Académique Documents

Professionnel Documents

Culture Documents

Man Assigment

Transféré par

CrazyStar NorbyCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Man Assigment

Transféré par

CrazyStar NorbyDroits d'auteur :

Formats disponibles

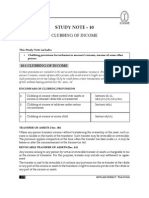

Mandatory assigment

Royal Unibrew A/S

The assignment covers two companies:

-

The brewery Royal Unibrew A/S, www.royalunibrew.com

The brewery Harboe A/S, www.harboes-bryggeri.dk

A resum of the yearly accounts of the companies is enclosed in the Excel sheets

for the period 2009 - 2011 for Royal Unibrew A/S and 2008/09 - 2010/11 for Harboe A/S

Task

A) Calculate the selected financial keyfigures for Royal Unibrew A/S

(Profitability, Earnings capacity, Capital adjustment, Solvency & liquidity)

B) Comment the development in the key figures and find the reasons behind the

development (use their webpage to find further information about the company)

C) Calculate the seleceted financial keyfigures for Harboe A/S.

(Profitability, Earnings capacity, Capital adjustment, Solvency & liquidity)

D) Comment the development in the key figures and find the reasons behind the

development (use their webpage to find further information about the company)

E) Make a comparisation of these two breweries. What does the figures and development

show. Explain the differences.

C) Which of these two companies would you prefer to invest in and why?

Find at least 5 arguments

G) Deliver a written report from the group of maximum 5 pages with your calculation and your comments

Remember your classe and all the names in the group

Resume of the accounts for Royal Unibrew A/S 2008-2011

Group mill. dkk

Profit and loss

Turnover

Production cost

Contribution

Sales and distribution cost

Administration cost

Other external cost

Profit before interest (EBIT)

Result ass. Companies

Net financial cost

Profit before tax (EBT)

Tax

Profit of the year before minorities

Minorities share

The result of the year (EAT)

2008

4,179

-2,433

1,746

-1,388

-223

-505

-370

23

-106

-453

-30

-483

-1

-484

2009

3,816

-2,211

1,605

-1,147

-215

-35

208

26

-158

76

-24

52

-5

47

2010

3,775

-1,946

1,829

-1,200

-212

0

417

31

-73

375

-97

278

0

278

2011

3,431

-1,685

1,746

-1,085

-186

0

475

14

-28

461

-110

351

-3

348

Balance sheet

2007

2008

2009

2010

2011

Financial analysis Royal Unibrew

Assets

Non tangible assets

Tangible assets

Financial assets

Fixed assets total

774

1,557

266

2,597

486

2,080

177

2,743

480

2,014

180

2,674

402

1,772

201

2,375

391

1,601

298

2,290

Stock

Debtors

Other receivables

Cash

Current assets

ASSETS

352

578

96

158

1,184

3,781

415

542

261

90

1,308

4,051

238

409

77

92

816

3,490

187

407

51

37

682

3,057

173

379

29

19

600

2,890

Liabilities

Share capital

Retained profit

Dividen

Equity total

Minitity interest

59

963

59

1,081

39

56

484

0

540

35

112

845

0

957

38

112

1017

140

1,269

12

112

1006

190

1,308

13

Long term debt

Creditors

1,668

350

1,883

523

1,681

419

778

430

643

993

1070

1,593

395

814

2,661

3,781

3,476

4,051

2,495

3,490

Other short term liabilities

Short term liabilities

Total debt

LIABILITIES

Note:

