)

Other Stakeholders:

All Banks (ATM owner and account owner)

LINK (communication between banks)

FSA (bank regulation)

Summary Description:

Allows any bank customer to obtain cash from their bank account.

Priority:

Must Have

Risk Level:

High

Status:

Fully Detailed

Pre-Condition:

The ATM is operational

The bank customer has a card to insert into the ATM

Post-Contition:

The bank customer has received their cash (and optionally a receipt)

The bank has debited the customers bank account and recorded

details of the transaction

Basic Path:

1. The customer enters their card into the ATM

2. The ATM verifies that the card is a valid bank card

3. The ATM requests a PIN code

4. The customer enters their PIN code

5. The ATM validates the bank card against the PIN code

6. The ATM presents service options including Withdraw

7. The customer chooses Withdraw

8. The ATM presents options for amounts

9. The customer selects an amount or enters an amount

10. The ATM verifies that it has enough cash in its hopper

11. The ATM verifies that the customer is below withdraw limits

12. The ATM verifies sufficient funds in the customers bank account

13. The ATM debits the customers bank account

14. The ATM returns the customers bank card

15. The customer takes their bank card

16. The ATM issues the customers cash

17. The customer takes their cash

(Note: Steps 1-6 and related alternate paths, business rules and nonfunctional requirements could become a separate include use case at this

stage when it is recognised that they are reused for other use cases)

Use Case Specification - 4

Hippo Software Limited 2011

Alternative Paths:

(fully detailed)

2a

Invalid card

1. The ATM indicates that it is the wrong type of card

2. The ATM asks the customer to insert another card

3. Rejoin the basic path at step 2

2b

Card upside down

1. The ATM indicates that the card is upside down

2. The ATM asks the customer to insert the card again

3. Rejoin the basic path at step 2

5a

Stolen card

1. The ATM matches the card number to a stolen card

2. The ATM runs Process Stolen Card use case

3. End use case

(Note: Triggers an extend use case because logic of this alternate path is

complex with its own non-functional requirements and business rules)

5b

PIN invalid

1. The ATM indicates that the wrong PIN has be entered

2. If permitted number of tries is not exceeded, the ATM asks the

customer to enter their PIN again and rejoins the basic path at step 4

3. If permitted number of tries is exceeded, the ATM retains the card

and ends the use case

10a

Insufficient cash in the hopper

1. The ATM explains the limit on cash

2. The ATM asks the customer to enter a smaller amount

3. Rejoin the basic path at step 9

10b

Wrong denomination of cash in the hopper

1. The ATM explains the restriction on denomination

2. The ATM asks the customer to enter a different amount

3. Rejoin the basic path at step 9

11a

Withdrawal above withdraw limits

1. The ATM explains the withdrawal limit

2. The ATM asks the customer to enter a smaller amount

3. Rejoin the basic path at step 9

12a

Insufficient funds in customers bank account

1. The ATM explains the restriction on funds in bank account

2. The ATM asks the customer to enter a smaller amount

3. Rejoin the basic path at step 9

Use Case Specification - 5

Hippo Software Limited 2011

14a

Bank card stuck in machine

1. The ATM explains the machine malfunction

2. The ATM asks the customer to speak to bank staff

3. End use case

15a

Customer fails to take their bank card

1. The ATM prompts the customer to take their card

2. The ATM waits for a period of time

3. If card is not removed, the ATM retains the card

4. End use case

16a

Cash stuck in machine

1. The ATM explains the machine malfunction

2. The ATM asks the customer to speak to bank staff

3. End use case

17a

Customer fails to take their cash

1. The ATM prompts the customer to take their cash

2. The ATM waits for a period of time

3. If cash is not removed, the ATM retains the cash

4. End use case

*a

ATM cannot communicate with Banking System

1. The ATM explains the communication malfunction

2. The ATM asks the customer to speak to bank staff

3. End use case

*b

Customer does not respond to ATM prompt

1. The ATM prompts the customer to take action

2. The ATM waits for a period of time

3. If action is not taken, the ATM returns the card

4. Customer takes their card

5. End use case

Business Rules:

(fully detailed)

B1:

Format of PIN

The PIN is a 4 digit number which is stored on a chip in the card

B2:

Number of PIN retries

The customer is allowed to try re-entering their PIN 3 times

Use Case Specification - 6

Hippo Software Limited 2011

B3:

Service options

The current service options are: Enquire Balance, Withdraw, Deposit,

Change PIN, Transfer, Pay Bill, Top-up Mobile

B4:

Amount options

The current amount options are: 10, 20, 40, 60, 100

B5:

Withdraw limits

No more than 250 can be withdrawn from a single bank account each

day

Non-Functional

Requirements:

(fully detailed)

NF1: Time for complete transaction

The withdraw transaction should typically take less than 3 minutes to

complete

NF2: Security for PIN entry

The PIN should be encoded and shown as * symbols on the screen

when entered by the customer

NF3: Time to allow collection of card and cash

The ATM should leave the cash and cash for 30 seconds, and then

draw them back inside the machine if not taken by the customer within

this time limit

NF4: Language support

The ATM should support the following languages: English, French,

German and Spanish

NF5: Blind and partially blind support

The keyboard should contain Braille and it instructions should be

printed on the screen in large 36 point font size.

