Académique Documents

Professionnel Documents

Culture Documents

Tax Proposals

Transféré par

Sayak BoseCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tax Proposals

Transféré par

Sayak BoseDroits d'auteur :

Formats disponibles

ACCRETIVE SDU

India Budget

2013-14

A Tax Update

For abridged version, refer our separate communique of even date

Document date: 01.03.2013

INDIA BUDGET

2013-14

CONTENTS

DIRECT TAX PROPOSALS ....................................................................... 3

Corporate Tax ............................................................................. 3

Rates of Tax ................................................................................... 3

Applicability of Tax......................................................................... 3

Tax reliefs ....................................................................................... 4

Widening of Tax Base .................................................................... 6

General Anti-avoidance Rule (GAAR)............................................. 7

Select Cross-Border Measures ....................................................... 8

Withholding taxes / Tax Deduction at Source ............................... 8

Tax Administrative Measures ........................................................ 9

Other proposals ........................................................................... 10

Personal taxes .......................................................................... 11

Rate of tax.................................................................................... 11

Tax reliefs ..................................................................................... 12

Tax rationalization ....................................................................... 13

Other Taxes .............................................................................. 13

Commodities transaction tax (CTT) ............................................. 13

Wealth Tax ................................................................................... 14

Securities Transaction Tax (STT) .................................................. 14

Page 2 / 32

ACCRETIVE SDU

INDIRECT TAX PROPOSALS ................................................................... 15

Service Tax................................................................................ 15

Negative list ................................................................................. 15

Abatement ................................................................................... 15

Exemptions .................................................................................. 16

Amnesty Scheme .......................................................................... 17

Others .......................................................................................... 19

Central Excise ........................................................................... 20

Rate of duty ................................................................................. 20

Levy of Central Excise Duty Based on MRP .................................. 22

Penalties....................................................................................... 22

Advance Ruling ............................................................................ 23

Appeals ........................................................................................ 24

Others .......................................................................................... 24

Additional modes of recovery ...................................................... 25

CENVAT Credit .......................................................................... 25

Recovery of CENVAT credit .......................................................... 25

Customs.................................................................................... 26

Duty rates .................................................................................... 26

Exemptions .................................................................................. 27

Administrative.............................................................................. 27

Others .......................................................................................... 29

Goods and Service Tax (GST) ..................................................... 30

Central Sales Tax ....................................................................... 30

EFFECTIVE DATES .............................................................................. 31

INDIA BUDGET

ACCRETIVE SDU

2013-14

DIRECT TAX PROPOSALS

Applicability of Tax

CORPORATE TAX

Tax on buy-back of shares of unlisted companies

Rates of Tax

There are no changes in the tax rates for corporates.

However, the rates of surcharge have been increased.

The effective rate of tax in light of this proposal is

tabulated below.

Taxable Income (Rs)

Upto 1,00,00,000

1,00,00,001 to 10,00,00,000

Above 10,00,00,000

Domestic

Company

30.90%

32.45%

33.99%

Foreign

Company

41.20%

42.02%

43.26%

Marginal relief for surcharge shall be allowed.

In other cases, such as dividend distribution tax

(DDT) or tax on distributed income (through share

buy-backs), surcharge is increased to 10%.

There are no changes in the rates of Education

Cess and Secondary and Higher Education Cess,

which continues at 3%.

Page 3 / 32

With effect from 01.06.2013, a new levy of tax at

20% (exclusive of surcharge and cess) is proposed

on an unlisted company buying back its shares. The

difference between the consideration paid by the

company to the shareholder and the sum received

by the company at the time of issue of such shares

would be liable to tax as distributed income in the

hands of the domestic company. The above tax is in

addition and irrespective of the tax payable by the

domestic company on its profits for the year.

Where the company buying back the shares has

discharged this tax liability, the gains derived by the

shareholder on account of such buy-back would be

exempt from tax.

The new levy has been proposed as a measure to

curb tax avoidance schemes being adopted by

taxpayers to avoid payment of DDT that would

otherwise be applicable particularly where the

capital gain arising on buy-back would be exempt

from tax or chargeable at a lower rate.

Direct Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Tax reliefs

Investment allowance for manufacturing sector:

An investment allowance has been proposed for

taxpayers investing in excess of INR 100 crore in

new plant and machinery. The allowance would

be by way of an additional deduction amounting

to 15% of the actual cost of the new assets. The

assets need to be acquired and installed between

01.04.2013 and 31.03.2015.

The investment allowance is in addition to the

benefit of normal depreciation and the additional

depreciation currently prevalent. The investment

should be in new plant and machinery and

specifically

excludes

computers/computer

software.

The amount allowed as deduction shall be

chargeable to tax if the new asset is transferred

within 5 years. However, if the transfer is in

connection with an amalgamation or demerger,

the benefit can be availed by the resulting or the

amalgamated company.

Page 4 / 32

Extension of sunset for certain companies in the

power sector: Undertakings in the power sector

(involved

in

generation,

distribution,

transmission of power or substantial renovation /

modernization of existing transmission networks)

can claim a tax holiday in respect of specified

income where they commence prescribed

operations on or before 31.03.2014. Hitherto,

such tax holiday could be claimed by

undertakings that commence prescribed

operations on or before 31.03.2013.

Extension of lower rate of taxation on dividends

received from foreign subsidiaries of Indian

companies: The benefit of lower rate of taxation

of 15% on dividend income earned by an Indian

company from its specified foreign subsidiaries is

proposed to be extended till 31.03.2014, which

was hitherto available till 31.03.2013.

Direct Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Cascading effect of DDT on dividends from

foreign subsidiaries removed: Presently, in

computing dividends that are liable to DDT,

dividend received from an Indian subsidiary on

which DDT was paid could be excluded. Similar

relief is extended on dividends received by an

Indian company from a foreign subsidiary (i.e.

shareholding of more than 50%) which is taxed at

the lower rate of 15%. The dividend income

earned and distributed should be within the

same financial year to avail this benefit.

Extension of pass-through to entities registered

under SEBI AIF regulations: The SEBI (Venture

Capital Fund) Regulations 1996 (VCF Regulations)

were replaced in May 2012 by the SEBI

(Alternative Investment Funds) Regulations, 2012

(AIF Regulations). In light of this regulatory

development, it is proposed to extend pass

through status (i.e. income is taxable in the

hands of investors instead of the fund) to:

all Venture Capital Companies (VCCs),

Venture Capital Undertakings (VCUs) and

VCFs that were registered under the erstwhile

VCF Regulations;

all entities that are defined as VCUs under the

AIF regulations; and

all VCFs and VCCs registered as a sub-category

of Category 1 AIF under the AIF regulations.

Tax on income distributed by mutual funds to

individuals / HUF: With effect from 01.06.2013, a

uniform rate of 25% is proposed to be applied on

income distributed by a Mutual Fund to its unit

holders being individuals and Hindu Undivided

Families.

Tax on income distributed by an Infrastructure

Development Fund (IDF) set-up as a Mutual

Fund (MF) to non-resident: With effect from

01.06.2013, a lower rate of tax at 5% is proposed

with respect to interest income of a non-resident

from an IDF set-up as a MF.

Page 5 / 32

This provision would be applicable from FY 201213 onwards.

