Académique Documents

Professionnel Documents

Culture Documents

Computation of Taxable Income and Tax After General Reductions For Corporations

Transféré par

Kiều Thảo AnhTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Computation of Taxable Income and Tax After General Reductions For Corporations

Transféré par

Kiều Thảo AnhDroits d'auteur :

Formats disponibles

Solutions to Chapter 11 Assignment Problems

177

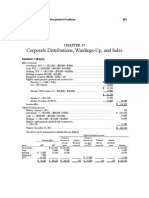

CHAPTER 11

Computation of Taxable Income and Tax After

General Reductions for Corporations

Solution 1 (Basic)

2008

Par. 3(a)

Par. 3(b)

Income from business.......................... $

Income from property..........................

$

Taxable capital gains............................

Allowable capital losses.......................

54,000

42,500

96,500

11,000

(2,000)

2009

$

$

2010

32,000

22,500

54,500

2,500

(2,500)

$

$

2011

Nil

18,000

18,000

5,000

(3,500)

19,500

n/a

(75,000)

Nil

Nil

62,500

10,500

73,000

9,000

Nil

(1)

Par. 3(c)

Par. 3(d)

$ 105,500

ABIL....................................................

(3,750)

Business loss........................................

n/a

Par. 3(e)

Income from Division B...................... $ 101,750

Sec. 112

Inter-company dividends......................

(42,500)

$

59,250

Sec. 110.1

Charitable donations:(2)

Carryover......................................

n/a

Current..........................................

(23,000)

$

36,250

Par. 111(1)(b)

Net capital losses(3)...............................

(9,000)

$

27,250

Par. 111(1)(a)

Non-capital losses(4)..............................

(27,250)

Taxable income....................................................................

Nil

54,500

n/a

n/a

$

54,500

(22,500)

$

32,000

(9,000)

$

23,000

$

23,000

(23,000)

Nil

Nil

(1,500)

Nil

Nil

82,000

n/a

n/a

$

82,000

(10,500)

$

71,500

(3,000)

(13,000)

$

55,500

(500)

$

55,000

(24,750)

$

30,250

NOTES TO SOLUTION

(1)

A maximum of $2,500 can be deducted in 2009.

(2)

Charitable donations:

2008: Lesser of:

2009: Lesser of:

2010: Lesser of:

2011: Lesser of:

(a) 75% of $101,750 = $76,313

(b) $23,000

Carryforward: Nil

(a) 75% of $54,500 = $40,875

(b) $9,000

Carryforward: Nil

(a) 75% of Nil = Nil

(b) $3,000

Carryforward: $3,000

(a) 75% of $82,000 = $61,500

(b) $3,000 + $13,000 = $16,000

Carryforward: Nil

(3) Net capital losses

1999 net capital loss converted to 2008 rates: $13,500 / ................................................

Net capital loss deducted in 2008 to the extent of net taxable capital gains................................

2009 net capital loss not utilized.................................................................................................

2010 net capital loss deducted to the extent of net taxable capital gains.....................................

2011 remaining net capital loss deducted in 2011 to the extent of net taxable capital gains

Available for carryforward..........................................................................................................

9,000

(9,000)

Nil

$

2,000

(1,500)

$

500

(500)

Nil

Introduction to Federal Income Taxation in Canada

178

(4) Non-capital losses

Par. 3(d) Loss from business in 2010............................................................... $ 75,000

Dividends deducted under section 112...............................................

18,000

Add: net capital loss deducted...................................................................................................

Less: par. 3(c): par. 3(a) dividends....................................................................

par. 3(b) taxable capital gain.....................................................

$

$

93,000

1,500

94,500

19,500

75,000

18,000

1,500

Losses utilized: 2008......................................................................................... $ 27,250

2009.........................................................................................

23,000

2011.........................................................................................

24,750

Closing balance.........................................................................................................................

75,000

Nil

Solutions to Chapter 11 Assignment Problems

179

Solution 2 (Advanced)

The data given in the problem statement can be summarized as follows:

carryforward losses

non-capital losses

2010repair business

$40,000

rental property

$2,000

current deemed

year-end losses

from non-capital

sources

rental property

$60,000

property

$5,000

recapturebuilding

TCGland

building

$5,000

2,000

allowable capital

losses

$10,000

business

potential elections

net capital losses

potential offset

business income

10,000

5,000

$22,000

taxable capital gain

$3,000

potential offset

expiration

after deemed

year-end

$5,000

$30,000

40,000

$70,000

potential

offset

Expected Results from Summary of Data

(a) No Election

Note that if no election is made, there is no income to offset the current business loss of $60,000 or the non-capital

loss carryforward of $40,000. Therefore, the non-capital loss available to carry forward from October 31, 2011 is

$100,000 (i.e., $60,000 + $40,000). Note that the $2,000 of non-capital loss carryforward from a property loss expires.

(b) Maximum Election

If the maximum election is made, the $3,000 of recapture offsets the business loss, leaving $57,000 (i.e.,

$60,000 $3,000) of net business loss. The $70,000 of taxable capital gain offsets the $22,000 of expiring losses,

leaving $48,000 (i.e., $70,000 $22,000) to offset the remaining $57,000 of business loss. There is no remaining

taxable capital gain to offset some of the $40,000 non-capital loss carryforward. As a result, the non-capital loss

available for carry forward from October 31, 2011 is $40,000.

(c) Partial Election

If only a partial election is made, it should be enough to offset only $20,000 of the $22,000 of expiring

losses. The other $2,000 of expiring loss is the property loss carryforward which can only be utilized if enough

Division B income is elected, resulting in the elimination of the current business loss, as was the case with the

maximum election. If a partial election of only $20,000 of taxable capital gain is made, the current business loss

of $60,000 is not offset and, hence, is available to carry forward, along with the $40,000 of business non-capital

losses, from October 31, 2011 for a total of $100,000.

Part A (Ignoring all possible elections)

An acquisition of control occurred when Chris acquired more than 50% of the voting shares of Transtek Inc.

from an unrelated person, Tom.

The taxation year of Transtek is deemed to end immediately before the acquisition of control, October 31,

2011 [ssec. 249(4)].

Tax returns are required to be filed for this short year (i.e., 10 months) and amounts, such as CCA (if

claimed), will have to be prorated.

It is assumed that any accrued losses in inventory and accounts receivable have been recognized in

calculating the business loss of $60,000.

There are no accrued losses on the depreciable property. Therefore, there is no adjustment required

[ssec. 111(5.1)].

Introduction to Federal Income Taxation in Canada

180

There is a $20,000 accrued loss on the rental property land that must be recognized. The ACB of the land is

reduced from $90,000 to $70,000 [par. 111(4)(c)]. The $20,000 reduction is deemed to be a capital loss

[par. 111(4)(d)].

The income (loss) for the taxation year ended October 31, 2011 is computed below.

Par. 3(a)

Par. 3(b)

Par. 3(c)

Par. 3(d)

Business income.............................................................................................................

Property income..............................................................................................................

Net capital gains:

Taxable capital gains............................................................................

Nil

Allowable capital loss: rental property ($20,000 1/2)......................... $ (10,000)

................................................................................................................

Business loss........................................................................................... $ (60,000)

Property loss............................................................................................

