Académique Documents

Professionnel Documents

Culture Documents

Mergers

Transféré par

Niro ThakurDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Mergers

Transféré par

Niro ThakurDroits d'auteur :

Formats disponibles

Mergers and Acquisitions

Introduction

Mergers and acquisitions are a major part of the corporate finance world that deals with buying,

selling and combining different companies to form larger entities. They are one of the key

activities of corporate restructuring and are worth millions of dollars. From a legal perspective, a

merger is a combination of two or more firms in which all but one legally ceases to exist and the

combined organization continues under the original name of the surviving firm [key-7]. Mergers

and acquisitions are undertaken by companies to achieve certain strategic and financial

objectives , which the managers of the acquiring firm believe are beneficial to the company.

Not all mergers activities are successful. KPMG found that 83% of mergers were unsuccessful in

producing any business benefit as regards shareholder value. The objective of this essay is to

study M&A activities in two different industries Cars & Chemicals and highlight the factors

that distinguish the successful mergers form the unsuccessful ones.

Mergers and acquisitions are the part of the modern corporate finance world. Theoretically

mergers and acquisitions should be value creating for the shareholders of both the offeror and

offered companies. In practice situation is more complicated. In this work I have generalized my

knowledge about the mergers, described current trends in corporative business, analyzed the life

examples and made my own well-grounded conclusion. Mergers and acquisitions often don't

create value for offered and even for offer or. The main reason is the fast decision on the wave of

recent "merger mania" without detailed research and long-term business perspective estimation.

Mergers and acquisitions

Mergers and acquisitions are the part of business strategy, which allow restricting, financing or

aiding the growing company through combining two business entities in one.

Merger is "voluntary amalgamation of two firms on roughly equal terms into one new legal

entity." (BusinessDictionary.com) http://www.businessdictionary.com/definition/merger.html

Acquisition is "acquiring control of a corporation, called a target, by stock purchase or exchange,

either hostile or friendly, also called takeover."

Mergers and Acquisitions

The difference between merger and acquisition is simple: merger is the unit of equals, and

acquisition is the "ingestion". After the merger the stocks of both or more) companies are

surrendered and new company stock is issued in its place, and after the acquisition the target

company ceases to exist while the buyer's stock continues to be traded. Thus, after the merger of

Daimler-Benz and Chrysler companies new company, DaimlerChrysler, was created.

Acquisition usually is the purchase of a small company by the bigger one, therefore it can be

friendly or hostile. Company-buyer can purchase the stocks or the assets of the target company to

take it over. The example of recent acquisition is the acquisition of Australian company Felix

Resources by China's Yanzhou Coal Mining Dynamic Exports, 2010)

However hostile takeovers or even the friendly acquisition could spoil the reputation of both

companies and cause the fall of the buyer's stocks. That is why usually companies proclaim the

action as the merger, though it's technically an acquisition. From the other hand, if the boards of

unequal companies negotiate the best strategy for both companies, this could be the real merger.

The problem of distinguishing the merger and the takeover becomes more complicated because

of different extensions, markets and products of the companies. There are few types of mergers

by the relationship between the companies:

"Horizontal merger - Two companies that are in direct competition and share the same

product lines and markets.

Vertical merger - A customer and company or a supplier and company.

Market-extension merger - Two companies that sell the same products in different

markets.

Product-extension merger - Two companies selling different but related products in the

same market.

Conglomeration - Two companies that have no common business areas." Investopedia, 2)

Mergers and Acquisitions

By the type of financing there are two main types of mergers: purchase merger and consolidation

merger. Thus, the difference between some types of merger and acquisition is only in name. "In

other words, the real difference lies in how the purchase is communicated to and received by the

target company's board of directors, employees and shareholders." )

Some researchers think that the ratio of mergers and acquisitions depends on global economical

situation. Thus, the globalization forced many companies to merger because of high competition

in the world trade and the domination of big corporations. Some corporations make such

strategic moves for higher rank in a more lucrative global market. The period of economic

recession caused the increase of number of mergers. First, corporations have no free finances to

provide acquisitions; second, individual organizations are less likely to be able to survive.

Main goals of mergers and acquisitions

The dominant rationale used to explain M&A activity is that acquiring firms seek improved

financial performance. The following motives are considered to improve financial performance: lowering the fixed costs by removing duplicate departments or operations;

increasing the scope of marketing and distribution, and other demand-side changes;

increased revenue or market share;

cross-selling;

reducing tax liability;

resources distributing across firms;

synergy.

Theoretically two companies together are more then two separate companies. That is why

synergy is the main criteria of the success for every merger or acquisition is the synergy. It makes

the value of the combined companies greater than the sum of the two parts.

Mergers and Acquisitions

Thomas Straub shows that M&A performance is a multi-dimensional function. For a successful

deal, the following key success factors should be taken into account:

Strategic logic which is reflected by six determinants: market similarities, market

complementarities, operational similarities, operational complementarities, market power,

and purchasing power..

