Académique Documents

Professionnel Documents

Culture Documents

Diskusi1-Determinan Customer Satisfaction Retail Banking

Transféré par

Niki PaikitoCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Diskusi1-Determinan Customer Satisfaction Retail Banking

Transféré par

Niki PaikitoDroits d'auteur :

Formats disponibles

Determinants of customer satisfaction in retail

banking

Terrence Levesque

Associate Professor, School of Business and Economics, Wilfrid Laurier

University, Waterloo, Ontario, Canada

Gordon H.G. McDougall

Professor, School of Business and Economics, Wilfrid Laurier University,

Waterloo, Ontario, Canada

Points out that customer

satisfaction and retention are

critical for retail banks, and

investigates the major determinants of customer satisfaction and future intentions in

the retail bank sector. Identifies the determinants which

include service quality dimensions (e.g. getting it right the

first time), service features

(e.g. competitive interest

rates), service problems,

service recovery and products

used. Finds, in particular, that

service problems and the

banks service recovery ability

have a major impact on customer satisfaction and intentions to switch.

Introduction

In an era of mature and intense competitive

pressures, many firms are focusing their

efforts on maintaining a loyal customer base.

This is particularly true in the financial services sector where deregulation has created

an environment that allows consumers considerable choice in satisfying their financial

needs. In response, many retail banks are

directing their strategies towards increasing

customer satisfaction and loyalty through

improved service quality.

Retail banks are pursuing this strategy, in

part, because of the difficulty in differentiating based on the service offering. Typically,

customers perceive very little difference in

the services offered by retail banks and any

new offering is quickly matched by competitors (Coskun and Frohlich, 1992; Devlin et al.,

1995). Also, retail banks, like many other

service providers, have discovered that

increasing customer retention rates can have

a substantial impact on profits.

The task facing these managers is to focus

on those activities that result in meeting or

exceeding customer expectations. The question is: what are the major determinants of

customer satisfaction? The main objective of

this paper is to identify these determinants in

the retail bank sector. To accomplish the

objective, information was collected from 325

respondents who rated their main financial

institution on aspects of service quality, service problem recovery, service features, product usage, satisfaction and future intentions.

The results provide insights for managers

concerned with improving customer satisfaction in retail banking.

Background

International Journal of

Bank Marketing

14/7 [1996] 1220

MCB University Press

[ISSN 0265-2323]

[ 12 ]

The rewards to firms that establish a loyal

customer base have been well documented

(Armstrong and Symonds, 1991; Heskett et al.,

1994; Reichheld and Sasser, 1990). In general,

increased loyalty leads to lower costs of servicing the firms customers, reduced marketing expenditures, increased business from

the existing customer base and greater profits. These rewards are particularly true in the

retail banking sector. By increasing loyalty, a

retail bank:

reduces its servicing costs (i.e. accounts do

not have to be opened or closed, and credit

ratings do not have to be established;

gains knowledge of the financial affairs and

needs of its customers (thereby allowing

effective and efficient targeting); and

has an opportunity to cross-sell existing

and new products and services.

In one case, a retail bank that increased its

customer retention rates by 5 per cent

increased its profits by 85 per cent (Reichheld

and Sasser, 1990).

Improving customer satisfaction, and

thereby retention rates, can come from a

variety of activities available to the firm. The

existing evidence suggests that major gains

in customer satisfaction are likely to come

from improvements in:

service quality;

service features; and

customer complaint handling.

Service quality

Not surprisingly, there are strong linkages

between service quality dimensions (e.g.

courteous service providers) and overall

customer satisfaction (Anderson and

Sullivan, 1993). However, there has been considerable debate as to the basic dimensions of

service quality (see Brown et al., 1993 and

Cronin and Taylor, 1992, for reviews), the

measurement of these dimensions (Brown et

al., 1993; Parasuraman et al., 1993; Smith,

1995; Teas, 1993), and the components of customer satisfaction (Hausknecht, 1990; Yi,

1990). Surprisingly, little empirical research

has examined the importance of service quality dimensions in determining customer

satisfaction (Fisk et al., 1993).

Extensive research has been conducted on

developing and measuring service quality

(Brown et al., 1993; Cronin and Taylor, 1992;

Parasuraman et al., 1985, 1988; Teas, 1993). A

review of this literature suggests the following:

The contention that service quality consists

of five basic dimensions (Parasuraman et

al., 1988) is very questionable (Brown et al.,

1993; Cronin and Taylor, 1992; Teas, 1993).

Instead, the number and composition of the

Terrence Levesque and

Gordon H.G. McDougall

Determinants of customer

satisfaction in retail banking

International Journal of

Bank Marketing

14/7 [1996] 1220

service quality dimensions are probably

dependent on the service setting (Brown et

al., 1993; Carman, 1990). Empirical evidence

and theoretical arguments suggest that

there may be two overriding dimensions to

service quality; the core or outcome aspects

(contractual) of the service, and the relational or process aspects (customeremployee relationship) of the service (Grnroos, 1985; McDougall and Levesque, 1994;

Morgan and Piercy, 1992; Parasuraman et

al., 1991b).

The contention that service quality should

be conceptualized and measured as a gap

between expectations and performance is

very questionable (Brown et al., 1993;

Cronin and Taylor, 1994; Smith, 1995; Teas,

1994). The evidence suggests that service

quality should be based on performance

measures alone (Brown et al., 1993; Cronin

and Taylor, 1994; Teas, 1994).