Direct Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Deduction of additional wages paid to new

regular workmen: Indian companies engaged in

the manufacture of goods in a factory can claim a

relief of 30% of additional wages paid to new

regular workmen employed during the financial

year. This relief was hitherto available to

industrial undertakings whereby employees of

non-manufacturing sectors (such as service

sectors) were also making a claim for the relief.

Given the intent of the relief, it is now proposed

to limit the same to wages paid in a factory that

manufactures goods.

<<this space is left blank intentionally>>

Page 6 / 32

Widening of Tax Base

Determination of sale value for immoveable

property held as stock-in-trade: Where land

and/or building held as stock in trade is

transferred for a value that is less than the value

adopted for stamp duty purposes, the stamp

duty value would be regarded as the sale

consideration for the purpose of computing

taxable business profits. Hitherto the valuation

principle was provided only for transfer of land or

building held as a capital asset.

It is also proposed that in situations where the

date of the agreement differs from the date of

registration, the appropriate date for computing

the value for stamp duty would be the date of

the agreement. However this would apply only in

cases where part consideration is at least

received before the date of the agreement and in

a mode other than cash.

Direct Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Taxation of receipt of immovable properties for

inadequate consideration: Presently, where

individuals and Hindu Undivided Families receive

immoveable properties without consideration,

the stamp duty value (where the same exceeds

INR 50,000/-) of such immoveable properties is

regarded as income. Now the provision is also

proposed to apply in cases where the immovable

property

is

received

for

inadequate

consideration.

General Anti-avoidance Rule (GAAR)

A number of representations were made against the

GAAR provisions introduced by the Finance Act,

2012. Pursuant to this, the Government constituted

an Expert Committee (EC) to inter alia consult with

stakeholders and finalize the GAAR guidelines with a

road map for implementation. The major

recommendations of the EC that were accepted by

the Government, with some modifications have

been proposed as law. The key highlights include:

Page 7 / 32

The new GAAR provisions will come into force

with effect from FY 2015-16.

GAAR would apply to arrangements (or a step in

the arrangement) having the main purpose of

obtaining a tax benefit.

The GAAR Approving Panel would now consist of

a Chairperson who is or has been a Judge of a

High Court; one Member of the Indian Revenue

Service of the rank of Chief Commissioner of

Income-tax; and one Member who shall be an

academic or scholar having special knowledge of

matters such as direct taxes, business accounts

and international trade practices.

Taxpayer could approach the Authority for

Advance Rulings to determine whether an

arrangement qualifies as an impermissible

avoidance arrangement prior to entering into the

arrangement.

Direct Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Select Cross-Border Measures

Withholding taxes / Tax Deduction at Source

Taxation of royalty income and fees for

technical services (FTS): The withholding tax rate

on royalty and FTS payments to non-residents is

proposed to be increased to 25% from the

erstwhile 10%. However, non-residents could

seek relief of lower rates if any, provided for in

the applicable double taxation avoidance

agreement (DTAA).

Withholding tax on transfer of immovable

property (other than agricultural land): With

effect from 01.06.2013, a withholding tax at the

rate of 1% is proposed on consideration paid /

payable to a resident for transfer of immovable

property (other than agricultural land). The

withholding tax is applicable only where the

consideration exceeds INR 50 lakh.

Tax Residency Certificate (TRC): Last year, the

law was amended to mandate that a taxpayer

claiming relief under the relevant DTAA would

need to obtain a TRC. It is now proposed that

obtaining the TRC shall be a necessary but not

sufficient condition to claim relief under the

DTAA. This provision is effective from FY 2012-13.

Concessional rate of withholding tax on interest

in case of certain rupee denominated long-term

infrastructure bonds: Under the existing

provisions, any interest paid by an Indian

company to a non-resident in respect of an

approved foreign currency borrowing from

sources outside India between 01.07.2012 to

01.07.2015, is subject to withholding tax at 5%.

This benefit is now extended to interest on

rupee-denominated long term infrastructure

bonds subject to certain conditions.

Page 8 / 32

Direct Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Surcharge on withholding tax in respect of

payments to non-resident individuals and

foreign companies: Withholding tax in respect of

payments to non-resident individuals would

include surcharge of 10% where the payments

made or likely to be made exceed INR 1 crore.

Withholding tax in respect of payments to

foreign companies would include surcharge of:

2%, for payments made or likely to be made

exceed INR 1 crore but not INR 10 crore.

5%, for payments made or likely to be made

exceed INR 10 crore.

<<this space is left blank intentionally>>

Page 9 / 32

Tax Administrative Measures

Defective return: With effect from 01.06.2013, a

return would be defective if the tax and interest

due at the time of filing of the return has not

been paid.

Directions for special audit: Currently for the

purpose of directing a taxpayer to undertake an

audit of its accounts, the tax officer is required to

consider only the nature and complexity of the

accounts of the taxpayer. With effect from

01.06.2013, the tax officer should consider the

following parameters:

Nature and complexity of accounts;

Volume of the accounts;

Doubts about the correctness of the accounts;

Multiplicity of transactions in the accounts; or

Specialized nature of business activity of the

taxpayer.

Direct Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Penalty for non-filing of Annual Information

Return (AIR): Where the AIR is not furnished

within the time prescribed in a notice requiring

the same from the tax officer, a penalty of

INR 500/- per day would be applicable for every

day beyond the day prescribed in the notice upto

the day of filing the AIR. Hitherto the penalty was

INR 100/- per day.

Other proposals

Taxation regime for securitization trusts: A new

taxation regime is proposed to be introduced for

trusts established to undertake securitization

activities. The salient features of the proposed

regime are:

Exemption of tax on income of such trusts

from the activity of securitization.

Requirement of the trust to pay income-tax

on income distributed to investors at:

(i) 25 percent in case of individual or HUF;

(ii) Zero percent in cases of persons who are

exempt from tax.

(iii) 30 percent in any other case.

<<this space is left blank intentionally>>

The distributed income received by the

investor would accordingly be exempt from

tax.

Page 10 / 32

Direct Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Rationalization of definition of urban land: The

scope of urban land to be regarded as a capital

asset has been rationalized. Accordingly, land

situated within the jurisdictions of a municipality

or cantonment board with reference to the

population of such area and within the specified

distance, as measured aerially would be regarded

as capital asset:

Land situated not more than 2 kms., from the

local limits of any municipality or cantonment

board and having a population of more than

10,000 but not exceeding 1 lakh; or

Land situated not more than 6 kms., from the

local limits of any municipality or cantonment

board and having a population of more than 1

lakh but not exceeding 10 lakh; or

PERSONAL TAXES

Rate of tax

There has been no change in the tax slabs for

individuals and HUFs. There is a marginal respite for

resident individuals having a total income not

exceeding Rs 5 lakh, who would be allowed a tax

rebate of 100% of the tax, not exceeding INR 2,000.

A surcharge on income-tax would be applicable at 10%

if the total income of the individual exceeds INR 1

crore.

Land situated not more than 8 kms., from the

local limits of any municipality or cantonment

board and having a population of more than

10 lakh.

Page 11 / 32

Direct Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Tax reliefs

Deduction of interest on housing loan: A deduction

would be available upto INR 1 lakh in respect of

interest on housing loan subject to the following

conditions:

The housing loan is sanctioned by a financial

institution in FY 2013-14

The loan does not exceed INR 25 lakh

The value of the residential house property does

not exceed INR 40 lakh

The taxpayer does not own any house property

on the date of sanction of housing loan

In case of short fall in the above deduction, the

balance can be carried forward to the FY 201415.