Organizational integration which is reflected by three determinants: acquisition

experience, relative size, cultural compatibility.

Financial / price perspective which is reflected by three determinants: acquisition

premium, bidding process, and due diligence.

At the same time, near the half of mergers and acquisitions is not successful. Often the

executives of the acquiring company overestimate revenue and cost synergies. That is why they

make typical mistakes, described in the "Harvard Business Review" article by Dan Lovallo and

others: they rely upon future revenues too much, pay more for target firms than they're worth and

ignore the possibilities of future loss. (Lovallo, 2)

"Several studies have found a sharp divergence between market participants' pre-merger

expectations about the post-merger performance of merging firms, and the firms' actual

performance rates. David Ravens craft and F. M. Scherer's (1987) large-scale study of

manufacturing firms, for example, found that while the share prices of merging firms did on

average rise with the announcement of the proposed restructuring, post-merger profit rates were

unimpressive. Indeed, they find that nearly one-third of all acquisitions during the 1960s and

1970s were eventually divested. Ravens craft and Scherer conclude that mergers typically

promote managerial "empire building" rather than efficiency, and they support increased

restrictions on takeover activity. Michael Jensen, founder of the Journal of Financial Economics,

suggests changes in the tax code to favor dividends and share repurchases over direct

reinvestment, thus limiting managers' ability to channel "free cash flow" into unproductive."

Mergers and Acquisitions

Investors in a company thatareaiming to take over another one must determine whether the

purchase will be beneficial to them. In order to do so, they must ask themselves how much the

company being acquired is really worth.

Mergers and Acquisitions

Literature Review

A merger adds value only if the merging companies are worth more than each one of them. This

section focuses on understanding the objectives behind the merger and acquisition activities and

how they add value to the firms. The author aims to use the literature developed here to analyze

the industrial case studies in the next section.

Definition

For most practical purposes, mergers and acquisitions are treated as synonyms. The main

difference between these two appears to be in the method of execution. Sherman and Hart (2006)

define mergers as two companies joining together (usually through the exchange of shares) as

peers to become one.. They define acquisitions as involving typically one company -the

buyer- that purchases the assets or shares of the seller, with the form of payment being cash, the

securities of the buyer, or other assets of value to the seller. An acquisition can be friendly as

well as hostile. When the target companys management are receptive to the idea of the

acquisition and recommends shareholders approval, the acquisition is generally referred to as

friendly

Motivations for Mergers and Acquisitions

DePamphilis (2010) gives the following reasons for M&A: synergy, diversification, market

power and strategic realignment. Brealey, Myers and Allen add to that by pointing out that

promise of complementary resources and surplus funds and inefficiency elimination are also

major reasons for acquisitions. Sudarsanam(1995) states that a more fundamental objective for

the firms is to enhance the wealth of shareholders through accessing sustainable competitive

advantage of the acquirer.

Sherman and Hart (2006) provide the following objectives for mergers:

to respond to competitive cost pressures through economics of scale and scope.

to improve process engineering and technology

to increase scale of production in existing product lines

6

Mergers and Acquisitions

to find additional uses for existing management teams

to redeploy excess capital in more profitable and complementary ways

In a merger, there is no buyer or seller. Merger is always seen as happening between equals and

though one firm may have contributed more than the others, or may have initiated the discussion,

the data gathering and due diligence part is always a two ways and mutual process.

Top 10 Indian Mergers and Acquisitions of 2014

Mergers and acquisitions (M & A) is the area of corporate finances, management and strategy

dealing which deals with purchasing and/or joining with other companies.

Though the two are often mentioned together, a merger is very different from an acquisition.

A merger, in a nutshell, involves two corporate entities joining forces and becoming a new

business entity, with a new name. It usually involves two companies of same size and stature

joining hands.

An acquisition, on the other hand, involves one bigger business taking over a smaller company

which may be absorbed into the parent company or run as a subsidiary. The company being taken

over is referred to as the target company in the corporate world.

Here is a list of some of the most happening mergers and acquisitions in India in the year

2014, listed in random order.

1. Flipkart- Myntra

The huge and most talked about takeover or acquisition of the year. The seven year old

Bangalore based domestic e-retailer acquired the online fashion portal for an undisclosed

amount in May 2014. Industry analysts and insiders believe it was a $300 million or Rs 2,000

crore deal.

Flipkart co-founder Sachin Bansal insisted that this was a completely different acquisition

story as it was not driven by distress, alluding to a plethora of small e-commerce players

Mergers and Acquisitions

either having wound up or been bought over in the past two years. Together, both company heads

claimed, they were scripting one of the largest e-commerce stories.

2. Asian Paints- Ess Ess Bathroom Products

Asian paints signed a deal with Ess Ess Bathroom products Pvt Ltd to acquire its front end sales

business for an undisclosed sum in May, 2014.