Items used to measure service quality

should reflect the specific service setting

under investigation (Carman, 1990).

To elaborate on the two major dimensions of

service quality, Parasuraman et al. (1991b)

summarized the nature of the core (outcome)

and relational (process) constructs:

[While] reliability is largely concerned with

the service outcome, tangibles, responsiveness, assurance, and empathy are more

concerned with the service process.

Whereas customers judge the accuracy and

dependability (i.e. reliability) of the delivered service, they judge the other dimensions as the service is being delivered (p. 41).

While the number of underlying dimensions

has been shown to vary with the service setting, it appears reasonable to suggest that the

service core and relational dimensions will

emerge in nearly all cases as they form the

basis for the service.

Service features

Customer satisfaction is also related to the

service offering. With retail banking, the

convenience and competitiveness of the

providers offerings can be expected to affect

a customers overall satisfaction and ongoing

patronage. Research has shown that location

is a major determinant of bank choice

(Anderson et al., 1976; Laroche and Taylor,

1988; Thwaites and Vere, 1995). Underlying

location are the customer benefits of convenience and accessibility which are enabling

factors that make it easy for the customer to

do business with the bank. The banks ability

to deliver these benefits on an ongoing basis

to its existing clientele will probably impact

on customer satisfaction.

Another determinant of bank choice is

competitive interest rates (Laroche and

Taylor, 1988). While differences in rates,

either savings or borrowings, are likely to be

minimal between competing banks,

customers are concerned that they are getting competitive rates on savings or loans

because of the impact on their financial situation. Again, customer satisfaction is likely to

be influenced by the perceived competitiveness of the banks interest rates.

Customer complaint handling

A major reason why customers switch service

providers is unsatisfactory problem resolution (Hart et al., 1990). When customers face a

problem, they may respond by exiting

(switching to a new supplier), voicing

(attempting to remedy the problem by complaining) or loyalty (staying with the supplier

anticipating that things will get better)

(Hirschman, 1970). Given that customers of

retail banks have relatively high switching

costs, it is likely that a dissatisfying experience will evoke a passive reaction (no complaint) or a complaint. Given that the customer complains, the banks response can

lead to customer states ranging from dissatisfaction to satisfaction. In fact, anecdotal evidence suggests that when the service

provider accepts responsibility and resolves

the problem, the customer becomes bonded

to the organization (Hart et al., 1990). When

customers complain, they give the firm a

chance to rectify the problem and, interestingly, if the firm recovers successfully, to

increase loyalty and profits (Fornell and

Wernerfelt, 1987). Thus, customer complaint

handling can have an influence on customer

satisfaction and retention.

Situational factors

To date, little empirical evidence exists as to

how customer product usage patterns impact

on customer satisfaction. Customers or segments with different needs or usage patterns

may have different determinants of customer

satisfaction. In the retail banking sector,

customers who use particular products (e.g.

loans or mortgages) may focus on service

features, such as competitive interest rates,

more than customers who do not hold these

products. Thus, the determinants of customer

satisfaction towards the service provider may

vary depending on customer or segment

characteristics.

Customer satisfaction

While customer retention is the goal of the

service provider, surrogate measures are

typically used owing to the constraints

involved in longitudinal studies. These measures relate to attitudes or future intentions

towards the service provider. There is sufficient evidence to suggest that customer

[ 13 ]

Terrence Levesque and

Gordon H.G. McDougall

Determinants of customer

satisfaction in retail banking

International Journal of

Bank Marketing

14/7 [1996] 1220

satisfaction can and should be viewed as an

attitude (Yi, 1990). For example, in retail

banking there is an ongoing relationship

between the service provider and the customer. Here, customer satisfaction is based on

an evaluation of multiple interactions. For

this investigation, satisfaction is considered

as a composite of overall customer attitudes

towards the service provider that incorporates a number of measures.

Three frequently used measures are overall

service quality, meeting expectations and

customer satisfaction (Hausknecht, 1990;

Heskett et al., 1994; Jones and Sasser, 1995).

Also, typical measures of future intentions

are recommending the service to a friend and

propensity to switch (Heskett et al., 1994).

While there are some problems with using

either customer satisfaction or future intention measures to capture future behaviour,

the inclusion of multiple measures reduces

the problems.

Summary

In summary, the plan is to investigate the role

of service quality, service features, service

problems and situational factors on customer

satisfaction and future intentions with their

main financial institution. The results should

provide retail bank managers with a better

understanding of the drivers of customer

satisfaction in this service setting.

The next section details the methodology of

the study, followed by the results.

Methodology

Measures used

The major goal of this study was to identify

the drivers of customer satisfaction in retail

banking. To begin, an inventory of service

quality items was identified. Prior research

on SERVQUAL (Carman, 1990; Cronin and

Taylor, 1992; Parasuraman et al., 1988, 1991a)

provided items to measure the core and relational dimensions of service quality (Table I).

In addition, two items were selected to measure the tangible dimension, another potential driver of customer satisfaction (Parasuraman et al., 1988).

