Académique Documents

Professionnel Documents

Culture Documents

Econ2209 Week 3

Transféré par

jinglebelliezCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Econ2209 Week 3

Transféré par

jinglebelliezDroits d'auteur :

Formats disponibles

Business Forecasting

ECON2209

Slides 03

Lecturer: Minxian Yang

BF-03

my, School of Economics, UNSW

Ch.4 Statistical Graphics

Lecture Plan

Graphs of data: merits and limitations

Examples: use graphs to show data features

Time series differ from random sample

Components in time series

Classical decomposition

BF-03

my, School of Economics, UNSW

Ch.4 Statistical Graphics

Statistical Graphics

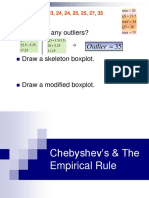

Example: Anscombes quartet

obs

X1

Y1

X2

Y2

X3

Y3

X4

Y4

1

2

3

4

5

6

7

8

9

10

11

10

8

13

9

11

14

6

4

12

7

5

8.04

6.95

7.58

8.81

8.33

9.96

7.24

4.26

10.84

4.82

5.68

10

8

13

9

11

14

6

4

12

7

5

9.14

8.14

8.74

8.77

9.26

8.10

6.13

3.10

9.13

7.26

4.74

10

8

13

9

11

14

6

4

12

7

5

7.46

6.77

12.74

7.11

7.81

8.84

6.08

5.39

8.15

6.42

5.73

8

8

8

8

8

8

8

19

8

8

8

6.58

5.76

7.71

8.84

8.47

7.04

5.25

12.5

5.56

7.91

6.89

Why identical

regression line?

BF-03

y = 3.00 + 0.50 x,

(1.12)

R 2 = 0.67

(0.12)

my, School of Economics, UNSW

Ch.4 Statistical Graphics

Example

Scatter plots explain it vividly.

Y1 vs. X1

Y2 vs. X2

11

11

10

10

9

8

Y2

Y1

8

7

7

6

6

3

3

10 11 12 13 14 15

X1

Y3 vs. X3

10 11 12 13 14 15

X2

Y4 vs. X4

13

13

12

12

11

11

10

10

Y4

Y3

9

8

9

8

7

6

6

5

4

3

10 11 12 13 14 15

10

X3

BF-03

12

14

16

18

20

X4

my, School of Economics, UNSW

Ch.4 Statistical Graphics

Advantages of graphs

Graphs represent data visually and help us to see

data features/patterns.

A graph is worth a thousand of words.

Graphs make anomalies/outliers apparent.

Graphs are effective in comparing data sets.

But it is hard to visualise high dimensional data.

BF-03

my, School of Economics, UNSW

Ch.4 Statistical Graphics

Scatter plots

Useful to reveal the relationship between two

variables.

ls y c z

======================================================

Variable

Coefficient

Std. Error

t-Statistic

Prob.

eg. xyz.dat

C

10.04891

0.272825

36.83280

0.0000

Z

-0.364783

Y vs. X

0.242923

-1.501641

0.1400

Y vs. Z

13

13

12

12

11

11

10

10

14

14

Weak relation?

It could be

y = b0+b1z+b2x + u

5

-3

-2

-1

-3

-2

-1

BF-03

my, School of Economics, UNSW

Ch.4 Statistical Graphics

Scatter plots

eg. xyz.dat. Partial relationship

of y and z (after controlling for x):

regress y on c x to get resid01;

regress z on c x to get resid02;

scatter plot resid01 against resid02.