The company on May 14, 2014 has entered into a binding agreement with Ess Ess Bathroom

Products Pvt. Ltd and its promoters to acquire its entire front-end sales business including

brands, network and sales infrastructure, Asian Paints said in a filing to the BSE on Wednesday.

Ess Ess produces high end products in bath and wash segment in India and taking them over led

to a 3.3% rise in share price for Asian paints.

3. RIL- Network 18 Media and Investments

Reliance Industries Limited (RIL) took over 78% shares in Network 18 in May 2104 for Rs

4,000 crores. Network 18 was founded by Raghav Behl and includes moneycontrol.com,

In.com, IBNLive.com, Firstpost.com, Cricketnext.in, Homeshop18.com, Bookmyshow.com

while TV18 group includes CNBC-TV18, CNN-IBN, Colors, IBN7 and CNBC Awaaz.

4. Merck- Sigma Deal

One of the leading Indian manufacturers, Merck KGaA took over US based Sigma-Aldrich

Company for $17 billion in cash, hoping the deal will help boost its lab supplies business.

Sigma is the leading supplier of organic chemicals and bio chemicals to research laboratories and

supplies groups like Pfizer and Novartis with lab substances.

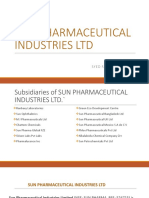

5. Ranbaxy- Sun Pharmaceuticals

Sun Pharmaceutical Industries Limited, a multinational pharmaceutical company headquartered

in Mumbai, Maharashtra which manufactures and sells pharmaceutical formulations and active

8

Mergers and Acquisitions

pharmaceutical ingredients (APIs) primarily in India and the United States bought the Ranbaxy

Laboratories. The deal is expected to be completed in December, 2014.

Ranbaxy shareholders will get 4 shares of Sun Pharma for every 5 Ranbaxy shares held by them.

The deal, worth $4 billion, will lead to a 16.4 dilution in the equity capital of Sun Pharma.

6. TCS- CMC

Tata Consultancy Services (TCS), the $13 billion flagship software unit of the Tata Group, has

announced a merger with the listed CMC with itself as part of the groups renewed efforts to

consolidate its IT businesses under a single entity.

At present, CMC employs over 6,000 people and has annual revenues worth Rs 2,000 crores.

The deal was inked a few days back. TCS already held a 51% stake in CMC.

7. Tata Power- PT Arutmin Indonesia

Indias largest private power producer, Tata Power, purchased 30% stake in Indonesian coal

manufacturing firm for Rs 47.4 billion. Earlier this year, they sold off 5% of its stake in PT

Arutmin Indonesia (Arutmin) and PT Kaltim Prima Coal (KPC) for Rs. 250 billion due to falling

coal prices globally. It plans to sell the remaining 25% stake for $ 1 billion soon too.

8. Tirumala Milk Lactalis

The largest dairy player in the world, Groupe Lactalis SA, acquired the 18 year old Hyderabad

based Tirumala Milk products for a whopping Rs 1750 crore ($275 million)in January, 2014.

Founded in 1896 by D Brahmanandam, B Brahma Naidu, B Nageswara Rao, Dr N Venkata Rao

and R Satyanarayana, Tirumala is the second largest private dairy company in South India.

Lactalis acquired 100% of their shares.

Mergers and Acquisitions

9. Aditya Birla Minacs- CSP CX

Aditya Birla Nuvo Ltd (ABNL) owned ABNL IT & ITeS Ltd. was sold to a Canadian based

technology outsourcing firm marking Aditya Birlas exit for the IT industry.

The deal was chalked out with a group of investors led by Capital Square Partners (CSP) and CX

Partners (CXP) for $260 million (approximately Rs. 1,600 crore).

10. Sterling India Resorts- Thomas Cook India

Billionaire Prem Watsa owned Thomas Cook India bought the Sterling Resorts India for Rs 870

crores in , marking Thomas Cooks entry into the hospitality sector. Thomas Cook had earlier

acquired Ikya Human Solutions in 2013.

11. BMW

The Global Car Industry has many major collaborative and ownership links. Within these links

there are many factors that affects the market share of a car company, which include trying to

enter into the International Market, the role of technology in the industry; e.g. how technology

has changed over the years and what the effects of that change have resulted in; the impact of

social and legislative requirements that have to be followed and how the buyers of cars will

change and how it has varied over the years. In the case of BMW-Rover, given the increasing

dynamic of car industry.

Why some mergers succeed and why some fail?

KPMG, based upon detailed empirical research, identified six factors that lead to successful

mergers. These factors are: proper initial synergy evaluation, well thought out integration project

10

Mergers and Acquisitions

planning, due diligence, gathering a capable management team, resolving cultural issues and

most importantly, good and transparent communications.

The big problem in measuring the failure of a merger is in determining the criteria that should be

met for a merger to be deemed so. Failure of a merger may stem from the information

asymmetries arising from the pre-merger period and the problems of cooperation and

coordination when recently merged [key-3]. Also the target company may only have a superficial

strategic fit and the failure may result from a flawed business and corporate strategy [key-19].

