Académique Documents

Professionnel Documents

Culture Documents

Cash Flow

Transféré par

tipusemuaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Cash Flow

Transféré par

tipusemuaDroits d'auteur :

Formats disponibles

Cash ow

Up to overdraft limit no headroom / returned payments

For other uses, see Cash ow (disambiguation).

Cash Flow is the movement of money into or out of a

business, project, or nancial product. It is usually measured during a specied, limited period of time. Measurement of cash ow can be used for calculating other

parameters that give information on a companys value

and situation.

Stretch to pay salaries each month

Trade creditor arrears

Taxation arrears

Rent arrears

to determine a projects rate of return or value. The

time of cash ows into and out of projects are used

as inputs in nancial models such as internal rate of

return and net present value.

No working capital buer surviving day to day

Negative working capital on balance sheet over

geared / losses?

to determine problems with a businesss liquidity.

Being protable does not necessarily mean being

liquid. A company can fail because of a shortage

of cash even while protable.

Lack of funds for remedial action (redundancies /

premises relocation)

as an alternative measure of a businesss prots

when it is believed that accrual accounting concepts

do not represent economic realities. For instance, a

company may be notionally protable but generating little operational cash (as may be the case for a

company that barters its products rather than selling

for cash). In such a case, the company may be deriving additional operating cash by issuing shares or

raising additional debt nance.

Lack of protability insucient to support owner

/ managers lifestyle

Unable to pay for professional advice

1 Business nancials

The (total) net cash ow of a company over a period (typically a quarter, half year, or a full year) is equal to the

change in cash balance over this period: positive if the

cash balance increases (more cash becomes available),

negative if the cash balance decreases. The total net cash

to evaluate the risks within a nancial product, e.g., ow is the sum of cash ows that are classied in three

matching cash requirements, evaluating default risk, areas:

re-investment requirements, etc.

cash ow can be used to evaluate the 'quality' of income generated by accrual accounting. When net

income is composed of large non-cash items it is

considered low quality.

1. Operational cash ows: Cash received or expended

as a result of the companys internal business activities. It includes cash earnings plus changes to

working capital. Over the medium term this must

be net positive if the company is to remain solvent.

Cash ow notion is based loosely on cash ow statement

accounting standards. the term is exible and can refer to

time intervals spanning over past-future. It can refer to

the total of all ows involved or a subset of those ows.

Subset terms include net cash ow, operating cash ow

and free cash ow.

2. Investment cash ows: Cash received from the sale

of long-life assets, or spent on capital expenditure

(investments, acquisitions and long-life assets).

Symptoms of cash ow problems.[1] There are many

reasons a business can suer cash ow problems some

are down to mismanagement and poor decisions, and in

some cases factors outside of your control. Any of the

following symptoms can indicate that a business is experiencing cash ow problems:

3. Financing cash ows: Cash received from the issue

of debt and equity, or paid out as dividends, share

repurchases or debt repayments.

1

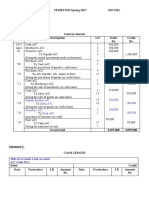

Examples

The net cash ow only provides a limited amount of information. Compare, for example, the cash ows over three

years of two companies:

Company B has a higher yearly cash ow. However,

Company A is actually earning more cash by its core activities and has already spent 45M in long term investments, of which the revenues will only show up after three

years.

See also

Cash ow sign convention

Cash ow hedge

Cash ow projection

Cash ow statement

Internal rate of return

Net present value

Return of capital

References

[1] Faulds, Carl. Symptoms of cash ow problems. Retrieved 10 Feb 2015.

External links

International Federation of Accountants International Good Practice Guidance on Project Appraisal

Using Discounted Cash Flow

A Review of Academic Research on the Reporting

of Cash Flows from Operations

EXTERNAL LINKS

Text and image sources, contributors, and licenses

6.1

Text

Cash ow Source: http://en.wikipedia.org/wiki/Cash%20flow?oldid=661070127 Contributors: WojPob, Ed Poor, Edward, Patrick, Kku,

Mic, Tango, Ellywa, Hectorthebat, Robbot, Hankwang, Baldhur, Greudin, Utcursch, Icurite, RayBirks, Ukexpat, Monkeyman, RedWordSmith, Notinasnaid, Bender235, Rubicon, DS1953, Jerryseinfeld, Zetawoof, Gary, TheParanoidOne, Snowolf, Velella, Uucp, Versageek, Netkinetic, Rzelnik, Brookie, DanielVonEhren, Lkinkade, Feezo, Mel Etitis, Mindmatrix, Ronnotel, JIP, OMouse, Dpr, Pabix,

Feco, FlaBot, Michaelschmatz, DVdm, YurikBot, Retired username, Renata3, JeremyStein, Zwobot, Shawnc, Shyam, Andman8, SmackBot, Amit A., Quinsareth, Matt 314, Dlohcierekims sock, RJN, Ceoil, SirIsaacBrock, Lukebe, Kuru, AtD, Slakr, Waggers, MTSbot~enwiki, Hu12, Finlin, CmdrObot, Karenjc, Djstreet, MC10, RkuipersNL, Omer Coskuner, Weaverdm, Pascal.Tesson, Sweikart, NMChico24, Omicronpersei8, RichardVeryard, SvenAERTS, AntiVandalBot, Dvunkannon, Gregalton, Fayenatic london, JAnDbot, Agentnj,