EViews:

Type in top panel

ls y c x

On the result window, click

Proc, Make Residual Series,

resid01 (in Name for resid series), OK

Type in top panel

ls z c x

On the result window, click

Proc, Make Residual Series,

resid02 (in Name for resid series), OK

RESID01 vs. RESID02

Type in top panel

group grp resid02 resid01

grp.linefit

4

3

RESID01

Also compare the result of

ls resid01 resid02

against the result of

ls y c x z

1

0

-1

-2

-3

-3

-2

-1

Dependent Variable: Y,

Variable

Coefficient

C

9.884732

X

1.073140

Z

-0.638011

Sample: 1 48

Std. Error

0.190297

0.150341

0.172499

t-Statistic

51.94359

7.138031

-3.698642

Prob.

0.0000

0.0000

0.0006

RESID02

BF-03

my, School of Economics, UNSW

Ch.4 Statistical Graphics

Time series plot

eg. liquor.dat, monthly sales, 1967.01 1994.12

trend (increase over time on average)

seasonality (reoccurring pattern: Dec high, Feb low)

2800

Liquor Sales

2400

2000

1600

1200

800

400

68 70 72 74 76 78 80 82 84 86 88 90 92

BF-03

my, School of Economics, UNSW

Ch.4 Statistical Graphics

Time series plot

eg. US 10-year treasury bond yield (monthly, %), 530obs

persistent (gentle moves with few large jumps)

random trend (ups & downs without a clear pattern)

10-year T-bond Yield

16

14

12

10

8

6

4

2

65

BF-03

70

75

80

85

90

95

my, School of Economics, UNSW

00

05

Ch.4 Statistical Graphics

Time series plot

eg. Change of US 10-year treasury bond yield (monthly)

fluctuate about 0 (never move away for long)

volatile (change direction frequently with large spikes)

yt = yt yt 1

Change of 10-year T-bond Yield

EViews:

Read in bond10y.csv

File, Open, Foreign Data as Workfile,

bond10y.csv (in File name), Open,

Finish

Type in top panel

plot close

genr dy=close-close(-1)

plot dy

hist dy

-1

-2

65

BF-03

70

75

80

85

90

95

00

05

my, School of Economics, UNSW

10

Ch.4 Statistical Graphics

Time series plot

Time series plots reveal

trends

seasonalities

volatilities (mount of variation)

breaks (pattern changes)

outliers (unusual observations)

in data.

First thing in time series analysis: plotting data

BF-03

my, School of Economics, UNSW

11

Ch.4 Statistical Graphics

Histogram

Describes how data are distributed.

(frequency distribution)

eg. Change of US 10-year treasury bond yield (monthly)

Thick-tailed (caused by a small number of large jumps)

Change of 10-year T-bond Yield

100

Sample 1962M01 2006M02

Observations 529

80

60

40

20

Mean

Median

Maximum

Minimum

Std. Dev.

Skewness

Kurtosis

0.000926

0.010000

1.590000

-1.880000

0.348751

-0.280792

6.565498

Jarque-Bera

Probability

287.1622

0.000000

Normal distribution:

skewness = 0,

kurtosis = 3.

At the 5% level,

reject normality if

Jarque-Bera > 5.99.

0

-1.5

BF-03

-1.0

-0.5

0.0

0.5

1.0

1.5

my, School of Economics, UNSW

12

Ch.4 Statistical Graphics

Empirical cumulative distribution (cdf)

Another way to look at how data are distributed.

eg. Change of US 10-year treasury bond yield (monthly)

Empirical CDF

80% of

observations are

below 0.23

1.0

Probability

0.8

0.6

0.4

0.2

0.0

-1.6

-1.2

-0.8

-0.4

0.0

0.4

0.8

1.2

Change

BF-03

my, School of Economics, UNSW

13

Ch.4 Statistical Graphics

QQ-plot

Check how a theoretical distribution fits data.