Page 12 / 32

Tax exemption on sum received by a person with

disabilities under a life insurance policy: Currently

any sum received under a life insurance policy by a

person with disabilities or a person suffering from

specified diseases is exempt subject to the condition

that the premium paid for such policy does not

exceed 10% of the actual capital sum assured. The

premium threshold is increased to 15% for life

insurance policy issued on or after 01.04.2013.

Deduction in respect of health insurance premium

extended: Any contribution made by an individual

taxpayer to the Central Government Health Scheme

or any schemes of state and central governments,

which are similar to the Central Government Health

Scheme would be eligible for a tax deduction.

Direct Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Deduction in respect of investment in equity

savings scheme extended to investments in units of

equity oriented fund: In order to incentivize capital

market investments by new retail investors, a

deduction would be available to individual taxpayers

in respect of investments in units of equity oriented

funds to the extent of 50% of the investments or

INR 25,000, whichever is less. Hitherto, the benefit

was limited to investments in equity shares.

The deduction would be available for a period of

three consecutive years beginning with the year in

which the listed equity shares or listed units were

first acquired by the new retail investor. The

deduction would now be available to a taxpayer

whose gross total income for the relevant year does

not exceed INR 12 lakh.

Deduction in respect of contribution to the

National Children Fund: It is proposed to allow

100% deduction in respect of any sum contributed

to the National Childrens Fund vis--vis the earlier

limit of 50% of the contribution.

Page 13 / 32

Tax rationalization

Rationalization of provisions in respect of keyman

insurance policy: A keyman insurance policy which

has been assigned to any person during its term,

with or without consideration, would be treated as

a keyman insurance policy and any sum received

under such policy would not be exempt from tax in

the hands of the assignee.

OTHER TAXES

Commodities transaction tax (CTT)

A new tax called CTT would be levied on

transactions of sale of derivatives in respect of

commodities, other than agricultural commodities,

traded in recognized associations. The tax would be

levied at 0.01% on the commodities transaction.

Such tax would be allowed as a deductible

expenditure to the taxpayer (who has paid the CTT)

if the business income of such taxpayer includes

income from taxable commodities transactions.

Direct Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Wealth Tax

Securities Transaction Tax (STT)

It is proposed to facilitate electronic filing of

annexure-less wealth tax returns along the lines of

the income-tax return.

STT on transactions of specified securities would be

reduced effective from 01.06.2013. The proposed

rates of STT are as follows:

<<this space is left blank intentionally>>

Nature of taxable

securities transaction

Delivery based purchase

of units of an equity

oriented fund entered

into in a recognised stock

exchange

Delivery based sale of

units of an equity

oriented fund entered

into in a recognised stock

exchange

Sale of a futures in

securities

Sale of a unit of an equity

oriented fund to the

mutual fund

1

Page 14 / 32

Payable

by

Purchaser

Rates (in %) 1

Seller

0.001

(0.1)

Seller

0.01

(0.017)

0.001

(0.25)

Seller

Rates in brackets refer to existing rates

Direct Tax Proposals

Nil

(0.1)

INDIA BUDGET

ACCRETIVE SDU

2013-14

INDIRECT TAX PROPOSALS

SERVICE TAX

The mean rate of service tax remains unchanged at

12.36% (including education cess).

Negative list

Medicinal or toilet preparations: Manufacture or

processing of medicinal or toilet preparations liable

to duty under Medicinal and Toilet Preparations

(Excise Duties) Act, 1955 is proposed to be included

under the negative list. Hitherto, only such

processing liable to duty under Central Excise Act,

1944 and State Excise Acts was included.

Vocational Educational Course: Specified courses

run by an industrial training institute or an industrial

training centre affiliated to the State Council for

Vocational Training is proposed to be included

under the negative list. Hitherto, only courses

affiliated to National Council were covered.

Further, the exemption in respect of courses run by

institute affiliated to National Skill Development

Corporation is withdrawn.

Page 15 / 32

Agriculture Testing: The exclusion of testing service

from levy of service tax is extended to all agriculture

or agricultural produce. It was hitherto restricted

only to seeds.

Abatement

Construction of complex: The deemed deduction

for computation of service tax in respect of

residential units which is currently at 75% is reduced

to 70% where service tax is paid on the total value

including the value of land. The increased rate

would be applicable only in respect of residential

units measuring 2000 sft or more of carpet area and

which are charged at more than INR 1 Crore.

Consequently, the effective rate of service tax in

such cases is increased to 3.708% from 3.09%.

The current rate of 3.09% would continue in respect

of units measuring upto 2000 sft or which are

charged at INR 1 Crore or less.

Indirect Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Exemptions

Auxiliary Education Services and Renting of

Immovable Property Services provided by an

educational institution is proposed to be taxed. The

exemption hitherto available would be withdrawn.

Temporary transfer or permitting the use /

enjoyment of copyrights with respect to

cinematograph films is proposed to be exempt only

if the transfer is for exhibition in a cinema hall or

cinema theatre. Hitherto, such transactions were

exempted irrespective of the purpose of transfer.

Service tax is proposed to be extended to

restaurant, eating joint or mess if it has a facility of

air conditioning or central air heating facility wholly

or partly. Hitherto, it was liable to service tax only if

it had the license to serve liquor in addition to air

conditioning or air heating facility.

Page 16 / 32

Exemption to services by way of transportation of

the following goods by rail or vessel in India is

withdrawn.

Petroleum and petroleum products

Postal mail or mail bag

Household effects

Exemption to services provided by a goods

transport agency by way of transport in a goods

carriage is extended to the following:

all agricultural produce (hitherto, it was

applicable only for fruits, vegetables, eggs, milk,

food grains or pulses)

foodstuff including flours, tea, coffee, jaggery,

sugar, milk products, salt and edible oil, excluding

alcoholic beverages

chemical fertilizer and oilcakes

newspaper or magazines registered with the

Registrar of Newspapers

relief materials meant for victims of natural or

man-made disasters, calamities, accidents or

mishap

defence or military equipment

Indirect Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Services provided by Indian Railways: A

retrospective exemption is provided to all taxable

services provided by the Indian Railways prior to the

01.07. 2012 to the extent show cause notices have

been issued upto 28.02.2013.

Exemption is withdrawn in respect of the following

services. Consequently, the same would be liable to

service tax.

Vehicle parking provided to general public

Repair or maintenance services provided to

Government, local authority or a governmental

authority

Services of advancement of any object of general

public utility (as charitable activities) up to INR 25

lakhs

Amnesty Scheme

The Government has proposed to introduce a scheme

called the Service Tax Voluntary Compliance

Encouragement Scheme, 2013, to encourage service

providers to file returns and pay taxes. The salient

features of the scheme are as follows:

Application to be made before 31.12.2013

All interest, penalties and other proceedings

otherwise applicable would be waived

Any person may opt for the scheme in respect of

transactions where no notice is issued or order

passed upto 28.02.2013

Service tax dues for the period 01.10.2007 to

31.12.2012 not paid as on 01.03.2012 may be paid

and returns filed

The scheme may be opted even by persons who

have filed returns if the returns do not disclose the

true liability, subject to conditions

Page 17 / 32

Indirect Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Cases where inquiry or investigation or audit has

begun may also opt for the scheme, subject to

conditions

The scheme would not be applicable to:

Cases where a best judgement assessments

made or notice is issued for recovery of service

tax on or before 01.03.2013

Similar transactions in subsequent periods where

best judgement assessment is made or notice is

issued for recovery of taxes in any earlier

period/s

Cases where the return is filed and appropriate

disclosures made but where the tax liability is not

discharged

Total tax liability to be discharged in two equated

installments, (i) before 31.12.2013 and (ii) before

30.06.2014.