Also, the bank marketing literature provided items on service features ( LeBlanc and

Nguygen, 1988; Lewis, 1991; Teas and Wong,

1991). These items might be considered as

enabling features, related to convenience and

accessibility, that contribute to service quality by making the service easier or more

comfortable for the customer. Enabling features include convenience, as measured by

branch locations and automatic teller

machines, the clarity of bank statements

and communications, range of services and

[ 14 ]

accessibility as defined by the banks internal

and external physical layout. The common

aspect of these items is that they enable customers to conduct their business with the

service provider more readily and easily.

Consequently, these items may contribute to

the overall value of a customers experience

with the service provider.

An item was also added on the perceived

competitiveness of the banks interest rates.

The service marketing literature has concentrated on items measuring service quality to

determine customer satisfaction (Parasuraman et al., 1991b). Missing in this discussion

is the role that the firms pricing policies play

in the customers evaluation of the financial

institution. Because customers switch brands

or banks in reaction to pricing policies (part

of the service offering), they may perceive

this feature as part of customer satisfaction.

For this reason, the item was included in the

questionnaire.

In total, 17 items were selected to measure

service quality and service features. Respondents were asked to identify their main financial institution and then to evaluate this institution on the 17 items (Table I). All items were

measured on seven-point Likert scales from 1

(Strongly disagree) to 7 (Strongly agree).

Three items were used to measure

customer satisfaction and two items to measure future intentions towards the service

provider (Table I). These measures have frequently been used in both academic and practitioner studies of customer satisfaction

(Brown et al., 1993; Hausknecht, 1990; Heskett

et al., 1994; Jones and Sasser, 1995; Yi, 1990).

Information on significant service problems was obtained by asking respondents:

if they had encountered a problem with

their main financial institution in the past

six months;

if they had, had they complained; and

if they had complained, how satisfied were

they with the banks response (five-point

satisfaction scale).

Information on financial services used (e.g.

loans, savings accounts) was obtained (17

services) as well as the number of banks

respondents dealt with. This information

formed the basis for the situational measures.

The questionnaire was pre-tested and,

based on the debriefing of the pre-test respondents (n = 12), minor changes were made to

improve the clarity and visual layout of the

questionnaire.

Data collection

The data were gathered from members of a

church congregation. An announcement was

made at the church services that researchers

from a university were conducting a study on

Terrence Levesque and

Gordon H.G. McDougall

Determinants of customer

satisfaction in retail banking

Table I

The measures used

International Journal of

Bank Marketing

14/7 [1996] 1220

Service quality

Service features

Core

When my bank promises to do

something by a certain time,

it does so

My bank performs the service

right the first time

My bank provides its services

at the time it promises to do so

My bank performs the service

accurately

My bank tells you exactly when

services will be performed

Enabling

My bank offers a complete range

of services

My bank has convenient branch

locations

My bank provides easily

understood statements

It is very easy to get in and out

of my bank quickly

Customer satisfaction and

future intentions

Competitive

My bank offers competitive

interest rates

Relational

Employees in my bank have the

required skills and knowledge to

perform the service

Employees in my bank are always

willing to help

Employees in my bank are

consistently courteous

My bank gives me individual

attention

Employees of my bank understand

my specific needs

Customer satisfaction

Considering everything, I am

extremely satisfied with my bank

My bank always meets my

expectations

The overall quality of the services

provided by my bank is excellent

Future intentions

If people asked me, I would

strongly recommend that they

deal with my bank

Things happen at my bank that

make me want to switch my

accounts elsewhere

Tangibles

My banks physical facilities are

visually appealing

My banks employees are

neat in appearance

service quality. Members were asked to take a

questionnaire, complete it at home and

return it by mail in a stamped, addressed

envelope, to the university. For each questionnaire completed, the researchers donated

$5.00 to a charity sponsored by the church.

Four hundred questionnaires were distributed and 325 were returned for a response

rate of 81 per cent. By way of summary, the

sample was 60 per cent female, had a mean

age in the 40-49 range, with average income in

the $40,000-$49,000 range. Eighty-two per cent

owned their own home, and 57 per cent had

completed some post-secondary education.

The demographic profile of the sample was

compared with the population characteristics

of the city where the study was undertaken.

Comparisons were made on gender, age, education, home ownership, family size and

household income. No significant differences

were found on family size and household

income. Significant differences were found on

gender (sample was 60 per cent female; community was 50 per cent), home ownership

(sample had 82 per cent home ownership;

community had 62 per cent), age (sample

under-represented in 20-39 age groups, overrepresented in 40-49 age group), and education (sample under-represented in less than

high school, over-represented in post-high

school education).

An examination of banking experience

revealed that all respondents had a main

financial institution. On average, respondents dealt with 2.2 banks and used a variety

of bank services in the past 12 months (e.g. 71

per cent used a chequing account, 75 per cent

used a savings account, 39 per cent had a term

deposit and 50 per cent had a retirement savings plan).

Results

Preliminary analysis

The responses to the 17 items concerning

service quality and service features were

factor analysed to determine whether a

[ 15 ]

Terrence Levesque and

Gordon H.G. McDougall

Determinants of customer

satisfaction in retail banking

International Journal of

Bank Marketing

14/7 [1996] 1220

solution involving the core, relational,

tangible and enabling dimensions could be

detected. The factor analysis yielded three

factors with eigenvalues exceeding 1.0, providing reasonable support for the two service

quality (relational and core) dimensions and

one service feature dimension (Table II). A

three-factor oblique solution was the most

interpretable of all the solutions examined.