The following table from Carlton(1997), who cites Coopers and Lybrands (1992) study of 100

failed mergers, summarizes the key causes of success and failures of mergers:

11

Causes of Failures

Causes of Success

Target management attitudes

and cultural differences

Detailed post-acquisition integration

plans and speed of implementation

No post-acquisition

integration plans

Clarity of acquisition purpose

Lack of knowledge of industry

or target

Good cultural fit

Poor management of target

High degree of target management and

cooperation

No prior acquisition

experience

Knowledge of target and its industry

Mergers and Acquisitions

Industry Case Studies

BMW AG. The Rover Company

The Rover Company was a British Car manufacturing company founded in 1878 as Starley &

Sutton Co. of Coventry and originally produced bicycles and motorbikes. It produced its first car

in 1904 under its now famous marque of the Viking Longship. After a string of mergers,

nationalisation and takeovers, it became a part of the British Leyland Motor Corporation in 1968.

The group was sold to British Aerospace in 1988 and in 1994, the control of the group was

passed to BMW of Germany.

BMW AG is a German automobile, engine and motorcycle manufacturing company which began

life as a aircraft engine company in the early 1900s. In 1923, it began manufacturing its first

motorcycles and started car production in the 1928 after acquiring the Eisenach vehicle factory

[key-9]. BMW acquired the Rover Company in 1994 for 800mn. After investing about 2bn

and getting no synergies, it sold the company in 2000 to Phoenix Consortium for 10.

The Acquisition

BMW had a number of motives behind the acquisition of the Rover company. The primary

among them was to grow. BMW wanted to increase their market spread while achieving a

greater volume spread [key-16]. They saw Rover, which came up for sale at the right time as the

perfect deal at that time. Rover had acquired significant cost advantages due to its association

with Japanese production methods. They also had the front-wheel driving and the 4 x 4

technology that BMW wanted to acquire. The price BMW paid was deemed to be a bargain as

the cost to develop the technology and the production methods from scratch were significantly

more.

Another major factor in the acquisition was the low level of cost in the British manufacturing

sector compared to the costs in Germany [key-15]. These costs, which were 60% lesser in

Britain, had the ability to substantially reduce BMW costs. Rover also has in its repository

12

Mergers and Acquisitions

brands such as Mini and MG Rover, which offered BMW the chance to exploit new markets and

segments

.

Analysis

Behind the acquisition of Rover by BMW, there was certainly a strategic motive and proper

plans of gaining synergies. However, the acquisition was unsuccessful because they didnt plan

the entire process well. Palmer(2003) quotes both Kloss and Boorn in describing how the

strategic plan got stuck in the upper echelons of the hierarchy due to lack of communication and

coordination. BMWs integration plan suggested a three phase process in which the initial two

years were wasted in just providing financial help without any integration of the two

companies. It was 3-4 years before any concrete integration plans began and only in 1999 were

the two companies fully integrated [key-16].

Another important problem for this deal was the linguistic differences between the two

companies. Although BMWs top management could do business in English, the engineers and

the middle managers were unable to do so. This created a lack of communication problem which

eventually delayed the integration process. There were also substantial differences between the

business culture of BMW and Rover. As Batcheler(2001) points out, the German direct approach

was in contrast to the more relaxed approach followed by the British.

Sirower (1997) suggested that it is incorrect to judge the soundness of an acquisition based on

what it would have cost to develop that business from scratch. For this case, it seems to be this

same problem as BMWs decision was partly based on the substantial cost difference between

developing the technologies in house and buying it from Rover. BMW didnt achieve the

synergies and ended up spending 2bn and sold the company off to Phoenix Consortium for a

token sum of 10.

AkzoNobel N.V Imperial Chemicals Industries plc.

13

Mergers and Acquisitions

AkzoNobel N.V is a Dutch multinational company, specializing in coatings and specialty

chemicals. The companys history can be traced back to the 17th century but the present entity

was created in 1994 by the merger of the Dutch company, Akzo and the Swedish company

Nobel.

ICI was formed when four British chemical companies merged in 1926. By 1970s, it had

expanded into continental Europe and the USA with a diverse variety of products ranging from

heavy chemicals to pharmaceuticals. It continued to grow meteorically throughout the 80s,

however, in 1993, owing to shrinking customer base and tough competition from abroad, it

began slimming down and sold off its pharmaceutical business as Zeneca. On January 2, 2008,

following the initial announcement in August, 2007, ICI was taken over by AkzoNobel N.V.