Page 18 / 32

Upon declaration, if the taxes are not paid as

prescribed, the same would be liable to be paid

along with interest starting from 01.07.2014 on or

before 31.12.2014

The amount of tax so paid shall not be refundable

under any circumstances.

It is provided that no matter shall be reopened

before any authority or court in respect of

declaration made under this scheme. However, if

the Commissioner has reason to believe that the

declaration made is substantially false, normal

recovery proceedings may be initiated.

The Rules with respect to the Form and manner of filing

is yet to be issued.

Indirect Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Notes:

Others

Changes in penalty provisions:

Offence

Proposed

penalty

Existing

penalty

Person liable to pay service

tax or required to take

registration, fails to take

registration

Upto INR

10,000

Upto INR

10,000 or

INR 200 per

day of

default WEH

Penalty on the director,

manager, secretary or any

other person responsible

for conduct of business and

was knowingly concerned

with specified offences

Upto INR

1,00,000

NA

Imprisonment in case of

failure to pay any amount

collected as service tax

beyond a period of 6

months where the amount

exceeds INR 50 lakhs

(including subsequent

offences)

May extend

upto 7 years

WEH whichever is higher

Page 19 / 32

May extend

upto 3 years

Any officer above the rank of a Superintendent

and authorized by the Commissioner may arrest

the concerned person with respect to the

imprisonment indicated above.

An offence involving imprisonment indicated

above is cognizable. It is further provided that all

other offences would be non-cognizable and

bailable.

Relevant procedural

introduced.

provisions

have

been

Recovery of tax: Where the appellate authority or

tribunal or court concludes that extended period of

limitation of 5 years is not applicable against a

person to whom notice was issued, it is provided

that the recovery of such tax dues may be initiated

for the prescribed period of 18 months.

Indirect Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Filing of memorandum of cross objections:

Appellate tribunal can admit an appeal or permit

the filing of memorandum of cross objections after

the expiry of the relevant period for assessee if

sufficient cause is shown. Hitherto, the provision to

file memorandum of cross objections after the due

date was available only to the revenue department.

Advance Ruling: The facility of advance ruling is

proposed to be extended to resident public limited

companies.

Similar amendment is made under the Central Excise

provisions

CENTRAL EXCISE

Rate of duty

The peak rate of Central Excise Duty remains

unchanged at 12% (effective rate at 12.36%).

Rate of duty on mobile handsets including cellular

phones, having retail sale price more than INR 2000,

is increased to 6% from 1%. However, the rate of

duty where the retail sale price is upto INR 2000,

remains unchanged at rate of 1%.

Readymade garments and made ups of cotton, not

containing any other textile materials, is wholly

exempted from duty.

However, the manufacturer has the option to pay

central excise duty at rate of 6% and avail CENVAT

credit in lieu of claiming the said exemption. The

position as existed prior to Budget 2011-12 is

restored.

Page 20 / 32

Indirect Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Units availing area based exemption in the State of

Himachal Pradesh and Uttarakhand would be

exempted from central excise duty on intermediate

goods which are manufactured and captively

consumed.

Compounded rate of Central Excise Duty on each

cold rolling machine of stainless pattis / pattas is

increased to INR 40,000 from INR 30,000.

<<this space is left blank intentionally>>

Changes in duty rates on certain specific goods:

Description

Diesel motor vehicles chassis

for transport of goods

Motor vehicle > 1500 cc*

Ships, tugs, pusher craft ,

dredgers and other vessels

Heena powder or paste not

mixed with any other ingredient

Handmade carpets, Carpets &

other textile floor coverings of

coir & jute whether or not

handmade

Silver produced during the

process of zinc or lead from the

stage of zinc or lead or

concentrate

Marble slabs and tiles per sqmt

Tapioca Starch**

Tapioca Sago (sabudana)

*

**

Page 21 / 32

w.e.f.

01.03.2013

Upto

28.02.2013

30%

NIL

27%

6%

NIL

6%

NIL

2%

4%

12%

13%

INR 60

NIL

NIL

14%

INR 30

6%

6%

If solely used as taxis additional duty of excise shall be exempt.

Manufactured and consumed captively in the manufacture

tapioca saga (sabudana).

Indirect Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Levy of Central Excise Duty Based on MRP

Medicaments exclusively used in Ayurvedic, Unani,

Sidha, Homeopathic or Bio-Chemic systems and sold

under a brand name are notified for levy Central

Excise duty based on Maximum Retail Price (MRP).

The Central Government has notified 35% as

abatement for the said goods. Accordingly,

Central Excise Duty would be payable on 65% MRP

and the effective rate would be 8.034% (@ 12.36%).

Penalties

Threshold for initiating prosecution enhanced: The

Government is empowered to initiate prosecution

proceedings in respect of offences involving evasion

of duty exceeding INR 50 lakhs. Hitherto, the

threshold was at INR 30 lakhs. The terms of

imprisonment which is prescribed as upto 7 years

remains changed.

Page 22 / 32

Specific offences to be cognizable and nonbailable: It is proposed that an offence involving

evasion of Central Excise Duty (non-payment or

utilization of CENVAT credits) of over INR 50 lakhs

shall be cognizable and non-bailable.

In view of the above only those persons who are

arrested under non-cognizable offences can be

released on bail on executing a personal bond with

or without sureties. Hitherto, the provisions of

release of arrested persons on bail were applicable

to both, cognizable or non-cognizable offences.

Similar provisions relating to penalties and offences are

introduced under the Customs provisions.

Indirect Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Issue of statement shall be deemed to be notice:

Mere issue of a statement containing the details of

non-levy, short-levy, non-payment, short payment

or erroneous refund would constitute the

requirements of issue of show cause notice. This

would be applicable to cases where a show cause

notice is already issued for similar matters for

earlier period if the grounds relied upon are the

same.

Service of documents: Presently the notices and

other documents should be served under registered

post with the acknowledgement due. It is proposed

to include the following additional modes of

delivery to suffice service:

Speed post with proof of delivery

Courier as approved by the CBEC

Page 23 / 32

Advance Ruling

Advance Rulings: The expression activity is

redefined to include any new business of production

or manufacture proposed to be undertaken by an

existing manufacturer. Accordingly, manufacturers

may apply for an advance ruling for such new

businesses.

Additionally, it is proposed to extend the provisions

and enable the manufacturers to seek an advance

ruling on questions relating to admissibility of credit

of service tax paid on input services used in relation

to manufacture of excisable goods. Hitherto, the

provisions of advance ruling were applicable only to

admissibility of credit of excise duty paid on inputs.