(5,000)

Division B income..........................................................................................................

Nil

Nil

Nil

Nil

$ (65,000)

Nil

The net capital losses (($10,000 1/2) + $10,000 = $15,000) expire immediately following the October 31,

2011 year-end [par. 111(4)(a)].

The non-capital loss balance at November 1, 2011 is computed as follows:

Balance, Jan. 1, 2011..........................................................................................................................

Loss for taxation year ended Oct. 31, 2011:

from business...................................................................................................... $

60,000

from property......................................................................................................

5,000

$

65,000

Less Par. 3(c) amount determined above.................................................................

Nil

Balance, Oct. 31, 2011........................................................................................................................

Less: unutilized losses about to expire:

non-capital property losses............................................................................. $

2,000

current property loss......................................................................................

5,000

......................................................................................................................

Balance, Nov. 1, 2011.........................................................................................................................

42,000

65,000

$ 107,000

(7,000)

$ 100,000

Only the portion of the non-capital loss that may reasonably be regarded as a loss from carrying on a

business ($40,000 + $60,000 = $100,000) is deductible after October 31, 2011. Thus, the rental losses ($2,000 +

$5,000 = $7,000) expire immediately following the October 31, 2011 year-end [par. 111(5)(a)].

The $100,000 non-capital loss will be deductible only if the following condition is met the transmission

repair business is carried on for profit or with a reasonable expectation of profit throughout the taxation year in

which the losses are to be claimed [spar. 111(5)(a)(i)]. The condition appears to be met for the June 30, 2012 and

the June 30, 2013 taxation years. The transmission repair business was carried on throughout each of the years. It

was carried on for profit for the taxation year ended June 30, 2013. Due to Chriss work ethic and contacts in the

industry, it is reasonable to assume that it was carried on with a reasonable expectation of profit for the taxation

year ended June 30, 2012, despite the loss that was actually realized.

The $100,000 non-capital loss is deductible only to the extent of income from the transmission repair

business and income from a business selling similar products or providing similar services [spar. 111(5)(a)(ii)].

Thus, $54,000 of the non-capital loss incurred prior to November 1, 2011 is deductible for the June 30, 2013

taxation year. None of it is deductible for the June 30, 2012 taxation year due to the loss in that year. The

remainder ($100,000 $54,000 = $46,000) can be carried forward to 2014 subject to these same restrictions.

These restrictions do not apply to the non-capital loss ($25,000 $6,000 = $19,000) incurred in the taxation

year ended June 30, 2012. Thus $11,000 of the 2012 non-capital loss is deductible in 2013, in addition to the

$54,000 mentioned above.

Part B (i) (Maximum election)

Paragraph 111(4)(e) allows Transtek to elect to be deemed to have disposed of the repair shop land for

proceeds of $140,000 (maximum) and the repair shop building for proceeds of $230,000 (maximum). If Transtek

makes this election, the ACB of the land on November 1, 2011 will be $140,000 and the ACB of the building will

be $230,000. The new undepreciated capital cost for the building will be limited by paragraph 13(7)( f) to

$150,000 + 1/2 ($230,000 150,000) = $190,000.

The income for the taxation year ended October 31, 2011 will be as follows:

Par. 3(a):

Business income..............................................................................................................

Property income..............................................................................................................

Nil

Nil

Solutions to Chapter 11 Assignment Problems

Par. 3(b):

Par. 3(c)

Par. 3(d)

Net capital gains:

Taxable capital gains:

Repair shop land ($140,000 $80,000) 1/2........................................

Repair shop building ($230,000 $150,000) 1/2................................

Allowable capital loss ($20,000 1/2)......................................................

.................................................................................................................

Business loss............................................................................................

Less: recapture building ($147,000 $150,000).................................

Property loss............................................................................................

Division B income.......................................................................................................

Division C deductions:

Par. 111(1)(a) Net capital loss from 2010..................................

Par. 111(1)(b) Non-capital loss:

Business..............................................................

$

(Nil)

Property..............................................................

(Nil)

Taxable income....................................................................................

Non-capital loss balance, Nov. 1, 2011:

Business

Balance, Jan. 1, 2011.................................................................... $

40,000

Added in taxation year ended Oct. 31, 2011

($60K $5K $5K $57K)...................................................

7,000

Utilized in taxation year ended Oct. 31, 2011 or expired..............

(Nil)

Remaining.................................................................................... $

47,000

181

30,000

40,000

$

70,000

(10,000)

$

$

$ (60,000)

3,000

$ (57,000)

(5,000)

$

(62,000)

Nil

(5,000)

(Nil)

60,000

60,000

Property

2,000

(5,000)

Nil

Total

$

42,000

Nil

(2,000)

Nil

7,000

(2,000)

47,000

The $47,000 remaining may reasonably be regarded as a loss from carrying on business and thus is

deductible in a taxation year after October 31, 2011, subject to the restrictions discussed in Part A.

By making the maximum elections possible, the non-capital loss balance of Transtek at November 1, 2011

has been significantly reduced.

Part B (ii)(Minimum election to utilize expiring losses)

The following losses will expire October 31, 2011, if not utilized:

The 2010 net capital loss....................................................................................................

The Oct. 31, 2011 allowable capital loss.............................................................................

The rental loss portion of the 2010 non-capital loss............................................................

The Oct. 31, 2011 rental loss..............................................................................................

5,000

10,000

2,000

5,000

22,000

It is impossible to utilize the rental loss portion of the 2010 non-capital loss of $2,000 without triggering

sufficient income under paragraph 3(c) to utilize the entire October 31, 2011 business loss. This would not be

beneficial. Therefore, only $20,000 of the expiring losses will be used.

To utilize these losses in the taxation year ending October 31, 2011, a capital gain of 2 $20,000 = $40,000

is needed. To avoid recapture, the election should be made on the land, not the building.* Thus, Transtek will

elect under paragraph 111(4)(e) to be deemed to have disposed of the repair shop land for proceeds of $120,000,

i.e., (2 $20,000) + 80,000. The ACB of the land at November 1, 2011 will be $120,000.

* An alternative is considered below.

The income for the taxation year ended October 31, 2011 will be as follows:

Par. 3(a)

Business income.......................................................................................

Property income.......................................................................................

Par. 3(b) Net capital gains:

Taxable capital gain:

Repair shop land ($120,000 $80,000) 1/2............................................

Allowable capital loss ($20,000 1/2)......................................................

Par. 3(c).......................................................................................................................

Par. 3(d) Business loss............................................................................................

Property loss............................................................................................

Division B income.......................................................................................................

Nil

Nil

$

20,000

(10,000)

$ (60,000)

(5,000)

$

$

10,000

10,000

(65,000)

Nil

Introduction to Federal Income Taxation in Canada

182

Division C deductions:

Par. 111(1)(a) Net capital loss from 2010.............................................................

Taxable income...........................................................................................................

$ (5,000)

Nil

The net capital loss claimed has no effect on taxable income, but it will increase the non-capital loss balance.

The non-capital loss balance at November 1, 2011 is computed as follows:

Balance, Jan. 1, 2011...................................................................................................

Par. 3(d) Loss for taxation year ended Oct. 31, 2011:

from business.............................................................................................

from property.............................................................................................