The Acquisitions

After AkzoNobel sold off its pharmaceutical business Organon in 2007, it became a much more

focused in the coatings sector, which was now considered to be the core business of the group

[key-12]. The chief executive of the group, Hans Wijers identified ICI as the next attractive

target because of the many strategic and financial benefits[key-1]. One of the most important

benefit was the possible creation of one of the largest coatings and specialty chemical company

in the World. Akzo was the global leader in industrial coatings and ICI was very strong in the

decorative paint market. Many solvents and chemicals are common to both the companies and

this gives tremendous synergy opportunities for the combined company [key-20]. The enlarged

Akzo Nobel group could also benefit from a diversified and broad geographic presence and

highly attractive platforms for growth in emerging markets[key-1].

At the time of the deal, the strategic synergies estimated by Akzo was 280mn. Financially, the

deal was expected to enhance the earnings to the shareholders, generate an internal rate of return

above Akzo Nobels WACC (8%) and create positive EVA in year three following the

transaction.

Akzo paid 670p for each ICI share and the deal was finalised for 8.0bn on January 2, 2008.

Akzo de-listed ICI from the London Stock Exchange on the January 3rd and sold off its adhesive

14

Mergers and Acquisitions

and electronic material business to Hankel. The majority of the ICI businesses were integrated

into Akzo.

15

Mergers and Acquisitions

Analysis

The acquisition of ICI by AkzoNobel was seen by the majority of the analysts as a good strategic

deal. ABN AMRO (as quoted in Pansari, 2009) said, we certainly believe in the strategic

rationale behind the ICI acquisition By acquiring ICI, AkzoNobel will be some 60% larger by

turnover than its nearest competitor. ICI Coatings offers an excellent complementary fit, both

in terms of geographical spread and in product mix. However, there was some doubts about

whether Akzo paid too much for the deal. Deutsche Banks comment (quoted in Pansari, 2009)

shows their skepticism, We welcome Akzos efforts to make the proposed deal more attractive

but still struggle with the numbers. With integration risk, execution risk and a lack of visibility

on ICI managements future role the risk/reward profile is not attractive enough But, the

acquisition has turned out to be successful with Akzo meeting all the synergy targets in time.

Akzo initially set a synergy target of 280mn by the end of 2010, which they updated to 340 mn

in 2008. As of 2009, they had delivered about 90% of the total value amounting to 300mn.

The main reasons for the success of Akzo were the presence of a well planned integration plan

and the rapid implementation of that plan. Unlike BMW, which took no steps to integrate Rover

in the initial two years, Akzo planned on a total integration in the first three years. They were

able to find a balance between the cultural and linguistic differences between the two companies

and were thus able to avoid communication problems. The author believes that all of MacDonald

and Beaviss (2001) key characteristics for a successful integration process namely a

comprehensive integration plan, rigorous cost/benefit/risk management control mechanisms,

dedicated leadership did exist in this deal. As a result of this successful deal, Akzo Nobel is very

well positioned now with market leadership positions in many markets, excellent geographic

spread of sales and profitability and strong ability to outspend the competition in technology and

innovation without negatively affecting the profitability.

16

Mergers and Acquisitions

Employee Issues and Failure Of Mergers And Acquisitions Management

Globalization has demanded change in business practices because of its initiated competition

(Schuler and Tarique, 2007). However, two streams can be found in the literature suggesting two

different views about this phenomenon of globalization. One view suggests that it is being

evolved to accomplish the power, politics, and wealth accumulation objectives and to do so, it

has been instilled through carefully planned strategies, plans and tactics (Chomsky, 1999;

Schuler and Tarique, 2007). Other view conveys a contrasting philosophy asserting that it is a

social phenomenon which is benefiting the people around the globe by reducing monopolies of

few (Castells,1996).

Though these two views convey two opposite messages stating it political fixture designed for

the purpose of gaining control of power, authority and wealth or a phenomenon which is

operating to benefiting the people around the globe has instigated challenges for the business

organization, somehow. Whether these are threats or opportunities, these are challenging

(Mourdoukoutas, 2006). This phenomenon has changed the face of the world economy, and

economic conditions of most of the countries are forcing the organization to change their

business strategies. The organizations are using various forms of collaborations and alliances

such as mergers, acquisitions and joint ventures inside and across the national boundaries in

order to survive through the threats or to grow on the new challenging opportunities provided by

globalization. Kogut and Singh (1988) state that collaborations such as joint ventures, mergers

and acquisitions are the source of sharing and spreading and sharing risks over partners firms.

According to Contractor and Lorange (1988) such collaborations "allow developing and

harnessing knowledge of the host organization". Choi and Hong (2002) suggest that

"collaborations can be for the purpose of knowledge or/and material flow".

17

Mergers and Acquisitions

Change Management and Success of Collaborative Efforts

Organizational change usually is perceived or rightly believed to contain threat or challenging

opportunities of personal loss or rewards respectively as consequences of the change for the

stakeholders. Lorenzi and Riley (2000) state that these threats or risks can fluctuate from simply

disturbance of established routines to job insecurity if we talk about the internal stakeholders.

While Hall (2002) classifies the change as shot tem and long-term and states the trade-offs

between short and long run.