Indirect Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Appeals

Validity period for stay granted by CESTAT: Every

appeal filed before the CESTAT in respect of which a

stay is granted is required to be disposed-off within

180 days from the date of stay order.

However, with respect to appeals which are not

disposed-off within the said period due to reasons

not attributable to the appellant, the CESTAT, on

application, may extend the stay granted by another

185 days, aggregating 365 days, within which the

CESTAT should dispose the appeal.

By virtue of Section 86(7) of the Finance Act, 1994,

the same will be applicable to service tax. Further,

similar amendment is proposed under the Customs

law.

Enhancement of monetary limit of the single

bench: It is proposed to increase the monetary limit

of the Single Bench of the Tribunal to hear and

dispose-off appeals to INR 50 lakhs from INR 10

lakhs.

By virtue of Section 86(7) of the Finance Act, 1994,

the same will be applicable to service tax. Further,

similar amendment is proposed under the Customs

law.

Others

Interest payable by the Government on finalization

of provisional assessment: Where upon finalization

of provisional assessment, Central Excise Duty

becomes payable to the manufacturer, it is provided

that interest shall be payable at the prescribed rate

after expiry of 3 months from the date of

application.

Hitherto, it was provided that interest is payable

from the first day of the month for which the refund

is determined.

Page 24 / 32

Indirect Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

CENVAT CREDIT

Additional modes of recovery

In line with the provisions contained under

Service Tax law, it is proposed to empower

jurisdictional central excise officers to initiate

following modes of recovery of any sum due to

Government:

the

the

the

the

May require any other Central Excise or Customs

Officer to deduct such sums out of the amounts

due to such person;

May require any other person from whom any

amount is due to such person or who may be

holding money for or on his account, to the

extent, as is sufficient to pay the arrears of

revenue.

Recovery of CENVAT credit

CENVAT credit is repayable in cases where capital

goods / inputs are removed as such; or where the

capital goods are removed after being used; or

where the inputs / capital goods are partially / fully

written off.

In this regard, it is provided that in case of failure to

repay the above CENVAT credits, the same shall be

recoverable as CENVAT wrongly taken and utilized

together with interest.

In this regard, it is provided that the person to

whom the notice is issued is bound to comply

with the same.

Page 25 / 32

Indirect Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

CUSTOMS

Duty rates

Description

The mean rate of basic customs duty remains

unchanged at 10% on non-agricultural goods.

Changes in duty rates on certain specific goods:

Description

Proposed

rate

Agriculture/Agro Processing/plantation Sector

Dehulled oat grain

15%

Hazel nuts

10%

Metals

Stainless steel wire cloth stripe for

5%

use in manufacture of catalytic

convertors and their parts

Wash coat for use in manufacture of

5%

catalytic convertors and their parts

Precious Metals

Pre-forms of precious and semi2%

precious stones

Capital Goods/Infrastructure

Steam coal BCD / CVD

2% /2%

Bituminous coal BCD/ CVD

2%

Page 26 / 32

Current

rate

30%

30%

10%

7.5%

10%

Nil /1%

5% /6%

Specified machinery for leather and

footwear industry

Aircrafts and Ships

Yachts and motor boats

Environment Protection

Lithium ion automotive battery for

manufacture of lithiumion battery

packs

for

supply

to

the

manufacturers of hybrid and electric

vehicles

Textiles

Raw silk (not thrown) of all grades

Textile machinery and parts

Electronics/Hardware

Set top boxes for TV

Automobiles

Import of cars with CIF value more

than US $ 40,000 for petrol car and

engine capacity exceeds 3000cc and

diesel car engine capacity exceeds

2500cc

Motor cycle with engine capacity

800cc or more

Indirect Tax Proposals

Proposed

rate

Current

rate

25%

10%

Nil

10%

15%

5%

5%

7.5%

10%

5%

100%

75%

75%

60%

5%

7.5%

INDIA BUDGET

ACCRETIVE SDU

2013-14

Description

Proposed

rate

Agriculture/Agro Processing/Plantation Sector

De-oiled rice bran oil cake

Nil

Metals

Unprocessed ilmenite

10%

Ilmenite

5%

Bauxite

10%

Current

rate

10%

Nil

Nil

Nil

Exemptions

Import of parts for maintenance, repair and

overhaul or testing of aircrafts is allowed without

payment of import duty, subject to the condition

that such goods are consumed / installed with 3

months. It is now increased the time limit of

consumption / installation to 1 year from 3 months.

Similar enhancement in time limit is made in respect

of consumption of imported goods for the purpose

of repair of ocean going vessels by ship repair units.

Import of specified parts of electric and hybrid

vehicles is exempt from basic customs duty, special

additional duty and countervailing duty upto

01.04.2013. This date is extended upto 31.03.2015.

Page 27 / 32

Export flat rolled products of iron or non-alloy

steel, plated or coated with zinc are exempted from

export duty with retrospective effect from

01.03.2011.

Withdrawal of exemption: Exemption from

education cess and secondary & higher education

cess is withdrawn on aeroplanes, helicopters and

their parts.

Administrative

Provisional attachment of property: Where any

duty is not levied, short levied, erroneously

refunded or interest is not paid, it is proposed that

the property belonging to the person on whom

notice was issued may be provisionally attached.

However, it may be noted that this would be

applicable only if the above is due to reasons

involving collusion, willful mis-statement or

suppression of facts.

Indirect Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Refund claim and Show Cause Notice: In cases

where the refund of customs duty or duty demand

is less than INR 100, it is proposed that the claim of

refund or serving of show cause notice, as the case

may be, would not be entertained.

Payment of duty upon assessment of BoE: It is

proposed to reduce the number of days to 2 from 5

(excluding holidays) within which the importer is

required to pay the import duty once the BoE is

returned for payment.

Landing of Vessels and Aircrafts: It is proposed to

empower the CBEC to permit landing of vessels and

aircrafts at any place other than customs port and

customs airport.

Any delay beyond 2 days would be liable for

payment of interest.

Electronic filing of import and export manifest: It is

proposed that the import or export manifest should

be filed electronically. However, in circumstances

where the electronic filing is not feasible, the

Commissioner of Customs would be empowered to

allow filing of the same in any other manner.

Restriction on storage of imported goods in

warehouse: It is proposed to restrict the general

period of storage of imported goods in a public or

private warehouse, pending clearance, to 30 days.

However, the same may be extended by the

Commissioner of Customs by not more than 30 days

at a time.

Page 28 / 32

Threshold for punishment increased: For an offence

involving evasion or attempted evasion of duty, the

threshold for imposing punishment is increased to

INR 50 lakhs from INR 30 lakhs.

Exemption of duty on goods removed as samples:

The whole of the import duties payable on goods

removed as samples for testing or examination and

which are consumed or destroyed as part of the

process is exempt. Hitherto, the exemption was

applicable only if the duties payable on such goods

was less than INR 5.

Indirect Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

Others

Advance Rulings: With reference to importers and

exporters, the expression activity is redefined to

include any new business of import or export

proposed to be undertaken by the existing importer

or exporter. Accordingly, the importers or exporters

may apply for an advance ruling for such new

businesses.