The item loadings in the factor pattern provided a convincing interpretation of the core

and relational constructs.

The third factor associated items that

described the bank as opposed to its employees behaviour or the banks fulfilment of its

core performance obligations. These aspects

included the appearance of employees and

facilities (the tangibles), the clarity of statements and the convenience of its location.

These features surround the customer

transactions, which were captured by the

core and relational factors. The a priori

assumption that two separate factors, tangibles and enabling, would be present was not

supported by these results.

Table II

Factor analysis service quality items

Fac1

Pattern

Fac2

Fac3

0.89

0.88

0.86

0.72

0.03

0.02

0.04

0.06

0.02

0.10

0.03

0.14

Core

Provides services when promised

Do it right the first time

Performs service accurately

Do something by a certain time

Tells when services performed

0.00

0.06

0.07

0.01

0.20

0.93

0.92

0.89

0.83

0.56

0.08

0.03

0.01

0.01

0.15

Features

Visually appealing facilities

Convenient branch locations

Easily understood statements

Easy to get in/out quickly

Employees neat appearance

0.09

0.12

0.02

0.22

0.15

0.10

0.02

0.05

0.01

0.09

0.83

0.79

0.61

0.55

0.46

Relational

Gives individual attention

Consistently courteous

Always wiling to help

Understands specific needs

Non-loading items

Employees have the skill/knowledge

0.35

0.39

0.14

Complete range of services

0.26

0.16

0.38

Offers competitive rates

0.36

0.11

0.26

Notes:

All numbers are item loadings. The initial solution yields three factors with eigenvalues of

7.1, 1.7, and 1.3 that account for 42, 10, and 8 per cent of the total response variance

respectively. The items have been reordered for the table presentation.

n = 293

[ 16 ]

The moderate correlation between the core

and relational factors (0.545) showed that

there was some overlap in respondents

judgements about core quality and relational

quality. The connection was not so strong,

however, to impede estimation of the contributions of service core quality and service

relational quality to overall satisfaction using

regression analysis.

Reliability analysis was conducted for the

items comprising each of the three factors

and the Cronbach alphas were: relational

(0.87), core (0.90) and features (0.72). In the

subsequent analysis, the constructs were

defined as the linear combination of the items

measuring the dimension.

The three items not associated with any

factor (Table II) were examined and it was

found that two items complete range of

services and offers competitive rates

were related and consequently only one of the

two items, offers competitive rates, was

kept for the subsequent analysis. In summary,

the service quality determinants included for

the following analysis were three constructs

core, relational, features and two single

items, employees have the skill/knowledge

and offers competitive rates.

The service problem/recovery measure was

structured as two variables:

1 whether the respondent experienced a

problem in the last six months and complained to the bank about it (1) or not (0);

and

2 for those respondents who complained,

their level of satisfaction with the complaint handling of the bank (1 is very

unsatisfied to 5 is very satisfied).

This structure permitted testing the effects of

experience with problems and satisfaction

with complaint handling by the service

provider.

The preliminary analysis also included an

examination of the correlation coefficients

between the situational variables products

used and number of banks used and the

customer satisfaction and future intentions

measures. The purpose was to identify those

variables that offered potential for explaining

the dependent measures. Based on this analysis, two variables were identified and

included in the subsequent analysis:

1 holding both a mortgage and loan with the

main financial institution or not; and

2 dealing with a single bank or more than

one bank.

The final stage of the preliminary analysis

examined the relationship among, first, the

three customer satisfaction measures and,

second, the two future intentions measures.

A reliability analysis of the three satisfaction

Terrence Levesque and

Gordon H.G. McDougall

Determinants of customer

satisfaction in retail banking

International Journal of

Bank Marketing

14/7 [1996] 1220

measures provided a Cronbach alpha of 0.92

indicating that the three items were measuring a single construct. The correlation coefficient between the two future intentions measures was 0.54, which provides only moderate

support for a single underlying construct.

The decision was made to analyse these two

items separately. For the subsequent analysis,

three dependent measures were used: a customer satisfaction measure based on summing the three items and two single items,

propensity to switch and recommend to

friend measuring aspects of future intentions.

Determinants of customer satisfaction and

future intentions

The primary objective of this research was to

identify the major determinants of customer

satisfaction and future intentions with

respect to retail banking. Table III provides

the results of the three empirical models and

their determinants.

The customer satisfaction model fits the

data very well (adjusted R2 = 0.71). With one

exception, all the explanatory variables were

significant which suggests that, in retail

banking, customer satisfaction is driven by a

number of factors, including but not limited

to, service quality dimensions. The key

explanatory variables were in the service

quality domain; core and relational performance, problem encountered and satisfaction

with problem recovery. However, the banks

features (e.g. location), the competitiveness of

Table III

Regression coefficients for the customer satisfaction and future intentions

measures

Customer

satisfaction

Recommend

to friend

Consider

switching

Relational performance

0.31*

0.43*

0.21

Core performance

0.31*

0.24*

0.52*

Features performance

0.14*

0.20*

0.07

Competitive rates

0.11*

0.18*

0.08

Skilled employees

0.15*

0.14*

0.02

Problem encountereda

1.03*

1.38*

1.80*

Satisfaction with problem recoveryb

0.23*

0.30*

0.23

Hold mortgage and loanc

0.15*

0.17

0.24

Single or multiple bank userd

0.05

0.06

0.28

Constant

0.02

1.06*

0.77

Adjusted R2

0.71

0.57

0.29

Notes:

* p < 0.05

a Within last six months, respondent experienced a problem and complained (no = 0,

yes = 1)

b Respondent satisfaction with banks response to problem (very satisfied = 5;

very unsatisfied = 1)

c Respondent holds mortgage and loan at the bank (no = 0, yes = 1)

d Respondent deals with one bank (0) or more than one bank (1)

the banks interest rates, the customers

judgements about the bank employees skills

and whether the customer was a borrower

were all factors that drove customer satisfaction. Whether the customer was a single or

multiple bank user was not significant in the

model.

All of the coefficients were in the expected

direction. Customer satisfaction improved as

the customers judgement about core and

relational quality and features performance

became more favourable and with the customers satisfaction with the banks problem

recovery efforts. Customers who had encountered a problem or who were borrowers rated

banks less favourably than others.

It was interesting to note that the banks

features and competitive interest rates were

significant contributors to customer satisfaction. The inclusion of features and benefits

beyond the traditional service quality

determinants provided a more complete and

comprehensive picture of the factors that

contributed to a customers overall attitude

towards the service.

The recommend to friend model was very

similar to the customer satisfaction model.

The two main differences were that relational

performance was a stronger driver in the

recommend to friend model and, if a problem

was encountered, it had a greater negative

impact on willingness to recommend. This

suggests that, while there are similarities

between the determinants of customer satisfaction and recommend to friend, the differences indicate that behavioural intentions

(i.e. recommend to friend) are driven more by

specific determinants.

The intentions to switch model was substantially different from the two previous

models. First, the explanatory power of the

model was lower, with an adjusted R2 of 0.29.

Second, the two significant determinants

were core performance (e.g. getting it right

the first time) and problem encountered.

Improvements in the customers judgement

concerning core performance reduced the

intention to switch. If a customer encountered a problem, regardless of the banks

ability to handle that problem, intentions to

switch increased. In this study, core performance and problems encountered were the

primary drivers of intentions to switch; other

factors such as relational performance, competitive rates, features performance or problem recovery did not play a role.

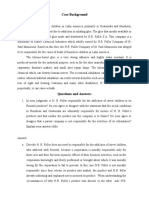

It is useful to discuss the results concerning

problem encounter and service problem

recovery. As noted previously, the literature

suggests that satisfactory problem recovery

can increase customer loyalty towards the

service provider (Figure 1). That is, through

[ 17 ]

Terrence Levesque and

Gordon H.G. McDougall

Determinants of customer

satisfaction in retail banking

International Journal of

Bank Marketing

14/7 [1996] 1220

the recovery process, the service provider can

actually increase customer satisfaction and

bond the customer to the organization

(Hart et al., 1990). Conversely, unsatisfactory

problem recovery reduces customer satisfaction and loyalty.

The results showed that respondents who

experienced a problem had a significant and

dramatic drop in customer satisfaction, willingness to recommend to friend, and, conversely, an increase in consider switching.

This confirms and reinforces the serious

consequences of unsatisfactory customer

service (Reichheld and Sasser, 1990). The

results also showed that satisfaction with

problem recovery restored, but did not

enhance, customer satisfaction (Figure 2).

Further, satisfaction with problem recovery

Figure 1

Customer satisfaction and problem recovery: theoretical model

Customer satisfaction

Very satisfied

Recovery more than

offsets problem

Average

customer

satisfaction (no

problem

experienced)

Recovery does not

offset problem

Very dissatisfied

Satisfaction with problem recovery

Very

Very

dissatisfied

satisfied

Figure 2

Customer satisfaction and problem recovery: study findings

Customer satisfaction

Very satisfied

Average

customer

satisfaction (no

problem

experienced)

Recovery does not

offset problem

Very dissatisfied

Satisfaction with problem recovery

Very

Very

dissatisfied

satisfied

[ 18 ]

does not ameliorate the respondents intention to switch. This calls into question the

proposition that satisfactory problem recovery can actually increase overall customer

satisfaction.

Discussion

The analysis of the 17 items comprising various aspects of service quality and service

features suggests that in retail banking, two

dimensions core and relational are present, as is a third dimension labelled features. Two prior investigations in retail banking which focused only on service quality

items identified five dimensions (Parasuraman et al., 1988) or possibly one or three

dimensions (Brown et al., 1993). Recognizing

that this research broadened the measures

used, considering all three studies it appears

reasonable to conclude that service quality

in retail banking may comprise two basic

dimensions core and relational. In addition,

items that reflect various features of the service offering are appropriate in the retail

banking sector.

Of particular interest was the finding that

three items did not load on any factor. This

suggests that some aspects of service quality

or the service offering that contribute to

customer satisfaction are unidimensional.

Further research on an even broader range of

items which incorporate other aspects of the

service offering would be useful to gain a

more comprehensive picture of the determinants of customer satisfaction.

The primary objective of this study was to

identify the drivers of customer satisfaction

in retail banking. Overall, both core and

relational performance were important drivers. Features such as convenience also contributed to customer satisfaction, as did competitive interest rates and skilled employees.