For a perfect fit, the QQ-plot is a straight line.

eg. Change of US 10-year

treasury bond yield:

It appears non-normal.

std normal distribution:

(1/529)th quantile = -2.90

6

4

Normal Quantile

data with 529 observations:

(1/529)th quantile = -1.88

Theoretical Quantile-Quantile

(-1.88, -2.90)

2

0

-2

-4

-6

-2

-1

Change

BF-03

my, School of Economics, UNSW

14

Ch.4 Statistical Graphics

EViews

Commands for the examples

EViews:

Read in bond10y.csv

File, Open, Foreign Data as Workfile,

bond10y.csv (in File name), Open,

Finish

Type in top panel

genr dy=close-close(-1)

plot close dy

dy.line

dy.hist

dy.distplot cdf

dy.qqplot

scalar q80=@quantile(dy, .8)

scalar qn529=@qnorm(1/529)

BF-03

my, School of Economics, UNSW

15

Ch.4 Statistical Graphics

Style of graphs

Easy to understand

eg. indicate the meaning of axes

Highlight the point you are trying to make

Informative

eg. make self-explained graphs

Attractive

eg. use of proper colours and symbols

Avoid chart junk

eg. abuse of colours, shadings, grids,

BF-03

my, School of Economics, UNSW

16

Ch.4 Statistical Graphics

Decomposition of a Time Series

Time series versus random sample

A random sample

is a set of independent observations on a variable,

often collected at one point in time.

eg. Income of a randomly-selected household

Med-insurance status of a randomly-selected household

A time series

is a set of observations on a variable observed

over consecutive time intervals.

eg. T-bond rate, gold price, retail sales, (daily, annual,...)

BF-03

my, School of Economics, UNSW

17

Ch.4 Statistical Graphics

Features of economic time series data

Trend, seasonality, fluctuation/cycle

Autocorrelation (future is influenced by present)

eg. Department stores turnover: 1982.04 1999.10

Trend (sales growing), Seasonality (peak & trough repeats)

Cycle (random fluctuations)

8.0

2000

7.6

1600

7.2

1200

6.8

800

6.4

400

6.0

5.6

0

82

84

86

88

90

92

94

96

98

82

84

Retail Turnover ($M)

BF-03

my, School of Economics, UNSW

86

88

90

92

94

96

98

log Retail Turnover

18

Ch.4 Statistical Graphics

Features of economic time series data

eg. Gold price ($US per fine ounce, London 3pm, 1/80-11/99)

- sub-samples very different; varying trends (randomly);

- persistent with few large jumps

Gold Price (USD/fine ounce, London 3pm)

700

600

500

400

300

200

80

BF-03

82

84

86

88

90

92

94

96

98

my, School of Economics, UNSW

19

Ch.4 Statistical Graphics

Trend, seasonality and cycle

Let yt be a time series (observable).

Trend, mt, is the smoothly evolving part of yt.

It represents the long-run movement of yt.

log Retail Turnover: Trend

eg.

Trend in log retail turnover

8.0

7.6

7.2

6.8

6.4

6.0

5.6

82

BF-03

84

my, School of Economics, UNSW

86

88

90

92

94

96

98

20

Ch.4 Statistical Graphics

Trend, seasonality and cycle

Seasonality, st, is the repetitive part of yt.

It repeats over a fixed number of periods.

eg. quartly seasonality repeats over 4 quarters.

eg. Log retail turnover: raw trend = detreded

= seasonality + cycle

log Retail Turnover: Trend & Seasonality

Cycle

Raw-Trend

Seasonality

.8

7

.4

6

5

.0

.12

.08

.00

-.04

-.08

-1

-.12

82

BF-03

-.4

.04

84

86

88

90

92

94

96

98

84

my, School of Economics, UNSW

86

88

90

92

94

96

98

21

Ch.4 Statistical Graphics

Trend, seasonality and cycle

Cycle, xt, is the random fluctuation in yt, aka

irregular component. It is a RV for each t.

eg. Interesting to know how xt and xt -1 are associated.