Baggage Rules: The duty free allowance is amended

as follows:

Description

WEF

01.03.2013

Upto

28.02.2013

Jewellery by Gentlemen*

50,000

10,000

Jewellery by Ladies*

1,00,000

20,000

Crew member of vessel /

1500

600

aircraft

Note: * Applicable to an Indian passenger who has

been residing abroad for atleast one year or a

person who is transferring his residence to India

Page 29 / 32

Export of goods imported by post: The provisions

enabling export of warehoused goods without

payment of duties is proposed to extended to goods

imported by post. Accordingly, based on the label or

declaration accompanying the postal imports, the

importer may export the goods without payment of

duties.

Re-designate customs house agents: It is proposed

that customs house agents shall be re-designated

as customs brokers.

Representation before the office of Customs: It is

proposed that any person who is convicted for any

offence under the Service Tax provisions would not

be qualified to represent any other person before

the customs authorities.

Prohibition of imports and exports: With a view to

regulate the import or export of designs and

geographical indications, it is proposed to include

the same under the list of prohibited goods.

Accordingly, it follows that import and export of

such goods would be subject to conditions as may

be specified.

Indirect Tax Proposals

INDIA BUDGET

ACCRETIVE SDU

2013-14

GOODS AND SERVICE TAX (GST)

CENTRAL SALES TAX

State Finance Ministers and the GST Council to draft

the GST Law

The rate of CST remains unchanged at 2% when goods

are sold against declaration in Form C.

Draft Bills on the Constitutional Amendment and the

GST Law to be placed before the Parliament in the

next few months;

Honble Finance Minister: Hope inspires courage. I

propose to take the first decisive step by setting

apart, in the Budget, a sum of `9,000 crore

towards the first instalment of the balance of CST

compensation. I appeal to the State Finance

Ministers to realise the serious intent of the

Government to introduce GST and come forward

to work with the Government and bring about a

transformational change in the tax structure of

the country.

Page 30 / 32

Indirect Tax Proposals

<<this space is left blank intentionally>>

INDIA BUDGET

ACCRETIVE SDU

2013-14

EFFECTIVE DATES

Customs:

The Direct Tax proposals are effective for the FY 201314 unless alternatively provided therein.

Service Tax:

Particulars

Particulars

Effective date

Notifications

01.03.2013

Amendments in Customs Act, Upon enactment of

1962

Finance Bill, 2013

Effective Date

Change in abatement for

01.03.2013

residential unit

Exemptions

01.04.2013

Service Tax Voluntary Compliance

Date of

Encouragement Scheme 2013

enactment of

Amendment to Finance Act, 1994 Finance Bill, 2013

<<this space is left blank intentionally>>

Central Excise:

Particulars

CENVAT Credit Rules

Central Excise Rules

Amendments in Central

Excise Act, 1944

Notifications

Other Rules

Page 31 / 32

Effective date

01.03.2013

01.03.2013

Upon enactment of

Finance Bill, 2013

01.03.2013

01.03.2013

Effective Dates

INDIA BUDGET

2013-14

ACCRETIVE SDU

specialists@accretiveglobal.com

+ 91 (80) 22261371

Accretive SDU Consulting Private Limited

'Trade Centre', 6th Floor,

No.29/4, Race Course Road

Bangalore 560 001

India

Document date: 01.03.2013

The views expressed and the information provided in this newsletter are of general nature and are not intended to address the circumstances of any

particular individual or entity. Further, the above content should neither be regarded as comprehensive nor sufficient for making decisions. Although

we endeavour to provide accurate and timely information, there is no assurance or guarantee in this regard. No one should act on the information or

views provided in this publication without appropriate professional advice. Accretive will not be responsible for any loss arising from any actions taken

or to be taken or not taken by anyone based on this publication.

This is meant for private circulation only.

Vous aimerez peut-être aussi

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Documentary Stamp TaxDocument120 pagesDocumentary Stamp Taxnegotiator50% (2)

- CH 21 TBDocument18 pagesCH 21 TBJessica Garcia100% (1)

- Direct Taxes Code 2010Document14 pagesDirect Taxes Code 2010musti_shahPas encore d'évaluation

- Corporate Taxation in BangladeshDocument8 pagesCorporate Taxation in Bangladeshskn092Pas encore d'évaluation

- FAQ For PIC and Cash GrantDocument4 pagesFAQ For PIC and Cash GrantSathis KumarPas encore d'évaluation

- Deloitte Tax Alert - Corporate Tax Rates Slashed and Fiscal Relief AnnouncedDocument4 pagesDeloitte Tax Alert - Corporate Tax Rates Slashed and Fiscal Relief AnnouncedSunil GidwaniPas encore d'évaluation

- Direct Taxes Code 2013Document11 pagesDirect Taxes Code 2013Hiral PatelPas encore d'évaluation

- Corporation Tax GuideDocument122 pagesCorporation Tax Guideishu1707Pas encore d'évaluation

- Tax-Free Exchanges That Are Not Subject To Income Tax, Capital Gains Tax, Documentary Stamp Tax And/or Value-Added Tax, As The Case May BeDocument7 pagesTax-Free Exchanges That Are Not Subject To Income Tax, Capital Gains Tax, Documentary Stamp Tax And/or Value-Added Tax, As The Case May BeJouhara ObeñitaPas encore d'évaluation

- One Advice For Investors Earning Dividend Income - Unlearn, Then Relearn!Document6 pagesOne Advice For Investors Earning Dividend Income - Unlearn, Then Relearn!Ramasayi Gummadi100% (1)

- Federal Budget 2020-21Document7 pagesFederal Budget 2020-21yiang.tranPas encore d'évaluation

- Budget PLUS 2011Document108 pagesBudget PLUS 2011Meenu Mittal SinghalPas encore d'évaluation

- SJMS Associates Budget Highlights 2014Document50 pagesSJMS Associates Budget Highlights 2014Tharindu PereraPas encore d'évaluation

- 2024 Tax Vision Presented by Morison Tax (Full)Document21 pages2024 Tax Vision Presented by Morison Tax (Full)bigbrotherfrancisbonnefoyPas encore d'évaluation

- Direct Tax CodeDocument10 pagesDirect Tax Codejgaurav80Pas encore d'évaluation

- Direct Tax CodeDocument8 pagesDirect Tax CodeImran HassanPas encore d'évaluation

- Taxation in Companies-Module IIIDocument10 pagesTaxation in Companies-Module IIIlathaharihimaPas encore d'évaluation

- Blog Details Declaration and Payment of Dividend 20Document9 pagesBlog Details Declaration and Payment of Dividend 20Abhinay KumarPas encore d'évaluation

- Transitional Provisions: B26 Single Tier System and TheDocument2 pagesTransitional Provisions: B26 Single Tier System and TheyrijvszpPas encore d'évaluation

- P6MYS AnsDocument12 pagesP6MYS AnsLi HYu ClfEiPas encore d'évaluation

- Nigeria - Highlights of Finance Act 2021 - EY - GlobalDocument16 pagesNigeria - Highlights of Finance Act 2021 - EY - GlobalAyodeji BabatundePas encore d'évaluation

- Using Relevant Examples Discuss The Importance of Board of Governors in An Institution of LearningDocument10 pagesUsing Relevant Examples Discuss The Importance of Board of Governors in An Institution of Learningivanongia2000Pas encore d'évaluation

- In Brief: Recent DevelopmentsDocument7 pagesIn Brief: Recent DevelopmentsScar IcePas encore d'évaluation