SHCarter, Financeinfo, BadBoysDriveAudi, DerHexer, Retail Investor, MartinBot, Poeloq, Rgoodermote, Eliz81, Stathisgould, Rwyn3,

Jayhands, Rising*From*Ashes, Halmstad, VolkovBot, CWii, Freedom24, Vipul S. Chawathe, Gogarburn, SueHay, Dixon coxon, Melsaran, LeaveSleaves, ^demonBot2, Synthebot, Cmcnicoll, Brianga, SieBot, Q4sales, Emesee, Trefgy, Khuilla mia, ClueBot, Abhinav,

Konkursor, Excirial, IgorMerlino, Vivio Testarossa, CAVincent, Apparition11, DumZiBoT, Jman03, XLinkBot, Rror, Skarebo, Addbot,

Some jerk on the Internet, MrOllie, Download, Favonian, Culmensis, Lonnback, Luckas-bot, Yobot, DemocraticLuntz, Piano non troppo,

Flewis, Materialscientist, Capricorn42, ComputThis, C4andrei, NTW1981, VS6507, Agbr~enwiki, D'ohBot, DrilBot, RedBot, Intersog,

Msavins, Yunshui, LogAntiLog, Mean as custard, Afb525, EmausBot, Sgaladima, K6ka, ZroBot, Makecat, Tolly4bolly, Andystwong,

Hang Li Po, TYelliot, ClueBot NG, CocuBot, 23deano23, Damonfelich, Comboapp, Snow Blizzard, Lanakae, Jm drm, Frosty, Wieldthespade, Mitchyo2209, Kennethande, Casius12, BethNaught, Ericstonerz, SamanthaSnell, Arashfayyazi, Jonnyandrew, Jonathanince and

Anonymous: 195

6.2

Images

File:Hauptbuch_Hochstetter_vor_1828.jpg Source: http://upload.wikimedia.org/wikipedia/commons/4/49/Hauptbuch_Hochstetter_

vor_1828.jpg License: Public domain Contributors: Own work Original artist: Photo: Andreas Praefcke

File:Portal-puzzle.svg Source: http://upload.wikimedia.org/wikipedia/en/f/fd/Portal-puzzle.svg License: Public domain Contributors: ?

Original artist: ?

File:Question_book-new.svg Source: http://upload.wikimedia.org/wikipedia/en/9/99/Question_book-new.svg License: Cc-by-sa-3.0

Contributors:

Created from scratch in Adobe Illustrator. Based on Image:Question book.png created by User:Equazcion Original artist:

Tkgd2007

6.3

Content license

Creative Commons Attribution-Share Alike 3.0

Vous aimerez peut-être aussi

- FirefightingDocument12 pagesFirefightingtipusemua0% (1)

- Discounted Cash FlowDocument6 pagesDiscounted Cash Flowtipusemua100% (1)

- Electromotive Force (EMF)Document9 pagesElectromotive Force (EMF)tipusemuaPas encore d'évaluation

- Kinkaku JiDocument5 pagesKinkaku JitipusemuaPas encore d'évaluation

- Kinetic Energy Recovery SystemDocument5 pagesKinetic Energy Recovery SystemtipusemuaPas encore d'évaluation

- Parseval TheoremDocument3 pagesParseval TheoremtipusemuaPas encore d'évaluation

- HcciDocument7 pagesHccitipusemuaPas encore d'évaluation

- Net Present ValueDocument6 pagesNet Present ValuetipusemuaPas encore d'évaluation

- Kansei EngineeringDocument5 pagesKansei EngineeringtipusemuaPas encore d'évaluation

- Joseph FourierDocument7 pagesJoseph FouriertipusemuaPas encore d'évaluation

- Discounted Cash FlowDocument6 pagesDiscounted Cash Flowtipusemua100% (1)

- Chiang MaiDocument14 pagesChiang MaitipusemuaPas encore d'évaluation

- CorondischargDocument8 pagesCorondischargtipusemuaPas encore d'évaluation

- Joseph FourierDocument7 pagesJoseph FouriertipusemuaPas encore d'évaluation

- Operating ReserveDocument3 pagesOperating ReservetipusemuaPas encore d'évaluation

- Dew PointDocument6 pagesDew PointtipusemuaPas encore d'évaluation

- Joseph FourierDocument7 pagesJoseph FouriertipusemuaPas encore d'évaluation

- Body ForceDocument2 pagesBody ForcetipusemuaPas encore d'évaluation

- Alternative Fuel VehicleDocument20 pagesAlternative Fuel VehicletipusemuaPas encore d'évaluation

- Body ForceDocument2 pagesBody ForcetipusemuaPas encore d'évaluation

- Comm RailDocument5 pagesComm RailtipusemuaPas encore d'évaluation

- Postgraduate Courses 2012-2013Document151 pagesPostgraduate Courses 2012-2013tipusemuaPas encore d'évaluation