eg. Log retail turnover: cycle = raw trend seasonality

Theoretical Quantile-Quantile

Cycle

3

.08

Normal Quantile

.12

.04

.00

-.04

1

0

-1

-.08

-2

-.12

-3

-.12

82

84

86

88

90

92

94

96

98

-.08

-.04

.00

.04

.08

.12

Cycle

BF-03

my, School of Economics, UNSW

22

Ch.4 Statistical Graphics

Classical decomposition of yt

CD is a model that splits the observable time

series, yt, into three unobserved components:

Normalized to zero:

trend (mt), seasonality(st), cycle(xt)

so that each

component is

Additive decomposition

identified.

yt = mt + st + xt ,

st + p = st ,

s

i =1

t +i

= 0,

E( xt ) = 0,

where p is the number of periods in a season.

eg. p = 12 for monthly series

Multiplicative decomposition: Yt = Mt St Xt

But log(Yt) has an additive decomposition.

BF-03

my, School of Economics, UNSW

23

Ch.4 Statistical Graphics

Classical decomposition of yt

e.g. Department stores turnover: 1982.04 1999.10

log Retail Turnover

Trend

8.0

8.0

7.6

7.5

7.2

7.0

6.8

6.5

6.4

6.0

6.0

5.6

5.5

82

84

86

88

90

92

94

96

98

82

84

86

88

Seasonality

90

92

94

96

98

Cycle

1.5

.3

1.0

.2

.1

0.5

.0

0.0

-.1

-0.5

-.2

-1.0

-.3

82

BF-03

84

86

88

90

92

94

96

98

my, School of Economics, UNSW

82

84

86

88

90

92

94

96

98

24

Ch.4 Statistical Graphics

Data and EViews

EViews:

Read in data by clicking

File, New, Workfile, Dated (in Workfile structure), Monthly (in Frequency),

1982:01 (in Start date), 1999:10 (in End date), OK;

Proc (on Workfile window), Import, Import from file,

departstoresTurnover05.xls (in File name), Open, Finish, OK

Time series plot of log sales by typing in top panel

genr y=log(sales)

y.line

Generate MA trend

genr ma12b=(y(-6)+y(-5)+y(-4)+y(-3)+y(-2)+y(-1)+y+y(1)+y(2)+y(3)+y(4)+y(5))/12

genr ma12f=(y(-5)+y(-4)+y(-3)+y(-2)+y(-1)+y+y(1)+y(2)+y(3)+y(4)+y(5)+y(6))/12

genr ma12=0.5*(ma12b+ma12f)

De-trended series

genr ydt=y-m12

plot y ma12

plot y ma12 ydt

BF-03

my, School of Economics, UNSW

25

Ch.4 Statistical Graphics

Summary

List the types of graphs we used today.

Why plotting data is important?

What are the major components in a time series?

What is the additive decomposition?

Why must the seasonal component sum to zero

over a season?

Why is the mean of cycle component normalised

to zero?

BF-03

my, School of Economics, UNSW

26

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Chicago Booth BUS 41100 Practice Final Exam Fall 2020 SolutionsDocument7 pagesChicago Booth BUS 41100 Practice Final Exam Fall 2020 SolutionsJohnPas encore d'évaluation

- Standad DevDocument8 pagesStandad DevMuhammad Amir AkhterPas encore d'évaluation

- Stat 101 Mid Term 2021Document6 pagesStat 101 Mid Term 2021صلاح الصلاحيPas encore d'évaluation

- Chapter 6-8 Sampling and EstimationDocument48 pagesChapter 6-8 Sampling and EstimationAkashPas encore d'évaluation

- Chapter 5 (Fractiles) (Kyna B. David)Document26 pagesChapter 5 (Fractiles) (Kyna B. David)KBDPas encore d'évaluation

- Artikel Jurnal AYUDocument16 pagesArtikel Jurnal AYUAyu RiskyPas encore d'évaluation

- Cocjin, Lanceta, Taypen Group7Document12 pagesCocjin, Lanceta, Taypen Group7Alessa LamesPas encore d'évaluation