Add: Net capital loss deducted....................................................................................

Less: Par. 3(c) amount determined above....................................................................

$

60,000

5,000

$ 65,000

5,000

$ 70,000

(10,000)

42,000

60,000

*

$ 102,000

(2,000)

$ 100,000

Balance, Oct. 31, 2011................................................................................................

Less: the unutilized non-capital property loss..............................................................

Balance, Nov. 1, 2011..................................................................................................

* Exactly equal to the business loss above.

Only the portion of the non-capital loss that may reasonably be regarded as a loss from carrying on a business

($40,000 + $60,000 = $100,000) is deductible after October 31, 2011. It is subject to the restrictions discussed in Part A.

Summary:

The three alternatives presented above are summarized as follows for comparative purposes:

Taxable Income for the Deemed Taxation Year Ended October 31, 2011:

No election

Par. 3(a) Income from non-capital sources ( 0).

Nil

Par. 3(b) Net taxable capital gains ( 0):

Deemed taxable capital gains (elective):

land.............................................

Nil

building.......................................

Nil

Accrued allowable capital loss (automatic):

rental land................................... $

Nil

(10,000)

Par. 3(c) Par. 3(a) + par. 3(b)......................

Nil

Par. 3(d) Losses from non-capital sources and ABILs:

Loss from business operations............ $

(60,000)

Recapture (elective): building.............

Nil

Loss from property..............................

(5,000)

(65,000

)

Division B income......................................

Nil

Optional net capital loss deducted...............

Nil

Non-capital loss deducted:

From property.....................................

Nil

From business.....................................

Nil

Nil

Taxable income...........................................

Nil

Maximum election

Nil

$ 30,000

40,000

(10,000)

Partial election

Nil

$ 20,000

Nil

$ 60,000

(10,000)

$ 60,000

$

(60,000)

3,000

(5,000)

(62,000)

$ 10,000

$

(60,000)

Nil

(5,000)

(65,000

)

Nil

Nil

(5,000)

Nil

Nil

$ 10,000

(5,000)

(Nil)

Nil

Nil

Nil

Nil

Nil

Non-Capital Losses Available for Carryforward at Deemed Taxation Year Ended October 31, 2011:

Balance from Jan. 1, 2011.............................

Non-capital loss Oct. 31, 2011:

Par. 3(d) losses see above................

Add: net capital losses deducted...........

No election

$ 42,000

Less: par. 3(c) income see above.....

$65,000

Nil

$65,000

Nil

Less: losses utilized at Oct. 31, 2011...........

Nil

65,000

$107,000

Maximum election

$42,000

$62,000

5,000

$67,000

60,000

Nil

7,000

$49,000

Partial election

$ 42,000

$65,000

5,000

$70,000

10,000

Nil

60,000

$ 102,000

Solutions to Chapter 11 Assignment Problems

183

losses not utilized but expired:

Current property loss.................... $ 5,000

Carryforward property loss...........

2,000

Available for carryforward from Nov. 1, 2011

Net Capital Losses available for Carryforward

7,000

$ 100,000

Nil

Nil

2,000

2,000

$ 47,000

Nil

Nil

2,000

2,000

$ 100,000

Nil

184

Introduction to Federal Income Taxation in Canada

The results of the above comparison of the three alternatives are further summarized as follows:

Options

Taxable income......................................................................

Net capital loss deducted.......................................................

Non-capital loss balance, Nov. 1, 2011..................................

ACB of repair shop land........................................................

ACB of repair shop building..................................................

UCC of repair shop building..................................................

(A)

$

Nil

Nil

100,000

80,000

150,000

147,000

(B)(i)

$

Nil

5,000

47,000

140,000

230,000

190,000

*

(B)(ii)

Nil

$

5,000

100,000

120,000

150,000

147,000

* $147,000 + $3,000 + 1/2 ($230,000 $150,000)

Option B (ii) is better if the non-capital loss can be offset by income generated in the next 20 years. The

resultant lower ACB of the land and building under this option is only relevant on a disposition. The lower UCC

on the building only represents an opportunity loss of CCA at a 4% declining balance rate.

Consider the alternative of electing deemed proceeds of disposition of $190,000 (i.e., (2 $20,000) + $150,000)

on the repair shop building. Income under paragraph 3(b) would be the same as for Part B (ii). However, the business

loss under paragraph 3(d) would be only $57,000 (i.e., $60,000 $3,000 recapture), since recapture would be triggered.

This would reduce the non-capital loss balance at November 1, 2011 by $3,000 to $97,000. However, the UCC of the

repair shop building could be increased from $147,000 to $170,000 (i.e., +$3,000 of recapture + $20,000 of taxable

capital gain). The increased CCA base would begin to shelter income from tax, in this case, in the year ended June 30,

2012, when the corporation earns a profit. If, for example, the corporation uses a discount rate of 10% and faces a tax

rate of 20%, the present value of the tax shield on the incremental UCC base of $23,000 (i.e., $170,000 $147,000) at

the 4% CCA rate is:

$23,000 .04 .20

$1,314

.04 .10

The value of the extra $3,000 in the non-capital loss balance in the same year and at the same assumed tax

rate of 20% is $600 (i.e., 20% of $3,000).

Solutions to Chapter 11 Assignment Problems

185

Solution 3 (Advanced)

The data given in the problem statement can be summarized as follows:

carryforward losses

2008

2009

2010

current deemed

year-end losses

non-capital losses

$60,000

45,000

25,000

$130,000

from non-capital

sources

ACL

businessoperations

inventory

equipment

2,000

$10,000

20,000

16,000

potential elections

recapturebuilding

$20,000

TCGland

building

$12,000

allowable capital

losses

$2,000

$46,000

$5,500

potential offset

business income

property

net capital losses

$6,000

4,000

2,000

$12,000

expiration

after deemed

year-end

potential offset

5,500

$19,500

taxable capital gain

$20,000

5,000

$25,000

potential

offset

The two election options to consider are the maximum election and the partial election.

(a) Maximum Election

If the maximum election is made, the $20,000 of recapture offsets the business loss, leaving $26,000 (i.e.,

$46,000 $20,000) of net business loss. The $25,000 of taxable capital gain offsets the $19,500 of expiring

losses, leaving $5,500 (i.e., $25,000 $19,500) to offset the remaining $26,000 of business loss, leaving $20,500

of that business loss. As a result, the non-capital loss available for carry forward from June 30, 2011 is $150,500

(i.e., $20,500 + $130,000).

(b) Partial Election

If only a partial election is made to offset the $19,500 of expiring losses, the current business loss of

$46,000 is not offset and, hence, is available to carry forward, along with the $130,000 of non-capital losses,

from June 30, 2011 for a total of $176,000. If the election is made on the land, the ACB of the land can be

increased without a tax cost.

(c) No Election

Note that if no election is made there is no income to offset the current business loss of $46,000 or the noncapital loss carryforward of $130,000. Therefore, the non-capital loss available to carry forward from June 30,

2011 is $176,000 (i.e., $46,000 + $130,000), which is the same as in the partial election, but there is no increase

in any cost value.