in calculating the return on equity use the the result of the year

2008

2009

2010

2011

Profitability

Return on investment

Profit margin ratio

Asset turnover ratio

Return on equity

-12.4%

-8.9%

1.1

-11.4%

1.2%

5.5%

1.0

6.9%

8.5%

11.0%

1.2

9.4%

11.7%

13.8%

1.2

9.2%

Earning capacity

Contribution margin

Index turnover

Index sales and distribution cost

Index administration cost

Capacity cost total

Capacity ratio

Break even turnover

Safety margin

41.8%

100

100

100

2,116

0.83

5,065

-21.2%

42.1%

91

83

96

1,397

1.15

3,321

13.0%

48.5%

90

86

95

1,412

1.30

2,914

22.8%

50.9%

82

78

83

1,271

1.37

2,498

27.2%

Capital adjustment analysis

Fixed asset turnover ratio

1.6

1.4

1.5

1.5

784

398

Stock turnover ratio

Debtor turnover ratios

5.9

7.5

9.3

8.0

10.4

9.3

9.7

8.7

568

998

387

785

Solvency and liquidity

1,776

3,057

1,569

2,890

13.3%

0.8

0.6

6.44

27.4%

1.0

0.7

2.61

41.5%

0.7

0.5

1.40

45.3%

0.8

0.5

1.20

Solvency ratio

Current ratio

Acid test ratio

D/E ratio gearing ratio

Resume of the accounts of Harboe A/S 2008/09 - 2011/12

Group mill. dkk

Resultatopgrelse

Turnover

Production cost

Contribution

Sales and distribution cost

Administration ocst

Other external cast

Profit before interest (EBIT)

Result ass. Companies

Net financial cost

Profit before tax (EBT)

Tax

Profit of the year before minorities

Minorities share

The result of the year (EAT)

08/09

1,545

-1,299

246

-173

-32

0

41

1

-7

35

-9

26

0

26

09/10

1,525

-1,247

278

-175

-39

0

64

-3

-3

58

-15

43

0

43

10/11

1,321

-1,024

297

-183

-47

0

67

0

-6

61

-20

41

0

41

11/12

1,410

-1,122

288

-187

-41

0

60

0

-9

51

-13

38

0

38

Balance sheet

Assets

Non tangible assets

Tangible assets

Financial assets

Fixed assets total

Stock

Debtors

Other receivables

Cash

Current assets

ASSETS

Liabilities

Share capital

Retained profit

Dividen

Equity total

Minitity interest

Long term debt

Creditors

Other short term liabilities

Short term liabilities

Total debt

LIABILITIES

30/4 08

30/4 09

30/4 10

30/4 11

30/4 12

6

794

10

810

11

801

298

1,110

16

858

287

1,161

23

872

289

1,184

36

803

270

1,109

115

237

25

12

389

1,199

118

267

51

60

496

1,606

122

304

14

44

484

1,645

138

302

21

40

501

1,685

137

278

28

24

467

1,576

60

637

0

60

604

0

60

670

0

60

693

0

60

730

0

697

0

109

186

207

393

502

1,199

664

0

422

200

320

520

942

1,606

730

0

386

188

341

529

915

1,645

753

0

346

216

370

586

932

1,685

790

0

350

190

246

436

786

1,576

Financial analysis Harboe

Profitability

Return on investment

Profit margin ratio

Asset turnover ratio

Return on equity

Earning capacity

Contribution margin

Index turnover

Index sales and distribution cost

Index administration cost

Capacity cost total

Capacity ratio

Break even turnover

Safety margin

Capital adjustment analysis

Fixed asset turnover ratio

Stock turnover ratio

Debtor turnover ratios

Solvency and liquidity

Solvency ratio

Current ratio

Acid test ratio

D/E ratio

08/09

09/10

10/11

11/12

2.9%

2.7%

1.1

6.0%

3.9%

4.2%

0.9

9.2%

4.0%

5.1%

0.8

9.0%

3.7%

4.3%

0.9

7.8%

15.9%

100

100

100

205

1.20

8

99.5%

18.2%

99

101

100

214

1.30

7

99.5%

22.5%

86

106

100

230

1.29

6

99.6%

20.4%

91

108

100

228

1.26

6

99.6%

1.1

-11.2

6.1

0.9

-10.4

5.3

0.8

-7.9

4.4

0.9

-8.2

4.9

41.3%

1

1

1.4

44.4%

1

1

1.3

44.7%

1

1

1.2

50.1%

1

1

1.0

Comparisation of the financial ratios

Royal

Unibrew

2011

Harboe

2011/12

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The 3 Secrets To Trading Momentum Indicators Pt6Document34 pagesThe 3 Secrets To Trading Momentum Indicators Pt6JasgeoPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- How To Start A Hedge Fund in The USDocument24 pagesHow To Start A Hedge Fund in The USFranklin KellerPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Nike Case Final Group 4Document15 pagesNike Case Final Group 4Monika Maheshwari100% (1)