- DRC FX 0 Afc4Document116 pagesDRC FX 0 Afc4James ZhanPas encore d'évaluation

- EBE Dummy VariablesDocument9 pagesEBE Dummy VariablesHarsha DuttaPas encore d'évaluation

- Soal Nomor 1: Sgot/Sgpt Hemoglobin Trigliserid Totalkolestrol HDL LDL N Valid Missing Mean Std. DeviationDocument18 pagesSoal Nomor 1: Sgot/Sgpt Hemoglobin Trigliserid Totalkolestrol HDL LDL N Valid Missing Mean Std. DeviationRaudhah SimahatePas encore d'évaluation

- Brand Image Terhadap Loyalitas Pelanggan J.Co Donuts & Coffee Di PlazaDocument17 pagesBrand Image Terhadap Loyalitas Pelanggan J.Co Donuts & Coffee Di PlazaPutri AnisaPas encore d'évaluation

- Lesson 5 - Chebyshev and Empirical RuleDocument24 pagesLesson 5 - Chebyshev and Empirical RuleAdam BrionesPas encore d'évaluation

- Reka Bentuk EksperimenDocument31 pagesReka Bentuk Eksperimenshantiny suppiayah100% (1)

- TQ Statistics 11 - Q3 UPDATEDDocument2 pagesTQ Statistics 11 - Q3 UPDATEDanon_754485983Pas encore d'évaluation

- Holland 1986Document17 pagesHolland 1986Anthony OrihuelaPas encore d'évaluation

- SamplingDocument66 pagesSamplingMerleAngeliM.SantosPas encore d'évaluation

- MDM4U Formula Sheet New 2021Document2 pagesMDM4U Formula Sheet New 2021Andrew StewardsonPas encore d'évaluation

- Statistic Reviewer (Masters Degree)Document11 pagesStatistic Reviewer (Masters Degree)Japhet TendoyPas encore d'évaluation

- Probability and StatisticsDocument29 pagesProbability and StatisticsChe Rry100% (1)

- Midterm ExamDocument7 pagesMidterm ExamkidhafPas encore d'évaluation

- R&D Dan Intangible Asset Pada Nilai Perusahaan: Kinerja Keuangan Sebagai Variabel Intervening PengaruhDocument22 pagesR&D Dan Intangible Asset Pada Nilai Perusahaan: Kinerja Keuangan Sebagai Variabel Intervening PengaruhTsania FerrariniPas encore d'évaluation

- Sharpe Single Index ModelDocument25 pagesSharpe Single Index ModelWeeping MonkPas encore d'évaluation

- ENME392-Sample FinalDocument8 pagesENME392-Sample FinalSam AdamsPas encore d'évaluation

- Value at RiskDocument5 pagesValue at Riskgaurav112011Pas encore d'évaluation

- By Okite MosesDocument33 pagesBy Okite MosesBanolka NobPas encore d'évaluation

- Machine Learning NotesDocument115 pagesMachine Learning Notescocacola_thanda100% (1)

- Multivariate Analysis of Variance (MANOVA) PDFDocument20 pagesMultivariate Analysis of Variance (MANOVA) PDFscjofyWFawlroa2r06YFVabfbajPas encore d'évaluation

- University of Central Punjab Faculty of EngineeringDocument3 pagesUniversity of Central Punjab Faculty of EngineeringYasirPas encore d'évaluation

- Ilmu Ukur Kayu Rahmadini Syakira Putri 2004016036Document8 pagesIlmu Ukur Kayu Rahmadini Syakira Putri 2004016036RahmadiniputriPas encore d'évaluation

- Section 1: Practice Questions (Students Are To Attempt All These Questions) Concept of Random and Non-Random Samples 1 (2007/NJC/P2/Q6i)Document15 pagesSection 1: Practice Questions (Students Are To Attempt All These Questions) Concept of Random and Non-Random Samples 1 (2007/NJC/P2/Q6i)Timothy HandokoPas encore d'évaluation