Deemed Year-end

Buscat Ltd. is deemed to have a taxation year ending June 30, 2011, immediately before the acquisition of

control by Buns Plus Ltd. on July 1, 2011 [ssec. 249(4)]. Tax returns will have to be filed for this short taxation

year (i.e., 6 months) and amounts such as CCA will have to be prorated. In addition, the short taxation year will

cause the counting of a carryforward year for the non-capital losses from 2008, 2009, and 2010.

Loss from Non-capital Sources

Losses from non-capital sources for the deemed taxation year ended June 30, 2011, before any elections and

options are computed as follows:

Introduction to Federal Income Taxation in Canada

186

Loss from business.............................................................................................................

Add: Inventory loss [ssec. 10(1)] ($85,000 $65,000)....................................................

Bakery equipment Deemed CCA ($86,000 $70,000).......................................

Total business losses...........................................................................................................

Add: Property loss (will expire unless utilized by June 30, 2011)....................................

Total losses from non-capital sources.................................................................................

$

$

$

10,000

20,000

16,000

46,000

5,500

51,500

Maximum Election

Division B income and taxable income

Par. 3(a)

Par. 3(b)

Income from non-capital sources......................................................................................

Net taxable capital gains:..................................................................................................

Election on land [($195,000 $155,000) 1/2]..........................................................

Election on building [($75,000 $65,000) 1/2].......................................................

Less: Allowable capital loss......................................................................................

Sum of par. 3(a) plus par. 3(b) less any Subdivision e deductions (nil).............................

Property loss................................................................................................ $

5,500

Business losses............................................................................................

46,000

$ 51,500

Less: Building recapture..............................................................................

(20,000)

Sec. 3 income.......................................................................................................................................

Division C deductions:

Net capital losses: 2008......................................................................................... $

6,000

2009.........................................................................................

4,000

2010.........................................................................................

2,000

Taxable income....................................................................................................................................

Par. 3(c)

Par. 3(d)

Nil

$ 20,000

5,000

$ 25,000

(2,000)

$ 23,000

31,500

Nil

$ 12,000

Nil

Non-capital losses available for carryforward after acquisition of control:

Balance July 1, 2011

2008 non-CL...........................................................................................................

2009 non-CL...........................................................................................................

2010 non-CL...........................................................................................................

Non-CL from deemed taxation year before acquisition of control:

Total par. 3(d) loss (see above calculation)..............................................................

Add: Net capital loss deducted................................................................................

60,000

45,000

25,000

$ 130,000

31,500

12,000

$ 43,500

Less: Par. 3(c) income above...................................................................................

(23,000)

Total non-capital losses........................................................................................................................

20,500

$ 150,500

The $150,500 loss carryforward balance must reasonably be regarded as its loss from carrying on a

business.

2008, 2009, and 2010 loss carryforwards from a business as stated in the question.....................

June 30, 2010 business loss net of recapture........................................................... $ 26,000

Less portion of this loss used against par. 3(c) income*..........................................

(5,500)

* Par. 3(c) income........................................................................................................

Less:

Property losses....................................................................... $ 5,500

Net capital losses restored as business losses.......................

12,000

$ 130,000

20,500

$ 150,500

$ 23,000

(17,500)

$ 5,500

The non-capital losses will expire in 20 taxation years, including the deemed taxation year, from the year of

the loss as follows, assuming that Buscat Ltd.s fiscal year-end after the acquisition of control returns to

December 31.

2008 non-CL on December 31, 2027

2009 non-CL on December 31, 2028

2010 non-CL on December 31, 2029

2011 deemed taxation year on December 31, 2030

Solutions to Chapter 11 Assignment Problems

187

The adjusted cost base/capital cost of the properties which were deemed to be sold at their fair market values

would be:

Capital cost

Bakery equipment........................................................................

$ 100,000

Land............................................................................................ n/a

Building* (Class 1)......................................................................

70,000

UCC

70,000

n/a

70,000

Adjusted cost base

$ 100,000

195,000

75,000

* $65,000 + 1/2 ($75,000 $65,000).

In order for these non-capital losses to be deductible in subsequent fiscal periods, two conditions in

subparagraph 111(5)(a)(i) must be met:

(a) the bakery business which generated the loss must be carried on throughout the taxation year in which

the non-capital loss is deducted; and

(b) the bakery business must be carried on for profit or with a reasonable expectation of profit.

It would appear that both conditions will be met, since the Buscat business is being carried on and Buns Plus

expects that the Buscat bakery business will earn a profit of $65,000 in 2012.

If the conditions of subparagraph 111(5)(a)(i) are met, then the non-capital losses may be deducted from

income of the bakery business that generated the loss plus the income from the sale of similar products or

services. If it can be assumed that the bakery business, transferred to Buscat Ltd., sells similar products and/or

services as the Buscat bakery business, then the maximum $90,000 of non-capital losses can be deducted on

December 31, 2011 as follows:

Lesser of:

(a) Net income for year.............................................................................................................

(b) Income from: the loss business...................................................................

Nil

the sale of similar products................................................... $ 130,000

90,000

$ 130,000

The remaining $60,500 ($150,500 $90,000) of non-capital losses can be carried forward to 2012 subject to

the deductibility tests discussed above.

Partial election

The minimum amount to be elected upon under paragraph 111(4)(e) (i.e., proceeds of disposition) should be

an amount equal to 2 times the sum of:

(a) the allowable capital loss of $2,000 which is about to expire,

(b) the net capital losses of $12,000 which would otherwise expire, and

(c) the property loss of $5,500 which otherwise expires plus the adjusted cost base of the property to be

elected upon.

If the land was chosen as the asset to trigger all of the taxable capital gain, then the deemed proceeds would

be determined as:

[2 ($2,000 + $5,500 + $12,000) + $155,000] or $194,000

The resulting taxable income computation would be:

Par. 3(a)

Par. 3(b)

Non-capital sources of income

Net taxable capital gain:

Land, 1/2 ($194,000 $155,000).............................................................. $ 19,500

Allowable capital loss..............................................................................

(2,000)

Par. 3(c)

Sum of par. 3(a) plus par. 3(b) less any Subdivision e deductions (nil)...........................

Par. 3(d) Property loss............................................................................................ $

5,500

Business loss............................................................................................

46,000

$ 51,500

Less: Building recapture..........................................................................

Nil

Sec. 3 income.....................................................................................................................................

Division C

Net capital loss...................................................................................................................................

Taxable income..................................................................................................................................

Non-capital losses available for carryforward after the acquisition of control:

Balance, July 1, 2011..........................................................................................................................

Non-capital losses from the deemed taxation year ended June 30, 2010..................... $ 51,500

Add: Net capital losses deducted above......................................................................

12,000

$ 63,500

Less: Par. 3(c) income above......................................................................................

(17,500)

Total non-capital losses......................................................................................................................

Nil

$

$

17,500

17,500

51,500

Nil

$

12,000

Nil

$ 130,000

46,000

*

$ 176,000

Introduction to Federal Income Taxation in Canada

188

* Exactly equal to the business loss above.

Summary

The two alternatives presented above are summarized as follows for comparative purposes:

Taxable Income for the Deemed Taxation Year Ended June 30, 2011:

Maximum election

Partial election

Par. 3(a) Income from non-capital sources ( 0)............