- Vaishnavi ProjectDocument72 pagesVaishnavi ProjectAkshada DhaparePas encore d'évaluation

- Budget 2023 CKDocument16 pagesBudget 2023 CKVenkateswar raoPas encore d'évaluation

- Taxation Aspects of M&A: Capital GainDocument4 pagesTaxation Aspects of M&A: Capital Gainnikesh_shah_1Pas encore d'évaluation

- DTTL Tax Bangladeshhighlights 2023Document10 pagesDTTL Tax Bangladeshhighlights 2023stevePas encore d'évaluation

- DTC ProvisionsDocument3 pagesDTC ProvisionsrajdeeppawarPas encore d'évaluation

- Corporate TaxDocument17 pagesCorporate TaxVishnupriya RameshPas encore d'évaluation

- Budget 2013 - 2014Document11 pagesBudget 2013 - 2014sdfdhgtj894Pas encore d'évaluation

- Professional Level - Options Module, Paper P6 (MYS) Advanced Taxation (Malaysia) September/December 2016 Sample Answers 1Document8 pagesProfessional Level - Options Module, Paper P6 (MYS) Advanced Taxation (Malaysia) September/December 2016 Sample Answers 1kok kuan wongPas encore d'évaluation

- P6mys 2016 Septdec ADocument13 pagesP6mys 2016 Septdec AChoo LeePas encore d'évaluation

- An Introduction To The Enterprise Investment Scheme (EIS) - UKDocument13 pagesAn Introduction To The Enterprise Investment Scheme (EIS) - UKWeAreKopiPas encore d'évaluation

- Question 1 Paper13Document6 pagesQuestion 1 Paper13Anshu AbhishekPas encore d'évaluation

- Section 36 of Income TaxDocument3 pagesSection 36 of Income TaxMOUSOM ROYPas encore d'évaluation

- Etaxguide Cit Enterprise-Innovation-SchemeDocument37 pagesEtaxguide Cit Enterprise-Innovation-Schemei91171618Pas encore d'évaluation

- TAX Budget2012 Annexa4Document40 pagesTAX Budget2012 Annexa4Fiona Jinn NPas encore d'évaluation

- Tax Watch Bulletin Tax Amendment Bills 2023Document22 pagesTax Watch Bulletin Tax Amendment Bills 2023BonniePas encore d'évaluation

- International Taxation in India - Recent Developments & Outlook (Part - Ii)Document6 pagesInternational Taxation in India - Recent Developments & Outlook (Part - Ii)ManishJainPas encore d'évaluation

- 132.tax On Dividends - FDD.02.25.10 PDFDocument3 pages132.tax On Dividends - FDD.02.25.10 PDFKarla BarbacenaPas encore d'évaluation

- AcvdvdDocument4 pagesAcvdvdvivek kasamPas encore d'évaluation

- Annexa 8Document29 pagesAnnexa 8gladtan0511Pas encore d'évaluation

- Samilcommentary Dec2023 enDocument10 pagesSamilcommentary Dec2023 enhekele9111Pas encore d'évaluation

- Coursework For Public Finance - 091654Document6 pagesCoursework For Public Finance - 091654ivanongia2000Pas encore d'évaluation

- Deloitte Tax Pocket Guide 2014Document20 pagesDeloitte Tax Pocket Guide 2014YHPas encore d'évaluation

- Taxation System in IndiaDocument30 pagesTaxation System in IndiaSwapnil Pisal-DeshmukhPas encore d'évaluation

- Once The Direct Taxes CodeDocument6 pagesOnce The Direct Taxes Codevipzjain007Pas encore d'évaluation

- Tax Aspects of M&ADocument18 pagesTax Aspects of M&AManeet TutejaPas encore d'évaluation

- Repatriation of ProfitDocument3 pagesRepatriation of ProfitUmang KatochPas encore d'évaluation

- Dividend Distribution TaxDocument8 pagesDividend Distribution TaxAchintya P RPas encore d'évaluation

- Financial Planning & Tax Management - Section - 115-O of The Indian Income Tax Act, 1961Document8 pagesFinancial Planning & Tax Management - Section - 115-O of The Indian Income Tax Act, 1961Gaurav KumarPas encore d'évaluation

- India Tax Profile: Produced in Conjunction With The KPMG Asia Pacific Tax CentreDocument24 pagesIndia Tax Profile: Produced in Conjunction With The KPMG Asia Pacific Tax CentreUday MunjalPas encore d'évaluation

- Taxation Aspects of M&A Carry Forward and Set Off of Accumulated Loss and Unabsorbed DepreciationDocument5 pagesTaxation Aspects of M&A Carry Forward and Set Off of Accumulated Loss and Unabsorbed DepreciationKARISHMAATA2Pas encore d'évaluation

- LLP Tech MemoDocument4 pagesLLP Tech MemoGroup SharePas encore d'évaluation

- Direct Tax 2010Document2 pagesDirect Tax 2010Shivam TiwariPas encore d'évaluation

- Corporate Recovery and Tax Incentives For EnterprisesDocument5 pagesCorporate Recovery and Tax Incentives For EnterprisesIvy BosePas encore d'évaluation

- Accounting Standard 22Document12 pagesAccounting Standard 22Rupesh MorePas encore d'évaluation

- South African Tax Thesis TopicsDocument6 pagesSouth African Tax Thesis Topicsdnr68wp2100% (2)

- Lesson 5 Tax Planning With Reference To Capital StructureDocument37 pagesLesson 5 Tax Planning With Reference To Capital StructurekelvinPas encore d'évaluation

- Business Income Tax (Schedule C)Document12 pagesBusiness Income Tax (Schedule C)Jichang HikPas encore d'évaluation

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeD'Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeÉvaluation : 1 sur 5 étoiles1/5 (1)

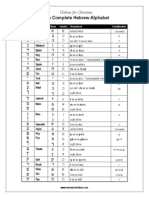

- Hebrew AlphabetDocument1 pageHebrew AlphabetJames GregoryPas encore d'évaluation

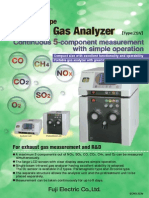

- For Gas Measurement in A Heat Treat Furnace: Type:ZFGDocument6 pagesFor Gas Measurement in A Heat Treat Furnace: Type:ZFGSayak BosePas encore d'évaluation

- Temperature Controller: Slim! Easy Operation! CompactDocument2 pagesTemperature Controller: Slim! Easy Operation! CompactSayak BosePas encore d'évaluation

- Temperature Controller: Slim! Easy Operation! CompactDocument2 pagesTemperature Controller: Slim! Easy Operation! CompactSayak BosePas encore d'évaluation

- For Gas Measurement in A Heat Treat Furnace: Type:ZFGDocument6 pagesFor Gas Measurement in A Heat Treat Furnace: Type:ZFGSayak BosePas encore d'évaluation

- For Gas Measurement in A Heat Treat Furnace: Type:ZFGDocument6 pagesFor Gas Measurement in A Heat Treat Furnace: Type:ZFGSayak BosePas encore d'évaluation

- Infrared Gas AnalyzerDocument2 pagesInfrared Gas AnalyzerSayak BosePas encore d'évaluation