Use of the term "change management" has been widespread in management writings and

organizational studies (Ackoff, 1981, 1990). Interest of managers and researchers in change

management topic has been stimulated by the commentary of Peter Drucker (1999), stating

whether change can be managed at all or organizations are merely led or facilitated because of its

episodes. In the words of Lorenzi and Riley (2000)

"Change management is the process by which an organization gets to its future state, its vision.

While traditional planning processes delineate the steps on the journey, change management

attempts to facilitate that journey".

Consequently, implementing change instigates crafting a vision for change, and it proceeds

further by empowering and allowing individuals to work as agents in the process to

accomplishing that vision. These agents require realistic and future oriented strategies, plans and

tactics to make successful transformation. However, since managing change is not simple and

requires top managers to have a holistic approach which addresses all the major factors and

disturbances arising from them.

18

Mergers and Acquisitions

Factors Requiring Attention

Kauser and Shaw (2004) that though employees' can affect the success of such collaborations,

however, there are plenty of factors that have more devastating impact on the success. In fact,

firms investing in such collaborations face various uncertainties, resulting in affecting the

intended outcomes. Gulati and Singh (1998) state that such uncertainties can stem from

numerous factors that can be critical in hampering success in the firms with different norms,

cultures, future plans and intentions. If these are the international joint ventures, various factors

such as difference in national cultures, varying labour market conditions, different political and

legal system can be crucial in defining success in collaborations (Bratton and Gold, 2007).

Unavailability of "timely and adequate allocation and sharing of resources" is one of the main

reasons that can cause some type of failure in such collaborative efforts and hence should be

given proper focus while addressing the change arising from collaborations (Boddy et al, 1998).

Given the dynamic and volatile business environment, timely and adequate allocation of

resources, including human, capital an information, are vital in the success of mergers and

acquisitions (Yan and Zeng, 1999). Earlier, Yan (1998) believed that bargaining power, control

and trust are the main factors that can play central role in the successful mergers and

acquisitions. Sirmon and Lane (2004) state that cultural compatibility should be taken care, while

going into such collaborations.

Lorange and Roos (1992) that these are the intentions of the collaborating firms that cause issues,

resulting in impeding the success. Lorange and Roos (1992) further state that difference in

objectives, and differing practices, norms, values also contribute towards failures. Fey and

Beamish (2000) suggest that varying intentions, lack of cultural compatibility, and differences in

objectives are the main factors that create uncertainties in employees, resulting in impeding the

success. Hennart et al, (1998) collaboration without clear identification of need and objectives of

collaboration, lack of concentration towards qualitative factors cause failures because it hinder

effective decision making.

19

Mergers and Acquisitions

Looking at the above statements and assertions, it can be argued though employees related issues

can cause failures but it is the failure to manage change due to lack of vision to identify the

factors and manage them is the main reason. Employee related issues such, according to Hennart

et al, (1998), arise from lack of trust in the new working arrangements. If top management is able

to remove these issues by giving incentives, ensuring security and involving them in the entire

process of initiation and development of such collaborations, employees related issues can be

solved (Sirmon & Lane, 2004). Yan (1998) evidence that such failures are the result of

incomplete contracts because of improper decision-making on behalf of the people who are

supposed to manage change by efficiently responding to and reacting to changing business

environment through proper attention to various internal and external factors. Sirmon and Lane,

(2004) suggest that it is the lack of vision to predict the severity of change which can result from

the new business arrangements. These collaborations demand employees' new roles and hence,

human resource management should be well prepared to play its new roles in these changing

business arrangements along with their traditional roles of hiring, training etc. Inability to do so

means failure of collaborations whether it is mergers, acquisitions or joint ventures (Sirmon and

Lane, (2004) and in this regard, role of human resource management need to be changed due to

globalization and its wedged factors such as culture, political and social structures, economic

conditions, labour market conditions, market size. Human resource management role should be

sensitive to all the factors and effective in cross cultural environment, both organizational and

national (Scullion and Linehan, 2005).

For instance, national culture, defined by Hofstede (1980, 1991) as values, beliefs, and

assumptions distinguishing people of different societies from one another, with Power Distance,

Uncertainty Avoidance, Collectivism-Individualism, and Masculinity-Femininity dimensions

affect the HRM role and practices in this era of globalization, where companies are driven to go

limitless in terms of nationalities. For example, Budhwar and Boyne (2004) state that in India,

hiring and promotion is completed keeping in view religion, caste system, and culture. (Clark &

Pugh (2000) suggest that feminine culture of Netherland is not suitable to use hard HRM.

According to Hofstede (1983) and Blunt & Jones (1986), that Kenya's culture showing

uncertainty-avoidance dimension needs that organization should take care various ceremonies

such as funerals and marriages. Similarly, tensions arsing form different organizational culture

20

Mergers and Acquisitions

(in case if it is different) and national culture requires more than traditional HRM role (Cooke et

al 2008).