Nil

Nil

Par. 3(b) Net taxable capital gains ( 0):

Deemed taxable capital gains (elective):

land.................................................... $ 20,000

$ 19,500

building..............................................

5,000

Nil

Allowable capital loss...............................

(2,000) $ 23,000

(2,000) $ 17,500

Par. 3(c) Par. 3(a) + par. 3(b)........................................

$ 23,000

$ 17,500

Par. 3(d) Losses from non-capital sources and ABILs:

Loss from business.................................... $ (46,000)

$ (46,000)

Recapture (elective): building....................

20,000

Nil

Loss from property....................................

(5,500)

(31,500)

(5,500)

(51,500)

Division B income...........................................................

Nil

Nil

Optional net capital loss deducted...................................

(12,000)

(12,000)

Non-capital loss deducted................................................

Nil

Nil

Taxable income................................................................

Nil

Nil

Non-Capital Losses available for Carryforward at Deemed Taxation Year ended June 30, 2011:

Maximum election

Partial election

Balance, Jan. 1, 2011.......................................................

$ 130,000

$ 130,000

Non-capital loss June. 30, 2011:

Par. 3(d) losses see above.................................... $ 31,500

$ 51,500

Add: net capital losses deducted...............................

12,000

12,000

$ 43,500

$ 63,500

Less: par. 3(c) income see above.........................

(23,000)

20,500

(17,500)

46,000

$ 150,500

$ 176,000

Less: losses utilized at June 30, 2011.............................

Nil

Nil

losses not utilized but expired...............................

Nil

Nil

Nil

Nil

Available for carryforward from June. 30, 2011..............

$ 150,500

$ 176,000

Net Capital Losses available for Carryforward...............

Nil

Nil

The results of the above comparison of the two alternatives are further summarized as follows:

Options

Taxable income.........................................................................

Net capital loss deducted..........................................................

Total non-capital losses available for carryforward..................

ACB of land..............................................................................

UCC of building (Class 1)........................................................

ACB of building........................................................................

(a)

0

$ 12,000

150,500

195,000

70,000

75,000

(b)

0

$ 12,000

176,000

194,000

45,000

65,000

Difference

0

0

$ 25,500

(1,000)

(25,000)

(10,000)

Option (b) is better if the additional $25,500 of non-capital loss can be offset by income generated in the

next 20 years. The resultant lower ACB of the land under this option is only relevant on a disposition. The lower

UCC on the building only represents a loss of CCA at a 4% declining balance rate. On the other hand, if an

additional $25,500 of income cannot be generated in the next 20 years (i.e., business losses continue),

alternative (a) is better. Note that 20 years is a long time to sustain continued business losses without generating

at least $25,000 of business income. It is unlikely that alternative (a) is better, unless the land and building will

be sold in the near future.

Solutions to Chapter 11 Assignment Problems

189

Solution 4 (Basic)

Net income before income taxes.........................................................................................................

Add: Loss on the sale of investment [ssec. 9(3)]...................................................... $

10,000

Depreciation and amortization [par. 18(1)(b)].................................................

104,900

Interest on income tax payments [par. 18(1)(t)]...............................................

435

Club dues [par. 18(1)(l)]..................................................................................

1,750

Political contributions [par. 18(1)(n)]..............................................................

2,500

Charitable donations [par. 18(1)(a)].................................................................

22,500

Property tax on vacant land [ssec. 18(2)].........................................................

3,000

Life insurance premium [pars. 18(1)(a), (b), (c)].............................................

1,950

Subtotal...........................................................................................................

Deduct: Capital cost allowance [par. 20(1)(a)].......................................................... $ 149,500

Gain on sale of land [ssec. 9(3)]..................................................................

126,200

Add: Taxable capital gain on business land [sec. 38]: 1/2 ($200,000 $73,800)....

Allowable capital loss on investments [sec. 38]: 1/2 ($75,000 $85,000):....

Net income under Division B......................................................................................

Less Division C deductions:

Charitable donations [sec. 110.1].........................................................................

Dividends [sec. 112]............................................................................................

Non-capital loss [par. 111(1)(b)]..........................................................................

Net capital loss [par. 111(1)(a)]: $75,000 4/3 1/2.............................................

Taxable income...........................................................................................................

The following items were correctly included on the accounting income statement:

(a) Landscaping costs [par. 20(1)(aa)];

(b) Site investigation fees [par. 20(1)(dd)];

(c) Dividends from taxable Canadian corporations [par. 12(1)(j)]; and

(d) Dividends from foreign corporations [par. 12(1)(k)].

342,000

147,035

489,035

(275,700)

213,335

58,100

271,435

(189,100)

82,335

63,100

(5,000)

22,500

42,800

73,800

50,000

190

Introduction to Federal Income Taxation in Canada

Solution 5 (Basic)

[Reference: Chicago Blower (Canada) Ltd. v. M.N.R., 66 DTC 471 (T.A.B.)]

(A) Facts fall within Regulation 400(2)(b)

(i) the company carried on business in each province through an agent,

the agent was established in a particular place, clearly identified to the public,

occupied building with various warehouse facilities,

the agent had general authority to contract,

the agent had a stock of merchandise from which he filled orders,

the exception to this was on orders for larger fans,

thus, the condition was met at least in part,

(ii) therefore, the company does have a permanent establishment in the provinces indicated.

(B) This conclusion differs from that in the Sunbeam case which can be distinguished on its facts,

(i) in the Sunbeam case, the taxpayers representatives in Quebec did not have authority to make contracts

on the companys behalf,

(ii) there was no telephone listing in the companys name and that name did not appear on any business

signs.

Solutions to Chapter 11 Assignment Problems

191

Solution 6 (Basic)

Income under Division B from consulting business...........................................................................

Canadian investment royalty income..................................................................................................

U.K. non-foreign affiliate dividend income........................................................................................

Taxable dividend received from non-connected Canadian corporations.............................................

Taxable capital gains..........................................................................................................................

Income under Division B....................................................................................................................

Deduct:

Charitable donations (not exceeding 75% $305,000 = $228,750)............................................

Canadian dividends received.......................................................................................................

1999 net capital loss ($12,000 1/2 / 3/4; limited to taxable capital gains of $6,000)....................

Taxable income..................................................................................................................................

Basic federal tax at 38% of $194,000.................................................................................................

Deduct: Abatement from federal tax (see Schedule 1)........................................................................

Net......................................................................................................................................................

Deduct:

Non-business foreign tax credit (see Schedule 2)........................................................................

Business foreign tax credit (see Schedule 3)...............................................................................

Tax reduction (11.5% of $194,000).............................................................................................

Part I tax payable (federal).................................................................................................................

Provincial tax:

British Columbia 10% of $77,600...............................................................................................

Alberta rate 10% of $58,200.......................................................................................................

Total tax..............................................................................................................................................

264,000

10,000

20,000

5,000

6,000

305,000

(100,000)

(5,000)

(6,000)

$ 194,000

$

73,720

(13,580)

$

60,140

(2,573)

(17,486)

(22,310)

$

17,771

7,760

5,820

31,351

Schedule 1: Abatement from federal tax

Gross revenues.........................................

% gr. revenues (1).....................................

Salaries and wages...................................