- For Gas Measurement in A Heat Treat Furnace: Type:ZFGDocument6 pagesFor Gas Measurement in A Heat Treat Furnace: Type:ZFGSayak BosePas encore d'évaluation

- For Gas Measurement in A Heat Treat Furnace: Type:ZFGDocument6 pagesFor Gas Measurement in A Heat Treat Furnace: Type:ZFGSayak BosePas encore d'évaluation

- For Gas Measurement in A Heat Treat Furnace: Type:ZFGDocument6 pagesFor Gas Measurement in A Heat Treat Furnace: Type:ZFGSayak BosePas encore d'évaluation

- For Gas Measurement in A Heat Treat Furnace: Type:ZFGDocument6 pagesFor Gas Measurement in A Heat Treat Furnace: Type:ZFGSayak BosePas encore d'évaluation

- For Gas Measurement in A Heat Treat Furnace: Type:ZFGDocument6 pagesFor Gas Measurement in A Heat Treat Furnace: Type:ZFGSayak BosePas encore d'évaluation

- For Gas Measurement in A Heat Treat Furnace: Type:ZFGDocument6 pagesFor Gas Measurement in A Heat Treat Furnace: Type:ZFGSayak BosePas encore d'évaluation

- For Gas Measurement in A Heat Treat Furnace: Type:ZFGDocument6 pagesFor Gas Measurement in A Heat Treat Furnace: Type:ZFGSayak BosePas encore d'évaluation

- 4 RDocument29 pages4 RSayak BosePas encore d'évaluation

- 4 DFGF 654Document12 pages4 DFGF 654Sayak BosePas encore d'évaluation

- 7ML19981DF01Document12 pages7ML19981DF01Jose LunaPas encore d'évaluation

- Infrared Gas AnalyzerDocument2 pagesInfrared Gas AnalyzerSayak BosePas encore d'évaluation

- For Gas Measurement in A Heat Treat Furnace: Type:ZFGDocument6 pagesFor Gas Measurement in A Heat Treat Furnace: Type:ZFGSayak BosePas encore d'évaluation

- Polyester IP65 Enclosures: M20 M12 M16 M16Document1 pagePolyester IP65 Enclosures: M20 M12 M16 M16Sayak BosePas encore d'évaluation

- Telemecanique PDFDocument60 pagesTelemecanique PDFMario PerezPas encore d'évaluation

- 4 DFGF 654Document12 pages4 DFGF 654Sayak BosePas encore d'évaluation

- TDocument1 pageTSayak BosePas encore d'évaluation

- 4 DFGF 654Document12 pages4 DFGF 654Sayak BosePas encore d'évaluation

- Process Control & Instrumentation Part III P&I Symbols: B.T.S FEE (D. Bord Lycée ST Michel - 54) Sem 12Document3 pagesProcess Control & Instrumentation Part III P&I Symbols: B.T.S FEE (D. Bord Lycée ST Michel - 54) Sem 12Sayak BosePas encore d'évaluation

- TDocument1 pageTSayak BosePas encore d'évaluation

- United States District Court Central District of California: 8:21-Cv-00403-Jvs-AdsxDocument114 pagesUnited States District Court Central District of California: 8:21-Cv-00403-Jvs-Adsxtriguy_2010Pas encore d'évaluation

- ATT Receipt George PDFDocument1 pageATT Receipt George PDFBrennan BargerPas encore d'évaluation

- Strategy 10: Long StraddleDocument9 pagesStrategy 10: Long StraddlenemchandPas encore d'évaluation

- Unit IvDocument26 pagesUnit Ivthella deva prasadPas encore d'évaluation

- Q.P. Code:36461: Activity Preceding Activity NT (Days) CT (Days) Blenders Packers FillersDocument3 pagesQ.P. Code:36461: Activity Preceding Activity NT (Days) CT (Days) Blenders Packers Fillersmms a19Pas encore d'évaluation

- Assignment Subject Code BM 0001 (4 Credits) 60 Marks Set I Subject: Financial Accounting - An IntroductionDocument6 pagesAssignment Subject Code BM 0001 (4 Credits) 60 Marks Set I Subject: Financial Accounting - An IntroductionAbdul Lateef KhanPas encore d'évaluation

- Special Lecture Handouts in TaxationDocument24 pagesSpecial Lecture Handouts in TaxationTep DomingoPas encore d'évaluation

- Financing Strategy at Tata SteelDocument23 pagesFinancing Strategy at Tata SteelSarangPas encore d'évaluation

- Chapter 12 Insurance Tax PowerpointDocument30 pagesChapter 12 Insurance Tax Powerpointapi-302252730Pas encore d'évaluation

- 1099TaxForm PDFDocument1 page1099TaxForm PDFJennifer WalkerPas encore d'évaluation

- SECTION 4.1 Payment or PerformanceDocument6 pagesSECTION 4.1 Payment or PerformanceMars TubalinalPas encore d'évaluation

- Apple Vs SamsungDocument1 pageApple Vs SamsungCem KaradumanPas encore d'évaluation

- Cryptocurrencies and Its Contemporary Impact On The Preparation of The Financial StatementDocument4 pagesCryptocurrencies and Its Contemporary Impact On The Preparation of The Financial StatementAziz Rajim BundaPas encore d'évaluation

- Trent's Mortgage & Finance BrokingDocument10 pagesTrent's Mortgage & Finance BrokingTrent FetahPas encore d'évaluation

- Stock Market Report 04122010Document2 pagesStock Market Report 04122010kaushaljiPas encore d'évaluation

- Annual Report-2076-77 PDFDocument228 pagesAnnual Report-2076-77 PDFAbhishek ChaurasiyaPas encore d'évaluation

- Hanlon Heitzman 2010Document53 pagesHanlon Heitzman 2010vita cahyanaPas encore d'évaluation

- G.R. No. 201665Document11 pagesG.R. No. 201665ailynvdsPas encore d'évaluation

- Overhead Costing - NotesDocument6 pagesOverhead Costing - NotesMohamed MuizPas encore d'évaluation

- Abjamesola Tailoring Services Case StudyDocument17 pagesAbjamesola Tailoring Services Case StudyTintin Tao-onPas encore d'évaluation

- MCQ - LiabilitiesDocument4 pagesMCQ - LiabilitiesEshaPas encore d'évaluation

- The Accounting Cycle: Preparing An Annual Report: Irwin/Mcgraw-HillDocument36 pagesThe Accounting Cycle: Preparing An Annual Report: Irwin/Mcgraw-HillJumma KhanPas encore d'évaluation

- Summary - Rule 68 71Document32 pagesSummary - Rule 68 71Allana NacinoPas encore d'évaluation

- Profits and Gains of Business or Profession: After Studying This Chapter, You Would Be Able ToDocument214 pagesProfits and Gains of Business or Profession: After Studying This Chapter, You Would Be Able ToPragasPas encore d'évaluation

- Ah! Ventures Startup Support ServicesDocument22 pagesAh! Ventures Startup Support ServicesabhishekPas encore d'évaluation

- Payment InstructionDocument2 pagesPayment Instructionjiachendu.caPas encore d'évaluation

- Introduction To PPPDocument25 pagesIntroduction To PPPswatiPas encore d'évaluation

- A Guide To UK Oil and Gas TaxationDocument172 pagesA Guide To UK Oil and Gas Taxationkalite123Pas encore d'évaluation