This means that in case of international collaborations, these factors can cause serious problems

and hence organizations need to develop and deploy a policy that pay attention to these factors as

well to avoid future harms.

In case of mergers and acquisitions in different countries, political, legal, and social structures

influence HRM role and functions (Noe & Ford, 1992). Economic system of a specific country

with different governance structures is also hard on playing its cards to alter the HRM role and

practices in its own terms. Labor Market conditions, (Ali, 2000), market size (Tayeb, 2005) also

needs different motivational and promotional strategies as same standard for all markets cannot

work. Same quantitative target will not work for sales persons in London and Lancaster. Role of

unions is also important in shaping HRM decisions of selections, promotions, wages (Collins et

al, 1993), and motivation (Rosen et al, 1986)

It means that new business environment may require different business practices, demanding

different role of HRM and that is its role envisioned in strategic HRM (SHRM. Bratton & Gold

(2007: 56) define SHRM as "The HR polices and process that result from the global competitive

activities of multinational companies and that explicitly link international HR practices and

processes with the worldwide strategic goals of those companies" It means that HRM is no mere

an administrative facility but has received or expected recognition as a strategic business

collaborator. Companies are actively relating the HRM in the development and

implementation of both people and business strategies (Christina Evans, 2003). It means that

HRM needs to manage people and proactively support the overall management and decision

making of the organizational. According to Guest (2002) managing people includes ensuring

commitment from employees, building high trust and flexible roles, creating focus on values,

flattering hierarchical structure of the organization, and ensuring autonomy at national level and

enhancing self control. In the era of globalization, where new forms of organizations are

unavoidable, Christina Evans (2003) goes further to explain the HRM role stating that it

contributes to overall development of the organization through performance measures, agenda

building, translating strategic level strategies into HR deliverables. Holbeche (1999) suggests

21

Mergers and Acquisitions

that role of HRM is strategic rather than operational, proactive rather than traditional reactive,

changing instead of stagnant, and of employee champion. Ulrich (2000) suggests that HRM role

in competitive world is turning knowledge into action.

Conclusion

The success or the failure of a merger or acquisition activity depends upon a lot of factors both

endogenous and exogenous. The presence of the right mix of people at the helm and the presence

of just a proper integration plan is not always enough. The speed of implementation has to be

there and the managers should be able to communicate properly their intentions to the lower

levels properly. Proper research into the acquired company and its activities are important for the

firms before going ahead with their merger plans. BMW made some key mistakes before going

ahead with the Rover deal regarding the speed of integration, communicating and lack of proper

research. Akzo on the other hand were well planned and their integration was swift and effective.

They overcame the communication and cultural problem and devised ways to create massive

synergies for the company.

From the study of mergers and acquisitions here, the author has been able to understand the key

factors necessary for a such deal and the how the theory developed in the literature review relates

to the practical real world problems.

22

Mergers and Acquisitions

23

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Patient Appointment SystemDocument11 pagesPatient Appointment SystemNaziya BocusPas encore d'évaluation

- Microeconomic Analysis of Pharmaceutical IndustryDocument10 pagesMicroeconomic Analysis of Pharmaceutical IndustrySayan MukherjeePas encore d'évaluation

- Cipla..NCP 2..rachit N Ritika Singh NewDocument19 pagesCipla..NCP 2..rachit N Ritika Singh NewInder Garg88% (8)

- CCSD FinalDocument51 pagesCCSD FinalNiro ThakurPas encore d'évaluation

- Start e Gic CostDocument21 pagesStart e Gic CostNiro ThakurPas encore d'évaluation

- PROJECT REPORT On Retail Sector in India by Satishpgoyal PDFDocument77 pagesPROJECT REPORT On Retail Sector in India by Satishpgoyal PDFNiro ThakurPas encore d'évaluation

- Cyber Cafe ManagementDocument42 pagesCyber Cafe ManagementNiro Thakur100% (1)

- What Is Strategic Cost ManagementDocument4 pagesWhat Is Strategic Cost ManagementNiro ThakurPas encore d'évaluation

- DisabledDocument45 pagesDisabledNiro ThakurPas encore d'évaluation

- Employee Management SystemDocument94 pagesEmployee Management SystemNiro Thakur100% (1)

- Net Banking SystemDocument4 pagesNet Banking SystemNiro ThakurPas encore d'évaluation

- DoctorDocument30 pagesDoctorNiro ThakurPas encore d'évaluation

- QuestionnaireDocument3 pagesQuestionnaireNiro ThakurPas encore d'évaluation

- Bank Management SystemDocument35 pagesBank Management SystemNiro ThakurPas encore d'évaluation

- Human Resource Management in International Organizations: Sonja TrevenDocument13 pagesHuman Resource Management in International Organizations: Sonja TrevenxisiaPas encore d'évaluation