% S&W (2)...............................................

(1) ( 2)

............................................

2

B.C.

$3,000K

30%

$500K

50%

Alberta

$3,000K

30%

$300K

30%

Total Cdn.

$6,000K

60%

$800K

80%

U.S.

$4,000K

40%

$200K

20%

Total

$10,000K

100%

$1,000K

100%

40%

30%

70%

30%

100%

Abatement: 10% of 70% of $194,000 = $13,580

Allocation of income to: B.C. 40% $194,000 = $77,600

Alberta 30% $194,000 = $58,200

Schedule 2: Non-business foreign tax credit (U.K. income)

Lesser of:

(i) tax paid

(ii)

income from U.K.

income less dividends and

net capital loss carryover

3,000

2,573

tax otherwise payable after

abatement minus general

tax reduction

$20,000

...........................................................................

$305,000 $5,000 $6,000

($60,140 $22,310)

$20,000

$294,000

$37,850 =.........................................................................

Lesser amount is $3,000.

Schedule 3: Business foreign tax credit (U.S. income)

Least of:

(i) tax paid and unused credit ($16,000 + $3,000)........................................................................

(ii)

tax otherwise payable

minus general tax

reduction

$ 19,000

Introduction to Federal Income Taxation in Canada

192

income from U.S.

income less dividends and

net capital loss carryover

$100,000

$305,000 $5,000 $6,000

$100,000

$294,000

($73,720 $22,310)

$51,410 =.....................................................................

$ 17,486

(iii) tax otherwise payable before any reduction or credits plus surtax less non-business tax credit

($73,720 $22,310 $2,573).................................................................................................

Least amount is $17,486.

$ 48,837

Solutions to Chapter 11 Assignment Problems

Solution 7 (Basic)

(A) The maximum investment tax credit is

20% [$1,700,000 + $300,000] = $400,000

Note that the used equipment is not a qualified expenditure for the purposes of subsection 127(9)

because it is not new property [Reg. 2902(2)(iii)].

(B) Taxable income before sec. 37 deduction........................................................................ $ 3,200,000

Section 37 deduction.......................................................................................................

(2,200,000)

Taxable income............................................................................................................... $ 1,000,000

Net tax 16.5%.................................................................................................................. $

165,000

Investment tax credit.......................................................................................................

(165,000)

Net federal tax payable under Part I................................................................................

Nil

(C) The remaining investment tax credit of $235,000 (i.e., $400,000 $165,000) may be carried back three

and forward 20 taxation years.

(D) Section 37 SR&ED expenditures in first year................................................................. $ 2,200,000

Section 37 deduction in first year....................................................................................

(2,200,000)

Balance at the beginning of the second year....................................................................

Nil

Less: ITC claim for first year..........................................................................................

(180,000)

Recapture in second year [par. 12(1)(t)]..........................................................................

180,000

Balance after recapture....................................................................................................

Nil

If no further SR&ED expenditures are made in the following year, the income inclusion would be

$165,000 [par. 12(1)(t)].

193

Introduction to Federal Income Taxation in Canada

194

Solution 8 (Basic)

Income under Division B:

Operating profits.................................................................................................................................

Dividends from taxable Canadian corporations..................................................................................

Canadian investment income (i.e., interest income)............................................................................

Foreign investment income ($61,000 + $10,000)................................................................................

$

Add: donations.................................................................................................................................

Division B income..............................................................................................................................

Less: Division C deductions:

Taxable dividends deductible under sec. 112................................................................. $ 85,000

Donations (max. 75% of $718,255 = $538,691)............................................................

9,755

Non-capital losses.........................................................................................................

255,545

Taxable income...........................................................................................................................................

Federal tax (38% of $367,955)...................................................................................................................

Federal abatement (10% of $367,955)........................................................................................................

Federal tax after abatement.........................................................................................................................

Less: Foreign non-business tax credit(1)..............................................................................

6,807

Tax rate reduction (11.5% of $367,955).....................................................................

42,315

Federal tax before investment tax credit.....................................................................................................

Investment tax credit (10% of $250,000)....................................................................................................

Part I federal tax payable............................................................................................................................

New Brunswick tax @ 11% of $367,955....................................................................................................

Total tax liability.........................................................................................................................................

500,000

85,000

52,500

71,000

708,500

9,755

718,255

(350,300)

367,955

139,823

(36,796)

$ 103,027

$

$

(49,122)

53,905

(25,000)

$

28,905

40,475

$

69,380

$

NOTE TO SOLUTION

(1) Foreign non-business tax credit

Lesser of:

(i) Amount paid................................................................................................................

$71,000

($103,027 $42,315) .............................

(ii)

$718,255 $85,000

10,000

6,807

Solutions to Chapter 11 Assignment Problems

195

Solution 9 (Advanced)

Net income under Division B...........................................................................................................

Division C deductions: Dividends from taxable Canadian corporations.......................................

Charitable donations (max. 75% $2,097,000).......................................

Net capital losses ($9,000 1/2 / 3/4).........................................................

Non-capital losses....................................................................................

Taxable income................................................................................................................................

Tax @ 38%.......................................................................................................................................

Federal abatement(1)..........................................................................................................................

Non-business foreign tax deductions(2).............................................................................................

Business foreign tax deductions(3).....................................................................................................

Tax reduction (11.5% of $1,966,000)................................................................................................

Federal tax before investment tax credit...........................................................................................

Investment tax credit(4)......................................................................................................................

Federal Part I tax payable.................................................................................................................

Provincial tax payable: Ontario @ 11.5% $963,340..................................................................

Alberta @ 10% $196,600.....................................................................

$ 2,097,000

(15,000)

(50,000)

(6,000)

(60,000)

$ 1,966,000

$

747,080

(115,994)

$

631,086

(3,000)

(200,000)

(226,090)

$

201,996

(30,000)

$

171,996

$

110,784

19,660

$

130,444

NOTES TO SOLUTION

(1) Federal abatement:

Gross revenue

Salaries & wages

Amount

%

Amount

%

Average percentage

1

Ontario............ $ 6,000,000

54.6% $ 2,540,000

43.3%

/2 (54.6% + 43.3%) = 49.0%

1

Alberta............

400,000

3.6

960,000

16.4

/2 (3.6% + 16.4%) = 10.0%

1

$ 6,400,000

58.2

$ 3,500,000

59.7

/2 (58.2% + 59.7%) = 59.0%

U.S..................

4,600,000

41.8

2,360,000

40.3

Total................ $ 11,000,000

100.0% $ 5,860,000

100.0%

Allocation of taxable income to each province:

Ontario..................................................................................... 49% $1,966,000 =

$

963,340

Alberta..................................................................................... 10% $1,966,000 =

196,600

Taxable income earned in a province or territory.....................

$ 1,159,940

Abatement is 10% $1,159,940 = $115,994.

(2)

Non-business foreign tax deduction:

lesser of:

(a) tax paid

(b)

3,000

tax otherwise payable

foreign non - business income (basic abatement general reduction)

Div. B income - par. 111(1)( b) - sec.112

$20,000

($631

,086 $226,090)

................................................................................................................................

$

3,902

$2,097,000 $6,000 $15,000

(3)

Business foreign tax deduction:

least of:

(a) tax paid..............................................................................................................................