- Lyrics of Maanuthu Mandhayilae From Movie Kizhakku Cheemayilae at ThiraiPaadalDocument1 pageLyrics of Maanuthu Mandhayilae From Movie Kizhakku Cheemayilae at ThiraiPaadaltipusemuaPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Alok Kumar: 1. Introduction To Corporate RestructuringDocument12 pagesAlok Kumar: 1. Introduction To Corporate RestructuringChandrabhan NathawatPas encore d'évaluation

- Taller 1Document6 pagesTaller 1Kevin BetancurPas encore d'évaluation

- Part Time JobsDocument4 pagesPart Time Jobslakhan_pank0% (1)

- ADIB SukukDocument27 pagesADIB SukukalamctcPas encore d'évaluation

- Macroeconomics I: Aggregate Demand I: Building The IS-LM ModelDocument24 pagesMacroeconomics I: Aggregate Demand I: Building The IS-LM Model우상백Pas encore d'évaluation

- Chapter 3 (Unit 1)Document21 pagesChapter 3 (Unit 1)GiriPas encore d'évaluation

- Cash Payments Journal Lesson ActivityDocument7 pagesCash Payments Journal Lesson ActivityJanice BaltorPas encore d'évaluation

- Forwards Futures and OptionsDocument11 pagesForwards Futures and OptionsSHELIN SHAJI 1621038Pas encore d'évaluation

- Superlite Cash Loan - ADA FormDocument2 pagesSuperlite Cash Loan - ADA Formvangie3339515Pas encore d'évaluation

- Equitable PCI Bank Vs NG Sheung NgorDocument2 pagesEquitable PCI Bank Vs NG Sheung NgorRobert QuiambaoPas encore d'évaluation

- SH Eq 2 - ProblemsDocument9 pagesSH Eq 2 - ProblemsLordcille AguilarPas encore d'évaluation

- Dividend PolicyDocument42 pagesDividend PolicysubraysPas encore d'évaluation

- 40CW-2010!03!23 MBT - Special Deposits To Retire DebtsDocument6 pages40CW-2010!03!23 MBT - Special Deposits To Retire DebtsMe100% (5)

- Assignment No. 01 SEMESTER Spring 2017 MGT101: 280,000 280,000 Farhan Brother A/C Sales A/C Furniture A/C Cash A/CDocument2 pagesAssignment No. 01 SEMESTER Spring 2017 MGT101: 280,000 280,000 Farhan Brother A/C Sales A/C Furniture A/C Cash A/CHalima SaadiaPas encore d'évaluation

- Comparative Study of Saraswat Co-Operative Bank and Abhudaya Co-Operative BankDocument74 pagesComparative Study of Saraswat Co-Operative Bank and Abhudaya Co-Operative BankAakash SonarPas encore d'évaluation

- Credit Card StatementDocument4 pagesCredit Card Statementsaeed shamiPas encore d'évaluation

- Problem 1: Finals - ReceivablesDocument4 pagesProblem 1: Finals - ReceivablesLeslie Beltran ChiangPas encore d'évaluation

- Awareness of Mutual Fund Among Investors From Ing Vysya BankDocument97 pagesAwareness of Mutual Fund Among Investors From Ing Vysya Bankrahulkesarwani01Pas encore d'évaluation

- Aries Inc Holds A 90 Interest in Sharatan LTD ADocument1 pageAries Inc Holds A 90 Interest in Sharatan LTD Ahassan taimourPas encore d'évaluation

- Guarantor's FormDocument2 pagesGuarantor's Formadebo_yemiPas encore d'évaluation

- Form A2 - LRSDocument6 pagesForm A2 - LRSAbhi YadavPas encore d'évaluation

- Letter of Guarantee by CorporateDocument6 pagesLetter of Guarantee by CorporateTira MagdPas encore d'évaluation

- Rules and Regulations of The Bank of Albania Vol IIDocument205 pagesRules and Regulations of The Bank of Albania Vol IIShef DomiPas encore d'évaluation

- 5 QB3-INTEGERS - G7-Answer KeyDocument3 pages5 QB3-INTEGERS - G7-Answer KeyTrupti DevpuriaPas encore d'évaluation

- FS Preparation and Correcting A TBDocument11 pagesFS Preparation and Correcting A TBJulia Mae AlbanoPas encore d'évaluation

- Practical Research (ABM)Document22 pagesPractical Research (ABM)Francheska Imie R. CorillaPas encore d'évaluation

- Reviewer Intacc 1n2Document58 pagesReviewer Intacc 1n2John100% (1)

- B. Com 4th Sem SyllabusDocument16 pagesB. Com 4th Sem SyllabusDEEPAK DINESH VANSUTRE0% (1)

- I: Multiple Choice (30 Points) : These Statements Are True or False? (25 Points/correct Answer)Document4 pagesI: Multiple Choice (30 Points) : These Statements Are True or False? (25 Points/correct Answer)Mỹ Dung PhạmPas encore d'évaluation

- Plus Two Accountancy with CA, Focused Area-2021Document68 pagesPlus Two Accountancy with CA, Focused Area-202137 Riya ThomasPas encore d'évaluation