- Statement of Financial PositionDocument3 pagesStatement of Financial Positionlyka0% (1)

- A Study of Challenges Faced by Equity Investors Investing in Stock MarketDocument33 pagesA Study of Challenges Faced by Equity Investors Investing in Stock MarketPratikJain100% (1)

- Warren Buffett CalculationsDocument24 pagesWarren Buffett Calculationseric_stPas encore d'évaluation

- Presentacion CapitalDocument11 pagesPresentacion CapitalLiliana Martínez LiraPas encore d'évaluation

- NFJPIA - Mockboard 2011 - MAS PDFDocument7 pagesNFJPIA - Mockboard 2011 - MAS PDFDanica PelenioPas encore d'évaluation

- Ias 34Document11 pagesIas 34Shah Kamal100% (1)

- Fundamentals of AccountingDocument3 pagesFundamentals of AccountingImma Therese YuPas encore d'évaluation

- Buy Back of SharesDocument32 pagesBuy Back of SharesMehul SesodiyaPas encore d'évaluation

- Viking Offshore and Marine LTD Annual Report 2013Document201 pagesViking Offshore and Marine LTD Annual Report 2013WeR1 Consultants Pte LtdPas encore d'évaluation

- Nism Questions-26 GDocument14 pagesNism Questions-26 GabhishekPas encore d'évaluation

- WoolworthsDocument55 pagesWoolworthsjohnsmithlovestodo69Pas encore d'évaluation

- NFO Tata Growing Economies Infrastructure FundDocument12 pagesNFO Tata Growing Economies Infrastructure FundDrashti Investments100% (1)

- Country Risk Analysis: Dr. Sangeeta YadavDocument22 pagesCountry Risk Analysis: Dr. Sangeeta YadavAmit BarmanPas encore d'évaluation

- Clubbing of Income-10Document7 pagesClubbing of Income-10s4sahithPas encore d'évaluation

- Mutual FundsDocument60 pagesMutual FundsParshva Doshi60% (5)

- CCM Group Limited Receives Shareholder Approval For Name Change, Diversification Into IT, Rights Issue and Bonus Shares IssueDocument2 pagesCCM Group Limited Receives Shareholder Approval For Name Change, Diversification Into IT, Rights Issue and Bonus Shares IssueWeR1 Consultants Pte LtdPas encore d'évaluation

- Financial Management Practices and Their Impact On Organizational PerformanceDocument10 pagesFinancial Management Practices and Their Impact On Organizational PerformanceIzey OdiasePas encore d'évaluation

- Chapter 03 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Document98 pagesChapter 03 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais Azeemi33% (6)

- Pert 9 - Equity InvestmentDocument2 pagesPert 9 - Equity InvestmentVidya IntaniPas encore d'évaluation

- Literature ReviewDocument8 pagesLiterature ReviewKEDARANATHA PADHY100% (1)

- Mutual Funds and Other Investment Companies: Ph.D. Economics Sabanci UniversityDocument21 pagesMutual Funds and Other Investment Companies: Ph.D. Economics Sabanci UniversitySammar AmmarPas encore d'évaluation

- McDonalds Financial AnalysisDocument11 pagesMcDonalds Financial AnalysisHooksA01Pas encore d'évaluation

- Letter To Board - February 25Document2 pagesLetter To Board - February 25MangrovePartnersPas encore d'évaluation

- Investment and Portfolio ManagementDocument16 pagesInvestment and Portfolio ManagementmudeyPas encore d'évaluation

- Spas 10 8 PDFDocument6 pagesSpas 10 8 PDFJeet SarkarPas encore d'évaluation

- 562 Spring2003Document5 pages562 Spring2003Emmy W. RosyidiPas encore d'évaluation