- QuestionnaireDocument3 pagesQuestionnaireNiro ThakurPas encore d'évaluation

- What Is Strategic Cost ManagementDocument4 pagesWhat Is Strategic Cost ManagementNiro ThakurPas encore d'évaluation

- Start e Gic CostDocument21 pagesStart e Gic CostNiro ThakurPas encore d'évaluation

- A Survey of Employee EngagementDocument31 pagesA Survey of Employee EngagementToni Krispin0% (1)

- FY20 Q1 Earnings Call TranscriptDocument24 pagesFY20 Q1 Earnings Call Transcriptrishab agarwalPas encore d'évaluation

- Sun Pharma: Leading Pharma CompanyDocument43 pagesSun Pharma: Leading Pharma CompanyRishabhJaysawal100% (1)

- Final Report Cygnus - SUN PHARMADocument23 pagesFinal Report Cygnus - SUN PHARMAsrinathr99Pas encore d'évaluation

- Pharma Formulation R&D Professional: Dr. Ajinath Eknath ShirsatDocument3 pagesPharma Formulation R&D Professional: Dr. Ajinath Eknath ShirsatAdinath ShirsatPas encore d'évaluation

- Generic Strategy: Strategic ManagementDocument5 pagesGeneric Strategy: Strategic ManagementBhargesh PatelPas encore d'évaluation

- Sun Pharma Announces Distribution Alliance With Mitsubishi Tanabe Pharma Corporation in Japan (Company Update)Document3 pagesSun Pharma Announces Distribution Alliance With Mitsubishi Tanabe Pharma Corporation in Japan (Company Update)Shyam SunderPas encore d'évaluation

- Financial Analysis - SUN PHARMADocument16 pagesFinancial Analysis - SUN PHARMASyed fayas thanveer SPas encore d'évaluation

- Motilal Oswal Healthcare Report PDFDocument150 pagesMotilal Oswal Healthcare Report PDFankur lakhiaPas encore d'évaluation

- IIM Indore paper analyzes Sun Pharma's acquisition of RanbaxyDocument25 pagesIIM Indore paper analyzes Sun Pharma's acquisition of RanbaxyDipesh ThakkarPas encore d'évaluation

- Drug NameDocument83 pagesDrug NameHima Bindu ValluriPas encore d'évaluation

- M&A PharamaDocument9 pagesM&A PharamaAlex WilsonPas encore d'évaluation

- IDirect HealthCheck Aug16Document31 pagesIDirect HealthCheck Aug16Dinesh ChoudharyPas encore d'évaluation

- PPPL Rejected Expiry 10 - Sep - 2019Document34 pagesPPPL Rejected Expiry 10 - Sep - 2019ANANTHA BABU APas encore d'évaluation

- AstraZeneca AB v. Sun Pharma Global FZE Et. Al.Document14 pagesAstraZeneca AB v. Sun Pharma Global FZE Et. Al.PriorSmartPas encore d'évaluation

- Pharmaceuticals ListDocument24 pagesPharmaceuticals ListSunny Singh100% (1)

- Definition of MoraleDocument33 pagesDefinition of MoralesnraviPas encore d'évaluation

- Sun Pharma Presentation on Problems and SolutionsDocument7 pagesSun Pharma Presentation on Problems and SolutionsKriti SoniPas encore d'évaluation

- Indian Pharma Export Strategy Task Force ReportDocument4 pagesIndian Pharma Export Strategy Task Force ReportDeepakSawantPas encore d'évaluation

- Pharma Top 10 PlayersDocument10 pagesPharma Top 10 PlayersArnab MondalPas encore d'évaluation

- What Are The Best Stocks To Invest in India For 2017 - QuoraDocument94 pagesWhat Are The Best Stocks To Invest in India For 2017 - QuoraAchint KumarPas encore d'évaluation

- 19 July 2011 Letters for IssueDocument9 pages19 July 2011 Letters for IssueTanuj VarshneyPas encore d'évaluation

- Sanjivani Parenteral internship reportDocument116 pagesSanjivani Parenteral internship reportNikhil KhobragadePas encore d'évaluation

- Sun Pharma IR PresentationDocument56 pagesSun Pharma IR PresentationAishwarya MauryaPas encore d'évaluation

- Sun Pharma Announces Absorica Patent Litigation Settlement (Company Update)Document1 pageSun Pharma Announces Absorica Patent Litigation Settlement (Company Update)Shyam SunderPas encore d'évaluation

- Sun Pharma Enters Japanese Prescription Market (Company Update)Document2 pagesSun Pharma Enters Japanese Prescription Market (Company Update)Shyam SunderPas encore d'évaluation

- Merger & AcquisitionDocument48 pagesMerger & AcquisitionAshfaque Ul Haque100% (1)

- Pharmaceuticals 270111Document34 pagesPharmaceuticals 270111Sidd SinghPas encore d'évaluation

- Sun Pharma AnalysisDocument38 pagesSun Pharma Analysisabhinav pandey63% (8)