The importance of these findings is that positive attitudes towards a retail bank are driven

by service quality components, such as the

employee-customer relationship, as well as

other features/benefits of the service.

The results also show that a service problem which is not resolved has a substantial

impact on the customers attitude towards the

service provider. These results confirm the

importance of problem recovery in maintaining customer satisfaction (Hart et al., 1990).

However, the results do not support the contention that satisfactory problem recovery

leads to heightened customer satisfaction or

closer bonding of the customer to the

provider. At best, satisfactory problem recovery leads to the same level of customer satisfaction as if a problem had not occurred.

Further research is required to determine if,

Terrence Levesque and

Gordon H.G. McDougall

Determinants of customer

satisfaction in retail banking

International Journal of

Bank Marketing

14/7 [1996] 1220

and when, satisfactory problem recovery

leads to delighted customers.

A situational characteristic, holding both a

mortgage and a loan, leads to lower levels of

satisfaction. It would appear that borrowers versus non-borrowers (who are likely

to be lenders) experience situations that create some level of dissatisfaction. While many

of them may not complain, the borrowers

hold less positive attitudes towards the service provider than do non-borrowers. Based

on personal observation, it is possible that

borrowers resent, to some degree, the

demands and conditions retail banks place on

them. For example, borrowers may be more

critical than non-borrowers because it is

costing them more.

Propensity to switch was driven by core

performance and problems encountered

within the past six months. In particular, it is

important to note that, even if the problem

was resolved to the customers satisfaction,

the propensity to switch was significantly

higher. It appears that if customers experienced a problem which was serious enough to

complain about, regardless of the service

providers response, the customers switching

intentions increased. Again, these results did

not support the proposition that satisfactory

problem recovery maintains or improves

customer loyalty.

Considering managerial implications, the

results point to one general recommendation

for managing service offerings and several

specific conclusions for managing customer

satisfaction in retail banks. Overall, the organizing framework for managing customer

evaluations of a service offering should focus

first on the core and relational dimensions.

These two dimensions yield clean and convincing directions for designing service offerings, staff development programmes and

customer complaint management systems.

The items (Table I) that comprise the core

dimensions concern accuracy, expectancy,

meeting promises and informing customers

about when services will be performed. They

are clear signposts concerning quality standards for employees for every transaction.

Also, the items outline the range of issues

that are the primary causes of customer complaint behaviour.

The items which comprise the relational

dimension set the tone of the relationship

between the customer and the service representative. They are straightforward features

and traits of employees; in a sense, the results

confirm common understanding and practice.

Managers also need to be aware that customer satisfaction is based on service quality

and other aspects of the service offering such

as convenience and service specific factors

(e.g. competitive interest rates). Managers

should probably consider the value or contribution to customer satisfaction of each

dimension of the total service offering and

allocate resources accordingly. Regarding

customer complaints, managers should

attempt to get things right the first time.

When customers complain, satisfactory problem recovery maintains satisfaction, but

switching intentions increase. Unsatisfactory

problem recovery leads to dramatic declines

in customer satisfaction and increases in

switching intentions.

Concerning specific implications for retail

banking, the results suggest that service

quality judgements form the basis of customer satisfaction. The relative sensitivity of

customer satisfaction to the core and relational aspects of service quality points to the

role of the various service features in the

overall design of the offering, staff training

and complaint management. In retail banking, it appears that core and relational features ought to be equally weighted when

managers are interested in improving customer satisfaction. In contrast, when the

focus is on reducing switching intentions (i.e.

increase customer retention) considerable

emphasis should fall on core items (i.e. getting it right the first time) and ensuring successful problem recovery. In this case, the

influence of relational features is far less

important.

Concerning future investigations,

researchers should consider taking a broader

view towards identifying the components of

service quality and the overall service offering. The components should encompass not

only the recently identified constructs (e.g.

core, relational) but also constructs/items

that reflect the service offering (e.g. competitive rates). Future investigations in this area

might focus on the complete service package

and seek to develop a framework which is

based on the major customer benefits derived

from the service. This approach might yield

useful insights into the composition of the

service from the customers viewpoint. Also,

including more measures of customer satisfaction and future intentions might offer

further insights into the drivers of these customer outcomes. In particular, the inclusion

of measures of perceived value may be a fruitful direction to pursue.

To summarize, a major contribution of this

study is the provision of an approach for

managers to identify the determinants of

customer satisfaction and future intentions

towards the service provider. The approach

should incorporate constructs or items

beyond service quality to capture the domain

of factors that drive customer satisfaction.

Also, the study provided insights and

[ 19 ]

Terrence Levesque and

Gordon H.G. McDougall

Determinants of customer

satisfaction in retail banking

implications for managers in retail banks

who want to improve customer satisfaction

and retention rates.

International Journal of

Bank Marketing

14/7 [1996] 1220

References

[ 20 ]

Anderson, E.A. and Sullivan, M.W. (1993), The

antecedents and consequences of customer

satisfaction for firms, Marketing Science, Vol.

12, Spring, pp. 125-43.

Anderson, W.T. Jr, Cox, E.P. III and Fulcher, D.H.

(1976), Bank selection decisions and market

segmentation, Journal of Marketing, Vol. 40.

No. 1, pp. 40-5.