(b)

tax otherwise payable

foreign business income (basic general reduction)

200,000

Div. B income - par. 111(1)( b) - sec. 112

$800,000

($747,080 $226,090.....................................................................................

)

$

200,767

$2,097,000 $6,000 $15,000

(c) tax otherwise payable minus non-business foreign tax deduction

($747,080 $226,090 $3,000)......................................................................................

517,980

(4) Investment tax credit: 20% $150,000 = $30,000

Since all $150,000 of the expenditure was deducted in 2011, all $30,000 of the ITC claimed in 2011 will be

included in income in 2012 [par. 12(1)(t)].

Introduction to Federal Income Taxation in Canada

196

Advisory Case

King Enterprises Inc.

ADVISORY CASE DISCUSSION NOTES

This case deals primarily with the issues surrounding acquisition of control and the adjustment to, and carry

forward of, the losses of Royal.

1. Deemed year-end

Day before the closing.

This uses up one of the years for the carryover of losses unless the AOC occurs on the same date,

or very close to it, as the year end of Royal.

Can choose any new year-end within 12 months.

2. Accrued but unrealized losses

Accrued terminal losses, if CCA has been claimed in the past, but did not cover full decline in

value.

If the allowance for doubtful accounts was not fully claimed last year then it needs to be.

Is there an accrued loss on ECP or non-depreciable capital property?

3. Election

Do any of the assets have a fair market value in excess of their tax values?

Designation available under paragraph 111(4)(e) to use up losses that will expire on the AOC or

that might expire before they can be utilized.

4. Expiry of losses on the AOC

Property losses, net capital losses, ABILs.

Did the sale of land and building cause a net capital loss?

They have had six years of losses, so the carry forward period getting shorter, especially, with the

deemed year-end on acquisition of control counting as one taxation year.

o not a major problem with a 20-year carry forward

5. Utilization of losses

Need to meet 3 conditions in order for the business losses to be available after the AOC:

i) The business that generated the loss must be carried on throughout the year. The forms

business of Royal must be continued.

ii) The forms business must be carried on with a reasonable expectation of profit. Ian

seems to think that he can make it profitable.

iii) The losses carried over can be applied against income only from the same business

or from the sale of similar products or services. The forms losses of Royal can only

be used against the profits from the forms business or from the sale of forms. There

could be some grey area here, but Ian should not assume that he can use Royals

losses against Kings profits.

Vous aimerez peut-être aussi

- Computation of Taxable Income and Tax After General Reductions For CorporationsDocument35 pagesComputation of Taxable Income and Tax After General Reductions For Corporationsjahcaveman75% (4)

- CHAPTER 5 Depreciable Capital Property and Eligible Capital PropertyDocument20 pagesCHAPTER 5 Depreciable Capital Property and Eligible Capital PropertyNia ニア Mulyaningsih100% (6)

- Chapter 16 & 17 ProblemsDocument31 pagesChapter 16 & 17 ProblemsKevin Tee100% (3)

- MC Tax QuestionsDocument15 pagesMC Tax QuestionsTreymayne0% (2)

- Chap 06Document30 pagesChap 06Tim JamesPas encore d'évaluation

- ACCO320Midterm Fall2013FNDocument14 pagesACCO320Midterm Fall2013FNzzPas encore d'évaluation

- Prep Cof Asn06 W04.quiz.sDocument3 pagesPrep Cof Asn06 W04.quiz.sKate BPas encore d'évaluation

- Chapter 08, Modern Advanced Accounting-Review Q & ExrDocument36 pagesChapter 08, Modern Advanced Accounting-Review Q & Exrrlg4814100% (5)

- Business Valuation TemplateDocument2 pagesBusiness Valuation TemplateAkshay MathurPas encore d'évaluation

- BU 357 Wilfrid Laurier HomeworkDocument35 pagesBU 357 Wilfrid Laurier HomeworkNia ニア MulyaningsihPas encore d'évaluation

- Pony Up - Case #1Document7 pagesPony Up - Case #1Cassandra LynnPas encore d'évaluation

- Chap 02Document25 pagesChap 02Tim JamesPas encore d'évaluation

- Chapter 01 - Introduction To Federal Taxation in CanadaDocument40 pagesChapter 01 - Introduction To Federal Taxation in CanadaDonna So100% (2)

- Test Bank For Modern Advanced Accounting in Canada Canadian 7th Edition by HiltonDocument6 pagesTest Bank For Modern Advanced Accounting in Canada Canadian 7th Edition by Hiltonhezodyvar80% (5)

- Tax QuestionsDocument261 pagesTax QuestionsPocaGuri100% (1)

- Beechy 7ce v2 Ch18Document89 pagesBeechy 7ce v2 Ch18منیر سادات0% (2)

- VrioDocument3 pagesVrioKiều Thảo AnhPas encore d'évaluation

- Chapter 16 Sol 2020 WKDocument53 pagesChapter 16 Sol 2020 WKVu Khanh LePas encore d'évaluation

- Chap03 Sol OddDocument19 pagesChap03 Sol OddRussell WilsonPas encore d'évaluation

- Tax Answers 2Document280 pagesTax Answers 2Don83% (6)

- Chap 01Document13 pagesChap 01Tim JamesPas encore d'évaluation

- BUS345 Midterm 1 NotesDocument31 pagesBUS345 Midterm 1 NotesՄարիա ՄինասեանPas encore d'évaluation

- Chapter 1 - Sol - 2023 Introduction To Federal Income Taxation in Canada, 44th EditionDocument5 pagesChapter 1 - Sol - 2023 Introduction To Federal Income Taxation in Canada, 44th Editionfullgradestore2023Pas encore d'évaluation

- CH 7 Answer KeyDocument88 pagesCH 7 Answer KeyT m100% (1)

- Chapter 11 Question Answer KeyDocument91 pagesChapter 11 Question Answer KeyBrian Schweinsteiger Fok100% (1)

- Controls at The Bellagio Casino ResortDocument2 pagesControls at The Bellagio Casino ResortFareeha Anwar0% (1)

- 655 Week 9 Notes PDFDocument75 pages655 Week 9 Notes PDFsanaha786Pas encore d'évaluation

- Chapter 11 - Computation of Taxable Income and TaxDocument22 pagesChapter 11 - Computation of Taxable Income and TaxMichelle Tan100% (1)

- Management Accounting Lecture Notes 2016 4 - Cfe Excerpt T8mwc6land7z7x8cld0w PDFDocument31 pagesManagement Accounting Lecture Notes 2016 4 - Cfe Excerpt T8mwc6land7z7x8cld0w PDFjj67% (3)

- Ch02 SolutionDocument6 pagesCh02 SolutionMalekPas encore d'évaluation

- Chapter 5Document26 pagesChapter 5Reese Parker33% (3)

- Chapter 5 Question Answer KeyDocument83 pagesChapter 5 Question Answer KeyBrian Schweinsteiger FokPas encore d'évaluation

- Case Study 5.2Document5 pagesCase Study 5.2Jessa Beloy100% (6)

- Budgeting in EducationDocument4 pagesBudgeting in Educationvanessa adriano100% (2)