Use Case Specification - 7

Hippo Software Limited 2011

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hospital Management System Project 4Document3 pagesHospital Management System Project 4Farhan Ali100% (1)

- Created by Trial Version: Student Employee Card IssueDocument1 pageCreated by Trial Version: Student Employee Card IssueFarhan AliPas encore d'évaluation

- Created by Trial Version: Student Employee Card IssueDocument1 pageCreated by Trial Version: Student Employee Card IssueFarhan AliPas encore d'évaluation

- Bba Syllabus Sem 1Document8 pagesBba Syllabus Sem 1Farhan AliPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Uml GuidelinesDocument5 pagesUml GuidelinesNikhil GoelPas encore d'évaluation

- Disease Prediction and Drug Recommendation Using Machine LearningDocument26 pagesDisease Prediction and Drug Recommendation Using Machine LearningTelu Tejaswini100% (1)

- Evaluation of Machine Learning Algorithms For The Detection of Fake Bank CurrencyDocument41 pagesEvaluation of Machine Learning Algorithms For The Detection of Fake Bank CurrencySanthosh Reddy100% (1)

- AI Enterprise Guide enDocument15 pagesAI Enterprise Guide enSamit AroraPas encore d'évaluation

- Case Study InceptionDocument24 pagesCase Study InceptionAlexPas encore d'évaluation

- INF20003 Unit Outline Semester 2 2020-1Document10 pagesINF20003 Unit Outline Semester 2 2020-1Hoàng DũngPas encore d'évaluation

- SDS NewDocument14 pagesSDS NewPrashi JainPas encore d'évaluation

- UseCase Specification TemplateDocument20 pagesUseCase Specification TemplateKumar Siva0% (1)

- Online Exam Registration SystemDocument7 pagesOnline Exam Registration SystemShravan thouti100% (3)

- Software Life-Cycle Management: Openup and Architecture Handbook OverviewDocument58 pagesSoftware Life-Cycle Management: Openup and Architecture Handbook Overviewtongaboardi2363Pas encore d'évaluation

- Grugs VerificiationDocument66 pagesGrugs VerificiationMathew AdebunmiPas encore d'évaluation

- Functional, Process and Non-Functional ViewsDocument21 pagesFunctional, Process and Non-Functional ViewsAnonymous rlCOoiPas encore d'évaluation

- Analytics in Banking:: Time To Realize The ValueDocument11 pagesAnalytics in Banking:: Time To Realize The ValuePrashant JindalPas encore d'évaluation

- Interaction Diagrams For Example ATM SystemDocument7 pagesInteraction Diagrams For Example ATM SystemMuhammad Yaqub Mohsin BhattiPas encore d'évaluation

- Business Analyst ResumeDocument5 pagesBusiness Analyst Resumecnu29Pas encore d'évaluation

- L3 UML-Part2 Chapter2Document62 pagesL3 UML-Part2 Chapter2goktuPas encore d'évaluation

- Logic Midterm Reviewer PDFDocument8 pagesLogic Midterm Reviewer PDFMariz TrajanoPas encore d'évaluation

- Sol ArcDocument26 pagesSol ArcpatilparagossPas encore d'évaluation

- The Ultimate Guide To Testing and BDD PDFDocument25 pagesThe Ultimate Guide To Testing and BDD PDFAdmin LSP Dindik JatimPas encore d'évaluation

- System MOdelingDocument73 pagesSystem MOdelingSadaf ManoPas encore d'évaluation

- Lab Manual: Sub: Software Engineering Lab (6KS07) Software Engineering Lab 6KS07 Software Engineering Lab P-2, C-1Document11 pagesLab Manual: Sub: Software Engineering Lab (6KS07) Software Engineering Lab 6KS07 Software Engineering Lab P-2, C-1Computer Science & Engg, PusadPas encore d'évaluation

- NahomDocument23 pagesNahomnahom workuPas encore d'évaluation

- Criminal Record System Documentation FinalDocument58 pagesCriminal Record System Documentation FinalTekurCoderPas encore d'évaluation

- SRS - Web Publishing SystemDocument31 pagesSRS - Web Publishing Systemthegauravchatterjee50% (2)

- Use Cases Requirement AnalysisDocument86 pagesUse Cases Requirement AnalysisSureshChandrasekaranPas encore d'évaluation

- Online Hospital Management SystemDocument32 pagesOnline Hospital Management SystemSantosh BiswalPas encore d'évaluation

- Dental Clinic Management SystemDocument157 pagesDental Clinic Management SystemFreeProjectz.com94% (54)

- Online House Rent Management System in Debre MarkosDocument63 pagesOnline House Rent Management System in Debre MarkosFetiya KedirPas encore d'évaluation

- Cricbuzz Project ManagementDocument41 pagesCricbuzz Project Managementyuvaraj romeo100% (1)

- Final DocumentationDocument55 pagesFinal Documentationshakibul islamPas encore d'évaluation