Armstrong, L. and Symonds, W.C. (1991), Beyond

May I Help You?, Business Week, Special

Issue, pp. 100-2.

Brown, T.J., Churchill, G.A. Jr and Peter, J.P.

(1993), Improving the measurement of service quality, Journal of Retailing, Vol. 69,

Spring, pp. 127-38.

Carman, J.M. (1990), Consumer perceptions of

service quality: an assessment of the

SERVQUAL dimensions, Journal of

Retailing, Vol. 66, Spring, pp. 35-55.

Coskun, A. and Frohlich, C.J. (1992), Service: the

competitive edge in banking Journal of

Services Marketing, Vol. 6 No. 1, pp. 15-22.

Cronin, J.J. and Taylor, S.A. (1992), Measuring

service quality: a re-examination and extension, Journal of Marketing, Vol. 56 No. 3,

pp. 55-68.

Cronin, J.J. and Taylor, S.A. (1994), SERVPERF

versus SERVQUAL: reconciling performancebased and perceptions-minus-expectations

measurement of service quality, Journal of

Marketing, Vol. 58 No. 1, pp. 125-31.

Devlin, J.F., Ennew, C.T. and Mirza, M. (1995),

Organizational positioning in retail financial services, Journal of Marketing Management, Vol. 11, pp. 119-32.

Fisk, R.P., Brown, S.W. and Bitner, M.J. (1993),

Tracking the evolution of the services marketing literature, Journal of Retailing, Vol.

69, Spring, pp. 61-103.

Fornell, C. and Wernerfelt, B. (1987), Defensive

marketing strategy by customer complaint

management: a theoretical analysis, Journal

of Marketing Research, Vol. 24 No. 4, pp. 337-46.

Grnroos, C. (1985), Internal marketing theory

and practice, in Block, T.M., Upah, G.D. and

Zeithaml, V.A. (Eds), Services Marketing in a

Changing Environment, American Marketing

Association, Chicago, IL, pp. 41-7.

Hart, C.W.L., Heskett, J.L. and Sasser, E.W. Jr

(1990), The profitable art of service recovery, Harvard Business Review, Vol. 68 No. 4,

pp. 148-56.

Hausknecht, D.C. (1990), Measurement scales in

customer satisfaction/dissatisfaction, Journal of Consumer Satisfaction, Dissatisfaction

and Complaining Behaviour, Vol. 3, pp. 1-11.

Heskett, J.L., Jones, T.O., Loveman, G.W., Sasser,

W.E. Jr and Schlesinger, L.A. (1994), Putting

the service-profit chain to work, Harvard

Business Review, Vol. 72 No. 4, pp. 164-74.

Hirschman, A.O. (1970), Exit, Voice and Loyalty,

Harvard University Press, Cambridge, MA.

Jones, T.O. and Sasser, W.E. Jr (1995), Why satisfied customers defect, Harvard Business

Review, Vol. 73 No. 6, pp. 88-99.

Laroche, M. and Taylor, T. (1988), An empirical

study of major segmentation issues in retail

banking, International Journal of Bank

Marketing, Vol. 6 No. 1, pp. 31-48.

LeBlanc, G. and Nguygen, N. (1988), Customers

perceptions of service quality in financial

institutions, International Journal of Bank

Marketing, Vol. 6 No. 4, pp. 7-18.

Lewis, B.R. (1991), Service quality: an international comparison of bank customers expectations and perceptions, Journal of Marketing Management, Vol. 7 No. 1, pp. 47-62.

McDougall, G. and Levesque, T. (1994), A revised

view of service quality dimensions: an empirical investigation, Journal of Professional

Services Marketing, Vol. 11 No. 1, pp. 189-210.

Morgan, N.A. and Piercy, N.F. (1992), Market-led

quality, Industrial Marketing Management,

Vol. 21 No. 2, pp. 111-18.

Parasuraman, A., Berry, L.L. and Zeithaml, V.A.

(1991a), Refinement and reassessment of the

SERVQUAL scale, Journal of Retailing, Vol.

67, Winter, pp. 420-50.

Parasuraman, A., Berry, L.L. and Zeithaml, V.A.

(1991b), Understanding customer expectations of service, Sloan Management Review,

Vol. 39, Spring, pp. 39-48.

Parasuraman, A., Berry, L.L. and Zeithaml, V.A.

(1993), More on improving service quality

measurement, Journal of Retailing, Vol. 69,

Spring, pp. 140-7.

Parasuraman, A., Zeithaml, V.A. and Berry, L.L.

(1985), Conceptual model of service quality

and its implications for future research,

Journal of Marketing, Vol. 49, Autumn, pp. 4150.

Parasuraman, A., Zeithaml, V.A. and Berry, L.L.

(1988), SERVQUAL: a multiple-item scale for

measuring consumer perceptions of service

quality, Journal of Retailing, Vol. 64, Spring,

pp. 12-40.

Reichheld, F.F. and Sasser, W.E. Jr (1990), Zero

defections: quality comes to service, Harvard Business Review, Vol. 68 No. 5, pp. 105-11.

Smith, A.M. (1995), Measuring service quality: is

SERVQUAL now redundant?, Journal of

Marketing Management, Vol. 11 Nos. 1-3, pp.

257-76.