- Multiplier Model Web Chapter Colander HgdAMRUlA2Document30 pagesMultiplier Model Web Chapter Colander HgdAMRUlA2Himanshu SethPas encore d'évaluation

- Corporate Distributions, Windings-Up, and Sales: Solutions To Chapter 15 Assignment ProblemsDocument21 pagesCorporate Distributions, Windings-Up, and Sales: Solutions To Chapter 15 Assignment ProblemsKiều Thảo AnhPas encore d'évaluation

- Hilton6e SM08Document70 pagesHilton6e SM08Eych MendozaPas encore d'évaluation

- Chapter 01 - PowerPoint - Introduction To Taxation in Canada - 2013Document32 pagesChapter 01 - PowerPoint - Introduction To Taxation in Canada - 2013melsun007Pas encore d'évaluation

- Depreciable Property and Eligible Capital Property: Solutions To Chapter 5 Assignment ProblemsDocument27 pagesDepreciable Property and Eligible Capital Property: Solutions To Chapter 5 Assignment ProblemsOktariadie RamadhianPas encore d'évaluation

- Solution Manual For Accounting Tools For Business Decision Makers 4th Edition by KimmelDocument18 pagesSolution Manual For Accounting Tools For Business Decision Makers 4th Edition by KimmelKristine AstilleroPas encore d'évaluation

- Chapter 7 Federal Taxation Textbook SolutionsDocument26 pagesChapter 7 Federal Taxation Textbook SolutionsReese Parker0% (1)

- Controls at Belagio Resort CaseDocument21 pagesControls at Belagio Resort CasemaastrichtpiePas encore d'évaluation

- Business Combinations: 2005 Mcgraw-Hill Ryerson Limited. All Rights Reserved. 52Document37 pagesBusiness Combinations: 2005 Mcgraw-Hill Ryerson Limited. All Rights Reserved. 52cpscbd9Pas encore d'évaluation

- Download: Acc 307 Final Exam Part 1Document2 pagesDownload: Acc 307 Final Exam Part 1AlexPas encore d'évaluation

- Chapter Two SolutionsDocument9 pagesChapter Two Solutionsapi-3705855Pas encore d'évaluation

- Guide To Accounting Standards For Private Enterprises Chapter 45 Financial Instruments July 2016Document74 pagesGuide To Accounting Standards For Private Enterprises Chapter 45 Financial Instruments July 2016Shariful HoquePas encore d'évaluation

- CH 12 NotesDocument23 pagesCH 12 NotesBec barronPas encore d'évaluation

- Corporate Finance Week 3 Slide SolutionsDocument6 pagesCorporate Finance Week 3 Slide SolutionsKate BPas encore d'évaluation

- Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions ManualDocument9 pagesByrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions Manuallemon787100% (5)

- Financial and Managerial Accounting ForDocument626 pagesFinancial and Managerial Accounting ForSalil GoelPas encore d'évaluation

- Corporate Finance Week 2 Student NotesDocument77 pagesCorporate Finance Week 2 Student NotesnishitPas encore d'évaluation

- CPA Audit: © 2019 HOCK International, LLC. For Personal Use Only by Original Purchaser. Resale Prohibited. IDocument34 pagesCPA Audit: © 2019 HOCK International, LLC. For Personal Use Only by Original Purchaser. Resale Prohibited. IDavid D'souzaPas encore d'évaluation

- Chapter 4 Question Answer KeyDocument63 pagesChapter 4 Question Answer KeyBrian Schweinsteiger Fok100% (2)

- Bellagio Case - Owais RafiqDocument6 pagesBellagio Case - Owais Rafiqowaisra67% (3)

- Chapter 3Document8 pagesChapter 3lijijiw23Pas encore d'évaluation

- 2 MOCK CPA Evaluation CFE Day 1 Case That Links Back To Capstone 1Document16 pages2 MOCK CPA Evaluation CFE Day 1 Case That Links Back To Capstone 1nnauthooPas encore d'évaluation

- Chapter 009 Test BankDocument13 pagesChapter 009 Test Banknadecho1Pas encore d'évaluation

- Revenue and Monetary Assets: Changes From Eleventh EditionDocument21 pagesRevenue and Monetary Assets: Changes From Eleventh EditionMenahil KPas encore d'évaluation

- CH 2-3-4 Exam SolutionsDocument6 pagesCH 2-3-4 Exam SolutionsadlkfjPas encore d'évaluation

- Chapter 02 - Basic Financial StatementsDocument139 pagesChapter 02 - Basic Financial StatementsElio BazPas encore d'évaluation

- Chap 13 Statement of Cash FlowsPractice QuestionsDocument7 pagesChap 13 Statement of Cash FlowsPractice QuestionshatanolovePas encore d'évaluation

- Accounting For Income Tax HandoutsDocument4 pagesAccounting For Income Tax HandoutsMichael Bongalonta0% (1)

- Solutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Document5 pagesSolutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Adam IngberPas encore d'évaluation

- ACCT 3110 CH 7 Homework E 4 8 13 19 20 27Document7 pagesACCT 3110 CH 7 Homework E 4 8 13 19 20 27John Job100% (1)

- Problem Set 6 BS CS 6Document3 pagesProblem Set 6 BS CS 6Rubab MirzaPas encore d'évaluation

- Residential Commercial: 497 SOMERSET STREET, Ottawa, Ontario K1R5J7Document2 pagesResidential Commercial: 497 SOMERSET STREET, Ottawa, Ontario K1R5J7Kiều Thảo AnhPas encore d'évaluation

- Economic Rent: Value Chain Capabiliti Es Resource Interior Resource Based View (VRIO) FutureDocument1 pageEconomic Rent: Value Chain Capabiliti Es Resource Interior Resource Based View (VRIO) FutureKiều Thảo AnhPas encore d'évaluation

- Chapter 01Document10 pagesChapter 01Kiều Thảo AnhPas encore d'évaluation

- Test UploadDocument100 pagesTest UploadKiều Thảo AnhPas encore d'évaluation

- Resource Based ViewDocument1 pageResource Based ViewKiều Thảo AnhPas encore d'évaluation

- Fina-4332 001Document7 pagesFina-4332 001Kiều Thảo AnhPas encore d'évaluation

- Chap 004Document119 pagesChap 004Kiều Thảo AnhPas encore d'évaluation

- Ch01 Horngren IsmDocument19 pagesCh01 Horngren IsmKiều Thảo AnhPas encore d'évaluation

- Chap 009Document78 pagesChap 009Kiều Thảo AnhPas encore d'évaluation

- Chap 006Document78 pagesChap 006Kiều Thảo Anh100% (1)

- True / False Questions: Module G Variables SamplingDocument119 pagesTrue / False Questions: Module G Variables SamplingKiều Thảo AnhPas encore d'évaluation

- Mod HDocument103 pagesMod HKiều Thảo AnhPas encore d'évaluation

- Sol14 4eDocument103 pagesSol14 4eKiều Thảo Anh100% (1)

- Taxation Answers 2Document9 pagesTaxation Answers 2Kiều Thảo AnhPas encore d'évaluation

- MFT Samp Questions BusinessDocument7 pagesMFT Samp Questions BusinessKiều Thảo AnhPas encore d'évaluation