Teas, R.K. (1993), Expectations, performance

evaluation, and consumers perceptions of

quality, Journal of Marketing, Vol. 57 No. 4,

pp. 18-34.

Teas, R.K. (1994), Expectations as a comparison

standard in measuring service quality: an

assessment of a reassessment, Journal of

Marketing, Vol. 58 No. 1, pp. 132-9.

Teas, R.K. and Wong, J. (1991), Measurement of

customer perceptions of the retail bank service delivery system, Journal of Marketing

Management, Vol. 7 No.1, pp. 147-67.

Thwaites, D. and Vere, L. (1995), Bank selection

criteria a student perspective, Journal of

Marketing Management, Vol. 11 Nos 1-3, pp.

133-49.

Yi, Y. (1990), A critical review of consumer satisfaction, in Zeithaml, V.A. (Ed.), Review of

Marketing, American Marketing Association,

Chicago, IL, pp. 68-123.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Marketing Jewellery ProjectDocument58 pagesMarketing Jewellery Projectsushant318850% (30)

- Adani Wilmar LTDDocument55 pagesAdani Wilmar LTDAmit ChotaiPas encore d'évaluation

- Maxwell Corporation - Distribution: QuestionsDocument1 pageMaxwell Corporation - Distribution: QuestionssakuraaPas encore d'évaluation

- 111111111Document64 pages111111111Prachi ParmarPas encore d'évaluation

- JADEBLUEDocument4 pagesJADEBLUESALONI SHAHPas encore d'évaluation

- End-Term Presentn PPT TemplateDocument13 pagesEnd-Term Presentn PPT TemplateSagar SachdevaPas encore d'évaluation

- Objective 1: Introduction of Walmart: Assessment Task On Walmart, USA Submitted by Aekansh (80012100449)Document8 pagesObjective 1: Introduction of Walmart: Assessment Task On Walmart, USA Submitted by Aekansh (80012100449)Aekansh KaushikPas encore d'évaluation

- University of Benghazi Faculty of Information Technology: Nasser M. AMAITIKDocument13 pagesUniversity of Benghazi Faculty of Information Technology: Nasser M. AMAITIKAhmed AloshibiPas encore d'évaluation

- Machine Learning Case Studies v1 PDFDocument16 pagesMachine Learning Case Studies v1 PDFrandom100% (1)

- DC Regulation Navi MumbaiDocument22 pagesDC Regulation Navi MumbaiShaikh Tanveer AlamPas encore d'évaluation

- Airtel Case Study Channel StrategyDocument2 pagesAirtel Case Study Channel StrategyTushar GuptaPas encore d'évaluation

- BE HB Fuller PaperDocument3 pagesBE HB Fuller PaperVitri Vidia RizalantiPas encore d'évaluation

- New Luxury Creators and The Forces That Support Them: Opportunities For Action in Consumer MarketsDocument11 pagesNew Luxury Creators and The Forces That Support Them: Opportunities For Action in Consumer MarketsAlejandro LamasPas encore d'évaluation

- Hafele Company AnalysisDocument7 pagesHafele Company AnalysisManu Gupta100% (1)

- Hong Kong Dried Fish MarketDocument29 pagesHong Kong Dried Fish MarketdeakuswantoPas encore d'évaluation

- HRM in Retail: Dr. Parveen NagpalDocument23 pagesHRM in Retail: Dr. Parveen NagpalMisbah UllahPas encore d'évaluation

- Amazon Fulfillment ProcessDocument1 pageAmazon Fulfillment ProcessRAHUL RNAIRPas encore d'évaluation

- InBloom Manual 1-2 PDFDocument85 pagesInBloom Manual 1-2 PDFsubPas encore d'évaluation

- Case Study On Alibabas TaobaoDocument8 pagesCase Study On Alibabas TaobaoChen ChengPas encore d'évaluation

- BCG Most Innovative CompaniesDocument22 pagesBCG Most Innovative CompaniesBaty NePas encore d'évaluation

- Pet ReportDocument14 pagesPet ReportAshwini SanilPas encore d'évaluation

- Notes On Branding Study Notes For BCom MCom and MBA StudentsDocument20 pagesNotes On Branding Study Notes For BCom MCom and MBA StudentsMd Tahsin RizwanPas encore d'évaluation

- The Zara Brand StrategyDocument13 pagesThe Zara Brand StrategyAkansha PanwarPas encore d'évaluation

- 6311026a77541 Agrenovera CaseDocument3 pages6311026a77541 Agrenovera CaseJenil RitaPas encore d'évaluation

- 09 - Chapter 2-5 PDFDocument34 pages09 - Chapter 2-5 PDFMiko100% (2)

- Ebiz Transfromation MatrixDocument15 pagesEbiz Transfromation MatrixekaPas encore d'évaluation

- Case #2 - Amy's BakeryDocument3 pagesCase #2 - Amy's BakeryGift NantawanPas encore d'évaluation

- Tesco Case Study PDFDocument19 pagesTesco Case Study PDFT Yoges Thiru Moorthy100% (1)

- MIA Report of Ashritha Cashew IndustriesDocument17 pagesMIA Report of Ashritha Cashew IndustriesShrihari KPas encore d'évaluation

- Aadhaar Retail Ltd.Document22 pagesAadhaar Retail Ltd.Rajveer GuptaPas encore d'évaluation